Global Network Synchronization ICs Market Size, Share and Analysis Report By Technology (Precision Time Protocol (PTP),Network Time Protocol (NTP), Synchronous Ethernet (SyncE), GPS-based Synchronization, Others), By Application (5G Networks, Cloud Computing, IoT (Internet of Things), Edge Computing, Smart Grids and Energy Networks, Others), By Vertical (IT and Communication, Consumer Electronics, Industrial Application, Data Centers, Other Applications), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174594

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Technology Analysis

- Application Analysis

- Vertical Analysis

- Increasing Adoption Technologies

- Investment and Business Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

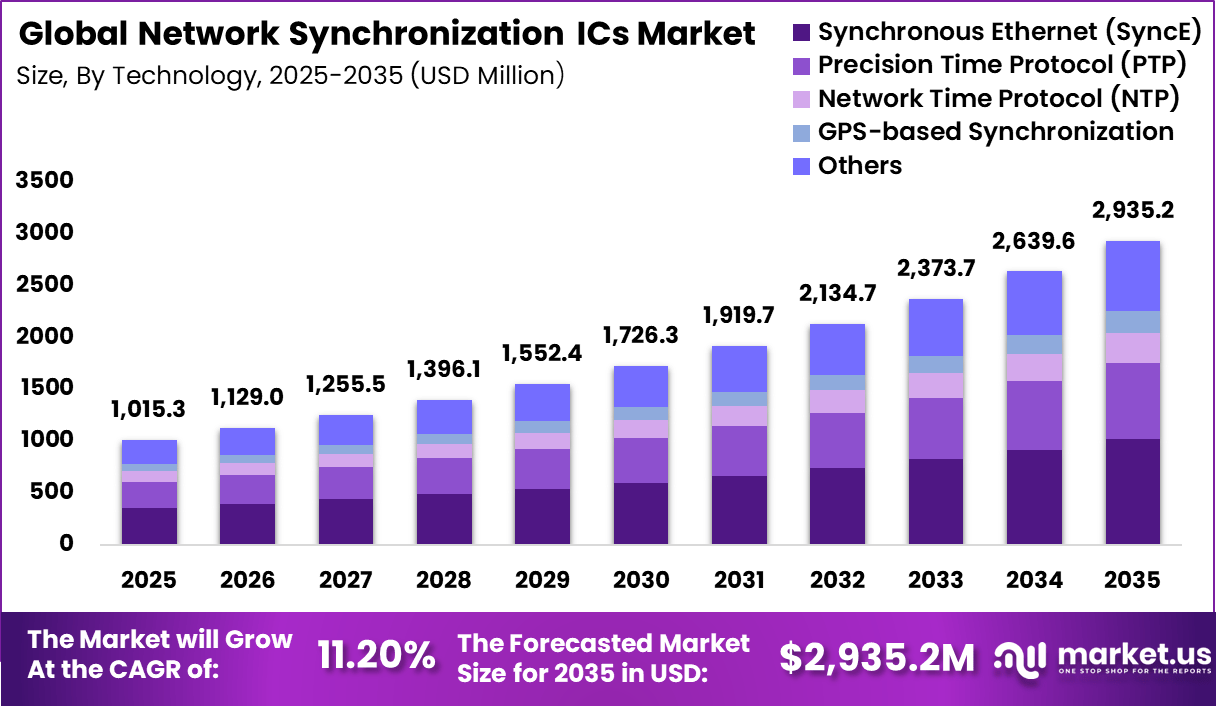

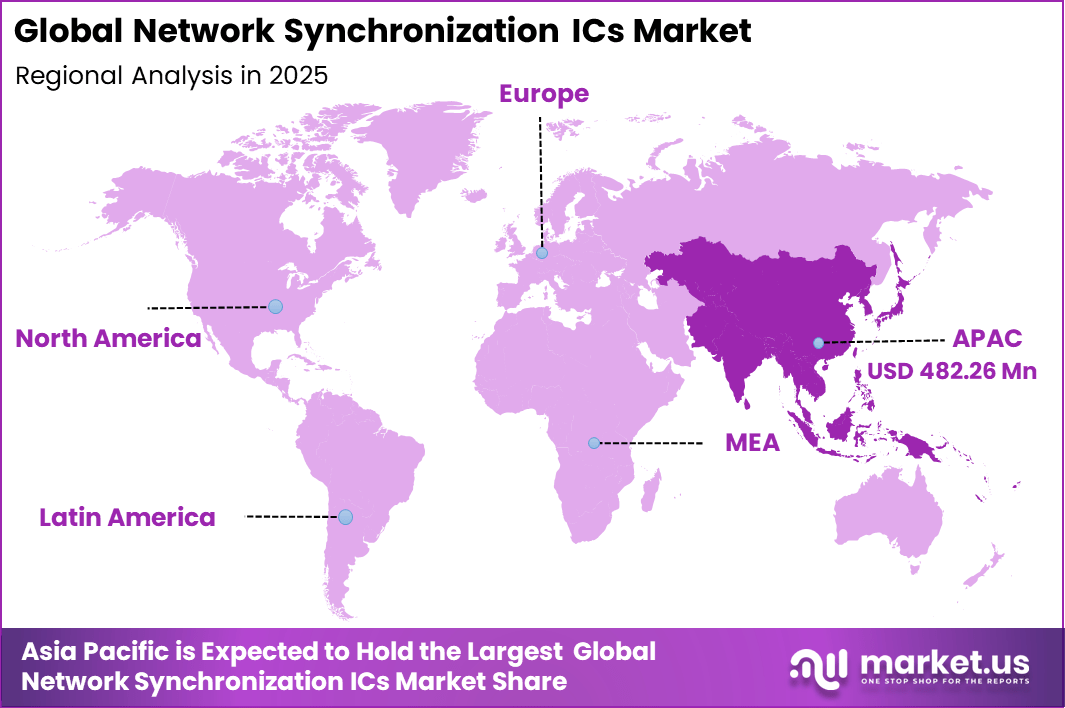

The Global Network Synchronization ICs Market generated USD 1,015.3 million in 2025 and is predicted to register growth from USD 1,129 million in 2026 to about USD 2,935.2 million by 2035, recording a CAGR of 11.20% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 47.5% share, holding USD 482.26 Million revenue.

The network synchronization ICs market refers to integrated circuits designed to maintain precise timing and synchronization across communication networks. These components ensure accurate clock alignment between network elements such as base stations, switches, routers, and data centers. Network synchronization ICs are essential for reliable data transmission, reduced latency, and coordinated network operations. They are widely used in telecommunications, industrial networks, data centers, and broadcast systems.

