Neutropenia Treatment Market By Treatment (Colony-stimulating Factors, Antifungals, Antibiotics, and Antivirals), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, and Retail Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152425

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

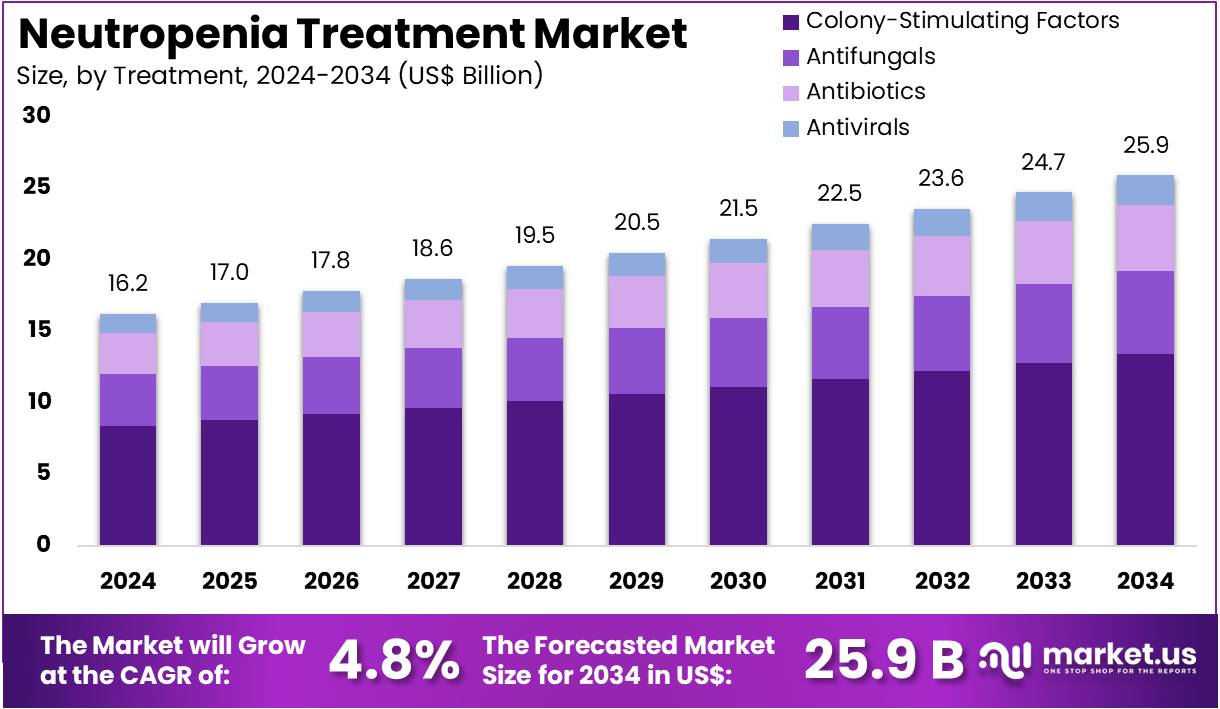

The Neutropenia Treatment Market Size is expected to be worth around US$ 25.9 billion by 2034 from US$ 16.2 billion in 2024, growing at a CAGR of 4.8% during the forecast period 2025 to 2034.

Rising incidence of cancer and the growing use of chemotherapy are driving the demand for neutropenia treatments, as neutropenia—characterized by low levels of neutrophils, a type of white blood cell—commonly results from cancer therapies that suppress bone marrow function. According to the World Health Organization (WHO), in 2022, nearly 20 million new cancer cases and approximately 9.7 million cancer-related deaths occurred globally, contributing significantly to the prevalence of neutropenia.

As cancer treatments become more aggressive, the need for effective treatments to manage neutropenia also increases, ensuring patients maintain a healthy immune system during and after therapy. Growth in biologic therapies and granulocyte colony-stimulating factors (G-CSFs) have improved treatment options, providing effective ways to stimulate the production of neutrophils. The increasing adoption of prophylactic therapies, which help prevent neutropenia before it occurs, presents opportunities for earlier intervention and better management of the condition.

New trends in neutropenia treatment focus on personalized medicine, where patient-specific factors, such as genetic makeup and treatment history, guide therapy choices to improve outcomes and minimize side effects. Additionally, the rise of long-acting injectable treatments is reducing the frequency of hospital visits for patients, improving their quality of life.

