Global Musical Instruments Market Size, Share, Growth Analysis By Product Type (String Instruments, Electronic & Electromechanical Musical Instruments, Percussion Instruments, Wind Instruments, Acoustic Pianos & Stringed Keyboard Instruments, Others), By Type (Portable, Fixed), By End-user (Commercial Music, Personal Use, Production/Direction, Others), By Distribution Channel (Online [E-commerce, Company Website], Offline, [Advanced or Professional Musicians, Multi-brand Stores or Specialty Shops, Others]), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171414

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

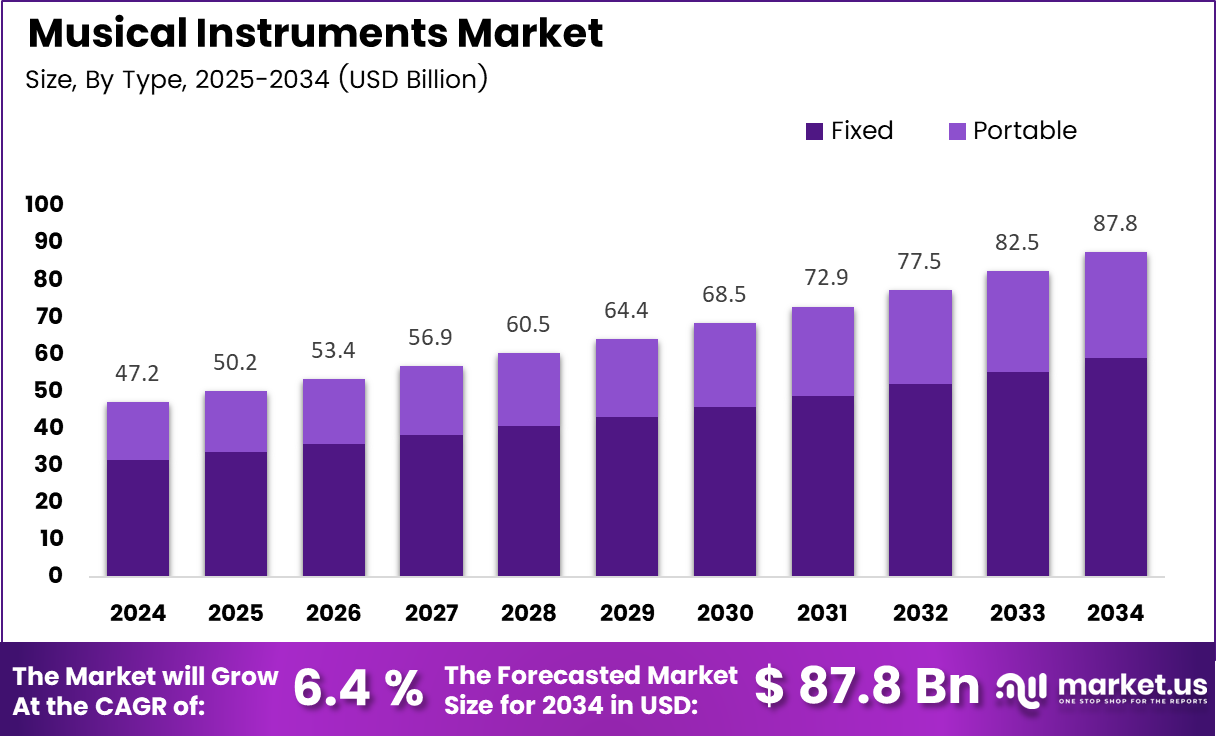

The Global Musical Instruments Market size is expected to be worth around USD 87.8 billion by 2034, from USD 47.2 billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

The Musical Instruments market refers to the global ecosystem involved in designing, manufacturing, distributing, maintaining, and preserving instruments used for music creation, education, performance, and cultural conservation. Broadly, it spans acoustic and electronic instruments, accessories, and aftersales services, supporting both artistic expression and commercial music activity across professional, institutional, and personal use environments.