Adoption supports stable and high-performance network infrastructure. Market development has been influenced by increasing demand for high-speed and low-latency networks. Modern communication systems rely on precise timing to function correctly. Traditional synchronization methods are often insufficient for advanced network requirements. Dedicated ICs provide higher accuracy and reliability. As networks become more complex, synchronization solutions gain importance.

One major driving factor of the network synchronization ICs market is the expansion of advanced communication networks. Technologies such as high-capacity mobile networks and fiber-based systems require precise timing. Synchronization ICs help maintain signal integrity and coordination. Accurate timing reduces data errors and service interruptions. Network performance requirements drive adoption.

Another key driver is the growth of data-intensive and real-time applications. Applications such as cloud computing, video streaming, and industrial automation depend on synchronized data flow. Poor timing can cause latency and packet loss. Synchronization ICs ensure consistent performance. Demand for real-time reliability supports market growth.

Demand for network synchronization ICs is influenced by ongoing upgrades in telecommunications infrastructure. Network operators modernize systems to support higher speeds and capacity. Synchronization components are required during these upgrades. Increased infrastructure investment supports steady demand. Network modernization remains a key demand factor.

Top Market Takeaways

- By technology, Synchronous Ethernet (SyncE) captured 34.8% of the network synchronization ICs market, providing precise timing for telecom networks with low jitter and high reliability.

- By application, 5G networks led at 41.3%, relying on Sync ICs for fronthaul synchronization in base stations and small cells.