Research into novel agents, including those that target specific molecular pathways involved in neutrophil production, continues to offer new opportunities for the treatment of severe neutropenia and its complications. As the understanding of neutropenia deepens, the development of more targeted and effective therapies remains a major focus for healthcare providers and pharmaceutical companies, driving the market forward.

Key Takeaways

- In 2024, the market for neutropenia treatment generated a revenue of US$ 16.2 billion, with a CAGR of 4.8%, and is expected to reach US$ 25.9 billion by the year 2034.

- The treatment segment is divided into colony-stimulating factors, antifungals, antibiotics, and antivirals, with colony-stimulating factors taking the lead in 2023 with a market share of 51.8%.

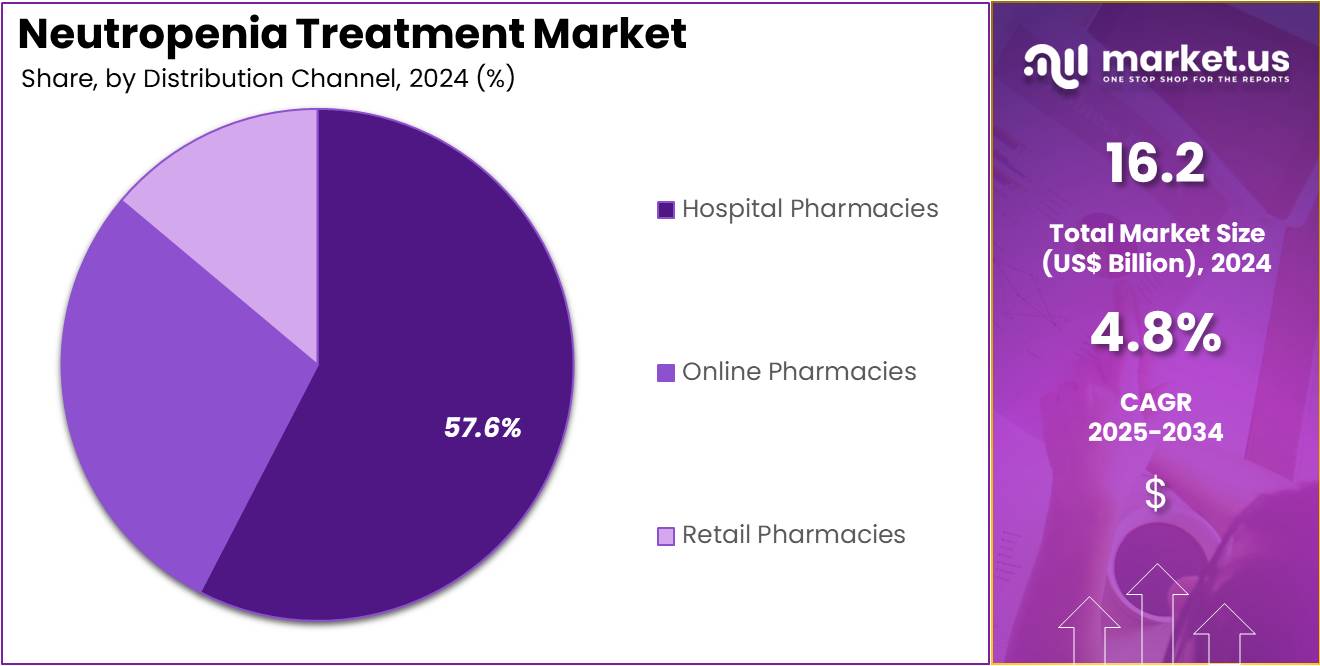

- Considering distribution channel, the market is divided into hospital pharmacies, online pharmacies, and retail pharmacies. Among these, hospital pharmacies held a significant share of 57.6%.

