Global Monk Fruit Sweetener Market Size, Share, And Business Benefits By Product (Organic, Conventional), By Form (Solid, Liquid), By End Use (Bakery and Confectionery, Beverages, Dairy and Frozen Desserts, Pharmaceuticals, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155415

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

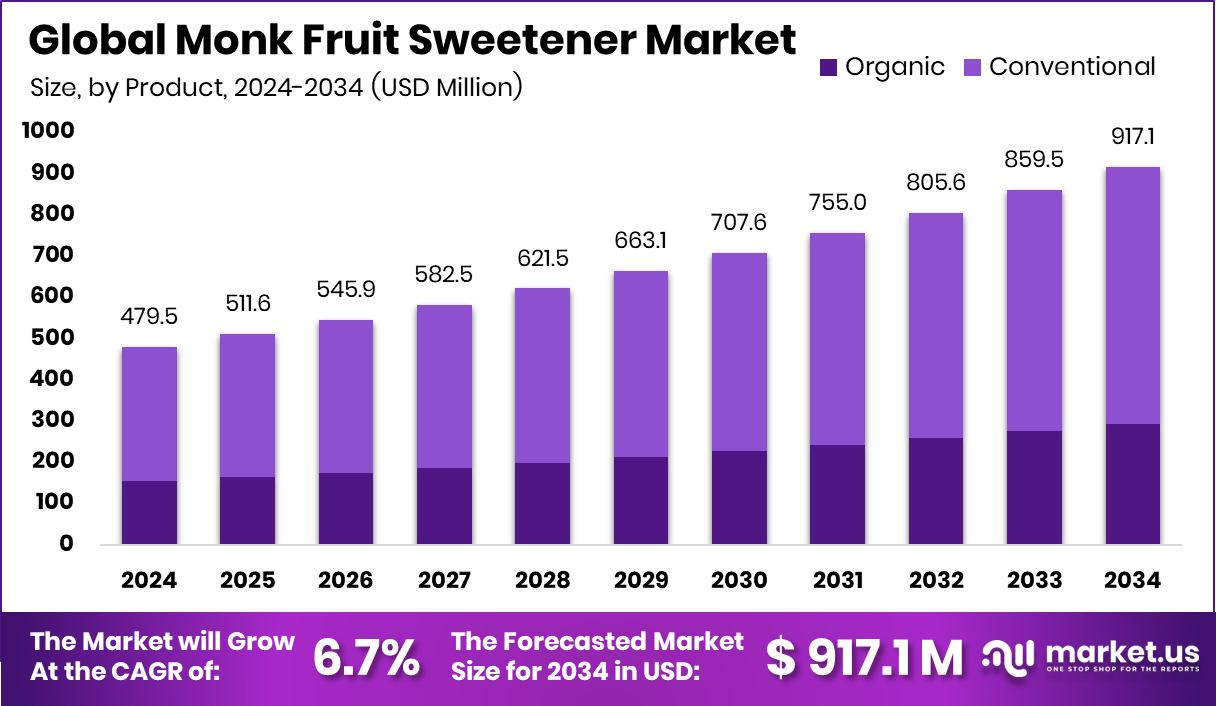

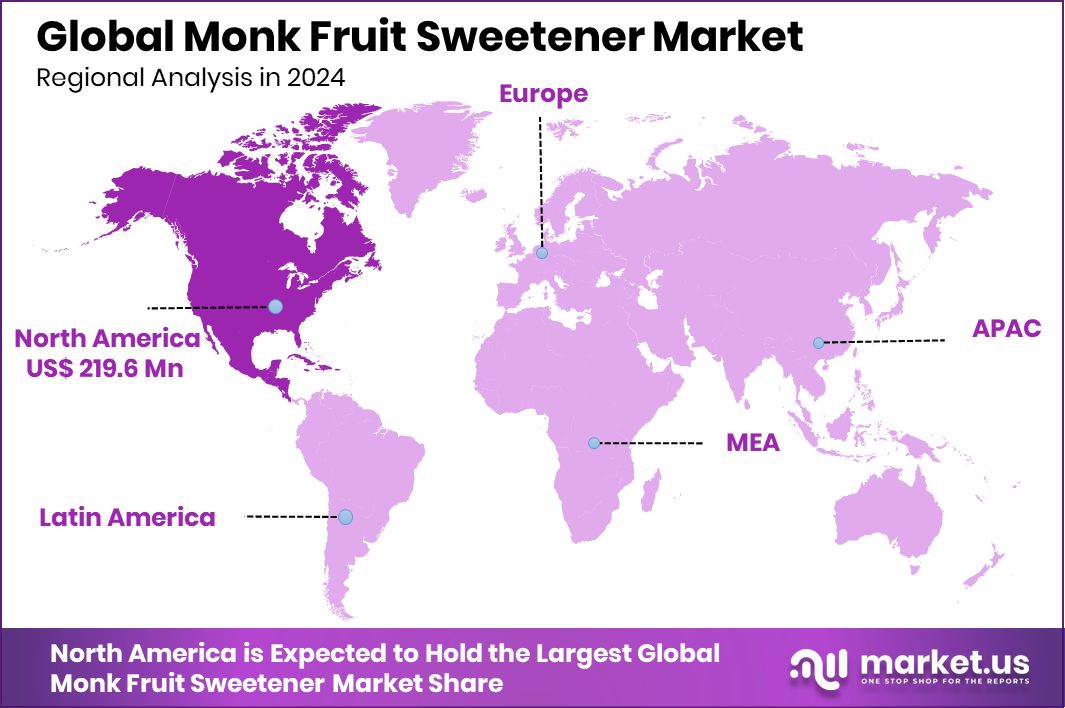

The Global Monk Fruit Sweetener Market is expected to be worth around USD 917.1 million by 2034, up from USD 479.5 million in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034. Expanding product availability in retail channels strengthens North America’s 45.80% dominant market position further.

Monk fruit sweetener is a natural, zero-calorie sugar substitute made from the extract of monk fruit, also known as luo han guo. Native to Southeast Asia, monk fruit contains compounds called mogrosides, which provide intense sweetness without raising blood sugar levels. It is commonly used in beverages, baked goods, and packaged foods as a healthier alternative to refined sugar, especially for those managing weight or blood sugar levels

The monk fruit sweetener market refers to the global trade, production, and consumption of monk fruit-based sugar alternatives. It covers the cultivation of the fruit, extraction processes, and its application in various food and beverage products. The market is gaining traction due to rising consumer preference for natural, plant-based, and low-calorie sweeteners, alongside stricter regulations on sugar usage in processed foods.

The market is growing as consumers become more health-conscious, seeking clean-label and chemical-free sweetening options. Increasing awareness of the negative effects of excessive sugar consumption, such as obesity and diabetes, is boosting demand for monk fruit products. The demand is rising sharply in both developed and emerging economies due to the popularity of low-sugar and keto-friendly diets. Its natural origin and zero-calorie profile make it attractive to health-focused and diabetic consumers.

Supporting this growth, Elo Life Systems has secured $20.5 million in fresh funding to accelerate the commercialization of its monk fruit–based sweetener, while Good Monk has raised ₹7 crore in a Pre-Series A round to support its growth plans.

Additionally, Cure Hydration closed a $5.6 million Series A funding round to expand operations, a newly launched functional tea brand has received $6.7 million to debut in Wegmans and Whole Foods, and the parent company of Super Coffee has obtained $106 million to drive continued expansion.

Key Takeaways

- The Global Monk Fruit Sweetener Market is expected to be worth around USD 917.1 million by 2034, up from USD 479.5 million in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034.

- In the Monk Fruit Sweetener Market, conventional products dominate, holding a strong 69.3% market share globally.

- Solid form leads the Monk Fruit Sweetener Market, capturing 78.4% share due to easy storage and processing advantages.

