Global Mushroom Drinks Market Size, Share Analysis Report By Product (Mushroom Coffee, Mushroom Tea, Mushroom Elixirs, Others), By Form (Liquid, Powder), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153181

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

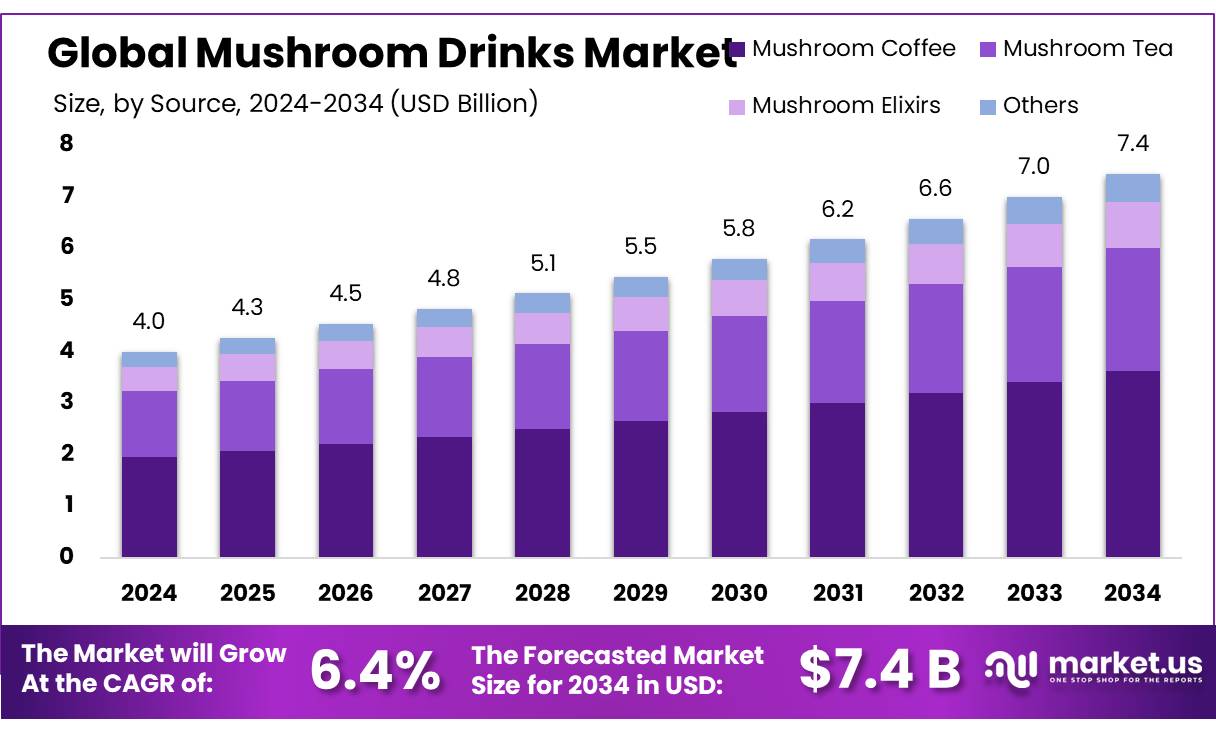

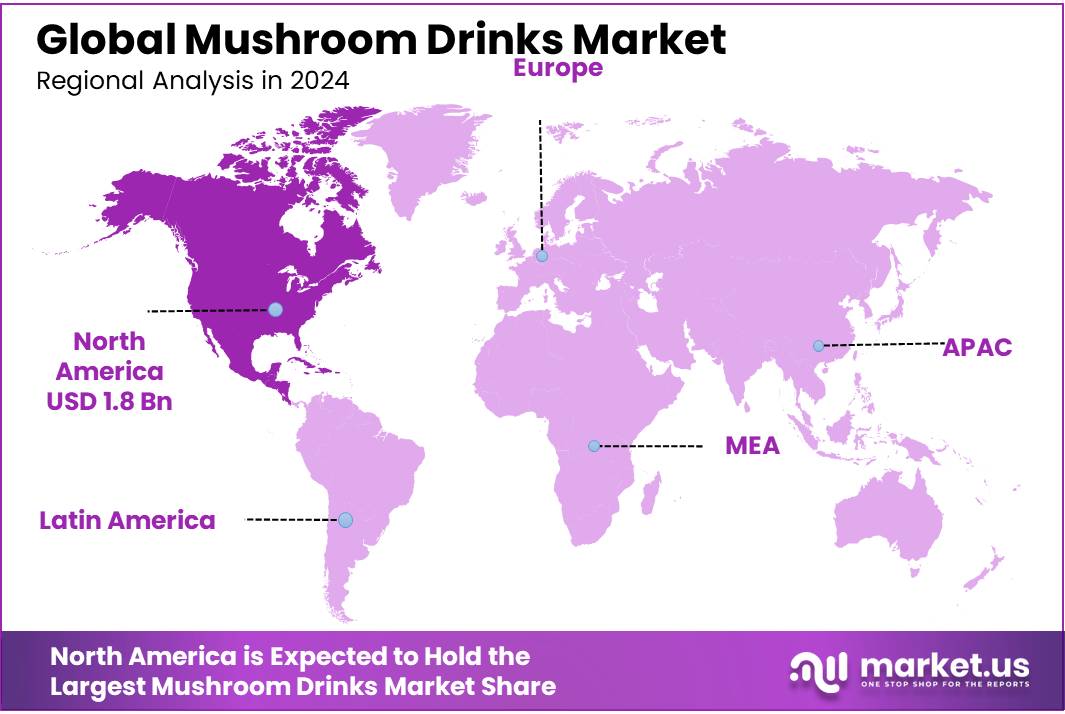

The Global Mushroom Drinks Market size is expected to be worth around USD 7.4 Billion by 2034, from USD 4.0 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 46.7% share, holding USD 1.8 Billion revenue.

Mushroom drink concentrates are specialized formulations derived from medicinal and functional mushrooms—such as Reishi, Lion’s Mane, Chaga, Cordyceps and others—designed for infusion into beverages like coffee, tea, smoothies, and hot chocolates. These concentrates offer consumers convenient access to purported health benefits, including cognitive support, immune enhancement, stress reduction, and anti-inflammatory effects. Incorporation of traditional mushrooms into modern beverage formats has been encouraged by shifting preferences toward natural, holistic wellness products.

Key drivers include surging consumer interest in natural, wellness-oriented beverages, particularly among GenZ and Millennials. In the UK, health drink sales rose 54% year-on-year, with mushroom coffee emerging as a popular substitute for traditional coffee and alcohol. Adaptogenic mushroom shots are gaining shelf presence through retailers like Marks & Spencer. Nutritionally, mushrooms enrich diets with essential minerals, vitamins, and antioxidants like ergothioneine—evidenced in USDA/NHANES dietary modeling.

U.S. Department of Agriculture (USDA) Economic Research Service has documented a significant rise in mushroom consumption—from 0.69 lb to 3.94 lb per capita over several decades—highlighting support for agricultural production and innovation. In Canada, production increased modestly in 2023, with total value rising 2.2% to CAD 710 million, reflecting ongoing investment and sector stability. Although explicit concentrate-specific subsidies are limited, agricultural extension services and research funding directed toward specialty crops, including mushrooms, underpin upstream ingredient quality and supply that support drink concentrate formulation.

Governments are responding with regulatory frameworks and support measures. In the U.S., the Mushroom Council, under the USDA’s Agricultural Marketing Service, administers a research and promotion program funded by assessments on producers/importers exceeding 500,000 lb annually, aimed at “maintaining and expanding” mushroom markets. Further regulatory alignment occurred in December 2024, when the USDA amended its National Organic Program to define organic mushroom production standards—covering spawn, substrate, compost, etc.—with compliance required by February 2027 .

