Global Modular Flooring Market By Product Type (Flexible LVT, Rigid LVT, Carpet Tile, Polyolefin, Rubber, Ceramic, Others), By Design Type (Wood Finish, Stone Finish, Patterned), By Type (Vinyl Tiles, Carpet Tiles, Laminate Flooring, Engineered Wood), By Durability Level (Standard, Heavy Duty, Luxury, By Installation Method (GlueDown, Interlocking, LooseLay), By End Use (Residential, Non-residential) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174887

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Design Type Analysis

- By Type Analysis

- By Durability Level Analysis

- By Installation Method Analysis

- By End Use Analysis

- Key Market Segments

- Emerging Trends

- Drivers

- Restraints

- Opportunity

- Regional Insights

- Key Players Analysis

- Recent Industry Developments

- Report Scope

Report Overview

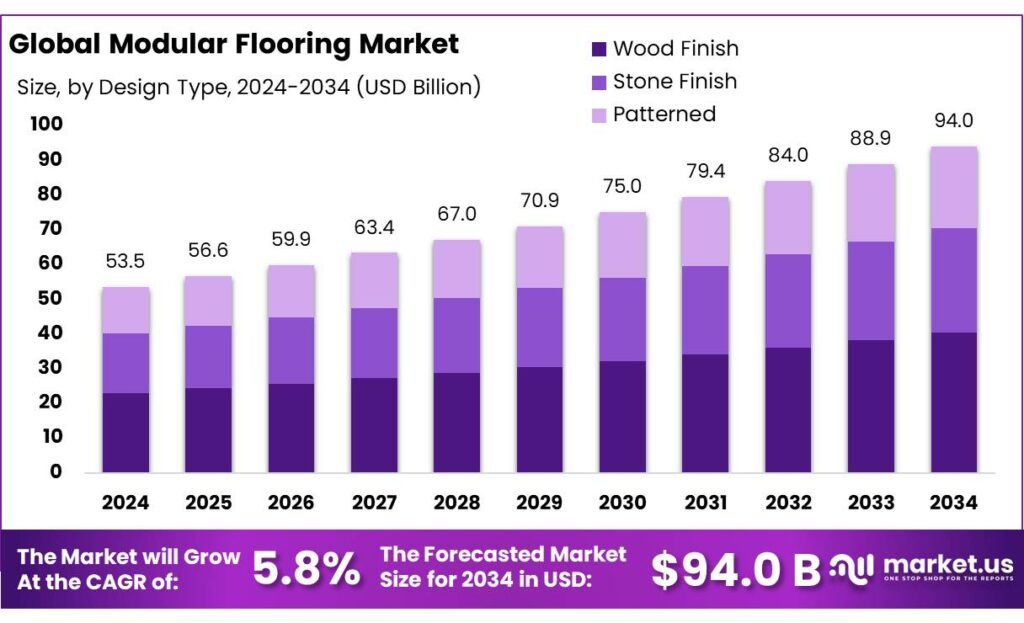

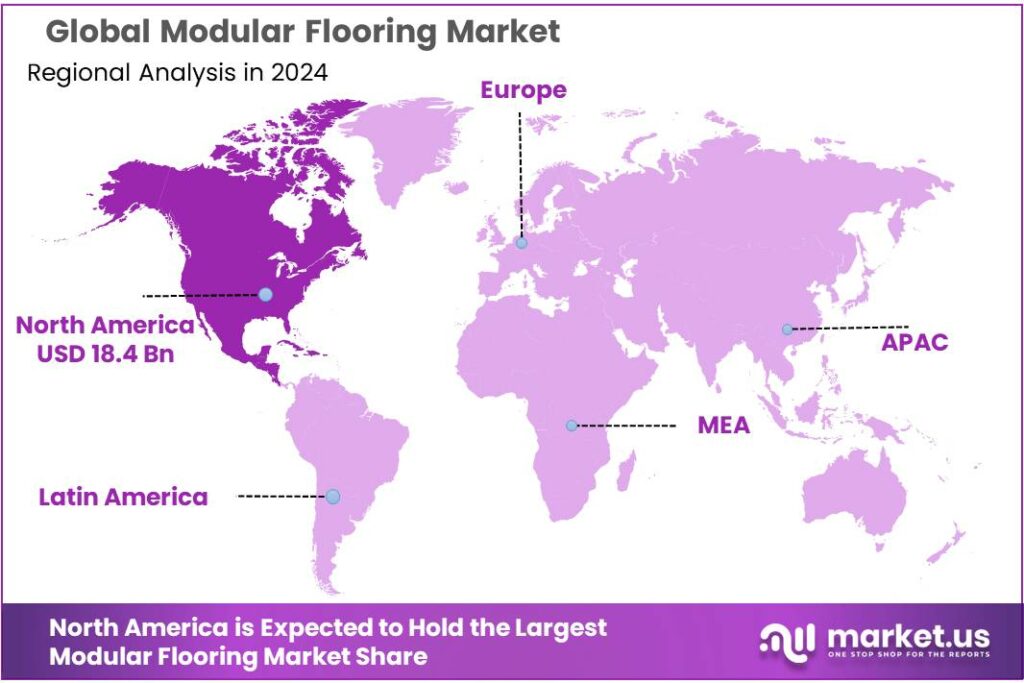

Global Modular Flooring Market size is expected to be worth around USD 94.0 Billion by 2034, from USD 53.5 Billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 34.4% share, holding USD 18.4 Billion in revenue.

Modular flooring is increasingly treated as an operational asset rather than a finishing material. In industrial sites, it is used to create fast, replaceable floor surfaces—typically interlocking tiles or panels (PVC, rubber, polypropylene, ESD-safe compounds, and raised-access systems)—that can be installed, lifted, and reconfigured with minimal interruption.

The industrial scenario is being shaped by three overlapping forces: higher hygiene expectations, faster retrofit cycles, and policy-led building upgrades. In the European Union, overall industrial activity is massive—Eurostat reports the value of sold production in the EU at €5,860 billion in 2024—and even incremental shifts toward faster-maintenance