Global mPOS Terminals & Soft POS Market By Component (Hardware, Software, Services), By Terminal Type (Traditional mPOS Dongles, Smart mPOS Terminals, Soft POS on Smartphones), By End-User (Retail Stores, Hospitality, Services, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174981

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- mPOS Adoption and Usage

- Soft POS Adoption and Usage

- Drivers Impact Analysis

- Restraint Impact Analysis

- Component Analysis

- Terminal Type Analysis

- End-User Analysis

- Key Reasons for Adoption

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

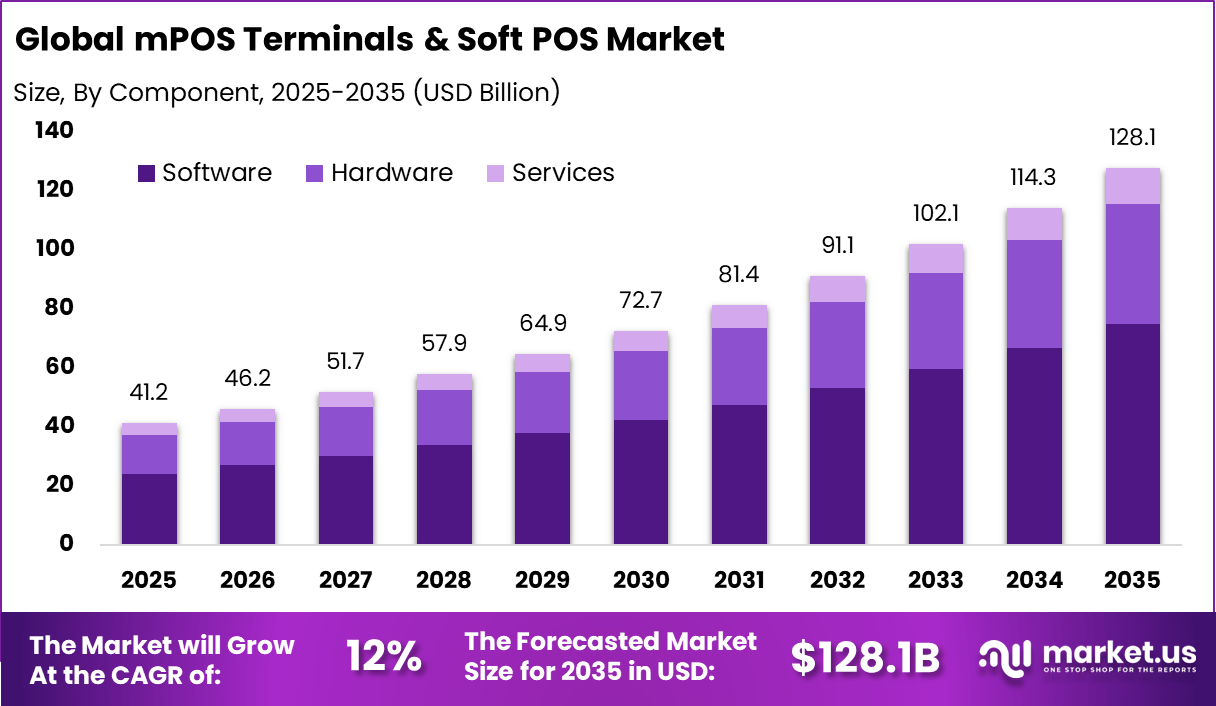

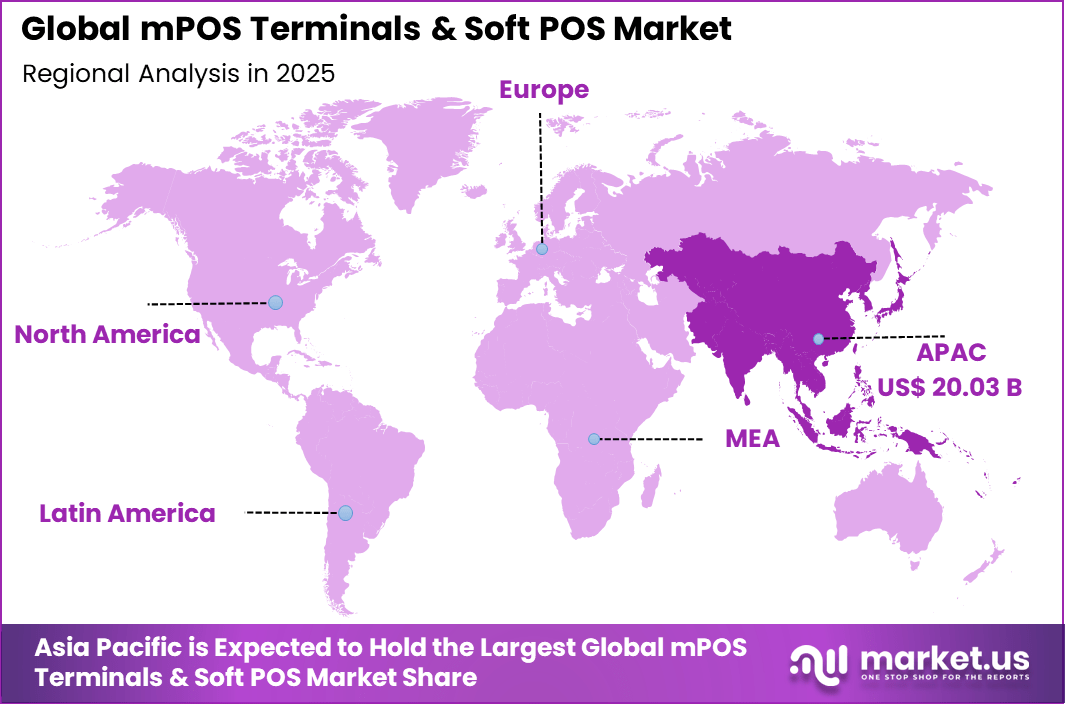

The Global mPOS Terminals & Soft POS Market generated USD 41.2 billion in 2025 and is predicted to register growth from USD 46.2 billion in 2026 to about USD 128.1 billion by 2035, recording a CAGR of 12% throughout the forecast span. In 2025, Asia Pacific held a dominan market position, capturing more than a 48.6% share, holding USD 20.03 Billion revenue.

The mPOS terminals and Soft POS market refers to the ecosystem of technologies and services that enable merchants to accept payments using mobile and software based devices rather than traditional fixed payment terminals. Mobile POS (mPOS) devices generally consist of dedicated hardware paired with smartphones or tablets to process card payments and other forms of electronic payment, providing mobility and ease of use.