From a market perspective, growth is driven by rising music education enrollment, increasing disposable income, and sustained interest in creative hobbies. Additionally, digital learning platforms and home based content creation continue expanding instrument adoption. As a result, the market benefits from both informational demand and transactional purchases across offline retail and online music equipment channels.

Government investment and regulatory frameworks also influence the Musical Instruments market, particularly through cultural preservation, museum standards, and sustainable material sourcing. Public funding for arts education, orchestral programs, and heritage conservation indirectly supports instrument demand. Meanwhile, environmental regulations increasingly govern the use of rare tone woods, encouraging certified sourcing and alternative materials.

opportunities emerge in premium craftsmanship, restoration services, and museum grade instrument care. Demand for historically accurate replicas and acoustically optimized instruments is increasing. Furthermore, institutional buyers such as conservatories and museums prioritize durability, tonal stability, and compliance with international preservation guidelines, strengthening long term procurement cycles.

Scientific research on materials significantly shapes instrument design and valuation. According to Hutchins’ violin acoustics research, nearly 500 stringed instruments were carved over half a century, supported by over 100 experimental studies, highlighting the role of empirical acoustics in performance optimization and material selection within the Musical Instruments market.

Material science data further supports quality differentiation. According to Survey, spruce (Picea abies) shows density ranges of 0.17–0.32, pine (Pinus sylvestris) 0.17–0.32, maple (Acer spp.) 0.15–0.26, oak (Quercus spp.) 0.20–0.32, walnut (Juglans regia) 0.20–0.27, linden (Tilia spp.) 0.19–0.28, poplar (Populus spp.) 0.15–0.28, ebony (Diospyros spp.) 0.27–0.30, and Brazilian rosewood (Dalbergia nigra) 0.24–0.37.

Consequently, these quantified material properties directly influence resonance, durability, and regulatory acceptance, reinforcing informed procurement decisions. In conclusion, the Musical Instruments market remains structurally resilient, balancing artistic tradition with material science, regulatory oversight, and evolving consumer behavior, while offering sustained growth opportunities across education, preservation, and professional performance segments.

Key Takeaways

- The global Musical Instruments Market is projected to reach USD 87.8 billion by 2034, growing from USD 47.2 billion in 2024 at a 6.4% CAGR.

- String Instruments dominate the product landscape with a market share of 35.8%, reflecting strong demand from education, cultural, and live performance applications.

- Portable instruments lead the market by type, accounting for 67.2% share, supported by mobility, home-based music creation, and digital learning trends.

- Personal use represents the largest end-user segment with 48.7% share, driven by hobbyist growth and online music education adoption.