materials can translate into meaningful demand for modular surfaces in plants and logistics buildings. In food and beverage specifically, the operating scale is large and compliance-driven: FoodDrinkEurope reports the EU food and drink industry generates €1.1 trillion turnover, employs 4.6 million people, and creates €229 billion in value added.

Government initiatives that expand food infrastructure can indirectly lift adoption of industrial-grade modular flooring. In India, the Union Cabinet approved a total outlay of ₹6,520 crore for the Pradhan Mantri Kisan Sampada Yojana for 2021–22 to 2025–26, including an additional ₹1,920 crore, and it specifically references support for 50 multi-product food irradiation units and 100 NABL-accredited food testing labs.

Regulation and certification signals reinforce this direction. In the United States, FDA’s FSMA implementation includes the Preventive Controls for Human Food rule, which became final in September 2015 and requires covered facilities to maintain a food safety plan with hazard analysis and risk-based preventive controls. On the industry systems side, the ISO Survey’s 2022 explanatory note reports 51,535 valid certificates for ISO 22000 in 2022.

Key Takeaways

- Modular Flooring Market size is expected to be worth around USD 94.0 Billion by 2034, from USD 53.5 Billion in 2024, growing at a CAGR of 5.8%.

- Flexible LVT held a dominant market position, capturing more than a 31.7% share in the global modular flooring market.

- Wood Finish held a dominant market position, capturing more than a 43.5% share in the modular flooring market.

- Vinyl Tiles held a dominant market position, capturing more than a 59.8% share in the modular flooring market.

- Standard held a dominant market position, capturing more than a 44.1% share in the modular flooring market.

