Global Mooring Buoy Market By Material(Steel, Plastic, Others), By Deployment Location(Coastal, Offshore), By Sensor Integration(Sensor-Integrated Buoys, Non-Sensor Buoys), By End-Use(Oil & Gas, Marine & Defense, Aquaculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122664

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

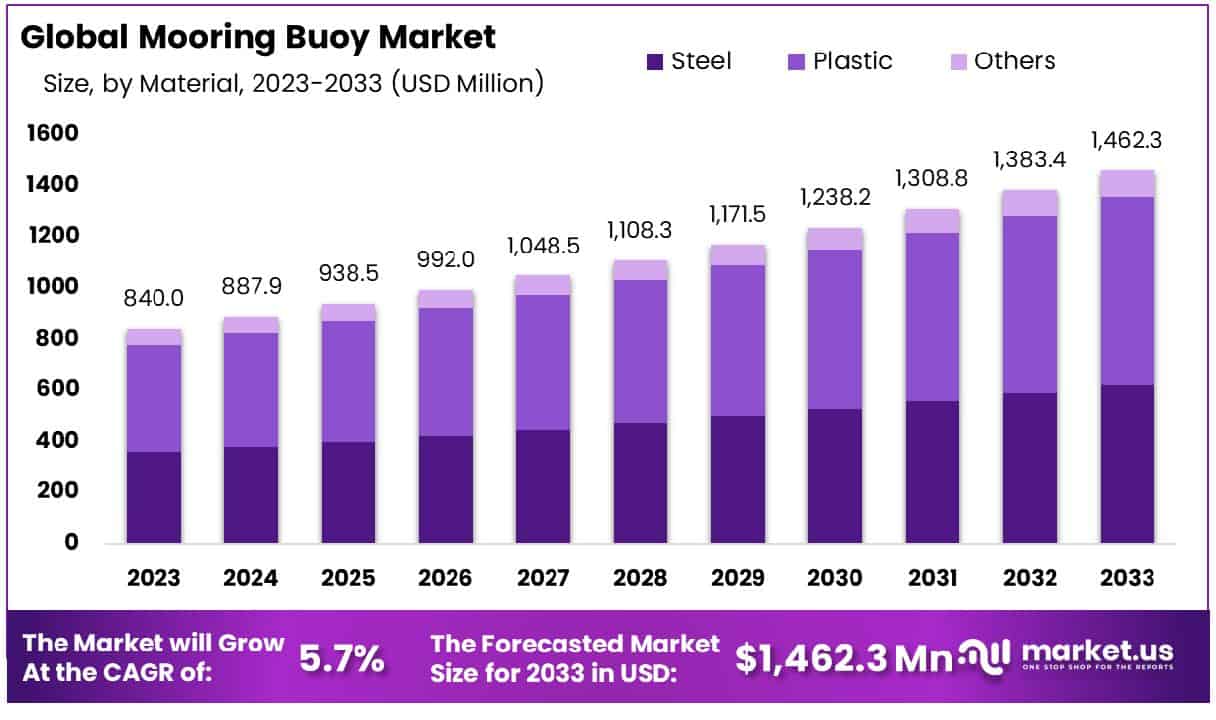

The Global Mooring Buoy Market size is expected to be worth around USD 1,462.3 Million by 2033, From USD 840.0 Million by 2023, growing at a CAGR of 5.7% during the forecast period from 2024 to 2033.

The Mooring Buoy Market comprises the manufacturing and distribution of floating devices designed to anchor vessels securely without needing to reach the seabed. These buoys are critical in facilitating efficient and safe docking, particularly in deep waters. They are utilized across various sectors, including maritime transportation, fishing, and energy, particularly for oil rigs and offshore wind farms.

This market caters to the enhancement of maritime operations, focusing on innovations in durability and technology to meet global safety standards, thereby supporting the strategic operational goals of enterprises within the marine industry.

The Mooring Buoy market is currently navigating a transformative phase influenced by fluctuations in the oil and gas industry, a key end-user sector. Recent data underscores a significant downward trend in the U.S. oil rig count, which in turn impacts demand dynamics within this market. Specifically, from 2022 to August 2023, the total U.S. rig count observed a decline of 18.2%, reducing from 762 to 623 rigs. This reduction was primarily seen in oil rigs, which decreased by 6.5%, and gas rigs, which fell by 12.8%. The trend continued into 2024, with the total rig count decreasing further by 17.3% from May to June 2024, signifying a potential sustained downturn.