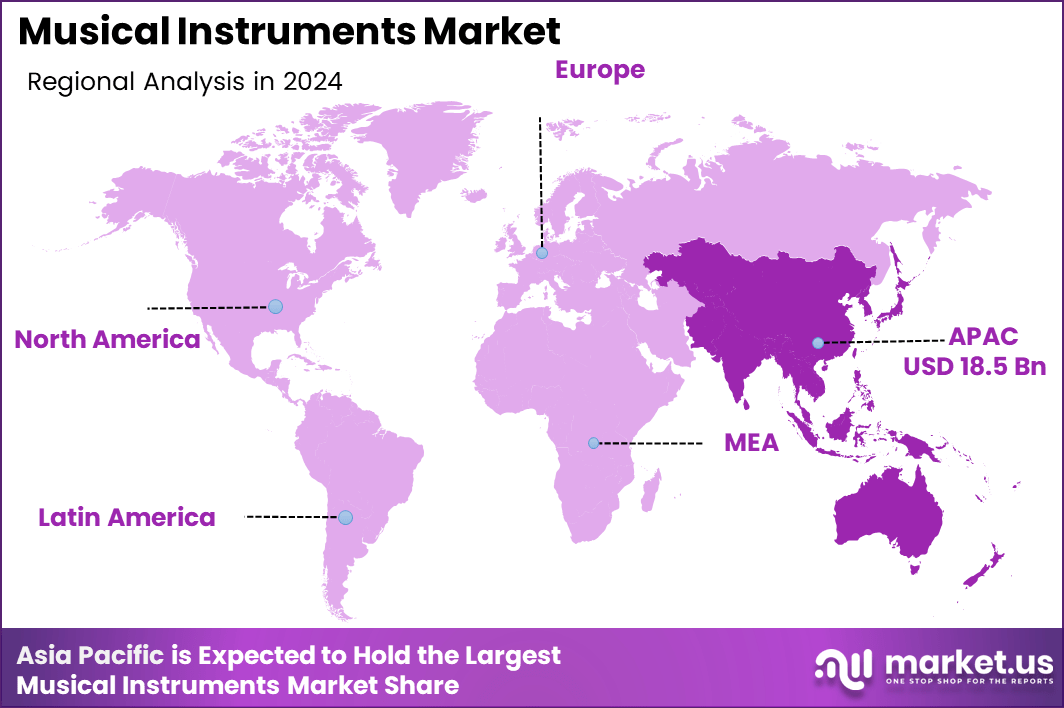

- Asia Pacific holds the leading regional position with a 39.4% market share, valued at USD 18.5 billion in 2024.

By Product Type Analysis

String Instruments dominate with 35.8% due to their deep cultural relevance, wide genre adoption, and strong presence in education and live performances.

In 2024, String Instruments held a dominant market position in the By Product Type Analysis segment of Musical Instruments Market, with a 35.8% share. Moreover, their extensive use across classical, folk, and modern music sustains consistent demand. Additionally, affordability options and long product lifecycles further strengthen their leadership.

Electronic & Electromechanical Musical Instruments continue gaining traction as digital music production expands globally. Furthermore, rising home studios, live electronic performances, and integration with software platforms drive steady adoption. As a result, demand remains strong among younger musicians and content creators.

Percussion Instruments maintain stable demand due to their essential role in rhythm-driven genres and music education. Moreover, increasing participation in cultural events and marching bands supports sustained sales across both traditional and modern percussion formats.

Wind Instruments remain relevant in orchestral, jazz, and educational settings. In addition, government-supported music programs and school band initiatives support regular replacement cycles and long-term usage.

Acoustic Pianos & Stringed Keyboard Instruments retain importance in classical training and professional studios. Meanwhile, their premium positioning limits volume growth but supports consistent value contribution.

Others include niche and experimental instruments catering to specific regional or artistic needs, thereby contributing incremental market diversity.

By Type Analysis

Portable instruments lead with 67.2% driven by mobility, ease of storage, and growing preference for flexible music creation.

In 2024, Portable instruments held a dominant market position in the By Type Analysis segment of Musical Instruments Market, with a 67.2% share. Moreover, urban lifestyles and frequent live music performances accelerate adoption. Additionally, portability aligns well with digital content creation trends.

Fixed instruments continue serving institutional, studio, and classical performance needs. However, their space requirements and higher costs limit broader adoption, although demand remains stable among professionals and educational institutions.

By End-user Analysis

Personal Use dominates with 48.7% supported by hobbyist growth, online learning, and home-based music engagement.

In 2024, Personal Use held a dominant market position in the By End-user Analysis segment of Musical Instruments Market, with a 48.7% share. Furthermore, increased leisure spending and digital tutorials encourage individual purchases. Consequently, entry-level and mid-range instruments see strong demand.

Commercial Music users rely on instruments for live performances, events, and recordings. Additionally, consistent replacement needs and performance quality requirements sustain steady purchasing patterns.

Production/Direction users focus on studio-grade instruments for composition and sound design. Meanwhile, integration with recording technologies supports specialized demand.

Others include educational institutions and community groups that contribute recurring but budget-conscious purchases.

