Global Mineral Turpentine Oil Market Size, Share Analysis Report By Grade (Low Flash Point, Regular Flash Point, High Flash Point), By Application (Paint Thinner, Extraction Solvent, Cleaning Solvent, Degreasing Solvent, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164485

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

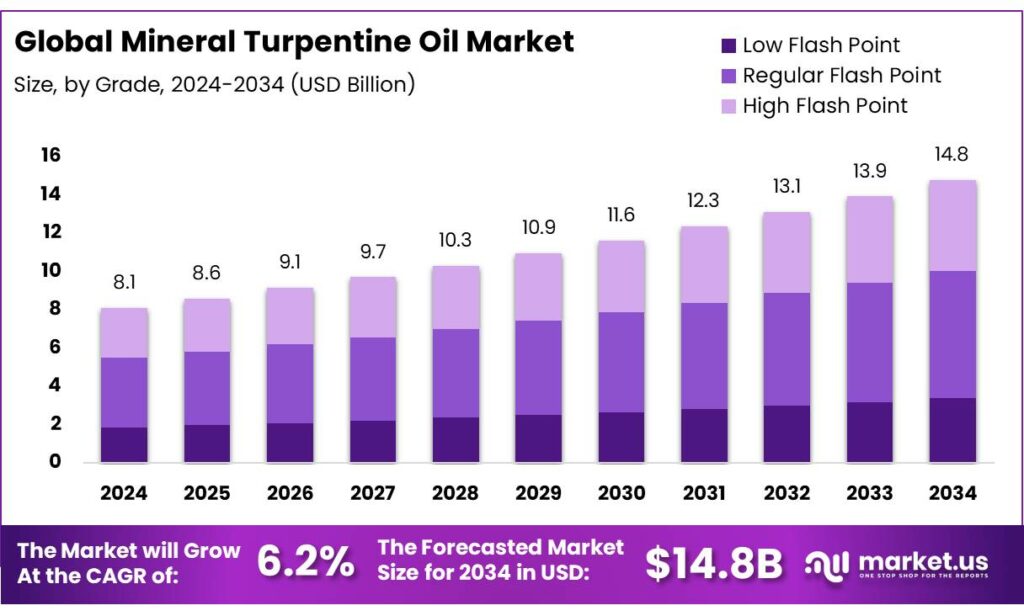

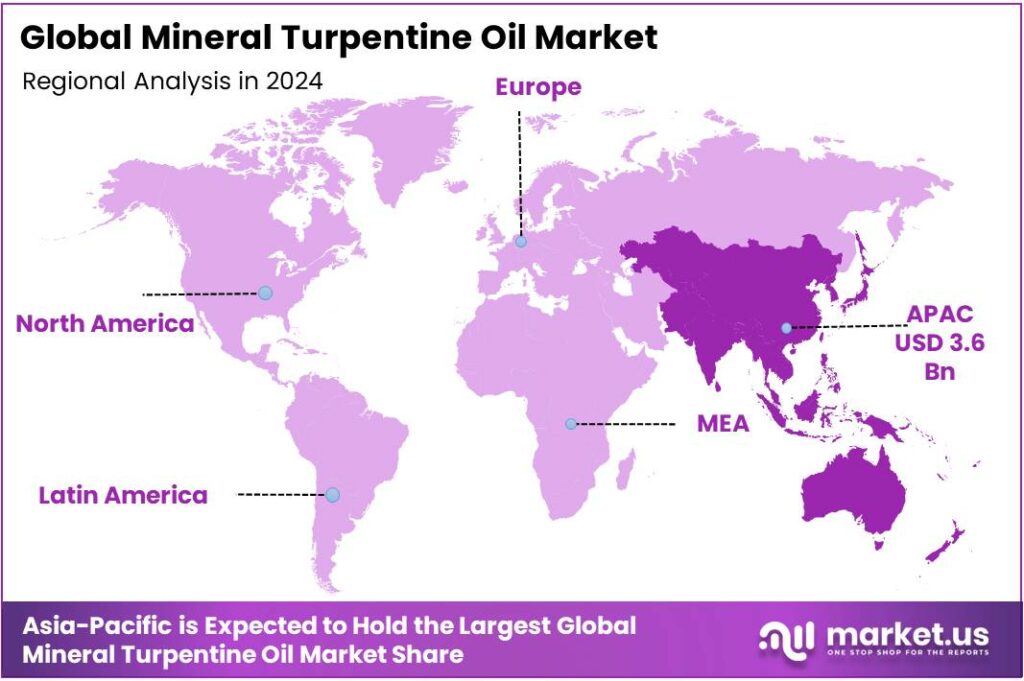

The Global Mineral Turpentine Oil Market size is expected to be worth around USD 14.8 Billion by 2034, from USD 8.1 Billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 44.8% share, holding USD 3.6 Billion in revenue.

