Global Neuromorphic Hardware Market Size, Share, Industry Analysis Report By Type (Processor, Memory, Sensor, Others), By Application (Image & Video Processing/Computer Vision, Natural Language Processing (NLP), Sensor Fusion, Other Applications), By Vertical (Consumer Electronics, Aerospace & Defense, Automotive, Industrial, Medical, IT & Telecom, Other Verticals), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161521

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

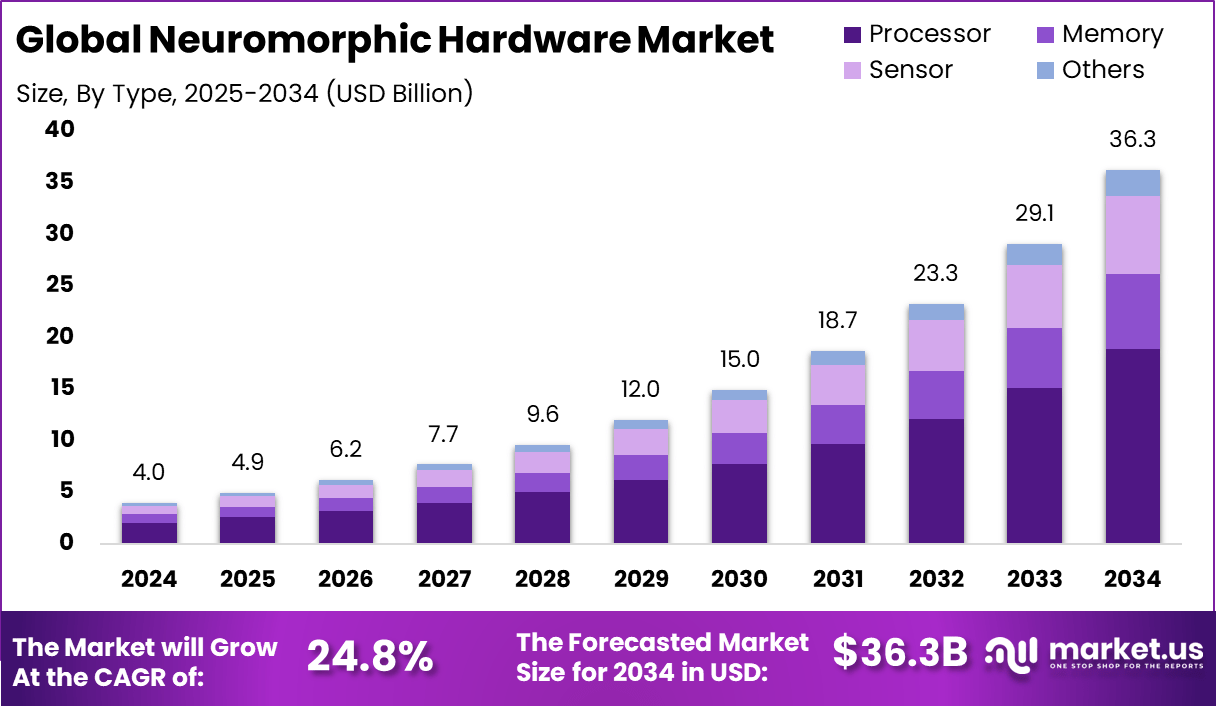

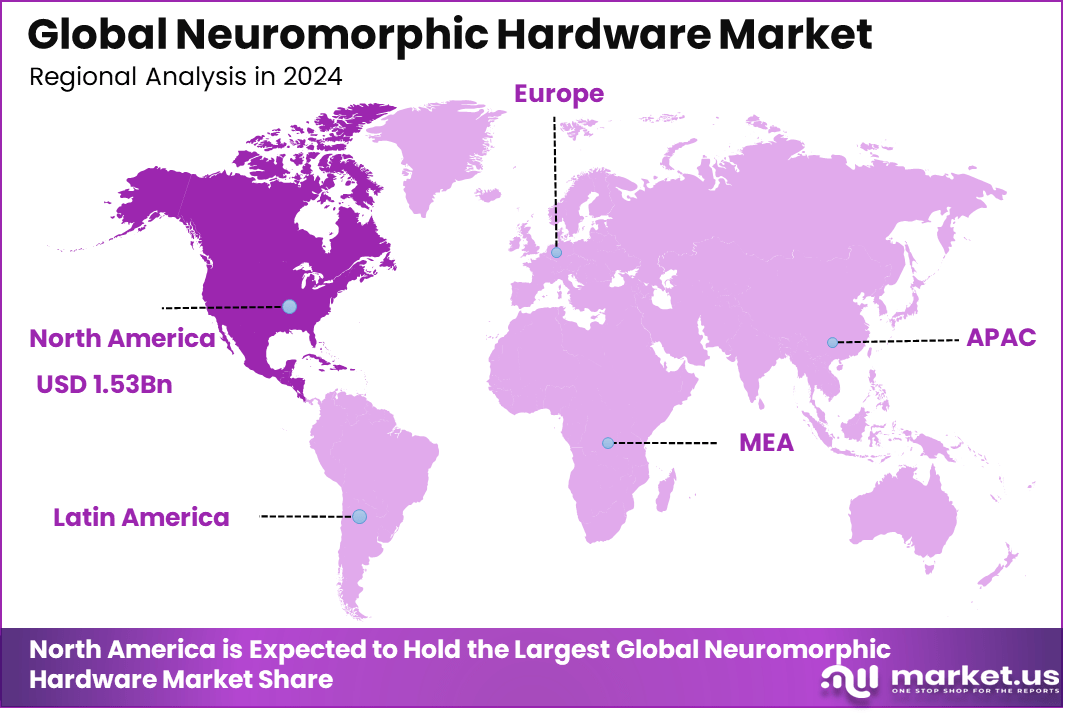

The Global Neuromorphic Hardware Market generated USD 4.0 billion in 2024 and is predicted to register growth from USD 4.9 billion in 2025 to about USD 36.3 billion by 2034, recording a CAGR of 24.8% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38.4% share, holding USD 1.53 Billion revenue.

The neuromorphic hardware market focuses on computing systems designed to mimic the structure and functioning of the human brain. These chips use spiking neural networks and event-driven processing to handle data with high efficiency and low power use. They are applied in autonomous systems, robotics, edge devices, medical imaging, defense technologies, and real-time analytics. Unlike conventional processors, neuromorphic hardware operates through parallel signal pathways and adaptive learning mechanisms.

Top driving factors include the quest for lower power consumption and higher processing speeds, especially for applications in robotics, healthcare, and autonomous systems. These technologies require hardware that can handle complex pattern recognition without draining excessive energy, which neuromorphic chips excel at. The demand for intelligent edge devices, where processing occurs locally rather than relying on centralized data centers, also boosts market growth.

The adoption of these advanced systems is further driven by technological innovations, such as the integration of sensing and processing within single chips and developments in memristor-based memory. These innovations significantly reduce data transfer latency and power consumption, making neuromorphic hardware more appealing for time-sensitive applications.

Top Market Takeaways

- By Type, Processors accounted for 52%, making them the dominant segment and the backbone of neuromorphic hardware.

