Global Nano Tin Powder Market Size, Share Analysis Report by Size (0-50 nm, 51-100 nm, 101-150 nm, and Above 150 nm), By Application (Electronics, Chemical, Paint And Coating, Metallurgy, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173130

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

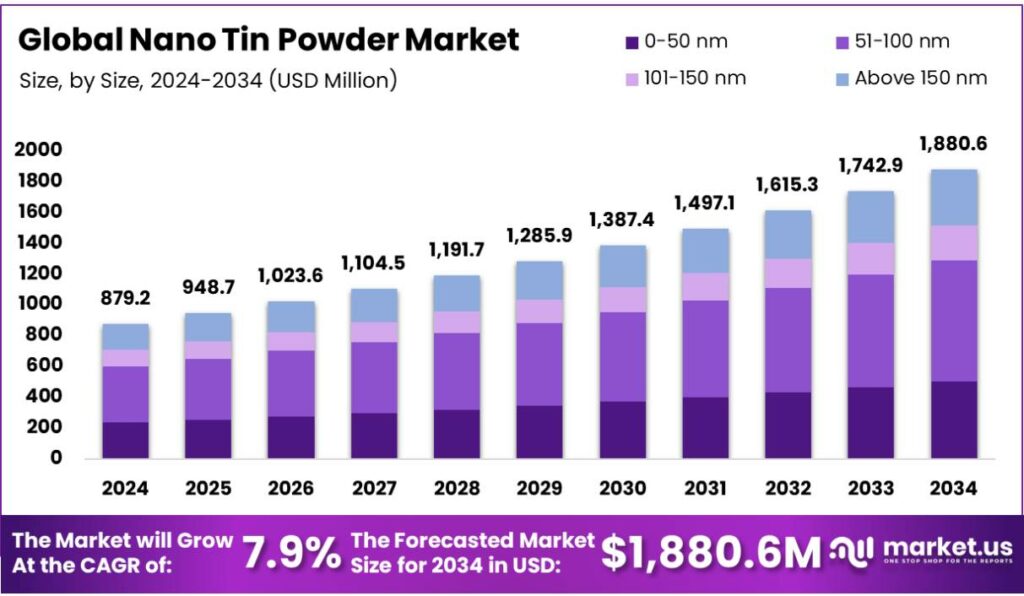

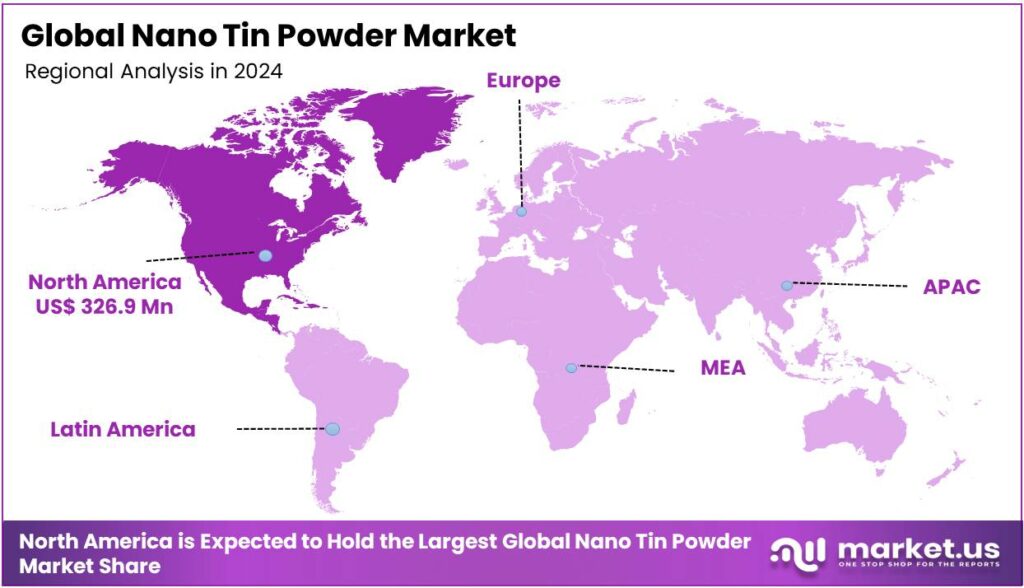

The Global Nano Tin Powder Market size is expected to be worth around USD 1880.6 Million by 2034, from USD 879.2 Million in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 37.2% share, holding USD 326.9 Million in revenue.

