Global Network as a Service Market By Type (WAN-as-a-service, and LAN-as-a-service), By Enterprise Size (Large Enterprise, and SMEs), By Application (WAN Optimization, Bandwidth on Demand, Cloud and SaaS Connectivity, Network Access Control, Virtual Private Network, Secure Web Gateway, UCaaS/Video Conferencing, and Other Applications) By Industry Vertical, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2024

- Report ID: 100978

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Network as a service Market size is expected to be worth around USD 115.7 Billion By 2032, from USD 14.6 billion in 2023, growing at a CAGR of 26.7% during the forecast period from 2023 to 2032.

Network as a Service (NaaS) is a modern approach to networking that provides businesses with scalable and flexible network capabilities without requiring them to own or manage physical infrastructure. It operates on a cloud-based subscription model, enabling organizations to access, manage, and maintain network services over the internet. NaaS integrates various networking functions such as bandwidth, connectivity, and network security, which can be provisioned quickly to meet the dynamic needs of businesses.

The NaaS market is expanding rapidly, driven by the need for scalable network solutions that can support the increasing amount of data and services moving to the cloud. Businesses are looking for ways to reduce the complexity of their network infrastructures and shift from capital-intensive models to operational cost models. The market is characterized by a strong presence of both established players and emerging challengers who are continuously innovating to provide enhanced network capabilities.

The focus is on delivering solutions that are not only efficient and secure but also capable of integrating with multi-cloud environments and supporting the vast array of IoT devices being deployed across industries. The shift towards remote working models, the increase in cloud-based applications, and the growing need for cost-effective network management solutions are major drivers for the NaaS market. Organizations are seeking greater flexibility and agility in their network operations to quickly adapt to market changes and business opportunities.

The economic advantage of converting capital expenditure into operational expenditure is also a significant factor, as it allows businesses to allocate resources more efficiently and scale their operations without hefty upfront investments. There is a substantial demand for NaaS solutions that offer robust security, enhanced connectivity, and seamless integration with existing IT infrastructure.

For instance, In October 2023, Lumen Technologies took a significant step forward in the network services industry by integrating its Network-as-a-Service (NaaS) platform with Equinix Fabric. This collaboration aims to provide customers with an instant, seamless network-buying experience. With this integration, businesses can now quickly access Lumen Internet On-Demand and future NaaS services, giving them the ability to scale bandwidth effortlessly and tailor services to meet their needs.

Opportunities are particularly pronounced in sectors like healthcare, finance, and retail, where organizations are rapidly digitalizing their operations. The ability to quickly deploy and scale network services according to business needs provides a competitive edge, making NaaS an attractive option for businesses aiming to expand their digital footprint without compromising on security or performance.

According to a survey conducted by Aruba with 2400 IT decision-makers, 38% of IT leaders are planning to up their investments in cloud-based networking, and 35% are focusing on AI-based networking in response to the effects of COVID-19. The objective is to establish infrastructures that are more agile and automated, catering to the demands of hybrid work environments. Moreover, the adoption of Network-as-a-Service is anticipated to experience a 38% boost over the next two years as businesses reshape strategies amid the ongoing impact of COVID-19.

Technological advancements such as AI and machine learning are being integrated into NaaS solutions to provide smarter, proactive network management. These technologies enhance the ability of NaaS platforms to predict network failures, optimize data traffic, and ensure high availability and reliability. Innovations in virtualization and software-defined networking (SDN) are also pivotal, as they allow for more flexible and configurable networking solutions that can be adjusted in real-time to meet the evolving demands of businesses.

Key Takeaways

- Market Growth: The Network as a Service (NaaS) market was valued at USD 14.6 billion in 2023 and is projected to reach USD 115.7 billion by 2032, with a significant CAGR of 26.7%.

- Driving Factors: The surge in cloud computing adoption and the rise in remote work have boosted the demand for NaaS solutions. NaaS provides a scalable and cost-effective approach for organizations to manage their network infrastructure, catering to the needs of remote and mobile workers.

- Security Concerns: While NaaS offers standardized and scalable solutions, the lack of customization might limit its adoption in industries requiring tailored networking solutions. Data security and privacy concerns also pose potential restraints to the expansion of the NaaS market.

