Non-alcoholic Steatohepatitis Treatment Market By Drug (Vitamin E & Pioglitazone, Semaglutide, Obeticholic Acid (OCA), Lanifibranor, and Others), By Disease Stage (NASH Stage F4, NASH Stage F3, NASH Stage F2, NASH Stage F1, and NASH Stage F0), By Distribution Channel (Hospital Pharmacies, Retail & Specialty Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151363

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

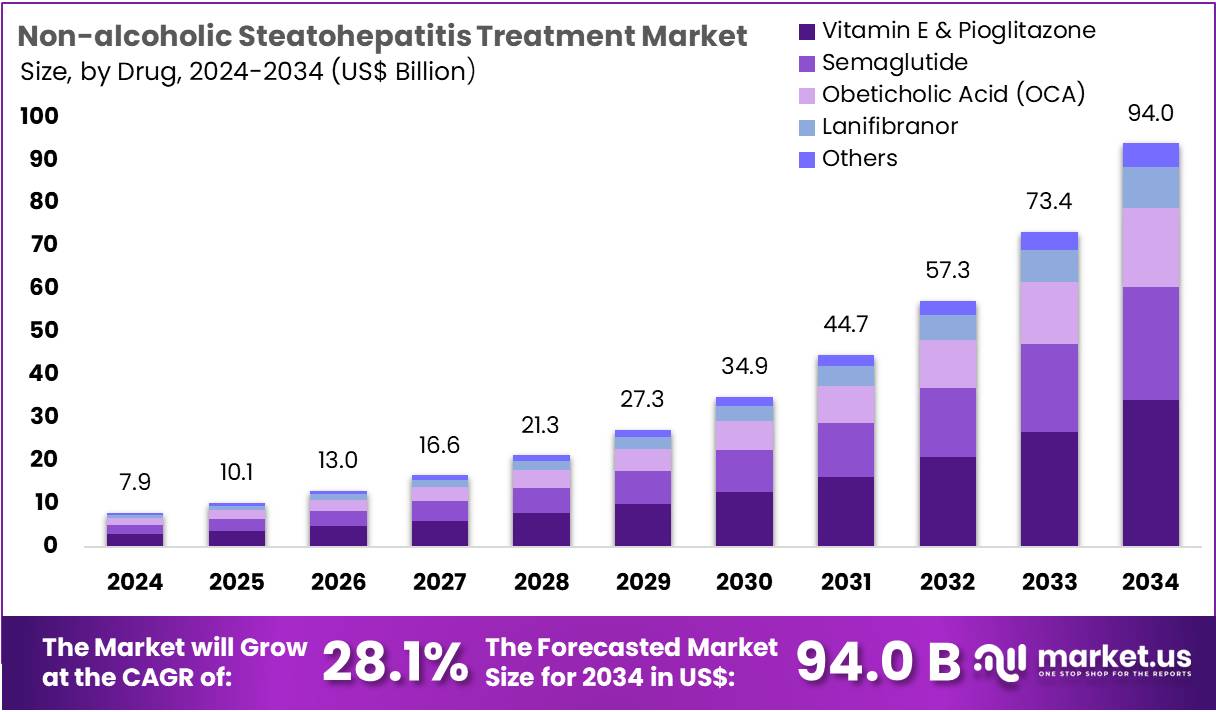

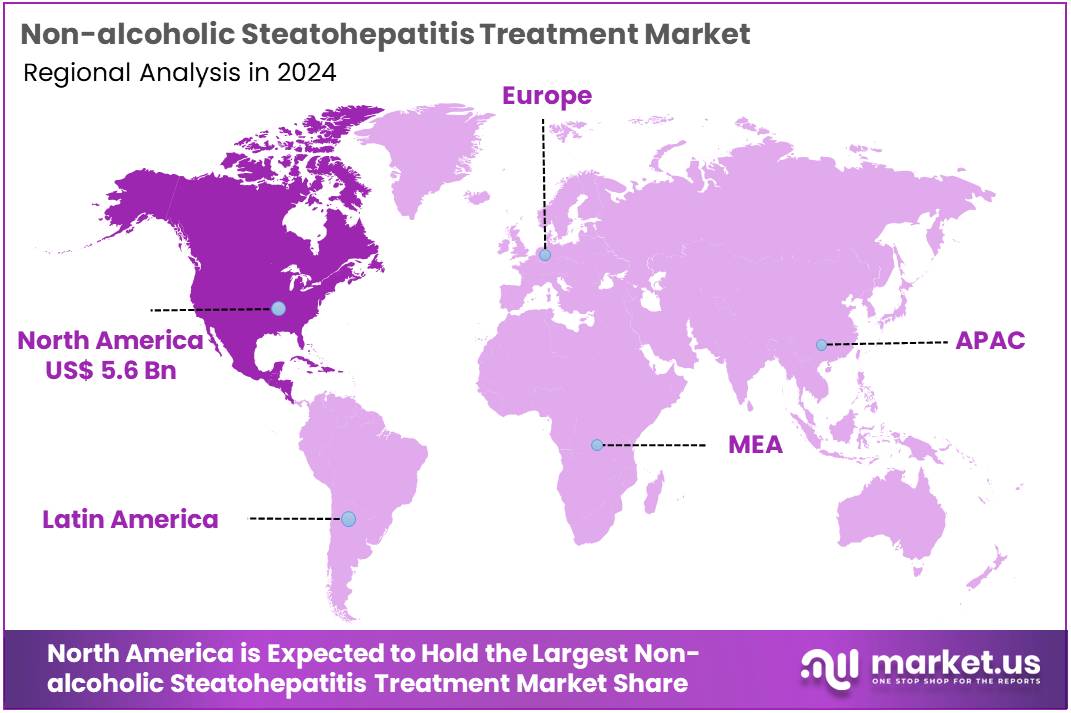

The Non-alcoholic Steatohepatitis Treatment Market Size is expected to be worth around US$ 94.0 billion by 2034 from US$ 7.9 billion in 2024, growing at a CAGR of 28.1% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 71.1% share and holds US$ 5.6 Billion market value for the year.

Rising incidence rates of non-alcoholic steatohepatitis (NASH) and growing awareness of its long-term health consequences are driving the demand for effective treatments in the market. NASH, a progressive liver disease often associated with obesity, type 2 diabetes, and metabolic syndrome, has become a major concern due to its potential to lead to cirrhosis, liver cancer, and liver failure. As a result, there is an urgent need for therapeutics that can address both the underlying causes and the symptoms of the disease.

The market is seeing significant growth due to the introduction of novel drug classes, including anti-fibrotic agents and metabolic regulators. These treatments aim to reduce liver fat, inflammation, and fibrosis, offering new hope for patients with NASH. Recent advancements in targeted therapies, such as oral treatments, are enhancing patient compliance and expanding the potential for widespread use.

In May 2024, the US Food and Drug Administration (FDA) approved Rezdiffra (resmetirom) from Madrigal Pharmaceuticals for adults with noncirrhotic, non-alcoholic steatohepatitis (NASH) and moderate to advanced liver fibrosis. This approval marks a key milestone in NASH treatment, as the drug is intended to complement lifestyle changes like diet and exercise, underscoring the growing focus on combination therapies to manage the disease. The increasing development of such treatments presents significant opportunities to address the unmet needs in NASH management.

Key Takeaways

- In 2024, the market for non-alcoholic steatohepatitis treatment generated a revenue of US$ 7.9 billion, with a CAGR of 28.1%, and is expected to reach US$ 94.0 billion by the year 2034.

- The drug segment is divided into vitamin e & pioglitazone, semaglutide, obeticholic acid (oca), lanifibranor, and others, with vitamin e & pioglitazone taking the lead in 2023 with a market share of 36.5%.

