Global No-Code Robotics Platforms Market By Component (Platform (Visual Workflow, Form-based, Others), Services (Professional Services, Managed Services)), By Deployment Mode (On-Premises, Cloud-based), By Application (Inspection & Monitoring, Customer Interaction & Service, Data Collection & Mapping, Repetitive Manipulation Tasks, Others), By Enterprise Size (Small & Medium Enterprises, Large Enterprises), By End-User (Industrial, Commercial, Educational, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 170760

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Component Analysis

- Deployment Mode Analysis

- Application Analysis

- Enterprise Size Analysis

- End-User Analysis

- Key Reasons for Adoption

- Investment and Business Benefits

- Key Benefits

- Key Usage Areas

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Opportunities & Threats

- Key Challenges

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

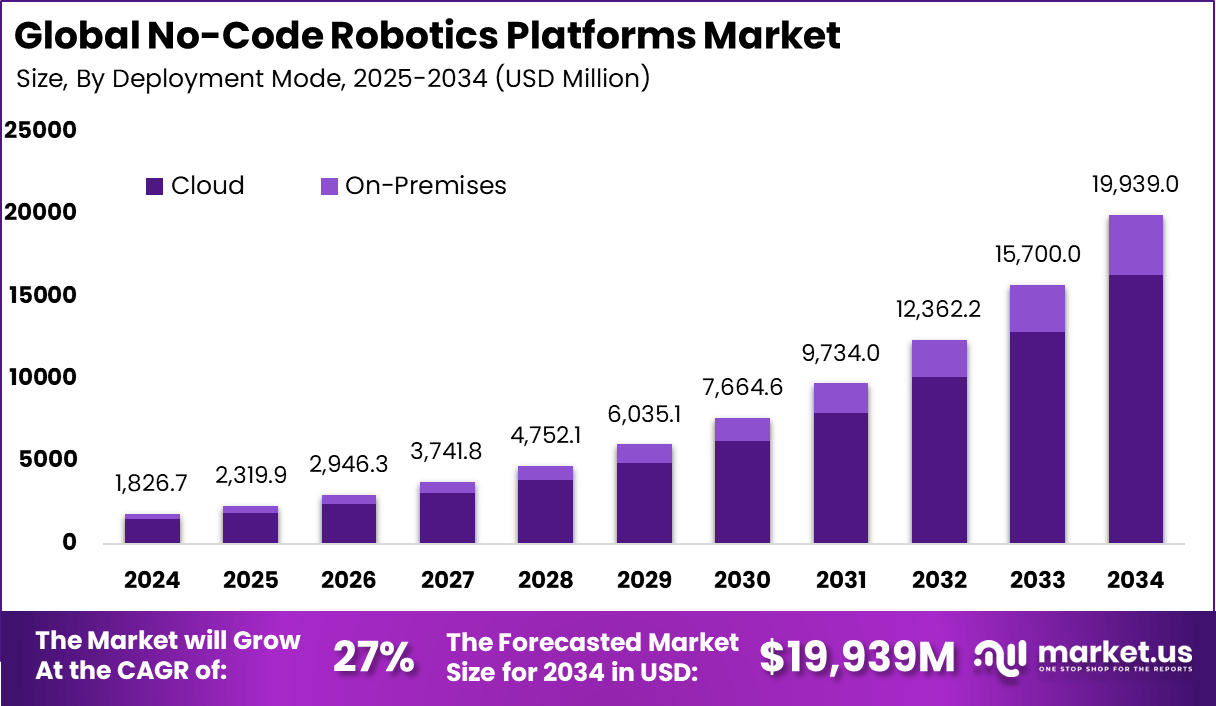

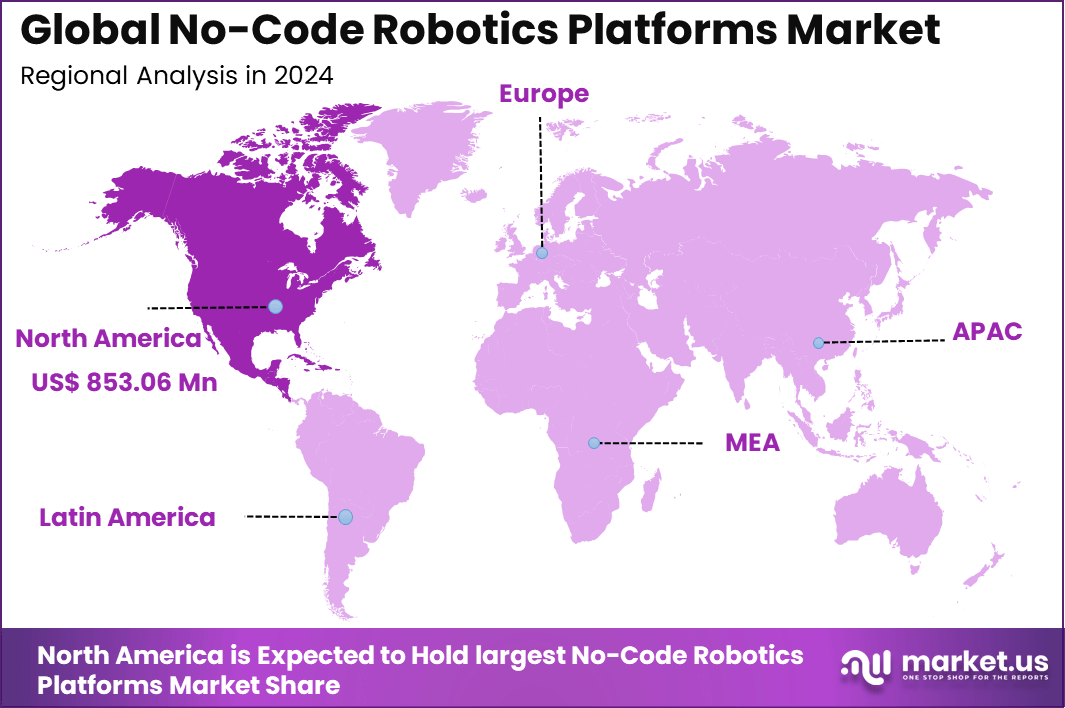

The Global No-Code Robotics Platforms Market generated USD 1826.7 million in 2024 and is predicted to register growth from USD 2,319.9 million in 2025 to about USD 19,939 million by 2034, recording a CAGR of 27% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 46.7% share, holding USD 853.06 Million revenue.

The no-code robotics platforms market refers to software and interface solutions that allow users to configure, control, and deploy robotic automation without writing traditional programming code. These platforms typically use visual interfaces, drag-and-drop tools, and pre-designed templates to enable operators, engineers, and even non-technical staff to build robotic workflows. This approach lowers barriers to robot adoption by reducing the need for specialized programming expertise and shortening deployment timelines.

No-code robotics is part of a broader trend where industrial and enterprise automation becomes more accessible across organizational roles and skill levels. This market plays a crucial role in expanding access to robotics automation across industries such as manufacturing, logistics, warehousing, healthcare, and more. By simplifying robot programming and setup, it allows companies to integrate robots into processes like pick-and-place, inspection, material handling, and repetitive task execution more quickly and with fewer technical resources.

Growth in this market is driven by the need to democratize automation and improve productivity without investing heavily in specialized robotics engineers. Traditional robot programming requires deep technical knowledge, but no-code platforms replace this with intuitive interfaces that can drastically cut setup time from weeks to days or even hours. Developers are increasingly combining drag-and-drop robotics tools with artificial intelligence and machine vision to further simplify complex tasks.

Demand for no-code robotics platforms is rising as businesses seek to reduce costs, streamline operations, and improve agility. In manufacturing, logistics, and warehousing, robotic solutions are increasingly evaluated not just for high-volume production but also for flexible task automation in dynamic environments. Surveys of industrial automation initiatives show that a significant share of organizations are prioritizing user-friendly robotics interfaces to overcome internal skill shortages and accelerate operational improvements.