Soft POS (software point-of-sale) expands this concept by allowing compatible smartphones or tablets with NFC capability to act as full payment terminals without the need for additional card reader hardware. Both solutions serve as alternatives to traditional payment terminals, improving flexibility for merchants and mobile commerce environments.

One important driving factor for this market is the increasing preference for contactless and mobile enabled transactions across consumer and business segments. Merchants are seeking ways to minimize checkout friction and support contactless payments, which has accelerated the deployment of mPOS and Soft POS systems that can quickly accept NFC based card and wallet transactions at the point of interaction.

Another driver is the need for operational efficiency and reduced capital expenditure in payment acceptance infrastructure. Soft POS particularly lowers initial hardware costs by eliminating the need for dedicated payment terminals, using existing mobile devices instead and allowing smaller merchants to set up payment acceptance with minimal investment.

Demand for mPOS and Soft POS solutions is growing as merchants of all sizes look for flexible and scalable payment acceptance options. Retailers and service providers increasingly prioritize solutions that support mobility, real-time processing, and integration with digital business systems. The ability to process transactions at inventory shelves, tableside in restaurants, or during field services enhances customer convenience and supports omnichannel commerce models.

Top Market Takeaways

- By component, software led the mPOS terminals and soft POS market with 58.4% share, powering transaction processing, analytics, and seamless payment integrations.

