Global Military Vehicle Electrification Market By Technology (Hybrid, Fully electric), By Platform (Combat vehicles, Support vehicles, Unmanned armored vehicles), By System (Power Generation, Cooling Systems, Energy Storage, Traction Drive Systems, Power Conversion, Transmission System), By Mode of Operation (Manned, Autonomous/semi-autonomous) and By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 73089

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

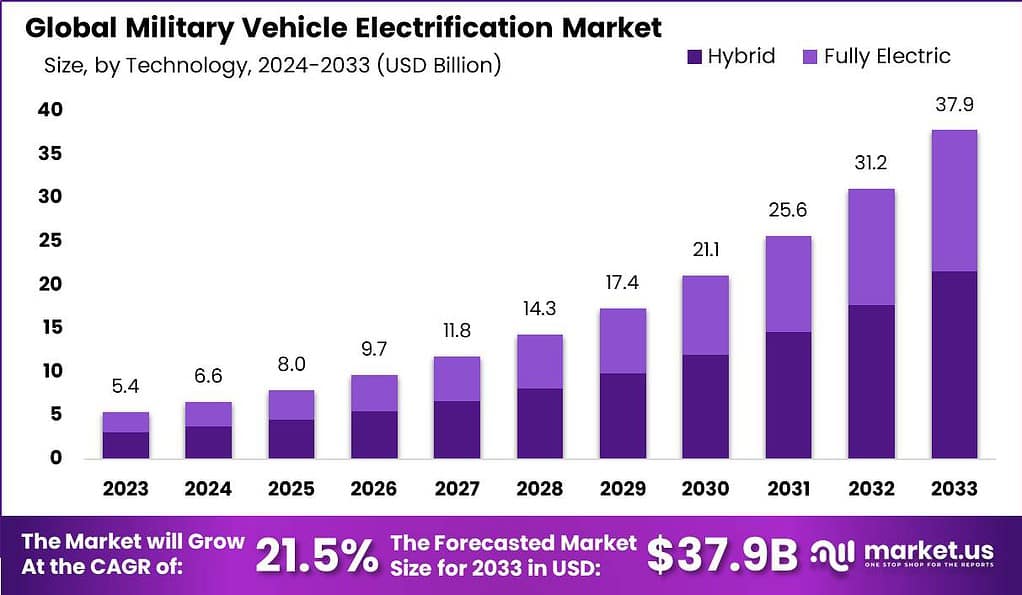

The Global Military Vehicle Electrification Market is anticipated to be USD 37.9 billion by 2033. It is estimated to record a steady CAGR of 21.5% in the Forecast period 2024 to 2033. It is likely to total USD 6.6 billion in 2024.

Military vehicle electrification refers to the process of incorporating electric power and propulsion systems into military vehicles, including tanks, armored vehicles, transport vehicles, and support vehicles. It involves replacing traditional internal combustion engines with electric motors, utilizing advanced battery technologies, and integrating sophisticated power management systems.

The primary goal of military vehicle electrification is to enhance the operational capabilities and efficiency of military fleets while reducing their environmental impact. Electric power systems offer several advantages over conventional combustion engines, including improved fuel efficiency, reduced emissions, and quieter operation. These benefits can contribute to enhanced stealth capabilities, longer operational range, and reduced logistical requirements for military missions.

The military vehicle electrification market refers to the global market for products and services related to the electrification of military vehicles. This market encompasses various components and systems, including electric motors, advanced batteries, power management systems, charging infrastructure, and integration services. IT is also influenced by government policies and regulations promoting the adoption of electric vehicles in the defense sector. Incentives and funding support from governments can accelerate the deployment of electric military vehicles and create a favorable market environment for industry players.

Analyst Viewpoint

One of the primary driving factors behind the surge in military vehicle electrification is the increasing global emphasis on sustainability and reduced carbon emissions. Governments and defense organizations worldwide are recognizing the need to align their military operations with environmentally responsible practices. Electrifying military vehicles represents a tangible step towards achieving this goal. As nations strive to meet their climate commitments, the demand for eco-friendly military solutions has intensified, propelling the adoption of electrified platforms.