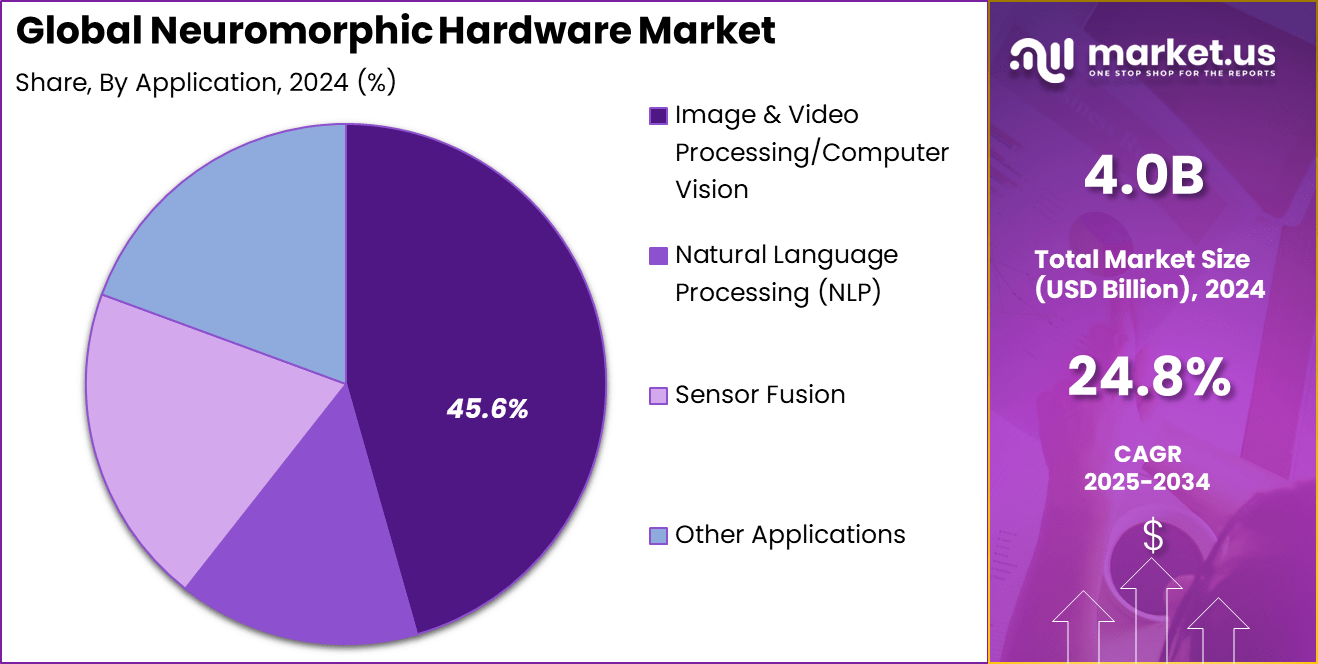

- By Application, Image and video processing, including computer vision, held 45.6%, showing its vital role in AI-driven tasks.

- By Vertical, Consumer electronics captured 25.2%, highlighting growing use in smart devices and everyday AI integration.

- By Region, North America led with 38.4%, supported by advanced R&D and early adoption of emerging AI hardware.

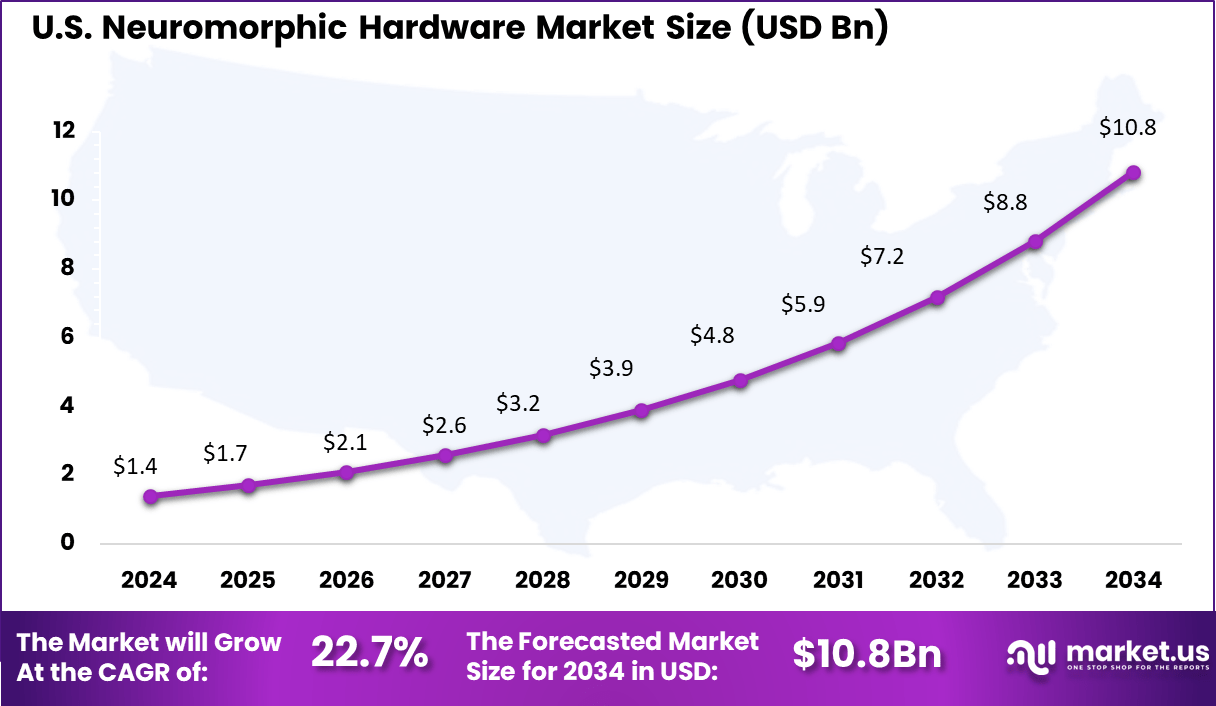

- The U.S. market reached USD 1.4 billion, expanding at a CAGR of 22.7%, reflecting strong growth momentum.