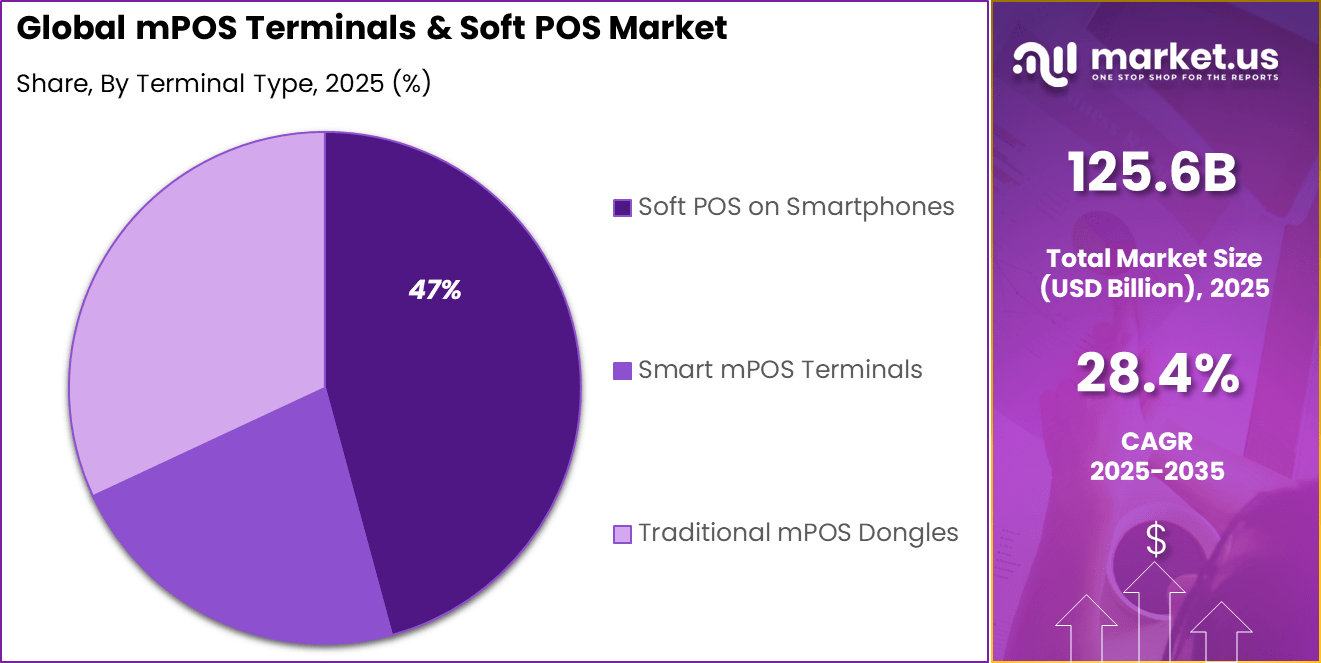

- By terminal type, soft POS on smartphones captured 47.3%, enabling merchants to accept contactless payments using NFC-enabled mobile devices without dedicated hardware.

- By end-user, micro-merchants dominated at 52.8%, benefiting from low-cost, portable solutions for small-scale transactions in retail and services.

