Global Mobile Number Verification Market Size, Share, Industry Analysis Report By Component (Software, Services), By Deployment Mode (On-Premises, Cloud), By Organization Size (Small and Medium Enterprises, Large Enterprises), By Application (BFSI, E-commerce, Healthcare, IT and Telecommunications, Government, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034.

- Published date: Dec. 2025

- Report ID: 170990

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Market and Revenue Statistics

- Role of Generative AI

- U.S. Market Size

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- Application Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

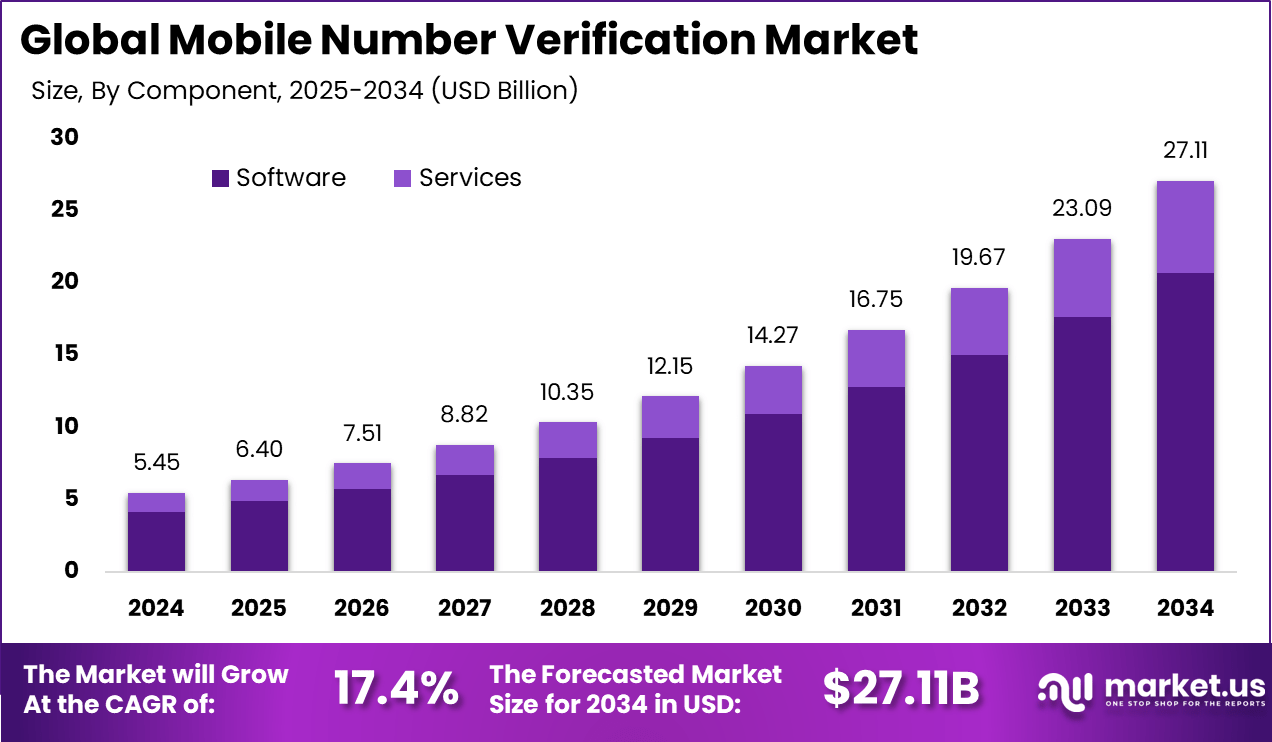

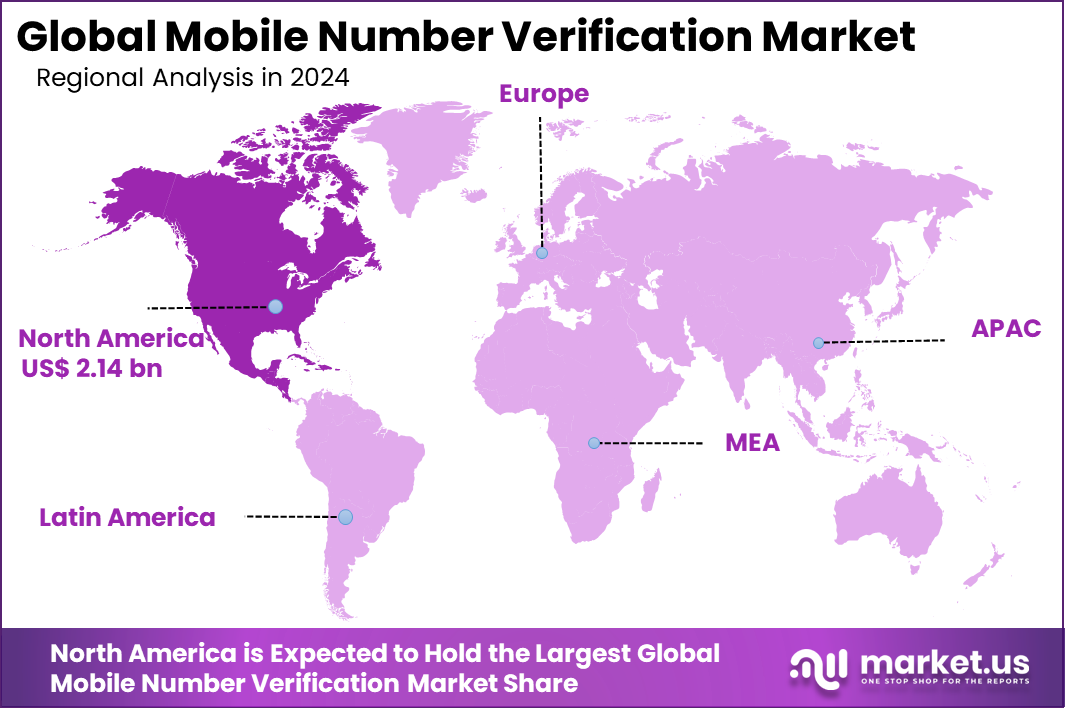

The Global Mobile Number Verification Market size is expected to be worth around USD 27.11 billion by 2034, from USD 5.45 billion in 2024, growing at a CAGR of 17.4% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 39.3% share, holding USD 2.14 billion in revenue.

The mobile number verification market refers to services and solutions that confirm whether a mobile phone number provided by a user is valid, active, and legitimately associated with that person or account. Verification typically leverages SMS codes, OTPs or network-based identity checks to authenticate users during onboarding, login, or transaction flows. These solutions help businesses manage digital identity, reduce fraud, support regulatory compliance, and improve overall trust in user-initiated activities on digital platforms.