Top Market Takeaways

- By component, platforms took 73.4% of the no-code robotics platforms market, as they let users build robot tasks without writing code.

- By deployment mode, cloud-based solutions held 81.8% share, offering easy access and updates from anywhere.

- By application, repetitive manipulation tasks led with 34.2%, used for simple picking, placing, and sorting jobs.

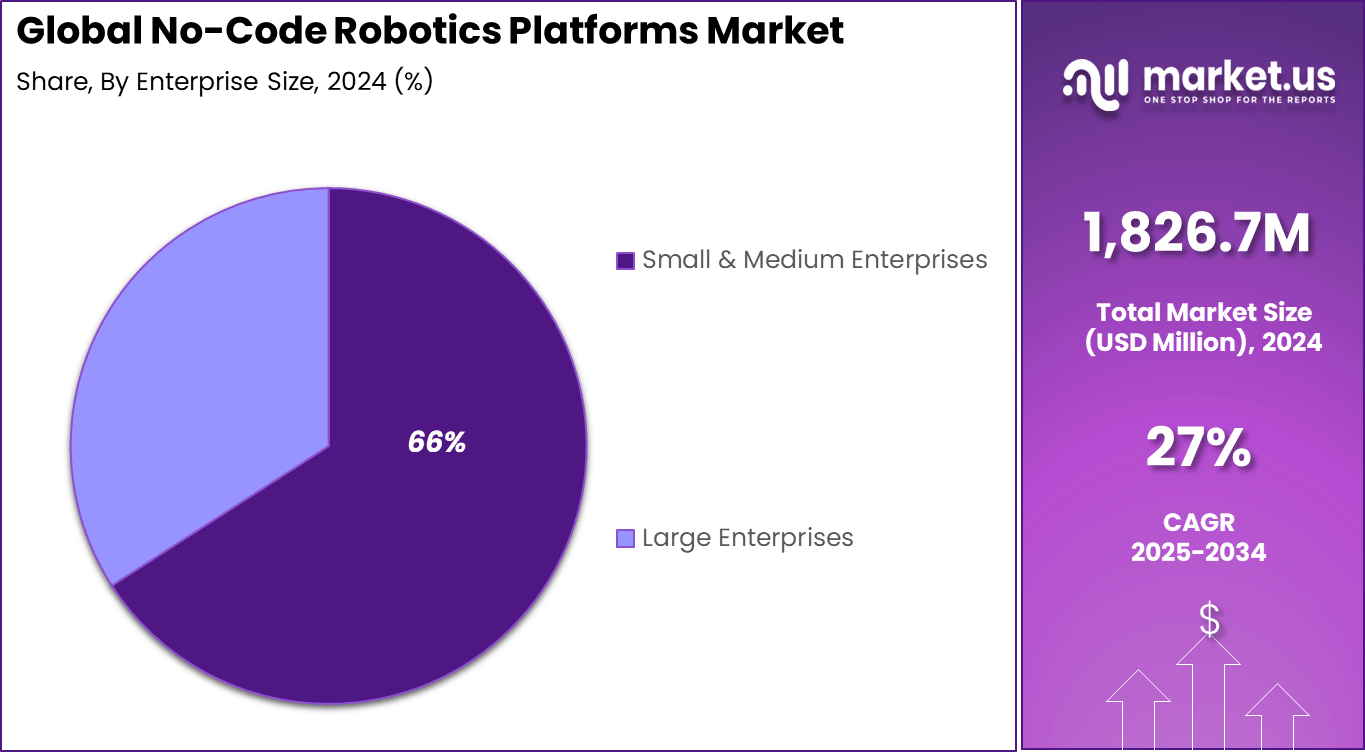

- By enterprise size, small and medium enterprises captured 65.9%, as no-code tools lower costs and speed up setup for smaller firms.