Key Takeaways

- The global mushroom drinks market is projected to reach USD 7.4 billion by 2034, up from USD 4.0 billion in 2024, expanding at a CAGR of 6.4%.

- Mushroom coffee led the product segment, accounting for over 48.7% of the global market share.

- By form, powdered mushroom drinks held a dominant position, capturing more than 64.9% of the total market.

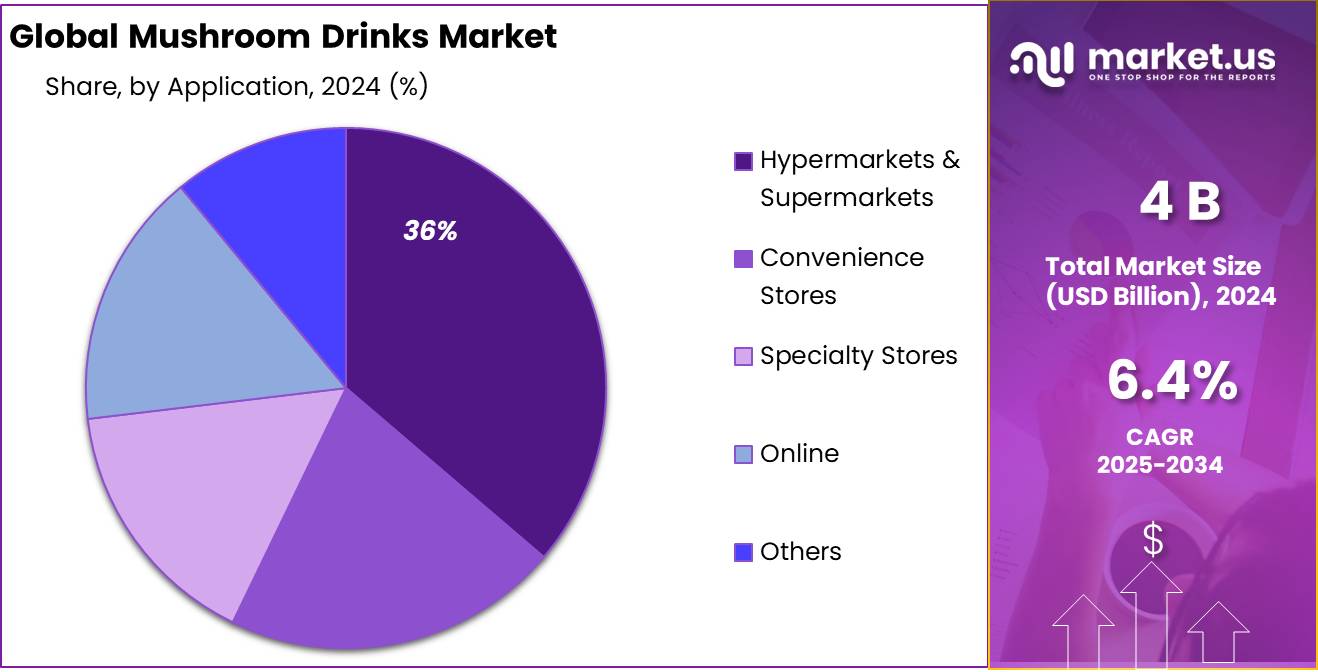

- Hypermarkets and supermarkets represented the leading distribution channel, contributing to over 36.4% of global sales.

- North America stood out as the top regional market, holding a 46.7% share and reaching a value of approximately USD 1.8 billion.

By Product Analysis

Mushroom Coffee dominates with 48.7% share in 2024 due to its rising popularity among health-conscious consumers.

In 2024, Mushroom Coffee held a dominant market position, capturing more than a 48.7% share of the global mushroom drinks market. This strong lead can be linked to the growing number of consumers turning to functional beverages that offer both taste and health benefits. Mushroom coffee blends, often made with lion’s mane, chaga, or cordyceps, are gaining traction as healthier alternatives to traditional coffee, offering improved focus and reduced jitters. The shift in consumer preferences—especially among working professionals and wellness-focused individuals—has helped mushroom coffee maintain its lead. In 2025, this segment is expected to continue growing steadily as more brands introduce convenient formats like instant sachets, concentrate drops, and ready-to-drink bottles.

