Global Mobile Phone Protective Covers Market Market Size, Share, Growth Analysis By Product (Body Gloves, Pouch, Phone Skin, Hybrid Cases, Others), By Case Type (Back Plate Cases, Folio Cases, Others), By Material Type (Silicon, Genuine and PU Leather, Plastic, Others), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168531

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

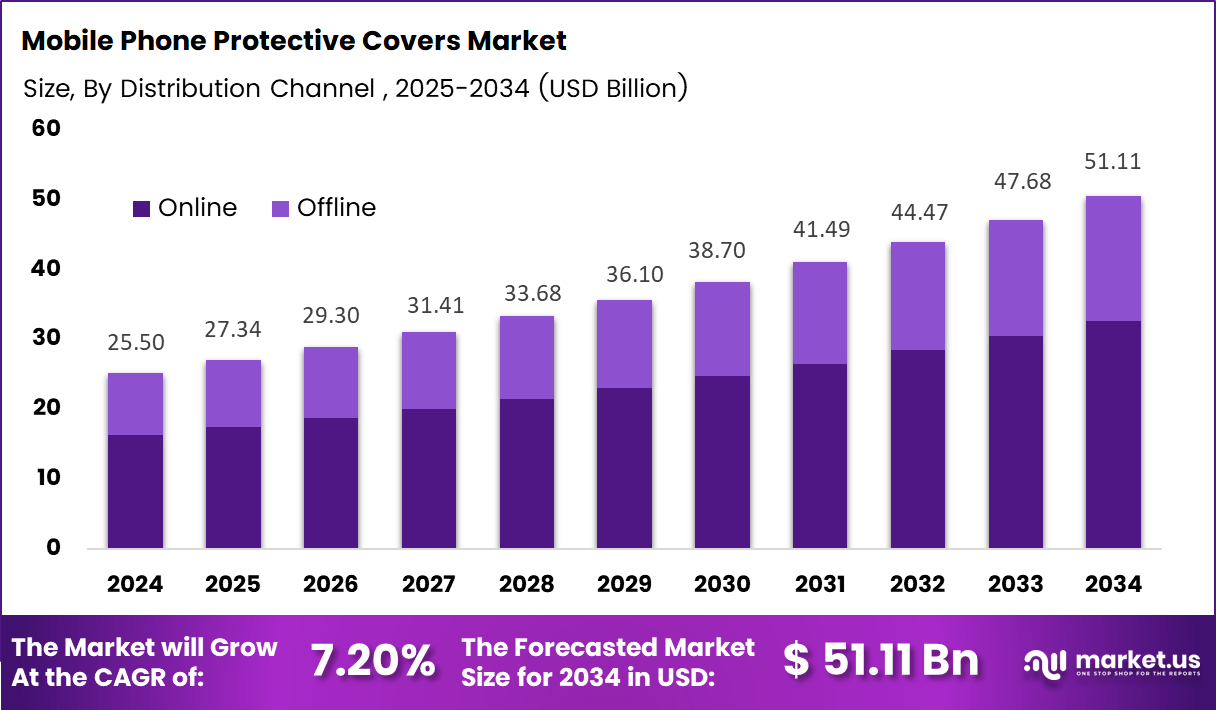

The Global Mobile Phone Protective Covers Market size is expected to be worth around USD 51.11 Billion by 2034, from USD 25.5 Billion in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034.

Mobile Phone Protective Covers Market represents a fast-growing accessory segment that safeguards devices against drops, scratches, and daily wear. The market expands as consumers prioritize durability, convenience, and personalization across diverse smartphone categories. This sector benefits from rising device penetration, evolving materials, and advanced charging ecosystems that reshape accessory compatibility and user expectations.

The Mobile Phone Protective Covers Market continues to grow as manufacturers introduce lightweight, shock-resistant, and eco-friendly designs. Increasing smartphone reliance accelerates replacement cycles, encouraging steady demand. Additionally, evolving form factors and premium device adoption enhance opportunities for innovative case materials, textured grips, and enhanced thermal-management accessories.