Nano tin powder is an extremely fine powder of elemental tin (Sn) or its compounds (such as SnO₂) with nanometer-sized particles, offering unique properties such as high surface area and conductivity, making it valuable for products, such as anti-static coatings. Its market is experiencing growth driven primarily by its applications in electronics, catalysis, and advanced materials. In the electronics sector, nano tin powder plays a pivotal role in soldering, enabling the production of smaller, more efficient semiconductors and circuit boards. This demand is further fueled by the increasing miniaturization of electronic devices such as smartphones and laptops.

Additionally, nano tin powder in catalysis for chemical processes and in coatings for corrosion-resistant applications presents new opportunities. However, challenges such as potential toxicity to human health and the environment, particularly with finer particle sizes, pose significant hurdles. Despite these challenges, the adoption of nano tin powder in biomedical and advanced material sectors highlights its versatility, making it an essential component in emerging technologies.

- According to the International Tin Association, in 2024, the global refined tin production reached approximately 371,200 tons, representing a decline of 2.7% from 2023. Around 63% of this tin originated from the top ten leading smelters in the world, out of which seven were from Southeast Asia. In addition, China is the leading producer and exporter of the material, producing about 194,000 tons of tin in 2024.

Key Takeaways

- The global nano tin powder market was valued at USD 879.2 million in 2024.

- The global nano tin powder market is projected to grow at a CAGR of 7.9% and is estimated to reach USD 1880.96 Million by 2034.

- Based on the size, nano tin powder of size 51-100 nm dominated the market, with a market share of around 41.8%.

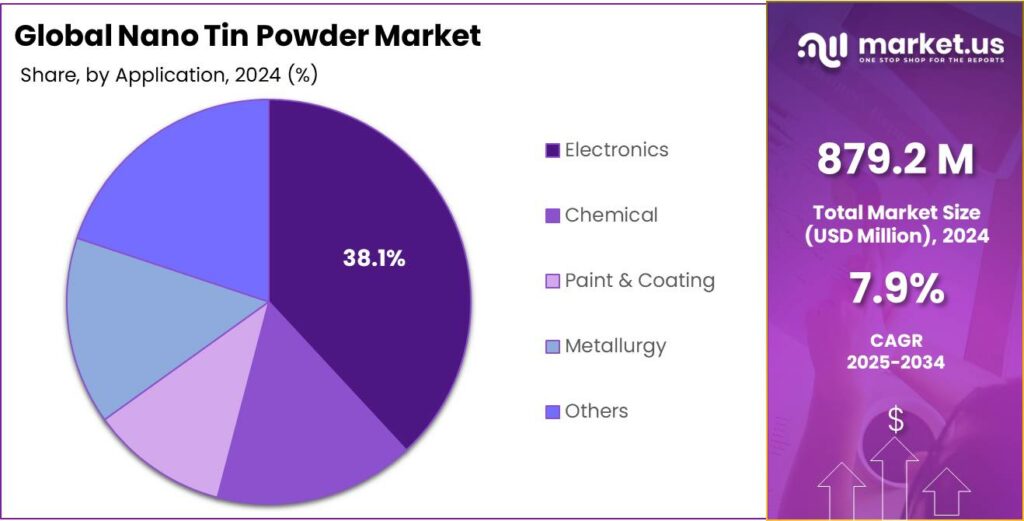

- Among the applications of nano tin powder, the electronics sector held a major share in the market, 38.1% of the market share.

- In 2024, North America was the most dominant region in the nano tin powder market, accounting for around 37.2% of the total global consumption.

Size Analysis

Nano Tin Powder of Size 51-100 nm Held the Largest Share in the Market.

The nano tin powder market is segmented based on the size into 0-50 nm, 51-100 nm, 101-150 nm, and above 150 nm. The nano tin powder of size 51-100 nm dominated the market, comprising around 41.8% of the market share. Nano tin powder in the size range of 51-100 nm is widely used due to its balanced combination of properties, making it versatile for various applications. This size range offers an optimal surface area to volume ratio, enhancing reactivity and conductivity without causing excessive reactivity or instability, which can occur with finer powders, 0-50 nm.

