Global Military Drone Market By Drone Type (Fixed-Wing Drones, Rotary-Wing Drones, Hybrid Drones), By Sight Range(Visual Line of Sight (VLOS), Extended Visual Line of Sight (EVLOS), Beyond Visual Line of Sight (BVLOS)), By Application (Intelligence, Surveillance, and Reconnaissance (ISR), Logistics and Supply, Combat Operations, Other Applications), By Operation (Remote-Piloted Drones, Semi-Autonomous Drones, Fully Autonomous Drones), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Aug. 2024

- Report ID: 125365

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

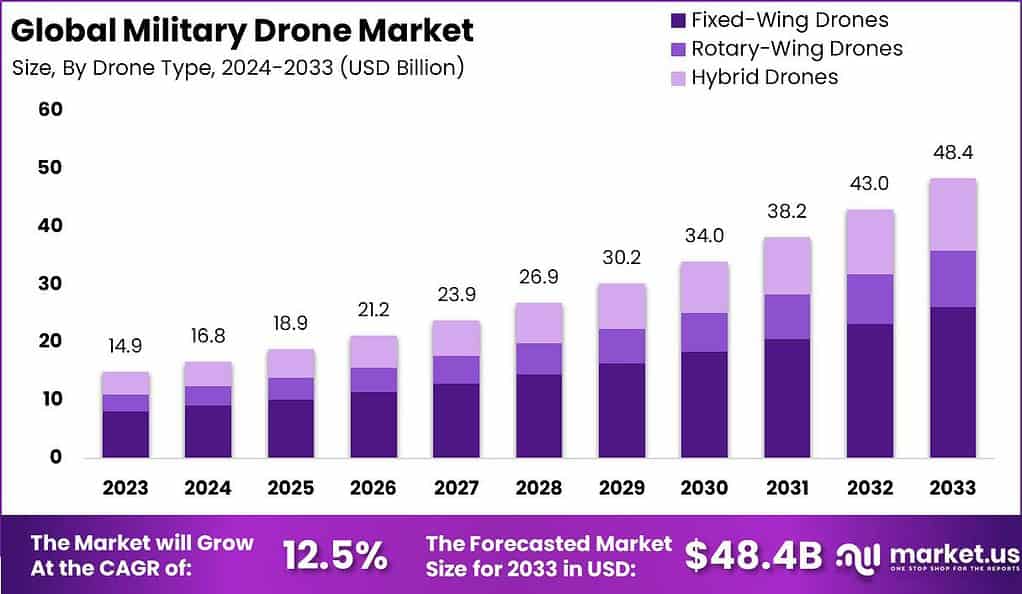

The Global Military Drone Market size is expected to be worth around USD 48.4 Billion By 2033, from USD 14.9 Billion in 2023, growing at a CAGR of 12.5% during the forecast period from 2024 to 2033.

Military drones, also known as unmanned aerial vehicles (UAVs), are a pivotal component in modern defense strategies worldwide due to their versatility in surveillance, reconnaissance, and targeted strike operations. These drones provide armed forces with a significant tactical advantage by performing missions in high-risk environments without endangering personnel.

The military drone market has witnessed significant growth in recent years, driven by advancements in technology, increasing defense budgets, and rising demand for surveillance and reconnaissance missions. Military drones, also known as unmanned aerial vehicles (UAVs), are widely used for intelligence gathering, target acquisition, and combat operations.

One of the primary growth factors is the continuous modernization of military equipment by various countries to enhance their defense capabilities. Drones offer a tactical advantage by providing real-time data and imagery, enabling informed decision-making in critical situations. Additionally, the development of lighter, more durable materials has improved drone performance and longevity, further boosting their adoption.

However, the market faces several challenges. Regulatory issues, including airspace management and drone operation laws, pose significant hurdles. There’s also the challenge of ensuring the security of drone communications to prevent hacking and misuse, which requires constant updates and monitoring.