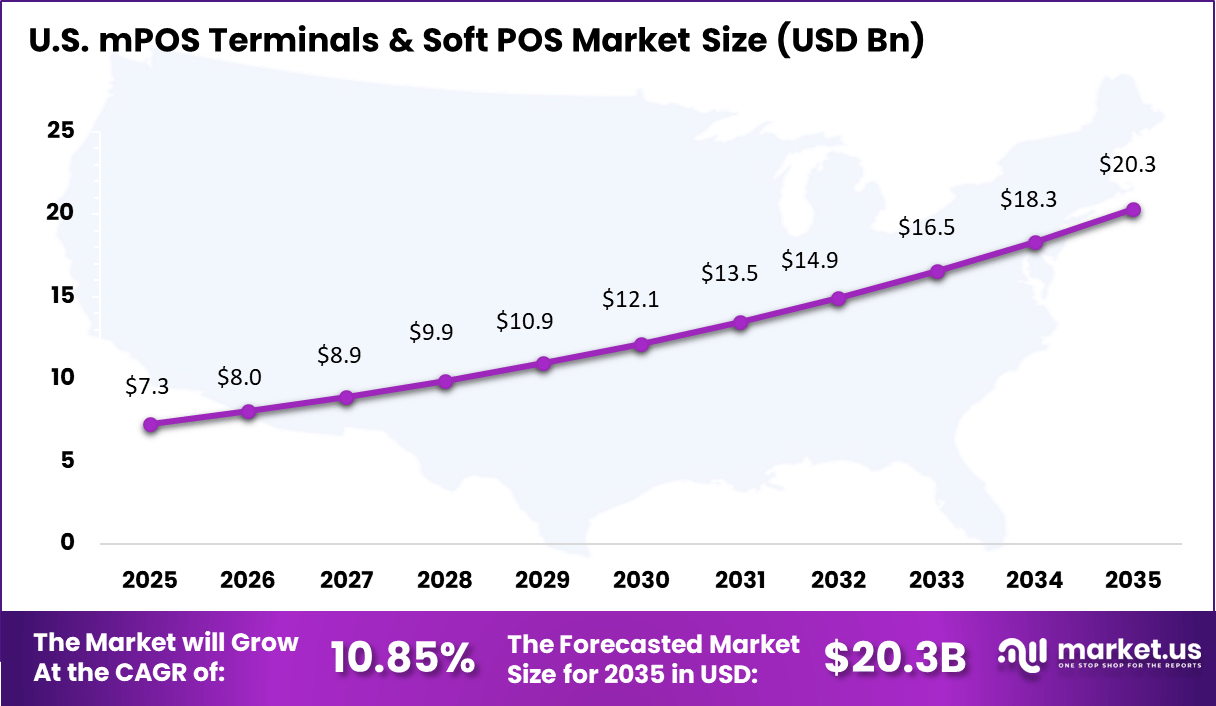

- Asia-Pacific accounted for 48.6% of the global market, with the U.S. valued at USD 7.25 billion and growing at a CAGR of 10.85%.

mPOS Adoption and Usage

- The global installed base of mPOS terminals reached an estimated 119 million units in 2024, with more than 90 million supporting NFC payments.

- Large enterprises currently account for a significant share of mPOS usage, using the systems to manage complex and multi location operations.

- Small and medium enterprises are adopting mPOS rapidly, attracted by mobility, lower setup costs, and ease of deployment.

- North America and Europe lead in market revenue, while Asia Pacific is the fastest growing region, supported by digitalization and cashless economy initiatives.

Soft POS Adoption and Usage

- The number of merchants using Soft POS solutions is projected to exceed 34.5 million globally by 2027, up from about 6 million in 2022.

- Soft POS transaction values are expected to grow by 2,150% between 2025 and 2030, reaching around USD 540 billion by the end of the decade.

- Micro and small businesses are the primary adopters, as Soft POS removes the need for dedicated hardware and lowers entry costs.

- Android devices currently dominate Soft POS usage due to wide availability and cost efficiency.

- Adoption on iOS is expected to rise, supported by growing availability of tap to pay features on smartphones.

Drivers Impact Analysis

Key Growth Driver Influence on Projected Growth (~)% Geographical Significance Expected Timeframe of Impact Rapid adoption of cashless payments among small and mid sized merchants +4.9 Asia Pacific, Europe Short to medium term Expansion of smartphone based Soft POS acceptance +4.3 Asia Pacific, North America Short term Growth of eCommerce enablement for offline merchants +3.8 Asia Pacific, Latin America Medium term Government initiatives supporting digital payments and financial inclusion +3.2 Asia Pacific, Middle East Medium to long term Rising demand for flexible and mobile checkout solutions +2.7 Global Long term Restraint Impact Analysis

