Global Mobile and Wireless Backhaul Market Size, Share, Growth Analysis Report By Component (Equipment, Services), By Equipment (Microwave Equipment, Millimeter Equipment, Sub-6 GHz Equipment, Others), By Service (Network Services, System Integration Services, Professional Services), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132722

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

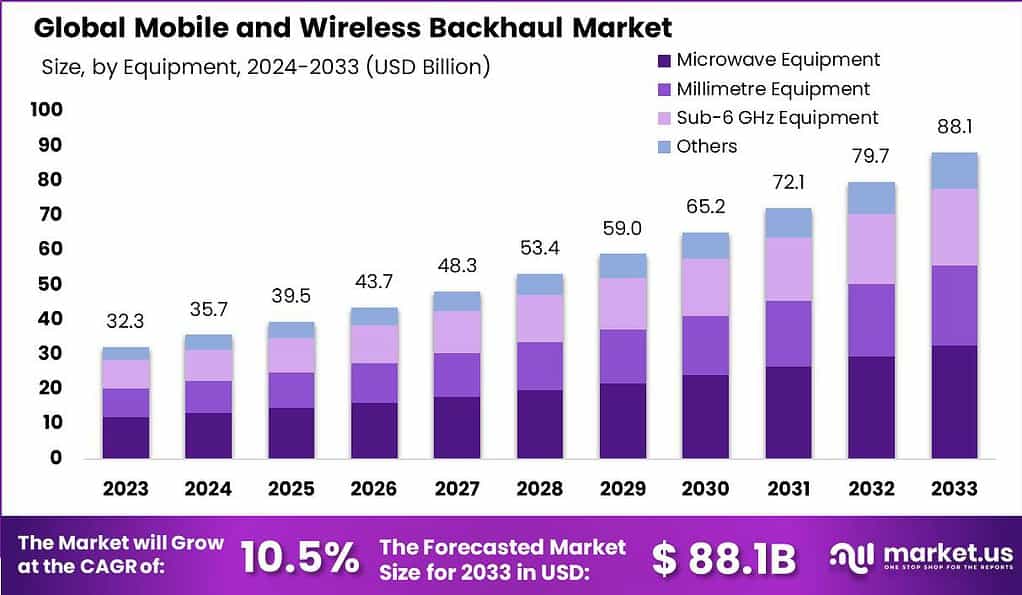

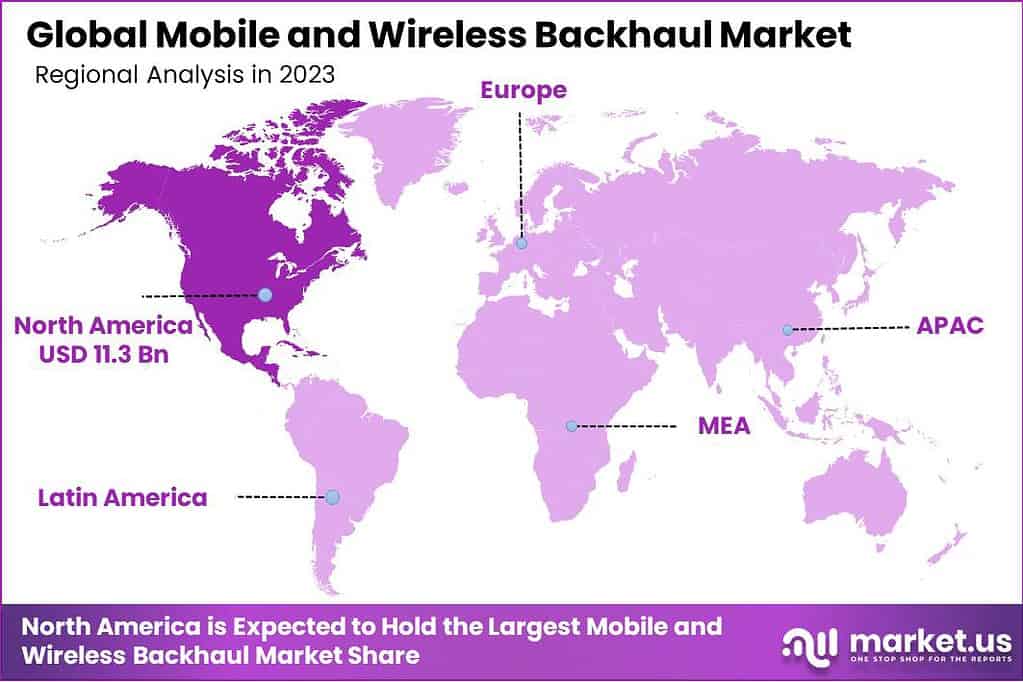

The Global Mobile and Wireless Backhaul Market size is expected to be worth around USD 88.1 Billion By 2033, from USD 32.3 Billion in 2023, growing at a CAGR of 10.56% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position geographically, capturing over 35% of the market share, with revenue reaching USD 11.3 billion.

