Global Multiwall Polycarbonate Sheet Market Size, Share, Growth Analysis By Product Type (Twin-wall Sheets, Triple-wall Sheets, and Others), By Category (Clear and Colored), By Application Method (Building and Construction, Automotive, Electronics, Agriculture, Aerospace and Defense, Advertising, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167435

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

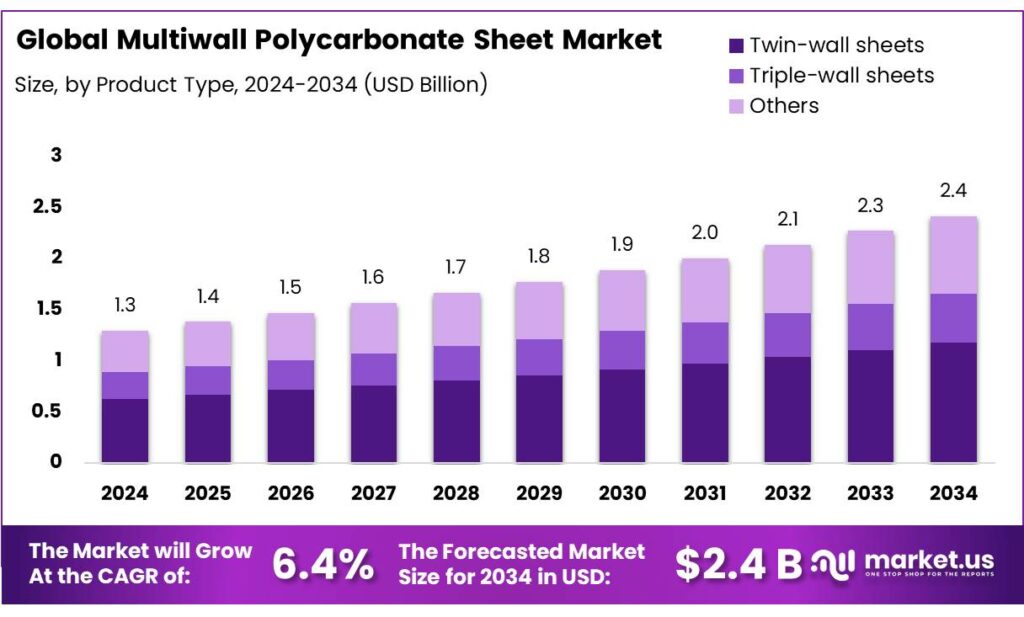

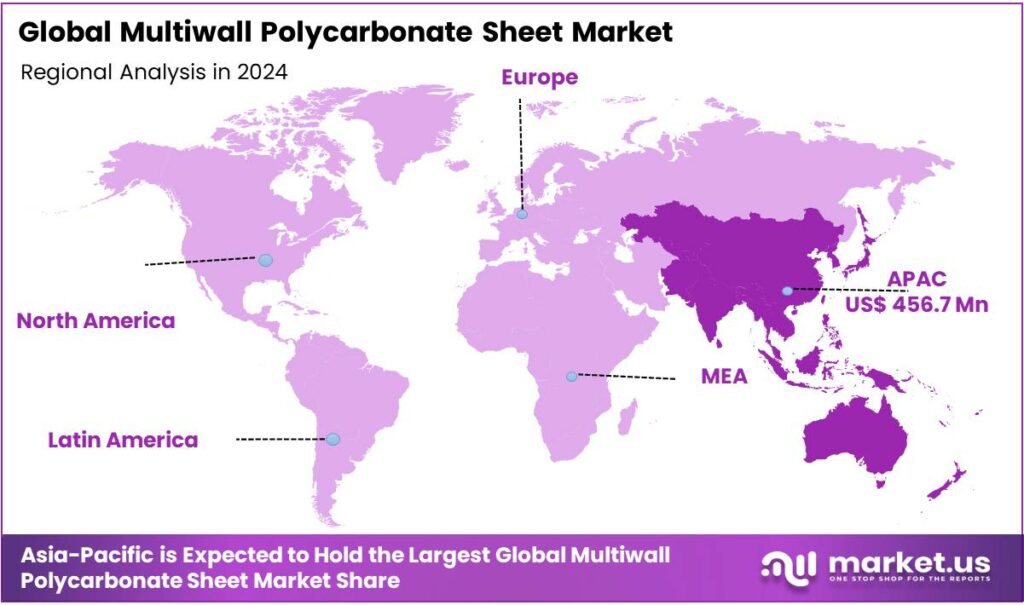

The Global Multiwall Polycarbonate Sheet Market size is expected to be worth around USD 2.4 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominan market position, capturing more than a 36.7% share, holding USD 456.7 Million revenue.

