Global Multivitamin-Infused Skincare Market Size, Share, Growth Analysis By Product Type (Serums, Creams/Lotions, Masks, Capsules), By Vitamin Blend (Vitamin C + E Complexes, Vitamin B3 (Niacinamide) Blends, Vitamin A + Derivatives, Multi-Antioxidant Formulations), By Claim (Clean-Label, Natural/Organic, Dermatologist-Tested, Vegan), By Function (Anti-Aging, Brightening, Repair & Protection, Hydration, Others), By Channel (E-Commerce, Mass Retail, Pharmacies, Specialty Beauty Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170270

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Vitamin Blend Analysis

- Claim Analysis

- Function Analysis

- Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Emerging Trends

- Regional Analysis

- Key Multivitamin-Infused Skincare Company Insights

- Key Companies

- Recent Developments

- Report Scope

Report Overview

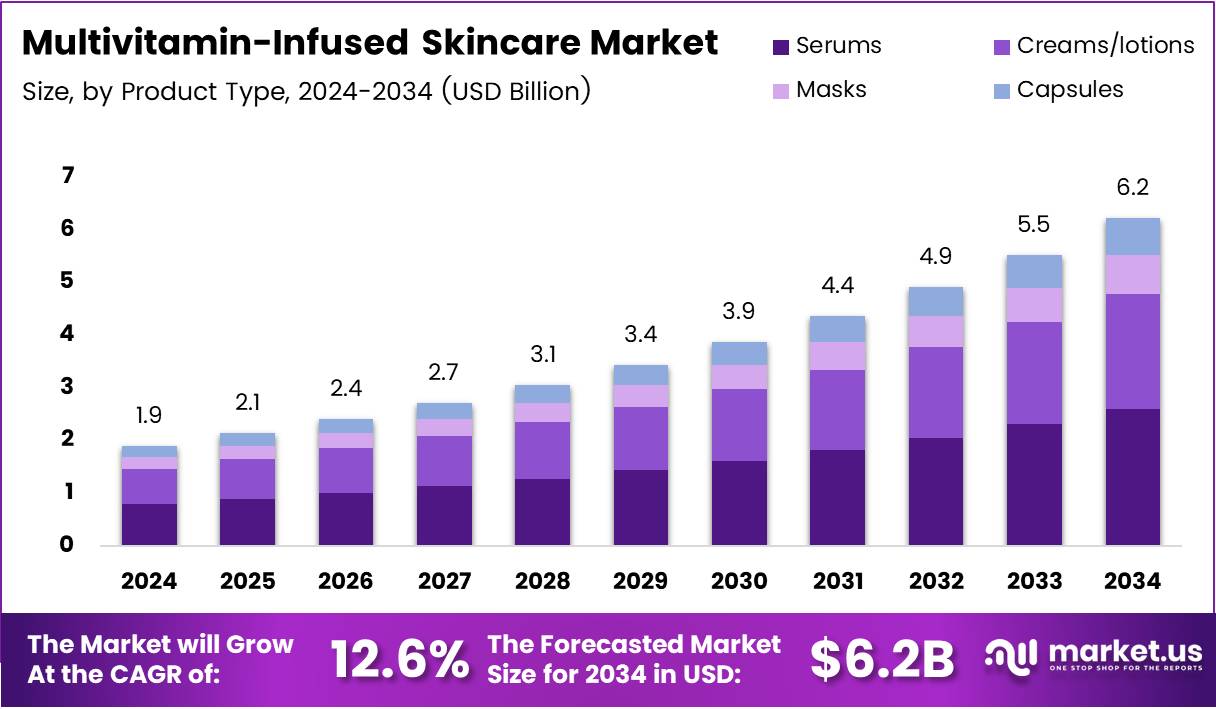

The global Multivitamin-Infused Skincare Market is projected to reach approximately USD 6.2 billion by 2034, up from USD 1.9 billion in 2024, expanding at a CAGR of 12.6% during the forecast period from 2025 to 2034. This robust growth reflects increasing consumer demand for scientifically backed skincare solutions that combine multiple vitamins.