Mobile and wireless backhaul refers to the process of transporting data from cell sites or other wireless network endpoints to a central data repository or the main network. This backhaul includes all the intermediate links between the core network and the small subnetworks at the edge of the entire hierarchical network. These connections are crucial for transmitting a wide range of data, allowing for efficient and reliable communication across different segments of the network.

The mobile and wireless backhaul market encompasses the technologies and services involved in the transportation of data from various wireless broadband, mobile stations, and services to the core of a telecommunication network. This market plays a pivotal role in expanding mobile network coverage and capacity, especially with the ongoing rollout of 5G networks which require dense, high-capacity backhaul solutions.

Key factors driving the mobile and wireless backhaul market include the rapid growth in mobile data traffic due to the surge in smartphone usage and internet penetration. The expanding deployment of 4G and 5G networks requires robust backhaul solutions to handle the increased data volumes efficiently. Additionally, the evolution of network technologies that necessitate higher bandwidth and faster transmission speeds continues to propel the demand for advanced backhaul solutions.

The demand for mobile and wireless backhaul solutions has surged as users increasingly rely on mobile devices for both personal and professional tasks. The massive adoption of 5G networks, with their low latency and high-speed capabilities, has amplified the need for robust backhaul systems. Also there is a notable uptick in mobile data consumption, necessitating more advanced backhaul solutions to ensure network efficiency and scalability.

The market is witnessing significant demand, particularly for solutions that support the efficient handling of the burgeoning data traffic from the Internet of Things (IoT) devices. Telecom service providers are increasingly investing in mobile and wireless backhaul infrastructure to support the growing number of IoT-ready networks and to manage the data effectively.

This is seen as a critical opportunity area for market players, as the successful deployment of these networks is essential for the next generation of mobile communication. Technological advancements are a cornerstone of the growth in the mobile and wireless backhaul market. Innovations in point-to-point (PTP) and point-to-multipoint (PTM) configurations, alongside improvements in network services and system integration, play a vital role.

The integration of newer technologies such as millimeter-wave, microwave, and sub-6 GHz equipment helps in enhancing the capacity and efficiency of backhaul networks. These technologies are pivotal in meeting the demands for higher data rates and supporting the dense deployments of small cells that are characteristic of modern urban telecommunications infrastructure

Key Takeaways

- The Global Mobile and Wireless Backhaul Market size is expected to reach USD 88.1 billion by 2033, up from USD 32.3 billion in 2023, growing at a compound annual growth rate (CAGR) of 10.56% during the forecast period from 2024 to 2033.

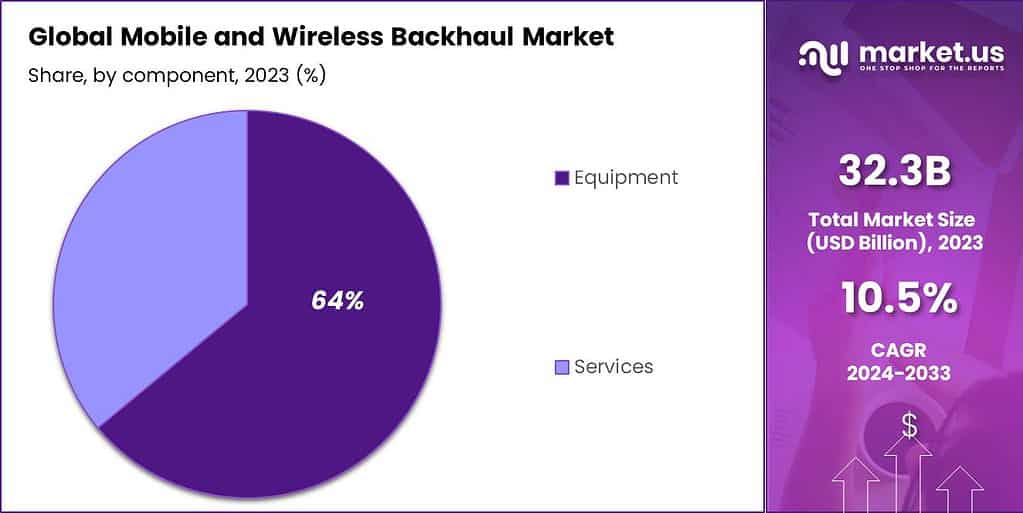

- In 2023, the Equipment segment held a dominant position in the Mobile and Wireless Backhaul Market, accounting for over 64% of the market share.

