Global Nickel Market By Class Type(Class 1 (99.8%), Class 2 (Less than 99.8%), Nickel Alloys), By Application(Stainless Steel, Special Steels, Batteries, Electroplating, Alloys, Others), By End-Use(Transportation and Defense, Fabricated Metal Products, Electrical and Electronics, Chemical, Petrochemical, Construction, Consumer Durables, Industrial Machinery, Others) Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sep 2024

- Report ID: 128617

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

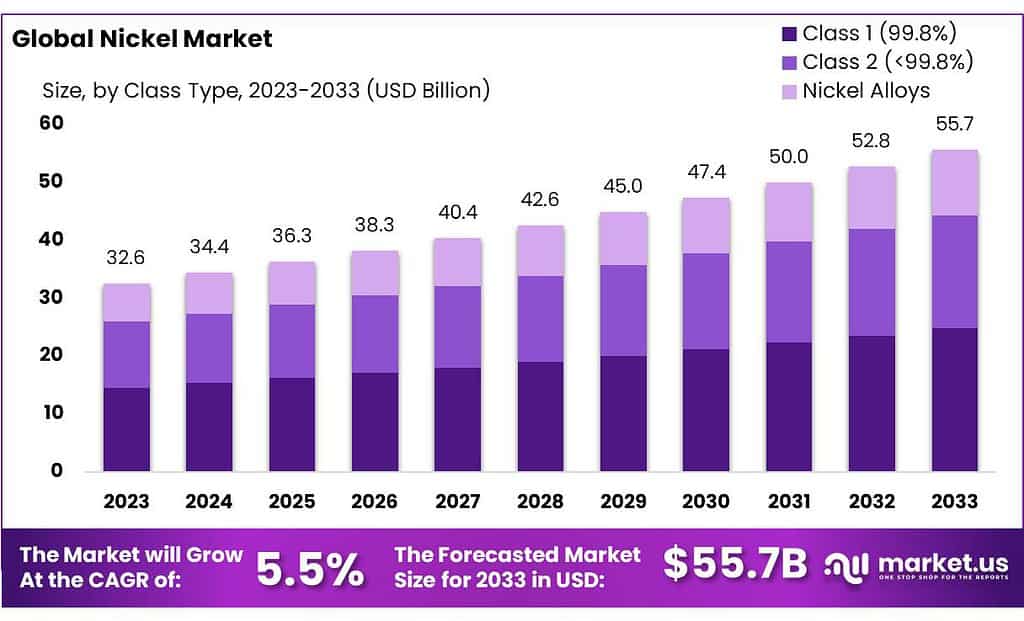

The global Nickel Market size is expected to be worth around USD 55.7 billion by 2033, from USD 32.6 billion in 2023, growing at a CAGR of 5.5% during the forecast period from 2023 to 2033.

The global nickel market is integral to numerous industries, driven by its essential role in producing stainless steel, alloys, and batteries. Nickel’s exceptional properties, such as corrosion resistance, high strength, and temperature resilience, make it indispensable in diverse sectors.

In 2023, global nickel production was approximately 2.5 million metric tons, with significant contributions from Indonesia and the Philippines. The stainless steel industry, consuming about 70% of this production, heavily influences nickel demand, leveraging it primarily in construction, automotive, and consumer goods manufacturing.

Additionally, the burgeoning electric vehicle (EV) sector has amplified the demand for nickel, essential in lithium-ion battery production, which is pivotal for both EVs and energy storage solutions. Alloy production, another significant end-use of nickel, incorporates it into nickel-chromium and nickel-cobalt alloys for aerospace, electronics, and power generation applications.

Trade dynamics are crucial in the nickel market, with Indonesia emerging as the top exporter by shipping approximately 150,000 metric tons in 2023. In contrast, China stands as the primary importer, bringing in around 450,000 metric tons, accounting for about 40% of global nickel imports.

This trade is heavily influenced by government policies, including environmental regulations aimed at reducing the mining and processing impact, and export controls designed to boost domestic processing and add value within exporting countries like Indonesia. These elements collectively shape the complex and dynamic landscape of the global nickel market.

Key Takeaways

- The global nickel market is set to grow from USD 32.6 billion in 2023 to USD 55.7 billion by 2033, at a 5.5% CAGR.

- Class 1 (99.8%) nickel held a dominant market position, capturing more than a 44.6% share.