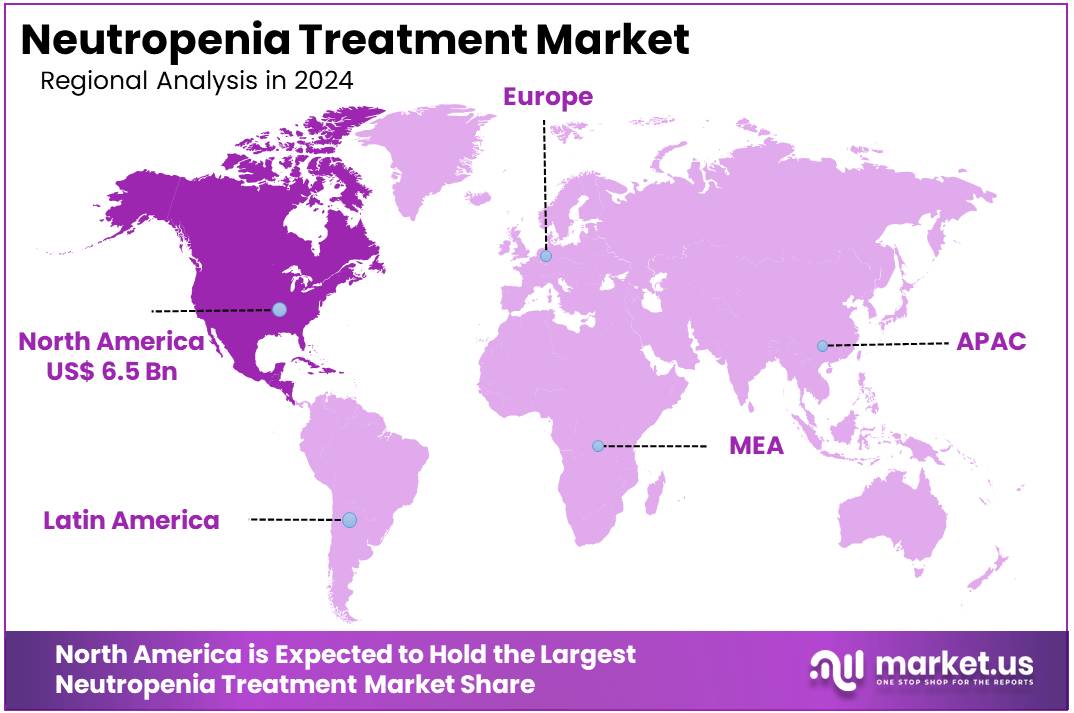

- North America led the market by securing a market share of 39.9% in 2023.

Treatment Analysis

Colony-stimulating factors (CSFs) are expected to dominate the neutropenia treatment market, holding 51.8% of the market share. CSFs, such as granulocyte colony-stimulating factor (G-CSF), are essential in promoting the production of neutrophils to prevent infection in neutropenic patients, especially those undergoing chemotherapy or battling bone marrow disorders. The growth of this segment is anticipated to be driven by the rising incidence of neutropenia, particularly in cancer patients and individuals with hematologic disorders.

CSFs significantly enhance the immune system’s ability to fight infections, improving patient outcomes and recovery. The development of more effective CSF formulations with improved safety profiles and shorter treatment durations is likely to further boost adoption. As the global cancer incidence increases, alongside the growing need for immune support therapies, the demand for CSFs is expected to continue its upward trajectory, cementing its dominance in neutropenia treatment.

Distribution Channel Analysis

Hospital pharmacies are projected to remain the largest distribution channel in the neutropenia treatment market, comprising 57.6% of the market share. Hospitals are at the forefront of managing neutropenia, especially in patients receiving intensive treatments like chemotherapy and those with compromised immune systems. The growth of this segment is anticipated to be fueled by the increasing number of patients requiring specialized care in hospital settings, where neutropenia treatments, such as colony-stimulating factors and antifungals, are typically administered.

Hospital pharmacies are critical in providing timely, controlled access to these therapies, ensuring proper monitoring and management of side effects. As healthcare systems globally focus on improving patient outcomes and reducing hospital stays, the demand for neutropenia treatments through hospital pharmacies will continue to grow. Moreover, the increasing adoption of advanced therapeutic protocols and the availability of new treatment options are likely to further support the continued prominence of hospital pharmacies in the neutropenia care market.

Key Market Segments

By Treatment

- Colony-stimulating Factors

- Antifungals

- Antibiotics

- Antivirals

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

Drivers

Increasing Incidence of Chemotherapy-Induced Neutropenia (CIN) is Driving the Market

The rising global incidence of cancer and the widespread use of myelosuppressive chemotherapy regimens are key drivers for the neutropenia treatment market. Chemotherapy, while effective in targeting cancer cells, often damages rapidly dividing white blood cells, including neutrophils, leading to a condition known as chemotherapy-induced neutropenia (CIN). This side effect significantly increases the risk of serious infections, which can lead to treatment delays, dose reductions, hospitalizations, and even death.