Powders smaller than 50 nm can be more challenging to handle and may lead to aggregation or toxicity concerns, particularly in biomedical applications. In contrast, powders larger than 100 nm, such as those in the 101-150 nm range, often exhibit reduced surface activity and lower performance in catalysis or electronics applications. The 51-100 nm range provides the ideal characteristics for achieving high performance while maintaining ease of handling and application efficiency.

Application Analysis

The Nano Tin Powder Was Mostly Utilized in the Electronics Sector.

Based on the applications of nano tin powder, the market is divided into electronics, chemical, paint & coating, metallurgy, and other applications. The electronics sector dominated the market, with a market share of 38.1%. The electronics sector is the largest consumer of nano tin powder due to its critical role in the production of advanced, miniaturized components that require high conductivity and precision.

The increasing demand for smaller, lighter, and more energy-efficient electronic devices, such as smartphones, computers, and wearables, directly drives the demand for nano tin powder. While other sectors, such as chemical, paint & coatings, and metallurgy, utilize nano tin powder, their demand is comparatively limited due to more established material alternatives, lower performance requirements, or different functional needs in those industries. The rapid technological advancements in electronics continue to prioritize nano tin powder’s unique properties, securing its dominant role in this sector.

Key Market Segments

By Size

- 0-50 nm

- 51-100 nm

- 101-150 nm

- Above 150 nm

By Application

- Electronics

- Chemical

- Paint & Coating

- Metallurgy

- Others

Drivers

Demand from the Semiconductor and Electronics Industry Drives the Nano Tin Powder Market.

The demand from the semiconductor and electronics industries has significantly contributed to the growth of the nano tin powder market. Nano tin powder, with its unique properties such as high surface area and excellent conductivity, plays a pivotal role in the manufacturing of advanced electronics and semiconductor devices. In the semiconductor sector, nano tin powder is used in soldering processes, enabling the production of smaller, more efficient microchips, which are essential for modern consumer electronics such as smartphones, tablets, and laptops.

For instance, the chips powering modern smartphones contain more than 15 billion transistors and as of 2025, an estimated 4.7 billion individuals owned a smartphone significantly increasing demand for advanced semiconductor components. Similarly, AI data centers can contain hundreds of billions of transistors, a number so high that if counted one transistor per second, it would take more than 6,000 years to count all the transistors on a single chip.

As the miniaturization of electronic devices continues, the requirement for high-performance materials such as nano tin powder increases. In addition, the growing trend of electric vehicles and renewable energy solutions drives demand for nano tin powder in the production of high-performance batteries and energy storage systems. The rise in demand for compact and energy-efficient devices directly correlates with the expanding demand for nano tin powder in these industries.

Restraints

Potential Toxicity to Environment and Human Health Poses a Challenge to the Nano Tin Powder Market.

The potential toxicity of nano tin powder to the environment and human health represents a significant challenge for its widespread adoption. Inhalation of nanoparticles has been associated with respiratory issues and other health complications in short-term and long-term exposures. These nanoparticles can penetrate deeper into the lungs, causing inflammation or affecting the cardiovascular system.

Similarly, it is a potential environmental contaminant due to its stability, persistence, and ability to bioaccumulate in the food chain. A primary mechanism of toxicity for many metal-based nanoparticles, including tin, is the generation of reactive oxygen species (ROS) within cells, leading to oxidative stress, DNA damage, and cell death. The improper disposal of nano tin powder could lead to soil and water contamination, further exacerbating environmental risks.

Consequently, regulatory bodies are placing increasing emphasis on safety protocols for handling, storage, and disposal of such materials. For instance, according to the Occupational Safety and Health Administration (OSHA), for general inorganic tin compounds, there is a legal airborne permissible exposure limit (PEL) of 2 milligrams per cubic meter (mg/m³) as an 8-hour time-weighted average. Similarly, several laws focus on waste management, pushing for high recycling, banning landfilling of recoverable waste, and controlling waste shipments internationally, ensuring responsible handling and preventing illegal exports, particularly of hazardous e-waste.

Opportunity

Application in Catalysis and Coatings Creates Opportunities in the Nano Tin Powder Market.