- Stainless steel consumed about 70% of global nickel production in 2023, driving demand in the construction, automotive, and consumer goods sectors.

- Asia Pacific holds 46.6% of the global nickel market share, valued at USD 15.1 billion, driven by China and Indonesia.

- Transportation & Defense used over 22.1% of global nickel in 2023, crucial for vehicles and defense equipment due to its durability.

By Class Type

In 2023, Class 1 (99.8%) nickel held a dominant market position, capturing more than a 44.6% share. This high-purity nickel is primarily used in industries where superior quality is crucial, such as the manufacturing of lithium-ion batteries and special alloys. The demand in this segment is driven by the increasing adoption of electric vehicles and energy storage solutions, which require high-performance materials to enhance efficiency and battery life.

On the other hand, Class 2 nickel, which contains less than 99.8% nickel, caters to a wide range of applications that do not require the highest purity levels. This class is extensively used in the production of stainless steel and other nickel alloys, which are integral to construction and manufacturing industries. Although it commands a smaller portion of the market compared to Class 1, its versatility makes it indispensable across numerous sectors.

Nickel alloys represent a significant segment in the market, valued for their exceptional resistance to corrosion and ability to perform under high temperatures. These alloys are crucial in challenging environments such as aerospace, marine, and chemical processing industries. The unique properties of nickel alloys allow for their use in critical safety components, thus driving their demand in specialized applications.

By Application

In 2023, Stainless Steel held a dominant market position in the nickel application segments, capturing more than a 58.9% share. This segment benefits primarily from the widespread use of stainless steel in construction, automotive, and consumer goods due to its durability and resistance to corrosion. The robust demand is propelled by global urbanization and industrial growth, driving substantial consumption of nickel.

Special steels also represent a vital application for nickel, enhancing the material’s strength and resistance in demanding industrial environments. These steels are critical in the manufacturing of machinery and infrastructure where exceptional performance under stress is required.

Nickel usage in batteries, particularly for electric vehicles and portable electronics, is rapidly growing. This segment benefits from the global shift towards renewable energy and cleaner transportation solutions, where nickel is crucial for high-density energy storage in lithium-ion batteries.

Electroplating is another significant application where nickel’s properties are utilized to enhance the durability and aesthetic appeal of metals. Commonly used in automotive and electronics, nickel electroplating ensures products withstand wear and environmental factors.

Alloys segment utilizes nickel to improve metal characteristics such as heat resistance and physical strength, making it essential in aerospace, military, and high-temperature engineering applications.

By End-Use

In 2023, Transportation & Defense held a dominant market position in the nickel end-use segments, capturing more than a 22.1% share. This sector heavily relies on nickel for manufacturing vehicles and defense equipment due to its corrosion resistance and durability. The steady demand in this segment is supported by ongoing investments in infrastructure and military modernization globally.

Fabricated Metal Products also utilize nickel to enhance product quality and longevity. This application is crucial in creating components that must withstand extreme conditions, supporting industries like aerospace and construction.

The Electrical & Electronics sector benefits from nickel in producing durable and reliable devices. Its conductive properties make it ideal for a variety of electronic components, driving its demand in this rapidly evolving market.

Nickel’s role in the Chemical industry is indispensable, particularly in catalysts that facilitate chemical reactions. This segment leverages nickel’s reactive properties to improve process efficiencies, crucial for producing a wide range of chemical products.

In the Petrochemical sector, nickel is used in high-performance alloys that resist extreme temperatures and corrosive environments, essential for processing and refining applications.

The Construction industry, where nickel strengthens and protects structures against environmental challenges, continues to demand substantial amounts of this metal, mirroring the growth in global construction activities.

Consumer Durables, including appliances and fixtures, benefit from nickel’s aesthetic and protective properties, ensuring long-lasting and visually appealing products.

Industrial Machinery relies on nickel to enhance the performance and longevity of machines used in heavy industries, underscoring its importance in manufacturing and production lines.

Key Market Segments

By Class Type

- Class 1 (99.8%)

- Class 2 (<99.8%)

- Nickel Alloys

By Application

- Stainless Steel

- Special Steels

- Batteries

- Electroplating

- Alloys

- Others

By End-Use

- Transportation & Defense

- Fabricated Metal Products

- Electrical & Electronics

- Chemical

- Petrochemical

- Construction

- Consumer Durables

- Industrial Machinery

- Others

Drivers

Increasing Demand from Electric Vehicles (EVs)

The nickel market is witnessing significant growth driven by the increasing demand for electric vehicles (EVs). Nickel is a key component in the production of high-density energy storage solutions like lithium-ion batteries used in EVs. In 2024, the demand for nickel in battery applications is expected to continue rising, driven by the EV sector’s expansion and the ongoing global shift towards renewable energy sources.