Furthermore, rising digital lifestyles push governments worldwide to invest in smartphone manufacturing, creating long-term accessory demand. Regulatory encouragement for sustainable materials promotes biodegradable and recycled-plastic covers. These initiatives support greener supply chains while shaping the transition toward environmentally responsible mobile accessories in global retail and online marketplaces.

Moreover, expansion in wireless ecosystems promotes compatibility-driven product development. Consumers seek covers supporting wireless charging, magnetic attachments, and heat-dissipation features. As device functionality grows, case manufacturers integrate multifunctional elements such as kickstands, wallet slots, and camera-protection rings, strengthening value propositions for modern users seeking long-lasting and flexible accessories.

In addition, emerging markets witness rising disposable incomes, boosting premium case adoption. Device protection becomes essential as smartphone repair costs increase, encouraging users to invest in higher-quality covers. This trend creates significant untapped opportunities for shockproof, slim-fit, leather, and silicone-based mobile phone protective covers across retail chains and e-commerce platforms.

Transitioning to statistical insights, strong mobile adoption reinforces long-term demand. According to Consumer Insights, the annual smartphone user growth rate stands at 14.9%, fueling a consistent need for protective covers as device ownership rises globally across all age groups and income segments.

Furthermore, Apple holds a 20.1% global smartphone market share, according to IDC, strengthening demand for premium protective covers. Wireless charging adoption surpasses 35% of global users, as noted by Counterpoint, driving growth for MagSafe-compatible and wireless-ready cases. Additionally, foldable smartphone shipments grew 33% year-on-year in 2023, per IDC, expanding demand for specialized foldable covers tailored to flexible displays.

Key Takeaways

- The Global Mobile Phone Protective Covers Market reached USD 25.5 billion in 2024.

- The market is projected to reach USD 51.11 billion by 2034.

- The industry is expanding at a 7.2% CAGR from 2025 to 2034.

- Hybrid Cases dominate the By Product segment with a 43.2% share.

