Global Network Security Market Size, Share Report By Component (Solution (Anti-Malware and Antivirus, Firewall, Data Loss Prevention, Secure Web Gateway, Network Access Control, Unified Threat Management, Intrusion Detection Systems (IDS)/Intrusion Prevention Systems (IPS), Others), Services), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Healthcare, Retail and E-Commerce , Manufacturing, Energy and Utilities, Government and Defense, Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 130306

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Network Security Statistics

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- Industry Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Top 5 Business Benefits

- Regional Analysis

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

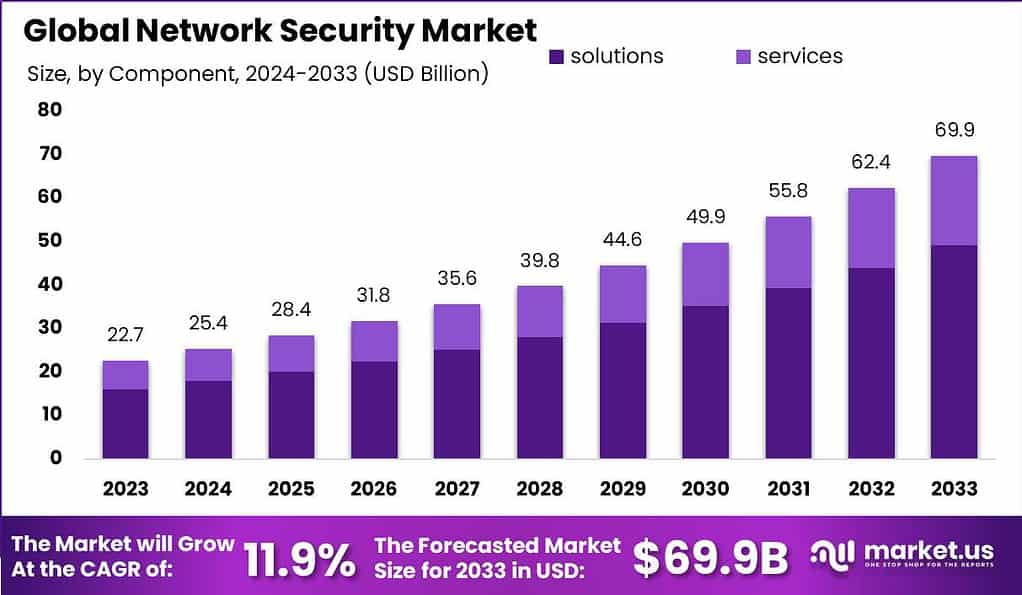

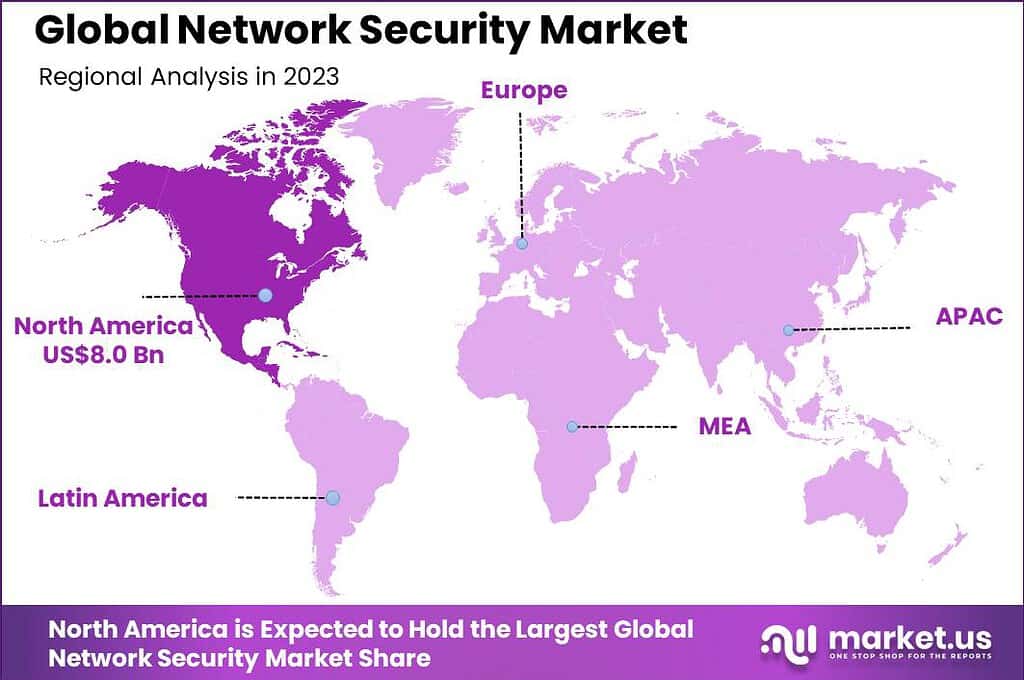

The Global Network Security Market size is expected to be worth around USD 69.9 Billion By 2033, from USD 22.7 Billion in 2023, growing at a CAGR of 11.90% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 35.4% share, holding USD 8.0 Billion revenue.

Network security refers to the suite of technologies, policies, and practices designed to protect the integrity, confidentiality, and accessibility of computer networks and data. It involves various measures to prevent unauthorized access, misuse, malfunction, modification, destruction, or improper disclosure, thereby ensuring the safety and privacy of the data transmitted or stored.

The network security market comprises companies that develop and provide these security solutions, catering to the needs of various sectors including government, healthcare, financial services, and more. This market is continuously evolving as it adapts to the ever-changing landscape of cyber threats and regulatory requirements.

The growth of the network security market is driven by several key factors such as increasing number of cyberattacks and data breaches compels businesses to enhance their cybersecurity measures, directly boosting demand for network security solutions. Additionally, the widespread adoption of cloud computing and the expansion of wireless network technologies have expanded the attack surface, necessitating more robust network security measures.

Furthermore, regulatory requirements and data protection laws in various regions mandate businesses to adopt enhanced security practices, further fueling market growth. The rise of the Internet of Things (IoT) and the integration of artificial intelligence in network security are also contributing to the dynamic expansion of this market.

The demand for network security solutions has been on the rise due to the growing number of data breaches. The digital transformation of companies and the increasing volume of data being transferred through networks demand robust security systems. Governments and organizations are continuously adopting stricter regulations for data protection, which has further driven the demand for network security tools to comply with these regulations.