Despite these challenges, the market presents substantial opportunities. The integration of artificial intelligence and machine learning can enhance autonomous capabilities of drones, making them smarter and more efficient. There’s also potential for growth in developing nations that are beginning to invest in unmanned technology for defense and security purposes.

According to Market.us, The Drone Market is poised for significant growth, with projections indicating it will reach a valuation of USD 101.1 billion by 2033, up from USD 34.5 billion in 2023, reflecting a compound annual growth rate (CAGR) of 12.7% during the forecast period from 2024 to 2033. This robust growth is driven by advancements in drone technology, increased adoption across various sectors, and substantial investments in drone research and development.

In the United States, over 40 drone companies are currently operating. Among these, China’s DJI dominates the global market with a 70% share. Despite being based in Shenzhen, China, 80% of DJI’s drones and other goods are sold internationally, and the company holds a commanding 77% share of the US market. Following DJI, Intel holds the second position in the US with a 3.7% market share, while the popular brand GoPro ranks fifth with a 1.8% share, and Kespry is at the bottom with a 0.3% share.

According to National Defense Magazine, global spending on unmanned aerial vehicles (UAVs) is anticipated to expand significantly in the coming decade, with militaries expected to invest around $98 billion in new intelligence-gathering and strike capabilities.

The United States is projected to maintain its leadership, with R&D spending increasing by approximately $2.7 billion in 2029 and procurement ramping up by about $3.3 billion by the end of the decade. Mini-UAVs are expected to dominate the market over the next ten years, accounting for roughly 38,000 of the 46,000 platforms that militaries worldwide are anticipated to procure.

Key Takeaways

- The global military drone market is poised for significant growth, with its size expected to reach USD 48.4 billion by 2033, up from USD 14.9 billion in 2023, reflecting a robust CAGR of 12.5% during the forecast period from 2024 to 2033.

- In 2023, the fixed-wing drones segment demonstrated market dominance, securing more than a 54.1% share.

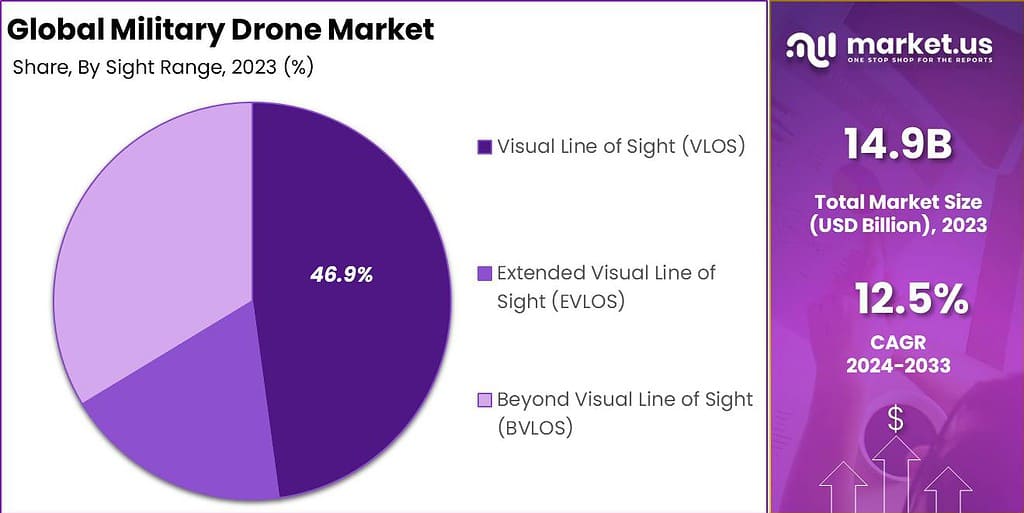

- The visual line of sight (VLOS) segment also led the market, capturing more than a 46.9% share.

- Additionally, the remote-piloted drones segment held a substantial position, accounting for more than a 69.5% share of the market.