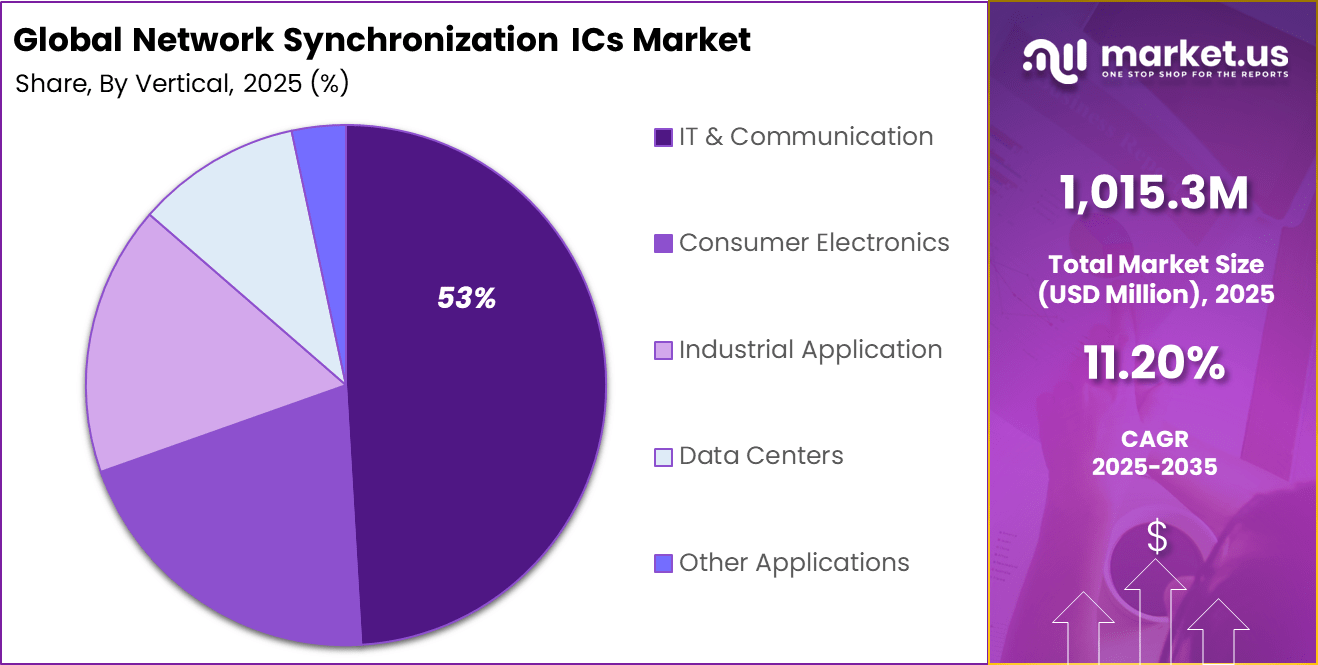

- By vertical, IT and telecommunications dominated with 52.6%, driving demand for timing solutions in next-gen mobile infrastructure.

