Global Neuromorphic Computing Market By Component (Hardware, Software, and Services), By Deployment Mode (Edge, and Cloud), By Application, By End-Use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: March 2024

- Report ID: 103751

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Driving Factors

- Restraining Factors

- By Component Analysis

- By Deployment Analysis

- By Application Analysis

- By End-Use Analysis

- Key Market Segments

- Opportunity

- Trends

- Regional Analysis

- Key Regions and Countries

- Key Players Analysis

- Top Key Players in Global Neuromorphic Computing Market

- Recent Developments

- Report Scope

Report Overview

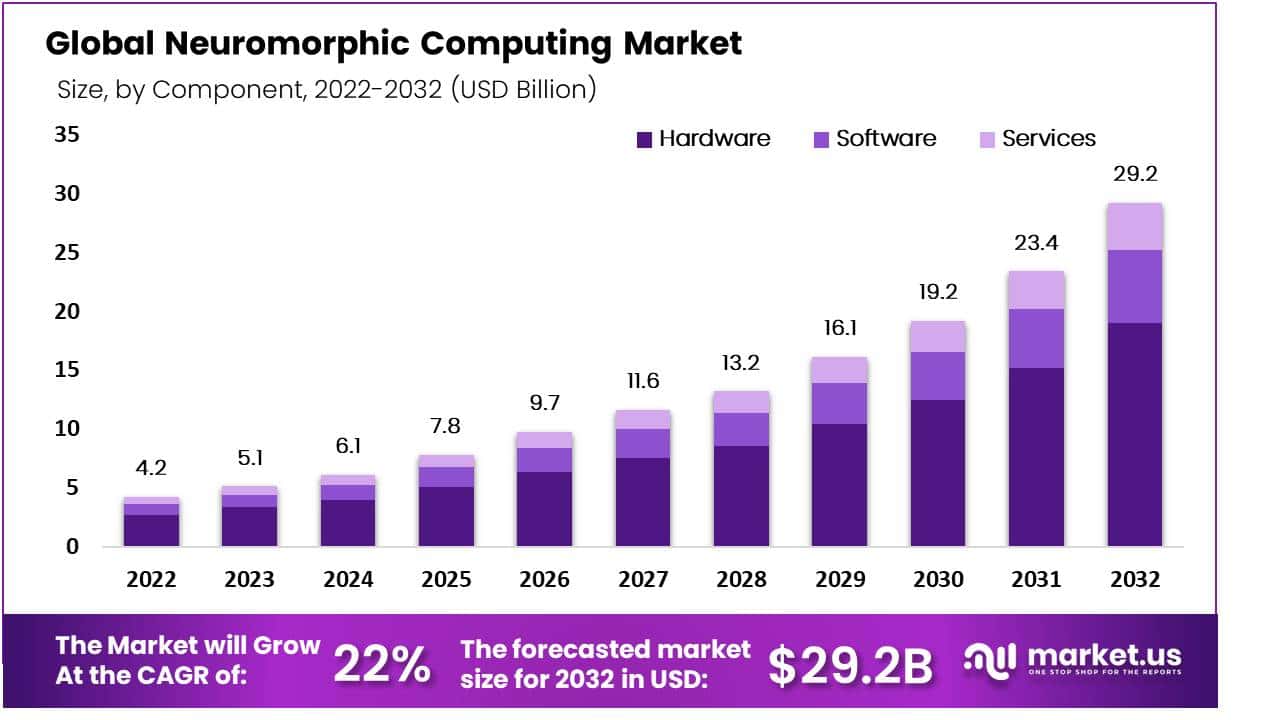

In 2023, the global neuromorphic computing market was worth USD 5.1 billion and will reach USD 29.2 billion by 2032. It is estimated to grow a CAGR of 22% between 2023-2032.

Neuromorphic computing refers to a field of computer science and engineering that aims to design and develop computer systems inspired by the structure and functionality of the human brain. It focuses on building hardware and software architectures that mimic the neural networks found in the brain, enabling more efficient and brain-like processing capabilities.