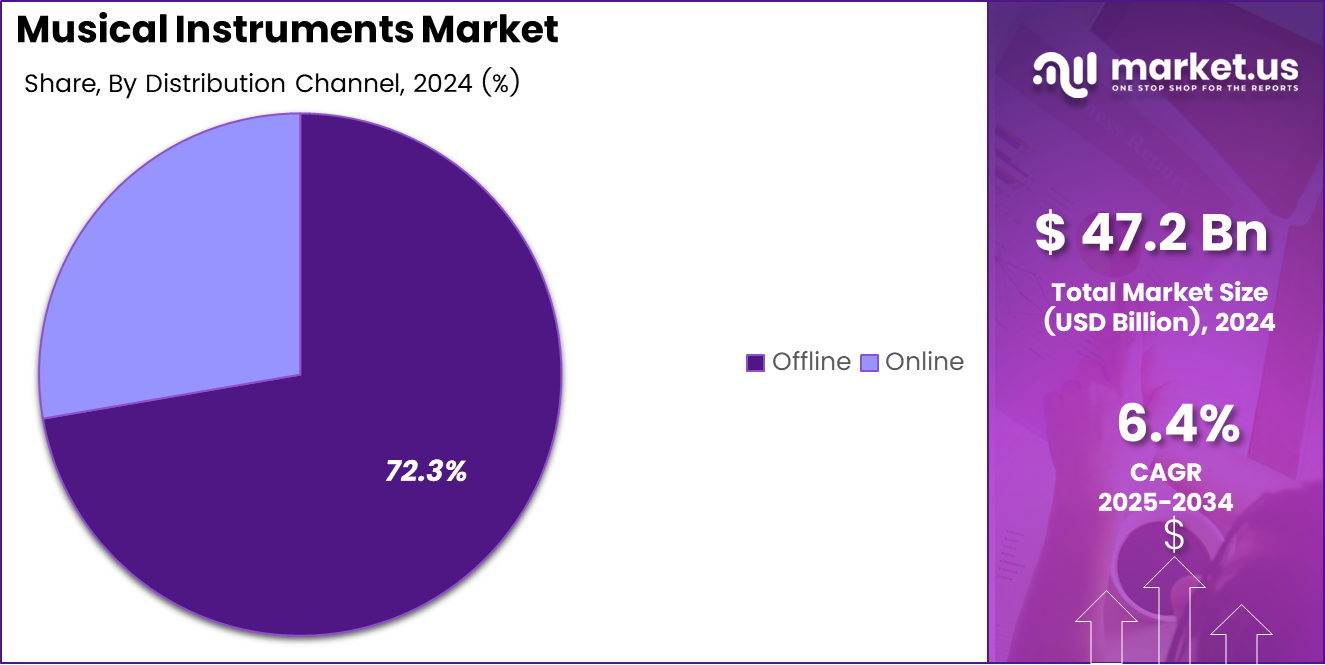

By Distribution Channel Analysis

Online channels gain visibility due to convenience and product variety. Moreover, digital reviews and tutorials influence purchase decisions.

E-commerce platforms expand reach through competitive pricing and bundled offers. Additionally, doorstep delivery supports higher conversion rates.

Company websites strengthen brand trust and enable customization options, thereby appealing to loyal customers.

Offline channels remain important for hands-on trials and expert guidance. Furthermore, advanced or professional musicians prefer physical evaluation before purchase.

Multi-brand stores or specialty shops offer curated selections and personalized service, supporting informed buying decisions.

Others include institutional procurement and second-hand markets that add depth to overall distribution dynamics.

Key Market Segments

By Product Type

- String Instruments

- Electronic & Electromechanical Musical Instruments

- Percussion Instruments

- Wind Instruments

- Acoustic Pianos & Stringed Keyboard Instruments

- Others

By Type

- Portable

- Fixed

By End-user

- Commercial Music

- Personal Use

- Production/Direction

- Others

By Distribution Channel

- Online

- E-commerce

- Company Website

- Offline

- Advanced or Professional Musicians

- Multi-brand Stores or Specialty Shops

- Others

Drivers

Rising Participation in Music Education Programs Drives Market Growth

Rising participation in music education across schools, colleges, and private institutes is supporting steady demand for musical instruments. Music is increasingly included in academic curricula, after school activities, and skill based learning programs. This creates consistent demand for student friendly instruments used in classrooms, training centers, and practice sessions.