Mobile number verification is commonly used across finance, e-commerce, healthcare, telecom, and government applications. This market plays a crucial role in safeguarding digital interactions by helping organisations verify the identity of users and reduce malicious activity. Mobile verification provides a foundational check that a phone number is active and reachable, which is often a first step in broader identity confirmation processes such as Know Your Customer (KYC) requirements in financial services.

According to plivo, verification has become critical as nearly 90% of businesses report revenue losses of up to 9% due to fraud, while consumers face losses totaling around USD 10 billion. As organizations expand their digital presence, these figures highlight that protecting customer data is essential to reduce financial risk and maintain trust.

Verifying mobile numbers reduces the risk of synthetic identities and fraudulent accounts, supports secure customer onboarding, and enhances communication reliability for alerts and transaction confirmations. In sectors where accurate identity verification is mandatory, such solutions help improve confidence in user records and operational data.

For instance, in January 2025, Infobip teamed up with Bharti Airtel and Vodafone Idea in India for Silent Mobile Verification (SMV), slashing app login friction without SMS OTPs. This telco partnership expands their U.S.-rooted network APIs, hitting fraud head-on in high-growth markets.

Key Takeaway

- In 2024, the software segment led the market with a 76.5% share.

- In 2024, on-premises deployment dominated with a 62.4% share.

- In 2024, large enterprises accounted for 68.5% of adoption.