Traditional computers, based on the von Neumann architecture, use a centralized processing unit (CPU) and separate memory units. In contrast, neuromorphic computing emphasizes distributed processing and incorporates memory and processing elements into a single interconnected system. This approach aims to overcome the limitations of conventional computers, such as high power consumption, limited parallelism, and a lack of cognitive capabilities. This has been the main driving factor of neuromorphic computing market.

Note: Actual Numbers Might Vary In The Final Report

Neuromorphic computing has applications in various fields, including robotics, artificial intelligence, cognitive science, and neuroscience. The rising demand for artificial intelligence (AI) and machine learning (ML) is a major factor that has propelled the demand for neuromorphic computing in multiple applications like semiconductors, robotics, automatic cars etc. Additionally, investments in research and development processes and the launch of innovative products is expected to fuel the neuromorphic computing market growth during the projection period.

Key Takeaway

- Market Trends: The advent of neuromorphic hardware and software technologies is also fuelling market expansion.

- Driving Factors: Increasing investment in neuromorphic computing research and development projects as key motivating forces.

- Restraining Factors: High costs associated with neuromorphic hardware and the limited availability of related software development tools pose obstacles for implementation.

- Challenges: Barriers of Standardization in Neuromorphic Computing Industry

- By Component Analysis: Hardware was the dominant segment within neuromorphic computing market in 2022 with 65.56% revenue share.

- By Deployment Analysis: Edge computing was found to dominate deployment segment with 67% market share by revenue share as of 2022.

- By Application Analysis: Image processing led the application segment with 47% revenue share by 2022.

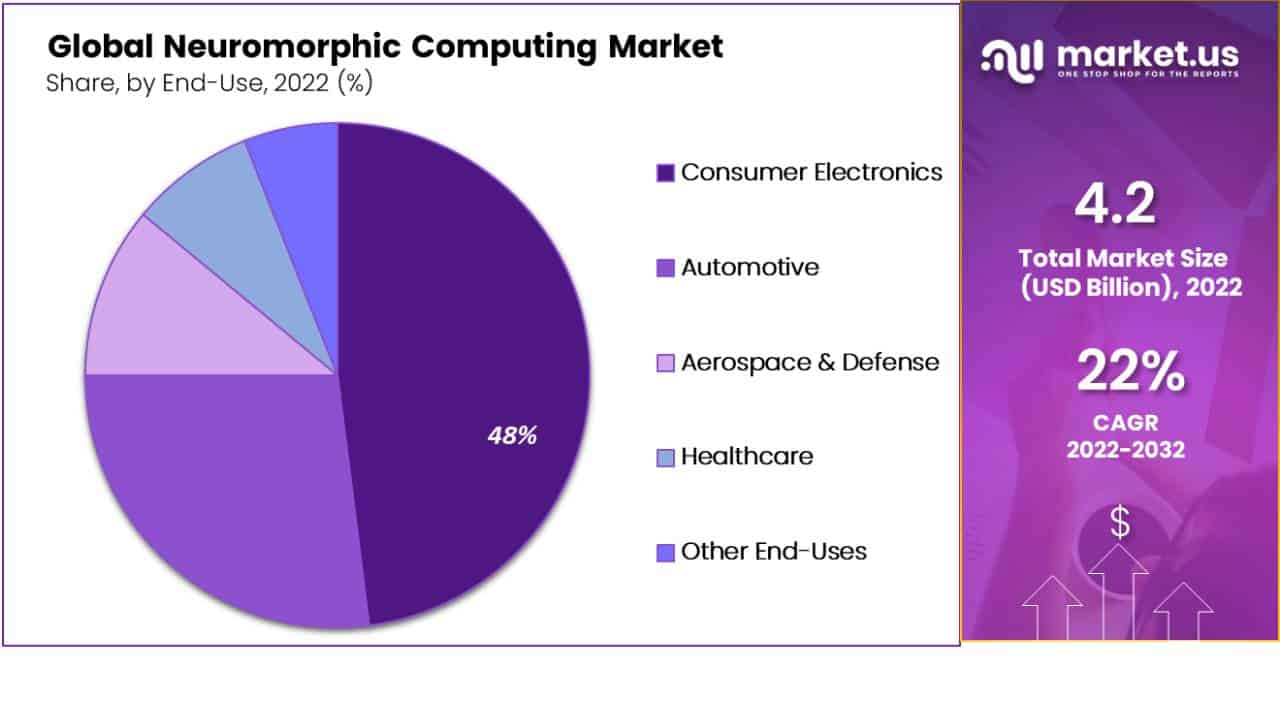

- By End-Use Analysis: Consumer electronics is expected to remain the predominant end use segment within neuromorphic computing market with 57% revenue share during its forecast period.