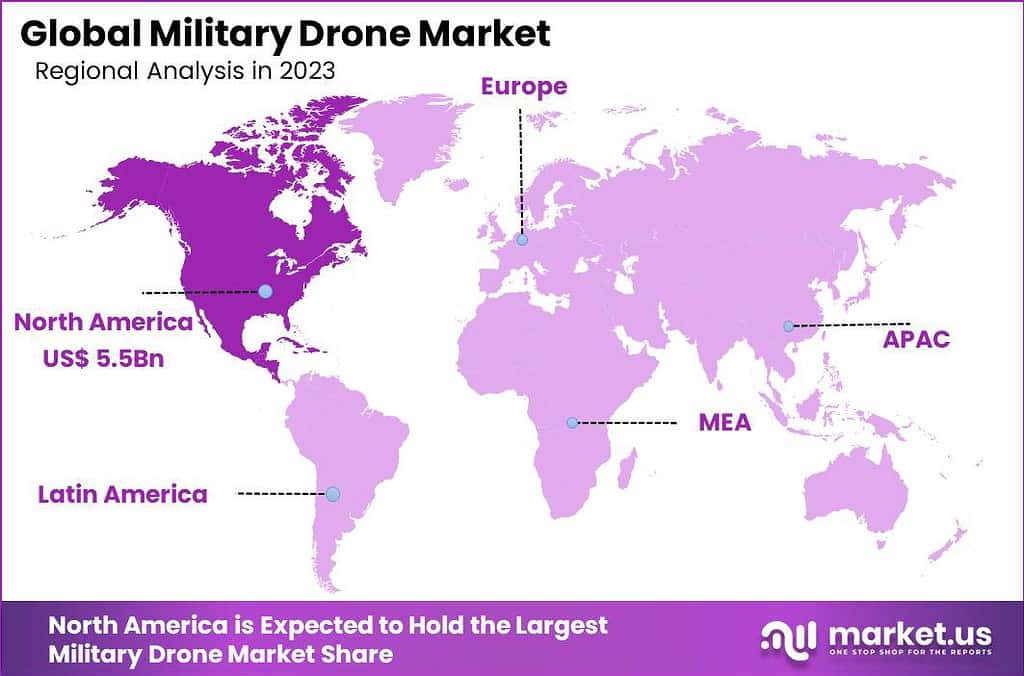

- North America emerged as a key player, holding a dominant market position with more than a 37.2% share and generating USD 5.5 billion in revenue.

Drone Type Analysis

In 2023, the Fixed-Wing Drones segment held a dominant market position, capturing more than a 54.1% share. This leadership is attributed to the unique advantages that fixed-wing drones offer, making them highly preferred for various military applications.

These drones are renowned for their ability to cover large distances and remain airborne for extended periods, which is crucial for surveillance, reconnaissance, and intelligence-gathering missions. Their design allows for greater payload capacity, enabling them to carry advanced sensors and communication equipment, which enhances their operational efficiency in complex military operations.

Moreover, fixed-wing drones are known for their high-speed capabilities and stability in flight, which are essential for tactical missions requiring rapid response and extensive area coverage. The military’s increasing focus on border security, counter-terrorism, and battlefield monitoring has further fueled the demand for these drones.

Their ability to operate in diverse environmental conditions, coupled with advancements in technology such as improved battery life and autonomous navigation systems, has solidified their leading position in the market. In addition, the versatility and cost-effectiveness of fixed-wing drones contribute to their widespread adoption.

They can be deployed in various scenarios, from strategic reconnaissance to combat support, making them an invaluable asset for modern militaries. The ongoing innovations and enhancements in fixed-wing drone technology, including stealth features and enhanced endurance, continue to drive their dominance in the military drone market.

Sight Range Analysis

In 2023, the Visual Line of Sight (VLOS) segment held a dominant market position in the military drone market, capturing more than a 46.9% share. This segment’s leading status can be attributed to its foundational role in military operations where direct visual contact with the drone is maintained by the operator.

VLOS operations are crucial for close-range missions, including surveillance, reconnaissance, and tactical assessments, where real-time decision-making and immediate response are critical. The reliability and lower technological barriers associated with VLOS systems make them a preferred choice for many defense forces, especially in environments where complex control systems and communication links may be compromised.

