Global Motorcycle Insurance Market Size, Share and Analysis Report By Insurance Type (Liability Insurance, Comprehensive and Collision Insurance, Medical Payments Insurance, Theft Insurance, Others), By Application (Personal, Commercial), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175607

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

- Strategic Investment Perspective

- Top Market Takeaways

- Key Insights Summary

- Drivers Impact Analysis

- Restraint Impact Analysis

- By Insurance Type

- By Application

- By Region

- Regional Driver Comparison

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Competitive Analysis

- Recent Developments

- Key Market Segments

- Report Scope

Strategic Investment Perspective

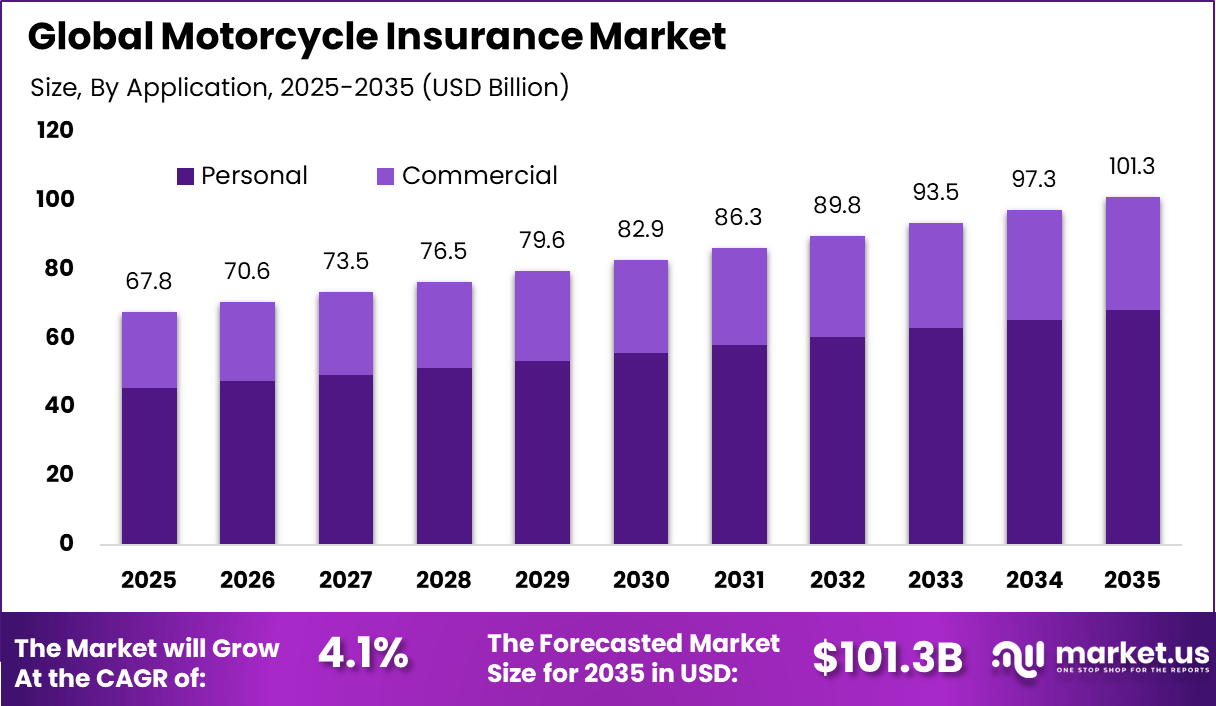

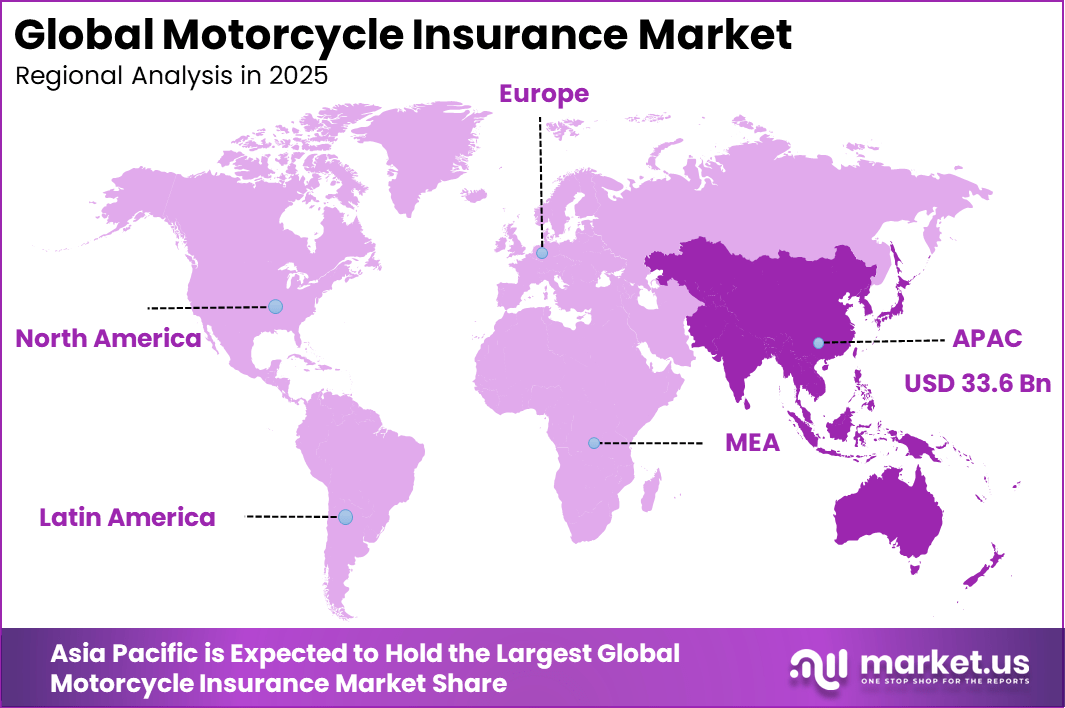

The Global Motorcycle Insurance Market presents a compelling defensive-growth investment opportunity, growing from USD 67.8 billion in 2025 to nearly USD 101.3 billion by 2035, at a CAGR of 4.1%. Asia Pacific’s dominant position, capturing more than 49.6% share and USD 33.6 billion in revenue, underscores the region’s leadership in two-wheeler usage and long-term growth potential for insurers and investors.

The motorcycle insurance market covers insurance products designed to protect motorcycle owners against financial loss from accidents, theft, damage, and liability. These policies typically include third-party liability, comprehensive coverage, collision protection, and personal accident benefits. Motorcycle insurance is required in many regions to ensure road safety and legal compliance. The market serves individual riders, fleet operators, delivery services, and motorcycle rental providers.

Adoption supports financial protection and responsible vehicle ownership. This market development has been influenced by the growing number of motorcycles used for personal transport and commercial purposes. Urban congestion and fuel efficiency needs encourage motorcycle usage. Increased road exposure raises the importance of insurance coverage. Insurers offer flexible plans to address diverse rider profiles. As motorcycle ownership expands, insurance demand continues to grow.

One major driving factor of the motorcycle insurance market is regulatory enforcement of mandatory insurance coverage. Governments require riders to hold minimum liability insurance. Compliance reduces financial risk for road users. Strict enforcement increases policy uptake. Legal requirements strongly drive adoption.

Digital insurance platforms play a key role in market adoption. Online policy purchase and renewal improve convenience. Mobile applications support quick claims processing. Digital documentation reduces paperwork. Technology adoption improves customer experience. Telematics and usage-based insurance technologies also support growth. Data from riding behavior improves risk assessment. Personalized premiums increase fairness.