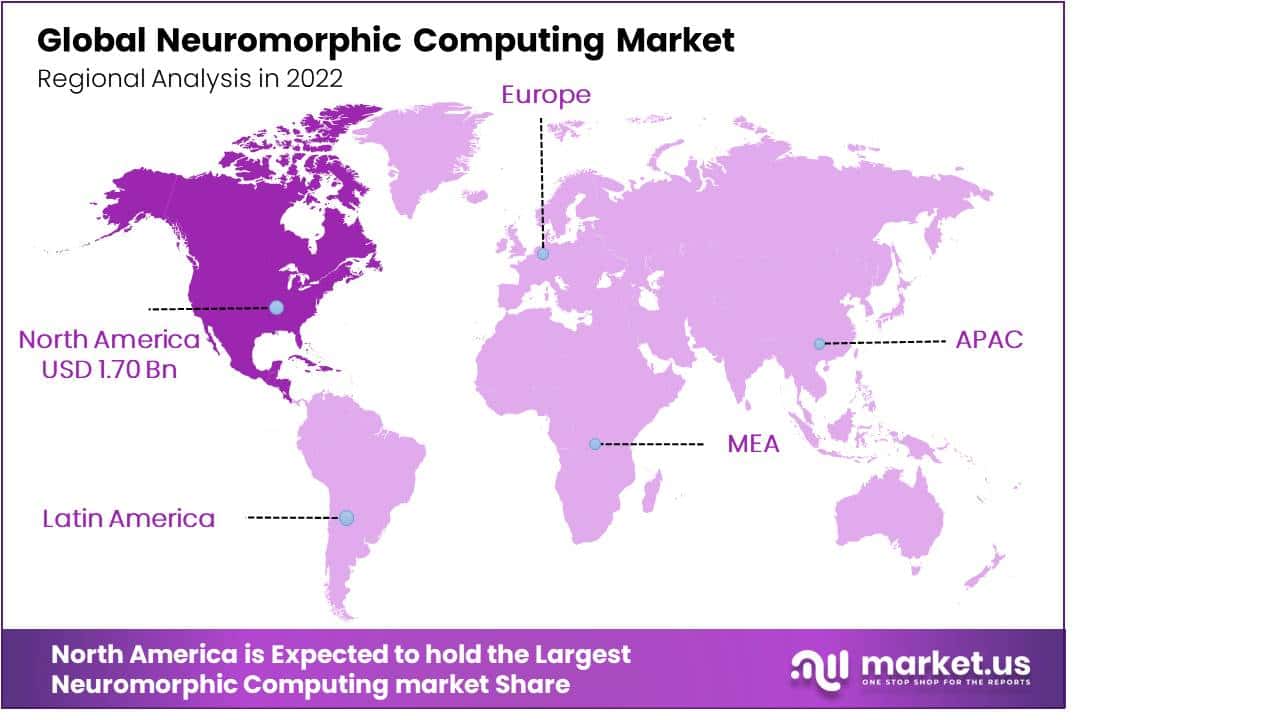

- Regional Analysis: North America is projected to hold 40.5% market share of neuromorphic computing within its projected time period.

- Top Key Players in Global Neuromorphic Computing Market: Intel Corporation, Qualcomm Inc., IBM Corporation, Samsung Electronics Co. Ltd., HRL Laboratories, Hewlett-Packard, Vicarious, General Vision Inc., Numenta, Knowm Inc., CEA-Leti and Other Key Players

Driving Factors

Rising Demand for AI & ML Showing Positive Signs for Neuromorphic Computing Market

The rising demand for artificial intelligence (AI) and machine learning (ML) has now reached the next level, which has opened many avenues for new, efficient, and advanced technologies such as, neuromorphic computing. Therefore, all over the globe, it is largely used in several applications across many industries. Computer vision, machine learning, neural networks, deep learning, facial and speech recognition, natural language processing, digital assistants, and some other fields are just a few of the many uses for this technology.