A multiwall polycarbonate sheet is a lightweight, durable, and weather-resistant plastic building material with a hollow, multi-chambered structure, like a honeycomb, that provides insulation. It’s often used as a more affordable and impact-resistant alternative to glass for applications like roofing, skylights, greenhouses, and various enclosures. The multiwall polycarbonate sheet market is primarily driven by the building and construction industry, where these sheets are valued for their durability, thermal insulation, UV resistance, and energy efficiency. These sheets provide an ideal solution for structures that require both strength and natural light.

Clear sheets are particularly popular for their ability to transmit sunlight while reducing energy costs, making them perfect for energy-efficient designs such as greenhouses. While the sheets are used in other industries such as automotive and agriculture, their applications are more limited compared to construction, where the need for large, cost-effective materials is higher. Additionally, the shift toward sustainability and circular economy practices is boosting the use of polycarbonate sheets, as they are recyclable and align with eco-friendly building trends. However, challenges such as competition from alternative materials and geopolitical tensions may impact market dynamics.

- In 2024, the vast majority of BPA, around, 98% is used to manufacture polycarbonate and Epoxy resins. In 2020, in Europe alone, the production of Bisphenol A reached up to 950,000 tons, out of which around 72% was used in the production of

Key Takeaways

- The global multiwall polycarbonate sheet market was valued at USD 1.3 billion in 2024.

- The global multiwall polycarbonate sheet market is projected to grow at a CAGR of 6.4% and is estimated to reach USD 2.4 billion by 2034.

- Based on the types of multiwall polycarbonate sheets, twin-wall sheets dominated the market, with around 48.7% of the total global market.

- On the basis of category, clear multiwall polycarbonate sheet held a major share of the market, around 61.6%.

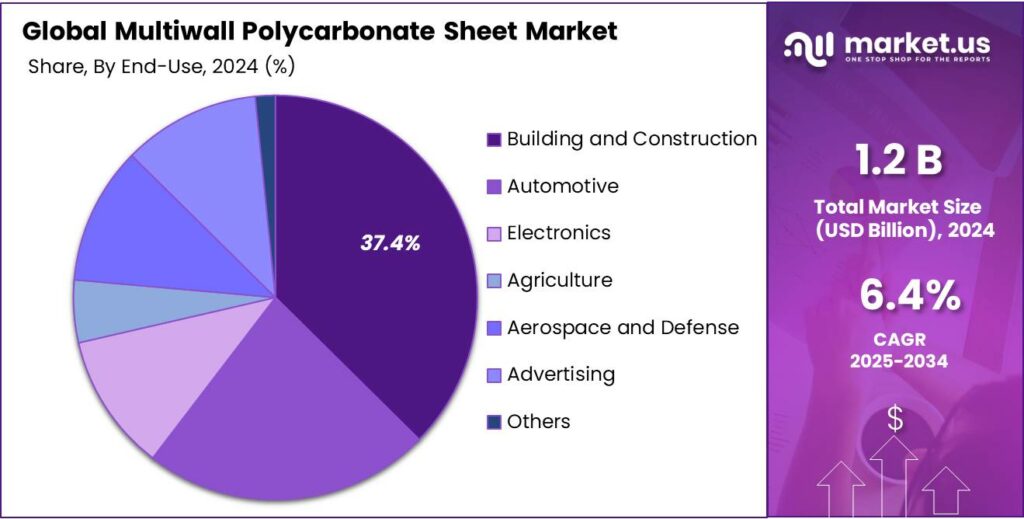

- Among the end-uses, the building and construction industry emerged as a major segment in the multiwall polycarbonate sheet market, with 37.4% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the multiwall polycarbonate sheet market, accounting for around 36.7% of the total global consumption.