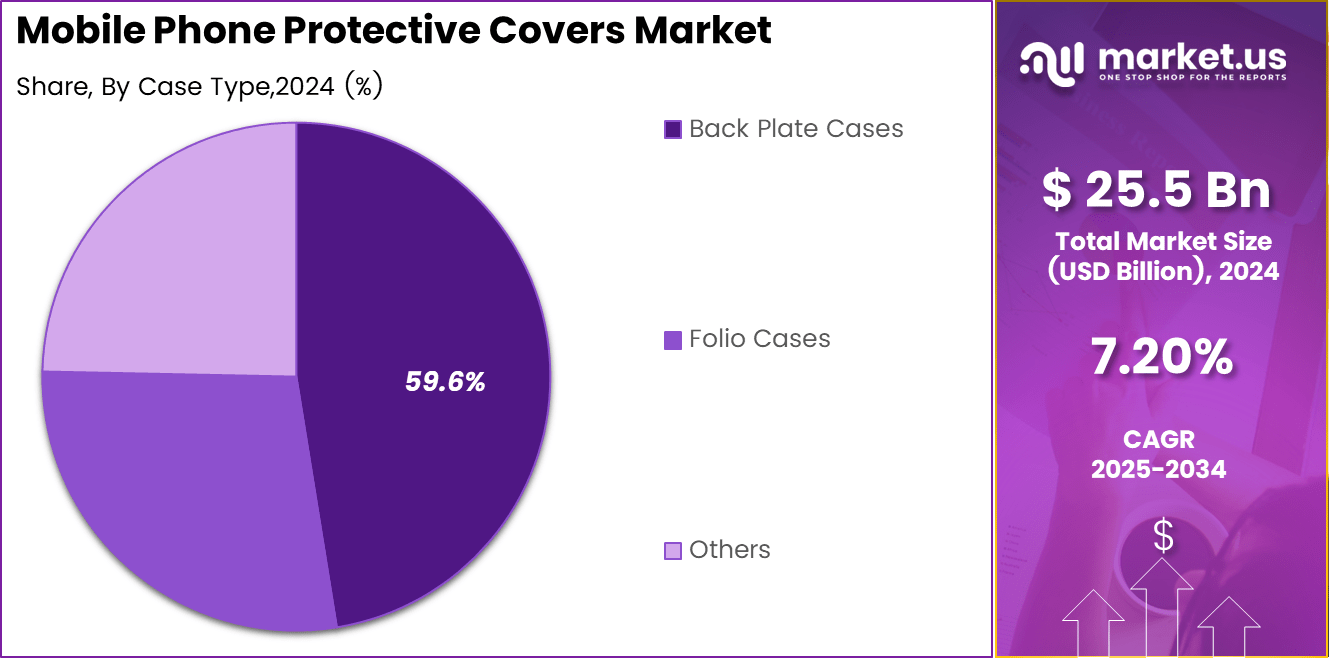

- Back Plate Cases lead the By Case Type segment with a 59.6% share.

- Silicon leads the By Material Type segment with a 46.8% share.

- Offline channels dominate the By Distribution Channel segment with a 63.9% share.

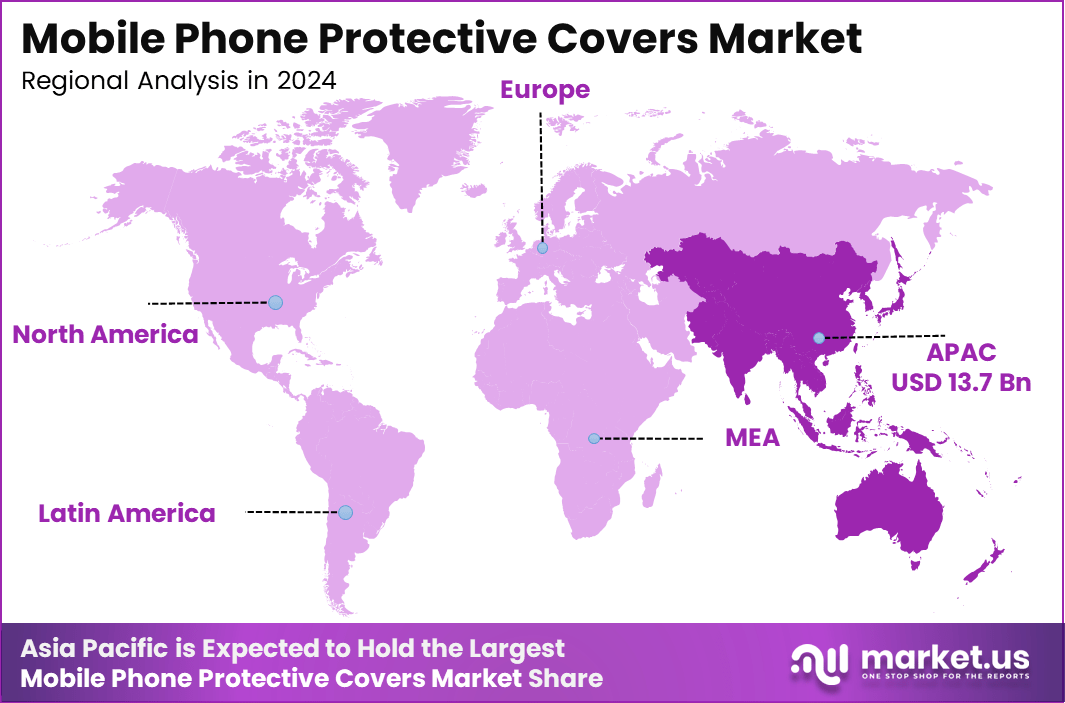

- Asia Pacific holds the largest regional market share at 53.8%, valued at USD 13.7 billion.

By Product Analysis

Hybrid Cases dominate with 43.2% due to their strong protection, durability, and compatibility across multiple smartphone categories.

In 2024, Hybrid Cases held a dominant market position in the By Product Analysis segment of the Mobile Phone Protective Covers Market, with a 43.2% share. This segment expands rapidly as users prefer reinforced material blends offering advanced shock absorption and improved longevity for everyday smartphone protection.

Body Gloves continue to grow as consumers seek slim, lightweight protective options. This sub-segment gains traction for its comfort and flexibility, making it appealing for users who prioritize grip-focused covers. Rising smartphone adoption further supports the demand for minimalistic yet effective Body Gloves across both premium and mid-range devices.