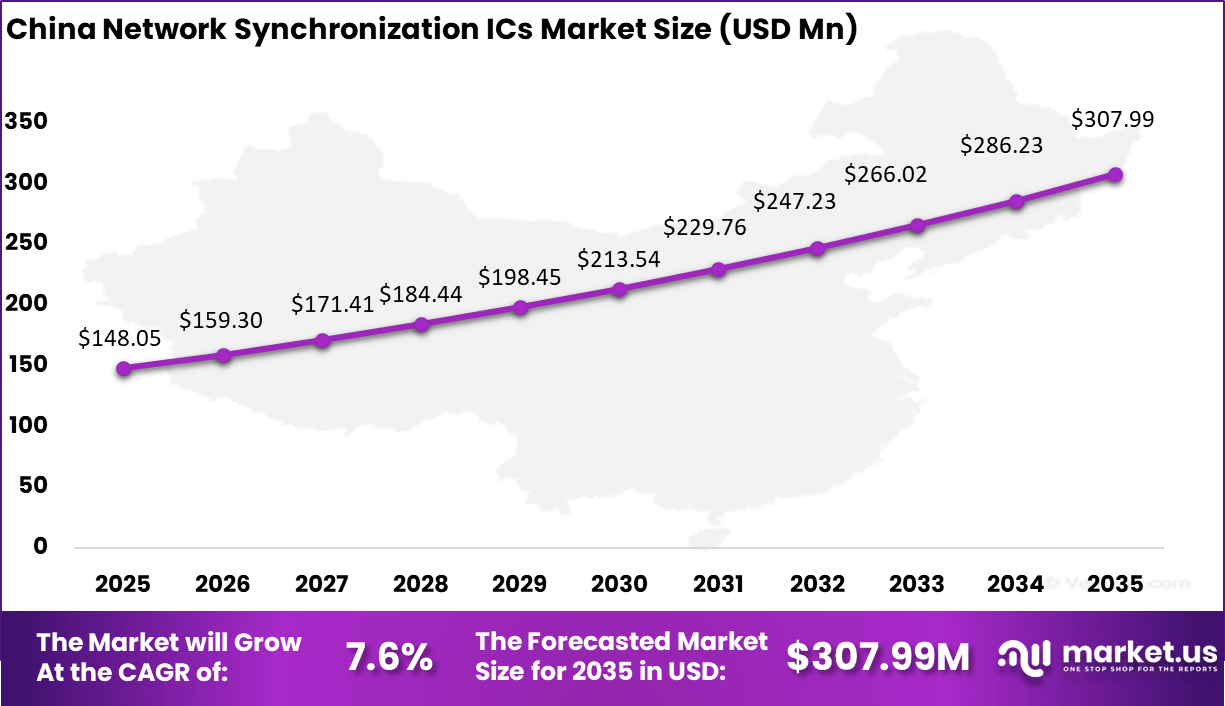

- APAC held 47.5% of the global market, with China valued at USD 148.05 million and growing at a CAGR of 7.6%.

Technology Analysis

Synchronous Ethernet accounts for 34.8% of the network synchronization ICs market, reflecting its importance in modern telecom networks. SyncE provides accurate frequency synchronization across network elements, which is essential for stable data transmission. Its role becomes more critical as networks handle higher data volumes and lower latency requirements. Telecom operators rely on SyncE to maintain timing accuracy across distributed network architectures.

This technology supports seamless coordination between network nodes, reducing packet loss and service disruption. Its compatibility with existing Ethernet infrastructure also supports wide adoption. As network complexity increases, SyncE remains a preferred synchronization method. Continuous improvements in timing accuracy enhance its reliability. This sustains its strong position within the market.

Application Analysis

5G networks represent 41.3% of application demand for network synchronization ICs. Precise timing is essential for 5G features such as massive connectivity, low latency, and network slicing. Synchronization ICs ensure coordinated operation across radio units and core networks.

The deployment of dense small-cell architectures increases synchronization requirements. Timing accuracy supports seamless handovers and efficient spectrum use. This makes synchronization ICs a critical component of 5G infrastructure. As 5G rollouts expand, demand for advanced synchronization solutions continues to rise. Operators invest in reliable ICs to support service quality. This drives sustained growth in this application segment.

Vertical Analysis

The IT and telecommunications vertical accounts for 52.6% of market demand, making it the dominant user segment. This vertical depends heavily on accurate network timing to ensure reliable communication services. Synchronization ICs support core functions such as data routing and traffic management.

Telecom service providers deploy synchronization ICs across base stations, routers, and switches. These components help maintain network stability and performance. IT infrastructure providers also integrate synchronization solutions into enterprise networking equipment. As data traffic increases, timing precision becomes more critical. The IT and telecommunications sector continues to invest in advanced synchronization technologies. This reinforces its leading market position.

Increasing Adoption Technologies

Advanced clock generation and timing technologies play a central role in market adoption. These technologies improve frequency accuracy and stability. High-performance timing solutions reduce jitter and drift. Improved precision enhances network reliability. Technology advancements support wider adoption.

Integration with software-defined networking technologies also supports growth. Synchronization ICs work alongside digital network management systems. Hardware and software coordination improves control. Flexible architectures support scalability. Technology convergence strengthens market appeal.

One key reason organizations adopt network synchronization ICs is improved network reliability. Accurate timing prevents data misalignment and service degradation. Stable synchronization supports consistent performance. Reliability is critical for mission-critical networks. This benefit drives adoption.

Another reason is support for scalability and future network expansion. Synchronization ICs enable networks to grow without timing conflicts. Consistent timing simplifies integration of new equipment. Scalability supports long-term planning. Growth readiness encourages investment.

Investment and Business Benefits

Investment opportunities in the network synchronization ICs market exist in next-generation communication infrastructure. Network upgrades require advanced timing components. Suppliers supporting modern standards attract interest. Long-term infrastructure demand supports growth. Investment focuses on high-precision solutions.

Another opportunity lies in industrial and automation networks. Manufacturing and energy systems require synchronized operations. Timing ICs improve coordination and safety. Industrial digitalization increases adoption. This segment offers expansion potential.

Network synchronization ICs improve operational efficiency by reducing network errors and downtime. Accurate timing supports smooth data transmission. Reduced disruptions lower maintenance costs. Efficiency gains improve service quality. Business performance benefits from stability.

These solutions also support improved quality of service and customer experience. Reliable networks deliver consistent performance. Reduced latency improves application responsiveness. Service reliability builds trust. Long-term customer satisfaction improves.

