Global Network Tokenisation Market By Component (Solutions, Services), By Token Type (Payment Tokens, Non-payment Tokens), By Deployment Mode (Cloud-based, On-premises), By End-User (Merchants, Payment Service Providers, Banks, Digital Wallets), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 175254

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Drivers Impact Analysis

- Restraint Impact Analysis

- Component Analysis

- Token Type Analysis

- Deployment Mode Analysis

- End-User Analysis

- Increasing Adoption Technologies

- Investment and Business Benefits

- Usage

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future outlook

- Recent Developments

- Report Scope

Report Overview

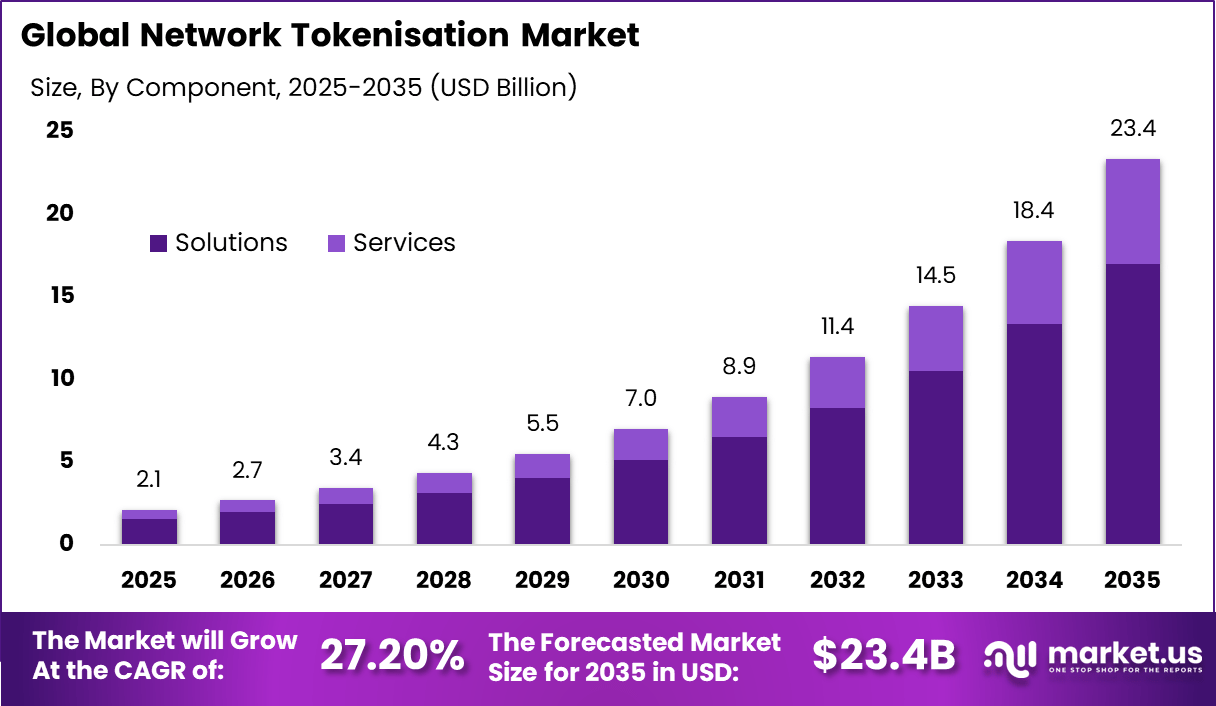

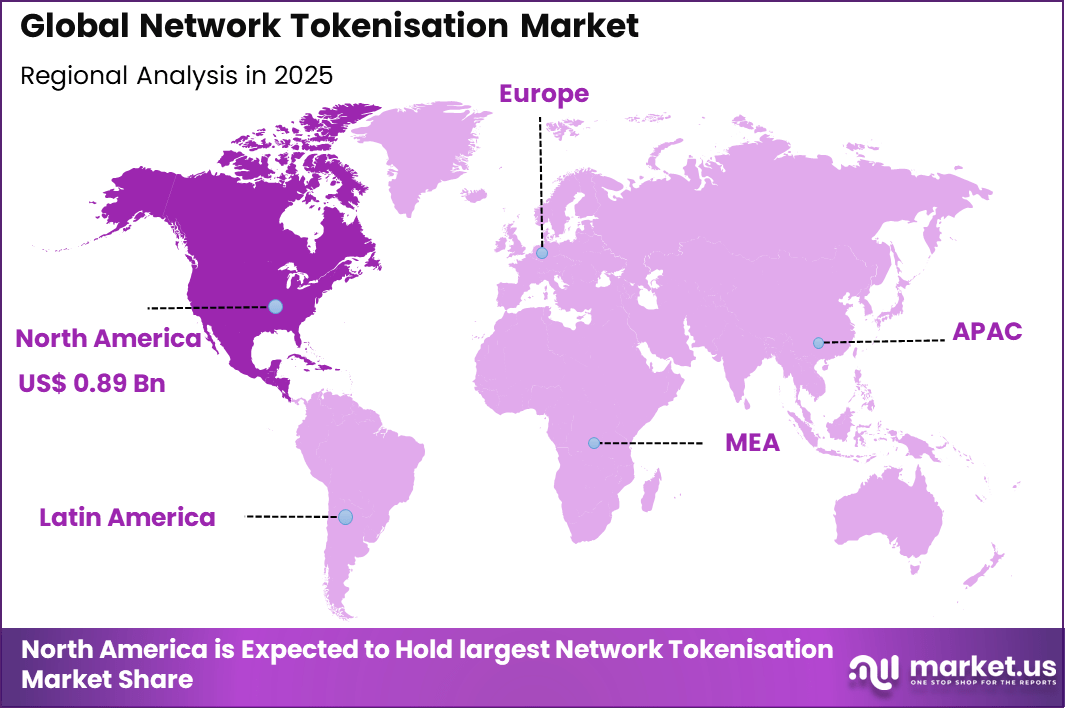

The Global Network Tokenisation Market generated USD 2.1 billion in 2025 and is predicted to register growth from USD 2.7 billion in 2026 to about USD 23.4 billion by 2035, recording a CAGR of 27.20% throughout the forecast span. In 2025, North America held a dominant market position, capturing more than a 42.6% share and generating USD 0.89 billion in revenue.

The Network Tokenisation Market refers to technologies and services that replace sensitive payment card details with secure digital tokens during transactions. These tokens are managed by payment networks and are used across online, in-app, and contactless payment environments. The objective is to reduce fraud risk while maintaining seamless payment experiences. Network tokenisation has become a foundational layer within modern digital payment ecosystems.

This market plays a critical role in securing card-not-present transactions, which continue to grow due to e-commerce and mobile payments. Tokenised credentials are bound to specific devices, merchants, or transaction channels, which limits misuse. The approach improves overall payment security without disrupting user experience. As digital commerce expands, network tokenisation is increasingly treated as a standard payment security requirement.

The main driving factors for the network tokenisation market are rising concerns about payment fraud and the need to protect customer data. As digital payments grow in volume, card information navigate many systems and devices, increasing exposure to breaches and attacks. Tokenisation reduces this exposure by limiting the use of actual card data.

Regulatory requirements for data protection and strong customer authentication also encourage the use of safer methods for handling payment information. The shift toward digital wallets, recurring payments, and subscription billing makes tokenisation attractive because tokens can be stored and reused without exposing actual card numbers.

Demand analysis shows that interest in network tokenisation continues to increase as merchants and payment providers prioritise secure and reliable payment processing. Large retailers integrate tokenisation into checkout systems to reduce fraud liability and improve customer trust. Payment processors and gateways include token services as part of broader security offerings to support diverse merchant needs.

Growing e-commerce activity and mobile payment adoption contribute to demand as tokenisation supports safe digital transactions. Small and medium sized businesses also benefit from solutions that lower the burden of securing card data. As digital payment use expands, investment in network tokenisation solutions is expected to remain strong, helping organisations manage risk and support secure payment interactions.

Top Market Takeaways

- By component, solutions led the network tokenisation market with 72.8% share, providing platforms for secure token provisioning and lifecycle management.