The military vehicle electrification market presents significant opportunities for innovation, technological advancement, and sustainability within the defense industry. As governments and armed forces around the world increasingly prioritize reducing greenhouse gas emissions and enhancing operational efficiency, there has been a growing interest in electrifying military vehicles.

One key opportunity lies in the development and deployment of electric propulsion systems for various military vehicles, including tanks, armored personnel carriers, and logistics vehicles. Electric propulsion offers numerous advantages over traditional internal combustion engines, such as improved fuel efficiency, reduced maintenance requirements, and enhanced stealth capabilities. Additionally, electric drivetrains can provide instant torque, allowing for improved acceleration and maneuverability on the battlefield.

Key Takeaways

- The Military Vehicle Electrification Market is anticipated to expand from USD 6.6 Billion in 2024 to USD 37.9 billion by 2033. The market is expected to grow at a CAGR of 21.5% through 2033.

- In 2023, the hybrid segment held a dominant market position, capturing more than a 57% share in the military vehicle electrification market.

- In 2023, the Combat Vehicles segment held a dominant market position, capturing more than a 40% share in the military vehicle electrification market.

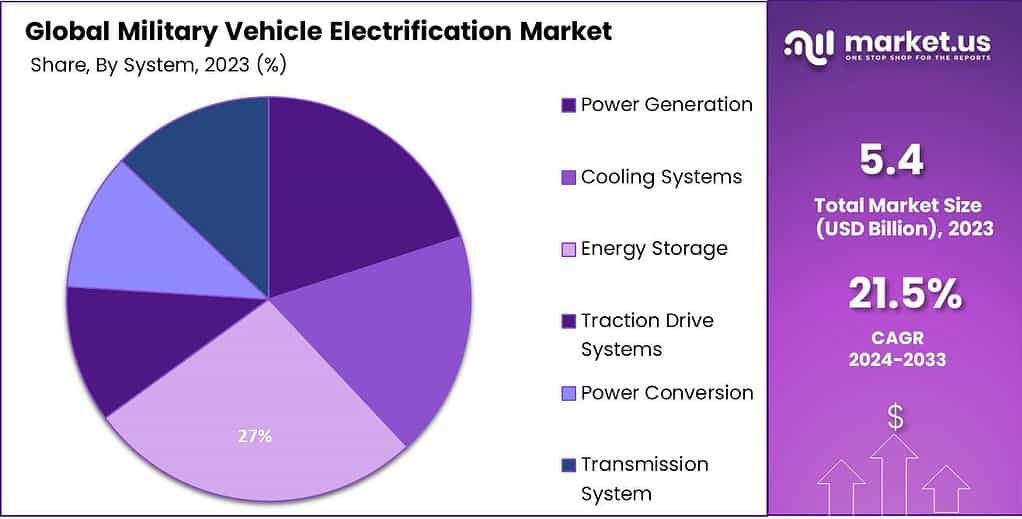

- In 2023, the Energy Storage segment held a dominant market position, capturing more than a 27% share in the military vehicle electrification market.

- In 2023, the Military Vehicle Electrification market witnessed the Manned segment taking a commanding position, accounting for a substantial market share exceeding 70%.

- In 2023, APAC (Asia-Pacific) emerged as the dominant region in the Military Vehicle Electrification Market, capturing more than a 31% share.

Technology Analysis

In 2023, the hybrid segment held a dominant market position, capturing more than a 57% share in the military vehicle electrification market. Hybrid military vehicles combine both traditional internal combustion engines (ICEs) and electric propulsion systems, offering a versatile and transitional solution for armed forces. The widespread adoption of hybrid technology can be attributed to several factors.

Firstly, hybrid military vehicles provide a seamless transition from conventional vehicles to fully electric ones. They allow armed forces to leverage the benefits of electric propulsion, such as improved fuel efficiency and reduced emissions, while still maintaining the familiarity and infrastructure compatibility of ICEs. This hybrid approach enables a gradual shift towards electrification without requiring immediate infrastructure upgrades or significant changes in operational practices.