Pouch covers maintain relevance by serving users who prefer full-device concealment and multi-functional usage. Their structured form offers detachable storage, smartphone screen protection, and dust resistance, ensuring consistent adoption in markets with higher outdoor usage. Additionally, their compatibility with varied phone sizes increases their placement within retail channels.

Phone Skin solutions and other segments progress steadily as personalization trends rise. Users choose skins for scratch resistance and aesthetic enhancements, especially among younger demographics. The Others category captures niche designs and emerging eco-friendly materials, reinforcing broader diversification in the mobile phone protective covers ecosystem.

By Case Type Analysis

Back Plate Cases dominate with 59.6% owing to strong demand for durable, easy-to-install rear protection.

In 2024, Back Plate Cases held a dominant market position in the By Case Type Analysis segment of the Mobile Phone Protective Covers Market, with a 59.6% share. Consumers prefer these cases for their drop resistance, slim build, and compatibility with camera modules and wireless charging systems.

Folio Cases continue gaining attention due to their multifunctionality, offering screen protection, card slots, and a book-style design. Their appeal increases among professionals seeking a premium, all-in-one protective option. As foldable and larger-display devices expand, folio-style covers experience consistent demand across global markets.

The other segment includes bumper frames, flip cases, magnetic cases, and designer variants. This sub-segment benefits from personalization and specialized use cases, such as enhanced grip, transparent aesthetics, and integrated kickstands. These covers enhance design flexibility and offer additional opportunities in niche consumer segments.

By Material Type Analysis

Silicon dominates with 46.8% due to its flexibility, affordability, and shock absorption.

In 2024, Silicon held a dominant market position in the By Material Type Analysis segment of the Mobile Phone Protective Covers Market, with a 46.8% share. Its soft-touch feel, non-slip surface, and drop resistance make it one of the most widely adopted materials across all smartphone categories.

Genuine and PU Leather segments attract users seeking premium aesthetics and long-lasting surface protection. These materials provide an elevated, professional appearance and maintain popularity across executive and luxury product lines. PU variants also offer cost-efficient alternatives, ensuring broader accessibility within mid-range consumer groups.

Plastic covers remain essential due to their lightweight structure, affordability, and customizable finishes. They appeal to mass-market consumers and support diverse styles, from transparent shells to printed designs. Their ease of manufacturing and compatibility across multiple device models maintain strong retail visibility.

The other segment encompasses emerging eco-friendly materials, hybrid composites, and rubber-based blends. These options appeal to environmentally conscious users and those seeking unique textures or reinforced durability. Their versatility promotes expansion across online marketplaces and specialty accessory brands.

By Distribution Channel Analysis

Offline dominates with 63.9% due to high retail visibility and immediate product access.

In 2024, Offline channels held a dominant market position in the By Distribution Channel Analysis segment of the Mobile Phone Protective Covers Market, with a 63.9% share. Physical stores benefit from consumer preference for touch-and-feel evaluation, immediate replacement, and personalized recommendations at purchase points.

Online distribution grows steadily as digital buying increases globally. E-commerce platforms offer extensive choices, competitive pricing, and quick delivery. Customized designs and exclusive online-only variants further support growth. This sub-segment continues expanding as smartphone ownership increases and digital payment adoption rises.

Key Market Segments

By Product

- Body Gloves

- Pouch

- Phone Skin

- Hybrid Cases

- Others

By Case Type

- Back Plate Cases

- Folio Cases

- Others

By Material Type

- Silicon

- Genuine and PU Leather

- Plastic

- Others

By Distribution Channel

- Online

- Offline

Drivers

Rising Shift Toward Shock-Absorbent and Impact-Resistant Material Innovations Drives Market Growth

The rising shift toward shock-absorbent and impact-resistant material innovations strengthens demand as consumers prefer cases that protect their devices during accidental drops. This trend accelerates as smartphone prices continue to rise, encouraging users to invest in covers that extend device lifespan. Manufacturers focus on advanced polymers, TPU blends, and hybrid constructions, which enhance overall product quality and market adoption.

The expansion of online smartphone accessory retailing across global e-commerce platforms further drives growth. Large marketplaces enable faster product discovery, comparison, and customization options, supporting higher sales volumes. Global e-commerce penetration also allows brands to reach consumers in emerging markets where offline accessory availability remains limited.