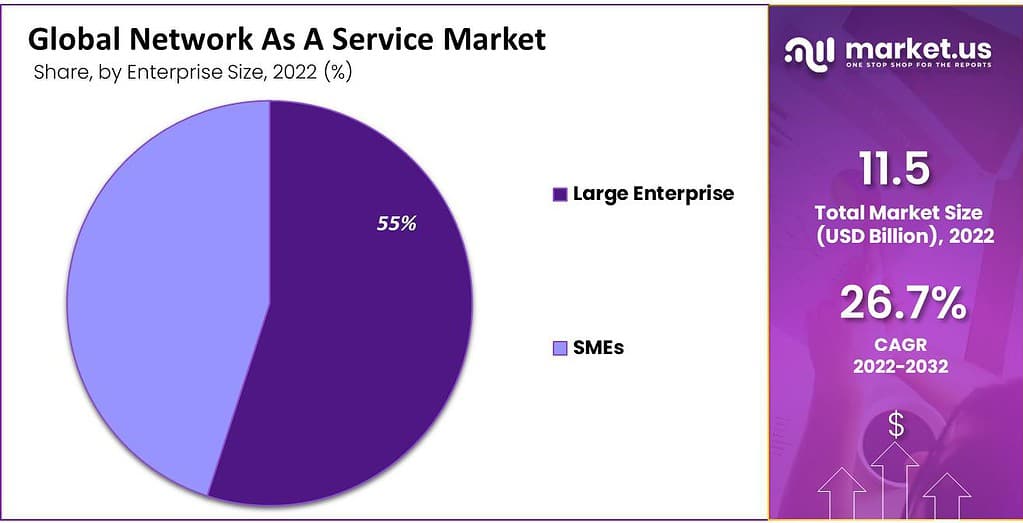

- Market Segmentation: The WAN-as-a-service segment held the largest revenue share in 2022, accounting for 66% of the market. Additionally, the large enterprise segment dominated the market, capturing 55% of the share, indicating the significance of NaaS for businesses with complex networking needs.

- Growth Opportunities: The emergence of 5G networks and the increased adoption of NaaS by small and medium-sized enterprises (SMEs) are expected to fuel market growth. Additionally, NaaS providers offering robust cybersecurity services are likely to witness substantial development.