Technological advancements in battery production are also playing a crucial role. Innovations aimed at increasing the energy density and efficiency of batteries are expected to boost the use of nickel, as it is essential for enhancing battery performance. The development of nickel-manganese-cobalt (NMC) cathodes, which require substantial amounts of nickel, highlights the metal’s critical role in the evolution of battery technology.

Moreover, government initiatives around the world are fostering the growth of the EV market and clean energy technologies, indirectly benefiting the nickel industry. Policies supporting the adoption of EVs, incentives for renewable energy projects, and investments in technology development are all contributing to increased nickel usage.

According to the International Nickel Study Group, despite a forecasted surplus in 2024 due to robust production, demand is set to grow from 3.195 million metric tons in 2023 to 3.474 million metric tons in 2024. This growth is largely fueled by the recovery of the stainless steel sector and the increasing application of nickel in EV batteries, which now account for almost 17% of total nickel demand.

These factors collectively indicate a strong market position for nickel, bolstered by both the automotive industry’s evolution and advancements in energy storage technologies. The continuous development and adoption of nickel-intensive technologies across various industries underscore the metal’s growing importance and its potential for sustained demand in the future.

Restraints

Environmental Impact of Nickel Mining: Nickel mining and processing are notably impactful on the environment, contributing to significant soil, water, and air pollution. The process of extracting nickel, especially through open-pit mining, often leads to deforestation, soil erosion, and contamination of water bodies with toxic chemicals used in the extraction process. For instance, nickel production in Indonesia, one of the largest nickel-producing countries, has resulted in environmental degradation in regions like Sulawesi, where deforestation rates have increased to make way for nickel mines.

Stringent Environmental Regulations: In response to these environmental concerns, governments and international bodies have implemented stringent regulations that restrict nickel mining activities and impose heavy penalties for non-compliance. The European Union’s REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulations have set strict guidelines on the use of nickel, especially in applications that involve prolonged contact with human skin, due to its allergenic properties. These regulations require companies to develop more environmentally friendly mining practices, increasing operational costs and potentially limiting market growth.

Community Resistance and Social Licenses to Operate: Community resistance has grown as awareness of environmental issues increases. Local communities, particularly in developing countries, have been more vocal in their opposition to mining projects due to the adverse environmental impacts and displacement issues. Obtaining social licenses to operate has become more challenging, delaying project approvals and increasing costs for mining companies. For example, in New Caledonia, protests by local groups have led to several disruptions in nickel operations, demanding better environmental practices and greater economic benefits for local populations.

Carbon Footprint and the Shift Toward Greener Alternatives: The high carbon footprint of nickel mining, largely due to reliance on fossil fuels in the extraction and refining processes, poses another significant challenge. As the global economy shifts towards greener and more sustainable practices, the pressure is on the nickel industry to innovate and reduce its carbon emissions. This transition requires substantial investment in cleaner technologies, which can be a barrier for smaller or less financially stable producers.

Impact on Market Dynamics: These environmental and regulatory challenges have a profound impact on the nickel market, affecting everything from production costs to supply chains. The International Energy Agency (IEA) has reported that the mining sector, including nickel, is under increasing pressure to reduce environmental impact, which could lead to higher prices for nickel as producers pass on the costs of compliance to consumers.

Opportunities

Rising Demand for Electric Vehicles (EVs): The surge in electric vehicle (EV) adoption represents a significant growth opportunity for the nickel market. Nickel is a critical component in lithium-ion batteries, which power most electric vehicles. In 2023, global EV sales reached approximately 10.7 million units, up from 6.6 million in 2021, marking a 62% increase within just two years. The International Energy Agency (IEA) projects that by 2030, the number of electric vehicles on the road could reach 230 million, requiring substantial amounts of nickel for battery production.

Government Initiatives and Policies: Government policies and incentives aimed at reducing carbon emissions and promoting renewable energy are driving increased demand for nickel. For instance, the U.S. and European Union have implemented various subsidies and tax breaks for EV purchases and investments in clean energy technologies. In the U.S., the Inflation Reduction Act of 2022 provides substantial tax credits for electric vehicles and renewable energy projects, which is expected to further boost the demand for nickel in battery production.