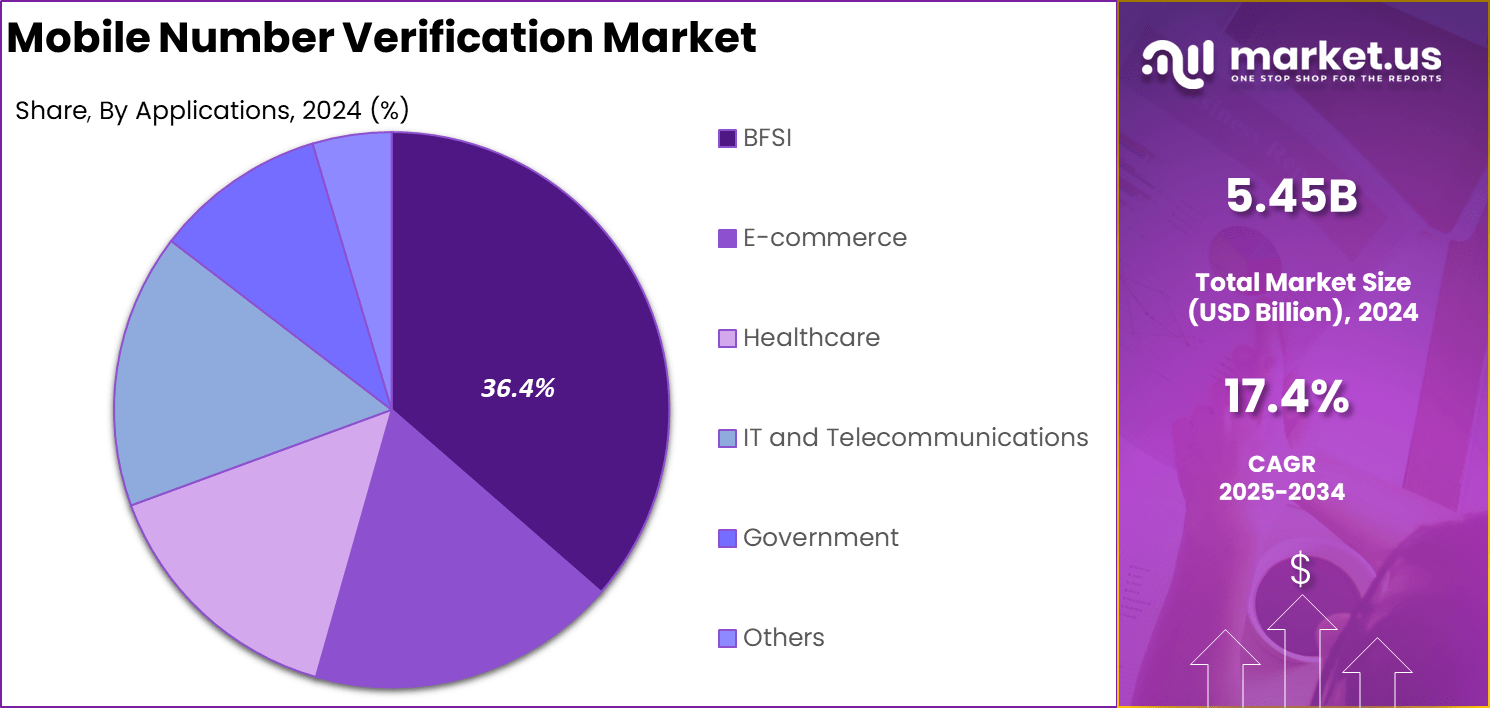

- In 2024, the BFSI sector held a 36.4% share due to high security needs.

- In 2024, the U.S. market showed strong momentum with a 15.0% growth rate.

- In 2024, North America led globally with over 39.3% share.

Market and Revenue Statistics

- Mobile identity revenue is expected to reach $25.5 billion by 2025.

- Revenue is projected to grow to $42.7 billion by 2029, a rise of 68%.

- Around 90% of businesses lose up to 9% of revenue due to fraud.

- Mobile verification is becoming essential for revenue protection.

- Multi-factor authentication can block 99.9% of automated attacks.

- Weak verification exposes consumers to nearly $10 billion in annual fraud losses.

- India’s Sanchar Saathi portal blocked 43.05 lakh mobile handsets by September 2025.

- The same initiative traced 26.70 lakh mobile devices.

- Regulatory action is strengthening mobile identity enforcement.

- Fraud prevention is a key driver of mobile verification adoption.

Role of Generative AI

Generative AI steps in to make mobile verification tougher against fraud by spotting patterns humans miss. Banks now use it to scan transactions in real time, checking things like unusual locations or device changes tied to a phone number.