- By end-user, industrial users accounted for 56.3%, applying platforms to factory work like assembly and packaging.

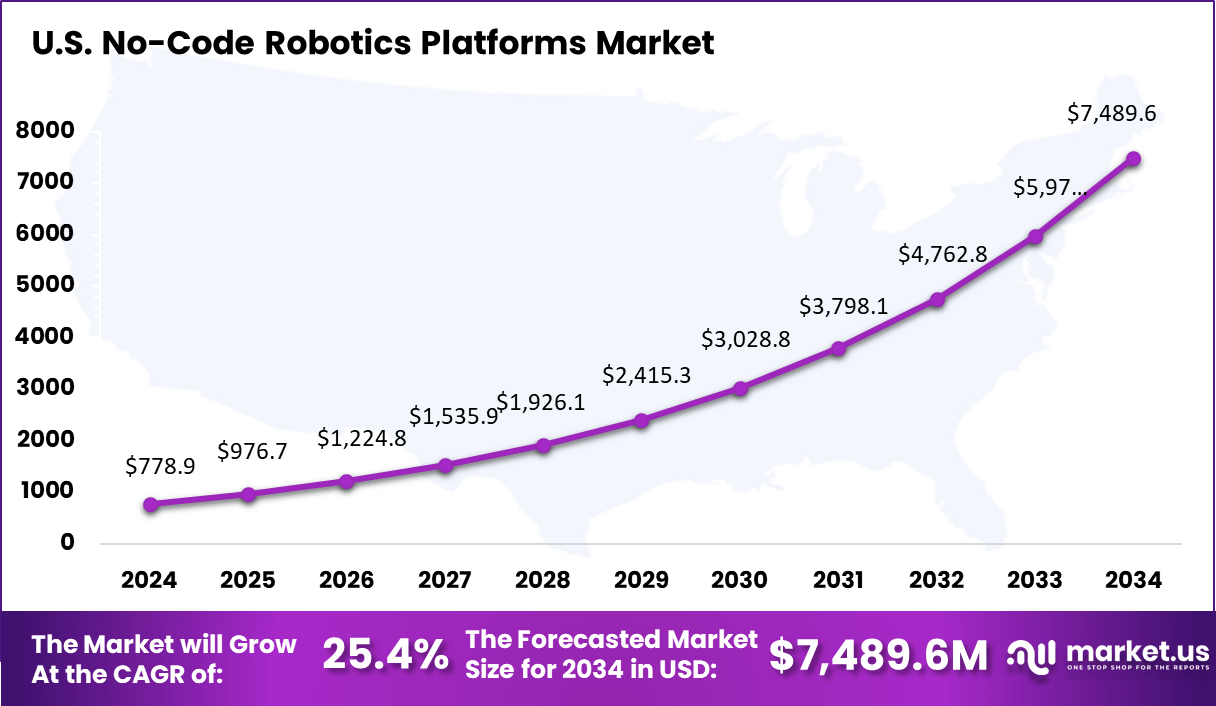

- North America had 46.7% of the global market, with the U.S. at USD 778.9 million in 2025 and growing at a CAGR of 25.4%.

Component Analysis

The platform segment holds 73.4% of the No-Code Robotics Platforms market, showing that most value in this market is created at the software platform level. These platforms allow users to design, configure, and deploy robotic tasks without writing code. Visual interfaces, drag and drop workflows, and prebuilt logic blocks make it possible for non-technical users to control robots effectively. This reduces dependency on specialized robotics programmers and shortens deployment time.

From a business perspective, platform-based solutions support faster experimentation and easier scaling across different robotic systems. Companies can reuse workflows, update tasks quickly, and standardize operations across sites. The strong share of this segment reflects growing demand for user-friendly robotics solutions that lower technical barriers while maintaining operational reliability and flexibility.