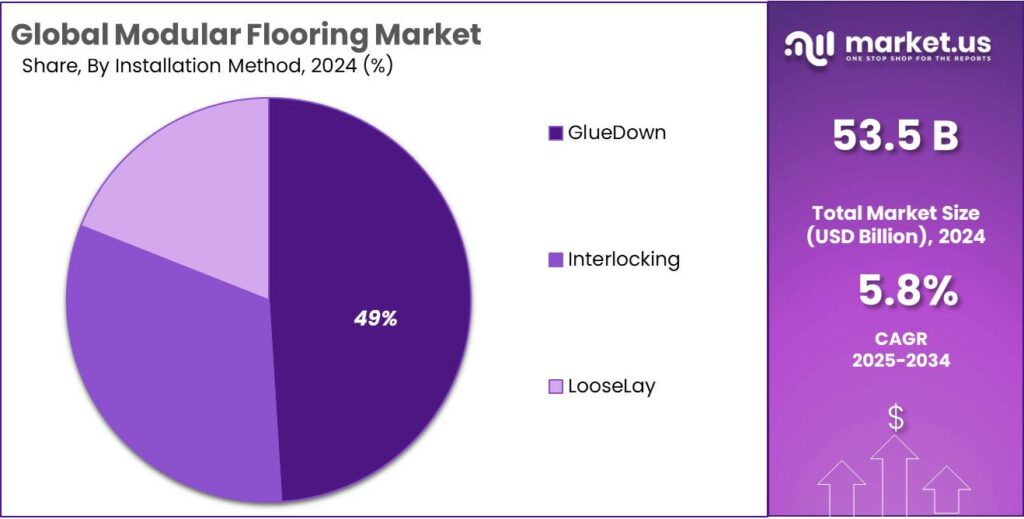

- GlueDown held a dominant market position, capturing more than a 49.3% share in the modular flooring market.

- Non-residential held a dominant market position, capturing more than a 59.9% share in the modular flooring market.

- North America stands out as the dominant region, holding a 34.4% share of the global modular flooring market, supported by a regional market value of USD 18.4 Bn.

By Product Type Analysis

Flexible LVT leads the Modular Flooring Market with a strong 31.7% share in 2024

In 2024, Flexible LVT held a dominant market position, capturing more than a 31.7% share in the global modular flooring market. Its strong presence comes from the material’s adaptability, easy installation, and ability to mimic premium surfaces like wood and stone without high maintenance. Consumers increasingly prefer flooring that offers both comfort and durability, and Flexible LVT fits well into modern housing upgrades, retail renovations, and office interiors. The year also saw rising adoption across emerging economies, where builders are shifting toward cost-effective and lightweight flooring alternatives. This trend supported Flexible LVT’s continued leadership within the product mix.

By Design Type Analysis

Wood Finish dominates with a strong 43.5% share due to its natural appeal and wide design acceptance

In 2024, Wood Finish held a dominant market position, capturing more than a 43.5% share in the modular flooring market. Its leadership is driven by the timeless look of natural wood, which continues to be the preferred choice in homes, hotels, workspaces, and retail interiors. Users appreciate the warmth, texture, and premium feel that wood-inspired designs bring, without the maintenance challenges of real hardwood. In 2024, renovation projects grew across both residential and commercial spaces, and modular solutions in wood finish became popular because they offer easy installation and a long lifespan. The combination of style, practicality, and affordability helped this segment maintain a significant lead.

By Type Analysis

Vinyl Tiles dominate with a strong 59.8% share due to their durability and easy installation

In 2024, Vinyl Tiles held a dominant market position, capturing more than a 59.8% share in the modular flooring market. Their leading role comes from the balance they offer between performance, cost, and design flexibility. Builders, homeowners, and commercial facility managers increasingly choose vinyl tiles because they are resistant to moisture, scratches, and heavy foot traffic. In 2024, renovation activity grew across homes, offices, healthcare facilities, and retail environments, and vinyl tiles became a preferred option thanks to their quick installation and low maintenance requirements. The ability to replicate natural surfaces like stone and wood without the high expense further strengthened their position.

By Durability Level Analysis

Standard durability dominates with a strong 44.1% share due to its balanced performance and affordability

In 2024, Standard held a dominant market position, capturing more than a 44.1% share in the modular flooring market. This segment leads because it offers the right balance between durability, cost, and everyday usability. Many residential projects and mid-traffic commercial spaces prefer standard-grade modular flooring as it delivers reliable performance without the premium cost associated with high-end durability levels. In 2024, rising home renovation activities and budget-friendly construction choices further supported the adoption of standard modular flooring, especially in apartments, offices, and educational spaces where moderate wear and tear is common.

By Installation Method Analysis

GlueDown leads with a strong 49.3% share due to its stability and long-term performance

In 2024, GlueDown held a dominant market position, capturing more than a 49.3% share in the modular flooring market. This installation method remains widely preferred because it offers strong bonding and a secure floor surface, especially in high-traffic environments. Commercial buildings, retail stores, healthcare facilities, and educational spaces often rely on GlueDown flooring to reduce movement and noise underfoot. In 2024, large-scale renovation projects favored this method as it provides a smooth, seamless finish and performs well under heavy furniture and continuous footfall. Its compatibility with various modular flooring types also supported its leading position.