Top Market Takeaways

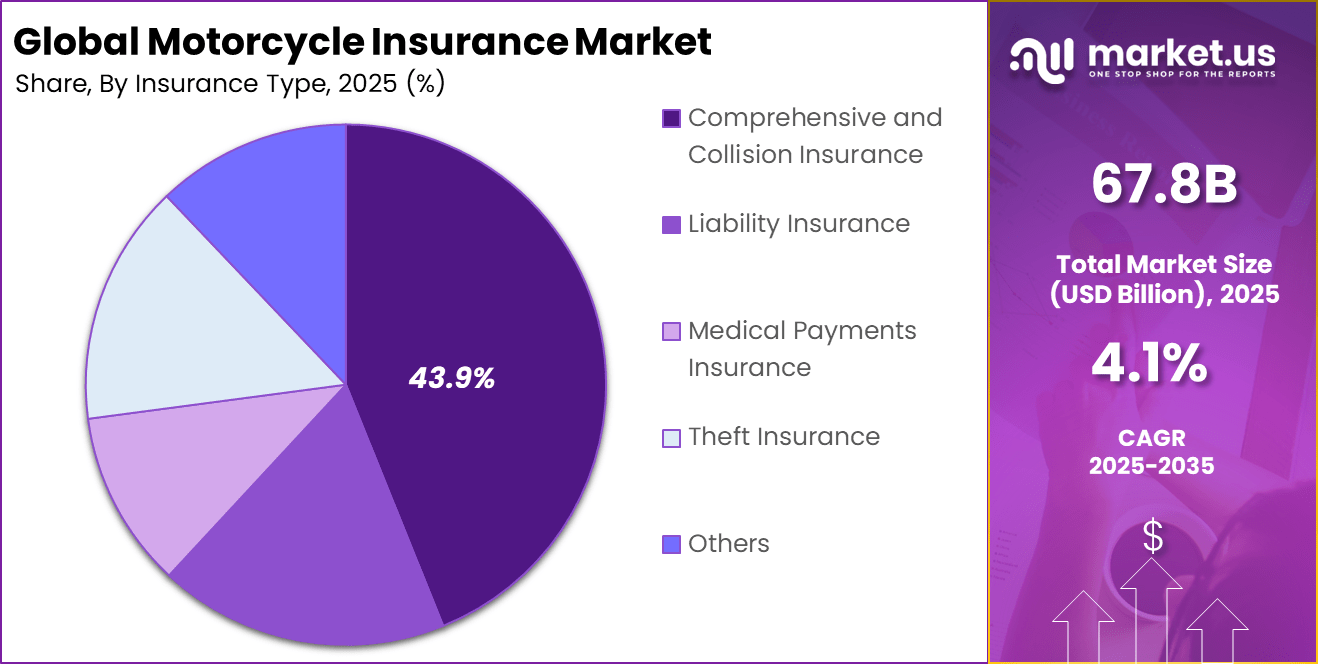

- In the motorcycle insurance market, the comprehensive and collision insurance segment held a dominant position, accounting for 43.9% of total demand by insurance type.

- By application, personal motorcycle insurance represented the largest share, capturing 67.3% of the overall market, supported by high individual ownership and daily usage patterns.

- Asia Pacific emerged as the leading regional market, holding 49.6% of the global share, driven by strong motorcycle penetration across developing economies.