A report shows 92% of financial groups see fraudsters using AI tools like deepfakes for fake verifications, so defenses generate synthetic bad examples to train systems better. This leads to 15-20% higher catch rates for odd mobile OTP attempts without bothering real users too much.

The tech also builds user behavior profiles from phone data, like typing speed or login times, to flag risks during verification. In payments, it creates fake fraud scenarios to keep models sharp as tricks evolve. Over three-quarters of banks focus AI here for stronger phone-based checks, blending it with OTP for layered protection that feels smooth.

U.S. Market Size

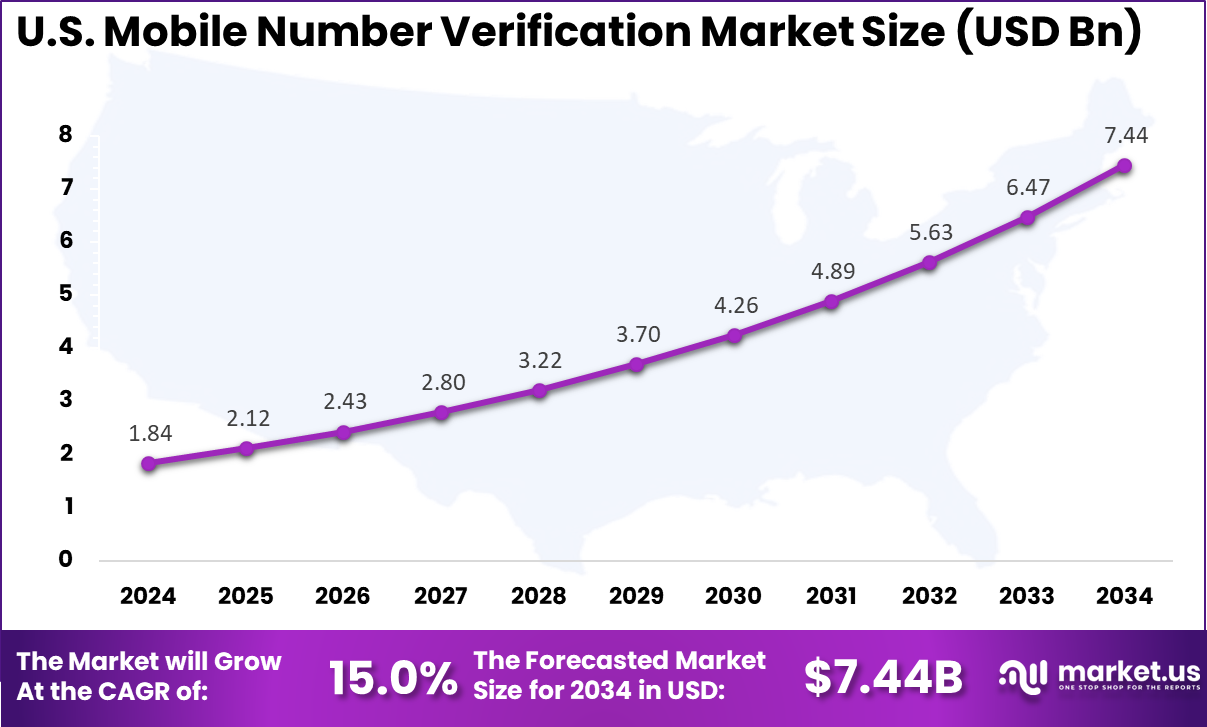

The United States reached USD 1.84 Billion with a CAGR of 15.0%, reflecting steady expansion of verification services. Growth is driven by increased online transactions and digital identity requirements. Enterprises continue to strengthen authentication frameworks.

For instance, in May 2025, Telesign was named a G2 Spring 2025 Leader in Authentication and Risk-Based Authentication, verifying over five billion unique phone numbers monthly. This recognition reinforces U.S. leadership in high-accuracy digital identity solutions for fraud prevention worldwide.

In 2024, North America held a dominant market position in the Global Mobile Number Verification Market, capturing more than a 39.3% share, holding USD 2.14 billion in revenue. This dominance is due to widespread mobile adoption and tough regulations like CCPA that require strong phone checks to fight fraud.

Businesses in banking and e-commerce lean on OTPs and silent verification for quick user onboarding. High-tech investments help scale these tools across apps, while rising cyber risks push large firms to protect customer data effectively.