Secondly, hybrid systems offer extended range capabilities, which are crucial for military applications. The combination of an ICE and electric drivetrain allows for greater operational flexibility and adaptability. Hybrid military vehicles can switch between electric mode for silent operations, reduced thermal signature, and improved stealth capabilities, and ICE mode for longer missions or when access to charging infrastructure is limited. This flexibility ensures that military vehicles can perform effectively in diverse operational environments and sustain longer missions without compromising performance.

Moreover, the hybrid segment benefits from the existing advancements in hybrid technology from the commercial automotive industry. The experience gained in developing hybrid passenger vehicles has paved the way for the adaptation of similar technologies in military applications. This cross-pollination of technology and expertise enables accelerated development and reduces the risks associated with deploying newer, fully electric powertrain solutions in military vehicles.

Platform Analysis

In 2023, the Combat Vehicles segment held a dominant market position, capturing more than a 40% share in the military vehicle electrification market. Combat vehicles, which include tanks, armored fighting vehicles, and infantry fighting vehicles, represent a significant portion of the demand for electrified military platforms. Several key factors contribute to the prominence of the Combat Vehicles segment.

Firstly, combat vehicles are at the forefront of military operations, requiring high levels of power, mobility, and agility. Electrification offers numerous advantages in these areas, making combat vehicles an ideal candidate for electrification efforts. Electric propulsion systems provide instant torque, enabling rapid acceleration and improved maneuverability on the battlefield. This enhances the responsiveness and effectiveness of combat vehicles in critical situations.

Secondly, combat vehicles often operate in close proximity to troops, necessitating reduced noise and thermal signatures for enhanced stealth capabilities. Electric propulsion systems offer quieter operation compared to conventional internal combustion engines, minimizing the acoustic signature of combat vehicles. Additionally, electric drivetrains generate less heat, reducing the thermal signature and making it more challenging for adversaries to detect the presence of these vehicles.

Moreover, combat vehicles typically have substantial power requirements to support various onboard systems, such as advanced weapon systems, communication equipment, and electronic warfare capabilities. Electrification enables more efficient power management, allowing combat vehicles to allocate power resources effectively and ensure the continuous operation of critical systems. This enhanced power management capability enhances the combat readiness and mission effectiveness of these vehicles.

Furthermore, combat vehicles are subject to stringent operational requirements, including durability, ruggedness, and survivability. Electric drivetrains offer advantages in these areas, as they have fewer moving parts compared to conventional engines, reducing the risk of mechanical failure and simplifying maintenance needs. This results in improved reliability and reduced downtime, contributing to the overall operational readiness of combat vehicles.

System Analysis

In 2023, the Energy Storage segment held a dominant market position, capturing more than a 27% share in the military vehicle electrification market. Energy storage systems play a crucial role in enabling the efficient and reliable operation of electrified military vehicles. Several key factors contribute to the prominence of the Energy Storage segment.

Firstly, energy storage systems provide the necessary power supply for electric military vehicles. They store electrical energy generated by the power generation system and supply it to various vehicle subsystems, including propulsion, onboard electronics, and auxiliary systems. The reliability and performance of energy storage systems directly impact the operational capabilities and mission endurance of military vehicles.

Secondly, energy storage systems contribute to the overall efficiency of electric military vehicles. They store excess energy during low-demand periods and release it when required, minimizing energy wastage and optimizing the utilization of available power. This improves the range and operational endurance of military vehicles, allowing them to perform missions for extended durations without the need for frequent recharging or refueling.

Moreover, the characteristics of energy storage systems, such as energy density, power density, and cycle life, directly influence the performance and capabilities of electric military vehicles. Higher energy density allows for increased energy storage capacity within a compact and lightweight package, enabling longer operational ranges. Similarly, higher power density ensures rapid energy discharge, facilitating quick acceleration and maneuverability on the battlefield. Extended cycle life ensures the longevity and reliability of energy storage systems, reducing the need for frequent replacements and maintenance.

Mode of Operation

In 2023, the Military Vehicle Electrification market witnessed the Manned segment taking a commanding position, accounting for a substantial market share exceeding 70%. This substantial market dominance can be attributed to several key factors. Firstly, the longstanding use of manned military vehicles has established a robust foundation within defense operations, with a wealth of experience and infrastructure already in place. Moreover, the trust in human control for mission-critical tasks remains high, as it offers a level of decision-making and adaptability that is not easily replicated by autonomous or semi-autonomous systems.