Mineral Turpentine Oil (MTO)—also known as white spirit or Stoddard solvent—is a middle-distillate petroleum solvent standardized in India under BIS IS:1745. Typical specifications include flash point ≥30 °C (Abel), initial/ final boiling point around 125–145 °C / ≤ 205–240 °C, and aromatics ≤40% v/v, parameters that make it suitable for paints, coatings, printing inks, adhesives, and metal-cleaning formulations.

Industrial activity and architectural/industrial coating demand anchor MTO consumption, which is embedded within global oil products demand. The IEA projects total world oil use at ~103.9 mb/d in 2025, with petrochemical-linked streams providing most of the incremental growth—an indicator that solvent-grade streams and downstream coatings demand remain structurally relevant even as transport fuels plateau.

On the supply side, state-owned and private refiners produce MTO to the BIS grade and distribute it in bulk and drums. Hindustan Petroleum publicly states it holds > 50% share of the domestic MTO market, underscoring the product’s integration with large public-sector refining and marketing networks that assure nationwide availability to paint and allied industries. Specifications sheets from marketing companies align offers to the IS:1745 “145/205 low-aromatic” cut, supporting consistent solvent performance for formulators.

Macro-energy conditions influence MTO cost curves. The International Energy Agency projects global oil demand growth of roughly 0.7 mb/d in 2025, with supply expanding faster; the U.S. EIA likewise expects inventories to build and Brent to average $62/b in Q4 2025 and $52/b in 2026, easing solvent feedstock prices and supporting margins for users with solvent-intensive processes.

Regulation steers quality, safety and formulation trends. Worker exposure is governed by established occupational limits: OSHA PEL 500 ppm (2,900 mg/m³) 8-hr TWA, NIOSH REL 350 mg/m³ TWA with a 1,800 mg/m³ 15-min ceiling, and IDLH 20,000 mg/m³ for Stoddard solvent. These numeric thresholds drive ventilation, PPE selection and substitution toward low-aromatic or odorless grades in sensitive applications.

Key Takeaways

- Mineral Turpentine Oil Market size is expected to be worth around USD 14.8 Billion by 2034, from USD 8.1 Billion in 2024, growing at a CAGR of 6.2%.

- Low Flash Point held a dominant market position, capturing more than a 44.8% share of the global mineral turpentine oil market.

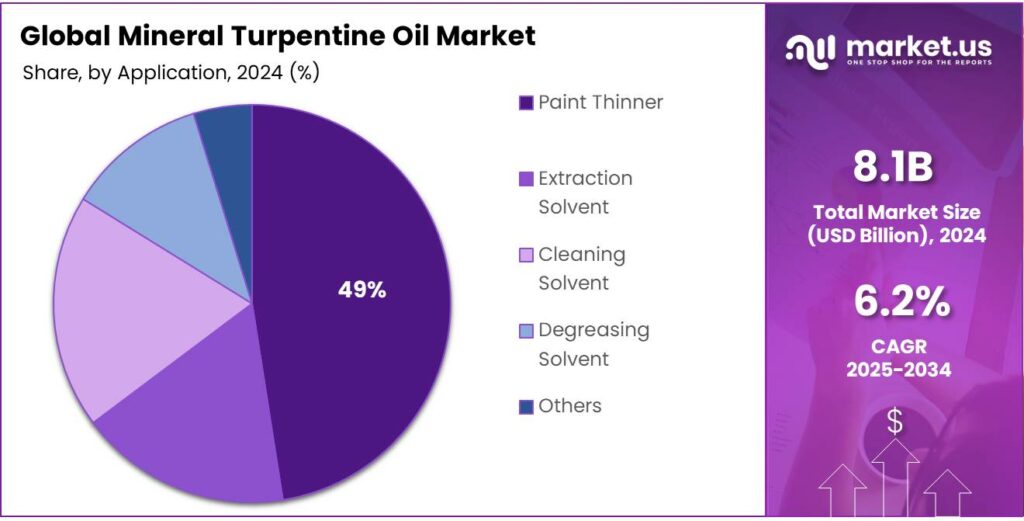

- Paint Thinner held a dominant market position, capturing more than a 49.9% share of the global mineral turpentine oil market.