Multivitamin-infused skincare represents a specialized category of cosmetic products formulated with multiple vitamin complexes to address various skin concerns simultaneously. These formulations typically combine vitamins C, E, B3, and A derivatives to deliver comprehensive skin nutrition. Consequently, they offer multi-functional benefits including anti-aging, brightening, hydration, and barrier repair in single-use products.

The market demonstrates significant expansion potential driven by growing consumer awareness of preventive skincare routines. Modern consumers increasingly prioritize ingredient transparency and dermatologist-backed formulations over conventional beauty products. Furthermore, the clean beauty movement has accelerated demand for vitamin-enriched products that deliver visible results without harmful additives.

E-commerce platforms have emerged as critical distribution channels, facilitating direct brand-to-consumer engagement and personalized skincare education. Digital marketing strategies enable brands to communicate complex vitamin benefits effectively to informed consumers. Additionally, social media influences purchasing decisions as beauty enthusiasts seek trending multivitamin formulations recommended by dermatologists and influencers.

Premium and masstige segments continue expanding their vitamin-infused product portfolios to capture health-conscious demographics. Brands invest heavily in research and development to overcome formulation stability challenges inherent in combining multiple active vitamins. Moreover, technological advancements in encapsulation and time-release delivery systems enhance vitamin bioavailability and product efficacy.

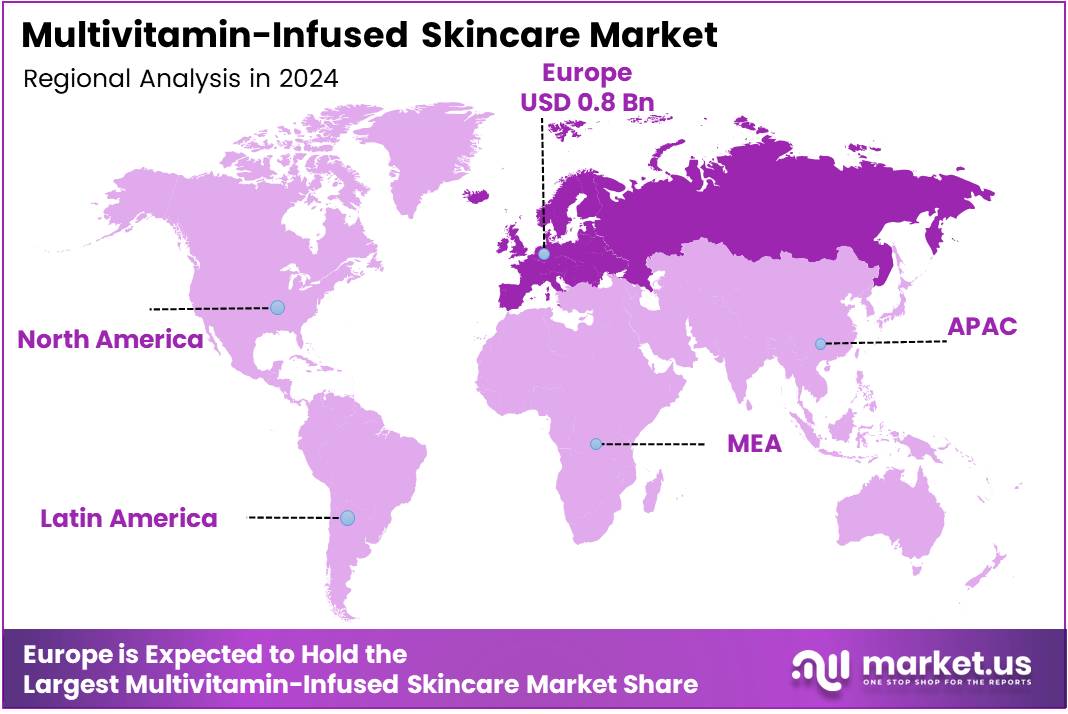

Regional market dynamics vary considerably, with Europe commanding 45.7% market share valued at USD 0.8 billion in 2024. North American and Asian markets demonstrate strong growth trajectories driven by rising disposable incomes and beauty consciousness.