- The Microwave Equipment segment also held a significant share in the Mobile and Wireless Backhaul Market in 2023, capturing more than 37% of the total market.

- The Network Services segment led the Mobile and Wireless Backhaul Market in 2023, securing more than 40% of the market share.

- North America dominated the market in 2023, holding over 35% of the market share, with revenue reaching USD 11.3 billion.

Component Analysis

In 2023, the Equipment segment held a dominant market position within the mobile and wireless backhaul market, capturing more than a 64% share. This prominence can largely be attributed to the critical role that backhaul equipment plays in the telecommunications infrastructure, facilitating the efficient transmission of data across expansive network architectures.

As mobile operators globally push towards broader 4G coverage and the deployment of 5G networks, the demand for advanced backhaul equipment that can handle increased data volumes and provide reliable, high-speed connectivity has surged.

Moreover, the equipment segment benefits from continuous technological advancements in microwave, millimeter-wave, and sub-6 GHz technologies. These technologies are essential for supporting the dense deployments of small cells in urban areas and are increasingly preferred for their ability to offer high capacity over wireless data transmission links.

The sector’s growth is also driven by the ongoing expansion of mobile network infrastructure in emerging markets, where operators are rapidly building out new cellular sites to widen their service coverage areas. This expansion necessitates substantial investments in backhaul equipment, which forms the backbone of any mobile network.

Additionally, as networks grow denser and user expectations towards network quality increase, the role of sophisticated backhaul equipment in reducing bottlenecks and enhancing the overall network efficiency becomes increasingly vital.

Given these factors, the equipment segment of the mobile and wireless backhaul market is expected to maintain its dominance. Investment in R&D by leading companies further propels innovation in this segment, ensuring that backhaul equipment evolves in tandem with the demands of newer and more data-intensive network applications.

Equipment Analysis

In 2023, the Microwave Equipment segment held a dominant market position in the mobile and wireless backhaul market, capturing more than a 37% share. This leading role is primarily due to the extensive deployment of microwave equipment in mobile backhaul networks, which are valued for their cost-effectiveness and reliability over medium and long distances.

Microwave technology offers a balance of capacity and range, making it an ideal choice for connecting cell sites to nearby aggregation points without the need for physical cabling. Moreover, microwave equipment has advanced significantly, with enhancements that have increased its spectrum efficiency and capacity.

These improvements are crucial as mobile operators expand their networks to accommodate rising data traffic and transition from 4G to 5G technologies. The capacity to handle more data at higher speeds without significant additional investments has made microwave equipment a go-to solution in many regions, particularly where laying fiber is impractical due to geographical or economic factors.

Additionally, the adaptability of microwave equipment to different environmental conditions without the need for extensive physical infrastructure has facilitated its adoption in diverse geographical markets, from dense urban areas to remote locations. This flexibility, combined with the advancements in adaptive modulation technologies, has enabled microwave systems to maintain high levels of network performance and reliability, further contributing to their market dominance.

The continued evolution of microwave technology, coupled with its ability to meet the stringent requirements of modern telecommunication networks, ensures that the Microwave Equipment segment will likely sustain its significant market share. Investment in research and development by leading market players is poised to drive further innovations, reinforcing the segment’s essential role in the global mobile and wireless backhaul market.

Service Analysis

In 2023, the Network Services segment held a dominant market position in the mobile and wireless backhaul market, capturing more than a 40% share. This dominance can be attributed to the critical role network services play in the deployment, operation, and maintenance of backhaul infrastructure.

Network services ensure the seamless transmission of data across mobile networks, which is vital as operators strive to meet the increasing demands for high-speed and uninterrupted mobile internet connectivity. The increasing complexity of mobile networks, especially with the transition towards 5G, underscores the importance of sophisticated network services.

These services include network design, optimization, and proactive maintenance, which help in maximizing network performance and efficiency while minimizing downtime and disruptions. As mobile data traffic continues to grow, driven by the proliferation of mobile devices and content-rich applications, the need for robust network services that can manage and sustain large volumes of data becomes even more crucial.

Furthermore, network services are essential for integrating new technologies within existing infrastructure, a common challenge as networks evolve. They play a pivotal role in scaling up operations smoothly, particularly in densely populated urban areas where high data throughput and reliability are expected. The strategic deployment of these services helps operators enhance their service quality and customer satisfaction, which is vital for competitive differentiation in the telecommunications industry.