- Asia-Pacific held a dominant position in the global mineral turpentine oil market, accounting for 44.8% of the total share and valued at approximately USD 3.6 billion.

By Grade Analysis

Low Flash Point Grade Leads the Market with 44.8% Share in 2024

In 2024, Low Flash Point held a dominant market position, capturing more than a 44.8% share of the global mineral turpentine oil market. This grade is widely preferred across paint, coatings, and cleaning industries due to its high solvency and faster evaporation rate, which makes it suitable for rapid-drying applications. The low flash point variant is particularly favored in regions with large-scale industrial production and automotive coating activities, where efficiency and cost control remain crucial.

The market growth for Low Flash Point grade in 2024 was supported by its extensive use in metal cleaning, varnish production, and oil-based paint formulations, where consistent viscosity and quick drying are required. Its broad adoption in developing economies, such as India and China, was driven by expanding construction and infrastructure projects, contributing significantly to overall demand. The product’s competitive pricing and compatibility with conventional coating systems have further reinforced its leading position in the segment.

By Application Analysis

Paint Thinner Dominates with 49.9% Share Owing to Its Extensive Industrial and Domestic Use

In 2024, Paint Thinner held a dominant market position, capturing more than a 49.9% share of the global mineral turpentine oil market. This segment has maintained its leadership due to the vital role mineral turpentine oil plays as a primary solvent in paints, varnishes, and coatings. The product’s excellent solvency, low cost, and compatibility with various alkyd-based systems have made it indispensable for both industrial and decorative paint applications. Its wide usage across construction, automotive, and furniture finishing industries further strengthened its market dominance during the year.

The strong market performance in 2024 was largely supported by growing construction and infrastructure projects worldwide, which boosted the demand for solvent-based paints and coatings. Rapid industrialization in emerging economies such as India, China, and Indonesia increased the consumption of paint thinner formulations for machinery maintenance and surface finishing. Additionally, small-scale workshops and domestic consumers continued to rely on mineral turpentine oil as an effective cleaning and thinning agent, reinforcing its stable demand base.

Key Market Segments

By Grade

- Low Flash Point

- Regular Flash Point

- High Flash Point

By Application

- Paint Thinner

- Extraction Solvent

- Cleaning Solvent

- Degreasing Solvent

- Others

Emerging Trends

Shift to low-odor MTO with closed-loop recovery in food-adjacent packaging

Food-sector throughput provides the pulse. The FAO reports the Food Price Index averaged 128.8 points in September 2025, 3.4% higher year-on-year, a sign of firm global demand that keeps processing lines busy and packaging volumes high—conditions that typically increase scheduled wash-ups and cleaning cycles.

FAO’s Cereal Supply and Demand Brief projects a global cereal stocks-to-use ratio of 30.6% in 2025/26, indicating “comfortable supply prospects.” These fundamentals translate into more ink and adhesive campaigns—and into more cleaning events where low-odor MTO remains operationally useful for tough residues that water-based cleaners struggle to lift.

India’s policy and infrastructure lens makes the trend even clearer. The Production Linked Incentive (PLI) scheme for food processing carries an outlay of ₹10,900 crore, and as of 31 October 2024 had already catalyzed ₹8,910 crore in investment across 213 locations and 2.89 lakh jobs, expanding the installed base of facilities that must run compliant cleaning and changeover routines.

Meanwhile, the Ministry of Food Processing Industries has approved 41 Mega Food Parks, creating dense hubs where processors, packaging converters, and logistics converge—ideal settings to deploy aromatic-controlled MTO with standardized SOPs and solvent-recovery loops that reduce emissions and cut solvent cost per shift.

Exports add a practical pull toward higher-grade, lower-odor options. APEDA notes that processed food contributed 23.4% of India’s agri exports in 2023–24, reinforcing the need for frequent artwork changes, multilingual labeling, and tighter hygiene protocols for diverse destination markets.

Drivers

Food And beverage processing and packaging boom

A powerful demand-side driver for Mineral Turpentine Oil (MTO) is the steady expansion of food and beverage processing—and the packaging, printing inks, and maintenance activities that support it. Food plants, canning lines, and packaging converters still use compliant, low-aromatic white-spirit grades for equipment cleaning, line flushing, and certain solvent-borne ink and coating systems.