This decline in rig activity directly correlates with reduced operational expenditures in offshore drilling, which consequently dampens the immediate demand for mooring buoys. These buoys are crucial for the secure anchorage of drilling platforms and vessels, and a reduction in new drilling sites reduces the market’s expansion opportunities. However, this scenario also presents a pivot towards maintenance and upgrade of existing infrastructure, where older mooring systems might need replacement or enhancement, thereby sustaining a baseline demand within the market.

Moreover, the industry must closely monitor shifts towards renewable energy sources and regulations affecting offshore drilling practices, as these will further define strategic directions. Companies operating within this space are encouraged to adapt by enhancing product offerings with advanced materials and technology integration, aiming for higher efficiency and compliance with environmental standards. Such strategic foresight will be vital for maintaining relevance and competitive advantage in a tightening market landscape.

Key Takeaways

- Market Growth: The Global Mooring Buoy Market size is expected to be worth around USD 1,462.3 Million by 2033, From USD 840.0 Million by 2023, growing at a CAGR of 5.7% during the forecast period from 2024 to 2033.

- Regional Dominance: In 2023, Asia Pacific holds 44.1% of the mooring buoy market, valued at USD 370.4 million.

- Segmentation Insights:

- By Material: Plastic materials dominate marine buoy production, comprising 50.4% of the materials used.

- By Location: Coastal areas are the preferred location for deploying marine buoys.

- By Senser Integration: Sensor-integrated buoys account for 55.4% of all marine buoy types.

- By End-Use: The oil & gas sector represents the largest end-user of buoys, comprising 58.4% of usage.

- Growth Opportunities: In 2023, the mooring buoy market is set to grow due to increased demand for eco-friendly, durable systems and advanced solutions for offshore wind farms.

Driving Factors

Increasing Global Trade and Maritime Traffic: Catalyst for Mooring Buoy Demand

The relentless expansion of global trade and the corresponding increase in maritime traffic serve as primary catalysts for the growth of the Mooring Buoy Market. As international trade volumes surge, there is a heightened demand for efficient maritime operations, directly influencing the need for robust mooring systems to ensure safe and secure vessel anchorage.

The increased traffic not only elevates the risk of maritime congestion but also necessitates enhanced mooring solutions to accommodate a higher frequency of ships at ports and harbors. This scenario propels the demand for advanced mooring buoys, which are crucial for optimizing the use of docking space and reducing turnaround times. The integration of technology in mooring solutions further augments their reliability and efficiency, making them indispensable in the face of escalating maritime traffic.

Expansion of Offshore Oil and Gas Exploration Activities: Driving Mooring Innovations

The expansion of offshore oil and gas exploration activities has a profound impact on the Mooring Buoy Market. Offshore drilling operations require highly reliable and durable mooring systems to maintain the stationkeeping of drilling rigs and production platforms in challenging marine environments. The volatile nature of oil markets and the consequent fluctuations in exploration activities directly influence the demand cycles in the mooring buoy sector.

As oil and gas companies venture into deeper waters, the complexity and technical requirements of mooring systems significantly increase, thereby driving innovations and advancements in buoy technology. This factor not only fuels market growth but also pushes the boundaries of what mooring buoys can achieve in terms of load capacity, durability, and environmental resistance.

Rising Investments in Port Infrastructure and Safety Measures: Enhancing Market Prospects

Investments in port infrastructure and the emphasis on safety measures are pivotal in shaping the Mooring Buoy Market. Modernizing port facilities to accommodate growing maritime traffic and larger vessels requires the installation of state-of-the-art mooring systems. These investments are often part of broader initiatives to enhance port safety and operational efficiency, which directly benefit the mooring buoy sector.

The integration of advanced materials and IoT-enabled technologies into mooring systems exemplifies how safety concerns and regulatory standards can catalyze market growth. Such enhancements not only improve the safety and efficiency of mooring operations but also extend the lifespan and performance reliability of the buoys, thereby attracting further investments from port authorities and shipping companies.