- Beverages remain the top end-use in the Monk Fruit Sweetener Market, accounting for 41.1% of demand.

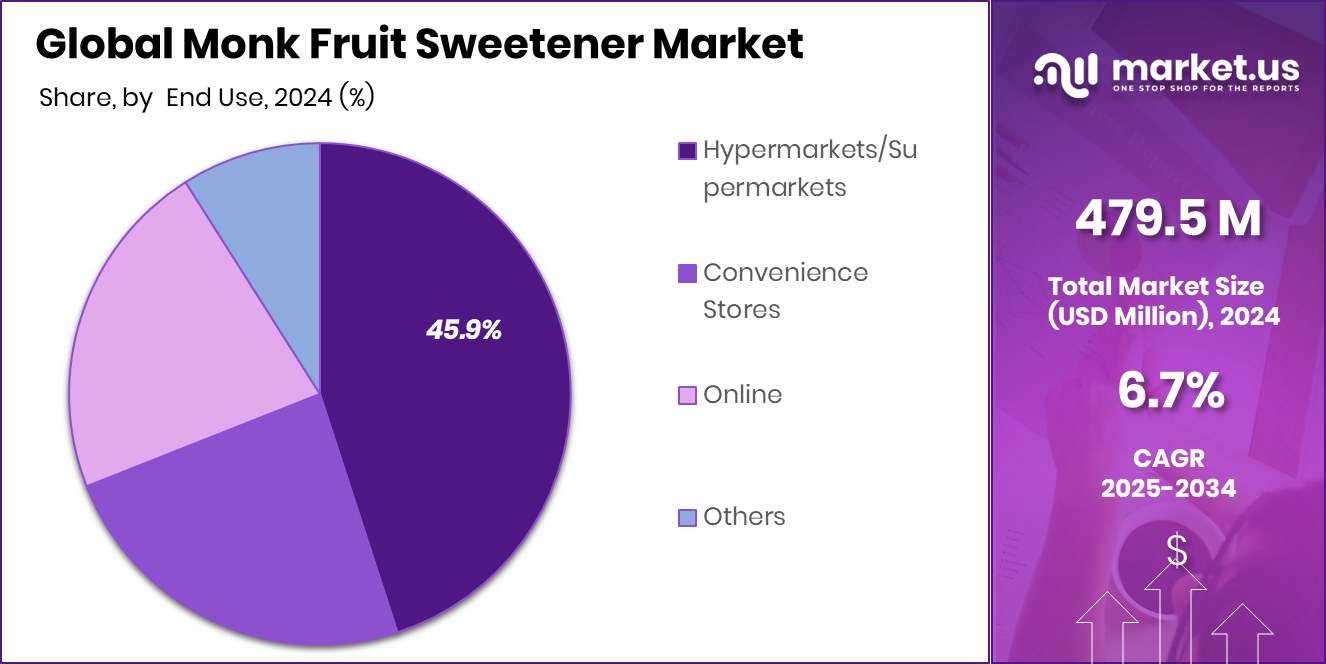

- Hypermarkets and supermarkets drive Monk Fruit Sweetener Market sales, representing 45.9% of total distribution channel share.

- North America 45.80% strong health awareness and sugar reduction trends drive monk fruit sweetener demand significantly higher.

By Product Analysis

Conventional products dominate the Monk Fruit Sweetener Market at 69.3%.

In 2024, Conventional held a dominant market position in the By Product segment of the Monk Fruit Sweetener Market, with a 69.3% share. This leadership is driven by its wide availability, lower production cost compared to organic variants, and established consumer acceptance. Conventional monk fruit sweeteners benefit from a mature supply chain, with large-scale cultivation and processing facilities ensuring consistent output and competitive pricing. These factors make it the preferred choice for bulk buyers, including food and beverage manufacturers, who seek cost-effective yet natural sweetening solutions.