Network security is gaining immense popularity among both large enterprises and small-to-medium-sized businesses (SMBs). The proliferation of cloud computing and the shift towards remote working models have exposed organizations to more vulnerabilities. As a result, there’s been a widespread adoption of advanced security solutions that are tailored for protecting cloud-based infrastructure and remote access. This popularity is expected to continue growing as businesses prioritize security over operational costs.

The market presents significant opportunities, especially with the rise of artificial intelligence (AI) and machine learning (ML) in security systems. These technologies enable predictive analysis and real-time threat detection, which can significantly enhance the effectiveness of traditional network security measures. Additionally, the growing use of the Internet of Things (IoT) devices is opening new opportunities for network security vendors to provide specialized solutions for safeguarding IoT ecosystems.

Based on the research findings of AIMultiple, the average cost of a data breach in 2023 escalated to approximately $4 million, marking the highest value ever recorded and representing a 15% increase over the past three years. Reflecting the gravity of this issue, about 95% of executives now prioritize IT security resilience as a core component of their strategic planning.

Furthermore, the prevalent vulnerability of organizations is underscored by the fact that 90% of them have reported experiencing at least one data breach or cyber incident. Alarmingly, on average, each employee has access to around 11 million files, highlighting significant potential risks in data management and security protocols.

Key Takeaways

- The Global Network Security Market is projected to grow from USD 22.7 billion in 2023 to approximately USD 69.9 billion by 2033, reflecting a compound annual growth rate (CAGR) of 11.90% during the forecast period from 2024 to 2033.

- The Solution segment of the market maintained a robust lead, with a market share exceeding 70.5%. This segment includes a range of products and services essential for protecting networks against cyber threats.

- The Cloud-Based segment emerged as a leader, capturing over 64.1% of the market. This dominance underscores the pivotal role of cloud technologies in network security.

- Large Enterprises held a significant position, accounting for more than 61.3% of the market. This reflects the high investment and adoption rates of network security solutions within large corporate structures.

- In the sector analysis, the IT and Telecommunications segment led the market, taking more than 23.0% of the overall share. This highlights the critical need for network security in this rapidly advancing industry.

- North America showcased a commanding presence in the market, securing over 35.4% of the total market share, with revenues surpassing USD 8.0 billion.