Restraining Factors

High Initial Installation and Maintenance Costs: Financial Barriers to Market Expansion

The high initial costs associated with the installation and maintenance of mooring buoys present significant financial barriers to the expansion of the Mooring Buoy Market. These costs often include not only the direct expenses of the buoys themselves but also the ancillary costs involved in deployment, such as specialized vessels and labor. For many ports and maritime operations, especially in developing regions, these up-front investments can be prohibitive, limiting the adoption of advanced mooring systems.

Additionally, the ongoing maintenance required to ensure the buoys remain effective in harsh marine environments adds to the total cost of ownership, further deterring potential users. This economic hurdle can restrain market growth, as stakeholders may opt for cheaper, less effective alternatives or delay upgrading existing infrastructure due to budget constraints.

Environmental Concerns and Regulatory Challenges: Complexities in Market Compliance

Environmental concerns and the resulting regulatory challenges significantly impact the Mooring Buoy Market. Mooring systems, particularly those used in sensitive marine habitats or in proximity to protected areas, can have detrimental effects on local ecosystems. The physical presence of buoys and their anchoring systems can disturb marine life and potentially damage seabed habitats. Consequently, stringent environmental regulations have been implemented to mitigate these impacts, requiring manufacturers and users of mooring buoys to comply with rigorous standards.

The need for environmental impact assessments and compliance with diverse regional regulations not only complicates the deployment of new mooring systems but also increases the time and cost associated with bringing these products to market. This scenario creates a dual challenge of adhering to environmental safeguards while striving to expand market reach, ultimately restraining rapid market growth.

By Material Analysis

Plastic dominates the market composition, comprising 50.4% of materials used in buoy production.

In 2023, Plastic held a dominant market position in the By Material segment of the Mooring Buoy Market, capturing more than a 50.4% share. The materials evaluated within this segment include Steel, Plastic, and Others. Plastic buoys are preferred for their durability, resistance to corrosion, and relatively low maintenance compared to steel. This material’s adaptability to various maritime environments, coupled with its cost-effectiveness, has bolstered its widespread adoption in both commercial and recreational marine activities.

Steel, while robust and capable of withstanding significant physical stress, accounted for a lesser share due to its susceptibility to corrosion and higher maintenance requirements. The ‘Others’ category, which encompasses alternative materials such as composite materials and rubber, is gradually gaining traction. These materials are recognized for their environmental resilience and reduced environmental footprint, which aligns with the increasing environmental regulations and sustainability trends in marine operations.

The overall Mooring Buoy Market is influenced by factors such as the expansion of marine trade routes, enhancement in port infrastructure, and heightened safety measures at sea. The dominance of plastic in this market is anticipated to persist, supported by technological advancements in material science that enhance the performance characteristics of plastic mooring buoys. Moving forward, the market is expected to see an increased integration of advanced technologies such as IoT sensors in mooring buoys, which could further influence material choice based on compatibility and functionality enhancements.

By Location Analysis

Coastal locations are preferred for buoy deployment due to environmental and operational advantages.

In 2023, Coastal held a dominant market position in the By Location segment of the Mooring Buoy Market. This segment includes Coastal and Offshore locations, with Coastal areas attracting significant usage due to their strategic importance in maritime operations. Coastal mooring buoys are primarily used for short-term anchorage, navigation aids, and in areas with heavy marine traffic such as ports, harbors, and nearshore facilities.

The accessibility and higher frequency of marine operations in coastal areas necessitate robust mooring solutions that can quickly adapt to dynamic conditions and provide stability for various maritime activities.

The prevalence of coastal mooring buoys is also bolstered by the extensive development of coastal infrastructure, including tourism facilities, marinas, and small-scale fishing operations, which depend heavily on reliable mooring systems. Moreover, coastal regions often serve as gateways for international trade, requiring efficient and secure mooring solutions to manage the influx of commercial ships.

Conversely, the Offshore segment, although smaller, is critical for operations such as deep-sea oil drilling, oceanographic research, and offshore wind farms. These buoys are designed to endure more challenging environmental conditions found in deeper waters, including stronger currents and more severe weather patterns.

Overall, the dominance of the Coastal segment in the Mooring Buoy Market is expected to continue, driven by increasing maritime traffic, coastal development, and the need for efficient maritime operations. However, as offshore activities expand, particularly in renewable energy and deep-sea exploration, the demand for advanced offshore mooring solutions is likely to rise, potentially altering future market dynamics.