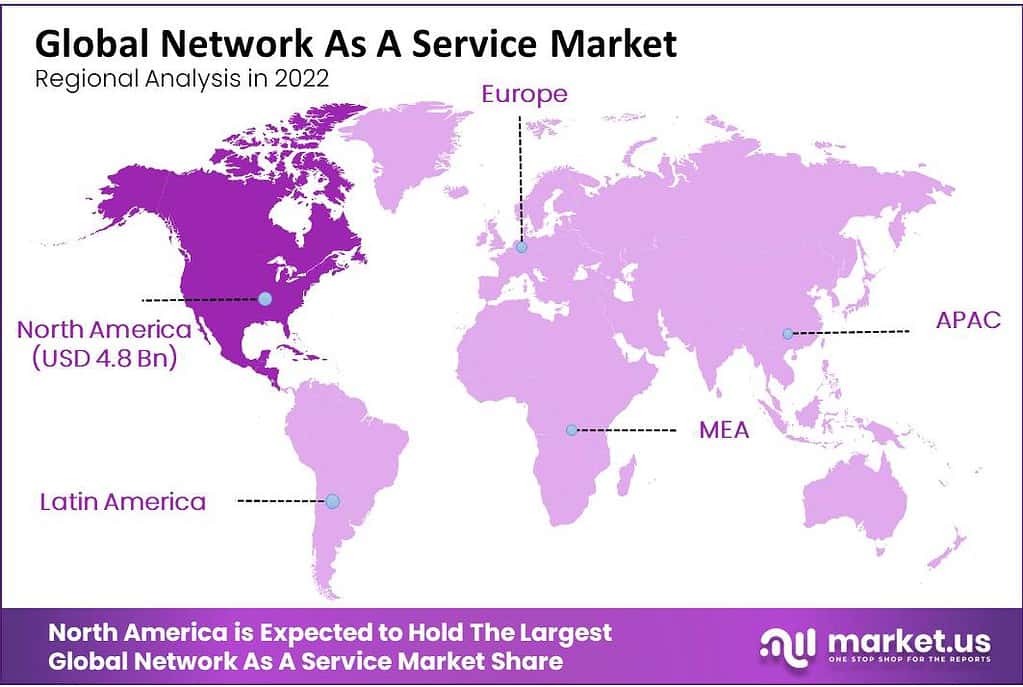

- Regional Analysis: North America led the global NaaS market, attributed to high cloud computing adoption and digital transformation initiatives. On the other hand, Asia Pacific is anticipated to be the fastest-growing region, driven by the adoption of cloud computing, growth in SMEs, and the deployment of 5G networks.

- Key Players: Major companies such as Cisco Systems Inc., Hewlett Packard Enterprise Co., and IBM Corporation have been prominent contributors to the expanding NaaS market. Recent developments, such as Cisco’s acquisition of Sentropy Technologies and IBM’s launch of IBM Cloud for Telecommunications, underscore the industry’s growth and innovation.

By Type Analysis

The Network as a Service (NaaS) market has been experiencing significant growth across various segments, with WAN-as-a-Service (WANaaS) emerging as a particularly dominant force. In 2022, the WANaaS segment held a commanding position in the market, securing over a 66% share. This segment’s prominence is further underscored by its projected Compound Annual Growth Rate (CAGR) of 33.6% over the forecast period. Several factors contribute to the robust performance and optimistic outlook for the WANaaS segment, which can be attributed to both technological advancements and evolving business needs.

Towards cloud computing and the increasing reliance on cloud-based services have been pivotal in driving the demand for WANaaS. Businesses are moving their operations to the cloud to achieve greater scalability, flexibility, and efficiency. WANaaS offers a cloud-based approach to managing wide area networks, enabling organizations to connect their multiple geographically dispersed locations with greater ease and less complexity. This is particularly advantageous for companies with extensive branch networks or those that require reliable access to cloud resources.

Secondly, the adoption of Software-Defined Wide Area Networking (SD-WAN) technology is a critical driver for the WANaaS segment. SD-WAN provides enhanced network agility, performance, and cost savings, attributes highly valued in today’s fast-paced business environment. By leveraging SD-WAN, WANaaS solutions can offer optimized application performance, improved bandwidth utilization, and automated network management. These benefits are compelling for enterprises looking to modernize their network infrastructure and support the growing demands of digital transformation.

Furthermore, the rise in remote work and the need for secure, reliable connectivity have also contributed to the growth of the WANaaS market. As organizations adapt to the new normal of remote and hybrid work models, ensuring seamless, secure access to corporate resources has become a priority. WANaaS solutions address these requirements by offering scalable, flexible, and secure WAN connectivity that supports the distributed workforce.

By Enterprise Size Analysis

In 2022, the Large Enterprise segment held a dominant market position in the Network as a Service (NaaS) Market, capturing more than a 55% share. This segment refers to organizations with a substantial scale of operations, extensive network infrastructure, and a high demand for network services. Large enterprises often require robust and scalable networking solutions to support their complex operations, distributed locations, and growing data requirements.

The dominance of the Large Enterprise segment can be attributed to several key factors. Firstly, large enterprises typically have a higher budget allocation for IT infrastructure and networking. This enables them to invest in advanced NaaS solutions that offer enhanced capabilities, such as high bandwidth, secure connectivity, and seamless integration with their existing systems.

Secondly, large enterprises often have multiple locations, both domestically and internationally. NaaS provides a streamlined approach to managing and connecting these distributed networks, allowing for centralized control and efficient resource allocation. The scalability of NaaS solutions is particularly beneficial for large enterprises as it accommodates their expanding network needs and facilitates the integration of new branches or acquisitions.

Furthermore, large enterprises typically have higher data volumes and stringent security requirements. NaaS providers offer advanced security features, including encryption, threat detection, and data privacy measures, which are crucial for protecting sensitive information and ensuring regulatory compliance.