The preference for VLOS in military applications is also driven by regulatory and safety concerns. Operating drones within the operator’s line of sight minimizes risks associated with lost communication or control, which are higher in more autonomous flight modes like EVLOS or BVLOS. Additionally, VLOS missions allow for quicker deployment and more precise control over the drone’s maneuvers, which is essential in dynamic and unpredictable combat scenarios.

Additionally, the current regulatory landscape heavily supports VLOS operations, with many countries having established clear guidelines and safety standards for their use. This regulatory clarity facilitates the rapid deployment of VLOS drones, allowing military units to integrate them into their operations without facing significant legal hurdles.

Application Analysis

In 2023, the Intelligence, Surveillance, and Reconnaissance (ISR) segment held a dominant market position in the military drone market, capturing more than a 60.8% share. This segment’s leadership is primarily due to the critical role ISR plays in modern warfare, where timely and accurate information is crucial for making informed decisions.

Drones equipped for ISR missions provide continuous real-time data about enemy movements and positions, significantly enhancing battlefield awareness and strategic planning. This capability is indispensable in both conventional and asymmetric warfare scenarios, driving substantial investment and deployment in this segment.

The superior capability of drones in the ISR role stems from their ability to operate covertly in hostile environments, reducing risk to human life and increasing the efficiency of intelligence gathering. The versatility of drones, allowing for multi-sensor integration, means they can perform a wide range of tasks, from electronic signal interception to optical surveillance, further cementing their value in ISR operations.

Their ability to relay live feedback to command centers allows for quicker response and adaptation during missions, an advantage in rapidly changing combat situations. Moreover, advancements in drone technology, such as improved endurance, stealth features, and automated data processing, enhance the effectiveness of ISR missions.

These technological enhancements enable drones to cover larger areas, stay in mission zones for extended periods, and provide higher quality intelligence. The critical nature of the intelligence gathered through ISR missions and the continuous innovation in drone capabilities are key drivers behind the dominance of this segment in the military drone market.

Operation Analysis

In 2023, the Remote-Piloted Drones segment held a dominant market position in the military drone market, capturing more than a 69.5% share. This segment’s prominence is largely attributed to the high level of control and immediate human decision-making it offers, which are critical in complex and sensitive military operations.

Remote-piloted drones provide the operator with a direct connection to the drone, facilitating precise maneuvers and allowing for real-time adjustments based on dynamic combat scenarios. This direct control mechanism is especially crucial in environments where split-second decisions can determine the success of a mission or the safety of allied forces.

The preference for remote-piloted drones is also supported by their proven track record of reliability and accuracy in target engagement and surveillance operations. The ability to directly pilot these drones minimizes the risks associated with signal delays or automation errors that might occur in more autonomous systems. This ensures that military operations can be carried out with greater precision, reducing collateral damage and enhancing mission effectiveness.

Furthermore, regulatory and security concerns favor the use of remote-piloted drones. Many defense forces are cautious about deploying fully autonomous systems due to potential vulnerabilities, such as hacking or malfunctioning during critical operations. By maintaining human oversight, military organizations can mitigate these risks, making remote-piloted drones a safer and more reliable choice. The established regulatory frameworks and operational protocols for remote-piloted drones further solidify their leading position in the military drone market.

Key Market Segments

Drone Type

- Fixed-Wing Drones

- Rotary-Wing Drones

- Hybrid Drones

Sight Range

- Visual Line of Sight (VLOS)

- Extended Visual Line of Sight (EVLOS)

- Beyond Visual Line of Sight (BVLOS)

Application

- Intelligence, Surveillance, and Reconnaissance (ISR)

- Logistics and Supply

- Combat Operations

- Other Applications

Operation

- Remote-Piloted Drones

- Semi-Autonomous Drones

- Fully Autonomous Drones

Driver

Increasing Government Funding and Technological Advancements

One significant driver for the military drone market is the substantial increase in government funding coupled with rapid technological advancements. These advancements, especially the integration of artificial intelligence in drones, are transforming their capabilities, enabling more complex operations ranging from navigation and data acquisition to sophisticated surveillance and targeting. This technological evolution is critical as it enhances the efficiency and functionality of military drones in diverse operations, thereby propelling the market forward.