India’s policy push is reinforcing this momentum. The Production Linked Incentive (PLI) scheme for food processing carries an outlay of ₹10,900 crore, aimed at scaling formal processing capacity and value addition—expansions that cascade into greater demand for packaging runs, line maintenance, and associated solvents such as MTO.

The government’s budget support is material. For FY 2024-25, the Ministry of Food Processing Industries received a Budget Estimate of ₹3,290 crore, a ~30% rise over the previous year’s revised estimate—funding that underwrites plant upgrades, cold chain, and quality infrastructure. These programs lead to more frequent cleaning cycles and more complex print/coating jobs, both of which raise solvent needs while tightening specifications toward low-odor, low-aromatic grades.

Export momentum adds another reinforcing loop. India’s agri-food and processed food exports reached about USD 49.4 billion in FY 2024-25, with processed products accounting for ~20.4% of that total. Exporters face stricter hygiene and labeling requirements, driving more line changeovers (and therefore cleaning) and more frequent packaging/ink adjustments for different markets. That lifts demand for high-purity solvents and for dearomatized, higher-flash MTO grades that help meet occupational exposure and VOC goals in long packaging shifts.

Global food price dynamics also matter because they influence processing throughput and packaging runs. FAO’s Food Price Index averaged 128.8 points in September 2025, 3.4% higher than a year earlier (though well below its 2022 peak). Periods of stronger commodity prices tend to bring faster turnover in staples and edible oils, prompting processors to schedule longer or more frequent shifts; this typically leads to more cleaning cycles and consumables use, including compliant white-spirit solvents for maintenance.

Restraints

Stricter food-packaging ink rules and MOH scrutiny

A major brake on Mineral Turpentine Oil (MTO) demand is the rapid tightening of food-packaging ink regulations and the scientific focus on mineral oil hydrocarbons (MOH) in food. India’s Food Safety and Standards (Packaging) Regulations, 2018 require that all printing inks used on food packages must conform to IS 15495 and that the printed surface must not directly contact food. These rules push converters toward low-migration, mineral-oil-free systems and away from white-spirit cleaners and solvent-borne inks that can complicate compliance.

European developments add pressure. In September 2023, the European Food Safety Authority updated its assessment of MOH in food. EFSA reported average dietary exposure to MOSH at 0.085–0.126 mg/kg body weight/day and 0.157–0.212 mg/kg bw/day at the 95th percentile for young populations. Crucially, EFSA reaffirmed that MOAH with three or more aromatic rings are genotoxic and carcinogenic, keeping regulators alert to any sources of MOH transfer—including mineral-oil-based inks and potential contamination from printed materials.

Policy measures are turning stricter guidelines into enforceable limits. The European Commission has highlighted EFSA’s 2023 opinion in its contaminant catalogue and, by late 2023/2025, was drafting maximum levels for MOAH in food, signalling forthcoming legal limits that will force rapid reformulation across printing, adhesives, and packaging operations connected to food. As maximum levels arrive, procurement teams will prioritise mineral-oil-free inks and low-VOC cleaners, further displacing MTO at converters and copackers.

Opportunity

Low-odor MTO for food-adjacent packaging clusters

India’s food-processing build-out is creating a practical opening for higher-grade, low-odor Mineral Turpentine Oil (MTO) in packaging and maintenance. The Production Linked Incentive (PLI) scheme for food processing carries an outlay of ₹10,900 crore through 2026-27, explicitly meant to scale formal manufacturing—more plants, more lines, and more packaging shifts that need reliable cleaning and ink/coating changeovers. This increases demand for dearomatized, higher-flash white-spirit grades that meet hygiene and worker-exposure expectations while remaining effective on stubborn residues.

Exports add a second tailwind. According to official APEDA data, India’s processed foods exports were about USD 7.70 billion in FY 2023-24, reflecting steady global demand for packaged foods. Separately, the Commerce Ministry reports fruits & vegetables exports rose to USD 3.87 billion in FY 2024-25, underscoring the need for compliant packaging, clear labeling, and frequent artwork changes for diverse destinations—each of which multiplies cleaning and changeover events.

Global food-market conditions also support throughput. FAO reports the Food Price Index averaged 128.8 in September 2025, 3.4% higher year-on-year; its cereals outlook shows record global cereal stocks approaching 898.7 million tonnes by end-2026 and a stocks-to-use ratio of 30.6% in 2025/26. When supply is comfortable and price signals are stable to slightly firm, processors run longer campaigns, and converters schedule more packaging lots.