The segment’s growth is further supported by its strong penetration in packaged foods, bakery products, beverages, and tabletop sweeteners. Manufacturers often choose conventional monk fruit due to its scalability and reliable sourcing, enabling them to meet rising demand without significant cost fluctuations. Additionally, advancements in conventional extraction techniques have improved taste profiles, making it more appealing to mainstream consumers.

Emerging markets are also contributing to this dominance, as conventional monk fruit sweeteners are more accessible in terms of pricing and distribution. With increasing health awareness and regulatory support for natural sweeteners, the conventional segment is expected to sustain its lead, catering to both household and industrial applications in the coming years.

By Form Analysis

Solid form leads the Monk Fruit Sweetener Market with 78.4% share.

In 2024, Solid held a dominant market position in the By Form segment of the Monk Fruit Sweetener Market, with a 78.4% share. This dominance is largely attributed to its versatility, longer shelf life, and ease of integration into various food and beverage applications. Solid monk fruit sweeteners, available in forms such as granules and powders, are widely preferred by both household consumers and commercial food processors due to their stability during storage and transportation.

The segment’s strong performance is also driven by the growing adoption of solid sweeteners in health-focused product formulations, especially in sugar-free and low-calorie packaged goods. Food manufacturers favor the solid form for its ability to blend evenly with other dry ingredients, maintaining consistent flavor profiles in large-scale production. Additionally, advancements in granulation and blending technology have improved texture and solubility, enhancing user convenience.

The widespread retail availability of solid monk fruit sweeteners, combined with attractive packaging and bulk purchase options, further supports market penetration. As consumer demand for natural, easy-to-use sugar alternatives continues to rise, the solid form is expected to maintain its lead in the coming years.

By End Use Analysis

Beverages hold a 41.1% share in the Monk Fruit Sweetener Market.

In 2024, Beverages held a dominant market position in the By End Use segment of the Monk Fruit Sweetener Market, with a 41.1% share. This leadership is driven by the growing consumer shift toward low-calorie, sugar-free, and natural drink options, where monk fruit serves as a preferred sweetening ingredient. Its clean, natural profile and zero-calorie content make it ideal for a wide range of beverages, including flavored water, energy drinks, soft drinks, teas, and functional health beverages. Manufacturers are increasingly formulating products with monk fruit to meet the rising demand from health-conscious consumers and those managing sugar intake.

The beverage industry’s adoption of monk fruit sweeteners is further supported by global sugar reduction initiatives and labeling regulations, encouraging brands to replace artificial sweeteners with plant-based alternatives. Monk fruit’s heat stability and compatibility with other natural ingredients enable consistent flavor quality across both ready-to-drink and powdered beverage mixes.

Large-scale beverage producers are also capitalizing on their marketing appeal, promoting monk fruit-sweetened drinks as premium, clean-label products. With increasing awareness of its health benefits and expanding distribution through retail and online channels, the beverage segment is set to remain the largest consumer of monk fruit sweeteners in the foreseeable future.

By Distribution Channel Analysis

Hypermarkets/Supermarkets capture 45.9% of Monk Fruit Sweetener Market sales.

In 2024, Hypermarkets/Supermarkets held a dominant market position in the By Distribution Channel segment of the Monk Fruit Sweetener Market, with a 45.9% share. This dominance is supported by their extensive product variety, wide geographic reach, and ability to cater to diverse consumer preferences under one roof. These retail formats offer consumers the convenience of physically comparing brands, pack sizes, and prices, which plays a significant role in purchasing decisions for specialty products like monk fruit sweeteners. Attractive in-store promotions, discounts, and product sampling further encourage trial and repeat purchases.

The segment’s strength is also driven by the growing trend of health-conscious shopping, with hypermarkets and supermarkets dedicating more shelf space to natural and plant-based sweeteners. Their established supply chains and vendor relationships ensure a steady and fresh stock of products, maintaining consumer trust. Additionally, strategic placement of monk fruit sweeteners in both health food aisles and general grocery sections increases visibility and impulse buying potential.