Usage

- Used in telecom infrastructure to synchronize base stations and network nodes

- Applied in data centers to maintain timing across servers and switches

- Deployed in broadcast systems for signal alignment and transmission accuracy

- Utilized in industrial networks to support real-time communication

- Integrated into emerging network technologies for precise timing control

Emerging Trends

Key Trend Description Multi-channel ICs adoption Quad-channel solutions handle complex 5G synchronization needs. Sub-nanosecond precision Enhanced PTP and SyncE for low-jitter applications. Low-power designs Optimized for edge devices and battery-powered systems. TSN integration support Time-sensitive networking for industrial real-time control. SDN/NFV compatibility Software-defined timing in virtualized networks. Growth Factors

Key Factors Description 5G network deployments Requires precise base station and fronthaul timing. Data center expansion Virtualization demands accurate time synchronization. IoT ecosystems growth Massive devices need coordinated low-latency operations. Industrial automation rise Industry 4.0 relies on precise factory floor timing. Telecom infrastructure upgrades Legacy to next-gen timing protocol transitions. Key Market Segments

By Technology

- Precision Time Protocol (PTP)

- Network Time Protocol (NTP)

- Synchronous Ethernet (SyncE)

- GPS-based Synchronization

- Others

By Application

- 5G Networks

- Cloud Computing

- IoT (Internet of Things)

- Edge Computing

- Smart Grids and Energy Networks

- Others

By Vertical

- IT & Communication

- Consumer Electronics

- Industrial Application

- Data Centers

- Other Applications

Regional Analysis

Asia Pacific accounted for 47.5% share, supported by rapid expansion of telecom infrastructure and strong deployment of high speed mobile and broadband networks across the region. Network synchronization ICs have been widely adopted to ensure precise timing and frequency alignment in 4G, 5G, and optical transport networks.

Demand has been driven by rising data traffic, network densification, and growing use of small cells and edge infrastructure. The region’s large scale rollout of telecom equipment and data centers has reinforced steady demand for accurate and reliable synchronization solutions.

China reached a market value of USD 148.05 Million and is projected to grow at a 7.6% CAGR, reflecting sustained investment in telecom modernization and network expansion. Adoption has been driven by large scale deployment of 5G base stations and backbone networks, where precise synchronization is essential for performance and reliability. Network synchronization ICs have supported time sensitive applications such as massive machine type communication and ultra reliable low latency services.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

The network synchronization ICs market is being driven by the heightened need for precise timing and coordination across high-speed communication infrastructures. Modern networks such as 5G, data centers, and broadband systems depend on accurate synchronization to ensure data integrity, reduce latency, and support seamless handovers across distributed nodes.

Synchronization integrated circuits provide the timing stability necessary to align clocks and signal phases across mixed hardware and software layers. As digital connectivity expands and network architectures become more complex, demand for reliable timing solutions that improve network performance and reduce errors continues to strengthen, particularly in telecommunications and real-time data processing applications.

Restraint Analysis

A key restraint in the network synchronization ICs market relates to the technical complexity and cost associated with developing and integrating high-precision timing components. Advanced synchronization ICs require sophisticated design, testing, and calibration to meet stringent performance standards under varying environmental and operational conditions.

Integrating these components into existing network infrastructures, particularly in legacy systems, often involves extensive engineering support and may require hardware redesigns, which can increase implementation cost and prolong deployment timelines. These factors can slow adoption rates among organisations with constrained budgets or established legacy equipment.

Opportunity Analysis

Emerging opportunities in the network synchronization ICs market are linked to the accelerating rollout of next generation communication standards and time sensitive networking applications. Technologies such as 5G and future wireless generations, industrial automation, smart grids, and connected autonomous systems all demand extremely accurate timing to operate efficiently and safely.

Synchronization ICs that support enhanced precision, lower jitter, and robust performance under diverse conditions are well positioned to capture value as these applications scale. There is also potential for integration with system-on-chip designs and modular network hardware platforms, which can simplify adoption and reduce overall system complexity.

Challenge Analysis

A central challenge confronting this market involves maintaining performance consistency and interoperability in heterogeneous network environments. Networks increasingly encompass components from multiple vendors, varied protocol standards, and diverse physical layers, which complicates the design of synchronization solutions that are universally compatible.

Ensuring timing accuracy across these mixed ecosystems requires rigorous validation and standard compliance testing. Additionally, balancing ultra-low latency requirements with energy efficiency and cost-effective manufacturing increases the technical demands on IC design and fabrication processes.

Competitive Analysis

The competitive landscape of the network synchronization ICs market is shaped by leading semiconductor manufacturers and timing technology specialists that support precise clocking and synchronization across telecom and networking infrastructure.