By Form Analysis

Powder form leads the mushroom drinks market with 64.9% share in 2024, thanks to its long shelf life and easy mixing.

In 2024, Powder held a dominant market position, capturing more than a 64.9% share in the global mushroom drinks market. This leading position is largely due to the convenience, versatility, and longer shelf stability that powdered mushroom concentrates offer. Consumers prefer powder form because it can be easily mixed into coffee, smoothies, or warm beverages without affecting taste or texture significantly. The powder format also allows users to control dosage based on their personal health goals, which adds to its popularity. In 2025, the powder segment is expected to maintain strong demand as more people adopt mushroom-based wellness routines and seek simple, travel-friendly options.

By Distribution Channel Analysis

Hypermarkets & Supermarkets lead with 36.4% share in 2024, driven by strong in-store visibility and easy product access.

In 2024, Hypermarkets & Supermarkets held a dominant market position, capturing more than a 36.4% share of the global mushroom drinks market. This leading position is due to the wide shelf presence, product variety, and instant availability offered by these retail outlets. Consumers often prefer buying health and wellness beverages like mushroom drinks from physical stores where they can compare brands, read labels, and get promotional deals. Many popular mushroom coffee powders, concentrates, and ready-to-drink products are now featured in dedicated wellness sections, especially in urban supermarkets. In 2025, this segment is expected to grow steadily as large retailers continue to expand their functional beverage offerings and partner with new-age wellness brands.

Key Market Segments

By Product

- Mushroom Coffee

- Mushroom Tea

- Mushroom Elixirs

- Others

By Form

- Liquid

- Powder

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

Emerging Trends

Gen Z’s Shift to Functional Mushroom Beverages

In recent months, a fascinating wave has surged through the beverage industry: GenerationZ is increasingly swapping coffee and alcohol for functional mushroom drinks. According to a survey by Savanta and Ocado, two-thirds of GenZ consumers now drink health-boosting beverages regularly—and half have replaced alcohol or sugary drinks with options like kombucha, matcha, and mushroom coffee

Ocado Retail also reported a staggering 54% year-over-year jump in sales of functional health drinks, with matcha tea sales up 67% and kefir up 30%. That same survey reveals 40% of GenZ have swapped their morning tea or coffee for matcha or mushroom coffee, seeking calmer energy and cognitive support.

This trend isn’t just a passing phase—it’s part of a broader wellness movement. Social media influencers and health-conscious GenZ consumers are drawn to adaptogenic properties in mushrooms like lion’s mane, reishi, and cordyceps. These blends are marketed to support stress management, focus, and overall well being—without the caffeine jitters.

Government and regulatory bodies are also playing a role. In the UK, the Food Standards Agency has strict rules preventing unverified health claims on food packaging—pushing companies to fund more human studies. In the US, the FDA’s new draft guidance for functional beverages emphasizes clarity on ingredient safety and health effects—driving brands to prioritize high-quality, scientifically backed formulations.

Drivers

Rising Demand for Functional Beverages Boosts Mushroom Drinks Market

One of the most important reasons behind the rising popularity of mushroom drinks is the growing demand for functional beverages that promote wellness and immunity. Across the globe, consumers are looking for healthier options in their everyday diet. Drinks made with medicinal mushrooms like reishi, lion’s mane, and chaga are becoming favorites for people who want natural energy, better focus, and improved gut health. These mushrooms are known for their adaptogenic and antioxidant properties, and when blended into beverages, they create a unique product that supports both mind and body.

According to the Food and Agriculture Organization (FAO), global mushroom production crossed 43.2 million tonnes in 2022, up from 40.1 million tonnes in 2020. This steady growth is not only due to culinary use but also because of expanding health applications like drinks and powders. The surge in production reflects the growing demand for mushrooms as functional food ingredients.