The need to prevent and manage CIN is paramount for ensuring patient safety and maintaining the efficacy of cancer treatments. While precise global incidence figures for CIN are continuously tracked in various clinical settings, the American Society of Clinical Oncology (ASCO) guidelines consistently emphasize the importance of prophylaxis with granulocyte colony-stimulating factors (G-CSFs) for patients at high risk of CIN, indicating a prevalent clinical challenge.

A study published in February 2024 by the National Center for Biotechnology Information (NCBI) on drug-induced neutropenia in Europe in 2022 reported a frequency ranging from 1.6 to 9.2 cases per million, highlighting the ongoing occurrence of drug-related neutropenic events. The growing number of cancer patients undergoing chemotherapy, particularly with more intensive regimens, directly translates into a sustained and increasing demand for effective treatments to prevent and manage this common and potentially life-threatening complication.

Restraints

High Cost of Biologics and Limited Awareness in Developing Regions is Restraining the Market

A significant restraint on the neutropenia treatment market is the high cost associated with biologic therapies, particularly granulocyte colony-stimulating factors (G-CSFs), and the limited awareness and diagnostic infrastructure in many developing regions. G-CSFs, such as filgrastim and pegfilgrastim, are the mainstay of neutropenia management, but their acquisition costs can be substantial, posing a financial burden on healthcare systems and patients. While biosimilars have introduced some cost-saving opportunities, the overall expenditure for these biological agents remains considerable, particularly for long-acting formulations.

Furthermore, in many low- and middle-income countries, a lack of adequate diagnostic facilities for accurate and timely neutrophil count monitoring, coupled with insufficient awareness among healthcare providers about neutropenia management protocols, limits the optimal and widespread use of available treatments. This dual challenge of high treatment costs and underdeveloped healthcare infrastructure in certain regions restricts market penetration and access to essential care.

Opportunities

Increasing Development of Biosimilars and Next-Generation G-CSFs Create Growth Opportunities

The increasing development and approval of biosimilars for existing G-CSFs, alongside research into next-generation and novel formulations, present significant growth opportunities in the neutropenia treatment market. Biosimilars offer cost-effective alternatives to originator biological drugs, thereby improving patient access and reducing the financial burden on healthcare systems, which can lead to broader adoption.

Concurrently, pharmaceutical companies are investing in developing long-acting G-CSF formulations or novel mechanisms of action that can provide improved convenience (fewer injections), enhanced efficacy, or better tolerability. The US Food and Drug Administration (FDA) has consistently approved G-CSF biosimilars, such as the approval of FULPHILA (pegfilgrastim-jmdb), the first FDA-approved pegfilgrastim biosimilar.

More recently, in November 2023, the FDA approved efbemalenograstim alfa-vuxw (Ryzneuta), a novel long-acting G-CSF, for the prevention and treatment of febrile neutropenia in adults with nonmyeloid malignancies receiving myelosuppressive chemotherapy, as reported by Oncology Practice Management. These advancements, including new biosimilar entrants and innovative long-acting therapies, contribute to a more competitive landscape, offering greater choice and potentially more convenient and effective options for patients and clinicians, driving market expansion.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the neutropenia treatment market, primarily through their impact on national healthcare budgets, pharmaceutical pricing, and patient affordability. During periods of economic stability and growth, governments and private insurance companies often have greater financial capacity to fund expensive treatments, including advanced biologic therapies for neutropenia, and to invest in healthcare infrastructure.

Conversely, economic downturns, high inflation, or austerity measures can lead to tightened healthcare budgets, potentially resulting in reduced reimbursement rates, delayed adoption of new therapies, or increased out-of-pocket costs for patients, which can limit access to essential care. The International Monetary Fund (IMF) indicated in its April 2025 “World Economic Outlook” that while global economic growth is stable, persistent geopolitical fragmentation and higher interest rates pose risks, which could indirectly impact healthcare spending and pharmaceutical innovation.

Geopolitical factors, such as international trade policies affecting the import and export of active pharmaceutical ingredients (APIs) and finished drug products, and the stability of global supply chains for crucial biologic manufacturing, also play a vital role. Political instability, trade disputes, or even public health crises can disrupt supply chains, increase manufacturing costs for pharmaceutical companies, and create uncertainty for global distribution, impacting the timely availability and pricing of essential medications like G-CSFs. However, the critical need for neutropenia management to prevent life-threatening infections in vulnerable patients ensures that healthcare systems prioritize access and innovation in this market, fostering resilience and continued development despite broader economic and political challenges.