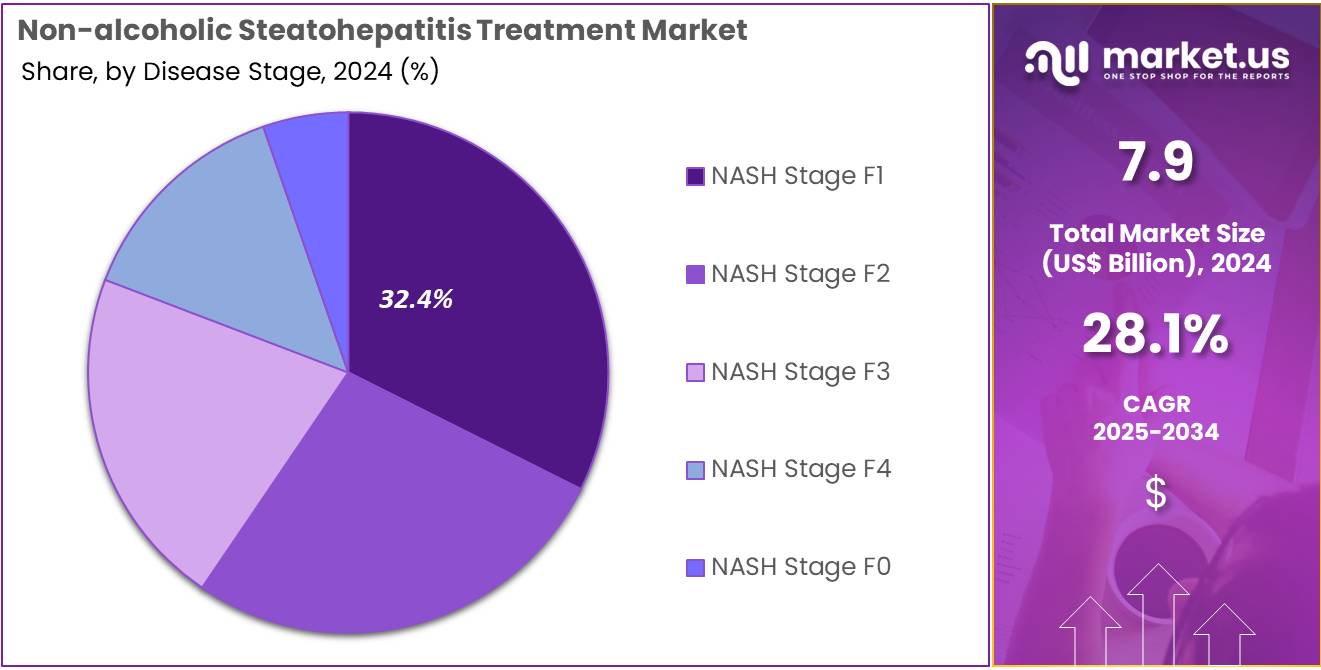

- Considering disease stage, the market is divided into NASH stage F4, NASH stage F3, NASH stage F2, NASH stage F1, and NASH stage F0. Among these, NASH stage F1 held a significant share of 32.4%.

- Furthermore, concerning the distribution channel segment, the hospital pharmacies sector stands out as the dominant player, holding the largest revenue share of 52.2% in the Non-alcoholic Steatohepatitis Treatment market.

- North America led the market by securing a market share of 71.1% in 2024.

Drug Analysis

Vitamin E and pioglitazone remain the dominant treatment combination in the NASH treatment market, with a 36.5% share. This drug combination has shown significant efficacy in improving liver health in NASH patients, particularly in the early stages of the disease. The use of vitamin E, a potent antioxidant, alongside pioglitazone, which targets insulin resistance, has proven to be effective in reducing liver inflammation and improving fibrosis scores.

The market for this combination treatment is expected to grow, driven by the increasing recognition of its benefits in patients with NASH, especially as more clinical studies continue to support its use. The approval and recommendation of these drugs for specific NASH stages will further contribute to their sustained market dominance. The growing awareness of the health implications of NASH, coupled with the increasing incidence of metabolic diseases, will further accelerate the adoption of Vitamin E and pioglitazone.

Disease Stage Analysis

NASH Stage F1 is expected to hold the largest market share of 32.4% as it represents an early stage of the disease where intervention is critical in halting disease progression. In this stage, patients typically have mild liver fibrosis, and appropriate treatment can prevent further damage and the progression to more severe stages like F2, F3, or F4.

The demand for treatments targeting NASH stage F1 is projected to grow due to the increasing recognition that early intervention is essential for better long-term outcomes. As healthcare providers become more focused on identifying and managing NASH in its early stages, the market for treatments specifically targeting F1 will expand.

Additionally, the relatively higher number of patients diagnosed at this stage compared to more advanced stages is likely to contribute to the growth of this segment, as early treatments can offer significant benefits in reducing complications.