Considering the projected Compound Annual Growth Rate (CAGR) of 31.3% for the forecast period, the Large Enterprise segment is expected to continue its dominance in the NaaS market. As large enterprises increasingly adopt cloud-based services, embrace digital transformation, and pursue agile networking solutions, the demand for NaaS is likely to grow. Moreover, advancements in technologies such as software-defined networking (SDN) and network virtualization will further support the needs of large enterprises, offering them greater flexibility, scalability, and cost savings.

By Application Analysis

In 2022, the Cloud and SaaS Connectivity segment emerged as the leading segment in the Network as a Service (NaaS) Market, capturing more than a 24% share. This segment focuses on providing network connectivity services specifically tailored for cloud-based applications and Software-as-a-Service (SaaS) platforms. The dominance of the Cloud and SaaS Connectivity segment can be attributed to several key factors.

Firstly, the increasing adoption of cloud computing and the rapid growth of SaaS applications have fueled the demand for reliable and high-performance network connectivity. Cloud-based services require seamless and secure connectivity between the user’s devices and the cloud infrastructure to ensure smooth data transfer, real-time access, and uninterrupted application usage. NaaS providers specializing in Cloud and SaaS Connectivity offer optimized network solutions that prioritize the needs of cloud-based applications, ensuring low latency, high bandwidth, and efficient data transmission.

Secondly, the scalability and flexibility offered by cloud-based services align well with the dynamic nature of modern businesses. Organizations are increasingly relying on SaaS applications for their day-to-day operations, such as customer relationship management (CRM), enterprise resource planning (ERP), and collaboration tools. The Cloud and SaaS Connectivity segment enables businesses to connect to these applications seamlessly, irrespective of their location or device, and scale their network resources based on fluctuating demands.

Furthermore, the growing emphasis on data security and compliance has also propelled the demand for specialized connectivity solutions for cloud-based services. NaaS providers focusing on Cloud and SaaS Connectivity offer robust security measures, such as encryption, secure access controls, and threat detection, to safeguard sensitive data transmitted between the cloud and end-users. This is particularly crucial for industries with strict regulatory requirements, such as healthcare, finance, and government sectors.

Considering the projected Compound Annual Growth Rate (CAGR) of 33.6% for the Cloud and SaaS Connectivity segment, its dominance in the NaaS market is expected to continue. As businesses increasingly migrate their applications and infrastructure to the cloud, the demand for reliable, fast, and secure connectivity will only grow. NaaS providers specializing in Cloud and SaaS Connectivity are well-positioned to cater to these needs, offering tailored solutions that optimize network performance, enable seamless integration with cloud services, and ensure data confidentiality.

By Industry Vertical Analysis

In 2022, the IT and Telecom segment emerged as the leading segment in the Network as a Service (NaaS) Market, capturing more than a 24% share. This segment focuses on providing networking solutions specifically tailored for the information technology (IT) and telecommunications industries. The dominance of the IT and Telecom segment can be attributed to several key factors.

Firstly, the IT and Telecom industry heavily relies on robust and scalable network infrastructure to support their operations. These industries require high-speed connectivity, seamless data transfer, and reliable communication channels to facilitate the exchange of information, support digital services, and ensure smooth collaboration. NaaS providers specializing in IT and Telecom offer tailored solutions that cater to the unique networking needs of these industries, such as high bandwidth, low latency, and advanced network management capabilities.

Secondly, the rapid growth of digital transformation initiatives within the IT and Telecom sectors has fueled the demand for agile networking solutions. As organizations adopt cloud computing, virtualization, and software-defined networking, the need for flexible, scalable, and cost-effective network services becomes paramount. NaaS providers specializing in IT and Telecom offer innovative solutions that enable organizations to optimize their network resources, streamline operations, and adapt to changing business requirements.

Furthermore, the IT and Telecom industries are characterized by constant technological advancements and evolving customer demands. This necessitates the need for reliable connectivity and seamless integration of new technologies and services. NaaS providers focusing on IT and Telecom understand these industry dynamics and offer solutions that support emerging technologies such as 5G networks, Internet of Things (IoT) devices, and edge computing, enabling organizations to stay at the forefront of innovation.

Considering the projected Compound Annual Growth Rate (CAGR) of 33.1% for the IT and Telecom segment, its dominance in the NaaS market is expected to continue. As the IT and Telecom industries continue to undergo digital transformation and adopt emerging technologies, the demand for specialized networking solutions will only grow. NaaS providers focusing on IT and Telecom are well-positioned to meet these demands, offering tailored services that optimize network performance, enhance security measures, and enable seamless integration with a wide range of IT and telecommunications applications.