Role of Generative AI

Generative AI is playing an increasing role in advancing neuromorphic hardware by pushing the boundaries of machine learning complexity. Around 45% of neuromorphic hardware development today is linked to improving generative AI models, which require vast computational efficiency to function effectively at the edge.

This synergy drives the need for more efficient, brain-inspired chips that support real-time generation and adaptation of data, allowing applications like natural language processing and image synthesis to run faster and with lower energy use. With more than 60% of new neuromorphic computing projects incorporating generative AI workloads, the integration between generative AI and neuromorphic systems is accelerating.

This creates a feedback loop where improvements in hardware enable more sophisticated AI models, while generative AI’s demands fuel continuous hardware innovation. This mutual growth highlights generative AI’s importance in shaping both the research direction and commercial deployment of neuromorphic computing technologies.

US Market Size

The United States is a major contributor within North America and a pivotal driver of growth with a reported neuromorphic hardware market worth around USD 1.4 billion. Leading semiconductor firms, research centers, and government-backed initiatives collaborate actively to develop next-generation neuromorphic processors that mimic brain-like functions with high energy efficiency and AI-calibrated architectures.

The US market benefits from advances in secure edge computing and real-time AI applications for autonomous driving, healthcare, and smart IoT devices. Investments in low-latency, privacy-enhancing AI chips position the country to remain at the forefront of neuromorphic technology commercialization. Its innovation ecosystem, combined with strong consumer and enterprise demand for intelligent devices, supports a high compound annual growth rate near 22.7%.

North America commands a commanding 38.4% share of the neuromorphic hardware market, thanks to its strong ecosystem of semiconductor manufacturing, academic research, and AI innovation hubs. The region benefits from significant public and private investments in neuromorphic computing, with well-established companies and startups driving early commercial applications.

The region’s technology infrastructure accelerates adoption, especially in sectors like defense, autonomous systems, and IoT. The emphasis on energy-efficient AI to reduce carbon footprints and meet sustainability goals further strengthens market growth in North America. Its role as a global innovation hub continues to shape product development, technical standards, and investment flows in neuromorphic computing.

By Type

In 2024, Processors dominate the neuromorphic hardware market with a strong 52% share. This is mainly because processors are designed to emulate the parallel processing and energy efficiency of biological neural networks, which is critical for complex AI workloads.

Their ability to handle real-time data processing and support sophisticated neural models makes them ideal silicon engines for emerging neuromorphic systems in robotics, edge computing, and AI acceleration. The dominance of processors is also supported by well-established manufacturing and design ecosystems that reduce integration risks for system builders.

Advanced processors such as spiking neural network chips are continuously refined to deliver low-power, high-efficiency computing, which meets growing demand for AI in real-world applications. This robust technology foundation keeps processor architectures central to the neuromorphic hardware landscape.

By Application

In 2024, Image and video processing or computer vision applications account for 45.6% of the neuromorphic hardware market, making them the top use case. Neuromorphic chips excel at these tasks because they mimic how the human brain processes visual information, allowing efficient real-time analysis such as facial recognition, object detection, and motion tracking. This capability is vital for sectors like autonomous vehicles, security systems, and consumer electronics.

These chips’ event-driven processing reduces power consumption significantly while improving speed and temporal resolution compared to classical architectures. The surge in demand for smart cameras, AI-powered phones, and surveillance systems drives this segment. Their energy-efficient, on-device processing reduces reliance on cloud infrastructure, aiding privacy and latency improvements in critical applications.

By Vertical

In 2024, Consumer electronics hold a 25.2% share of the neuromorphic hardware market, reflecting growing adoption in smart wearables, smartphones, and other connected devices. Neuromorphic chips enhance user experiences by enabling real-time AI features like biometrics, voice commands, and health monitoring with high energy efficiency suitable for battery-powered devices.

