Global N-Butylene Market Size, Share, And Business Benefit By Application (Polymers, Synthetic Rubber and Elastomer, Chemicals, Surfactant, Detergents, Others), By Distribution Channel (Direct, Indirect), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 163960

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

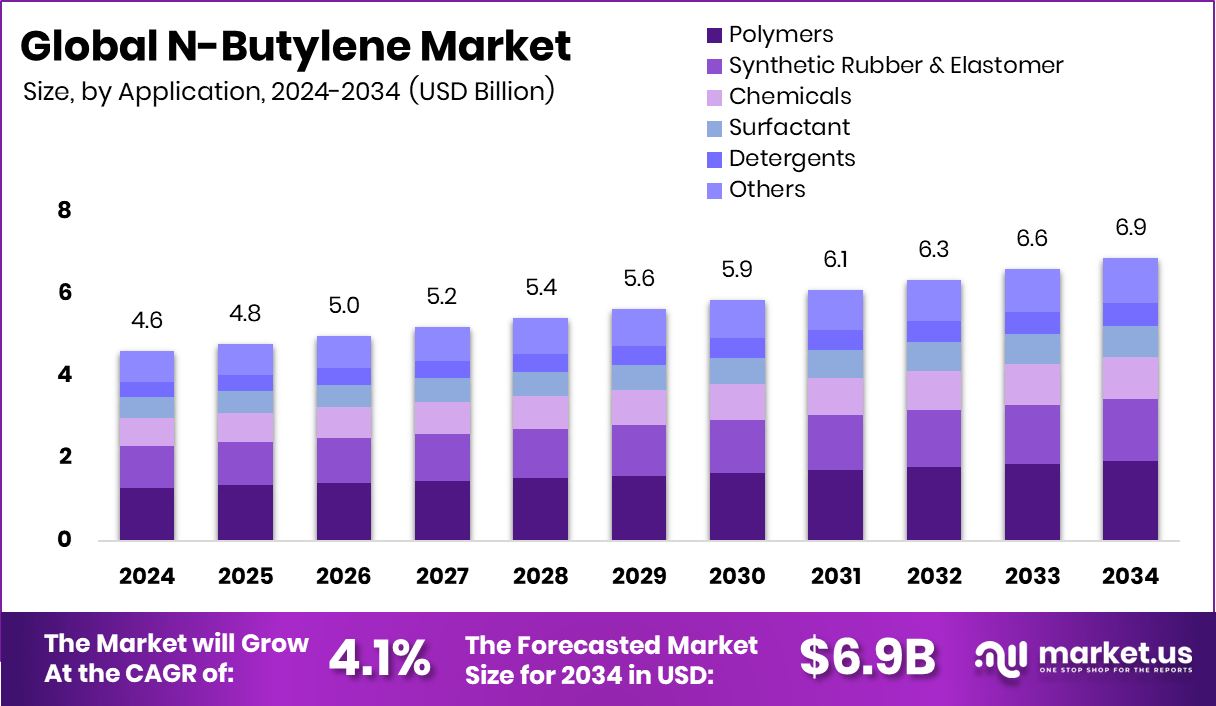

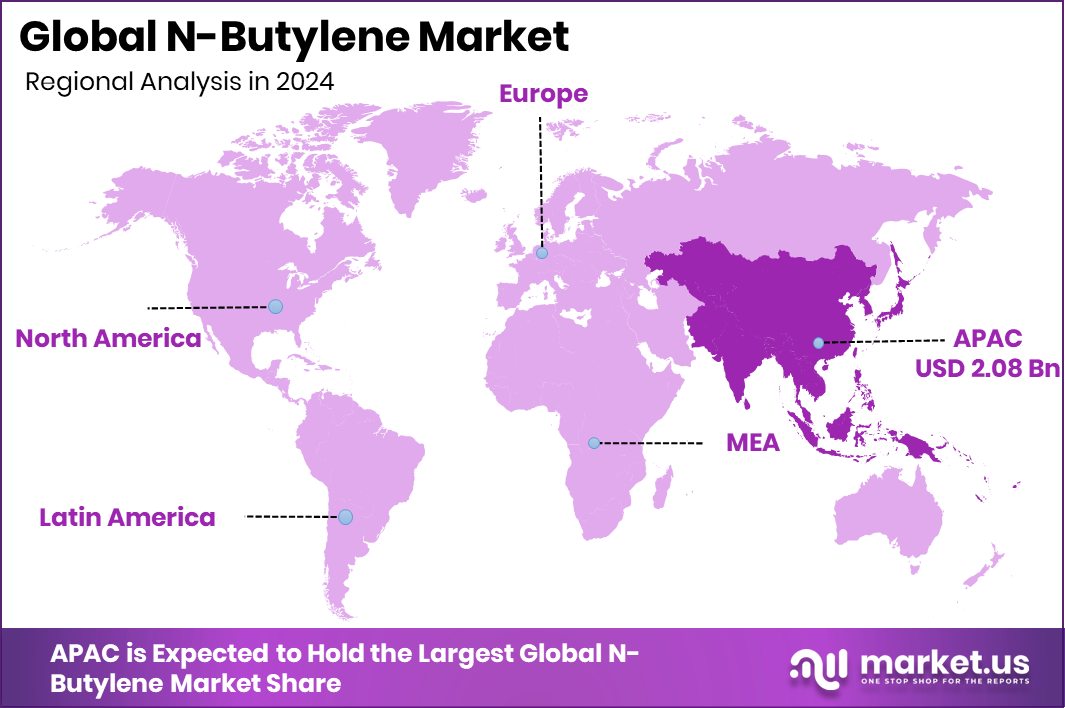

The Global N-Butylene Market is expected to be worth around USD 6.9 billion by 2034, up from USD 4.6 billion in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034. Rapid polymer production growth across Asia-Pacific sustained its 45.30% share, valuing USD 2.08 billion.

N-Butylene, also known as 1-butene, is a colorless, flammable hydrocarbon derived from the cracking of petroleum or natural gas liquids. It serves as a crucial building block in the petrochemical industry, primarily used in producing polymers, plasticizers, and synthetic lubricants. Its versatility lies in its ability to enhance flexibility, adhesion, and strength in various chemical formulations, making it essential for plastic, resin, and fuel additive manufacturing.

The N-Butylene Market represents the global trade and production of this olefin, spanning its use across chemical, polymer, and industrial applications. It is influenced by advancements in petrochemical infrastructure, demand for high-performance polymers, and the shift toward sustainable material production.

The market’s growth is driven by rising polymer demand and strong investment flows. Key funding, such as EF Polymer’s $6.6 million Series B round and Magpet Polymers’ ₹205 crore funding, highlights industrial confidence in sustainable chemical solutions.

Demand continues to grow with increasing polymer applications and industrial development. Initiatives like the $3 million federal grant for Akron’s polymer industry strengthen regional supply chains. Sustainability-focused ventures such as EF Polymer’s $6.6 million investment create opportunities for greener, bio-based production technologies within the N-Butylene value chain.

Key Takeaways

- The Global N-Butylene Market is expected to be worth around USD 6.9 billion by 2034, up from USD 4.6 billion in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034.

- In the N-Butylene Market, the Polymers segment accounted for a 39.4% share in 2024.