The application of nano tin powder in catalysis and coatings offers favorable opportunities for expanding its market potential. In catalysis, nano tin powder is increasingly utilized due to its enhanced surface area and reactivity, which allow it to act as an effective catalyst in various chemical reactions. For instance, it has been applied in the hydrogenation, carbon dioxide removal, and pollutant removal processes, essential in the production of fine chemicals and for regulatory compliance. Furthermore, nano tin powder is utilized in the development of advanced coatings, particularly in electronics and automotive industries.

According to the International Energy Agency (IEA), the global battery manufacturing capacity reached 3 TWh in 2024, and the next five years could see another tripling of production capacity if all announced projects are built. The ability of tin powder to form durable, corrosion-resistant, and electrically conductive coatings enhances the performance and longevity of components, such as circuit boards and batteries. As industries seek more efficient, durable, and environmentally friendly solutions, the use of nano tin powder in these fields is expected to increase.

Trends

Adoption of Materials in Biomedical and Advanced Materials.

The adoption of nano tin powder in biomedical and advanced materials is an ongoing trend that is shaping its prospects. In the biomedical field, nano tin powder is being explored for its potential in drug delivery systems, wound healing, and bioelectronics due to its biocompatibility and ability to interact with biological systems at the molecular level.

For instance, its use in targeted drug delivery can help improve the precision and effectiveness of treatments by enabling controlled release at specific sites within the body. Additionally, its integration into advanced materials is growing, particularly in the development of lightweight, high-strength composites and energy-efficient systems. In aerospace and defense, nano tin powder is incorporated into materials for its enhanced structural properties and conductivity. As industries continue to push the boundaries of innovation, the versatility of nano tin powder in these advanced applications demonstrates its growing importance in emerging technologies.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Nano Tin Powder Market by Shifting Trade Flows.

The geopolitical tensions have significantly impacted the nano tin powder market. These tensions, particularly between major global powers, have disrupted supply chains and trade routes, leading to a more volatile raw material market. The tin price surge has been particularly dramatic, with the metal hitting an all-time high of US$51,000 per ton in 2022. As countries impose trade restrictions or tariffs on critical materials, such as tin, which is essential for producing nano tin powder, manufacturers have faced challenges in securing a consistent supply.

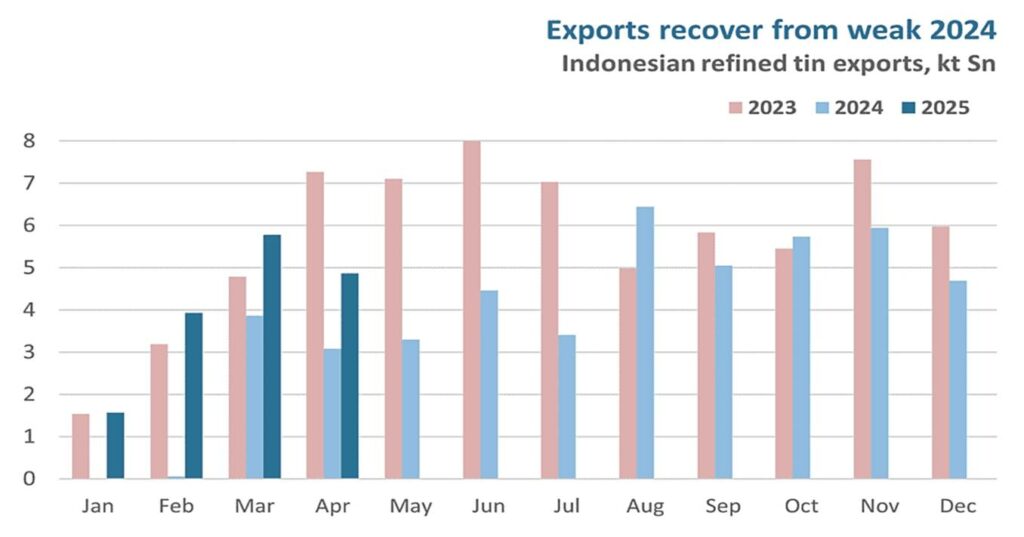

China (30%), Indonesia (25%), and Myanmar (15%) control approximately 70% of global production, creating significant supply security concerns for Western manufacturers. Indonesia stands as the second-largest tin producer globally, contributing an average annual yield of 70,000 to 84,000 metric tons. Instability in these regions causes price volatility in the global nano tin powder market. For instance, China, which historically provides approximately 18% of global tin ore supply, continues experiencing seasonal production constraints that have reduced ore availability for downstream smelters.