Given these dynamics, the Network Services segment is expected to maintain its significant share in the mobile and wireless backhaul market. Ongoing investments in network infrastructure and the push for more capable and efficient networks will likely fuel continued growth and innovation in this segment, making it a cornerstone of the global telecommunications ecosystem.

Key Market Segments

By Component

- Equipment

- Services

By Equipment

- Microwave Equipment

- Millimeter Equipment

- Sub-6 GHz Equipment

- Others

By Service

- Network Services

- System Integration Services

- Professional Services

Driver

Expanding Mobile Data Traffic and 5G Network Rollouts

With the rapid growth of mobile data traffic, the demand for seamless and high-speed connectivity continues to rise. This surge is largely fueled by the widespread adoption of smart devices, streaming services, and IoT-based applications.

As people increasingly depend on real-time data services like video calls, gaming, and augmented reality, the pressure on network operators to provide reliable, high-capacity networks has intensified. The roll-out of 5G networks compounds this need.

5G technology promises ultra-low latency, massive data transfer rates, and highly reliable connectivity, all of which demand robust mobile and wireless backhaul solutions to ensure optimal network performance.

Restraint

High Deployment and Maintenance Costs

One major barrier for the mobile and wireless backhaul market is the significant cost associated with deployment, expansion, and maintenance of backhaul infrastructure. Establishing and upgrading networks to support high-capacity data traffic often involve significant investments in fiber optics, microwave transmission, and supporting technologies.

For rural or less densely populated regions, these costs can be even more prohibitive, as the return on investment (ROI) tends to be lower due to fewer users. Additionally, maintaining and upgrading backhaul equipment to accommodate changing standards and increasing capacity requirements adds to ongoing expenses for network operators.

Opportunity

Emergence of Next-Gen Technologies and Smart City Projects

The rise of next-generation technologies like IoT, AI, and autonomous vehicles, along with smart city initiatives, presents a significant opportunity for the mobile and wireless backhaul market. Smart cities rely heavily on seamless connectivity for applications like traffic management, public safety, smart grids, and environmental monitoring.

These applications generate and require massive amounts of data to function effectively, creating a pressing need for high-capacity and low-latency backhaul solutions. The widespread adoption of IoT devices further accelerates this need, as billions of connected devices generate continuous streams of data that must be transported quickly and securely to centralized servers for processing and analysis.

Challenge

Spectrum Availability and Regulatory Issues

Spectrum availability remains a critical challenge for the mobile and wireless backhaul market. The use of spectrum bands for backhaul connectivity often competes with other applications and services, leading to congestion and limited availability. Regulations governing the allocation and use of spectrum vary from country to country, further complicating deployment efforts for global network operators.

Navigating these regulations and securing sufficient spectrum can be complex and costly, often requiring extensive negotiations with government bodies and industry stakeholders. Moreover, the evolving nature of spectrum allocation policies and the reallocation of bands for new uses, such as 5G, can create uncertainty and disrupt planned network deployments.

Emerging Trends

Mobile and wireless backhaul systems connecting cell sites to the core network are evolving rapidly to meet the demands of modern communication.

The deployment of 5G technology is a significant driver of this evolution, necessitating backhaul solutions that can handle increased bandwidth and lower latency requirements.The proliferation of small cells low-powered radio access nodes is also transforming backhaul strategies. These cells extend coverage and increase network capacity, especially in densely populated urban areas.

Another emerging trend is the integration of multi-access edge computing (MEC) into backhaul networks. By processing data closer to the end-user, MEC reduces network congestion and improves application performance, enhancing the overall user experience.

Additionally, the convergence of wireless and fiber backhaul is becoming more prevalent. While fiber offers high capacity and reliability, wireless backhaul provides flexibility and rapid deployment, especially in areas where laying fiber is challenging.

Business Benefits

Mobile and wireless backhaul are essential components of modern telecommunications, connecting cell towers to the core network and ensuring seamless data transmission. Implementing effective backhaul solutions offers several business advantages.

- Enhanced Network Capacity: By efficiently managing data traffic, backhaul solutions prevent congestion, leading to improved network performance and user satisfaction.

- Rapid Deployment: Wireless backhaul allows for quick setup, enabling businesses to establish connectivity in new locations without the delays associated with wired installations.

- Support for Advanced Technologies: Robust backhaul is crucial for the deployment of 5G networks, facilitating faster speeds and lower latency for advanced applications.