Product Type Analysis

Twin-Wall Multiwall Polycarbonate Sheets Dominated the Market in 2024.

The multiwall polycarbonate sheet market is segmented based on the product types into twin-wall sheets, triple-wall sheets, and others. The twin-wall multiwall polycarbonate sheets dominated the market, comprising around 48.7% of the market share. Twin-wall multiwall polycarbonate sheets are more commonly used than triple-wall or other multiwall variants due to their optimal balance of strength, insulation, and cost-effectiveness.

The two-layer design provides excellent thermal insulation and impact resistance while keeping the material lightweight, making it ideal for applications such as skylights, roofing, and greenhouses. In addition, twin-wall sheets offer a good level of UV protection, which helps reduce heat buildup and protects against harmful sun exposure. In contrast, triple-wall polycarbonate sheets, while offering slightly better insulation and rigidity, are often more expensive and heavier, which can be a drawback in projects where cost and ease of handling are crucial.

Category Analysis

Clear Multiwall Polycarbonate Sheet was a Prominent Segment in the Market.

The multiwall polycarbonate sheet market is segmented on the basis of category into clear and colored. The clear multiwall polycarbonate sheets led the market, constituting about 61.6% of the market share. These sheets are more commonly used than colored variants, primarily due to their superior light transmission and versatility.

In contrast, colored polycarbonate sheets, while useful in applications where privacy or aesthetic considerations are important, tend to reduce light transmission, making them less suitable for energy-efficient designs. Furthermore, clear sheets are more adaptable, as they can be used in a wider range of settings and are easier to integrate with existing structures, contributing to their greater popularity in both commercial and residential projects.

End-Use Analysis

The Building and Construction Industry Emerged as a Leading Segment in the Multiwall Polycarbonate Sheet Market.

On the basis of end-uses, the multiwall polycarbonate sheet market is segmented into building and construction, automotive, electronics, agriculture, aerospace and defense, advertising, and others. Approximately 37.4% of the multiwall polycarbonate sheet market revenue is generated from the building and construction industry, primarily due to their combination of durability, thermal insulation, and cost-effectiveness, which make them ideal for large-scale applications.

In construction, they are commonly used for roofing, skylights, facades, and greenhouses, where the need for lightweight yet strong, energy-efficient materials is critical. For instance, polycarbonate’s excellent thermal insulation and UV resistance help reduce energy costs and maintain stable indoor temperatures. While other industries, such as automotive and aerospace, use polycarbonate for strength, weight, and impact resistance that demand specialized formulations, making multiwall variants less common.

Key Market Segments

By Product Type

- Twin-wall sheets

- Triple-wall sheets

- Others

By Category

- Clear

- Colored

By End-Use

- Building and Construction

- Automotive

- Electronics

- Agriculture

- Aerospace and Defense

- Advertising

- Others

Drivers

Building and Construction Industry Drives the Multiwall Polycarbonate Sheet Market.

The building and construction industry plays a pivotal role in driving the demand for multiwall polycarbonate sheets due to their superior qualities, such as durability, thermal insulation, and UV resistance. These sheets are widely used in applications such as skylights, roofing, and facades, especially in commercial and residential buildings where natural lighting is a priority. Their lightweight nature and high impact resistance make them ideal for structures that require both strength and energy efficiency. For instance, multiwall polycarbonate is often used in greenhouse construction, where its insulating properties help regulate temperature, promoting plant growth.

According to the United States Green Building Council, in 2023, there were more than 6,000 LEED-certified commercial projects worldwide, representing 1.36 billion GSF (gross square feet). The rise in energy-efficient building designs and eco-friendly construction materials further boosts the popularity of polycarbonate sheets, as they help reduce heating and cooling costs.

Moreover, their ease of installation and low maintenance requirements make them a preferred choice for builders, especially in regions with harsh weather conditions, where they provide enhanced protection and longevity.

Restraints

Availability of Efficient Alternatives Poses a Significant Challenge in the Multiwall Polycarbonate Sheet Market.