Technological Advancements in Battery Technologies: Technological advancements in battery technologies are also opening new growth avenues for the nickel market. The development of high-nickel batteries, such as Nickel Manganese Cobalt (NMC) and Nickel Cobalt Aluminum (NCA) batteries, offers better energy density and longer lifespan, making them ideal for electric vehicles and large-scale energy storage systems. In 2024, it is anticipated that high-nickel batteries will dominate the market, further increasing the demand for nickel.

Expansion of Renewable Energy Infrastructure: The expansion of renewable energy infrastructure is another promising growth area. Nickel-based alloys are crucial for manufacturing equipment used in wind turbines, solar panels, and other renewable energy technologies due to their corrosion resistance and durability. According to the International Renewable Energy Agency (IRENA), global investments in renewable energy technologies reached approximately $366 billion in 2023, a 20% increase from the previous year. This investment surge is likely to drive the demand for nickel in the production of renewable energy equipment.

Increasing Industrial Applications: Nickel’s applications in various industrial sectors are expanding, offering additional growth potential. The use of nickel in stainless steel, which accounts for around 70% of global nickel consumption, continues to grow due to its high strength and corrosion resistance. In 2023, global stainless steel production was estimated to be about 51 million metric tons, driven by increased demand from the construction and automotive industries. Additionally, nickel is used in the aerospace and defense sectors for its superior strength-to-weight ratio, contributing to further market growth.

Strategic Investments and Partnerships: Strategic investments and partnerships within the nickel industry are also fueling growth. Companies are investing in new mining projects and expanding existing operations to meet the rising demand for nickel. For example, in 2023, Vale S.A., a major nickel producer, announced a $2.5 billion investment to expand its nickel production capacity in Canada, aiming to increase output by 20% over the next five years. Such investments are expected to enhance supply and support market growth.

Latest Trends

High-Purity Nickel Demand in Battery Production: One of the most significant trends in the nickel market is the increasing demand for high-purity nickel, particularly in the production of advanced lithium-ion batteries. As the electric vehicle (EV) market continues to expand, the need for batteries with higher energy density and greater efficiency has surged. High-purity nickel is crucial in this context because it helps to increase the energy storage capacity of batteries, thereby extending the driving range of EVs.

Growth of the Electric Vehicle Market: The growth of the electric vehicle market is a primary driver behind this trend. According to the International Energy Agency (IEA), the global stock of electric cars is projected to reach 145 million by 2030 under current policies, and up to 230 million if more aggressive policy actions are taken to combat climate change. This massive uptick in EV adoption directly correlates with increased demand for nickel, as nickel-based cathodes, such as nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminum (NCA), are preferred for most electric vehicle batteries.

Government Initiatives Supporting Nickel Usage: Governments worldwide are supporting this trend through various initiatives and regulations that encourage the use of clean energy technologies. For example, the European Union’s Green Deal and the United States federal incentives for clean energy technologies are accelerating the shift towards the electrification of transport and renewable energy storage solutions. These initiatives often include subsidies for EV purchases, grants for battery manufacturing, and investments in battery recycling technologies, all of which increase the demand for high-purity nickel.

Technological Innovations in Nickel Refining: Technological innovations in nickel refining processes are also playing a critical role. Companies are increasingly investing in methods to produce high-purity nickel more efficiently and sustainably. New technologies are being developed to reduce the environmental impact of nickel mining and processing, making the industry more aligned with global sustainability goals. These advancements not only improve the environmental footprint of nickel production but also reduce costs, making high-purity nickel more accessible for battery manufacturers.

Impact on Supply Chains: The rising demand for high-purity nickel is reshaping global nickel supply chains. Mining companies are expanding their operations in regions rich in nickel resources, such as Indonesia and the Philippines, to meet the growing market demand. Moreover, there is an increasing focus on securing stable and sustainable nickel supplies, leading to strategic partnerships and investments across the battery and automotive industries.

Regional Analysis

The global nickel market exhibits notable regional disparities, with Asia Pacific (APAC) emerging as the dominant region, accounting for 46.6% of the global market share, valued at approximately USD 15.1 billion. This significant market presence is driven by the robust industrial activities in countries such as China and Indonesia, where nickel is extensively utilized in stainless steel production and battery manufacturing.