Analog Devices, Broadcom, Infineon Technologies, Intel, NXP Semiconductors, Qualcomm, Microchip Technology, ON Semiconductor, Maxim Integrated, and IDT compete through advanced timing, clock generation, and jitter management solutions designed for 5G, data centers, and high speed networks. These companies benefit from strong R&D capabilities, long product lifecycles, and close partnerships with telecom equipment manufacturers.

At the same time, specialized players such as Arteris, Conemtech, Qulsar, and Qulsar, Inc. add competitive pressure by focusing on niche synchronization technologies, precision timing, and application specific designs. Competitive differentiation increasingly depends on timing accuracy, power efficiency, integration with network processors, and compliance with evolving telecom standards.

Top 5 companies in the Network Synchronization ICs Market

Company Core Product Focus Synchronization Technology Strength Key Application Areas Competitive Positioning Analog Devices, Inc. Timing and clock ICs Ultra-low jitter, high-precision clocking 5G networks, data centers Market leader in high-accuracy timing solutions Broadcom Inc. Network timing and switching ICs Carrier-grade synchronization Telecom infrastructure, switches Strong presence in large carrier deployments Texas Instruments Incorporated Clock and timing solutions Broad and reliable timing portfolio Industrial and telecom systems Scale driven leader with wide product range Renesas Electronics Corporation Timing and clock management ICs Integrated system-level synchronization Automotive and industrial networking Strong MCU and timing integration capability NXP Semiconductors N.V. Network synchronization ICs Ethernet and TSN based timing Automotive Ethernet, industrial automation Leadership in time-sensitive networking Top Key Players in the Market

- Analog Devices, Inc.

- Arteris, Inc.

- Broadcom Inc.

- Conemtech AB

- IDT (Integrated Device Technology)

- Infineon Technologies AG

- Intel Corporation

- Maxim Integrated

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Qualcomm Incorporated

- Qulsar, Inc.

- Realtek Semiconductor Corp.

- Renesas Electronics Corporation

- Semtech Corporation

- Silicon Laboratories Inc.

- Texas Instruments Incorporated

- Others

Future Outlook

Growth in the Network Synchronization ICs market is expected to remain steady as telecom and data networks require precise timing and coordination. These ICs play a key role in supporting reliable data transfer, low latency communication, and network stability.

Rising deployment of 5G, data centers, and high speed broadband infrastructure is supporting long term demand. Over time, higher accuracy, lower power consumption, and support for advanced timing standards are likely to expand use across communication and industrial networks.

Recent Developments

- January, 2026: Silicon Labs launched the Simplicity SDK for Zephyr at CES, enhancing their timing IC support for connected IoT with better QA and precision sync in wireless networks.

- December, 2025: Renesas kicked off sampling for the R-Car Gen 5 SoC family, including the X5H chip with up to 400 TOPS AI performance and advanced sync for multi-domain vehicle systems, set for CES 2026 demos.

Report Scope

Report Features Description Market Value (2025) USD 1,015.3 Mn Forecast Revenue (2035) USD 2,935.2 Mn CAGR(2025-2035) 11.20% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology (Precision Time Protocol (PTP), Network Time Protocol (NTP), Synchronous Ethernet (SyncE),GPS-based Synchronization, Others), By Application (5G Networks, Cloud Computing, IoT (Internet of Things), Edge Computing, Smart Grids and Energy Networks,Others), By Vertical (IT and Communication, Consumer Electronics, Industrial Application, Data Centers, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Analog Devices, Inc., Arteris, Inc., Broadcom Inc., Conemtech AB, IDT (Integrated Device Technology), Infineon Technologies AG, Intel Corporation, Maxim Integrated, Microchip Technology Inc., NXP Semiconductors N.V., ON Semiconductor Corporation, Qualcomm Incorporated, Qulsar, Inc., Realtek Semiconductor Corp., Renesas Electronics Corporation, Semtech Corporation, Silicon Laboratories Inc., Texas Instruments Incorporated, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Network Synchronization ICs MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Network Synchronization ICs MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Analog Devices, Inc.

- Arteris, Inc.

- Broadcom Inc.

- Conemtech AB

- IDT (Integrated Device Technology)

- Infineon Technologies AG

- Intel Corporation

- Maxim Integrated

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Qualcomm Incorporated

- Qulsar, Inc.

- Realtek Semiconductor Corp.

- Renesas Electronics Corporation

- Semtech Corporation

- Silicon Laboratories Inc.

- Texas Instruments Incorporated

- Others