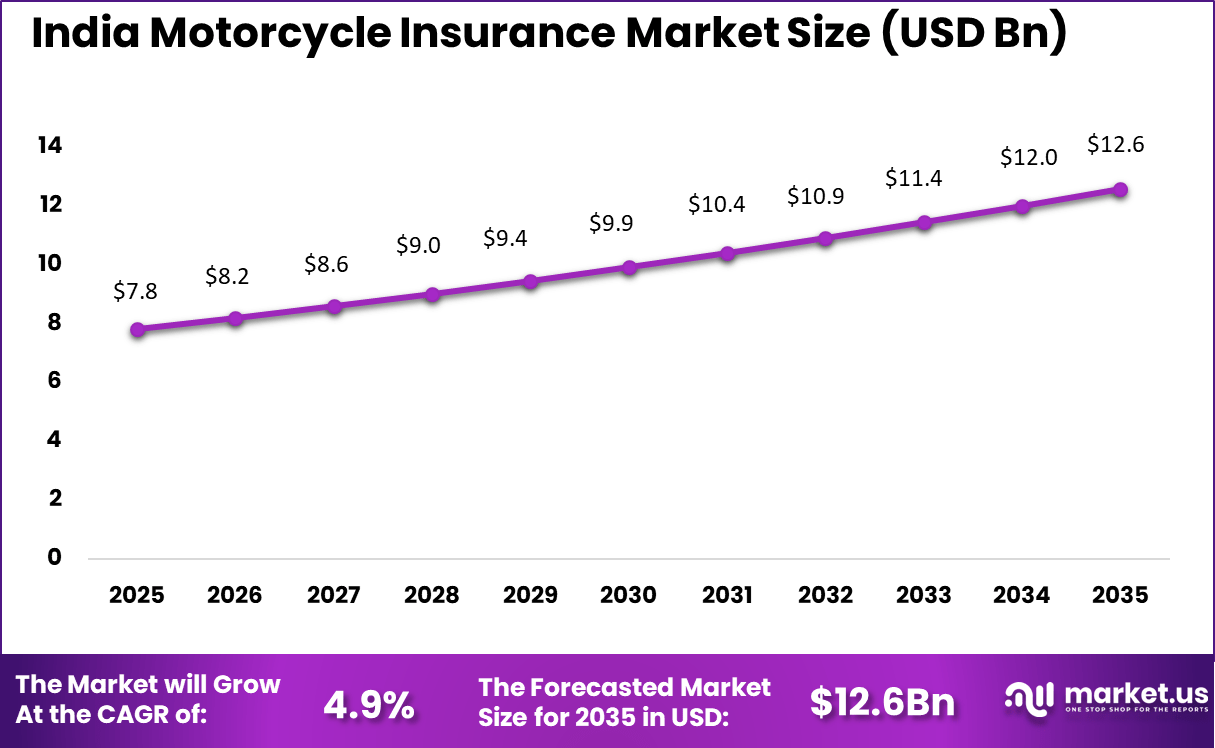

- Within Asia Pacific, India recorded a market value of USD 7.82 billion, supported by a steady compound annual growth rate of 4.94%, reflecting consistent demand for two wheeler insurance coverage.

Key Insights Summary

Global Adoption and Ownership

- In 2026, motorcycle and scooter ownership remained high across Asia, with around 58% of households in major Asian cities owning at least one two wheeler.

- By total vehicle volume, India led globally with 221 million motorcycles, followed by Indonesia with 112 million, China with 85 million, and the United States with 8.6 million units.

- In Europe, ownership intensity remained strong in Southern regions, with Greece recording 150 motorcycles per 1,000 people, followed by Italy at 114 per 1,000 people.

Usage Statistics

- Daily commuting and personal errands accounted for 46% of global two wheeler usage. In the Asia Pacific region, motorcycles supported nearly 51% of work and school travel, highlighting their role in urban mobility.

- Commercial and logistics usage, including delivery and business travel, represented 43% of total usage in 2026, with this segment valued at USD 58.34 billion.

- Leisure, tourism, rentals, and recreational use contributed 11% of total two wheeler usage worldwide.

- By vehicle category, light motorcycles and scooters were the most widely adopted, representing 47% of total global sales in 2026.

Electric Motorcycle Adoption

- In 2026, electric motorcycles accounted for 14.5% of global insurance premiums, supported by an adoption growth rate of 8.21%.

- Globally, electric motorcycle sales increased by 41% year over year entering 2026, reflecting rising acceptance of electric mobility in urban transport.

- In India, electric two wheeler sales reached 1.28 million units, although penetration of heavy electric motorcycles remained limited at 0.1%, compared with higher adoption among electric scooters.

- Technology integration continued to rise, with over 33% of new 2026 models equipped with AI-based navigation, and 29% offering connected or ride assist systems, supporting improved safety outcomes and reduced insurance risk.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Mandatory insurance regulations Legal requirement for two wheeler coverage ~1.5% Asia Pacific, Europe Short Term High motorcycle ownership Primary transport in urban and semi urban regions ~1.2% Asia Pacific Short Term Growth of delivery and gig economy Increased commercial motorcycle usage ~0.9% Asia Pacific, Latin America Mid Term Rising accident awareness Demand for financial protection ~0.7% Global Mid Term Expansion of digital insurance platforms Easier policy access and renewals ~0.5% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration Low premium affordability Cost sensitivity among riders ~1.4% Emerging Markets Short to Mid Term Limited insurance awareness Low penetration in rural areas ~1.1% Asia Pacific, Africa Mid Term High claim settlement costs Pressure on insurer margins ~0.9% Global Mid Term Informal vehicle usage Uninsured motorcycles ~0.7% Emerging Markets Long Term Slow premium growth Regulated pricing environments ~0.5% Global Long Term By Insurance Type

Comprehensive and collision insurance accounts for 43.9%, making it the leading insurance type in the motorcycle insurance market. This coverage protects against accidents, theft, vandalism, and natural events. Policyholders prefer broader protection to reduce financial risk. Comprehensive plans offer peace of mind to riders. Coverage flexibility remains an important factor.