Increasing replacement frequency due to frequent smartphone upgrades also contributes to rising demand. As users switch devices more often, they purchase new protective covers aligned with updated models and designs. This upgrade cycle promotes recurring sales for manufacturers and online retailers.

Restraints

Fluctuating Raw Material Availability for Premium Protective Polymers Restrains Market Growth

Fluctuating raw material availability for premium protective polymers creates supply-side uncertainty, resulting in inconsistent manufacturing costs. Variability in prices for TPU, silicone, and hybrid materials may influence production planning and limit the introduction of advanced case designs. Manufacturers with smaller production capacities face the greatest challenges in maintaining stable output.

Rising counterfeit accessory penetration across informal retail channels restricts formal market expansion. Low-priced replicas reduce revenue opportunities for established brands and weaken consumer trust in case quality. Counterfeit circulation is particularly high in markets with large unorganized retail clusters, resulting in downward price pressure on genuine products.

Limited durability perception of low-cost protective cases also acts as a restraint. Many consumers view budget cases as short-term accessories rather than long-lasting protection tools, reducing brand loyalty. This perception slows demand for higher-margin products unless manufacturers clearly communicate durability benefits through marketing and design enhancements.

Growth Factors

Expanding Demand for Antimicrobial and Hygiene-Focused Smartphone Covers Offers Significant Growth Opportunities

Expanding demand for antimicrobial and hygiene-focused smartphone covers creates strong opportunities as consumers become more aware of device cleanliness. Interest in germ-resistant materials grew after global health concerns, encouraging manufacturers to integrate antimicrobial coatings that appeal to health-conscious buyers. This supports premium pricing and broader adoption across developed markets.

Increasing uptake of eco-friendly, biodegradable, and plant-based protective cases further enhances the opportunity. Rising environmental awareness leads consumers to prefer cases made from recycled plastics, wheat straw composites, or biodegradable polymers. Brands that embrace sustainability gain a competitive advantage and attract environmentally responsible buyers.

Emerging Trends

Surge in Transparent and Minimalistic Case Designs Shapes Key Market Trends

A surge in transparent and minimalistic case designs shapes current trends as users prefer covers that showcase premium smartphone aesthetics. Clear TPU and hybrid cases maintain the visual appeal of flagship devices while offering essential protection. This trend strengthens among consumers who value clean, simple, and elegant smartphone appearances.

The growing popularity of MagSafe-compatible and magnetic-mount phone cases also defines the market direction. As magnetic charging and accessory ecosystems expand, users increasingly adopt cases engineered for seamless magnetic alignment. This creates demand for precision-designed cases that support charging convenience and accessory integration.

Rising demand for multifunctional wallet-style and kickstand-integrated covers continues to trend as users seek utility-driven designs. These multifunctional cases serve as card holders, viewing stands, and compact organizers, supporting convenience during travel, entertainment, and daily use. This trend appeals to buyers who want a single accessory serving multiple purposes.

Regional Analysis

Asia Pacific Dominates the Mobile Phone Protective Covers Market with a Market Share of 53.8%, Valued at USD 13.7 Billion

Asia Pacific maintains the leading position in the Mobile Phone Protective Covers Market due to its fast-growing smartphone user base, strong penetration of mid-range and premium devices, and rapid expansion of online retail channels across emerging economies. The dominance of the region reflects high replacement frequency, evolving fashion-driven purchasing behavior, and strong demand for customized and ruggedized protective covers. The region’s large youth population and increasing 4G/5G adoption further support the market’s strong growth trajectory, aligning with its substantial 53.8% share worth USD 13.7 billion in 2024.

North America Mobile Phone Protective Covers Market Trends

North America shows steady growth supported by a high concentration of premium smartphone users who prefer advanced, impact-resistant, and designer-focused protective covers. The region benefits from strong e-commerce penetration and consistent consumer interest in protective technologies such as MagSafe-compatible cases. Higher disposable incomes and a strong inclination toward branded and high-quality materials also strengthen regional sales.