Governments are also stepping in to support mushroom farming due to its low environmental footprint. For instance, India’s Ministry of Agriculture under its National Horticulture Mission is actively promoting mushroom cultivation by offering subsidies and technical training to small farmers. This kind of support helps keep the raw materials affordable and accessible, making mushroom-based drinks more viable for both producers and consumers.

In the United States, the USDA’s Organic Agriculture Research and Extension Initiative (OREI) funds several projects supporting organic mushroom farming, which is a key supply source for clean-label mushroom beverages. This aligns with the growing consumer shift towards organic and sustainable products. As a result, we’re seeing a new wave of startups and wellness brands entering the mushroom drink space, making it one of the fastest-growing categories in health-focused beverages.

Restraints

Lack of Consumer Awareness Slows Mushroom Drinks Adoption

One of the biggest challenges holding back the growth of mushroom drinks is the lack of consumer awareness and familiarity. While mushrooms like reishi, cordyceps, and lion’s mane have been used in traditional medicine for centuries, many people still don’t fully understand their benefits, especially in beverage form. In Western countries in particular, the idea of drinking mushrooms can feel unfamiliar or even unappealing to a large portion of the population. This perception gap is slowing down mainstream acceptance.

According to a global food survey by the International Food Information Council (IFIC), only 35% of U.S. consumers reported being familiar with functional mushrooms as of 2023. Even fewer—just 19%—had tried mushroom-based drinks. This suggests that while interest in wellness products is rising, many consumers are still hesitant or unaware of mushroom beverages and their potential benefits.

This hesitation is compounded by limited education campaigns and product visibility. Unlike kombucha or plant-based milks, which have benefited from strong branding and supermarket placement, mushroom drinks are often confined to niche wellness stores or online-only brands. As a result, many people don’t encounter these products in their regular shopping routines, reducing the chances of trial and repeat purchases.

Governments and food boards have taken steps to promote mushroom farming, but there’s still little focus on promoting mushroom-based functional foods to the broader public. While initiatives like India’s National Horticulture Board and the USDA’s Specialty Crop Block Grant Program support mushroom cultivation, they rarely include consumer education or product innovation funding. This leaves a gap in market connection—from the farm to the consumer.

Opportunity

Plant-Based Lifestyle Trend Opens New Doors for Mushroom Drinks

One major growth opportunity for mushroom drinks comes from the rising shift toward plant-based and sustainable lifestyles. More and more people today are choosing food and drinks that are natural, eco-friendly, and free from artificial ingredients. Mushroom-based beverages fit right into this movement—they’re not only plant-derived but also packed with health benefits like immune support, mental clarity, and natural energy. This makes them an easy swap for sugary sodas or over-caffeinated drinks.

According to the Good Food Institute, sales of plant-based foods in the United States reached US$ 8.1 billion in 2022, with plant-based beverages accounting for over US$ 2.8 billion of that total. While most of that is still dominated by almond, oat, and soy milks, it shows there is a strong and growing customer base ready to explore new plant-based options.

Governments and agriculture departments are also stepping in to support mushroom farming due to its low environmental impact. The USDA recognizes mushrooms as a sustainable crop that requires less water, land, and energy compared to traditional livestock or even many vegetables. This has led to increased support under initiatives like the USDA Organic Certification Cost Share Program, which helps small growers bring organic mushroom products to market—including those used in drinks.

In the UK, organizations like the Soil Association are working to promote sustainable farming and clean-label food production, which benefits functional beverage makers using natural ingredients like mushrooms. These changes signal a bigger shift in how people view food—less about just taste and more about wellness, sustainability, and values.

Regional Insights

North America leads with 46.7% share, generating USD 1.8 billion in 2024 due to strong consumer interest and retail presence

In 2024, North America emerged as the dominant region in the global mushroom drinks market, seizing 46.7% of total market share and reaching approximately USD 1.8 billion in revenue. This commanding position reflects the region’s mature wellness culture, high disposable income, and widespread availability of functional wellness products.