Key Restraint Influence on Projected Growth (~)% Geographical Significance Expected Timeframe of Impact Security concerns related to software based payment acceptance -2.6 Global Short to medium term Regulatory and certification complexity for Soft POS solutions -2.2 Europe, North America Medium term Dependence on smartphone hardware compatibility -1.9 Emerging markets Medium term Competitive pricing pressure among terminal providers -1.6 Global Medium to long term Limited awareness among traditional cash based merchants -1.3 Developing regions Long term Component Analysis

Software accounts for 58.4% of the mPOS Terminals and Soft POS market, highlighting that value creation is driven mainly by digital payment applications rather than physical hardware. mPOS software manages transaction processing, encryption, receipt generation, and integration with inventory or accounting systems.

Merchants prefer software-led solutions because they are easier to deploy, update, and scale across multiple devices. Software also enables rapid feature upgrades without replacing terminals. From an operational view, software-based mPOS solutions reduce setup cost and technical complexity.

Updates related to security, compliance, and payment features can be rolled out remotely. The strong share of this segment reflects market preference for flexible, app-driven payment solutions that adapt quickly to changing merchant needs.

Terminal Type Analysis

Soft POS on smartphones holds 47% of the terminal type segment, making it the most widely adopted option. Soft POS allows merchants to accept card payments directly on standard smartphones without additional hardware. This simplifies onboarding and lowers upfront investment, especially for small sellers. Smartphones act as both payment terminal and business management tool.

From a usability standpoint, Soft POS improves mobility and convenience. Merchants can accept payments anywhere, supporting delivery, pop-up stores, and field sales. The strong adoption of this segment reflects growing trust in secure, contactless smartphone-based payment acceptance.

End-User Analysis

Micro-merchants account for 52.8% of end-user demand, making them the largest user group in the market. These merchants include small retailers, street vendors, service providers, and independent sellers. They often operate with limited capital and require low-cost payment solutions. mPOS and Soft POS systems meet these needs by offering simple setup and affordable pricing.

For micro-merchants, digital payments improve sales reach and reduce cash handling risks. Software-based POS solutions also support transaction tracking and basic business insights. The strong presence of this segment reflects increasing digital payment adoption among small and informal businesses.

Key Reasons for Adoption

- Demand is rising for flexible and mobile payment acceptance solutions

- Small and medium businesses need affordable alternatives to traditional terminals

- Contactless payment preferences are increasing among consumers

- Merchants require faster setup and easier payment deployment

- Digital payment adoption is expanding across retail and service sectors

Benefits

- Payment acceptance becomes more convenient across different locations

- Hardware costs are reduced compared to traditional point-of-sale systems

- Checkout speed is improved, supporting better customer experience

- Business mobility is enhanced for field and on-the-go sales

- Payment security is maintained through certified software controls

Usage

- Used by retailers to accept card and contactless payments

- Applied by service providers for doorstep and on-site transactions

- Deployed by small merchants for quick payment setup

- Utilized in events and pop-up stores for temporary sales points

- Integrated with smartphones and tablets for software-based payment acceptance

Emerging Trends

Key Trend Description SoftPOS mainstream adoption Smartphones transform into payment terminals via NFC. Tap-on-phone capabilities Contactless payments using existing mobile devices. Biometric verification Fingerprint and face ID enhance secure transactions. Cloud-based transaction processing Real-time analytics and remote management. QR code and digital wallet integration Seamless omnichannel payment experiences. Growth Factors

Key Factors Description Small business digitization SMBs adopt affordable mobile payment solutions. Contactless payment preference Post-pandemic shift accelerates mPOS demand. Gig economy expansion Freelancers and drivers need portable terminals. Emerging market penetration Unbanked populations access digital payments. Cost advantages over fixed POS Lower upfront costs drive widespread adoption. Key Market Segments

By Component

- Hardware

- Software

- Services

By Terminal Type

- Traditional mPOS Dongles

- Smart mPOS Terminals

- Soft POS on Smartphones

By End-User

- Retail Stores

- Hospitality

- Services

- Others

Regional Analysis

Asia Pacific accounted for 48.6% share, supported by rapid expansion of digital payments, high smartphone penetration, and strong growth of small and medium merchants across the region. mPOS terminals and Soft POS solutions have been widely adopted to enable low cost and flexible card acceptance without complex hardware infrastructure.