Network Security Statistics

- 2,200 cyber attacks occur daily, equating to an attack every 39 seconds.

- The average cost of a data breach in 2024 has escalated to $4.88 million, with breaches in the U.S. averaging $9.44 million.

- Approximately 48% of small and medium-sized businesses (SMBs) have been targeted by cyberattacks, highlighting a deficit in their security measures understanding.

- Network security revenue is projected to grow at an annual rate of approximately 15%, aiming for a market volume of $40 billion by 2028.

- The U.S. leads in network security revenue, generating around $9 billion in 2023.

- In North America, the U.S. accounts for 80% of cyber crime incidents, with Canada responsible for 20%.

- A notable 80% of data breaches involve information stored in cloud environments, including public, private, or hybrid systems.

- From 2017 to 2022, U.S. internet users filed an annual average of 651,800 complaints regarding cyber issues.

- Organizations that employ network security AI and automation report average savings of approximately USD 1.8 million.

- An estimated 75% of industry leaders are considering the adoption of Zero-Trust architecture to bolster their security frameworks.

- A substantial 80% of hacking-related breaches stem from brute force or Distributed Denial of Service (DDoS) attacks, or through compromised credentials.

- About 50% of organizations have encountered malware activities that aim to steal information.

Component Analysis

In 2023, the Solution segment of the Network Security Market held a dominant market position, capturing more than a 70.5 % share. This leading status can primarily be attributed to the increasing complexity and frequency of cyber threats, which has compelled organizations across various sectors to prioritize robust security solutions. Solutions like firewalls, antivirus software, and intrusion detection systems (IDS) form the first line of defense against cyber attacks, ensuring a secure IT infrastructure.

The significant reliance on digital platforms for business operations has further fueled the demand for comprehensive security solutions. Organizations are investing heavily in anti-malware, data loss prevention, and secure web gateways to safeguard sensitive information and maintain compliance with regulatory requirements. These solutions are not only essential for detecting threats but also for preventing potential security breaches that could lead to financial losses and damage to reputation.

Also, the shift towards remote work settings due to recent global events has heightened the importance of network security solutions. Enterprises are increasingly adopting network access control and unified threat management systems to manage and secure remote connections. This shift has made network security solutions indispensable for maintaining operational continuity and protecting against an expanding landscape of cyber threats.

Overall, the Solution segment’s leadership in the Network Security Market is driven by the critical need for robust security mechanisms in an increasingly digital world. As cyber threats evolve, the demand for advanced and integrated solutions will likely continue to grow, further cementing the segment’s dominant market share.

Deployment Mode Analysis

In 2023, over 64.1% of the Network Security Market was captured by the Cloud-Based segment, underscoring its dominant position in the industry. This strong performance is primarily driven by the growing preference for flexible and scalable security solutions.

As businesses increasingly shift to cloud infrastructures, they seek network security options that can adapt quickly to dynamic environments without the limitations of traditional on-premise systems. Cloud-based security allows companies to manage security remotely and scale their resources as needed, making it an ideal fit for modern business operations.

The cloud-based model is leading the segment due to its ability to offer real-time threat monitoring and protection, which is crucial in today’s rapidly evolving cyber landscape. With the rise of remote work and digital transformation, companies are prioritizing the need for uninterrupted access to security updates and patches, which the cloud delivers seamlessly. They provide easier integration with existing systems and platforms, reducing the complexity and cost associated with maintaining on-premise infrastructures.

Another key factor contributing to the dominance of cloud-based network security is cost efficiency. Small and medium-sized enterprises (SMEs) benefit from the pay-as-you-go model offered by cloud providers, allowing them to access enterprise-level security features without the need for significant upfront investments. This affordability, coupled with enhanced flexibility, makes cloud-based solutions more appealing, especially for businesses looking to optimize their budgets.

Cloud-based security offers a higher level of collaboration between security teams and system administrators. It provides centralized control and visibility across distributed networks, enabling quicker response times to potential threats. This feature is essential for organizations operating across multiple locations or handling large volumes of sensitive data, making cloud-based solutions the preferred choice in the Network Security Market.

Organization Size Analysis

In 2023, the Large Enterprises segment held a dominant position in the Network Security Market, capturing more than 61.3% of the market share. This leadership is driven by the complex and expansive network infrastructures that large organizations manage. Large enterprises typically handle significant amounts of sensitive data, making advanced security solutions critical to their operations. As a result, these businesses invest heavily in robust network security systems to safeguard against evolving cyber threats.