These capabilities reduce the need for cloud communication, lowering latency and improving privacy. The segment growth is also fueled by increasing demand for intelligent edge computing in personal electronics, where performance and power savings are key.

Wearable technology alone is projected to grow at a double-digit rate, leveraging neuromorphic processors to handle continuous sensing and data analysis without rapid battery drain. This makes the consumer electronics vertical a major focus for neuromorphic innovation and deployment.

Emerging Trends

One emerging trend is the rapid adoption of event-driven sensors and photonic neuromorphic systems, which improve real-time adaptive processing beyond electrical means. The market is seeing a 37% increase in photonic implementations year over year, driven by their ultra-low power consumption and faster signal processing capabilities.

These systems emulate neuron spikes with light pulses, providing a next-level leap in speed and efficiency. Another trend is the growing focus on integrating neuromorphic processors into edge AI devices for industries like automotive, healthcare, and consumer electronics.

About 55% of neuromorphic hardware shipments in 2025 target edge AI applications, due to their ability to reduce cloud dependency and enhance privacy and response time. This shift from centralized data centers to intelligent local processing is reshaping how AI solutions are deployed globally.

Growth Factors

The main growth drivers include the accelerating need for low-power AI solutions aligned with climate-conscious computing goals. Power efficiency improvements delivered by neuromorphic chips contribute to a 15% reduction in energy consumption for AI workloads compared to conventional processors. This energy advantage attracts investments especially for battery-operated and autonomous systems.

Another growth factor is the expanding integration of neuromorphic technology in healthcare, where over 50% of new neuromorphic applications focus on real-time diagnostics and brain-computer interfaces. These sectors benefit from neuromorphic hardware’s ability to process complex signals swiftly and adaptively, which traditional hardware struggles with.

Key Market Segments

By Type

- Processor

- Memory

- Sensor

- Others

By Application

- Image & Video Processing/Computer Vision

- Natural Language Processing (NLP)

- Sensor Fusion

- Other Applications

By Vertical

- Consumer Electronics

- Aerospace & Defense

- Automotive

- Industrial

- Medical

- IT & Telecom

- Other Verticals

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Demand for Energy-Efficient AI Computing

Neuromorphic hardware is driven by the increasing demand for energy-efficient computing solutions, especially for artificial intelligence and machine learning applications. Unlike traditional processors, neuromorphic chips mimic the brain’s neural structure and operate with much lower power consumption. This makes them ideal for devices needing real-time processing with minimal energy use, such as edge AI, autonomous systems, and robotics.

The market is expanding as industries seek to reduce energy costs while improving AI performance. With AI becoming a staple technology across sectors, the efficiency gains provided by brain-inspired processors make neuromorphic hardware highly attractive. This has led to strong industry investment in developing specialized chips that offer real-time decision-making capabilities without heavy power demands.

Restraint

High Development and Production Costs

One major restraint for neuromorphic hardware is the high cost associated with designing and manufacturing these complex chips. Neuromorphic processors require specialized architectures that are difficult and expensive to develop, involving new materials and intricate circuit designs. Current manufacturing methods are not optimized for large-scale production, which keeps costs per unit high and limits wider adoption, especially among smaller companies and startups.

Moreover, the research and development cycles are long and resource-intensive, discouraging quick commercialization. This cost barrier affects the pace at which neuromorphic hardware can be integrated into commercial products and poses a challenge for the technology to compete on price with conventional processors, slowing overall market growth.

Opportunity

Advances in Brain-Inspired Computing Designs

The neuromorphic hardware market benefits from continuous advances in brain-inspired designs such as spiking neural networks and memristor technologies. These innovations enable devices to process complex data more efficiently and adapt in real time, opening new use cases like brain-computer interfaces and assistive technologies for neurological disorders.

The exploration of new materials and integration techniques also boosts performance and scalability, making these chips more viable for mainstream applications. Growing demand for smarter, low-latency devices in IoT, edge computing, and autonomous systems further drives the market opportunity as these technologies improve both cost-effectiveness and capability.