Demand has been driven by growth in retail, food service, transportation, and informal commerce, where mobile based payment acceptance improves transaction speed and customer convenience. The region’s diverse merchant base and increasing preference for cashless payments have reinforced steady adoption.

Regional Driver Comparison

Region Core Demand Driver Growth Influence Level Market Maturity Asia Pacific Mobile first payments and large merchant base Very High Mature North America Transition toward software based acceptance models High Mature Europe Strong contactless payment penetration High Mature Middle East Government led digital payment programs Medium Developing Latin America Expansion of SME digital commerce Medium Developing Africa Growth of mobile money ecosystems Low to Medium Early stage The U.S. market reached USD 7.25 Bn and is projected to grow at a 10.85% CAGR, reflecting steady adoption across retail, hospitality, and service sectors. Merchants have increasingly adopted mPOS and Soft POS solutions to support mobile checkout, curbside payments, and omnichannel retail experiences. Demand has been driven by the need for flexible payment acceptance, faster transaction processing, and improved customer experience.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Investor Type Impact Matrix

Investor Type Strategic Objective Risk Tolerance Market Influence Payment technology providers Expansion of merchant acceptance networks Medium High Fintech platforms Scalable software based payment solutions High Medium to High Hardware manufacturers Diversification toward hybrid POS models Medium Medium Private equity investors Recurring revenue from merchant services Medium Medium Strategic retail investors Improved checkout efficiency and reach Low to Medium Medium Technology Enablement Analysis

Technology Enabler Functional Role Impact on Adoption Adoption Timeline NFC enabled smartphones Contactless payment acceptance without hardware Very High Short term Secure software based PIN entry Compliance with card security standards High Short to medium term Cloud based merchant management platforms Centralized device and transaction control High Medium term Tokenization and encryption technologies Secure transaction processing Medium to High Medium term API driven integration with wallets and gateways Seamless payment ecosystem connectivity Medium Medium to long term Driver Analysis

Faster Contactless Acceptance for Small and Mobile Merchants

Growth in contactless payments is pushing merchants to adopt lighter, quicker acceptance tools, which supports demand for mPOS terminals and SoftPOS. Tap on phone models allow a merchant to accept contactless card and wallet payments using a compatible smartphone and an app, reducing dependence on dedicated hardware and making deployment easier for field sales, delivery, pop-up retail, and service businesses.

The same driver is reinforced by platform launches that broaden smartphone-based acceptance in more markets. Tap to Pay on iPhone expansions show that large ecosystems are making phone-based acceptance more available to merchants, which increases awareness and builds confidence in SoftPOS as a mainstream option.

Restraint Analysis

Security Certification and Ongoing Compliance Load

Security and certification requirements remain a practical restraint, particularly for SoftPOS deployments. The PCI Security Standards Council has defined security and test requirements for contactless payments on commercial off the shelf devices, which sets a high bar for protecting account data, controlling the payment environment, and validating implementations. These requirements can add time, cost, and specialist effort before a solution can be scaled across merchants.

Compliance obligations also extend beyond initial certification. Payment acceptance environments must be maintained through updates, monitoring, and operational controls, and merchants may still need support for secure setup and device management.

Opportunity Analysis

Smartphone Acceptance Expanding Through Networks and Market Openings

A clear opportunity is being created by payment networks actively promoting tap-to-phone acceptance to widen digital payment coverage. Network-led programs position SoftPOS as a practical way to bring contactless acceptance to new sellers and to extend acceptance points inside larger merchant footprints, without waiting for traditional terminal rollouts.

Another opportunity is emerging from market and policy shifts that increase access to NFC capabilities and enable new wallet and acceptance experiences. For example, PayPal has launched NFC-based tap-to-pay functionality for iPhone users in Germany following EU Digital Markets Act related changes, signaling that the ecosystem for phone-based payments is opening further and can support wider SoftPOS and mPOS growth.