With rising demand for sugar alternatives, these retail channels are expanding premium product offerings and private-label options to capture a larger customer base. As urbanization and organized retail continue to grow globally, hypermarkets and supermarkets are expected to sustain their lead in this segment.

Key Market Segments

By Product

- Organic

- Conventional

By Form

- Solid

- Liquid

By End Use

- Bakery and Confectionery

- Beverages

- Dairy and Frozen Desserts

- Pharmaceuticals

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online

- Others

Driving Factors

Rising Health Awareness and Sugar Reduction Trends

A key driving factor for the Monk Fruit Sweetener Market in 2024 is the rising global health awareness and the shift toward reducing sugar intake. Consumers are becoming more conscious of the health risks linked to excessive sugar consumption, such as obesity, diabetes, and heart disease. This has increased the demand for natural, zero-calorie sweeteners like monk fruit, which provide sweetness without raising blood sugar levels.

Governments and health organizations are also promoting sugar reduction through public campaigns and stricter food labeling regulations. As more people adopt low-sugar and clean-label diets, monk fruit sweeteners are becoming a preferred choice for both home use and in packaged food and beverage products, supporting steady market growth worldwide.

Restraining Factors

High Production Costs and Limited Crop Supply

One major restraining factor for the Monk Fruit Sweetener Market is its high production cost and limited crop availability. Monk fruit is mainly grown in specific regions of Southeast Asia, particularly in China, under certain climate and soil conditions. This limited cultivation area restricts large-scale production and makes the raw material relatively expensive compared to other sweeteners.

Additionally, the extraction process to obtain mogrosides, the natural sweetening compounds, is complex and cost-intensive, further raising the final product price. These factors can make monk fruit sweeteners less affordable for price-sensitive consumers and limit their presence in mass-market products. Expanding cultivation areas and improving processing efficiency will be essential to overcome this challenge and support wider adoption globally.

Growth Opportunity

Expanding Use in Functional and Healthy Beverages

A major growth opportunity for the Monk Fruit Sweetener Market lies in its expanding use within functional and healthy beverages. As consumers increasingly choose drinks that not only taste good but also offer health benefits, monk fruit sweetener is becoming a preferred ingredient. Its zero-calorie content, natural origin, and blood sugar-friendly profile make it ideal for sports drinks, vitamin-infused waters, herbal teas, and probiotic beverages.

Beverage brands can leverage monk fruit to create clean-label products that appeal to health-conscious buyers and those following low-carb or keto diets. With rising demand for plant-based and sugar-free drinks across both developed and emerging markets, this application offers strong potential for innovation, brand differentiation, and market expansion in the coming years.

Latest Trends

Blending Monk Fruit with Other Natural Sweeteners

One of the latest trends in the Monk Fruit Sweetener Market is blending monk fruit extract with other natural sweeteners such as stevia or erythritol. This approach helps balance taste, reduce any aftertaste, and improve the overall sweetness profile, making it closer to that of regular sugar. Such blends are increasingly used in baking mixes, beverages, snacks, and dietary supplements to cater to a wider range of consumer preferences.

By combining monk fruit with other ingredients, manufacturers can also optimize cost, as pure monk fruit extract can be expensive. This trend is gaining popularity in both retail and food service sectors, offering more versatile and appealing sugar alternatives for health-conscious and diabetic consumers.

Regional Analysis

In 2024, North America held a 45.80% share, valued at USD 219.6 million.

In 2024, North America emerged as the leading region in the Monk Fruit Sweetener Market, capturing a substantial 45.80% share, valued at USD 219.6 million. The region’s dominance is supported by high consumer awareness of natural and low-calorie sweeteners, coupled with growing concerns over sugar-related health issues such as obesity and diabetes. Favorable regulatory frameworks and a strong presence of health-focused food and beverage manufacturers have further accelerated market penetration. Europe is witnessing steady growth, driven by clean-label trends and the rising adoption of plant-based sweeteners in packaged foods.