Distribution Channel Analysis

Hospital pharmacies are projected to be the largest distribution channel in the NASH treatment market, holding a 52.2% share. Hospitals play a crucial role in managing patients with advanced liver diseases such as NASH, particularly in administering complex treatments and monitoring patient progress. The demand for hospital-based NASH treatments is expected to grow as more specialized care for patients with liver fibrosis and cirrhosis becomes available.

Hospital pharmacies are well-equipped to handle the prescription and distribution of both approved and investigational NASH treatments, making them the primary point of access for patients in need of advanced therapeutic options. As more therapies receive approval for NASH treatment, hospital pharmacies are likely to remain at the forefront of dispensing these drugs, given the increased complexity of managing patients at various stages of NASH. Additionally, the rising number of healthcare institutions specializing in liver disease management will further cement hospital pharmacies’ dominant position in the market.

Key Market Segments

By Drug

- Vitamin E & Pioglitazone

- Semaglutide

- Obeticholic Acid (OCA)

- Lanifibranor

- Others

By Disease Stage

- NASH Stage F4

- NASH Stage F3

- NASH Stage F2

- NASH Stage F1

- NASH Stage F0

By Distribution Channel

- Hospital Pharmacies

- Retail & Specialty Pharmacies

Drivers

Increasing Global Burden of NASH and Associated Risk Factors is Driving the Market

The growing global burden of non-alcoholic steatohepatitis (NASH) is a key driver of the NASH treatment market. This increase is largely due to the rising incidence of obesity, type 2 diabetes, and metabolic syndrome. NASH is a severe progression of non-alcoholic fatty liver disease (NAFLD) that can lead to liver fibrosis, cirrhosis, and even hepatocellular carcinoma. A meta-analysis published in PMC in March 2023 estimated that NAFLD affects 32.4% of the global adult population. This high prevalence indicates a large at-risk population in urgent need of treatment.

According to the World Health Organization (WHO), in 2022, about 2.5 billion adults aged 18 and above were overweight. Among them, 890 million were classified as obese. These figures were published in March 2024 and underline the direct link between obesity and the increasing NASH burden. The unmet need for effective therapies is prompting strong investment in clinical research and drug innovation. Pharmaceutical companies are intensifying efforts to develop disease-modifying treatments. This trend is expected to accelerate market expansion over the coming years. As the patient pool continues to grow, the focus on early diagnosis and targeted therapeutics will become increasingly important.

Restraints

High Rate of Clinical Trial Failures and Diagnostic Challenges are Restraining the Market

The non-alcoholic steatohepatitis treatment market faces significant restraint due to the historically high rate of clinical trial failures for investigational drugs and ongoing challenges in accurate non-invasive diagnosis. The complex pathophysiology of NASH, involving multiple interacting pathways, makes drug development particularly difficult, leading to many promising candidates failing in late-stage trials. A review in PMC in January 2024 highlighted that despite numerous agents being evaluated, only one drug had received accelerated approval for NASH.

Additionally, liver biopsy, the current gold standard for NASH diagnosis and staging, is invasive, costly, and prone to sampling variability, while non-invasive diagnostic methods still lack sufficient accuracy for widespread clinical use. These obstacles create uncertainty for pharmaceutical companies and hinder the rapid introduction of new, effective treatments.

Opportunities

Robust and Evolving Drug Pipeline Creates Growth Opportunities

The robust and evolving drug pipeline for non-alcoholic steatohepatitis, featuring multiple therapeutic candidates with diverse mechanisms of action, presents significant growth opportunities in the NASH treatment market. Pharmaceutical companies are investing heavily in developing new compounds that target various aspects of NASH pathogenesis, including inflammation, fibrosis, and metabolic dysfunction.

In March 2024, the US Food and Drug Administration (FDA) granted accelerated approval to Rezdiffra (resmetirom) for the treatment of non-cirrhotic NASH with moderate to advanced liver scarring, representing the first direct treatment option for NASH patients. This groundbreaking approval validates years of research and paves the way for other drugs in late-stage development, indicating a transformative period for NASH patients.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the non-alcoholic steatohepatitis treatment market, primarily through their impact on healthcare expenditure, pharmaceutical research and development (R&D) investments, and patient access to costly therapies. A robust global economy generally leads to increased healthcare spending by governments and private payers, which can facilitate greater investment in R&D for complex diseases like NASH and improve reimbursement policies for new treatments.