Moreover, many experts believe and forecast that neuromorphic computing will change the character and capabilities of a wide range of scientific and non-scientific applications over the course of the next ten years. Some of them include mobile applications, which need more and more potent processing resources. Thus, the rise in the scope of applications of neuromorphic computing due to increasing demand for artificial intelligence and machine learning is a key factor that is expected to drive the neuromorphic computing market growth during the forecasted time period.

Emergence of New Methods of Computing Due To the End of Moore’s Law

Moore’s Law was consistent throughout all spheres of digital electronics and computers for almost 50 years. This was mostly because of the silicon lithography method, which allows one to etch transistors on suitable materials. Today, a transistor is getting smaller and smaller until it reaches almost the size of an atom. This presents a significant challenge to current lithography methods. Moore’s Law is therefore slowing down.

Each year, a chip can hold twice as many micro components while keeping the same price, according to Moore’s Law. Neuromorphic computing is receiving a lot of interest from major chip makers like IBM and Intel because it has the ability to circumvent traditional designs and attain substantially better levels of efficiency. Thus, an increasing demand for new methods of computing is expected to duel the demand for neuromorphic computing during the projection period.

Restraining Factors

Lack of Standardization

Neuromorphic computing is still an emerging field, and there is currently a lack of standardized tools, frameworks, and programming languages. This lack of standardization makes it challenging for developers to create and optimize applications for neuromorphic systems, hindering their adoption and widespread use. Thus, a lack of standardization in neuromorphic computing may limit the neuromorphic computing market growth during the projected time period.

High Cost of Neuromorphic Computing

Building efficient hardware for neuromorphic computing is a significant challenge. The design of specialized chips or circuits capable of emulating the behavior of biological neurons and synapses requires advanced manufacturing processes and materials. These can be expensive, limiting the scalability and widespread adoption of neuromorphic computing. Thus, the high cost involved in neuromorphic computing is expected to have a negative impact on the growth of the market over the forecast period.

Limited Compatibility

Existing software and algorithms designed for conventional computing architectures may not be directly applicable to neuromorphic systems. Adapting and optimizing software for these specialized architectures can be time-consuming and require significant effort, limiting the portability and ease of integration with existing computing infrastructure. Thus, significantly less compatibility offered by these systems may limit their adoption in several applications.

By Component Analysis

Hardware Segment is Witnessing Highest Growth

The hardware segment leads the neuromorphic computing market in 2022 with the largest revenue share of 65%. The segment growth can be attributed to the increasing use of neuromorphic computing hardware for the purpose of accelerating computation in embedded devices.

Also, key investments in technology is expected to further stimulate the segment growth during the projection period. The U.S Department of Energy (DOE), for instance, awarded USD 2 million in funding in September 2020 for five key research efforts to develop neuromorphic computing. The DOE initiative promotes the creation of human brain-inspired neuromorphic computing hardware and software.

Also, the software segment is expected to witness significant growth during the forecast period. Increasing use of neuromorphic computing software in multiple applications such as IT, telecom, aerospace & defense, healthcare, etc., is a key factor that is expected to fuel the growth of the segment during the estimated time period. Also, key benefits offered by software like, data modeling, real-time data streaming, etc., are expected to contribute to the growth of the segment.

By Deployment Analysis

Edge Computing Dominates the Market

The edge computing segment dominates the deployment segment by accounting a revenue share of 67% in 2022. Edge computing can help reduce costs associated with cloud computing by offloading processing tasks to local devices or edge nodes. This reduces the need for large-scale cloud infrastructure and lowers data transmission costs. Additionally, by analyzing data locally and sending only valuable insights to the cloud, storage, and processing costs can be minimized. This is a key factor driving the growth of the segment.

Also, cloud computing is anticipated to witness high growth over the projection period. The growth of this segment is driven by key advantages offered by neuromorphic cloud computing, such as ability to access resources from any place with an internet connection, lower costs required for hardware and software, and flexibility of scaling resources.