The large share can be credited to several synergistic factors. Firstly, consumer awareness in North America about adaptogenic mushrooms—such as reishi, lion’s mane, and cordyceps—has grown steadily, fueled by education campaigns from governmental health agencies and independent research institutions. Secondly, the development of robust distribution channels—including major grocery retailers, health food stores, and online platforms—has ensured that mushroom beverages are easily accessible to a broad demographic. In 2024, supermarkets and hypermarkets accounted for roughly 47% of mushroom coffee distribution in the region

Additionally, the regulatory environment in North America offers clarity around functional ingredient labeling and permissible health claims, fostering brand innovation and consumer confidence. Growing interest in natural immunity support—particularly following public health focus on preventative care—has also driven repeat purchases and premium pricing.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Four Sigmatic pioneered the mushroom-coffee space over a decade ago by blending organic Arabica coffee with adaptogenic mushrooms like lion’s mane, chaga, and reishi to support focus, balanced energy, gut health, and immune function. The brand highlights its high consumer loyalty—claiming 90% satisfaction and 94% repurchase intent—and emphasizes clean-label, organic ingredients and functional benefits without compromising taste

Odyssey Wellness produces ready-to-drink functional mushroom elixirs designed to enhance cognition, energy, and mood, blending lion’s mane, cordyceps, Ltheanine, and Panax ginseng. Each product contains approximately 2,750 mg of potent mushroom extracts, is naturally sweetened with monk fruit, and is supported by innovation in RTD cognitive beverages. Odyssey positions itself as merging ancient mushroom remedies with modern flavors to appeal to wellness-driven consumers.

Peak State Coffee is the first brand to offer whole-bean coffee infused with functional mushrooms through a proprietary infusion process, delivering 500 mg of full-spectrum US-grown adaptogens per cup. The brand highlights benefits like brain support, immunity enhancement, and stress moderation, with products verified by third-party labs. Founded by a Northeastern University graduate in 2020, it gained early recognition by winning Colorado’s Naturally Boulder startup contest.

Top Key Players Outlook

- Four Sigmatic Foods, Inc.

- MUD\WTR, Inc.

- Laird Superfood, Inc.

- Odyssey Wellness LLC

- Peak State Coffee, Inc.

- Tamim Teas Company

- RYZE Superfoods, LLC

- Mushroom Cups International

- Real Mushrooms

- Laird Superfood, Inc.

- NeuRoast Company

- La Republica Superfoods

Recent Industry Developments

Peak State Coffee, Inc. has made a notable impact in 2024 by pioneering the world’s first whole-bean coffee infused with 500 mg of full-spectrum US-grown adaptogenic mushroom extract per 8 oz cup.

In February 2024, Odyssey secured USD 6 million in funding to scale production and expand distribution into convenience channels like 7 Eleven, helping its rollout into over 730 stores in Florida and alongside Wegmans across the East Coast.

By 2024 Four Sigmatic Foods Inc., achieved estimated annual revenue of $61.7 million, supported by a lean team of just 57 employees.

Report Scope

Report Features Description Market Value (2024) USD 4.0 Bn Forecast Revenue (2034) USD 7.4 Bn CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Mushroom Coffee, Mushroom Tea, Mushroom Elixirs, Others), By Form (Liquid, Powder), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Four Sigmatic Foods, Inc., MUD\WTR, Inc., Laird Superfood, Inc., Odyssey Wellness LLC, Peak State Coffee, Inc., Tamim Teas Company, RYZE Superfoods, LLC, Mushroom Cups International, Real Mushrooms, Laird Superfood, Inc., NeuRoast Company, La Republica Superfoods Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Four Sigmatic Foods, Inc.

- MUD\WTR, Inc.

- Laird Superfood, Inc.

- Odyssey Wellness LLC

- Peak State Coffee, Inc.

- Tamim Teas Company

- RYZE Superfoods, LLC

- Mushroom Cups International

- Real Mushrooms

- Laird Superfood, Inc.

- NeuRoast Company

- La Republica Superfoods