For instance, in November 2025, Vonage became the first to launch Fraud Prevention Network APIs, including Silent Authentication and SIM Swap detection, across all major U.S. carriers, enhancing phone number verification for identity protection. This innovation from its New Jersey headquarters underscores North America’s dominance in scalable, carrier-agnostic solutions that combat sophisticated fraud in real-time.

Component Analysis

In 2024, The Software segment held a dominant market position, capturing a 76.5% share of the Global Mobile Number Verification Market. They excel at real-time checks using OTPs and risk scoring, which speed up user onboarding in apps. Businesses rely on these tools to block fake numbers and handle high transaction volumes without extra hardware.

Integration into mobile platforms happens smoothly, cutting fraud risks effectively. This dominance comes from the need for fast, scalable verification in daily digital interactions. The shift toward software reflects broader trends in digital security. Companies find it easier to update and customize these systems for specific needs.

Silent authentication features add layers of protection without slowing users down. As mobile usage grows, software keeps pace by supporting global standards and compliance rules. Its flexibility makes it the go-to choice over hardware alternatives in most cases.

For Instance, in October 2025, Twilio updated its Verify API with new fields for toll-free verification, strengthening software-based phone checks. This change helps businesses handle regulatory needs for OTP delivery and number validation seamlessly. Software tools like these dominate because they process real-time data without hardware, fitting high-volume app integrations.

Deployment Mode Analysis

In 2024, the On-Premises segment held a dominant market position, capturing a 62.4% share of the Global Mobile Number Verification Market. These setups let organizations build custom security features like encryption and detailed logs. Sectors with strict privacy rules prefer this to avoid cloud vulnerabilities. Full ownership ensures verification processes align perfectly with internal policies. It builds trust in every phone number check performed.

Data sovereignty plays a big role in this preference. On-premises systems keep information local, meeting regional laws head-on. Customization allows for tailored risk engines that fit unique workflows. While cloud options exist, many stick with on-site for reliability during peak loads. This approach supports long-term stability in verification operations.

For instance, in September 2025, Vonage (Nexmo) retired its Number Verification API, shifting to an on-premises compatible Verify API with silent authentication. Developers gain control over fallbacks like SMS or voice, suiting on-site setups for data-sensitive operations. On-premises stays popular for custom security layers.

Organization Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 68.5% share of the Global Mobile Number Verification Market. They deploy verification to safeguard customer data across borders and teams. Resources enable custom builds that link real users to numbers accurately. Regulations push them to adopt robust systems early. This leads to widespread use in global setups.

Complexity in large firms demands advanced features like multi-factor checks. These organizations handle millions of verifications daily, needing seamless scaling. Investments in tech infrastructure give them an edge over smaller players. Verification becomes a core part of their security strategy, reducing breach risks significantly.

For Instance, in September 2025, Infobip expanded SMS via Microsoft Azure to 100+ countries, aiding large enterprises with global verification scale. This integration supports high-volume OTPs and number lookups for enterprise customer onboarding without disruptions.

Application Analysis

In 2024, The BFSI segment held a dominant market position, capturing a 36.4% share of the Global Mobile Number Verification Market. Banks confirm genuine numbers before loans or transfers, meeting anti-money laundering rules. Mobile banking relies on quick checks to keep users safe online. This sector drives demand with its high fraud exposure. Speed matches safety in daily ops.

In insurance and finance apps, it verifies users at signup to cut fake claims. Real-time alerts flag issues early, saving costs. Compliance teams value their audit trails for reviews. As digital shifts grow, BFSI pushes for better phone links. It remains core to secure financial flows.

For Instance, in May 2025, Telesign topped G2 rankings in authentication for BFSI risk-based checks. Their phone verification APIs integrate with banking systems to confirm numbers during high-value transfers, cutting account takeover risks effectively.

Emerging Trends

In the mobile number verification market, verification processes are being integrated more deeply into broader digital identity and access frameworks. Verification is no longer used only at account creation. It is now applied at multiple interaction points such as login, transaction confirmation, and sensitive action approval to ensure the authenticity of the user and the legitimacy of the number provided.

This multi stage application of mobile verification supports consistent identity checks and reduces the chances of unauthorized access or account compromise. The shift toward layered validation processes reflects a broader emphasis on secure user lifecycles and friction controlled user interaction, which strengthens trust in digital services.