Due to their multiple departments, subsidiaries, and remote locations, large enterprises encounter unique challenges in managing security across distributed networks. This complexity necessitates comprehensive and scalable network security solutions to safeguard their global operations. To effectively address these challenges, they require advanced threat detection, encryption, and intrusion prevention systems that can manage high traffic volumes and diverse network configurations.

Additionally, large organizations are subject to stringent regulatory and compliance requirements, which further drives their investment in cutting-edge security technologies. These businesses are often held to higher standards in terms of data protection, especially in industries like finance, healthcare, and government. To meet these requirements, large enterprises deploy network security systems that offer not only protection but also advanced reporting and auditing capabilities, positioning them as the key segment in this market.

Large enterprises tend to have larger IT budgets, enabling them to invest in the latest security technologies and infrastructure. Their ability to allocate substantial resources toward cybersecurity ensures they stay ahead of emerging threats. This financial strength, coupled with their need for sophisticated, high-performance security solutions, explains why the Large Enterprises segment continues to lead the Network Security Market

Industry Vertical Analysis

In 2023, the IT and Telecommunications segment held a dominant market position in the Network Security Market, capturing more than 23.0% of the overall share. This leadership stems from the critical role that IT and telecom companies play in maintaining global connectivity and data flow. As these sectors manage vast amounts of sensitive information and customer data, ensuring robust security measures is essential to prevent cyber threats and breaches.

The IT and telecommunications industries are at the forefront of digital transformation, with networks constantly expanding to accommodate new technologies like 5G, IoT, and cloud computing. These developments significantly increase the attack surface, making them prime targets for cybercriminals. As a result, companies in these industries invest heavily in advanced network security solutions to safeguard their infrastructure and protect customer data.

Telecom companies act as the backbone of internet services, managing large-scale network traffic and ensuring seamless communication. Any disruption to these services can have wide-ranging consequences for businesses and consumers alike. Therefore, telecom providers prioritize network security to maintain uptime and service reliability, further reinforcing their dominant position in the market.

Furthermore, regulatory compliance requirements, such as data protection laws and standards, push IT and telecom companies to adopt high-end security measures. They must adhere to strict protocols to avoid penalties and ensure customer trust. This need for compliance, combined with the sheer volume of data managed by these industries, explains why the IT and Telecommunications segment continues to lead the Network Security Market.

Key Market Segments

By Component

- Solution

• Anti-Malware and Antivirus

• Firewall

• Data Loss Prevention

• Secure Web Gateway

• Network Access Control

• Unified Threat Management

• Intrusion Detection Systems (IDS)/Intrusion Prevention Systems (IPS)

• Others - Services

By Deployment Mode

- Cloud-Based

- On-Premise

By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By Industry Vertical

- IT and Telecommunications

- BFSI

- Healthcare

- Retail and E-Commerce

- Manufacturing

- Energy and Utilities

- Government and Defense

- Other Industry Verticals

Driver

Increasing Cybersecurity Threats

Major key driver propelling the growth of the network security market is the rapid escalation of cybersecurity threats. In recent years, cyberattacks have become increasingly sophisticated, targeting businesses, governments, and individuals on a global scale. With the rise of digitization and cloud adoption, hackers and malicious actors are constantly finding new vulnerabilities to exploit, making it imperative for organizations to invest in robust network security solutions.

Organizations are particularly vulnerable as they expand their digital infrastructures, and this vulnerability is further amplified by the growth of remote work. Remote connections, cloud platforms, and mobile devices create additional entry points for attackers, thus intensifying the need for comprehensive network security systems.

For example, in 2021, ransomware attacks rose by over 150%, and these figures have only continued to grow in recent year. This trend shows no signs of slowing down, as cybercriminals are leveraging advanced techniques such as AI-driven attacks, zero-day exploits, and social engineering.

Restraint

High Implementation Costs

One of the major restraints hampering the growth of the network security market is the high cost associated with implementing comprehensive security solutions. Small and medium-sized enterprises (SMEs) often struggle with budget constraints, which can limit their ability to invest in cutting-edge security technologies. Solutions such as advanced firewalls, intrusion detection systems (IDS), data loss prevention (DLP), and secure web gateways typically require significant upfront investment in both hardware and software.