Additionally, the complexity of military operations often requires real-time human judgment and intervention, which has cemented the role of manned vehicles in various defense strategies. Furthermore, the gradual integration of electrification technologies into these manned vehicles has been pivotal in enhancing their operational efficiency, reducing carbon footprint, and ensuring sustainability – all of which resonate with the evolving global trend towards eco-friendly solutions.

As a result, the Manned segment continues to thrive and expand, combining the expertise of human operators with the advantages of electrification to bolster its dominant market position. While the shift towards autonomous and semi-autonomous modes is gaining momentum, the Manned segment remains an indispensable pillar of the Military Vehicle Electrification market.

Drivers

Increasing modern battlefield requirements such as silent mobility and low thermal signature

Stealth and covertness have become indispensable capabilities for military operations in the 21st century battlefield. Silent mobility and minimizing thermal signatures are critical requirements for special forces to conduct ambush attacks, infiltration missions or reconnaissance undetected. Even frontline combat vehicles need to reduce their acoustic and infrared signatures to avoid being spotted prematurely by the enemy.

This is driving widespread interest in electrifying military vehicles and platforms. Electric motors provide quiet, low heat operation compared to noisy, hot internal combustion engines. An electric drivetrain eliminates engine vibrations while auxiliary systems like transmissions, cooling pumps and exhausts that create sound and heat are minimized or eliminated. Combined with sound insulation around the cabin, electric military vehicles can run almost silently even at high speeds. Thermal scanning is also less effective against electric vehicles due to their lower heat signature and absence of hot exhaust.

Battery-powered electric propulsion gives military vehicles the ability to loiter silently in place over extended periods, which is near impossible for a idling engine. Electric power also enables the incorporation of active cooling systems to manage the vehicle’s thermal profile by channeling heat away from critical components. Stealth remains intact even when stationary for long durations.

The special forces community is particularly interested in leveraging electric vehicles for covert insertion and extraction during missions. Frontline forces also recognize the need to evade detection for as long as possible to gain tactical surprise. Vehicle electrification provides a tangible leap ahead in stealth capabilities that align closely with the way modern militaries need to operate to maintain the element of surprise and avoid threats.

Restraint

Enhancement in the power-to-weight ratio

While the advantages of electric drivetrains for military applications are clear, there remain technology constraints related to the power-to-weight ratio that is holding back widespread adoption currently. Militaries demand vehicles that are highly mobile with sufficient power while being as lightweight as possible for transportability. This requires a delicate balance that electric platforms are still struggling to achieve versus mature combustion engine technology.

Batteries continue to be the limiting factor, with energy density still lagging compared to diesel and other fuels. The bulk and weight of batteries powerful enough to match engine performance makes electric military vehicles much heavier. This affects mobility as well as transport – a key consideration given operational deployments. While battery densities are improving gradually, the pace may not match military requirements.

Electric motors also have some power-to-weight limitations, especially related to torque. The motors need to be oversized to provide enough torque for negotiating rough terrain or carrying heavy armor and weapons. This again increases platform weight. Cooling the motors and electronics adds more bulk. while power electronics remain comparatively heavy as well.

Alternative energy sources like fuel cells and hybrid systems are being explored to supplement batteries but come with their own complexities in military applications. Overall, the development of integrated electric power, propulsion and drivetrain components that minimize size and weight while maximizing power is still an evolving research area.

On the whole, the power-to-weight metric continues to favor mature combustion engine technology for the moment. While incrementally improving, batteries and electric motors still have ground to cover. Military engineers are hesitant about compromising mobility and deploy ability unless electric propulsion performance reaches parity with engines. This remains a restraining factor for now.

Opportunity

Demand for power resources

Modern militaries are deploying vast amounts of sophisticated electronics, sensors and communications technology on their platforms. These advanced systems have steep power requirements well beyond what mechanical and hydraulic systems drew. From radar and electronic warfare systems to satellite links, digital computing and network centric warfare capabilities, the thirst for on-board electrical power keeps growing.