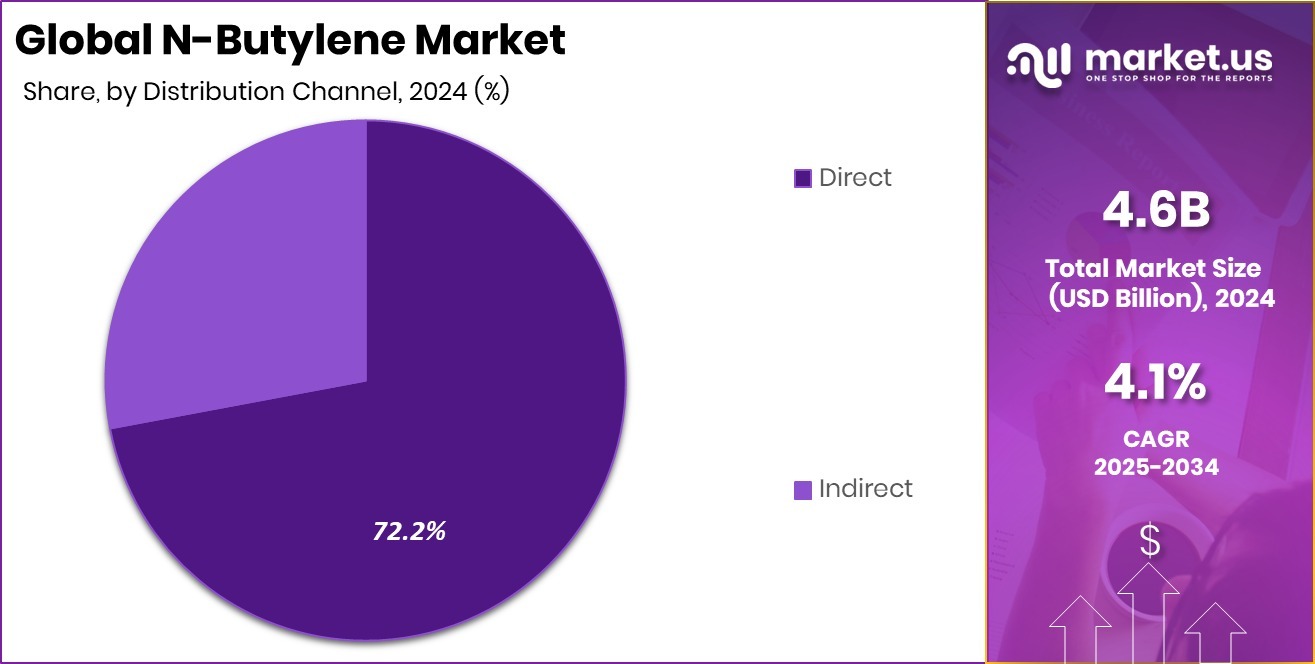

- The Direct channel dominated the N-Butylene Market with a commanding 72.2% share in 2024.

- In 2024, the Asia-Pacific dominated the N-Butylene market, capturing 45.30% regional share

By Application Analysis

The N-Butylene Market is largely driven by polymer applications, accounting for 39.4% market share.

In 2024, Polymers held a dominant market position in the By Application segment of the N-Butylene Market, capturing a significant 39.4% share. This dominance reflects the growing utilization of N-Butylene as a key intermediate in producing various polymer compounds, particularly for packaging, automotive, and industrial materials. Its strong performance is driven by rising polymer demand for lightweight, durable, and cost-efficient products across manufacturing sectors.

The segment’s stability also stems from advancements in polymer processing technologies that enhance yield and material performance. The 39.4% share highlights the pivotal role of polymer applications in sustaining global N-Butylene consumption, reinforcing its importance in the chemical value chain through consistent industrial integration and end-use diversification.

By Distribution Channel Analysis

The N-Butylene Market is dominated by direct distribution channels, holding 72.2% overall share.

In 2024, Direct held a dominant market position in the By Distribution Channel segment of the N-Butylene Market, accounting for a substantial 72.2% share. This dominance reflects the strong preference among manufacturers and end users for direct supply arrangements that ensure consistent quality, timely delivery, and cost efficiency. The direct distribution model allows producers to maintain better control over pricing structures and customer relationships while minimizing intermediary costs.

The 72.2% share highlights the efficiency and reliability of direct channels in meeting the specific requirements of industrial buyers, particularly in high-volume applications. This approach strengthens market transparency and supports long-term supply partnerships within the global N-Butylene distribution network.