Key Market Segments

Based on Type

- WAN-as-a-service

- LAN-as-a-service

Based on Enterprise Size

- Large Enterprise

- SMEs

Based on Application

- WAN Optimization

- Bandwidth on Demand

- Cloud and SaaS Connectivity

- Network Access Control

- Virtual Private Network

- Secure Web Gateway

- UCaaS/Video Conferencing

- Other Applications

Based on Industry Vertical

- BFSI

- Healthcare

- Manufacturing

- Retail and E-commerce

- Government and Public Sector

- IT and Telecom

- Other Industry Verticals

Driver

Reduction in the Amount of Time and Money Spent on Network Automation Procedures

The adoption of Network as a Service (NaaS) significantly reduces the time and financial resources expended on network automation procedures. NaaS simplifies network management and automation by leveraging cloud-based services, allowing businesses to deploy, manage, and scale their networks more efficiently. This shift enables enterprises to focus on core business activities rather than on the complexities of network infrastructure management. By eliminating the need for extensive hardware investments and reducing the reliance on specialized IT staff for network operations, companies can achieve substantial cost savings.

Furthermore, the scalability and flexibility offered by NaaS ensure that businesses can quickly adapt to changing network demands without incurring significant additional costs. This efficiency not only optimizes operational budgets but also accelerates the pace of digital transformation, making it a pivotal driver in the NaaS market.

Restraint

Lack of Standardization in the NaaS Market

A significant restraint in the Network as a Service (NaaS) market is the lack of standardization across services and solutions. This absence of uniform standards poses challenges for interoperability and integration among diverse network services and infrastructures. Businesses often find it difficult to seamlessly integrate NaaS solutions from different providers or to migrate from one service to another.

This fragmentation can lead to compatibility issues, increased operational complexities, and higher costs for businesses seeking to tailor their network infrastructure to specific needs. The lack of standardization also hinders the ability of enterprises to fully leverage the benefits of NaaS, such as scalability, flexibility, and cost efficiency, potentially slowing down the adoption rate of NaaS solutions across industries.

Opportunity

Adoption of a Hybrid Working Model

The widespread adoption of a hybrid working model presents a significant opportunity for the Network as a Service (NaaS) market. As businesses transition to a mix of remote and in-office work, the demand for flexible, scalable, and secure network solutions has surged. NaaS facilitates the hybrid work model by providing robust, cloud-based networking that supports seamless connectivity and access to corporate resources from anywhere. This adaptability ensures that employees can work efficiently, regardless of their location, while maintaining high levels of security and network performance.

Moreover, NaaS allows organizations to dynamically adjust their network capacity based on fluctuating demands, offering a cost-effective solution to the challenges posed by the hybrid working model. As more companies adopt this model, the potential for NaaS to support their evolving needs signifies a substantial growth opportunity in the market.

Challenge

Loss of WAN Connection Severely Impeding Business Network Activities

One of the major challenges in the Network as a Service (NaaS) market is the severe impact on business operations due to the loss of WAN (Wide Area Network) connection. WAN connections are critical for ensuring connectivity between different locations of a business, including data centers, branch offices, and cloud services. A disruption in WAN connectivity can halt business activities, leading to significant operational and financial losses. This vulnerability underscores the need for robust, reliable NaaS solutions that can ensure uninterrupted network service.

The challenge lies in designing and implementing NaaS infrastructures that can withstand various failure points, offer redundancy, and ensure business continuity. Overcoming this challenge requires innovative approaches in network design, including the use of multiple carriers and advanced technologies like SD-WAN, to mitigate the risks associated with WAN connectivity loss.

Growth Factors

The Network as a Service (NaaS) market is experiencing robust growth, fueled by several key factors. Firstly, the rise in cloud computing adoption is propelling the demand for NaaS, as it offers scalable, flexible, and cost-effective network solutions that are essential in a cloud-dominated tech landscape.

The transition from traditional CAPEX (capital expenditure) models to OPEX (operational expenditure) models is particularly appealing to businesses looking to optimize their spending in terms of network management and infrastructure development.