Current US tariff policies can indirectly affect the neutropenia treatment market. These tariffs influence the cost of imported active pharmaceutical ingredients (APIs), excipients, and specialized equipment used to produce granulocyte colony-stimulating factors (G-CSFs). Although the US has a strong pharmaceutical industry, it depends heavily on global supply chains. The US Census Bureau’s FT-900 report (2024) shows pharmaceutical imports totaled US$246.849 billion. This highlights the industry’s reliance on global sourcing for essential components and drugs. Tariff changes may impact the cost structure of manufacturers operating in or importing into the US.

Any new tariffs on imported raw materials or finished pharmaceutical products can lead to higher manufacturing costs. These increases may be passed to consumers through higher drug prices. Alternatively, pharmaceutical companies might absorb these costs. This could reduce funds available for research and development. In both cases, patient access to innovative neutropenia treatments may be affected. Rising costs also put pressure on healthcare systems already managing tight budgets. These developments can disrupt pricing strategies and impact market competitiveness.

On the other hand, tariff pressures may encourage pharmaceutical companies to invest in domestic production. This includes setting up facilities for APIs, excipients, and neutropenia drugs like G-CSFs. Local manufacturing reduces dependence on volatile international sources. It also enhances national medical security by ensuring stable supply chains. However, this strategic move involves high upfront investments and regulatory compliance costs. Despite these challenges, long-term benefits may include improved supply resilience and more stable drug availability in the US market.

Latest Trends

Integration of Artificial Intelligence (AI) for Personalized Risk Assessment and Treatment is a Recent Trend

A prominent recent trend in the neutropenia treatment market is the increasing integration of Artificial Intelligence (AI) for personalized risk assessment and optimized treatment strategies. AI algorithms are being developed and tested to analyze vast patient datasets, including chemotherapy regimens, comorbidities, genomic profiles, and real-time neutrophil counts, to predict an individual patient’s risk of developing severe neutropenia and associated complications. This allows clinicians to proactively implement prophylactic measures or adjust treatment plans, moving towards a more personalized approach to patient management.

Research presented at major hematology conferences in 2024-2025, and discussed in academic publications, consistently highlights the potential of AI in this field. For instance, a March 2025 ResearchGate publication on AI in hematology noted that AI algorithms can enhance diagnostic efficiency and aid in predicting disease progression, specifically mentioning their role in identifying abnormalities and classifying cells, which is crucial for monitoring neutrophil counts. This capability supports clinicians in making timely and informed decisions for individual patients. The development of AI-driven tools that can precisely identify high-risk patients and recommend optimal G-CSF dosing or alternative strategies represents a significant leap forward, enhancing patient safety and optimizing resource utilization in the management of low neutrophil counts.

Regional Analysis

North America is leading the Neutropenia Treatment Market

North America dominated the market with the highest revenue share of 39.9% owing to the increasing incidence of cancer and the widespread use of myelosuppressive chemotherapy, which frequently leads to a reduction in white blood cells. In the United States, the National Cancer Institute reported that approximately 1,958,310 new cancer cases are estimated to occur in 2023, many of which will require chemotherapy and consequently supportive care for treatment-induced side effects. Canada similarly projects 247,100 new cancer diagnoses for 2024, highlighting a substantial patient population undergoing treatments that often cause neutropenia.

The market’s expansion is further supported by the robust availability and increasing adoption of granulocyte colony-stimulating factors (G-CSFs) and their biosimilars, which are essential for preventing and managing severe infections associated with low neutrophil counts. The US Food and Drug Administration (FDA) has played a crucial role in this market by approving new therapies; for instance, eflapegrastim-xnst (Rolvedon) received FDA approval in September 2022 to reduce the incidence of infection in patients with non-myeloid malignancies receiving myelosuppressive anti-cancer drugs.

Key pharmaceutical players have reported substantial revenues in this segment. Sandoz, a global leader in biosimilars including G-CSFs, reported that its North America net sales for the full year 2024 reached US$ 2.437 billion, marking a 14.5% increase compared to US$ 2.129 billion in 2023, driven by strong volume growth across both generics and biosimilars. This broad availability and continued innovation in supportive care solutions are pivotal factors driving the market’s robust expansion across North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the rising cancer burden across the region, advancements in healthcare infrastructure, and the increasing adoption of aggressive chemotherapy regimens. In China, an estimated 4,824,700 new cancer cases occurred in 2022, as reported by the National Cancer Center of China, indicating a vast and growing patient population that will require supportive care to complete their cancer treatments.