By Senser Integration Analysis

Sensor-integrated buoys are increasingly adopted, constituting 55.4% of the buoy market.

In 2023, Sensor-Integrated Buoys held a dominant market position in the By Sensor Integration segment of the Mooring Buoy Market, capturing more than a 55.4% share. The segments assessed within this category are Sensor-Integrated Buoys and Non-Sensor Buoys. The rising demand for Sensor-Integrated Buoys is primarily driven by the increasing need for real-time data collection and monitoring in maritime operations. These buoys are equipped with smart sensors that provide critical information on weather conditions, water currents, and other environmental parameters, which are essential for the safe and efficient operation of maritime activities.

Sensor-Integrated Buoys are particularly favored in areas with high traffic and in regions prone to severe weather conditions, where continuous monitoring is crucial for navigation safety. The integration of sensors has also facilitated advancements in autonomous shipping technologies, where accurate and timely data is vital.

On the other hand, Non-Sensor Buoys, while still relevant, are generally used for simpler tasks such as demarcation and basic mooring operations. These buoys are less expensive and are preferred in controlled environments with minimal navigational risks.

The market’s preference for Sensor-Integrated Buoys is expected to grow further as the maritime security industry continues to embrace digital transformation. Innovations in sensor technology and a decline in the cost of IoT components are likely to expand the use of sensor-integrated solutions in mooring buoys, thereby enhancing maritime safety and operational efficiency.

By End-Use Analysis

The oil and gas sector leads buoy deployment, accounting for 58.4% of end-use applications.

In 2023, Oil & Gas held a dominant market position in the By End-Use segment of the Mooring Buoy Market, capturing more than a 58.4% share. The segments analyzed within this category include Oil & Gas, Marine & Defense, Aquaculture, and Others. The substantial share held by the Oil & Gas sector is attributed to the critical role of mooring buoys in offshore drilling operations, where they are used to secure drilling rigs, floating production units, and other essential equipment. The durability and reliability of these buoys are pivotal in environments that are often characterized by harsh weather conditions and high operational demands.

Mooring buoys in the Oil & Gas sector are specifically designed to withstand the rigorous conditions of the marine environment, ensuring stability and safety for the attached structures. The high investment in exploration and production activities in offshore oil fields has further driven the demand for advanced mooring solutions in this segment.

The Marine & Defense segment also utilizes mooring buoys extensively, particularly for naval operations and security measures along coastlines and at strategic maritime locations. In Aquaculture, mooring buoys are essential for anchoring fish farms, especially in open sea environments where stable positioning is crucial for the containment and protection of marine life.

The ‘Others’ category encompasses the use of mooring buoys in sectors like renewable energy, particularly in offshore wind farms, where they play a role in site demarcation and equipment anchorage. As the maritime industry continues to evolve, the demand for innovative mooring buoy solutions is expected to increase, driven by safety, environmental concerns, and technological advancements.

Key Market Segments

By Material

- Steel

- Plastic

- Others

By Deployment Location

- Coastal

- Offshore

By Sensor Integration

- Sensor-Integrated Buoys

- Non-Sensor Buoys

By End-Use

- Oil & Gas

- Marine & Defense

- Aquaculture

- Others

Growth Opportunities

Development of Eco-friendly and Highly Durable Mooring Systems

In 2023, the global mooring buoy market is poised for significant expansion, driven predominantly by the shift towards eco-friendly and highly durable mooring systems. This shift is a direct response to the increasing environmental regulations and the maritime industry’s commitment to sustainability. As traditional mooring systems often pose risks to marine ecosystems through physical damage and corrosion-related leaks, the demand for innovative, non-toxic materials that ensure longevity and minimize environmental impact has surged.

These advancements not only enhance the lifecycle and reliability of mooring systems but also reduce maintenance costs, presenting substantial long-term savings for operators. Consequently, manufacturers who invest in green technologies and materials are likely to witness heightened market penetration and competitive advantage.

Rising Demand for Advanced Mooring Solutions in Renewable Energy Projects

The expansion of renewable energy projects, particularly offshore wind farms, presents another lucrative growth opportunity for the mooring buoy market in 2023. Offshore wind energy, being at the forefront of renewable sources, requires robust and reliable mooring systems to ensure the stability of floating platforms under various marine conditions.