This presents a major opportunity for vehicle electrification to become the principal means of meeting electricity demands on military assets. Combat vehicles, aircraft, sea vessels and even soldiers are bristling with electronics needing copious power. Generators create noise and heat effusions that compromise stealth and can be spotted. Alternators driven by the engine divert power from mobility.

Electric vehicles can seamlessly supply large power loads silently and efficiently. Advanced power electronics can smartly manage electricity distribution across the vehicle. Apart from propelling the platform, onboard batteries become energy reservoirs powering all integrated systems. Efficient regeneration captures braking energy for reuse. Vehicle architecture can be designed with power generation and routing in mind.

For instance, hybrid electric drivetrains allow electric motors to meet average loads while the combustion engine handles peak loads. More all-electric designs use high capacity batteries with supplementary super capacitors or fuel cells as needed. Whether at camp or on the move, electric military vehicles can act as mobile power banks sustaining critical electronic assets.

Military missions demand that soldiers stay constantly connected, informed and tracked even in remote environments. Electric vehicles fill that gap providing abundant and silent electrical energy for communications, sensors and computing everywhere. This synergistic pairing of two advanced capabilities is already driving adoption of vehicle electrification across air, land and sea forces.

Challenges

Life and durability of integrated systems

While vehicle electrification brings immense possibilities, realizing a rugged, reliable and long-lasting fully electric military platform poses some fundamental engineering challenges. Military vehicles routinely operate under grueling conditions of temperature, terrain, velocities and unpredictable damage. Ensuring electric powertrains withstand such environments will require extensive, iterative design.

Batteries continue to be notoriously vulnerable to extreme temperatures, shocks and vibration. Military-grade protective casing adds weight and size while advanced thermal management further complicates integration. Preventing battery damage from the kinetic violence and pyrotechnics of battle is hard. Redundant battery packs may become standard.

Power electronics have to be specially hardened to survive electromagnetic pulses from nuclear or directed energy weapons. Susceptibility to intense radiated fields can cripple unmanned electric vehicles. Electronics also have to withstand constant jolts and shaking which stresses component soldering and causes failures over time. Ruggedizing adds bulk.

Electric motors need to be designed for high rotational speeds, sudden acceleration/deceleration cycles, prolonged overload conditions, and tolerance to debris ingestion and blasts. Controlling heat buildup and preventing bearing wear require expertise. Exposed cabling has to be secured from environmental factors and battle damage.

And all components have to seamlessly work together as an integrated system for years as per military lifetime requirements. However, electric systems decay faster than mechanical systems. Finding the optimal tradeoff between performance and robustness will involve extensive testing and evolution.

Key Market Segmentation

By Technology

- Hybrid

- Fully electric

By Platform

- Combat vehicles

- Support vehicles

- Unmanned armored vehicles

By System

- Power Generation

- Cooling Systems

- Energy Storage

- Traction Drive Systems

- Power Conversion

- Transmission System

By Mode of Operation

- Manned

- Autonomous/semi-autonomous

Regional Analysis

In 2023, APAC (Asia-Pacific) emerged as the dominant region in the Military Vehicle Electrification Market, capturing more than a 31% share. The region’s significant market position can be attributed to several factors. First and foremost, APAC is home to some of the world’s largest defense spenders, including China, India, and South Korea, who are actively modernizing their military vehicle fleets. These countries are increasingly focusing on reducing their carbon footprint and adopting greener technologies, which has led to a surge in the demand for electric and hybrid military vehicles.

Moreover, APAC boasts a robust manufacturing base for automotive and defense industries, with a strong presence of key market players and technological advancements. The region’s growing investments in research and development activities related to military vehicle electrification have resulted in the development of innovative solutions, further driving the market growth.

Moving on to other regions, North America also holds a significant market share in the Military Vehicle Electrification Market. The region is characterized by advanced defense capabilities, a strong focus on technological innovation, and a high level of defense spending. The United States, in particular, is a key contributor to the market growth in North America, owing to its substantial defense budget and ongoing efforts to enhance military vehicle efficiency and reduce emissions.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The global military vehicle electrification market is highly fragmented and competitive, with numerous companies seeking an edge. Key players include defense contractors, technology providers and automotive manufacturers. Companies typically focus on R&D activities, strategic partnerships and product innovations to strengthen their market positions and widen customer bases.