- Flexibility in Network Design: Wireless backhaul provides the flexibility to design networks that can adapt to various terrains and urban landscapes, enhancing coverage and connectivity.

- Facilitation of New Services: With robust backhaul, businesses can introduce new services like high-definition video streaming and real-time applications, meeting evolving customer expectations.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 35% share, with revenue reaching USD 11.3 billion. This significant market share can be attributed to several key factors like the region boasts a highly developed telecommunications infrastructure, which facilitates advanced backhaul solutions necessary for supporting increasing mobile traffic and the deployment of 5G networks.

Moreover, North America is home to some of the world’s leading telecom operators and backhaul service providers, who are continually investing in upgrading and expanding their network capabilities. The rapid adoption of mobile computing devices such as smartphones and tablets among consumers, coupled with the surge in data consumption due to streaming services, has pressured network operators to enhance their backhaul capacities.

Additionally, the U.S. and Canada are pioneers in technology adoption and have robust policies that support the growth of wireless infrastructure, which includes significant investments in 5G technologies. The governmental support for wireless technology enhancements further consolidates North America’s leading position in the global market.

APAC is expected to witness the fastest growth in the mobile and wireless backhaul market. This growth is driven by the increasing mobile subscriber base in densely populated countries such as China and India, combined with growing urbanization. Following, with a strategic focus on enhancing digital infrastructure and the aggressive rollout of 5G networks across the continent, European countries are rapidly adopting mobile and wireless backhaul solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

As the demand for high-speed connectivity and data-intensive applications grows, the role of key players in Mobile and wireless backhaul networks market becomes increasingly significant.

AT&T Inc. is a major player in the mobile and wireless backhaul market. This company has leveraged its extensive network infrastructure to provide robust backhaul solutions that support a wide range of services, from mobile internet to voice over LTE.

Cambridge Broadband Networks Ltd. specializes in wireless backhaul solutions using point-to-multipoint technology. Their innovative approach allows for efficient bandwidth management and exceptional service quality, especially in densely populated urban areas.

Cisco Systems Inc. is a global leader in IT and networking. In the realm of mobile and wireless backhaul, Cisco offers a variety of hardware and software solutions designed to ensure seamless data transmission between cellular networks. Their products are integral to building scalable, secure, and resilient backhaul networks that can support immense data traffic.

Top Key Players in the Market

- AT&T Inc.

- Bridgewave Communications Inc. (REMEC Broadband Wireless Networks)

- Broadcom Corporation (Avago Technologies)

- Cambridge Broadband Networks Ltd.

- Cisco Systems Inc.

- Ericsson AB

- Fujitsu Ltd.

- Huawei Technologies Co. Ltd.

- Nokia Oyj

- Tellabs Inc. (Marlin Equity Partners LLC)

- ZTE Corporation

- Other Key Players

Recent Developments

- In August 2023, EchoStar agreed to merge with DISH Network in an all-stock transaction, aiming to strengthen its wireless business. The merger was completed on December 31, 2023.

- In May 2024, T-Mobile announced plans to acquire the majority of UScellular’s wireless operations for approximately $4.4 billion. This deal includes about 30% of UScellular’s spectrum assets and leases on 2,700 towers. The transaction is expected to close by mid-2025.

Report Scope

Report Features Description Market Value (2023) USD 32.3 Bn Forecast Revenue (2033) USD 88.1Bn CAGR (2024-2033) 10.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Equipment, Services), By Equipment (Microwave Equipment, Millimeter Equipment, Sub-6 GHz Equipment, Others), By Service (Network Services, System Integration Services, Professional Services) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AT&T Inc., Bridgewave Communications Inc. (REMEC Broadband Wireless Networks), Broadcom Corporation (Avago Technologies), Cambridge Broadband Networks Ltd., Cisco Systems Inc., Ericsson AB, Fujitsu Ltd., Huawei Technologies Co. Ltd., Nokia Oyj, Tellabs Inc. (Marlin Equity Partners LLC), ZTE Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mobile and Wireless Backhaul MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Mobile and Wireless Backhaul MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- AT&T Inc.

- Bridgewave Communications Inc. (REMEC Broadband Wireless Networks)

- Broadcom Corporation (Avago Technologies)

- Cambridge Broadband Networks Ltd.

- Cisco Systems Inc.

- Ericsson AB

- Fujitsu Ltd.

- Huawei Technologies Co. Ltd.

- Nokia Oyj

- Tellabs Inc. (Marlin Equity Partners LLC)

- ZTE Corporation

- Other Key Players