The availability of efficient alternatives poses a significant challenge to the multiwall polycarbonate sheet market, as other materials such as glass, acrylic, and fiberglass offer similar benefits in terms of transparency, strength, and insulation. For instance, tempered glass is often used as an alternative in architectural applications due to its high optical clarity and resistance to scratching. Similarly, acrylic sheets, which are lighter than glass but offer comparable optical properties, have gained popularity in applications such as signage and skylights.

Similarly, fiberglass is frequently utilized for roofing and cladding due to its cost-effectiveness and resistance to weathering. While polycarbonate excels in impact resistance and energy efficiency, its higher cost and susceptibility to scratching compared to acrylic or glass can limit its appeal in certain applications. As more efficient and cost-effective alternatives enter the market, manufacturers face pressure to innovate and demonstrate the unique value of polycarbonate solutions, especially in highly competitive sectors of buildings, construction, and automotive.

Opportunity

Shift Towards Circular Economy Creates Opportunities in the Multiwall Polycarbonate Sheet Market.

The growing shift towards a circular economy is creating significant opportunities for the multiwall polycarbonate sheet market, as these materials align well with sustainability goals. Multiwall polycarbonate sheets are inherently recyclable, which fits within the principles of reducing waste and reusing materials. As industries and governments emphasize sustainable practices, demand for recyclable building materials such as polycarbonate is increasing. For instance, polycarbonate sheets used in construction projects can be repurposed at the end of their life cycle, reducing environmental impact.

Additionally, advancements in recycling technologies have made it easier to process polycarbonate materials, making it a viable option for businesses aiming to lower their carbon footprint. In April 2024, at the Chinaplas international trade fair in Shanghai, Covestro introduced a range of polycarbonates based on chemically recycled and attributed material from post-consumer waste via mass balance.

As awareness around the importance of resource efficiency grows, more builders and architects are incorporating polycarbonate solutions into their sustainable designs, promoting a circular approach in the construction industry.

Trends

Applications in the Automotive and Aerospace Industries.

The automotive and aerospace industries are increasingly adopting multiwall polycarbonate sheets due to their unique combination of lightweight, strength, and impact resistance. In the automotive sector, polycarbonate sheets are used for components such as sunroofs, windows, and headlamp lenses, where reducing weight can significantly improve fuel efficiency and overall performance. For instance, polycarbonate’s ability to withstand high impact and resist UV degradation makes it ideal for both interior and exterior automotive applications.

Similarly, in the aerospace sector, these sheets are being used for aircraft windows, fuselage panels, and canopies, providing a lightweight yet durable alternative to traditional materials such as glass and metal. Polycarbonate’s ability to withstand extreme temperatures and mechanical stress makes it suitable for use in advanced aerospace systems. As the push for fuel efficiency and sustainability in these industries grows, multiwall polycarbonate sheets are becoming a preferred choice for manufacturers looking to meet performance and environmental goals.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Multiwall Polycarbonate Sheet market by Disrupting the Essential Supply Chains in the Market.

The geopolitical tensions, particularly trade conflicts and political instability, have had a notable impact on the multiwall polycarbonate sheet market. For instance, ongoing tensions between major global players such as the United States, which is the biggest market for sustainable products for construction, and China, which is the largest manufacturer of sustainable products for construction, have led to fluctuating raw material prices for all plastics, affecting production costs and leading to supply shortages. These tensions resulted in trade restrictions that have delayed the import and export of key components needed for polycarbonate production, such as bisphenol A (BPA).

In regions such as Europe, the ongoing energy crises, exacerbated by the war in Ukraine, have further strained manufacturing capabilities, driving up the cost of raw materials such as petroleum derivatives used in polycarbonate production. Additionally, the uncertainty caused by geopolitical risks has led to shifts in investment patterns, with companies looking to diversify supply chains and reduce reliance on specific regions.

This has prompted manufacturers to explore alternative production locations, often in more politically stable countries, which can temporarily increase operational costs and production lead times. Furthermore, such instability may slow down construction projects and delay the adoption of polycarbonate solutions in new buildings or infrastructure, as companies prioritize cost management and risk mitigation during uncertain times.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Multiwall Polycarbonate Sheet Market.