The expanding influence of live concerts, music festivals, and performance based entertainment is also supporting market growth. Artists, bands, and event organizers require a wide range of instruments for rehearsals and live shows. This encourages frequent upgrades, replacements, and diversification of instrument collections across performance categories.

Increasing disposable income is enabling consumers to spend more on leisure and creative hobbies such as music. Households are more willing to invest in personal instruments for learning, recreation, or casual performance. This trend is visible across urban and semi urban regions where music is seen as both a hobby and a social activity.

Strong demand from worship centers, hospitality venues, and cultural organizations further supports the market. These institutions regularly use musical instruments for ceremonies, events, and guest experiences, ensuring stable and repeat demand.

Restraints

High Acquisition Costs of Professional Instruments Limit Market Expansion

High acquisition and maintenance costs of premium and professional grade instruments act as a key restraint for the musical instruments market. Advanced instruments often require skilled craftsmanship, imported materials, and precision tuning, making them expensive for individual buyers and small institutions.

Instrument sales are sensitive to economic slowdowns and cuts in discretionary spending. During uncertain economic conditions, consumers tend to delay non essential purchases such as musical instruments. This directly affects sales volumes, especially for mid range and premium product categories.

Limited access to skilled instructors in emerging and rural markets also restricts adoption. Without proper training support, potential learners may hesitate to invest in instruments. This slows market penetration in regions where musical education infrastructure is still developing.

Maintenance challenges further impact ownership decisions. Instruments require regular tuning, repairs, and proper storage, adding to long term costs. These factors collectively limit wider adoption, especially among first time buyers and budget conscious consumers.

Growth Factors

Growing Online Music Learning Platforms Create New Growth Opportunities

Growing penetration of online music learning platforms is creating strong growth opportunities for the musical instruments market. Digital tutorials, virtual classes, and app based lessons encourage learners to purchase instruments for home practice. Easy access to learning resources lowers entry barriers for beginners.

Rising demand for beginner and student level instruments in developing economies is another major opportunity. Expanding youth populations and growing interest in creative skills are driving affordable instrument purchases. Manufacturers are responding by offering cost effective and durable products.

Expansion of home studios and independent music production setups is also supporting market growth. Content creators and aspiring musicians are investing in instruments for recording and personal production. This trend is supported by social media platforms and digital distribution channels.

Together, these opportunities are reshaping buying behavior. Consumers are increasingly purchasing instruments for self learning, home based creation, and flexible use, supporting long term market expansion.

Emerging Trends

Growing Online Music Learning Platforms Create New Growth Opportunities

Growing penetration of online music learning platforms is creating strong growth opportunities for the musical instruments market. Digital tutorials, virtual classes, and app based lessons encourage learners to purchase instruments for home practice. Easy access to learning resources lowers entry barriers for beginners.

Rising demand for beginner and student level instruments in developing economies is another major opportunity. Expanding youth populations and growing interest in creative skills are driving affordable instrument purchases. Manufacturers are responding by offering cost effective and durable products.

Expansion of home studios and independent music production setups is also supporting market growth. Content creators and aspiring musicians are investing in instruments for recording and personal production. This trend is supported by social media platforms and digital distribution channels.

Together, these opportunities are reshaping buying behavior. Consumers are increasingly purchasing instruments for self learning, home based creation, and flexible use, supporting long term market expansion.

Regional Analysis

Asia Pacific Dominates the Musical Instruments Market with a Market Share of 39.4%, Valued at USD 18.5 Billion

Asia Pacific leads the Musical Instruments Market, supported by strong cultural integration of music, expanding middle class populations, and rising participation in formal and informal music education. In 2024, the region accounted for a dominant 39.4% share, with market value reaching USD 18.5 billion, driven by demand from schools, live performance venues, and growing digital music adoption. Government-backed arts programs and increasing affordability of instruments further support sustained regional expansion.

North America Musical Instruments Market Trends

North America represents a mature yet resilient market, driven by steady demand from professional musicians, hobbyists, and educational institutions. High participation in live concerts, worship music, and recording activities supports consistent instrument replacement and upgrades. The region also benefits from strong consumer spending on leisure activities and continued integration of music into school curricula.