Deployment Mode Analysis

Cloud-based deployment dominates the market with a share of 81.8%, driven by ease of access and centralized management. Cloud platforms allow users to design and manage robotic workflows from any location while maintaining a single system of control. This is especially valuable for organizations operating multiple robots across different sites. Cloud deployment also supports automatic updates and continuous feature improvements without local system maintenance.

Another key factor supporting cloud adoption is scalability. As robotic usage grows, cloud platforms can handle increased data and workflow complexity without requiring additional on-site infrastructure. This deployment model also reduces upfront costs and simplifies integration with other digital tools. The high share of cloud-based systems highlights the market’s preference for flexible and cost-efficient deployment options.

Application Analysis

Repetitive manipulation tasks account for 34.2% of application demand, making them a primary use case for no-code robotics platforms. These tasks include picking, placing, sorting, and basic assembly operations that follow consistent patterns. No-code platforms are well suited for these applications because workflows can be created quickly and adjusted easily without deep technical expertise.

The adoption of no-code tools for repetitive tasks also supports workforce productivity. Operators can modify robot behavior in response to process changes without waiting for software specialists. This flexibility reduces downtime and helps businesses respond faster to operational needs. The strong presence of this application segment reflects the practical value of no-code robotics in simplifying everyday industrial tasks.

Enterprise Size Analysis

Small and medium enterprises represent 66% of the market, showing that no-code robotics platforms strongly appeal to resource-limited organizations. SMEs often lack in-house robotics engineers and large IT teams. No-code platforms enable these businesses to adopt automation with minimal technical investment and faster return on effort.

For SMEs, the ability to deploy and adjust robotic workflows independently is a major advantage. Cloud-based and platform-centric solutions reduce complexity and operational risk. The high adoption among SMEs reflects a broader shift toward democratized automation, where advanced robotics tools become accessible to smaller businesses seeking efficiency and competitiveness.

End-User Analysis

The industrial segment accounts for 56.3% of end-user adoption, driven by manufacturing and production environments seeking flexible automation solutions. Industrial users apply no-code robotics platforms to streamline operations, reduce manual workload, and improve consistency in repetitive processes. These platforms allow quick setup and adjustment of robots without disrupting ongoing production.

Industrial organizations also value the ability to standardize robotic workflows across different machines and facilities. No-code platforms support faster training of operators and reduce dependence on external system integrators. The strong share of industrial end users highlights how no-code robotics is becoming an important tool for improving efficiency and adaptability in modern industrial operations.

Key Reasons for Adoption

Key technologies supporting adoption include visual programming interfaces, integrated machine vision, AI-assisted task selection, and cloud connectivity for centralized robot management. These features allow platforms to abstract programming complexity and provide real-time feedback, enabling quicker learning and iteration. Integration with digital twin and simulation tools further supports planning and validation before robots operate on physical floors.

Organizations adopt no-code robotics platforms to reduce time to deployment, lower training costs, and expand the pool of users who can configure robotic systems. These platforms enable teams with domain expertise in processes (rather than coding) to contribute directly to automation tasks. Faster onboarding and reduced dependency on specialist programmers improve operational scalability and help maintain continuity in environments where staff turnover is high.

Investment and Business Benefits

Investment opportunities exist in platform development, drag-and-drop interface enhancements, and AI integration to support intelligent automation decision making. Startups and software providers can also explore vertical-specific solutions tailored to industries such as food processing, electronics assembly, and healthcare automation. Demand for managed services, training, and support around no-code robotics platforms presents additional opportunities as organizations adopt these systems at scale.

No-code robotics platforms provide measurable business benefits, including reduced deployment time, lower dependency on specialist programmers, and improved flexibility to respond to operational changes. By enabling a broader set of users to participate in robotics configuration, organizations can iterate faster, reduce errors related to misconfiguration, and elevate workforce productivity. Automation tasks can be scaled more confidently as confidence in robotic performance grows.