In 2024, the Asia Pacific dominated the global multiwall polycarbonate sheet market, holding about 36.7% of the total global consumption. The market in the region is driven by rapid industrialization, urbanization, and the growing demand for energy-efficient building materials. Countries such as China, India, and Japan are major consumers of polycarbonate sheets, especially in the construction and automotive sectors. The region’s booming construction industry, fueled by infrastructure development and a rising demand for sustainable buildings, has significantly boosted the use of polycarbonate in roofing, skylights, and facades.

For instance, China’s extensive use of polycarbonate in greenhouses and industrial facilities reflects the region’s emphasis on both energy savings and durability. In Japan, polycarbonate sheets are widely used in the automotive sector, particularly for lightweight vehicle components. Additionally, the Asia Pacific region is a hub for manufacturing, where polycarbonate sheets are used domestically as well as exported globally. The region’s competitive manufacturing costs, coupled with increasing awareness of sustainable construction, position the Asia Pacific as a key leader in the market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major market players in the multiwall polycarbonate sheet market are SABIC, Covestro AG, 3A Composites, Trinseo, Teijin Limited, Mitsubishi Chemical Corporation, Excelite, Plazit-Polygal Group, Arla Plast AB, Palram Industries, DS Smith Plc, Brett Martin, Dott. Gallina s.r.l., Spartech, Takaroku Shoji Company Limited, Polyvalley Technology (Tianjin) Co., Exolon Group, and Danpal. Companies in the multiwall polycarbonate sheet market employ several strategies to boost sales.

These companies focus on offering customized solutions, such as different sheet sizes, colors, and thicknesses, which help meet specific customer needs and enhance product appeal. In addition, partnerships with architects, contractors, and builders are crucial for gaining long-term projects, particularly in the construction sector.

Similarly, companies often focus on educating customers about the advantages of polycarbonate, such as its insulation properties and UV resistance, through targeted marketing campaigns, trade shows, and technical seminars. Furthermore, expanding through e-commerce platforms has made it easier for businesses to reach a wider customer base and streamline the purchasing process.

The major players in the industry

- SABIC

- Covestro AG

- 3A Composites

- Trinseo

- Teijin Limited

- Mitsubishi Chemical Corporation

- Excelite

- Plazit-Polygal Group

- Arla Plast AB

- Palram Industries Ltd.

- DS Smith Plc

- Brett Martin Ltd.

- Gallina s.r.l.

- Spartech

- Takaroku Shoji Company Limited

- Polyvalley Technology (Tianjin) Co., Ltd.

- Exolon Group

- Danpal

- Other Key Players

Key Development

- In January 2022, Exolon Group and S.E.P., Società Europea Plastica, announced a cooperation in the area of modular panels to expand their polycarbonate sheet solutions for the building industry.

- In August 2025, Brett Martin and Amerilux International announced the opening of a joint venture, American Polycarbonate Company (APC). The joint venture is poised to begin extruding and manufacturing polycarbonate sheets in AmeriLux’s 500,000 square foot state-of-the-art manufacturing facility.

Report Scope

Report Features Description Market Value (2024) US$1.3 Bn Forecast Revenue (2034) US$2.4 Bn CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Twin-wall Sheets, Triple-wall Sheets, and Others), By Category (Clear and Coloured), By Application Method (Building and Construction, Automotive, Electronics, Agriculture, Aerospace and Defence, Advertising, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape SABIC, Covestro AG, 3A Composites, Trinseo, Teijin Limited, Mitsubishi Chemical Corporation, Excelite, Plazit-Polygal Group, Arla Plast AB, Palram Industries Ltd., DS Smith Plc, Brett Martin Ltd., Dott.Gallina s.r.l., Spartech, Takaroku Shoji Company Limited, Polyvalley Technology (Tianjin) Co., Ltd., Exolon Group, Danpal, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Multiwall Polycarbonate Sheet MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Multiwall Polycarbonate Sheet MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SABIC

- Covestro AG

- 3A Composites

- Trinseo

- Teijin Limited

- Mitsubishi Chemical Corporation

- Excelite

- Plazit-Polygal Group

- Arla Plast AB

- Palram Industries Ltd.

- DS Smith Plc

- Brett Martin Ltd.

- Gallina s.r.l.

- Spartech

- Takaroku Shoji Company Limited

- Polyvalley Technology (Tianjin) Co., Ltd.

- Exolon Group

- Danpal

- Other Key Players