According to research, 35% of consumers report that skincare trends affect their purchasing decisions, while 23% indicate trends somewhat influence buying behavior. This trend sensitivity underscores the importance of innovative vitamin formulations in capturing market share and maintaining competitive positioning in the evolving skincare landscape.

Key Takeaways

- Global Multivitamin-Infused Skincare Market projected to reach USD 6.2 billion by 2034 from USD 1.9 billion in 2024, growing at 12.6% CAGR.

- Europe dominates with 45.7% market share, valued at USD 0.8 billion in 2024.

- Serums segment leads product type category with 43.8% market share in 2024.

- Vitamin C + E complexes dominate vitamin blend segment with 48.2% share.

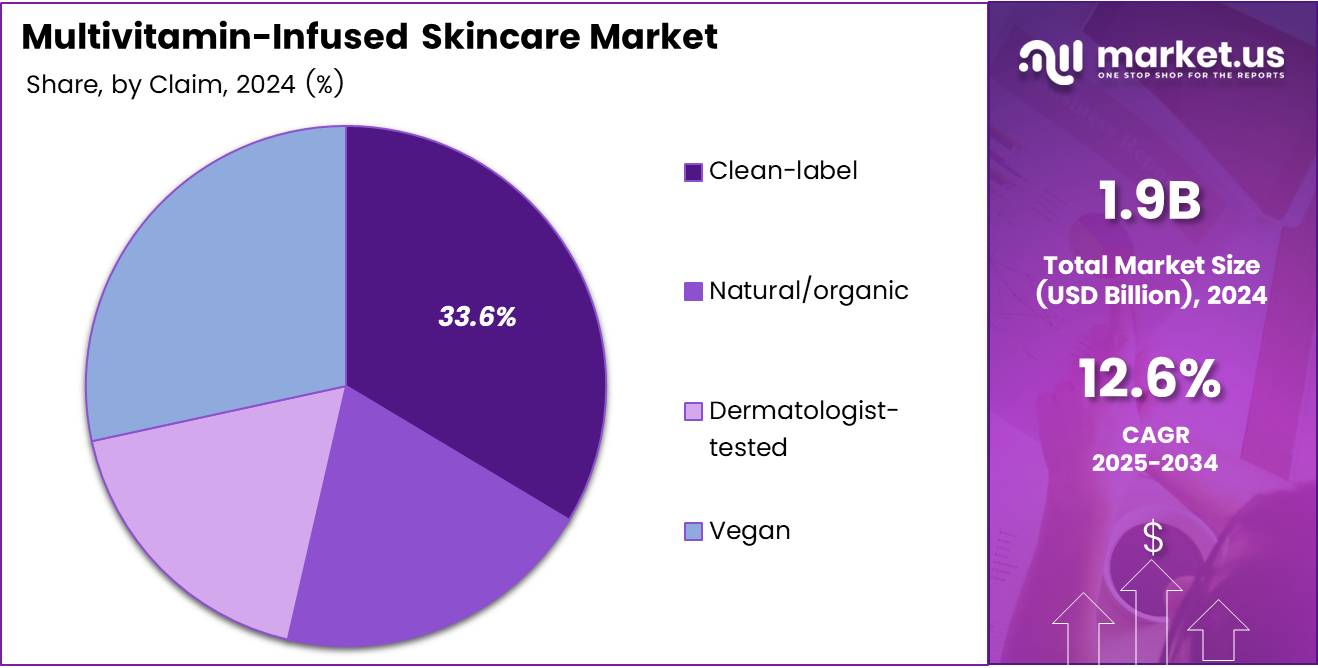

- Clean-label products account for 33.6% of claims-based segmentation.