The dominance of this insurance type is driven by rising motorcycle ownership. Riders increasingly seek protection beyond basic liability. Repair and replacement costs continue to rise. Comprehensive policies help manage unexpected expenses. This sustains steady demand for full-coverage insurance.

By Application

Personal application represents 67.3%, making it the largest usage segment. Individual riders purchase insurance primarily for daily commuting and leisure riding. Personal policies are tailored to individual risk profiles. Coverage options address personal safety and vehicle protection. Affordability and coverage clarity influence decisions.

Growth in personal applications is driven by urban mobility needs. Motorcycles are widely used for short-distance travel. Insurance supports financial security for riders. Awareness of road safety is increasing. This keeps personal insurance demand strong.

By Region

Asia Pacific accounts for 49.6%, supported by high motorcycle usage across the region. Two-wheelers are a primary mode of transport. Insurance adoption grows with regulatory requirements. Rising income levels support coverage uptake. The region remains dominant.

India reached USD 7.82 Billion with a CAGR of 4.94%, reflecting steady market expansion. Growth is driven by large motorcycle populations. Mandatory insurance regulations support adoption. Awareness of comprehensive coverage is improving. Market growth remains consistent.

Regional Driver Comparison

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn) Adoption Maturity Asia Pacific High two wheeler penetration 49.6% USD 33.6 Bn Advanced Europe Strong regulatory enforcement 22.4% USD 15.2 Bn Advanced North America Recreational motorcycle coverage 15.7% USD 10.6 Bn Advanced Latin America Urban mobility demand 7.1% USD 4.8 Bn Developing Middle East and Africa Growing vehicle ownership 5.2% USD 3.5 Bn Early Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Pattern Insurance companies Very High ~46.3% Stable premium income Long term portfolio growth Bancassurance providers High ~21.4% Cross selling opportunities Strategic partnerships Digital insurance platforms Moderate ~15.8% Customer acquisition efficiency Platform based expansion Reinsurance firms Moderate ~9.6% Risk diversification Capital allocation Micro insurance providers Low ~6.9% Rural market penetration Pilot driven Technology Enablement Analysis

Technology Layer Enablement Role Impact on Growth (%) Adoption Status Digital policy issuance Faster onboarding and renewals ~1.3% Mature Telematics based pricing Usage based premium models ~1.0% Growing Claims automation systems Faster settlement processes ~0.8% Growing Data analytics platforms Risk assessment and fraud detection ~0.6% Mature Mobile insurance apps Customer engagement ~0.4% Mature Driver Analysis

The motorcycle insurance market is being driven by the sustained growth in motorcycle ownership for personal transport, delivery services, and leisure activities. Riders and vehicle owners seek financial protection against liability, theft, accidents, and damage, which makes insurance a central requirement for legal compliance and risk management.

Rising awareness of financial risk and the need to secure repair costs and medical expenses after accidents encourages individuals to purchase comprehensive coverage. Digital platforms that simplify quotes, policy comparison, and online purchase are also supporting increased uptake by making insurance easier to access and manage.

Restraint Analysis

A notable restraint in the motorcycle insurance market is the perceived cost of premiums relative to riders’ budgets. Insurance pricing is influenced by factors such as rider age, driving history, motorcycle engine size, and claim frequency, which can result in higher premiums for younger or high-risk riders.

For many potential customers, especially novice riders or those on limited incomes, higher insurance costs can discourage policy purchase or lead to minimal coverage that may not fully protect them in the event of a loss. Price sensitivity therefore remains a constraint on broader market penetration.

Opportunity Analysis

Opportunities in the motorcycle insurance market are linked to the development of usage-based and customised policy offerings that align premiums with actual riding behaviour. Telematics, mobile apps, and data-driven risk assessment enable insurers to evaluate rider patterns, mileage, and riding conditions to offer tailored pricing solutions.

These personalised products can attract safer riders with lower costs and provide incentives for improved riding habits. There is also potential for bundled services that combine roadside assistance, legal protection, and emergency support to enhance value and differentiate offerings in a competitive landscape.