The complexity and scale of these projects necessitate advanced mooring solutions that can withstand harsh environments while maintaining operational efficiency. As governments and private sectors increase their investments in renewable energy infrastructure, the demand for sophisticated mooring systems is expected to escalate. This trend is anticipated to drive innovation and technological advancements in the market, thereby fueling further growth and development.

Latest Trends

Integration of Smart Technologies in Mooring Systems for Real-Time Data Monitoring

The global mooring buoy market in 2023 is witnessing a transformative trend with the integration of smart technologies into mooring systems. This integration facilitates real-time data monitoring, which significantly enhances operational safety and efficiency. By utilizing sensors and Internet of Things (IoT) technology, operators can monitor various parameters such as tension, motion, and environmental conditions in real time.

This capability not only prevents failures by predicting maintenance needs but also optimizes the performance of mooring systems, thus reducing downtime and operational costs. The adoption of these smart technologies is becoming increasingly prevalent as stakeholders recognize their potential to drive significant improvements in maritime operations.

Adoption of Synthetic and Composite Materials to Enhance Buoy Durability and Performance

Another prominent trend in the 2023 mooring buoy market is the adoption of synthetic and composite materials, which are replacing traditional steel and rubber. These materials offer superior durability and performance, particularly in harsh marine environments. Synthetic and composite materials are highly resistant to corrosion, ultraviolet light, and biological growth, which prolongs the lifespan of mooring buoys and reduces the frequency of replacements.

Furthermore, these materials are often lighter, which simplifies handling and installation processes. As the marine industry continues to evolve towards more sustainable and cost-effective operations, the shift to synthetic and composite materials is expected to accelerate, driving further innovations and market growth.

Regional Analysis

The Asia Pacific mooring buoy market holds a 44.1% share, valued at USD 370.4 million.

The global mooring buoy market is segmented into five key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each demonstrating unique market dynamics and growth opportunities.

Asia Pacific is the dominating region in the mooring buoy market, holding a substantial 44.1% share, valued at USD 370.4 million. This dominance is primarily driven by significant investments in maritime infrastructure and an increasing number of renewable energy projects, particularly offshore wind farms, in countries like China and Japan.

Europe also presents a robust market, propelled by stringent environmental regulations and the modernization of port infrastructure. The region’s focus on renewable energy and marine safety standards further accelerates the adoption of advanced mooring systems, supporting regional market expansion.

North America, with its well-established maritime industry, is advancing in the market by integrating smart technologies for better data monitoring and system management. The region’s emphasis on enhancing marine operational efficiency and safety is key to its market growth.

The Middle East & Africa region is witnessing gradual growth, with developments largely concentrated around the oil and gas sectors, which demand highly reliable mooring solutions for offshore drilling activities. The increase in maritime trade activities also contributes to the market’s expansion in this region.

Lastly, Latin America, though smaller in comparison, is experiencing growth due to the increase in both maritime trade and energy projects. The region’s growing emphasis on adopting sustainable and efficient maritime operations offers potential for market development.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In the context of the global Mooring Buoy Market for 2023, several key companies emerge as pivotal players shaping industry dynamics. Trelleborg Marine Systems, for instance, continues to lead with its innovative, resilient marine fender systems, significantly enhancing operational safety and efficiency in mooring operations. Their commitment to technological advancement and quality assurance positions them as a trusted provider in harsh maritime environments.

Eval Marine and Steinsvik are also noteworthy for their specialized buoy solutions tailored to aquaculture and oil extraction industries, highlighting the diversification within the market. Meanwhile, Fendercare Marine and Evergreen stand out for their extensive portfolios that include both manufacturing and servicing of mooring systems, serving a broad spectrum of clients from commercial shipping to navy operations.

Cylinder Mooring and Almarin excel in providing customized mooring solutions, which are crucial for meeting the specific needs of regional markets and smaller-scale operations, demonstrating an adaptability that is essential in a competitive global market.