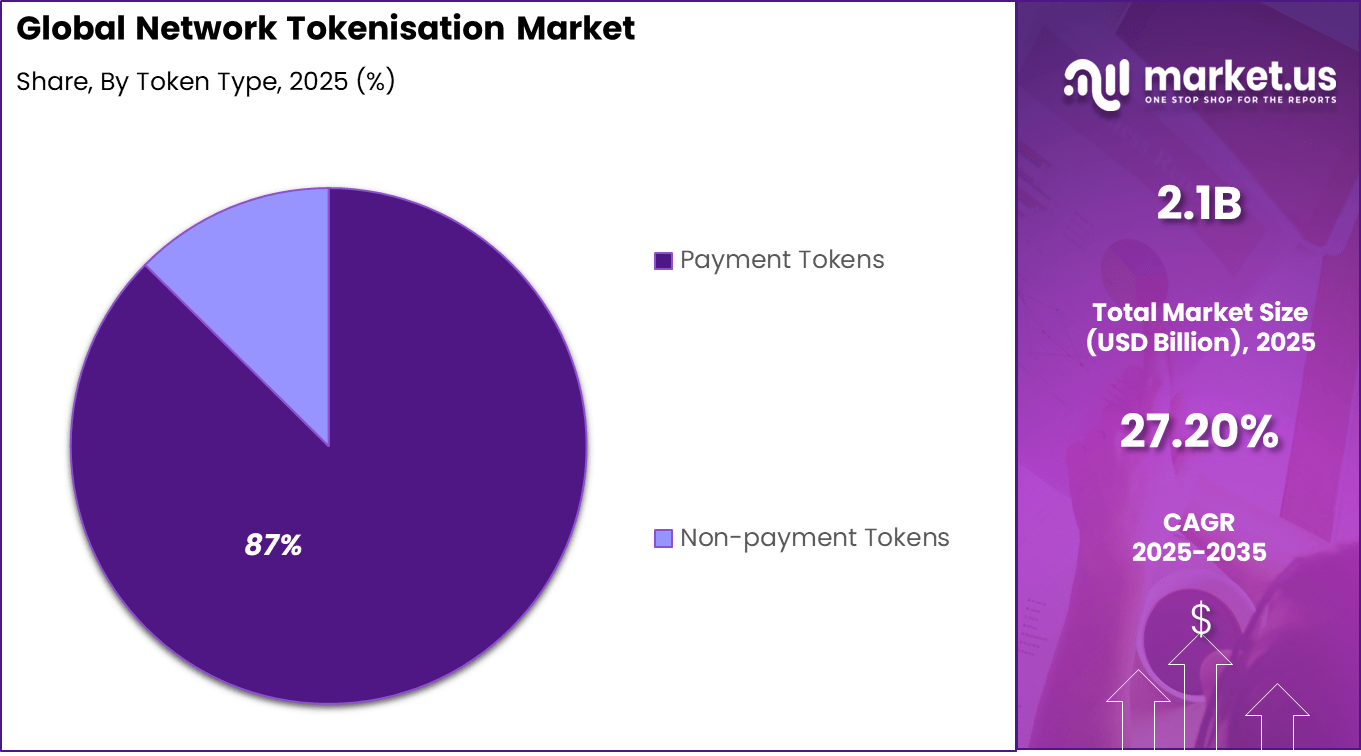

- By token type, payment tokens dominated at 87.4%, replacing sensitive card details to reduce fraud in e-commerce and mobile payments.

- By deployment mode, cloud-based systems captured 81.6%, enabling scalable, global token services with minimal latency.

- By end-user, digital wallets accounted for 48.3%, integrating tokens for one-click payments across apps and devices.