By End Use Analysis

Non-residential dominates with a strong 59.9% share due to expanding commercial and institutional projects

In 2024, Non-residential held a dominant market position, capturing more than a 59.9% share in the modular flooring market. This strong lead is driven by rising construction and renovation activities across offices, hospitals, retail chains, educational facilities, and hospitality spaces. Businesses increasingly prefer modular flooring because it supports fast installation, easy replacement, and consistent design across large spaces. In 2024, many commercial projects upgraded to modular formats to enhance durability and improve overall aesthetics, while also meeting safety and maintenance requirements. High foot traffic environments especially benefited from modular flooring’s resilience and long service life.

Key Market Segments

By Product Type

- Flexible LVT

- Rigid LVT

- Carpet Tile

- Polyolefin

- Rubber

- Ceramic

- Others

By Design Type

- Wood Finish

- Stone Finish

- Patterned

By Type

- Vinyl Tiles

- Carpet Tiles

- Laminate Flooring

- Engineered Wood

By Durability Level

- Standard

- Heavy Duty

- Luxury

By Installation Method

- GlueDown

- Interlocking

- LooseLay

By End Use

- Residential

- Non-residential

Emerging Trends

Fast, hygiene-focused retrofits in food plants are making modular flooring

One clear latest trend in modular flooring is that food and beverage sites are no longer waiting for a “big shutdown” to fix floors. Instead, they are doing small, fast retrofits—lane by lane, room by room—so cleaning teams can keep standards high without stopping production for long. This is why interlocking tiles, lift-and-replace panels, and modular anti-slip drainage surfaces are getting more attention in wash-down rooms, packing lines, cold rooms, and dispatch bays. The goal is simple: keep floors dry, easy to sanitize, and quick to repair when damage happens.

This shift is strongly linked to the pressure around food safety. The World Health Organization says contaminated food makes about 600 million people ill each year and causes 420,000 deaths. It also estimates US$ 110 billion is lost each year in productivity and medical costs in low- and middle-income countries due to unsafe food. These numbers are hard to ignore, and they push factories to remove “weak spots” where water, residues, and dirt can build up. A floor that can be opened, cleaned under, and repaired in a small section feels practical when audits are strict and schedules are tight.

Another reason this trend is growing is because the industry is trying to cut waste and protect usable stock. UNEP’s Food Waste Index Report 2024 estimates that 1.05 billion tonnes of food were wasted in 2022, about 19% of food available to consumers. The same report notes that households account for 631 million tonnes of that waste, which shows how big the problem is across the system. For food businesses, waste is not only a consumer issue; it is a warning sign that handling, storage, and hygiene need to be stronger everywhere.

A third part of the trend is happening through infrastructure build-out, especially in cold chain and processing capacity. In India, the Ministry of Food Processing Industries reported that, as of February 28, 2025, it had sanctioned 1,608 projects under PMKSY component schemes, including 41 Mega Food Parks and 394 Cold Chain projects. It also reported total disbursements of ₹6,198.76 crore in grants/subsidy since inception of these component schemes. When new cold rooms and processing units come up, or older ones are upgraded, floors become a high-priority item because they face pallet traffic, chemical cleaning, and temperature swings.

Drivers

Food-safety pressure in processing plants is pushing demand for clean, fast-repair modular floors

One major driving factor for modular flooring is the daily pressure on food processors to keep facilities cleaner, safer, and easier to audit—without stopping production for long repairs. In a food plant, the floor is not just a surface; it is where water, oils, sugar, flour dust, and raw material contact can build up. When a floor cracks, peels, or stays wet, it becomes a “hidden risk” zone for slips and for microbes to settle.

The food sector is also under a clear health reality: unsafe food is linked to huge illness numbers globally. The World Health Organization reports that unsafe food causes about 600 million foodborne disease cases and 420,000 deaths each year. When managers see those numbers, they do not think only about public health—they also think about recalls, shutdowns, and brand damage. Floors that stay wet, trap residues, or cannot be repaired quickly become an operational worry.