In the offshore sector, companies like BW Offshore, Petróleo Brasileiro S.A. (Petrobras), and Bumi Armada Berhad demonstrate robust performance by integrating mooring systems with floating production storage and offloading (FPSO) units, a key trend in offshore oil productions. Yinson Holdings Berhad, Altera Infrastructure, and Bluewater Energy Services further underscore this trend, with strategic initiatives aimed at sustainability and efficiency in their operations.

Century Energy Services Ltd. and MTC Engineering cater to niche segments, providing tailored solutions that address specific regional and operational requirements, thus enhancing their market presence and competitiveness.

Market Key Players

- Trelleborg Marine Systems

- Eval Marine

- Steinsvik

- Fendercare Marine

- Evergreen

- Cylinder Mooring

- Almarin

- BW Offshore

- Petróleo Brasileiro S.A.

- Bumi Armada Berhad

- Yinson Holdings Berhad

- Altera Infrastructure

- Bluewater Energy Services

- Century Energy Services Ltd.

- MTC Engineering

Recent Development

- In March 2024, Oasis Marine introduced the Oasis Hydrogen Buoy and Oasis Power Buoy for offshore hydrogen bunkering and electric charging, pioneering green power solutions supported by the Scottish Government and Innovate UK funding.

- In March 2024, Sandia National Laboratories, in collaboration with multiple partners including Woods Hole Oceanographic Institution, is developing a wave energy converter (WEC) for the Coastal Pioneer Array under NSF’s Ocean Observatories Initiative, aiming to enhance power supply reliability for ocean sensors.

- In November 2023, SafeSTS, a UK-based ship-to-ship service provider, earned recognition in four categories at the 2022 Ship Technology Excellence Awards for innovations including their Transhipment via Buoy (TVB) system and the PTX quick release system for hose protection during breakout incidents.

Report Scope

Report Features Description Market Value (2023) USD 840.0 Million Forecast Revenue (2033) USD 1,462.3 Million CAGR (2024-2033) 5.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material(Steel, Plastic, Others), By Deployment Location(Coastal, Offshore), By Sensor Integration(Sensor-Integrated Buoys, Non-Sensor Buoys), By End-Use(Oil & Gas, Marine & Defense, Aquaculture, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Trelleborg Marine Systems, Eval Marine, Steinsvik, Fendercare Marine, Evergreen, Cylinder Mooring, Almarin, BW Offshore, Petróleo Brasileiro S.A., Bumi Armada Berhad, Yinson Holdings Berhad, Altera Infrastructure, Bluewater Energy Services, Century Energy Services Ltd., MTC Engineering Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Mooring Buoy Market Size in 2023?The Global Mooring Buoy Market Size is USD 840.0 Million in 2023.

What is the projected CAGR at which the Global Mooring Buoy Market is expected to grow at?The Global Mooring Buoy Market is expected to grow at a CAGR of 5.7% (2024-2033).

List the segments encompassed in this report on the Global Mooring Buoy Market?Market.US has segmented the Global Mooring Buoy Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Material(Steel, Plastic, Others), By Deployment Location(Coastal, Offshore), By Sensor Integration(Sensor-Integrated Buoys, Non-Sensor Buoys), By End-Use(Oil & Gas, Marine & Defense, Aquaculture, Others)

List the key industry players of the Global Mooring Buoy Market?Trelleborg Marine Systems, Eval Marine, Steinsvik, Fendercare Marine, Evergreen, Cylinder Mooring, Almarin, BW Offshore, Petróleo Brasileiro S.A., Bumi Armada Berhad, Yinson Holdings Berhad, Altera Infrastructure, Bluewater Energy Services, Century Energy Services Ltd., MTC Engineering

Name the key areas of business for Global Mooring Buoy Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Mooring Buoy Market.

- Market Growth: The Global Mooring Buoy Market size is expected to be worth around USD 1,462.3 Million by 2033, From USD 840.0 Million by 2023, growing at a CAGR of 5.7% during the forecast period from 2024 to 2033.

-

-

- Trelleborg Marine Systems

- Eval Marine

- Steinsvik

- Fendercare Marine

- Evergreen

- Cylinder Mooring

- Almarin

- BW Offshore

- Petróleo Brasileiro S.A.

- Bumi Armada Berhad

- Yinson Holdings Berhad

- Altera Infrastructure

- Bluewater Energy Services

- Century Energy Services Ltd.

- MTC Engineering