Another trend is the evolution of verification techniques beyond basic one time password methods to more sophisticated approaches that leverage device based checks and automated authentication responses. Methods that validate the existence and status of a mobile number at the network level are gaining traction, supporting faster and more reliable verification that also improves user experience.

These innovations reflect the increasing demand for both security and simplicity in user verification processes. The adoption of real time verification methods that reduce manual input while maintaining strong assurance levels is becoming more widespread as businesses strive to improve conversion rates and reduce drop offs during onboarding.

Growth Factors

A principal growth factor for mobile number verification arises from the widespread adoption of digital services that depend on verified user identities. With more online transactions, digital interactions, and services requiring authenticated participation, businesses are placing greater emphasis on ensuring that phone numbers tied to accounts are valid and genuinely controlled by the user.

This trend supports stronger security postures and helps manage risks associated with fraud and misrepresentation, particularly where accounts grant access to sensitive information or financial capabilities. Verification of user mobile numbers has become a foundational step in protecting digital engagements.

Another significant factor driving market expansion is the rising concern over fraud and identity misuse in digital ecosystems. Phone number verification solutions help organizations detect and prevent fraudulent activities such as unauthorized account creation or access attempts by confirming the authenticity of contact details early in the user journey.

This protective function is valued by industries that handle personal data, financial information, or regulated services where verification of identity plays a key role in meeting compliance and customer protection goals. As awareness of these risks grows, so does the integration of rigorous mobile number verification practices across digital platforms.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- On-Premises

- Cloud

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Application

- BFSI

- E-commerce

- Healthcare

- IT and Telecommunications

- Government

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Digital Fraud Threats

Online fraud incidents have increased sharply, driving businesses to adopt mobile number verification as a critical security layer for sign-ups and logins. Financial institutions, e-commerce firms, and online service providers use this step to filter out fake accounts and reduce instances of account takeovers and payment-related scams. Growing digital activity has created a visible correlation between online engagement and cyber fraud exposure, reinforcing the need for mobile verification to ensure user authenticity.

Post-pandemic growth in mobile transactions has made fraud prevention tools indispensable for maintaining customer trust. Companies report that mobile number verification not only reduces fraud-related losses but also improves conversion by minimizing customer drop-offs during registration. As digital ecosystems expand, rapid and secure user validation continues to drive adoption across multiple sectors.

For instance, in October 2025, Twilio rolled out new fields for Toll-Free verification to tackle rising scam traffic in key markets. This update helps businesses link numbers to verified entities, cutting fraud in high-risk logins. Banks and e-shops now use it to block fake accounts faster. The change aligns with global pushes against digital threats. Adoption spiked right after launch.

Restraint

High Setup Costs

Deploying mobile number verification systems involves significant initial expenses, covering hardware, software licensing, and team training. Small and mid-sized enterprises often find it challenging to absorb these costs, which restricts widespread adoption. Many stick to basic or manual verification methods to manage expenses, slowing overall market expansion despite evident long-term benefits.

Startups and small online retailers are especially vulnerable to high compliance and integration fees. Meeting security regulations can consume a large share of limited budgets, discouraging investment in advanced verification infrastructure. This financial gap strengthens the competitive edge of large organizations that can afford comprehensive verification systems.

For instance, in August 2025, Twilio faced new regulatory costs in Hungary for local number compliance starting in October. Businesses must submit detailed documents, hiking setup fees for verification systems. Small firms delay rollouts due to these expenses. Training and audits add to the burden. This slows adoption in tight-budget operations.

Opportunities

Growth in Emerging Markets

Rapid smartphone adoption in emerging economies such as India, Indonesia, and Vietnam is creating fresh avenues for mobile number verification solutions. The surge in mobile-based financial services, e-commerce, and government digital platforms is increasing demand for fast, low-cost verification tools. Affordable data plans and expanding digital literacy further accelerate this shift toward mobile-first authentication.

Government initiatives supporting digital identity programs and paperless transactions add to the sector’s growth potential. Vendors can partner with local telecom providers to embed verification solutions into regional networks, offering efficient access to vast and previously underserved populations. This combination of high connectivity and low security infrastructure paves the way for strong market expansion.