By Application Analysis

Image Processing Application Shows Highest Growth

The image processing segment led the application segment with a revenue share of 47% in 2022. Increasing use of computer vision in several sectors, such as healthcare, entertainment, automotive, etc., along with technological advancements in image sensors, are major factors stimulating the growth of the segment.

Moreover, the signal processing segment is expected to grow at a high rate during the projection period. The growth of the segment is probably being fuelled by rising demand for processing audio & acoustics signals, along with the increasing implementation of AI and machine learning in the IT sector.

By End-Use Analysis

The Consumer Electronics Sector is the Major End-User

The consumer electronics segment is expected to dominate the neuromorphic computing market with a revenue share of 57% throughout the forecast period. High demand for neuromorphic computing in the consumer electronics sector is driven by key factors such as, rising demand for different types of electronic devices such as, PCs, laptops, etc., along with increasing demand for cost-effective integrated circuits.

Also, the automotive segment is anticipated to witness high growth during the projection period. Due to its low power consumption, higher speed, and optimum memory, neuromorphic chips are highly preferred in the automotive sector. Also, advancements in technology have led to an increase in the efficiency of AI and machine learning, which has increased productivity as well as quality. These are key factors stimulating the growth of the segment.

Note: Actual Numbers Might Vary In The Final Report

Key Market Segments

Component

- Hardware

- Software

- Services

Deployment Mode

- Edge

- Cloud

Application

- Image Processing

- Signal Processing

- Data Processing

- Object Detection

- Other Applications

End-Use

- Consumer Electronics

- Automotive

- Aerospace & Defense

- Healthcare

- Other End-Uses

Opportunity

Rising Investments from Defense Organizations

Major aerospace and defense R&D organizations have been making significant investments with the aim of developing cutting-edge neuromorphic computer hardware and software, and sensors. For instance, in a joint effort with IBM, the US Air Force Research Laboratory (AFRL) claimed to have created the Blue Raven, the largest neuromorphic processor yet created, for use in a variety of defense and aerospace applications.

Also, a new 2021 initiative from DARPA enabled neuromorphic learning algorithms for defense-related event-based infrared (IR) sensors. Moreover, the Moon to Mars initiative of the Australian government encouraged the use of neuromorphic vision sensors for intricate in-orbit procedures such as spacecraft docking, refueling, and cargo transfer or replacement. Thus, rising investments from defense organizations would promote the demand for neuromorphic computing and provide new growth opportunities for the market in the upcoming time period.

Trends

Key Collaborations and Partnerships

Several neuromorphic computing market players are focusing on crucial collaborations and partnerships to promote the use of neuromorphic computing, as well as improve its efficacy. For instance, in order to provide a neural network-oriented object learning method, in September 2022, Intel Corporation joined forces with the Technical University of Munich and the Italian Institute of Technology.

Through the implementation of an interactive online object-learning strategy, this collaboration hopes to leverage neuromorphic computing to provide robots the ability to learn new objects more quickly and accurately after deployment. Thus, such key collaborations and partnerships by market players can be considered a positive trend and are likely to boost the growth of the neuromorphic computing market in the upcoming time period.

Regional Analysis

North America Leads The Market By Holding Major Revenue Share in Account

The North America region is expected to hold the largest share of 40.5% in the neuromorphic computing market during the projected time period. The market growth in the region is stimulated by key factors such as government investments in neuromorphic computing, along with an increase in defense expenditure. For instance, the Department of Energy (DOE) stated in September 2022 that it would finance 22 research projects to develop neuromorphic computing with USD 15 million. It encourages the creation of hardware and software for neuromorphic computing.

Note: Actual Numbers Might Vary In The Final Report

Also, the Canadian government is concentrating on artificial intelligence technology, which is anticipated to fuel the demand for neuromorphic computing in the years to come. For instance, the Pan-Canadian Artificial Intelligence Strategy’s second phase was officially launched in June 2022, according to the Canadian Ministry of Innovation, Science, and Industry. The budget for 2021 includes a USD 443 million investment to support the strategy’s second phase. Thus, government investments in neuromorphic computing are anticipated to boost market growth in the region throughout the forecast period.