Furthermore, the increasing trend towards remote work has significantly boosted the need for reliable and secure network services that can support remote access on a large scale. NaaS provides businesses with the ability to rapidly scale up or down, depending on their operational needs, without the need for substantial upfront investments in physical network infrastructure. This agility is crucial in today’s dynamic business environment where market conditions and business needs can change rapidly.

The ongoing digital transformation initiatives across various industries also serve as a major driver for the NaaS market. As businesses continue to digitize their operations, the demand for efficient, scalable networking solutions that can support vast amounts of data and provide enhanced connectivity continues to rise. This is evident in sectors such as healthcare, finance, and retail, which are rapidly adopting digital technologies.

Emerging Trends

Emerging trends in the NaaS market include the integration of AI and machine learning technologies, which are enhancing network management and operations. These technologies help in optimizing network traffic flow, predicting network failures, and providing automated real-time resolutions. This is crucial for maintaining network reliability and performance, especially in scenarios involving complex networks and critical business operations.

Another significant trend is the increasing adoption of SD-WAN (software-defined wide area networks), which provides enhanced flexibility and control over network traffic, allowing businesses to optimize performance and reduce costs. Additionally, the integration of cybersecurity features within NaaS offerings is becoming more prevalent. As cyber threats evolve, having built-in security measures such as enhanced firewalls, intrusion detection systems, and encrypted data transfers is becoming a key differentiator for NaaS providers.

Business Benefits

Adopting NaaS presents numerous business benefits, including cost efficiency, improved network agility, and scalability. Businesses can avoid the large capital expenses typically associated with network upgrades and expansions by utilizing NaaS’s subscription-based model. This shift not only helps in budget management but also in achieving a better alignment of network costs with business growth and needs.

Additionally, NaaS allows organizations to deploy network services quickly and manage them efficiently, which is crucial for companies that need to adapt to rapid changes in their operational requirements. For industries that experience fluctuating demand, such as retail or media, the ability to scale network resources on-demand ensures that customer experiences remain consistent and satisfactory.

Finally, the managed nature of NaaS reduces the burden on internal IT teams, who would otherwise need to spend considerable time and resources on maintaining and troubleshooting network issues. By outsourcing these responsibilities to specialized service providers, businesses can focus more on core activities and strategic initiatives that drive growth and innovation.

Regional Analysis

In the landscape of the Network as a Service (NaaS) market, regional dynamics play a pivotal role in shaping market growth and opportunities. In 2022, North America emerged as the preeminent region, accounting for the largest revenue share in the NaaS market. This dominance can be attributed to several key factors. The region’s strong technological infrastructure, coupled with the presence of leading NaaS providers, has facilitated widespread adoption of NaaS solutions among businesses.

Moreover, North American enterprises, characterized by their readiness to embrace innovative technologies, have been quick to leverage NaaS for enhancing their network efficiency, security, and scalability. The robust demand for cloud services, driven by the digital transformation initiatives across industries, has further propelled the market’s growth in this region.

Conversely, Asia Pacific is poised to be the fastest-growing region in the NaaS market during the forecast period, with an anticipated CAGR of 34.1%. This rapid growth is propelled by the digital acceleration in emerging economies within the region, such as China, India, and Southeast Asia. Factors contributing to this surge include expanding internet penetration, the digitalization of businesses, and governmental initiatives promoting technological advancements.

The increasing demand for scalable and flexible networking solutions by the burgeoning number of SMEs in the region, along with the shift towards cloud-based services, plays a significant role in driving the adoption of NaaS. Additionally, the region’s growing IT infrastructure, aimed at supporting remote work and digital commerce, underscores the critical need for NaaS solutions, further accentuating the market’s expansion in Asia Pacific.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In recent years, the NaaS market is anticipated to expand as a solution to rising cloud computing use, digital transformation, and developing technologies. As the industry develops, with startups joining the market and current firms increasing their offers, the market share of important players is expected to change. For instance, one of the market’s biggest participants and providers of a wide range of networking solutions is Cisco Systems, Inc.

Market Key Players

- Hewlett Packard Enterprise Co.