Top Key Players

- BAE Systems plc

- General Dynamics Corporation

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Oshkosh Defense

- Raytheon Technologies Corporation

- Rheinmetall AG

- Elbit Systems Ltd.

- Navistar International Corporation

- QinetiQ Group plc

- Ricardo plc

- Leonardo S.p.A.

- Other Key Players

Recent Developments

1. General Dynamics Corporation:

- March 2023: Unveiled the “StrykerX,” an electric hybrid variant of the M1128 Stryker combat vehicle, offering improved fuel efficiency and silent operation for tactical missions.

- July 2023: Partnered with American Rheinmetall Vehicles to jointly develop and produce the “Next-Generation Combat Vehicle – Infantry Fighting Vehicle” (NGCV-IFV), featuring hybrid-electric propulsion for enhanced sustainability and combat capabilities.

2. Lockheed Martin Corporation:

- May 2023: Successfully completed the first live-fire demonstration of the “Joint Light Tactical Vehicle – Hybrid Electric” (JLTV-HE), showcasing its potential for silent deployment and improved fuel efficiency in combat situations.

- October 2023: Awarded a contract from the U.S. Army to develop a hybrid-electric variant of the M1 Abrams main battle tank, demonstrating ongoing efforts to electrify heavy armored vehicles.

3. Rheinmetall AG:

- February 2023: Acquired American Rheinmetall Vehicles, a U.S.-based manufacturer of military vehicles, gaining expertise in developing and integrating electric and hybrid propulsion systems for military applications.

- September 2023: Unveiled the “KF51 Panther” main battle tank with a hybrid-electric drivetrain option, highlighting its commitment to electrification across various military vehicle categories.

Report Scope

Report Features Description Market Value (2023) USD 5.4 billion Forecast Revenue (2033) USD 37.9 Billion CAGR (2023-2032) 21.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Hybrid, Fully electric), By Platform (Combat vehicles, Support vehicles, Unmanned armored vehicles), By System (Power Generation, Cooling Systems, Energy Storage, Traction Drive Systems, Power Conversion, Transmission System), By Mode of Operation (Manned, Autonomous/semi-autonomous) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape BAE Systems plc, General Dynamics Corporation, Northrop Grumman Corporation, Lockheed Martin Corporation, Oshkosh Defense, Raytheon Technologies Corporation, Rheinmetall AG, Elbit Systems Ltd., Navistar International Corporation, QinetiQ Group plc, Ricardo plc, Leonardo S.p.A., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Military Vehicle Electrification Market?The Military Vehicle Electrification Market refers to the application of electrification technologies in military vehicles, encompassing electric propulsion, hybrid systems, and related technologies to enhance efficiency and reduce environmental impact.

How big is Military Vehicle Electrification Industry?The Global Military Vehicle Electrification Market is anticipated to be USD 37.9 billion by 2033. It is estimated to record a steady CAGR of 21.5% in the Forecast period 2024 to 2033. It is likely to total USD 6.6 billion in 2024.

Why is Military Vehicle Electrification Important?Military Vehicle Electrification is important for improving fuel efficiency, reducing dependence on traditional energy sources, and enhancing the overall sustainability and operational capabilities of military fleets.

What Are the Key Drivers for Military Vehicle Electrification?The primary drivers include the need for increased operational efficiency, reduced environmental impact, improved logistics, and the exploration of alternative energy sources for military operations.

What Challenges Does the Military Vehicle Electrification Market Face?Challenges may include the development of robust and durable electrification technologies suitable for military environments, addressing logistical concerns, and ensuring compatibility with existing military infrastructure.

What Are the Global Trends in Military Vehicle Electrification?Global trends include increased research and development in electrification technologies, collaborations between defense contractors and technology firms, and a focus on sustainable and eco-friendly military solutions.

Military Vehicle Electrification MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample

Military Vehicle Electrification MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BAE Systems plc

- General Dynamics Corporation

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Oshkosh Defense

- Raytheon Technologies Corporation

- Rheinmetall AG

- Elbit Systems Ltd.

- Navistar International Corporation

- QinetiQ Group plc

- Ricardo plc

- Leonardo S.p.A.

- Other Key Players