This hygiene focus connects directly with food loss and waste reduction. FAO’s research highlights that roughly one-third of food produced for human consumption is lost or wasted—about 1.3 billion tonnes per year. On the waste side closer to consumers, UNEP estimates 1.05 billion tonnes of food were wasted in 2022, about 19% of food available to consumers. While flooring is not the only cause, processors know that contamination events, water ingress, and hygiene failures can trigger product disposal and rework. A floor that drains well, improves grip, and can be kept clean with consistent routines reduces the chance of small problems turning into large losses.

Government initiatives are also expanding food infrastructure, and that naturally increases demand for industrial-grade floors. In India, the Ministry of Food Processing Industries reported that, as of February 28, 2025, it had sanctioned 1,608 projects under PMKSY components, including 41 Mega Food Parks and 394 Cold Chain projects, and disbursed ₹6,198.76 crore in grants/subsidy since inception of the component schemes. Each new park, cold store, or processing unit brings more square meters of wet and heavy-use flooring where fast installation and easy replacement are valued.

Restraints

High Initial Cost and Perceived Value Are Slowing Adoption of Modular Flooring

One major restraining factor for modular flooring in food and industrial facilities is the higher upfront investment compared with traditional poured concrete or basic epoxy coatings. For many plant managers and owners, the short-term budget hit feels heavier than it seems on paper, even if the long-term benefits are clear. In daily operations—especially in small or medium-sized facilities where cash flow and working capital are tight—this perceived cost barrier can hold back decisions that, over time, could yield safer and more efficient floors.

Financial strain is not just a hypothetical concern. In the food sector, margins are often tight. According to the World Health Organization, unsafe food causes about 600 million illnesses and 420,000 deaths every year. Not only does this highlight the importance of good sanitation, it also shows the scale of risk facilities manage daily. Yet when plant leaders see big headline numbers and must balance budgets, their focus is still on immediate cost control, sometimes at the expense of preventive infrastructure like durable modular floors.

Government initiatives aimed at improving food processing infrastructure can help offset some cost barriers, but gaps remain. In India, the Ministry of Food Processing Industries reports 1,608 sanctioned projects under the Pradhan Mantri Kisan Sampada Yojana (PMKSY) as of early 2025, including 41 Mega Food Parks and 394 Cold Chain projects. Overall grants and subsidies of ₹6,198.76 crore have been disbursed to support value chain infrastructure. These programs help upgrade facilities but often emphasize large equipment and logistics, with less direct support earmarked for specialty building materials like advanced flooring.

Opportunity

Cold-chain and food-processing expansion creates a big retrofit opportunity for modular flooring

A major growth opportunity for modular flooring is coming from the fast expansion and upgrading of food processing and cold-chain facilities, where hygiene, uptime, and worker safety are non-negotiable. In these sites, flooring is not a “finish”; it is part of the hygiene system. When plants add new production lines, increase throughput, or build temperature-controlled rooms, they often need floors that can be installed quickly and kept in good condition without shutting down operations for days.

The need is tied to the real-world cost of unsafe food. The World Health Organization estimates that contaminated food leads to about 600 million illnesses and 420,000 deaths each year worldwide. For plant owners, those figures translate into stricter internal controls: tighter cleaning routines, better separation of wet and dry zones, and fewer “hard-to-fix” surfaces that can crack or hold moisture. In that environment, modular flooring becomes attractive in high-risk areas such as wash-down rooms, packaging lanes, raw material receiving, and cold rooms—spaces where the floor takes constant impact, water exposure, and chemical cleaning.

Food loss and waste also make the business case stronger. FAO’s widely cited estimate says roughly one-third of food produced for human consumption is lost or wasted—about 1.3 billion tonnes per year. UNEP’s Food Waste Index adds that 1.05 billion tonnes of food were wasted in 2022, equal to 19% of food available to consumers, at retail, food service, and household level. While flooring is not the only cause, food businesses know that spoilage and disposal can rise when hygiene breaks down or when downtime disrupts cold storage and packing schedules.