- Amdocs

- Megaport

- Akamai Technologies

- Cisco Systems Inc.

- Cloudflare Inc.

- AT&T Inc.

- Verizon Communications Inc.

- DXC Technology Company

- Synnex Corporation

- NEC Corporation

- IBM Corporation

- Palo Alto

- Other Key Players

Recent Developments

1. Hewlett Packard Enterprise Co. (HPE):

- February 2023: Launched “GreenLake Cloud Services,” a NaaS offering providing flexible consumption of network infrastructure and services as needed, expanding their HPE GreenLake portfolio.

- June 2023: Partnered with Microsoft Azure to deliver managed NaaS solutions on Azure Stack HCI, combining HPE’s NaaS expertise with Azure’s cloud capabilities.

2. Amdocs:

- March 2023: Acquired Openet, a provider of cloud-native network automation solutions, strengthening their NaaS offerings with automated service provisioning and lifecycle management.

- December 2023: Announced the “Amdocs NaaS Acceleration Framework,” a comprehensive approach to guide service providers in implementing and scaling their NaaS offerings.

3. Megaport:

- April 2023: Expanded its global footprint with the acquisition of Evolusion, a network service provider operating in Latin America, enhancing their NaaS reach and connectivity options.

- October 2023: Launched “Megaport Cloud Connect,” a NaaS solution offering direct and secure connections to multiple cloud providers from Megaport’s data centers.

4. Akamai Technologies:

- May 2023: Launched “Akamai Edge Connect,” a NaaS solution delivering secure and optimized connectivity between private networks and cloud environments, addressing hybrid and multi-cloud networking needs.

- November 2023: Partnered with Google Cloud to offer joint NaaS solutions combining Akamai’s edge capabilities with Google Cloud’s global infrastructure and services.

Report Scope

Report Features Description Market Value (2023) USD 14.6 Bn Forecast Revenue (2032) USD 115.7 Bn CAGR (2023-2032) 26.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type-WAN-as-a-service, and LAN-as-a-service; By Enterprise Size-Large Enterprise, and SMEs; By Application-WAN Optimization, Bandwidth on Demand, Cloud and SaaS Connectivity, Network Access Control, Virtual Private Network, Secure Web Gateway, UCaaS/Video Conferencing, and Other Applications; By Industry Vertical- IT and telecom, BFSI, healthcare, manufacturing, retail and E-commerce, government and public sector, and others Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Hewlett Packard Enterprise Co., Amdocs, Megaport, Akamai Technologies, Cisco Systems Inc., Cloudflare Inc., AT&T Inc., Verizon Communications Inc., DXC Technology Company, Synnex Corporation, NEC Corporation, IBM Corporation, Palo Alto, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Network-as-a-Service (NaaS)?Network-as-a-Service is a cloud-based networking solution that provides on-demand network infrastructure and services to businesses, allowing them to access and manage networking resources without the need for heavy upfront investments in hardware.

How big is Network as a service Industry?The Global Network as a service market was valued at USD 14.6 Billion in 2023 and is expected to grow to USD 115.7 Billion in 2032. Between 2022 and 2032, this market is estimated to register a CAGR of 26.7%.

Who are the key players in Network as a Service Market?Hewlett Packard Enterprise Co., Amdocs, Megaport, Akamai Technologies, Cisco Systems Inc., Cloudflare Inc., AT&T Inc., Verizon Communications Inc., DXC Technology Company, Synnex Corporation, NEC Corporation, IBM Corporation, Palo Alto, Other Key Players are the major companies operating in the Network as a Service Market.

Which is the fastest growing region in Network as a Service Market?Asia Pacific is Expected to be the Fastest Growing Region in Projected Period in Network as a Service Market.

Which region has the biggest share in Network as a Service Market?North America Accounted for the Largest Revenue Share in the Network as a Service Market in 2022.

Network as a Service MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample

Network as a Service MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Hewlett Packard Enterprise Co.

- Amdocs

- Megaport

- Akamai Technologies

- Cisco Systems Inc.

- Cloudflare Inc.

- AT&T Inc.

- Verizon Communications Inc.

- DXC Technology Company

- Synnex Corporation

- NEC Corporation

- IBM Corporation

- Palo Alto

- Other Key Players