Challenge Analysis

Device Diversity, Reliability, and Risk Control at Scale

A major challenge is managing consistent performance across many device models, operating system versions, and merchant environments. Unlike traditional fixed terminals, SoftPOS runs on consumer-grade hardware, so reliability and user experience can vary based on device quality, NFC performance, battery health, and network conditions. This increases support needs and raises the importance of strong device management and clear merchant training.

Fraud and abuse controls also remain a continuous challenge, especially as acceptance becomes easier to deploy. Standards exist to reduce risk, but real-world operations still require strong monitoring, secure onboarding, and rapid response to suspicious activity. As adoption grows, maintaining trust with banks, networks, and merchants depends on keeping acceptance simple for users while enforcing strict security and operational discipline.

Competitive Analysis

Global payment platforms such as Square, PayPal, and Stripe lead the market through app-based mPOS and Soft POS offerings. Their solutions enable smartphones and tablets to accept card and contactless payments. Easy onboarding, transparent pricing, and integrated analytics support adoption. Adyen strengthens enterprise adoption with omnichannel payment capabilities. Demand is driven by small merchants and mobile-first businesses seeking low-cost acceptance solutions.

Traditional POS hardware providers such as Ingenico, Verifone, and PAX Technology focus on secure and certified mPOS devices. Their platforms support EMV, NFC, and Soft POS functionality. Clover and Shopify combine hardware with software ecosystems. These players benefit from strong compliance, reliability, and merchant trust across retail and hospitality sectors.

Hospitality and vertical-focused providers such as Lightspeed, Toast, and Revel Systems emphasize integrated ordering, payments, and analytics. TouchBistro and Mswipe address regional and SME needs. Other vendors expand competition and pricing flexibility. This diverse landscape supports rapid adoption of mPOS and Soft POS across retail, food service, and on-the-go commerce.

Top Key Players in the Market

- Square

- PayPal

- SumUp

- Stripe

- Adyen

- Ingenico

- Verifone

- Clover

- Shopify

- Lightspeed

- Toast

- Revel Systems

- TouchBistro

- PAX Technology

- Mswipe

- Others

Future Outlook

Growth in the mPOS Terminals and Soft POS market is expected to remain strong as merchants look for flexible and low cost payment acceptance solutions. Mobile based POS systems allow smartphones and tablets to accept payments without heavy hardware investment.

Rising adoption among small retailers, delivery services, and mobile businesses is supporting demand. Over time, improved security standards, wider contactless payment use, and better integration with business software are likely to increase trust and adoption.

Recent Developments

- In 2025, Square launched a handheld mPOS in May for tap-to-pay mobility. They unified their POS app in April, boosting feature use by 80% for sellers. PAX entered merger talks with CMS in August to scale terminals.

- In 2025, PayPal’s Zettle pushed SoftPOS deeper into Europe with Android tap-to-pay, letting SMEs accept cards and wallets on existing devices. Plans expanded to more markets amid rising in-store volumes. It ties into PayPal’s broader POS strategy for hybrid online-offline sales.

Report Scope

Report Features Description Market Value (2025) USD 41.2 Bn Forecast Revenue (2035) USD 128.1 Bn CAGR(2025-2035) 12% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Terminal Type (Traditional mPOS Dongles, Smart mPOS Terminals, Soft POS on Smartphones), By End-User (Retail Stores, Hospitality, Services, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Square, PayPal, SumUp, Stripe, Adyen, Ingenico, Verifone, Clover, Shopify, Lightspeed, Toast, Revel Systems, TouchBistro, PAX Technology, Mswipe, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  mPOS Terminals & Soft POS MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

mPOS Terminals & Soft POS MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Square

- PayPal

- SumUp

- Stripe

- Adyen

- Ingenico

- Verifone

- Clover

- Shopify

- Lightspeed

- Toast

- Revel Systems

- TouchBistro

- PAX Technology

- Mswipe

- Others