- Anti-aging function holds 37.9% share among functional segments.

- E-Commerce channel captures 45.4% of distribution market share.

Product Type Analysis

Serums dominate with 43.8% market share due to superior absorption and concentrated vitamin delivery.

In 2024, Serums held a dominant market position in the Product Type segment of the Multivitamin-Infused Skincare Market, with a 43.8% share. Serums deliver highly concentrated vitamin formulations with lightweight textures that penetrate skin layers effectively. Their fast-absorbing properties make them ideal carriers for unstable vitamins requiring quick delivery. Additionally, consumers prefer serums for layering with other skincare products in multi-step routines.

Creams and lotions represent the second-largest product category in multivitamin skincare formulations. These products combine vitamin complexes with moisturizing agents to provide hydration alongside nutritional benefits. Their thicker textures appeal to consumers with dry skin seeking intensive nourishment. Furthermore, cream formats offer extended vitamin release throughout the day, supporting sustained skin health.

Masks deliver intensive vitamin treatments for periodic skin rejuvenation and repair. Sheet masks and overnight sleeping masks infused with vitamin cocktails provide concentrated treatments. These products cater to consumers seeking spa-like experiences at home. Moreover, mask formats allow higher vitamin concentrations without daily application concerns.

Capsules represent innovative single-dose vitamin skincare delivery systems ensuring formula freshness. Each capsule contains pre-measured vitamin blends protected from oxidation until application. This format eliminates stability concerns associated with multi-vitamin formulations. Consequently, capsules appeal to consumers prioritizing ingredient efficacy and minimal preservative exposure.

Vitamin Blend Analysis

Vitamin C + E complexes dominate with 48.2% share due to synergistic antioxidant protection and proven efficacy.

In 2024, Vitamin C + E complexes held a dominant market position in the Vitamin Blend segment of the Multivitamin-Infused Skincare Market, with a 48.2% share. This combination delivers powerful antioxidant protection against environmental stressors and free radical damage. Vitamin E stabilizes vitamin C, enhancing its photoprotective properties and extending formula shelf life. Furthermore, this synergistic blend addresses multiple skin concerns including brightening, collagen synthesis, and premature aging prevention.

Vitamin B3 (Niacinamide) blends represent increasingly popular formulations for barrier repair and inflammation reduction. Niacinamide improves skin texture, minimizes pores, and regulates sebum production effectively. Its compatibility with other actives makes it versatile for combination formulations. Moreover, dermatologists widely recommend niacinamide for sensitive skin conditions, driving consumer confidence and adoption rates.

Vitamin A and derivatives including retinol and retinoids target cellular renewal and anti-aging concerns. These formulations stimulate collagen production and accelerate skin cell turnover for improved texture. However, vitamin A derivatives require careful formulation to minimize irritation potential. Consequently, brands develop encapsulated and time-release versions to enhance tolerability while maintaining efficacy.

Multi-antioxidant formulations combine various vitamins with botanical extracts for comprehensive skin protection. These complex blends address oxidative stress from multiple pathways simultaneously. They appeal to consumers seeking all-in-one solutions for environmental defense. Additionally, multi-antioxidant products position themselves as premium offerings with advanced scientific backing and holistic skin health benefits.

Claim Analysis

Clean-label products dominate with 33.6% share driven by consumer demand for transparency and safe ingredients.

In 2024, Clean-label products held a dominant market position in the Claim segment of the Multivitamin-Infused Skincare Market, with a 33.6% share. Clean-label formulations exclude controversial ingredients such as parabens, sulfates, and synthetic fragrances. Consumers increasingly scrutinize ingredient lists, seeking products with recognizable and pronounceable components. Consequently, brands prioritize transparent sourcing and manufacturing processes to build trust and loyalty among health-conscious buyers.