Challenge

Algorithm Complexity and Software Development

Developing efficient algorithms that fully leverage neuromorphic hardware remains a key challenge. The architecture behind neuromorphic chips differs substantially from conventional computing, and creating software that can optimize their unique capabilities is highly complex. This requires specialized skills and significant effort, which slows down adoption and limits the practical impact of neuromorphic technology in commercial applications.

Software tools, programming languages, and frameworks specific to neuromorphic computing are still evolving, leading to fragmentation and difficulty for developers. Until a standardized and mature ecosystem emerges, the integration of these chips into larger AI systems and real-world products will face hurdles, impacting overall market growth.

Competitive Analysis

The Neuromorphic Hardware Market is led by major technology innovators such as Intel Corporation, IBM Corporation, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., and Hewlett Packard Enterprise (HPE). These companies are developing brain-inspired chips that enable low-power computing, edge intelligence, and real-time signal processing.

Specialized firms including BrainChip Holdings Ltd., GrAI Matter Labs, Innatera Nanosystems B.V., aiCTX AG, and Applied Brain Research Inc. focus on spiking neural network (SNN) processors and event-based computing architectures. Their solutions support ultra-efficient pattern recognition, embedded intelligence, and adaptive processing for IoT devices, drones, healthcare tools, and smart sensors.

Contributing players such as Knowm Inc., Prophesee SA, HRL Laboratories, LLC, SynSense AG, Micron Technology, Inc., SK Hynix Inc., Nepes Corporation, Numenta, Inc., and General Vision Inc., along with other emerging participants, are advancing neuromorphic memory, vision chips, and synaptic computing systems.

Top Key Players in the Market

- aiCTX AG

- Applied Brain Research Inc.

- BrainChip Holdings Ltd.

- General Vision Inc.

- GrAI Matter Labs

- Hewlett Packard Enterprise (HPE)

- HRL Laboratories, LLC

- IBM Corporation

- Innatera Nanosystems B.V.

- Intel Corporation

- Knowm Inc.

- Micron Technology, Inc.

- Nepes Corporation

- Numenta, Inc.

- Prophesee SA

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd.

- SK Hynix Inc.

- SynSense AG

- Others

Recent Developments

- July 2025, BrainChip Holdings unveiled the Akida Pulsar, the world’s first mass-market neuromorphic microcontroller tailored for edge sensor applications. This product stands out by delivering 500× lower energy consumption and 100× reduced latency compared to traditional AI cores, positioning it to disrupt AI at the edge significantly.

- May 2025, Innatera Nanosystems launched its first mass-produced neuromorphic chip, the Pulsar, designed with spiking neural networks for ultra-low power applications in wearables and IoT devices. This marked a significant move toward commercial readiness beyond R&D prototypes. The chip’s design enables sub-milliwatt power consumption and sub-millisecond latency, ideal for ambient intelligence and sensor fusion use cases.

Report Scope

Report Features Description Market Value (2024) USD 4.0 Bn Forecast Revenue (2034) USD 36.3 Bn CAGR(2025-2034) 24.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Processor, Memory, Sensor, Others), By Application (Image & Video Processing/Computer Vision, Natural Language Processing (NLP), Sensor Fusion, Other Applications), By Vertical (Consumer Electronics, Aerospace & Defense, Automotive, Industrial, Medical, IT & Telecom, Other Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape aiCTX AG, Applied Brain Research Inc., BrainChip Holdings Ltd., General Vision Inc., GrAI Matter Labs, Hewlett Packard Enterprise (HPE), HRL Laboratories, LLC, IBM Corporation, Innatera Nanosystems B.V., Intel Corporation, Knowm Inc., Micron Technology, Inc., Nepes Corporation, Numenta, Inc., Prophesee SA, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., SK Hynix Inc., SynSense AG, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Neuromorphic Hardware MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Neuromorphic Hardware MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- aiCTX AG

- Applied Brain Research Inc.

- BrainChip Holdings Ltd.

- General Vision Inc.

- GrAI Matter Labs

- Hewlett Packard Enterprise (HPE)

- HRL Laboratories, LLC

- IBM Corporation

- Innatera Nanosystems B.V.

- Intel Corporation

- Knowm Inc.

- Micron Technology, Inc.

- Nepes Corporation

- Numenta, Inc.

- Prophesee SA

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd.

- SK Hynix Inc.

- SynSense AG

- Others