For instance, in January 2025, Infobip partnered with MobiFone in Vietnam for the Mobile Identity verification rollout. This taps booming smartphone use in emerging Asia for quick user checks. Local carriers share data to cut fake sign-ups seamlessly. Businesses gain from faster onboarding in high-growth markets. Deal promises wider regional reach.

Challenges

Strict Privacy Rules

Stringent data protection laws such as GDPR in Europe and CCPA in the U.S. impose strict compliance requirements on businesses offering verification services. Firms must obtain explicit user consent and ensure secure data handling, which adds to operational complexity and compliance costs. Non-compliance carries risks of heavy penalties, discouraging organizations from experimenting with new verification technologies.

The diversity of privacy frameworks across different regions further complicates global deployment. Companies must tailor their verification processes to each jurisdiction, leading to higher administrative overhead and delayed rollouts. Balancing strong authentication with transparency and privacy protection remains one of the market’s toughest challenges.

For instance, in October 2025, Infobip navigated India’s TCS rules demanding SIM-based checks and session limits. New privacy standards raise consent hurdles for verifications. Apps must balance security with data rules or face blocks. Global firms adjust to varying laws. This tests seamless rollouts.

Key Players Analysis

Twilio, Sinch, Nexmo (Vonage), Infobip, and MessageBird lead the mobile number verification market by providing API based solutions for OTP delivery, SMS verification, and voice authentication. Their platforms are widely used by banks, fintech firms, e commerce platforms, and social networks. These companies focus on global carrier reach, high delivery success rates, and low latency verification. Growing demand for secure digital onboarding continues to strengthen their market position.

Telesign, BICS, Authy, Experian, CLX Communications, GlobalSign, and IDology strengthen the market with fraud detection, risk scoring, and identity verification layers linked to mobile numbers. Their solutions help businesses prevent account takeovers and fake registrations. These providers emphasize data accuracy, compliance, and real time threat intelligence. Rising concerns around digital fraud and identity misuse support wider adoption.

Acision, Aeris Communications, Routee, Mitto, Data8, OpenMarket, Kaleyra, and other players expand the landscape with regional connectivity, carrier level verification, and value added messaging services. Their offerings support enterprise scale verification and omnichannel communication. These companies focus on flexibility, local market expertise, and cost efficiency. Increasing mobile first service adoption continues to drive steady growth in the mobile number verification market.

Top Key Players in the Market

- Twilio

- Sinch

- Nexmo (Vonage)

- Infobip

- Telesign

- BICS

- MessageBird

- TeleSign

- Authy

- Experian

- CLX Communications

- GlobalSign

- IDology

- Acision

- Aeris Communications

- Routee

- Mitto

- Data8

- OpenMarket

- Kaleyra

- Others

Recent Developments

- In October 2025, Twilio rolled out mandatory pre-registration for Alphanumeric Sender IDs in Tanzania specifically for OTP traffic, helping businesses ensure reliable SMS verification deliveries without relying on default IDs. This compliance update reflects Twilio’s focus on navigating global regulations to keep mobile verification seamless for clients worldwide.

- In August 2025, Vonage (Nexmo) launched its Identity Insights API in beta, delivering real-time phone number intel like carrier details and SIM swap status in one call. This tool sharpens verification for fraud detection and user personalization, making it easier for apps to validate numbers securely.

Report Scope

Report Features Description Market Value (2024) USD 5.4 Bn Forecast Revenue (2034) USD 27.1 Bn CAGR(2025-2034) 17.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (On-Premises, Cloud), By Organization Size (Small and Medium Enterprises, Large Enterprises), By Application (BFSI, E-commerce, Healthcare, IT and Telecommunications, Government, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Twilio, Sinch, Nexmo (Vonage), Infobip, Telesign, BICS, MessageBird, TeleSign, Authy, Experian, CLX Communications, GlobalSign, IDology, Acision, Aeris Communications, Routee, Mitto, Data8, OpenMarket, Kaleyra, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mobile Number Verification MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Mobile Number Verification MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Twilio

- Sinch

- Nexmo (Vonage)

- Infobip

- Telesign

- BICS

- MessageBird

- TeleSign

- Authy

- Experian

- CLX Communications

- GlobalSign

- IDology

- Acision

- Aeris Communications

- Routee

- Mitto

- Data8

- OpenMarket

- Kaleyra

- Others