Natural and organic claims appeal to environmentally conscious consumers seeking plant-derived vitamin sources. These products emphasize botanical extracts and naturally occurring vitamins over synthetic alternatives. Organic certifications provide additional credibility and justify premium pricing strategies. Furthermore, natural formulations align with sustainable beauty movements and eco-friendly consumer values driving purchasing decisions.

Dermatologist-tested claims provide scientific validation and reduce perceived risk for consumers with sensitive skin. Clinical testing protocols ensure product safety and efficacy before market introduction. These claims particularly influence consumers managing specific skin conditions or concerns. Moreover, dermatologist endorsements bridge the gap between cosmetic and medical-grade skincare categories effectively.

Vegan claims address ethical concerns regarding animal-derived ingredients and testing practices. Vegan multivitamin skincare uses plant-based vitamin sources and excludes ingredients like collagen and lanolin. This positioning resonates with younger demographics prioritizing cruelty-free and sustainable consumption. Additionally, vegan certifications expand market reach to previously untapped consumer segments with specific ethical purchasing requirements.

Function Analysis

Anti-aging function dominates with 37.9% share as aging populations seek preventive vitamin-based solutions.

In 2024, Anti-aging function held a dominant market position in the Function segment of the Multivitamin-Infused Skincare Market, with a 37.9% share. Anti-aging formulations combine vitamins C, E, and A derivatives to combat visible signs of aging. These products target fine lines, wrinkles, loss of elasticity, and uneven skin tone effectively. Additionally, growing awareness of preventive skincare drives younger consumers to adopt anti-aging routines earlier in life.

Brightening products address hyperpigmentation, dark spots, and uneven complexion through vitamin C-rich formulations. Vitamin blends inhibit melanin production while promoting cellular turnover for radiant skin. These products particularly appeal to consumers in Asian markets prioritizing luminous complexions. Moreover, brightening claims resonate with consumers seeking alternatives to potentially harmful skin-lightening ingredients.

Repair and protection formulations strengthen skin barriers and defend against environmental damage. Vitamin E and B complexes support barrier integrity while neutralizing pollution and UV-induced oxidative stress. These multifunctional products address urban consumers’ concerns about environmental aggressors. Furthermore, repair claims appeal to consumers recovering from aggressive treatments or experiencing compromised skin conditions.

Hydration-focused products combine vitamins with humectants and emollients for moisture retention and plumpness. Vitamin B5 and E support natural moisture barriers while preventing transepidermal water loss. These formulations serve consumers with dehydrated skin seeking lightweight yet effective hydration. Other functional categories include specialized treatments for acne, redness, and sensitivity, expanding market applications and consumer reach significantly.

Channel Analysis

E-Commerce dominates with 45.4% share due to convenience, product education, and direct brand engagement.

In 2024, E-Commerce held a dominant market position in the Channel segment of the Multivitamin-Infused Skincare Market, with a 45.4% share. Online platforms provide extensive product information, ingredient education, and customer reviews influencing purchase decisions. Direct-to-consumer models enable brands to control messaging and build relationships with educated consumers. Additionally, e-commerce eliminates geographical barriers, allowing niche brands to reach global audiences efficiently and cost-effectively.

Mass retail channels including supermarkets and drugstores offer accessibility and competitive pricing for mainstream consumers. These outlets stock established brands with proven track records and broad appeal. Mass retail provides physical product examination opportunities valued by traditional shoppers. Furthermore, promotional activities and in-store displays drive impulse purchases among casual skincare users browsing routine shopping trips.

Pharmacies position multivitamin skincare as scientifically validated solutions recommended by healthcare professionals. Pharmacy channels appeal to consumers seeking trusted, efficacy-driven products for specific concerns. Professional staff provide consultations, enhancing credibility and reducing purchase risk. Moreover, pharmacy distribution supports medical-grade positioning and justifies premium pricing strategies effectively.

Specialty beauty retail including Sephora and Ulta offer curated selections with expert guidance and sampling opportunities. These channels provide immersive brand experiences through trained beauty advisors and testing stations. Specialty retailers attract beauty enthusiasts willing to invest in premium formulations. Other channels include department stores, salons, and spas, serving luxury segments seeking personalized consultations and exclusive product access.