Crucially, food-safety regulation is pushing quality, not elimination. In India, the Food Safety and Standards (Packaging) Regulations require inks to meet IS 15495 and prevent direct contact of printed surfaces with food. Many converters respond by phasing out mineral-oil-based inks on primary food contact, but they still need effective, low-odor cleaning agents for plates, aniloxes, metering systems, and laminators—especially during rapid changeovers.

Regional Insights

Asia-Pacific Leads the Mineral Turpentine Oil Market with 44.8% Share Valued at USD 3.6 Billion

In 2024, Asia-Pacific held a dominant position in the global mineral turpentine oil market, accounting for 44.8% of the total share and valued at approximately USD 3.6 billion. The regional growth is primarily attributed to the rapid expansion of the construction, automotive, and industrial manufacturing sectors across major economies such as China, India, Japan, and South Korea.

These countries collectively represent a significant portion of global solvent consumption, with mineral turpentine oil being a vital component in paints, coatings, and cleaning applications. The demand was further reinforced by the increasing production of alkyd-based paints and the surge in infrastructure renovation projects across the region.

China continues to be the largest contributor within the Asia-Pacific market, supported by its extensive manufacturing base and rising exports of industrial coatings. India has emerged as a key growth driver, owing to government-backed infrastructure programs such as the “Smart Cities Mission” and “Make in India,” which are fueling demand for paints and protective coatings. The expanding automotive and furniture industries in Southeast Asian nations such as Thailand and Indonesia have also boosted consumption levels.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Indian Oil Corporation Ltd is India’s largest downstream petroleum company, with a refining capacity of 80.55 MMTPA and a diversified product portfolio spanning fuels, pipelines and petrochemicals. While it is best known for fuels and lubricants, IOCL’s broad infrastructure and marketing footprint position it to supply solvents including mineral turpentine oil in the industrial sector. The company’s integrated model enables it to support solvent production from its refining stream and distribution through its extensive network.

Hindustan Petroleum Corporation Limited is a Maharatna public sector company with gross sales of about Rs 4,59,815 crore in 2023-24. Within its Bulk Fuels And Specialties business unit, HPCL markets a range of solvents including MTO and other specials for industrial customers. The company’s refinery-marketing infrastructure and industrial sales channels support its presence in the mineral turpentine oil segment.

Bharat Petroleum Corporation Limited is a major downstream state-owned entity. In its Industrial & Commercial business line, BPCL supplies Mineral Turpentine Oil meeting major paint manufacturers’ specifications, and also markets de-aromatised solvents as niche products. BPCL’s authoritative presence and solvent grade portfolio lend it a strong position in the solvent market, including mineral turpentine oils.

Top Key Players Outlook

- Indian Oil Corporation Ltd

- Hindustan Petroleum Corporation Limited

- Global Petro

- Sydney Solvents

- Powerzone Oil

- Bharat Petroleum Corporation Limited

- DHC Solvent Chemie GmbH

- Al Sanea

- GSB Chemical Co. Pty. Ltd

Recent Industry Developments

In 2024, Indian Oil Corporation Ltd operated with a refining capacity of about 80.55 million tonnes per annum (MMTPA) in its downstream business.

In 2024 Powerzone Oil Refinery, noted its standard offering with packaging in 200-litre drums and tailored bulk quantities, reflecting a transactional minimum order quantity of 200 litres.

Report Scope

Report Features Description Market Value (2024) USD 8.1 Bn Forecast Revenue (2034) USD 14.8 Bn CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Low Flash Point, Regular Flash Point, High Flash Point), By Application (Paint Thinner, Extraction Solvent, Cleaning Solvent, Degreasing Solvent, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Indian Oil Corporation Ltd, Hindustan Petroleum Corporation Limited, Global Petro, Sydney Solvents, Powerzone Oil, Bharat Petroleum Corporation Limited, DHC Solvent Chemie GmbH, Al Sanea, GSB Chemical Co. Pty. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mineral Turpentine Oil MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Mineral Turpentine Oil MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Indian Oil Corporation Ltd

- Hindustan Petroleum Corporation Limited

- Global Petro

- Sydney Solvents

- Powerzone Oil

- Bharat Petroleum Corporation Limited

- DHC Solvent Chemie GmbH

- Al Sanea

- GSB Chemical Co. Pty. Ltd