Government-backed infrastructure programs are another reason this opportunity is growing. In India, the Ministry of Food Processing Industries reported that, as of February 28, 2025, it had sanctioned 1,608 projects under PMKSY component schemes, including 41 Mega Food Parks and 394 Cold Chain projects, and disbursed ₹6,198.76 crore in grants/subsidy since inception of the component schemes.

Regional Insights

North America dominates the Modular Flooring Market with a 34.4% share, supported by strong construction demand and renovation activity valued at USD 18.4 Bn

North America stands out as the dominant region, holding a 34.4% share of the global modular flooring market, supported by a regional market value of USD 18.4 Bn. This leadership is mainly driven by consistent investment in commercial construction, residential remodeling, and institutional infrastructure across the region. In 2024, demand remained strong as offices, healthcare facilities, retail spaces, and educational buildings continued to upgrade interiors with durable and easy-to-install flooring solutions. Modular flooring gained preference due to its ability to reduce downtime during renovations while offering long service life and visual consistency.

The residential sector also contributed steadily, particularly through home improvement projects and multi-family housing developments. Homeowners across North America increasingly favored modular flooring for its low maintenance, moisture resistance, and wide design options that fit both modern and traditional interiors. In addition, the region’s focus on sustainability played an important role, as builders and property owners showed growing interest in flooring products that support recycling, lower emissions, and efficient material usage.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Mohawk operates with $11+ billion revenue, over 130 manufacturing facilities, and sells flooring in more than 170 countries. Its modular flooring strength comes from advanced vinyl, carpet tile, and resilient solutions. Continuous investment in R&D, energy-efficient production, and digital design tools helps Mohawk maintain strong global share and supply capability across commercial and residential sectors.

Interface, a modular flooring specialist, records $1.2+ billion revenue with operations in 100+ countries. The company is known for carpet tiles and modular resilient flooring, supported by strong sustainability goals. Its plants operate with high recycled content usage, and Interface maintains a significant commercial presence through interior design partnerships and global architectural networks.

Tarkett posts €3+ billion revenue and serves customers in 100+ countries with 34 manufacturing facilities. It offers vinyl tiles, carpet tiles, linoleum, and sports flooring. The company’s modular flooring share benefits from strong distribution in education, healthcare, and hospitality. Tarkett’s “closed-loop” recycling and circular design programs strengthen its competitive advantage.

Top Key Players Outlook

- Mohawk Industries, Inc.

- Shaw Industries Group, Inc.

- Interface, Inc.

- Tarkett S.A.

- Armstrong Flooring, Inc.

- Forbo Flooring Systems

- Milliken & Company

- Gerflor Group

- Beaulieu International Group

- LX Hausys

Recent Industry Developments

In 2024, Shaw Industries Group, Inc. continued to solidify its role in the modular flooring sector with approximately $6 billion in annual revenue, selling carpet tiles, resilient flooring (including LVT and SPC), and other floor coverings for both residential and commercial applications.

In 2024, Forbo Flooring Systems – a key division of Forbo Holding AG – played a meaningful role in the modular flooring sector with net sales of CHF 765.6 million and an operating profit (EBIT) of CHF 99.0 million reflecting steady demand for its vinyl tiles, linoleum, carpet tiles and Flotex modular floors used in offices, schools, healthcare and public spaces.

Report Scope

Report Features Description Market Value (2024) USD 53.5 Bn Forecast Revenue (2034) USD 94.0 Bn CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Flexible LVT, Rigid LVT, Carpet Tile, Polyolefin, Rubber, Ceramic, Others), By Design Type (Wood Finish, Stone Finish, Patterned), By Type (Vinyl Tiles, Carpet Tiles, Laminate Flooring, Engineered Wood), By Durability Level (Standard, Heavy Duty, Luxury, By Installation Method (GlueDown, Interlocking, LooseLay), By End Use (Residential, Non-residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mohawk Industries, Inc., Shaw Industries Group, Inc., Interface, Inc., Tarkett S.A., Armstrong Flooring, Inc., Forbo Flooring Systems, Milliken & Company, Gerflor Group, Beaulieu International Group, LX Hausys Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mohawk Industries, Inc.

- Shaw Industries Group, Inc.

- Interface, Inc.

- Tarkett S.A.

- Armstrong Flooring, Inc.

- Forbo Flooring Systems

- Milliken & Company

- Gerflor Group

- Beaulieu International Group

- LX Hausys