Key Market Segments

By Product Type

- Serums

- Creams/Lotions

- Masks

- Capsules

By Vitamin Blend

- Vitamin C + E Complexes

- Vitamin B3 (Niacinamide) Blends

- Vitamin A + Derivatives

- Multi-Antioxidant Formulations

By Claim

- Clean-Label

- Natural/Organic

- Dermatologist-Tested

- Vegan

By Function

- Anti-Aging

- Brightening

- Repair & Protection

- Hydration

- Others

By Channel

- E-Commerce

- Mass Retail

- Pharmacies

- Specialty Beauty Retail

- Others

Driving Factors

Rising Consumer Demand for Nutrient-Enriched Skincare Solutions Drives Market Expansion

Consumers increasingly recognize the connection between nutritional intake and skin health outcomes. This awareness translates into demand for topical vitamin formulations delivering nutrients directly to skin. Multivitamin-infused products offer convenient alternatives to complex supplement regimens for visible skin improvement. Furthermore, educational marketing campaigns by brands highlight specific vitamin benefits, empowering informed purchasing decisions.

Preventive skincare approaches gain momentum as consumers adopt proactive health management strategies. Vitamin-enriched formulations prevent damage before visible signs appear, appealing to younger demographics. Dermatologists recommend vitamin-based routines as essential components of comprehensive skin health protocols. Additionally, social media influencers and beauty experts amplify awareness of vitamin skincare benefits through educational content and product recommendations.

Premium and masstige brands continuously expand vitamin-infused product lines to capture growing demand. Advanced formulations combine multiple vitamins with cutting-edge delivery technologies for enhanced efficacy. Brands invest in clinical studies demonstrating measurable improvements in skin parameters. Moreover, the proliferation of vitamin-specific products for targeted concerns enables consumers to customize routines based on individual needs and preferences.

Restraining Factors

Formulation Stability Challenges Limit Product Development and Market Growth

Combining multiple vitamins in single formulations presents significant technical challenges affecting product stability. Vitamins C and A derivatives oxidize rapidly when exposed to light, air, and incompatible ingredients. This instability compromises efficacy and shortens shelf life, frustrating consumers expecting consistent results. Consequently, brands invest heavily in specialized packaging and stabilization technologies, increasing production costs substantially.

Higher manufacturing expenses associated with multivitamin formulations translate to elevated retail prices. Premium pricing limits accessibility for price-sensitive consumers in emerging markets and mass-market segments. Additionally, complex formulation requirements necessitate specialized expertise and quality control measures. These factors create barriers for smaller brands attempting to enter the multivitamin skincare category competitively.

Efficacy concerns arise when vitamin concentrations are insufficient or improperly formulated for skin penetration. Consumers often struggle to assess product quality and concentration levels from packaging information alone. Misleading marketing claims without clinical substantiation erode consumer trust and market credibility. Furthermore, the proliferation of low-quality products damages category reputation, requiring increased consumer education efforts from reputable brands.

Growth Opportunities

Product Innovation for Age-Specific Formulations Creates Significant Market Potential

Developing multivitamin skincare tailored to specific age groups addresses distinct skin needs throughout life stages. Younger consumers require preventive formulations with lighter textures and acne-compatible ingredients. Mature demographics seek intensive anti-aging blends with higher vitamin concentrations for visible correction. This segmentation strategy enables brands to expand portfolios and capture broader consumer bases effectively.

Clean-label and dermatologically tested products meet rising demand for safe, transparent formulations. Consumers increasingly scrutinize ingredient sourcing and manufacturing processes before making purchases. Third-party testing and certifications provide credibility, reducing perceived risk for sensitive skin users. Moreover, clean beauty positioning commands premium pricing while fostering brand loyalty among health-conscious consumers.