According to BioSpace in May 2025, R&D spending across the global pharmaceutical sector climbed 1.5% in 2024, following an 11.5% increase from 2022 to 2023, indicating sustained investment. Conversely, economic downturns or periods of high inflation can lead to tighter healthcare budgets, potentially delaying the adoption of new NASH treatments or increasing patient out-of-pocket costs, which might limit access to innovative drugs.

The Canadian Institute for Health Information (CIHI) reported in November 2024 that total health expenditures in Canada increased by 4.5% in 2023 and were expected to rise 5.7% in 2024, illustrating varying growth rates globally. Geopolitical factors, such as trade stability and international collaborations, are also crucial for the complex global supply chains involved in pharmaceutical manufacturing.

Disruptions caused by geopolitical tensions, as observed in various regions in 2024, can lead to increased costs and delays in sourcing specialized ingredients and manufacturing equipment, impacting drug production and availability. However, the high unmet medical need for NASH and the severe long-term consequences of the disease often provide a strong impetus for continued investment and development, offering a degree of market resilience.

Current US tariff policies can directly impact the non-alcoholic steatohepatitis treatment market by altering the cost of imported active pharmaceutical ingredients (APIs), specialized chemicals, and manufacturing equipment necessary for drug production. While the US is a leader in pharmaceutical innovation, it relies heavily on imports for many raw materials and intermediates.

A Yale University Budget Lab projection in May 2025 estimated that a 25% ad valorem tariff on pharmaceuticals could increase medication costs by an average of around US$600 per year per household in the US. The Observatory of Economic Complexity reported that in 2024, the US imported US$212 billion in pharmaceutical products, with Ireland, Switzerland, and Germany being top origins, indicating significant international reliance. This could translate to higher prices for NASH treatments, potentially impacting patient affordability and health system budgets.

Conversely, these tariff policies can act as a powerful incentive for pharmaceutical companies to invest in domestic manufacturing capabilities for NASH therapies and their components within the US. Industry representatives informed the House Energy and Commerce Health subcommittee in June 2025 that tax credits and long-term purchasing commitments could significantly enhance the US manufacturing base for essential medicines. This strategic shift aims to create a more localized and secure supply chain, reducing vulnerability to international disruptions and bolstering national self-sufficiency in providing critical treatments, despite the initial challenges of cost adjustments and infrastructure development.

Latest Trends

Shift Towards Early Diagnosis and Non-Invasive Assessment is a Recent Trend

A prominent recent trend in the non-alcoholic steatohepatitis treatment market is the increasing focus on early diagnosis and the development of non-invasive assessment tools. As awareness of NASH grows, there is a greater emphasis on identifying patients at earlier stages of the disease, ideally before significant fibrosis has occurred, to enable timely intervention and prevent progression to cirrhosis.

Researchers are actively developing and validating biomarkers, imaging techniques (such as MRI-PDFF and elastography), and scoring systems that can accurately identify NASH and fibrosis without the need for invasive liver biopsies. A 2023 publication in Gut noted the increasing use of non-invasive tests (NITs) in clinical trials for NASH, highlighting their potential for earlier detection and monitoring. This shift aims to make diagnosis more accessible, scalable, and patient-friendly, facilitating broader screening and earlier entry into treatment pathways.

Regional Analysis

North America is leading the Non-alcoholic Steatohepatitis Treatment Market

North America dominated the market with the highest revenue share of 71.1% owing to increasing disease prevalence and a landmark regulatory approval. Non-alcoholic fatty liver disease (NAFLD), which includes NASH, is a growing public health concern in the United States. While precise year-over-year prevalence changes for NASH specifically from 2022 to 2024 from direct government sources are still being tracked, the condition is strongly associated with metabolic disorders like obesity and type 2 diabetes, which remain prevalent.