Europe Mobile Phone Protective Covers Market Trends

Europe records stable demand driven by rising smartphone replacement cycles and growing adoption of environmentally conscious protective case materials. Consumers in the region increasingly seek durable, stylish, and sustainable cases, supporting the market’s shift toward biodegradable and plant-based alternatives. Offline specialty stores and expanding digital retail ecosystems contribute to consistent market performance.

Middle East and Africa Mobile Phone Protective Covers Market Trends

The Middle East and Africa experience moderate growth as smartphone penetration expands across urban centers and younger populations adopt more advanced devices. Consumers increasingly prioritize protective covers that offer both affordability and durability. Growing online shopping habits and improving retail connectivity further enhance product availability across regional markets.

Latin America Mobile Phone Protective Covers Market Trends

Latin America continues to develop as rising smartphone ownership and increased preference for budget-friendly accessories support demand. Economic recovery across key countries encourages consumers to upgrade devices and purchase protective covers that balance style with practicality. Online marketplaces and local accessory manufacturers play an essential role in boosting accessibility.

United States Mobile Phone Protective Covers Market Trends

The United States exhibits a strong interest in high-performance protective covers driven by a large premium smartphone ecosystem and frequent device upgrades. Consumers prefer technologically advanced cases with shock-absorbent materials, magnetic compatibility, and minimalist design trends. High adoption of digital retailing and strong accessory culture enhance the market’s overall expansion within the country.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Mobile Phone Protective Covers Market Company Insights

The global Mobile Phone Protective Covers Market in 2024 shows strong competitive intensity as consumers prioritize durability, style, and compatibility with advanced smartphone features. Within this landscape, Otter Box remains a dominant influence due to its commitment to rugged protection and multi-layered case engineering. The brand continues to appeal to users who prioritize high-impact resistance, supporting steady demand among outdoor professionals and premium smartphone owners seeking long-lasting security.

Spigen maintains a strong position by blending sleek design with affordability, making it a preferred choice for mainstream smartphone users. Its broad product range covers slim, hybrid, and armor-style cases, giving the company an edge in meeting varied consumer needs without compromising aesthetic appeal. The brand’s consistent focus on lightweight protection keeps it competitive in both online and offline retail channels.

UAG (Urban Armor Gear) strengthens its footprint by focusing on military-grade, ruggedized protective cases designed for extreme environments. Its angular and reinforced designs attract adventure-oriented users who require enhanced durability. The brand’s reputation for shock resistance and compatibility with flagship smartphones drives continued interest within niche but loyal user segments.

Tech21 differentiates itself through material science and impact-absorbing technologies that aim to minimize device damage from frequent drops. Its emphasis on transparent and slim-profile designs appeals to consumers who want visible device aesthetics while maintaining effective protection. The brand’s innovation-led positioning helps it sustain strong visibility across global retail networks.

Top Key Players in the Market

- Otter Box

- Spigen

- UAG (Urban Armor Gear)

- Tech21

- Casetify

- Mous

- ESR

- Ringke

- Nillkin

- Speck

Recent Developments

- In September 2024, OtterBox launched a full suite of cases for the iPhone 16 lineup, adding MagSafe compatibility and Camera Control support along with redesigned Defender and Symmetry series cases to boost appeal among premium users.

- In January 2025, OtterBox introduced new rugged cases for the Samsung Galaxy S25 series — including Symmetry and Defender Series models — reinforcing its position in the Android segment and expanding coverage beyond Apple devices.

Report Scope

Report Features Description Market Value (2024) USD 25.5 Billion Forecast Revenue (2034) USD 51.11 Billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Body Gloves, Pouch, Phone Skin, Hybrid Cases, Others), By Case Type (Back Plate Cases, Folio Cases, Others), By Material Type (Silicon, Genuine and PU Leather, Plastic, Others), By Distribution Channel (Online, Offline) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Otter Box, Spigen, UAG (Urban Armor Gear), Tech21, Casetify, Mous, ESR, Ringke, Nillkin, Speck Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mobile Phone Protective Covers MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Mobile Phone Protective Covers MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Otter Box

- Spigen

- UAG (Urban Armor Gear)

- Tech21

- Casetify

- Mous

- ESR

- Ringke

- Nillkin

- Speck