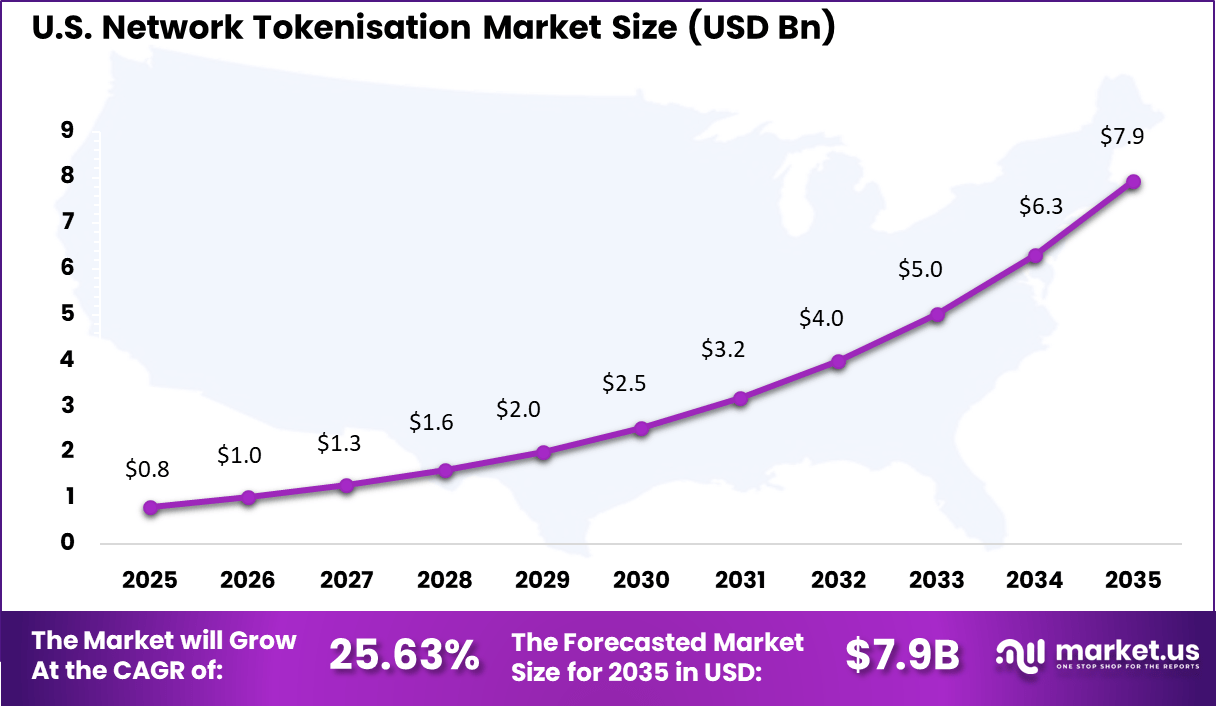

- North America held 42.6% of the global market, with the U.S. valued at USD 0.81 billion and growing at a CAGR of 25.63%.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Rising digital payment fraud and need for enhanced security +7.2% Global Short term Rapid growth of card-not-present and eCommerce transactions +6.1% North America, Europe, Asia Pacific Short to medium term Strong adoption of contactless and mobile wallet payments +5.4% Asia Pacific, North America Medium term Regulatory push for stronger payment data protection +4.3% Europe, North America Medium term Expansion of recurring and subscription-based payment models +3.1% Global Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Integration complexity with legacy payment systems -3.6% Global Short to medium term Limited awareness among small merchants -3.0% Emerging Markets Medium term Dependence on network and issuer readiness -2.5% Global Medium term Higher initial implementation costs for acquirers -2.1% Asia Pacific, Latin America Medium term Interoperability challenges across payment networks -1.7% Global Medium to long term Component Analysis

Solutions represent the dominant component in the Network Tokenisation Market, accounting for 72.8% of overall adoption. This dominance reflects the growing need for end to end platforms that manage token generation, lifecycle control, and secure transaction processing. Enterprises and payment ecosystems prioritize integrated solutions to reduce fraud exposure and simplify compliance.

The strong preference for solutions is also driven by the complexity of token management across multiple channels. Scalable platforms enable seamless integration with payment networks and digital services. As transaction volumes increase, solution based offerings remain central to implementation strategies.

Token Type Analysis

Payment tokens account for 87.4% of total token type usage, making them the most widely adopted category. This leadership is closely linked to the rapid expansion of digital payments and the need to replace sensitive card data with secure tokenized values. Payment tokens significantly reduce the risk of data breaches during transactions.

The dominance of payment tokens is reinforced by regulatory pressure and consumer trust requirements. Secure tokenization improves transaction approval rates and reduces fraud related losses. These benefits continue to drive widespread adoption across payment ecosystems.

Deployment Mode Analysis

Cloud based deployment leads the market with a share of 81.6%. Cloud infrastructure enables rapid scalability, centralized token management, and real time processing across regions. Organizations favor cloud deployment for its flexibility and lower operational complexity.

The adoption of cloud based models is further supported by increasing digital transaction volumes and remote service delivery. Cloud environments allow faster updates and integration with emerging payment technologies. This strengthens their position as the preferred deployment mode.

End-User Analysis

Digital wallets represent 48.3% of end user demand in the Network Tokenisation Market. Wallet providers rely heavily on tokenization to secure stored payment credentials and support seamless user experiences. Tokenization enables transactions without exposing sensitive financial data.

The growth of digital wallets is driven by mobile commerce and contactless payments. Security and convenience are key adoption drivers for end users. This sustains strong demand from the digital wallet segment.

Increasing Adoption Technologies

Mobile wallets and digital payment applications are key technologies supporting network tokenisation adoption. These platforms store tokenised credentials instead of raw card numbers. This allows payments to be completed securely across devices and channels. The integration of biometric authentication further strengthens transaction security.