Additionally, network security systems need continuous updates, maintenance, and monitoring to remain effective, which further increases the overall cost of ownership. Many businesses, especially those in developing markets, may find it difficult to allocate sufficient resources to implement such systems.

The costs associated with hiring skilled IT security personnel to manage and maintain these systems also contribute to the financial burden. As cybersecurity becomes more specialized, the demand for trained professionals has grown, leading to higher salaries and further inflating costs for organizations.

Opportunity

Growing Adoption of Cloud-Based Solutions

The growing adoption of cloud-based solutions presents a significant opportunity for the network security market. As businesses increasingly shift their operations to the cloud, the need for advanced security measures to protect cloud-based infrastructures is becoming paramount. Cloud computing offers numerous advantages, such as scalability, cost-efficiency, and flexibility, but it also introduces new security challenges.

Data stored in the cloud is more susceptible to cyberattacks, making cloud security a top priority for organizations across all industries.Cloud-based security solutions offer numerous benefits, including easier deployment, real-time updates, and reduced maintenance costs. These solutions are particularly appealing to small and medium-sized enterprises (SMEs), as they provide robust protection without the need for significant upfront investment in hardware or infrastructure.

Challenge

Skilled Workforce Shortage

A persistent challenge in the network security market is the shortage of skilled cybersecurity professionals. As security systems become more advanced, the need for highly skilled personnel to operate and manage these systems grows.

However, the supply of these professionals has not kept pace with the demand, leading to a significant gap. This shortage can hinder the effective implementation and management of network security measures, impacting the ability to defend against sophisticated cyber threats effectively.

Also, the growing complexity of modern IT infrastructures, with hybrid environments that combine on-premise systems, cloud platforms, and remote workforces. This complexity increases the difficulty of implementing and managing security solutions that can effectively protect all aspects of an organization’s network.

Emerging Trends

The Network Security Market is experiencing several emerging trends, each shaped by technological advancements, evolving cyber threats, and changing business environments. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into network security solutions is a significant trend. These technologies enhance the ability to detect and respond to threats in real-time.

The adoption of Zero Trust security models is rapidly gaining traction as organizations recognize that traditional security perimeters are no longer sufficient. In a Zero Trust framework, every access request is fully authenticated, authorized, and encrypted before being granted, regardless of where the request originates. This approach minimizes the attack surface and reduces the risk of insider threats, making it a key trend in the network security landscape.

As businesses continue to migrate to cloud environments, the demand for robust cloud security solutions is growing. This trend includes the development of specialized cloud-native security tools that provide visibility and control over data across all cloud services. Security providers are focusing on offering comprehensive solutions that can manage security policies, monitor compliance, and protect against threats across multiple cloud platforms.

Top 5 Business Benefits

Investing in the Network Security market offers numerous business benefits that can significantly enhance an organization’s resilience and reputation. It fosters customer trust and loyalty through a commitment to data security, while also allowing for scalable solutions that adapt to growth.

- Protection of Sensitive Data is crucial for safeguarding client information, financial records, and intellectual property. Effective security measures like encryption and access controls prevent unauthorized access and data breaches, helping businesses protect their vital assets.

- Maintenance of Business Continuity ensures that business operations run smoothly without interruption from cyber threats. By preventing disruptions caused by cyber attacks, businesses can maintain productivity and ensure continuous service delivery, which is essential for growth and customer satisfaction.

- Support for Remote Work is becoming the norm as network security enables secure access to corporate resources. Solutions such as VPNs and multi-factor authentication ensure that remote employees can work efficiently without compromising the security of the network.

- Company Reputation and Customer Trust is maintained by effectively safeguarding against data breaches. Customers are more likely to trust and engage with businesses that demonstrate a commitment to security, particularly in an era where data breaches are highly publicized. Maintaining strong security practices helps prevent the loss of customer trust and loyalty in the event of a security incident.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 35.4% share, with revenue exceeding USD 8.0 billion. This leadership is primarily attributed to the region’s advanced technological infrastructure, high concentration of cybersecurity firms, and widespread adoption of digital platforms.

The U.S. and Canada, in particular, have been proactive in implementing stringent cybersecurity regulations, which has driven significant investment in network security solutions. Large enterprises in industries such as BFSI, IT, healthcare, and defense continue to adopt sophisticated security systems, further fueling market growth in North America.