The Asia Pacific region, home to the primary cultivation areas for monk fruit, benefits from both local demand and strong export activities. Meanwhile, the Middle East & Africa and Latin America are gradually expanding their market presence as urbanization, changing dietary habits, and increasing retail access drive interest in sugar alternatives.

Across all regions, the demand is supported by innovation in product formats, broader retail distribution, and the growing popularity of keto-friendly and diabetic-safe diets. With strong health awareness and a well-established retail network, North America is expected to maintain its leadership, while emerging markets present significant opportunities for future expansion in the monk fruit sweetener industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Guilin Layn Natural Ingredients Corp. strengthened its position in the monk fruit sweetener segment by leveraging its vertically integrated supply chain in Guangxi, China. With large-scale cultivation and advanced extraction facilities, the company continued delivering high-purity mogroside V sweeteners to food and beverage manufacturers globally, maintaining consistent quality and cost control.

Archer Daniels Midland Company (ADM) expanded its natural sweetener portfolio, integrating monk fruit extracts into its functional ingredients line to meet rising clean-label demand. In 2024, ADM focused on enhancing formulation capabilities, enabling product developers to reduce sugar without compromising taste. Its global distribution network gave it a competitive edge in supplying major food brands.

Tate & Lyle PLC capitalized on the growing low-calorie sweetener market by advancing monk fruit-based blends that complement stevia and allulose. In 2024, the company emphasized R&D to improve taste profiles and solubility, targeting beverages, dairy, and confectionery sectors. Its customer innovation centers across North America, Europe, and Asia played a key role in co-developing solutions with clients.

Monk Fruit Corp., a pioneer in the category, retained its leadership by focusing solely on monk fruit cultivation and extraction. In 2024, it continued to invest in sustainable farming practices in China, ensuring long-term supply stability. By offering both conventional and organic-certified products, the company appealed to a broad range of manufacturers seeking premium natural sweeteners.

Top Key Players in the Market

- Guilin Layn Natural Ingredients Corp.

- Archer Daniels Midland Company (ADM)

- Tate & Lyle PLC

- Monk Fruit Corp.

- Cargill, Inc.

- GLG Life Tech Corp.

- Steviva Brands, Inc.

- NOW Foods

- Firmenich SA

- SweetLeaf

- Lakanto

Recent Developments

- In November 2024, Wisdom Natural Brands (parent company of SweetLeaf) acquired Drizzle Honey, a Canadian brand known for raw and superfood-infused honeys that are pure, bee-friendly, and free from added sugars and preservatives. This deal brings Drizzle products into U.S. markets, where SweetLeaf’s stevia, monk fruit, and other natural sweeteners are already sold—such as in Whole Foods, Walmart, Amazon, and more.

- In February 2024, GLG agreed to transfer its Runde production facility to another company, a move expected to wipe out nearly CAD 79 million in bank debt. This helps the company clean up its financials and focus better on its natural sweetener business, which includes monk fruit.

Report Scope

Report Features Description Market Value (2024) USD 479.5 Million Forecast Revenue (2034) USD 917.1 Million CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Organic, Conventional), By Form (Solid, Liquid), By End Use (Bakery and Confectionery, Beverages, Dairy and Frozen Desserts, Pharmaceuticals, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Guilin Layn Natural Ingredients Corp., Archer Daniels Midland Company (ADM), Tate & Lyle PLC, Monk Fruit Corp., Cargill, Inc., GLG Life Tech Corp., Steviva Brands, Inc., NOW Foods, Firmenich SA, SweetLeaf, Lakanto Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Monk Fruit Sweetener MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Monk Fruit Sweetener MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Guilin Layn Natural Ingredients Corp.

- Archer Daniels Midland Company (ADM)

- Tate & Lyle PLC

- Monk Fruit Corp.

- Cargill, Inc.

- GLG Life Tech Corp.

- Steviva Brands, Inc.

- NOW Foods

- Firmenich SA

- SweetLeaf

- Lakanto