Key Market Segments

By Application

- Polymers

- Synthetic Rubber and Elastomer

- Chemicals

- Surfactant

- Detergents

- Others

By Distribution Channel

- Direct

- Indirect

Driving Factors

Expanding Polymer Demand Driving Industrial Growth Worldwide

One of the major driving factors for the N-Butylene Market is the rapid growth in global polymer demand. N-Butylene is a vital raw material used in making polymers, resins, and plasticizers, which are widely used across the packaging, automotive, and construction industries. The increasing need for lightweight and durable materials continues to boost their consumption. Strong industry funding is also supporting this momentum.

For instance, the new $6.4 million funding for the Greater Akron polymer industry aims to enhance workforce training, skills development, and job placement, further strengthening the regional supply chain. Such initiatives not only expand the skilled workforce but also promote industrial innovation, helping boost overall N-Butylene production efficiency and supporting sustainable polymer manufacturing growth.

Restraining Factors

Environmental Concerns and Recycling Shift Limiting Growth

A key restraining factor for the N-Butylene Market is the increasing global emphasis on recycling and reducing dependence on petrochemical-based raw materials. Governments and industries are promoting circular economy practices that favor recycled and bio-based alternatives over conventional hydrocarbon derivatives like N-Butylene. This trend limits the expansion of traditional production capacity.

For example, Magpet Polymers secured ₹205 crore funding for India’s largest bottle-to-bottle recycling facility, marking a strong move toward sustainable polymer use and reduced virgin chemical demand. As more investments shift toward recycled materials and green solutions, producers of N-Butylene face growing challenges to align with evolving sustainability norms, potentially moderating long-term market growth despite ongoing industrial demand.

Growth Opportunity

Rising Investment in Polymer Innovation Creating Opportunities

A major growth opportunity for the N-Butylene Market lies in the increasing investment toward advanced polymer innovation and technology integration. N-Butylene serves as a key building block in producing specialty polymers and elastomers that cater to high-performance applications in packaging, automotive, and construction sectors. Recent funding initiatives are fueling this growth direction.

For instance, Polymer raised $23 million in a Series A funding round to develop Ethereum interoperability hubs, showcasing how polymer-based innovation is expanding beyond traditional uses into new technological frontiers.

Such investments highlight the broader confidence in polymer research and production efficiency, providing a strong foundation for N-Butylene producers to explore new formulations, eco-friendly derivatives, and high-value applications across evolving industrial ecosystems.

Latest Trends

Sustainable Polymer Development Emerging as Key Trend

A leading trend in the N-Butylene Market is the growing focus on sustainable polymer development and eco-friendly material innovation. Industries are increasingly exploring green chemical routes to reduce carbon emissions and reliance on fossil-based feedstocks. This shift aligns with global sustainability goals and circular economy initiatives.

A notable example is the Agritech startup EF Polymer, which raised Rs 33 crore in a Series A funding round to advance bio-based polymer solutions for agriculture. Such initiatives highlight the market’s transition toward renewable and biodegradable alternatives. As sustainability becomes central to manufacturing strategies, producers of N-Butylene are expected to invest in cleaner technologies and low-emission processes, shaping the next generation of sustainable polymer materials.

Regional Analysis

The market value in Asia-Pacific reached approximately USD 2.08 billion, driven by strong industrial expansion.

In 2024, Asia-Pacific emerged as the dominant region in the global N-Butylene market, accounting for a substantial 45.30% share, valued at around USD 2.08 billion. The region’s strong dominance is attributed to the expanding petrochemical and polymer industries in China, India, Japan, and South Korea. Growing demand for N-Butylene as a key feedstock in plasticizers, resins, and fuel additives further strengthened its regional leadership.

North America followed closely, supported by the U.S. shale gas boom and increasing production of olefins and downstream derivatives. Europe maintained a steady share driven by sustainability regulations promoting efficient chemical processing and the adoption of green feedstocks.