Online beauty platforms and direct-to-consumer channels facilitate rapid market expansion and consumer engagement. Digital distribution eliminates traditional retail barriers, enabling niche brands to reach targeted audiences efficiently. Subscription models and personalized recommendations enhance customer lifetime value and repeat purchase rates. Additionally, emerging markets in Asia and Latin America demonstrate strong growth potential as middle-class populations expand and prioritize skincare investments increasingly.

Emerging Trends

Advanced Delivery Technologies Transform Multivitamin Skincare Efficacy and Consumer Experience

Multivitamin serums and concentrates gain popularity due to superior bioavailability and concentrated active delivery. Lightweight serum textures penetrate skin layers effectively, maximizing vitamin absorption and visible results. Consumers appreciate fast-absorbing formulas compatible with layering in multi-step routines. Furthermore, serum formats enable higher vitamin concentrations without heavy textures associated with traditional creams.

Integration of multivitamin formulations with anti-aging and barrier repair claims expands functional positioning. Brands combine vitamins with peptides, ceramides, and hyaluronic acid for comprehensive skin solutions. Multi-functional products appeal to time-conscious consumers seeking simplified yet effective routines. Additionally, clinical claims substantiated by dermatological testing enhance credibility and justify premium pricing strategies.

Encapsulation and time-release technologies revolutionize vitamin stability and sustained delivery throughout the day. Microencapsulation protects sensitive vitamins from degradation until application, ensuring optimal potency. Time-release mechanisms provide continuous vitamin delivery, maximizing skin benefits over extended periods. Moreover, collaboration between skincare brands and dermatology experts lends scientific authority to product development, fostering consumer trust and driving adoption among medically minded buyers seeking evidence-based solutions.

Regional Analysis

Europe Dominates the Multivitamin-Infused Skincare Market with 45.7% Share, Valued at USD 0.8 Billion

Europe commands the largest market share in the multivitamin-infused skincare industry, holding 45.7% of the global market and valued at USD 0.8 billion in 2024. This dominance stems from sophisticated consumer preferences for scientifically validated skincare products and strong regulatory frameworks ensuring product safety. European consumers demonstrate high willingness to invest in premium vitamin-enriched formulations backed by clinical evidence. Additionally, established beauty retail infrastructure and influential dermatological communities drive product innovation and market penetration across the region.

North America Multivitamin-Infused Skincare Market Trends

North America represents a significant growth market driven by increasing health consciousness and clean beauty movements. American consumers actively seek transparent ingredient labeling and dermatologist-recommended formulations for preventive skincare. The region benefits from strong e-commerce infrastructure facilitating direct brand engagement and education. Furthermore, social media influence and celebrity endorsements accelerate adoption of trending multivitamin formulations among diverse demographic segments.

Asia Pacific Multivitamin-Infused Skincare Market Trends

Asia Pacific demonstrates rapid market expansion fueled by rising disposable incomes and beauty consciousness across emerging economies. Consumers in China, South Korea, and Japan prioritize innovative skincare technologies and vitamin-infused products for brightening and anti-aging. K-beauty and J-beauty trends emphasize multi-step routines incorporating specialized vitamin serums and essences. Moreover, growing middle-class populations and increasing urbanization drive demand for premium multivitamin skincare solutions throughout the region.

Middle East and Africa Multivitamin-Infused Skincare Market Trends

Middle East and Africa markets show emerging potential as urban populations adopt international skincare trends and premium products. Increasing awareness of vitamin benefits for skin protection against harsh environmental conditions drives regional demand. Luxury retail expansion and growing e-commerce penetration improve product accessibility across diverse markets. Additionally, rising female workforce participation and changing beauty standards contribute to increased skincare investment and category growth.

Latin America Multivitamin-Infused Skincare Market Trends

Latin America experiences steady growth driven by expanding middle-class demographics and increasing beauty product consumption. Brazilian and Mexican consumers show strong interest in natural and vitamin-enriched formulations aligned with regional preferences. Local brands increasingly incorporate multivitamin complexes to compete with international players entering the market. Furthermore, digital commerce growth and social media influence accelerate awareness and adoption of vitamin-infused skincare solutions across urban centers.