Challenge Analysis

A central challenge confronting this market involves balancing risk assessment with fair pricing and customer trust. Insurance companies must evaluate a wide range of variables, including rider behaviour, accident history, and regional risk factors, to set premiums that cover risk while remaining affordable.

Ensuring transparency in how pricing is determined and avoiding perceptions of unfair discrimination are essential to maintain customer confidence. Additionally, managing fraud, false claims, and claim disputes requires robust verification processes, which can increase operational complexity and cost.

Emerging Trends

Emerging trends in the motorcycle insurance market include the integration of digital platforms that streamline policy purchase, renewal, and claims processing. Mobile-first interfaces and self-service tools reduce administrative friction and improve customer experience.

Another trend is the use of data analytics and telematics to support dynamic pricing and personalised risk profiles, enabling more accurate alignment of premiums with rider behaviour. Insurers are also exploring value-added services such as safety training discounts, community engagement programmes, and digital alerts that support safer riding.

Growth Factors

Growth in the motorcycle insurance market is supported by increasing motorcycle use for commuting, delivery services, and recreational purposes. As urbanisation and traffic congestion grow, motorcycles remain a cost-effective mobility choice, driving demand for risk protection. Enhanced regulatory enforcement that requires minimum insurance coverage for road use further reinforces market expansion.

Advances in digital underwriting, data collection, and mobile engagement improve accessibility and efficiency for both insurers and policyholders. As riders prioritise financial protection and convenient service, the motorcycle insurance market continues to expand as a vital component of personal and commercial risk management.

Competitive Analysis

Major global insurers such as Liberty Mutual, AXA Inc., and Allianz Global Investors play an important role in the motorcycle insurance market. Their offerings typically cover liability, collision, theft, and personal injury protection. Strong underwriting models and digital policy management support customer acquisition. These players benefit from broad geographic presence and diversified insurance portfolios.

Large national insurers such as State Farm Insurance and Allstate focus on mass-market motorcycle riders. Their strength lies in extensive agent networks and bundled insurance products. HDI Global SE and Zurich Services support both personal and commercial motorcycle coverage. These companies emphasize claims efficiency, pricing stability, and regulatory compliance.

Reinsurance and risk management providers such as Munich Re Group support the market by enabling insurers to manage high-severity risk exposure. Prudential contributes through long-term risk management expertise. Other regional and niche insurers expand competitive intensity and product customization. This competitive landscape supports steady product innovation, flexible coverage options, and broader access to motorcycle insurance across developed and emerging markets.

Top Key Players in the Market

- Liberty Mutual

- HDI Global SE

- AXA Inc.

- Allianz Global Investors

- Cardinal Health

- State Farm Insurance

- Munich Re Group

- Zurich Services and Prudential

- Allstate

- Others

Recent Developments

- In February 2025, Allianz General Insurance took home the Motorcycle Insurance of the Year 2025 award in Malaysia for its enhanced Allianz Motorcycle Plus plan, now covering riders and pillion up to RM10,000 for accidents plus free roadside assistance up to 50km.

- In April 2025, HDI Global SE partnered with Cachet and Bolt Drive in Germany to launch adaptive fleet insurance tech, supporting micromobility and gig workers on two-wheelers with real-time platform-enabled coverage.

Key Market Segments

By Insurance Type

- Comprehensive and Collision Insurance

- Liability Insurance

- Medical Payments Insurance

- Theft Insurance

- Others

By Application

- Personal

- Commercial

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Report Scope

Report Features Description Market Value (2025) USD 67.8 Bn Forecast Revenue (2035) USD 101.3 Bn CAGR(2026-2035) 4.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Insurance Type (Liability Insurance, Comprehensive and Collision Insurance, Medical Payments Insurance, Theft Insurance, Others), By Application (Personal, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Liberty Mutual, HDI Global SE, AXA Inc., Allianz Global Investors, Cardinal Health, State Farm Insurance, Munich Re Group, Zurich Services and Prudential, Allstate, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Motorcycle Insurance MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Motorcycle Insurance MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Liberty Mutual

- HDI Global SE

- AXA Inc.

- Allianz Global Investors

- Cardinal Health

- State Farm Insurance

- Munich Re Group

- Zurich Services and Prudential

- Allstate

- Others