Key Benefits

- Lower development time supports quicker automation rollout

- Cost efficiency improves due to reduced coding effort

- User friendly interfaces improve workforce adoption

- Flexible workflows allow quick process adjustments

- Better collaboration between operations and IT teams

Key Usage Areas

- Manufacturing for configuring robotic tasks and workflows

- Warehousing for setting up pick and place operations

- Healthcare for simple service and assistive robots

- Education and training for robotics learning programs

- Small and mid sized enterprises adopting automation

Emerging Trends

Key Trend Description Drag Drop Robot Build Visual blocks allow users to create robot tasks without writing code. AI Auto Smart Help AI adds decision making support to robots using simple click based tools. Visual Flow Charts Robot workflows are designed like maps, removing the need for text coding. Cloud Team Share Robot programs are built online so teams can edit and update together. Link Easy Sensors Sensors, cameras, and arms connect easily with automatic setup. Growth Factors

Key Factors Description Few Code Experts Low code platforms allow non technical workers to build robot tasks quickly. Quick Test New Ideas Robot tasks can be changed and tested within hours instead of weeks. Factory Need Speed Manufacturing plants want fast robot setup without waiting for programmers. Low Cost Start Affordable tools help small businesses try robotics with limited investment. Big Robot Spread Growing robot adoption increases demand for easy to use development platforms. Key Market Segments

By Component

- Platform

- Visual Workflow

- Form-based

- Others

- Services

- Professional Services

- Managed Services

By Deployment Mode

- On-Premises

- Cloud-based

By Application

- Inspection & Monitoring

- Customer Interaction & Service

- Data Collection & Mapping

- Repetitive Manipulation Tasks

- Others

By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

By End-User

- Industrial

- Commercial

- Educational

- Others

Regional Analysis

North America held 46.7% share, driven by early adoption of software driven automation and strong demand for flexible robotics solutions across manufacturing, logistics, healthcare, and research environments. No code robotics platforms have gained traction as they allow operators with limited programming knowledge to configure, deploy, and modify robot tasks quickly.

This has reduced reliance on specialized engineers and shortened deployment cycles. Demand has also been supported by high labor costs and the need for faster automation returns, where easy to use platforms help organizations scale robotics without complex integration work.

The U.S. market reached USD 778.9 Mn and is projected to grow at a 25.4% CAGR, reflecting strong investment in automation software and digital manufacturing. Adoption has been concentrated among small and mid sized enterprises that seek automation but lack in house robotics expertise. No code platforms allow these users to implement robotic solutions for material handling, inspection, and assembly without long development timelines or high upfront costs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Opportunities & Threats

The No Code Robotics Platforms market offers strong opportunities as more companies look to adopt robots without relying on complex programming skills. These platforms allow users to design robot tasks through visual interfaces, drag and drop tools, and simple logic blocks. T

his approach reduces development time and helps businesses deploy robots faster across manufacturing, logistics, healthcare, and service environments. Growing labor shortages and the need for flexible automation are pushing demand for tools that can be used by operators, technicians, and engineers with limited coding experience.

The market faces threats related to performance limits and user expectations. No code platforms may not handle highly complex or specialized robotic tasks as efficiently as traditional programming approaches. This can lead to disappointment when users attempt to apply them beyond their practical scope. In industries with strict safety and reliability requirements, concerns about system control and validation may slow adoption.

Another threat is growing competition from low cost proprietary robot software and open source tools. Some robot manufacturers offer built in interfaces that reduce the need for third party platforms. Rapid technology change also creates risk, as platforms must continuously update features to stay compatible with new robots and sensors. Budget constraints and uncertainty around long term platform support can further affect buying decisions.

Key Challenges

- Limited flexibility for advanced or highly customized robot tasks

- Dependence on platform updates and vendor support

- Integration challenges with existing IT and automation systems

- User training needed to avoid workflow and safety errors

- Ensuring reliability and compliance in regulated environments

Competitive Analysis

The competitive landscape of the no-code robotics platforms market is shaped by the combination of robotic process automation software and industrial automation providers that aim to simplify robot and workflow programming. UiPath, Automation Anywhere, Blue Prism, ABBYY, WorkFusion, Kryon Systems, Softomotive, Nintex, ServiceNow, Pega Systems, Appian, and OutSystems compete by offering visual, drag and drop environments that allow non technical users to design, deploy, and manage automated tasks with limited coding effort.