A key development that directly fueled market expansion in 2024 was the US Food and Drug Administration’s (FDA) accelerated approval of Rezdiffra (resmetirom) on March 14, 2024. This marked a pivotal moment as Rezdiffra became the first oral medication specifically approved for treating adults with NASH and moderate to advanced liver fibrosis, addressing a substantial unmet medical need. This approval opens a new therapeutic avenue for patients and is expected to drive further investment and diagnostic efforts in the region, reflecting a crucial advancement in managing this progressive liver disease.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the rising prevalence of metabolic risk factors, improving diagnostic capabilities, and increasing healthcare investments across the region. In India, for instance, the Ministry of Health and Family Welfare recognized Non-Alcoholic Fatty Liver Disease (NAFLD) as a major Non-Communicable Disease in 2021, indicating a community prevalence ranging from 9% to 32%, a range that includes NASH.

This acknowledgment underscores the significant patient burden that requires effective interventions. Furthermore, the “Health at a Glance: Asia/Pacific 2024” report, a joint publication by the OECD and the World Health Organization (WHO), details an increasing trend in overall healthcare spending within the Asia Pacific, suggesting a growing capacity for adopting novel and advanced treatment options. This increased financial commitment to healthcare, coupled with government initiatives aimed at addressing non-communicable diseases and raising public awareness about liver health, is anticipated to accelerate the market for non-alcoholic steatohepatitis therapies throughout Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the non-alcoholic steatohepatitis (NASH) treatment market employ several strategies to drive growth, such as focusing on developing novel therapeutic options and improving drug efficacy. Companies actively invest in research and development to address the unmet medical needs in NASH, a condition with no approved treatments yet. They also prioritize forming partnerships with biotech firms and academic institutions to foster innovation and speed up drug development.

In addition, expanding their clinical trials to include diverse patient populations ensures the marketability and global reach of their treatments. These players aim to enhance patient access by collaborating with healthcare providers and regulators for faster approval and distribution. Intercept Pharmaceuticals is a key player in the NASH treatment market. Founded in 2007, Intercept focuses on developing therapies for liver diseases, with a significant emphasis on NASH.

The company’s lead product, Ocaliva, targets liver diseases, including NASH, by modulating bile acid receptors to reduce liver inflammation. Intercept continues to drive its growth by advancing its research pipeline and exploring potential treatments for a broader range of liver conditions. With a strong presence in the US and international markets, the company collaborates with healthcare providers and regulatory agencies to bring effective solutions to patients suffering from liver diseases.

Top Key Players in the Non-alcoholic Steatohepatitis Treatment Market

- The Bristol-Myers Squibb Company

- Shilpa Medicare

- Novo Nordisk A/S

- NGM Biopharmaceuticals, Inc

- Madrigal Pharmaceuticals Inc

- Inventiva

- Galmed Pharmaceuticals Ltd

- AbbVie Inc

Recent Developments

- In August 2024, Shilpa Medicare’s shares surged over 11 percent to a record high following the announcement of positive Phase 3 trial results for SMLNUD07 (NorUDCA), a drug aimed at treating Nonalcoholic Fatty Liver Disease (NAFLD). This breakthrough provides a new therapeutic option for a condition with limited current treatments.

- In June 2022, Novo Nordisk and Echosens entered a strategic partnership to address the underdiagnosis of non-alcoholic steatohepatitis (NASH). The collaboration focuses on non-invasive diagnostic solutions, aiming to double detection rates by 2025, unlocking new market opportunities and driving revenue growth for both

Report Scope

Report Features Description Market Value (2024) US$ 7.9 billion Forecast Revenue (2034) US$ 94.0 billion CAGR (2025-2034) 28.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug (Vitamin E & Pioglitazone, Semaglutide, Obeticholic Acid (OCA), Lanifibranor, and Others), By Disease Stage (NASH Stage F4, NASH Stage F3, NASH Stage F2, NASH Stage F1, and NASH Stage F0), By Distribution Channel (Hospital Pharmacies, Retail & Specialty Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The Bristol-Myers Squibb Company, Shilpa Medicare, Novo Nordisk A/S, NGM Biopharmaceuticals, Inc, Madrigal Pharmaceuticals Inc, Inventiva, Galmed Pharmaceuticals Ltd, AbbVie Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Non-alcoholic Steatohepatitis Treatment MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Non-alcoholic Steatohepatitis Treatment MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- The Bristol-Myers Squibb Company

- Shilpa Medicare

- Novo Nordisk A/S

- NGM Biopharmaceuticals, Inc

- Madrigal Pharmaceuticals Inc

- Inventiva

- Galmed Pharmaceuticals Ltd

- AbbVie Inc