The region has a stringent regulatory landscape that mandates strong cybersecurity measures across various industries. Regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) require businesses to adopt high-standard network security practices. This regulatory pressure has led to increased investment in network security technologies to avoid the heavy fines associated with non-compliance.

Additionally, the high incidence of cyber attacks in North America has heightened awareness and accelerated the adoption of network security solutions. Businesses in this region are often the targets of cybercriminals due to their large scale and lucrative data, which compels them to prioritize investments in cybersecurity. This proactive approach towards cybersecurity investment further fuels the growth of the network security market in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the dynamic landscape of the network security market, several key players stand out due to their innovative solutions and strategic market approaches.Each of these companies have a unique set of strengths, making them leaders in a market that is increasingly vital to the digital economy’s infrastructure.

IBM Corporation is a stalwart in the network security domain, offering a comprehensive range of solutions that include threat intelligence, data protection, and cloud security services. IBM’s strength lies in its integration of AI with cybersecurity, offering advanced threat detection and response capabilities. The company’s constant innovation and broad service offerings make it a trusted provider for enterprises seeking robust security architectures.

Microsoft Corporation’s entry into the network security market is fortified by its extensive cloud infrastructure, which supports a range of security solutions including identity and access management, threat protection, and information protection. Microsoft Azure’s security center plays a pivotal role in safeguarding assets in the cloud, making Microsoft a go-to provider for businesses heavily invested in cloud computing.

Cisco Systems, Inc. is Known for its networking expertise and also shines in the network security space with products like firewalls, VPNs, and endpoint security solutions. Cisco’s approach to network security is comprehensive, offering layered protection that encompasses network segmentation, intrusion prevention, and advanced threat protection. This holistic view makes Cisco a preferred choice for organizations looking to secure complex network environments.

Palo Alto Networks stands out for its focus on innovative security solutions like its next-generation firewalls and cloud-based security services. The company’s platform, which offers substantial visibility and control over network traffic, is designed to prevent known and unknown threats effectively. Palo Alto’s commitment to continuous innovation in threat detection and prevention technologies makes it a leader in the field, particularly attractive to industries facing sophisticated cyber threats.

Top Key Players in the Market

- IBM Corporation

- Microsoft Corporation

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- Broadcom Inc.

- Trend Micro Incorporated

- Sophos Ltd.

- Forcepoint

- Other Key Players

Recent Developments

- Fortinet expanded its secure networking portfolio with the introduction of FortiGate 90G in August 2023. Powered by Fortinet’s latest SP5 ASIC, this next-generation firewall provides AI-driven threat protection, scalability, and power efficiency, specifically targeting hybrid infrastructures. This release emphasizes Fortinet’s focus on converging networking and security to meet the demands of modern enterprises.

- Cisco Systems completed its acquisition of Splunk, a leader in data security and observability, for $28 billion in February 2024. This acquisition is aimed at enhancing Cisco’s cybersecurity portfolio, focusing on real-time threat detection and data analysis, making it a strategic move in the evolving network security landscape

- Palo Alto Networks and IBM announced a major partnership in May 2024 to deliver AI-powered security solutions. As part of this deal, Palo Alto Networks acquired IBM’s QRadar SaaS assets, with plans to transition clients to Palo Alto’s Cortex XSIAM platform. This collaboration aims to strengthen AI-driven security operations, offering enhanced cybersecurity solutions across both cloud and on-premise environments.

Report Scope

Report Features Description Market Value (2023) USD 22.7 Bn Forecast Revenue (2033) USD 69.9 Bn CAGR (2024-2033) 11.9 % Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution (Anti-Malware and Antivirus, Firewall, Data Loss Prevention, Secure Web Gateway, Network Access Control, Unified Threat Management, Intrusion Detection Systems (IDS)/Intrusion Prevention Systems (IPS), Others), Services), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Healthcare, Retail and E-Commerce , Manufacturing, Energy and Utilities, Government and Defense, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, Cisco Systems, Inc.,Palo Alto Networks, Inc.,Fortinet, Inc., Check Point Software Technologies Ltd.,Broadcom Inc.,Trend Micro Incorporated, Sophos Ltd.,Forcepoint, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Network Security MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Network Security MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Microsoft Corporation

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- Broadcom Inc.

- Trend Micro Incorporated

- Sophos Ltd.

- Forcepoint

- Other Key Players