In North America, the nickel market is characterized by a steady growth trajectory, supported by increasing demand for electric vehicles and energy storage solutions. The region’s market value is projected to experience moderate expansion, driven by advancements in battery technology and automotive applications.

Europe also reflects a growing interest in nickel, largely due to its critical role in the production of high-grade stainless steels and the rising focus on sustainable energy solutions. The European market benefits from substantial investments in nickel mining and processing facilities, aimed at supporting the region’s green energy transition.

The Middle East & Africa (MEA) region presents a more nascent but potentially lucrative market for nickel, with emerging industrial activities and infrastructure projects. The region’s market development is supported by investments in mining and resource extraction, although it currently holds a smaller share compared to APAC and Europe.

Latin America, while not as dominant, remains a key player in the global nickel market due to its substantial natural reserves and growing mining industry. Countries such as Brazil and Colombia contribute to the regional market’s development, driven by increasing international demand and exploration activities.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The nickel market is dominated by a group of leading global players whose operations span mining, processing, and trading. Anglo American Plc and BHP are prominent figures, leveraging their extensive mining portfolios and technological advancements to influence market dynamics. Glencore and Vale SA also play significant roles, with Vale being a major producer of nickel and Glencore contributing through its comprehensive supply chain capabilities.

Other key players include Norilsk Nickel, now commonly referred to as Nornickel, which is a major global supplier with extensive operations in Russia. The Metallurgical Corporation of China Ltd. and Sumitomo Metal Mining Co., Ltd. are crucial due to their strategic positions in the Asian and Japanese markets, respectively.

Additionally, companies such as First Quantum Minerals Ltd., South32 Ltd., and Sherritt International Corporation contribute to market diversity with their specialized nickel mining and refining operations. Each of these entities shapes the market landscape through their production capacities, technological advancements, and strategic investments, collectively driving the industry’s growth and development.

Top Key Players

- Anglo American Plc

- BHP

- Eramet

- First Quantum Minerals Ltd.

- Glencore

- IGO Ltd.

- Independence Group NL

- Jinchuan Group International Resources Co. Ltd.

- Lundin Mining Corporation

- Metallurgical Corporation of China Ltd.

- MMC Norilsk Nickel

- Norlisk Nickel

- Nornickel (Norilsk Nickel Mining and Metallurgical Co.)

- Rio Tinto

- Sherritt International Corporation

- South32 Ltd.

- Sumitomo Metal Mining Co., Ltd.

- Vale SA

- Western Areas Ltd.

Recent Developments

In 2023 Anglo American Plc, the company produced approximately 31,500 tons of nickel, reflecting a slight increase from previous years due to strategic investments in its nickel assets.

In 2023, BHP’s nickel production reached approximately 86,000 tons, reflecting a stable output from its Nickel West operations in Western Australia.

Report Scope

Report Features Description Market Value (2023) US$ 32.6 Bn Forecast Revenue (2033) US$ 55.7 Bn CAGR (2024-2033) 5.5% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Class Type(Class 1 (99.8%), Class 2 (<99.8%), Nickel Alloys), By Application(Stainless Steel, Special Steels, Batteries, Electroplating, Alloys, Others), By End-Use(Transportation and Defense, Fabricated Metal Products, Electrical and Electronics, Chemical, Petrochemical, Construction, Consumer Durables, Industrial Machinery, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Anglo American Plc, BHP, Eramet, First Quantum Minerals Ltd., Glencore, IGO Ltd., Independence Group NL, Jinchuan Group International Resources Co. Ltd., Lundin Mining Corporation, Metallurgical Corporation of China Ltd., MMC Norilsk Nickel, Norlisk Nickel, Nornickel (Norilsk Nickel Mining and Metallurgical Co.), Rio Tinto, Sherritt International Corporation, South32 Ltd., Sumitomo Metal Mining Co., Ltd., Vale SA, Western Areas Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anglo American Plc

- BHP

- Eramet

- First Quantum Minerals Ltd.

- Glencore

- IGO Ltd.

- Independence Group NL

- Jinchuan Group International Resources Co. Ltd.

- Lundin Mining Corporation

- Metallurgical Corporation of China Ltd.

- MMC Norilsk Nickel

- Norlisk Nickel

- Nornickel (Norilsk Nickel Mining and Metallurgical Co.)

- Rio Tinto

- Sherritt International Corporation

- South32 Ltd.

- Sumitomo Metal Mining Co., Ltd.

- Vale SA

- Western Areas Ltd.