Their strength lies in rapid deployment, strong community support, and integration with enterprise systems, which makes these platforms attractive for organizations seeking faster automation without deep engineering resources.

At the same time, industrial automation and robotics vendors such as ABB Robotics, KUKA, Siemens, Rockwell Automation, Mitsubishi Electric, and FANUC are extending no-code capabilities into robot programming, cell setup, and production workflows. Competition increasingly centers on ease of use, scalability across multiple robots or processes, security, and interoperability between IT and OT environments.

The presence of others reflects emerging software providers and system integrators offering lightweight or domain specific no-code solutions, which increases choice for end users and puts pressure on established vendors to improve usability, flexibility, and total cost of ownership.

Top Key Players in the Market

- UiPath

- Automation Anywhere

- Blue Prism

- ABBYY

- KUKA

- Siemens

- Rockwell Automation

- ABB Robotics

- Pega Systems

- Appian

- OutSystems

- Mitsubishi Electric

- FANUC

- UiPath Robotics Process Automation

- Softomotive

- WorkFusion

- Kryon Systems

- Nintex

- ServiceNow

- Others

Future Outlook

The future outlook for the No-Code Robotics Platforms market is expected to remain positive as more companies aim to adopt automation without relying heavily on robotics programmers. These platforms allow users to create, test, and adjust robot tasks using visual tools, which reduces setup time and lowers training effort.

Growing use of collaborative robots and service robots is supporting demand, as no-code tools fit well in environments where tasks change often. In the coming years, better integration with vision systems, sensors, and AI based decision tools is likely to expand platform capabilities, making robots easier to deploy across manufacturing, logistics, and service operations.

Opportunities lie in

- Automation adoption by non technical users: Simple interfaces can enable operators, supervisors, and engineers to build robot workflows without coding skills.

- Rapid reconfiguration for changing tasks: No-code tools support quick updates when products, layouts, or processes change.

- Expansion into education and training: Platforms can be used for skill development and early robotics exposure with minimal technical barriers.

Recent Developments

- September, 2025, UiPath introduced Fusion updates including Agent Sandbox so users can build automations with natural language and low code in one place.

- November, 2025, Automation Anywhere promoted its agentic process automation platform that blends AI and no‑code RPA for end‑to‑end business processes.

Report Scope

Report Features Description Market Value (2024) USD 1,826.7 Mn Forecast Revenue (2034) USD 19,939 Mn CAGR(2025-2034) 27% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Platform (Visual Workflow, Form-based, Others), Services (Professional Services, Managed Services)), By Deployment Mode (On-Premises, Cloud-based), By Application (Inspection & Monitoring, Customer Interaction & Service, Data Collection & Mapping, Repetitive Manipulation Tasks, Others), By Enterprise Size (Small & Medium Enterprises, Large Enterprises), By End-User (Industrial, Commercial, Educational, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape UiPath, Automation Anywhere, Blue Prism, ABBYY, KUKA, Siemens, Rockwell Automation, ABB Robotics, Pega Systems, Appian, OutSystems, Mitsubishi Electric, FANUC, UiPath Robotics Process Automation, Softomotive, WorkFusion, Kryon Systems, Nintex, ServiceNow, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  No-Code Robotics Platforms MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

No-Code Robotics Platforms MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- UiPath

- Automation Anywhere

- Blue Prism

- ABBYY

- KUKA

- Siemens

- Rockwell Automation

- ABB Robotics

- Pega Systems

- Appian

- OutSystems

- Mitsubishi Electric

- FANUC

- UiPath Robotics Process Automation

- Softomotive

- WorkFusion

- Kryon Systems

- Nintex

- ServiceNow

- Others