Meanwhile, the Middle East & Africa benefited from abundant hydrocarbon resources and new petrochemical investments aimed at export-driven growth. Latin America exhibited gradual development, with Brazil and Mexico witnessing rising demand from automotive and industrial applications.

Overall, Asia-Pacific’s robust manufacturing capacity, cost-effective feedstock availability, and ongoing expansion of polymer facilities established it as the key growth engine for the N-Butylene market in 2024, while other regions displayed steady to moderate growth, collectively contributing to the industry’s balanced global footprint.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Chevron Phillips Chemical Company continued to strengthen its position in the global N-Butylene market through its advanced olefins and polyolefins production capabilities. The company’s integrated petrochemical complexes in the U.S. Gulf Coast region enabled cost-efficient N-Butylene output, meeting growing demand from polymer, plasticizer, and fuel additive industries. Its sustainable feedstock initiatives and investment in circular polyethylene projects reflect a strong long-term strategy toward low-carbon chemical production.

SABIC maintained a competitive edge by leveraging its large-scale petrochemical infrastructure in Saudi Arabia and Asia. The company’s innovation in C4-based derivatives and improved catalyst efficiency helped optimize N-Butylene yields from its cracking units. In 2024, SABIC focused on operational excellence and strategic joint ventures to enhance regional supply reliability and strengthen its export footprint in Asia-Pacific and Europe.

Evonik Industries AG remained a significant specialty chemicals player in the N-Butylene value chain. The company utilized its expertise in advanced intermediates and performance materials to expand into high-purity N-butylene grades used in chemical synthesis and specialty coatings. Evonik’s focus on precision chemical engineering, combined with its commitment to sustainable production processes, positioned it favorably to capture growth in high-value applications during 2024.

Top Key Players in the Market

- Chevron Philips Chemical Company

- SABIC

- Evonik Industries AG

- CNOOC and Shell Petrochemicals Company Limited

- Shell Chemical LP

- Inner Mongolia China Coal Mengda New Energy and Chemical Co., Ltd.

- Zhonghua Quanzhou Petrochemical Co., Ltd.

- Qinghai Damei Coal Industry Co., Ltd.

- Taizhou Donglian Chemical Co., Ltd.

- PTT Global Chemical Public Company Limited

Recent Developments

- In August 2024, CPChem awarded a contract to Technip Energies for the supply of a proprietary “Low-CO₂ Cracking Furnace” at CPChem’s Sweeny, Texas, olefins unit. This equipment upgrade is designed to reduce fuel consumption and CO₂ emissions by about 30%.

- In March 2024, SABIC introduced a new specialty resin: LNP™ ELCRES SLX1271SR, a scratch-resistant, weatherable polymer for automotive exteriors, enabling molded-in colour thermoplastics and reducing VOC emissions compared to painted panels.

Report Scope

Report Features Description Market Value (2024) USD 4.6 Billion Forecast Revenue (2034) USD 6.9 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (Polymers, Synthetic Rubber and Elastomer, Chemicals, Surfactant, Detergents, Others), By Distribution Channel (Direct, Indirect) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Chevron Philips Chemical Company, SABIC, Evonik Industries AG, CNOOC and Shell Petrochemicals Company Limited, Shell Chemical LP, Inner Mongolia China Coal Mengda New Energy and Chemical Co., Ltd., Zhonghua Quanzhou Petrochemical Co., Ltd., Qinghai Damei Coal Industry Co., Ltd., Taizhou Donglian Chemical Co., Ltd., PTT Global Chemical Public Company Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Chevron Philips Chemical Company

- SABIC

- Evonik Industries AG

- CNOOC and Shell Petrochemicals Company Limited

- Shell Chemical LP

- Inner Mongolia China Coal Mengda New Energy and Chemical Co., Ltd.

- Zhonghua Quanzhou Petrochemical Co., Ltd.

- Qinghai Damei Coal Industry Co., Ltd.

- Taizhou Donglian Chemical Co., Ltd.

- PTT Global Chemical Public Company Limited