Cloud-based payment infrastructure is also accelerating tokenisation adoption. Cloud environments support scalable token management and real-time transaction processing. This enables consistent security across global payment networks. The combination of cloud and tokenisation improves operational efficiency and resilience.

The primary reason for adopting network tokenisation is enhanced security. Tokenised credentials significantly reduce the value of intercepted data to attackers. This lowers fraud risk without requiring complex changes to user behavior. Security improvements are achieved in the background, preserving user convenience.

Another reason is improved transaction performance. Tokenised payments often experience higher authorization success rates. This is because networks can better validate token-based transactions. Higher approval rates translate into better revenue outcomes for merchants and issuers.

Investment and Business Benefits

Investment opportunities exist in token lifecycle management platforms that support provisioning, renewal, and deactivation. As token volumes grow, efficient management becomes critical. Solutions that simplify integration for merchants and financial institutions are highly valued. These platforms support long-term scalability of tokenisation initiatives.

There is also opportunity in analytics and fraud intelligence built around tokenised data. While tokens protect sensitive information, they still enable transaction pattern analysis. Advanced analytics can improve fraud detection and customer insights. This creates additional value layers beyond basic payment security.

For merchants, network tokenisation reduces fraud exposure and operational costs associated with dispute handling. It also improves customer checkout experience by supporting faster and more reliable payments. These benefits contribute to higher conversion rates and customer satisfaction. Tokenisation becomes a revenue enabler rather than just a security tool.

For financial institutions, tokenisation strengthens trust and reduces liability from data breaches. It supports innovation in digital payment products without increasing risk. Tokenised credentials also simplify compliance with data protection requirements. These benefits support sustainable growth in digital payment services.

Usage

- Used in online payments to protect card details during transactions

- Applied in digital wallets for secure storage of payment credentials

- Deployed in subscription services for recurring billing protection

- Utilized in mobile applications for in-app purchases

- Integrated into merchant payment systems for end-to-end transaction security

Key Market Segments

By Component

- Solutions

- Services

By Token Type

- Payment Tokens

- Non-payment Tokens

By Deployment Mode

- Cloud-based

- On-premises

By End-User

- Merchants

- Payment Service Providers

- Banks

- Digital Wallets

Regional Analysis

North America accounted for 42.6% share, supported by strong adoption of advanced payment security technologies across banking, retail, and digital commerce ecosystems. Network tokenisation has been widely implemented to replace sensitive card data with secure tokens during transactions, reducing fraud risk and improving authorization rates.

Demand has been driven by rapid growth in eCommerce, digital wallets, and recurring payment models, where data security is critical. The region’s mature card payment infrastructure and high transaction volumes have reinforced steady adoption.

The U.S. market reached USD 0.81 Bn and is projected to grow at a 25.63% CAGR, reflecting rapid adoption by card networks, issuers, and large merchants. Network tokenisation has helped U.S. businesses reduce fraud losses, improve transaction success rates, and simplify compliance with security standards. Adoption has been particularly strong in subscription services, digital wallets, and in app payments, where stored credentials require enhanced protection.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Enhanced Security and Fraud Reduction in Digital Payments

One of the strongest drivers for the network tokenisation market is the increasing need to protect payment data and reduce fraud in digital transactions. Tokenisation replaces sensitive card information with unique digital tokens that carry no usable value outside a specific transaction environment. This reduces the exposure of payment credentials during processing and storage, which helps lower the likelihood of data breaches and fraud.

Network tokenisation also supports stronger payment authorization processes by ensuring that tokenised credentials remain usable even when underlying card details change or expire. This continuity helps avoid unnecessary declines and improves overall transaction success rates for merchants. The combination of data protection and improved authorization experience makes tokenisation attractive for financial institutions and merchants seeking to strengthen trust in digital commerce.

Restraint Analysis

Implementation Complexity and Integration Issues

A notable restraint in the network tokenisation market is the complexity involved in its implementation and integration across existing payment systems. Tokenisation requires careful alignment with payment processing platforms, token vaults, issuer systems, and network standards. Differences in API protocols, token formats, and security requirements across providers can add complexity and integration costs for businesses adopting the technology.

This complexity is often compounded when organisations must coordinate with multiple payment networks, banks, and service providers. The requirement to maintain consistent token mapping and ensure secure token management creates additional steps in system design, testing, and compliance reviews. For many enterprises, these technical and operational challenges slow down deployment and increase reliance on external partners for implementation expertise.