The World Health Organization (WHO) also reported an estimated 2.37 million new cancer cases in the South-East Asia Region in 2022, underscoring the significant demand for effective supportive care. Governments in several Asian countries are increasingly focusing on improving overall cancer care outcomes, which includes preventing and managing chemotherapy-related complications. Japan’s Ministry of Health, Labour and Welfare consistently updates its national cancer control strategies, which inherently support the use of supportive care agents like G-CSFs to ensure treatment adherence and patient safety.

Furthermore, India’s Ministry of Health and Family Welfare continues to strengthen its National Cancer Control Programme, which encompasses comprehensive cancer management, including supportive care for patients undergoing chemotherapy. Companies like Sandoz, with a strong biosimilar portfolio including G-CSFs, are expanding their presence in the region.

Sandoz reported its “International” segment (which includes Asia-Pacific) net sales for the full year 2024 reaching US$ 2.557 billion, showing a 2.5% increase compared to US$ 2.495 billion in 2023, reflecting increasing patient access and demand for their biosimilar products in these growing markets. This combination of rising disease incidence and improving healthcare capabilities is projected to drive significant growth for therapies that address chemotherapy-induced reductions in neutrophil counts across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the neutropenia treatment market employ various strategies to drive growth. They focus on expanding their product portfolios by developing novel therapies and research tools targeting neutropenia treatment. Companies invest in automation and high-throughput technologies to improve scalability and reproducibility in treatment processes. Strategic partnerships with biotechnology firms, research institutions, and healthcare providers help accelerate innovation and facilitate the integration of new therapies into clinical practices.

Additionally, players aim to strengthen their market presence by establishing facilities and distribution networks in key regions, ensuring timely and efficient delivery of services to support the growing demand for neutropenia treatment solutions. Amgen Inc. is a prominent player in the neutropenia treatment market. Headquartered in Thousand Oaks, California, Amgen is a biotechnology company that develops and manufactures innovative therapies for various medical conditions, including neutropenia.

The company’s flagship product, Neulasta (pegfilgrastim), is a long-acting granulocyte colony-stimulating factor (G-CSF) that stimulates the production of neutrophils in patients undergoing chemotherapy. Amgen’s commitment to research and development has led to the introduction of advanced therapies that address unmet medical needs in neutropenia management. Through strategic collaborations and a robust pipeline, Amgen continues to contribute significantly to the advancement of neutropenia treatment options.

Recent Developments

- In December 2023: Coherus BioSciences gained FDA approval for Udencya Onbody, a new on-body injector (OBI) iteration of its biosimilar pegfilgrastim-cbqv. This innovative device is designed to help cancer patients after chemotherapy by reducing the risk of febrile neutropenia, enhancing Coherus’ product offerings with an easy-to-use automated delivery system.

- In November 2023: Acrotech Biopharma and Evive Biotech achieved FDA approval for Ryzneuta, a novel treatment targeting the reduction of febrile neutropenia and infection rates in adult patients undergoing myelosuppressive therapies for non-myeloid cancers. This approval introduces a valuable option for both first-line and alternative therapies, expanding the available treatment choices for cancer patients.

Top Key Players in the Neutropenia Treatment Market

- Amgen Inc

- Teva Pharmaceutical Industries Ltd

- Coherus BioSciences, Inc

- Biocon Biologics Inc

- Pfizer Inc

- Evive Biotech

- G1 Therapeutics, Inc

- Merck & Co., Inc

Report Scope

Report Features Description Market Value (2024) US$ 16.2 billion Forecast Revenue (2034) US$ 25.9 billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Treatment (Colony-stimulating Factors, Antifungals, Antibiotics, and Antivirals), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, and Retail Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amgen Inc, Teva Pharmaceutical Industries Ltd, Coherus BioSciences, Inc, Biocon Biologics Inc, Pfizer Inc, Evive Biotech, G1 Therapeutics, Inc, Merck & Co., Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Neutropenia Treatment MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Neutropenia Treatment MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amgen Inc

- Teva Pharmaceutical Industries Ltd

- Coherus BioSciences, Inc

- Biocon Biologics Inc

- Pfizer Inc

- Evive Biotech

- G1 Therapeutics, Inc

- Merck & Co., Inc