Key Multivitamin-Infused Skincare Company Insights

The global multivitamin-infused skincare market in 2024 features several established players driving innovation and market expansion through strategic product development and portfolio diversification. Olay leverages its mass-market presence to deliver accessible vitamin-enriched formulations combining scientific research with affordability. The brand’s extensive retail distribution network ensures widespread consumer access to vitamin B3 and antioxidant-rich products targeting multiple age demographics effectively.

L’Oréal maintains market leadership through continuous innovation in vitamin delivery technologies and strategic acquisitions expanding its dermocosmetic portfolio. The company invests heavily in research facilities developing stabilized vitamin formulations with clinically proven efficacy. Its diverse brand portfolio addresses multiple price points and consumer segments from mass to luxury markets comprehensively.

The Ordinary disrupts traditional pricing models by offering high-concentration vitamin formulations at accessible price points with transparent ingredient communication. The brand’s minimalist approach and educational marketing resonate with informed consumers seeking efficacy over packaging. Its direct-to-consumer model and viral social media presence drive rapid adoption among younger demographics globally.

Murad positions itself as a dermatologist-founded brand combining vitamin science with clinical-grade formulations for targeted skin concerns. The brand emphasizes vitamin C innovations and multi-vitamin complexes backed by dermatological expertise and research. Its premium positioning and professional endorsements appeal to consumers seeking medical-grade skincare solutions with proven results and safety profiles.

Key Companies

- Olay

- L’Oréal

- The Ordinary

- Murad

- Clinique

- Estée Lauder

- Shiseido

- Drunk Elephant

- Neutrogena

- Paula’s Choice

Recent Developments

- In January 2024, Jones Road Beauty launched its Multi-Vitamin Serum, a skincare product formulated with vitamins C, B, and E to nourish and hydrate skin, expanding its clean beauty portfolio.

- In March 2024, Singapore-based skincare brand Allies of Skin secured a $20 million strategic growth investment from Meaningful Partners to support expansion, including in the United States market.

- In December 2024, L’Oréal Groupe signed an agreement to acquire South Korean skincare brand Dr.G from Swiss retailer Migros, expanding its global skincare portfolio and strengthening its position in Asian markets.

- In March 2025, IT Cosmetics launched the Do It All Radiant Concealer, a new serum-concealer product infused with multivitamin serum including vitamins B3, B5, and E for enhanced skincare benefits.

- In June 2025, L’Oréal Groupe agreed to acquire a majority stake in British skincare brand Medik8, strengthening its presence in premium dermocosmetics and vitamin-focused formulations.

- In December 2025, L’Oréal announced an increased stake in Swiss skincare and dermatology company Galderma, doubling its ownership to 20% with the deal expected to close in Q1 2026.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Billion Forecast Revenue (2034) USD 6.2 Billion CAGR (2025-2034) 12.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Serums, Creams/Lotions, Masks, Capsules), By Vitamin Blend (Vitamin C + E Complexes, Vitamin B3 (Niacinamide) Blends, Vitamin A + Derivatives, Multi-Antioxidant Formulations), By Claim (Clean-Label, Natural/Organic, Dermatologist-Tested, Vegan), By Function (Anti-Aging, Brightening, Repair & Protection, Hydration, Others), By Channel (E-Commerce, Mass Retail, Pharmacies, Specialty Beauty Retail, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Olay, L’Oréal, The Ordinary, Murad, Clinique, Estée Lauder, Shiseido, Drunk Elephant, Neutrogena, Paula’s Choice Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Multivitamin-Infused Skincare MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Multivitamin-Infused Skincare MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Olay

- L'Oréal

- The Ordinary

- Murad

- Clinique

- Estée Lauder

- Shiseido

- Drunk Elephant

- Neutrogena

- Paula's Choice