Opportunity Analysis

Broader Adoption Across Payment Channels

A key opportunity in this market arises from expanded adoption of network tokenisation across various payment channels and environments. As digital commerce grows, merchants and platforms are seeking ways to streamline checkout experiences while protecting customer data. Network tokens can be used across e-commerce sites, mobile wallets, and recurring payments, helping to unify tokenisation strategies across sales channels and reduce friction for returning customers.

This broader adoption also allows tokenisation services to extend beyond payments into areas such as subscription billing, digital wallets, and in-app transactions. By supporting unified token usage and automated update of card credentials, network tokenisation can improve customer retention and reduce abandoned purchases. Providers that position tokenisation as a seamless part of payment ecosystems can capture demand from merchants looking to optimize both conversion and security.

Challenge Analysis

Regulatory and Trust Barriers in Sensitive Data Ecosystems

One of the persistent challenges in this market is maintaining trust and regulatory compliance while handling highly sensitive payment data. Even though tokenisation reduces exposure to raw credentials, the systems that manage and store tokens must still meet strict data protection and compliance frameworks such as PCI security standards. Ensuring that these systems remain secure under audit and meet regional regulatory requirements adds ongoing operational responsibilities.

In markets with evolving data protection laws, organisations may face uncertainty about how tokenised data is classified under local privacy regulations. This can slow adoption or require additional legal and compliance oversight, as business leaders seek assurance that tokenised systems meet both security expectations and regulatory obligations. Providers must therefore balance secure infrastructure with clear compliance reporting and governance to maintain stakeholder confidence.

Competitive Analysis

Global card networks such as Visa, Mastercard, American Express, Discover, and JCB play a foundational role in network tokenisation. These networks issue and manage network-level tokens that replace sensitive card data during transactions. Their solutions improve fraud prevention and transaction approval rates. Strong acceptance infrastructure and regulatory alignment support global adoption across eCommerce and in-store payments.

Digital wallet and platform providers such as Apple Pay, Google Pay, and Samsung Pay accelerate tokenisation at the consumer layer. PayPal integrates network tokens across online and mobile checkouts. These platforms enhance user experience through secure, one-tap payments and device-level authentication. Adoption is driven by rising mobile commerce and contactless payment usage. Tokenisation also supports recurring and subscription-based payment models.

Payment processors and infrastructure providers such as Stripe, Adyen, FIS, Fiserv, and Worldpay embed network tokenisation into merchant acquiring systems. Marqeta supports modern card issuing and digital-first use cases. These players focus on interoperability, compliance, and scalability. Other vendors expand innovation and regional coverage, strengthening overall market maturity.

Top Key Players in the Market

- Visa

- Mastercard

- American Express

- Discover

- JCB

- Apple Pay

- Google Pay

- Samsung Pay

- PayPal

- Stripe

- Adyen

- FIS

- Fiserv

- Worldpay

- Marqeta

- Others

Future outlook

Growth in the Network Tokenisation market is expected to remain strong as digital payments focus on improved security and fraud reduction. Tokenisation replaces sensitive card details with secure digital tokens, which lowers the risk of data exposure during transactions.

Rising eCommerce activity and mobile wallet usage are supporting wider adoption. Over time, deeper integration with payment networks, merchants, and digital platforms is likely to improve transaction success rates and customer trust.

Recent Developments

- In February 2025, Visa acquired CardinalCommerce, the world’s largest authentication network, to ramp up tokenization integration in its Visa Checkout service and cut online shopping cart abandonment.

- In February 2025, Mastercard partnered with Visa on cross-provisioning, letting tokenized Mastercard credentials work in Visa Checkout and vice versa to speed up mobile and online token adoption.

Report Scope

Report Features Description Market Value (2025) USD 2.1 Bn Forecast Revenue (2035) USD 23.4 Bn CAGR (2025-2035) 27.20% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Token Type (Payment Tokens, Non-payment Tokens), By Deployment Mode (Cloud-based, On-premises), By End-User (Merchants, Payment Service Providers, Banks, Digital Wallets) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Visa, Mastercard, American Express, Discover, JCB, Apple Pay, Google Pay, Samsung Pay, PayPal, Stripe, Adyen, FIS, Fiserv, Worldpay, Marqeta, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Network Tokenisation MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Network Tokenisation MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Visa

- Mastercard

- American Express

- Discover

- JCB

- Apple Pay

- Google Pay

- Samsung Pay

- PayPal

- Stripe

- Adyen

- FIS

- Fiserv

- Worldpay

- Marqeta

- Others