Europe Musical Instruments Market Trends

Europe demonstrates stable growth, supported by a rich classical music heritage and widespread institutional music training. Demand remains strong across orchestral instruments, pianos, and band instruments used in conservatories and cultural organizations. Public funding for arts education and preservation of traditional music practices continues to sustain long-term market stability across key European countries.

Middle East and Africa Musical Instruments Market Trends

The Middle East and Africa market is gradually expanding, supported by increasing cultural events, religious music traditions, and hospitality sector growth. Rising investment in entertainment infrastructure and music festivals contributes to improving instrument demand. Adoption remains uneven across countries, but urban centers show consistent progress in music education and performance activities.

Latin America Musical Instruments Market Trends

Latin America shows moderate growth, driven by strong regional music traditions and expanding youth engagement in music programs. Demand is supported by community-based cultural initiatives, festivals, and informal music learning environments. Improving access to affordable instruments and rising interest in contemporary and traditional music genres continue to support regional market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Musical Instruments Company Insights

In 2024, the global musical instruments market reflects a blend of innovation and heritage with significant contributions from established manufacturers. Casio continues to leverage its electronic expertise to expand digital keyboard and portable instrument offerings, driving accessibility for beginners and professional musicians alike. Its focus on digital integration and user-friendly features is expected to sustain steady growth amid rising demand for hybrid performance solutions.

Cort remains a key player in the guitar segment, recognized for delivering quality instruments at competitive price points that appeal to a broad spectrum of players. The company’s manufacturing scale and strategic partnerships support its global distribution, reinforcing its market presence. Cort’s emphasis on craftsmanship and value positions it well as music education and amateur participation expand.

Fender holds a revered status in the electric guitar market and continues to capitalize on brand loyalty and iconic product lines. Its ongoing efforts to innovate through new materials, playability enhancements and expanded digital services aim to capture both legacy customers and younger musicians. Fender’s diversified portfolio spanning acoustics, amplifiers and accessories contributes to its robust performance in 2024.

Gibson sustains its legacy as a premium guitar maker with a focused strategy on high-end instruments and limited editions that resonate with collectors and professionals. The company’s reinforcement of heritage models alongside modern upgrades supports its niche differentiation. Gibson’s commitment to quality and brand prestige is projected to underpin its influence within the upper tier of the global musical instruments market.

Top Key Players in the Market

- Casio

- Cort

- Fender

- Gibson

- Ibanez

- Kawai

- Pearl

- Pluto

- QRS Music

- Roland

Recent Developments

- In Oct 2025, Communities Minister Gordon Lyons announced that 134 grants will be issued to individuals, bands, and groups across Northern Ireland under the 2025/26 Musical Instruments Programme. This initiative supports wider access to musical instruments and strengthens community based music participation and cultural development.

- In May 2024, Music Network welcomed the announcement by Catherine Martin T.D., Minister for Tourism, Culture, Arts, Gaeltacht, Sport and Media, confirming funding of €1,090,700 for the Music Capital Scheme 2024. The funding supports the purchase of musical instruments nationwide and enhances long term capacity for music education and performance across Ireland.

Report Scope

Report Features Description Market Value (2024) USD 47.2 billion Forecast Revenue (2034) USD 87.8 billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (String Instruments, Electronic & Electromechanical Musical Instruments, Percussion Instruments, Wind Instruments, Acoustic Pianos & Stringed Keyboard Instruments, Others), By Type (Portable, Fixed), By End-user (Commercial Music, Personal Use, Production/Direction, Others), By Distribution Channel (Online [E-commerce, Company Website], Offline, [Advanced or Professional Musicians, Multi-brand Stores or Specialty Shops, Others]) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Casio, Cort, Fender, Gibson, Ibanez, Kawai, Pearl, Pluto, QRS Music, Roland Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Casio

- Cort

- Fender

- Gibson

- Ibanez

- Kawai

- Pearl

- Pluto

- QRS Music

- Roland