Similarly, Myanmar’s political instability has removed approximately 15% of global refined tin capacity, which is about 40,000 tons of tin, while Indonesia’s regulatory tightening has created export bottlenecks affecting 25% of global concentrate supply. In addition, Peru’s tin production has faced infrastructure-related disruptions, with approximately 15% of capacity reduction due to transportation and logistical challenges affecting remote mining operations. Furthermore, the tensions have underscored the strategic importance of advanced materials such as nano tin powder in defense and technology sectors, spurring government investment in domestic production capabilities. For instance, while copper has gained approximately 250% and nickel about 180% during the same period from 2001, tin has gained approximately 738% rise in price.

Regional Analysis

North America Held the Largest Share of the Global Nano Tin Powder Market.

In 2024, North America dominated the global nano tin powder market, holding about 37.2% of the total global consumption. The region holds the largest share of the global nano tin powder market, driven by its robust industrial base and advanced technological infrastructure. The United States, in particular, is a key player due to its high demand for nano tin powder in sectors such as electronics, semiconductor manufacturing, and renewable energy.

The U.S. aerospace and defense exports rose to US$138.6 billion in 2024, up from US$135.9 billion in 2023. The region’s emphasis on innovation in industries of electric vehicles (EVs) and aerospace, which require efficient energy storage and corrosion-resistant materials, contributes to the significant use of nano tin powder.

The U.S. government’s ongoing support for clean energy technologies, such as battery development for EVs, further boosts demand. Under the US government’s Bipartisan Infrastructure Law (BIL), there is the National Electric Vehicle Infrastructure (NEVI) Formula Program, worth US$5 billion, and the Discretionary Grant Program for Charging and Fueling Infrastructure, worth US$2.5 billion, for EV infrastructure, manufacturing, and supply chain resilience. Additionally, the presence of major semiconductor and electronics companies in North America creates a steady demand for nano tin powder in precision soldering and microchip production.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the nano tin powder market focus on several strategic activities, such as product innovation, investments, and expansion, to cater to the growing demand, to gain a competitive edge, and to increase sales. The companies focus on investment in research and development (R&D) to innovate and improve the quality, efficiency, and applications of nano tin powder, such as enhancing its performance in electronics, catalysis, and biomedical fields.

In addition, these players focus on diversifying their product offerings, creating powders with varying particle sizes to cater to different industry needs. Furthermore, the companies emphasize strengthening supply chain management to ensure consistent product availability and reduce dependency on global supply fluctuations. Moreover, the players emphasize forming strategic partnerships with players in industries such as electronics, renewable energy, and automotive, which enables companies to secure long-term contracts and expand market reach.

The Major Players in The Industry

- American Elements

- Xinglu Chemical

- Nanochemazone

- US Research Nanomaterials Inc.

- Nanografi Nanotechnology

- IoLiTec Ionic Liquids Technologies GmbH

- SkySpring Nanomaterials Inc.

- Edgetech Industries LLC

- Others

Key Development

- In May 2025, China’s Xingye Silver & Tin Company agreed to acquire Atlantic Tin, the Achmmach mine developer. The Chinese company, which operates a major tin mine in Inner Mongolia, China, has offered A$0.24 per share.

- In September 2024, India, a major importer and consumer of refined tin, removed the import duty on tin. India is the sixth largest consumer of refined tin, importing a growing quantity, around 12,100 tons in 2023, almost entirely from Indonesia, with no significant domestic production.

Report Scope

Report Features Description Market Value (2024) USD 879.2 Mn Forecast Revenue (2034) USD 1880.6 Mn CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Size (0-50 nm, 51-100 nm, 101-150 nm, and Above 150 nm), By Application (Electronics, Chemical, Paint & Coating, Metallurgy, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape American Elements, Xinglu Chemical, Nanochemazone, US Research Nanomaterials, Nanografi Nanotechnology, IoLiTec Ionic Liquids Technologies GmbH, SkySpring Nanomaterials, Edgetech Industries LLC, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- American Elements

- Xinglu Chemical

- Nanochemazone

- US Research Nanomaterials Inc.

- Nanografi Nanotechnology

- IoLiTec Ionic Liquids Technologies GmbH

- SkySpring Nanomaterials Inc.

- Edgetech Industries LLC

- Others