Moreover, the Asia-Pacific region is likely to witness high growth during the estimated time period. The growth of the market in the region can be attributed to a rise in the adoption of data analytics and AI in multiple applications, along with increasing investments in new defense technologies. Moreover, technological advancements and increasing R&D investment is expected to fuel the expansion of the market throughout the region during the projection period.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global neuromorphic computing market is highly competitive, and major market players have a prominent presence in the market. The market is expected to grow at a high rate during the projection period due to the increasing use of neuromorphic computing in several applications. Additionally, key partnerships and collaborations and the launch of new products by key market players are likely to contribute to the market growth in the upcoming years.

Top Key Players in Global Neuromorphic Computing Market

- Intel Corporation

- Qualcomm Inc.

- IBM Corporation

- Samsung Electronics Co. Ltd.

- HRL Laboratories

- Hewlett-Packard

- Vicarious

- General Vision Inc.

- Numenta

- Knowm Inc.

- CEA-Leti

- Other Key Players

Recent Developments

- In December 2022, Intel, an American multinational corporation and technology company headquartered in Santa Clara, California, launched its AI neuromorphic technology that processes data 1,000 times quicker than conventional processors such as CPUs and GPUs while using much less energy during the process. As the technology is significantly energy efficient, it is well-suited for many different applications such as smart homes, industrial equipment, cybersecurity, etc.

- In April 2022, in order to enhance the integration of smart cockpits and neuromorphic processors, SynSense and BMW formed a partnership. It is a major step in incorporating the brain-like technologies of SynSense into intelligent cockpits. This partnership between SynSense and BMW in neuromorphic technology will center on the dynamic visual intelligence SoC-Speck from SynSense, which integrates an event-based sensor with a low-power SNN vision processor on a single chip.

Report Scope

Report Features Description Market Value (2022) US$ 4.2 Bn Forecast Revenue (2032) US$ 29.2 Bn CAGR (2023-2032) 22% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component- Hardware, Software, and Services, By Deployment Mode- Edge, Cloud, By Application- Image Processing, Signal Processing, Data Processing, Object Detection, and Other Applications, By End-Use- Consumer Electronics, Automotive, Aerospace & Defense, Healthcare, and Other End-Uses Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Intel Corporation, Qualcomm Inc., IBM Corporation, Samsung Electronics Co. Ltd., HRL Laboratories, Hewlett-Packard, Vicarious, General Vision Inc., Numenta, Knowm Inc, CEA-Leti, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is the Neuromorphic Computing Market?The market value of the Neuromorphic Computing Market in 2022 was US$ 4.2 billion and in 2032 will be US$ 29.2 billion.

What is neuromorphic computing?Neuromorphic computing refers to a field of computer science and engineering that aims to design and develop computer systems inspired by the structure and functionality of the human brain.

What factors are driving the demand for neuromorphic computing?The rising demand for artificial intelligence (AI) and machine learning (ML) has propelled the demand for neuromorphic computing.

What are the key components covered in the Neuromorphic Computing Market?The Neuromorphic Computing Market covers three key components: hardware, software, and services.

Which deployment modes are included in the Neuromorphic Computing Market?The Neuromorphic Computing Market includes two deployment modes: edge and cloud.

Who are the key players in the Neuromorphic Computing Market?The key players in the Neuromorphic Computing Market include Intel Corporation, Qualcomm Inc., IBM Corporation, Samsung Electronics Co. Ltd., HRL Laboratories, Hewlett-Packard, Vicarious, General Vision Inc., Numenta, Knowm Inc, CEA-Leti, and other key players.

What are the main applications of neuromorphic computing?Neuromorphic computing has applications in various fields, including robotics, artificial intelligence, cognitive science, and neuroscience.

Neuromorphic Computing MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Neuromorphic Computing MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Intel Corporation

- Qualcomm Inc.

- IBM Corporation

- Samsung Electronics Co. Ltd.

- HRL Laboratories

- Hewlett-Packard

- Vicarious

- General Vision Inc.

- Numenta

- Knowm Inc.

- CEA-Leti