Restraint

Regulatory and Ethical Challenges

A major restraint in the military drone market is the complex web of regulatory and ethical issues associated with drone deployment. These challenges are particularly pronounced in autonomous and semi-autonomous drones, where concerns about accountability in conflict scenarios lead to stringent regulations. The deployment of such advanced drones in sensitive or civilian areas raises ethical questions, potentially limiting more aggressive expansion or experimentation within this sector.

Opportunity

Expansion into New Markets and Applications

The military drone market is witnessing significant opportunities in expanding into new applications and markets. The growing adoption of drones for border surveillance, disaster response, and humanitarian missions opens new pathways for market growth.

These applications leverage the unique capabilities of drones to operate in challenging environments, providing real-time data and support where traditional methods may fall short. Additionally, the expansion into markets with increasing security needs, like the Asia-Pacific region, presents lucrative opportunities for the development and deployment of military drones.

Challenge

Technological Complexity and Dependence

A persistent challenge in the military drone market is the technological complexity and the high dependence on advanced components and systems. This dependency can lead to vulnerabilities, such as susceptibility to hacking or technological failures, which can compromise critical missions.

Furthermore, the rapid pace of technological advancements means that systems must be continually updated or replaced to stay effective and secure, requiring ongoing investment and expertise.

Growth Factors

The military drone market is experiencing significant growth due to several key factors. First, the increasing adoption of unmanned systems across various military applications, including surveillance, reconnaissance, and combat operations, is driving demand. These systems offer distinct advantages in terms of operational efficiency and risk reduction on the battlefield.

Another major growth driver is the continuous advancements in drone technology, particularly the integration of artificial intelligence (AI). This technological progression allows drones to operate with greater autonomy and precision, enhancing their effectiveness in complex military operations. The development of AI technologies enables drones to execute tasks ranging from flight navigation to tactical decision-making autonomously, which increases their utility in diverse military scenarios.

Furthermore, geopolitical tensions and increased defense spending by countries worldwide are propelling the expansion of the military drone market. Nations are investing heavily in modernizing their defense capabilities to enhance national security and preparedness, which includes substantial investments in unmanned aerial vehicles (UAVs).

Emerging Trends

Several emerging trends are shaping the future of the military drone market. The use of drones for a broader range of applications beyond traditional combat and surveillance roles, such as logistics support, disaster response, and border surveillance, is becoming increasingly common. This diversification is expanding the market’s scope and opening new opportunities for growth.

The miniaturization of drones is also a significant trend, with an increasing focus on developing small, more agile drones that can be used in a variety of operational contexts without being detected. These smaller drones are particularly useful for surveillance and target acquisition in environments where larger drones would be too conspicuous.

Lastly, there is a growing emphasis on enhancing the survivability and resilience of drones in hostile environments. This includes improvements in stealth capabilities, electronic warfare systems, and countermeasures against anti-drone defenses. These advancements are crucial for maintaining the effectiveness of drones in increasingly contested and complex battlefields.

Regional Analysis

In 2023, North America held a dominant market position in the military drone market, capturing more than a 37.2% share and holding USD 5.5 billion in revenue. This leadership is primarily due to the substantial investments and advancements in drone technology by key players in the region.

The United States, in particular, has been at the forefront of military drone development, with companies like General Atomics, Northrop Grumman, and Lockheed Martin leading the way. These companies have developed cutting-edge drones that are widely used for various military applications, including intelligence, surveillance, reconnaissance (ISR), and combat operations.

One of the significant factors contributing to North America’s dominance is the extensive use of drones by the U.S. military. The Department of Defense (DoD) has been a major driver of drone adoption, utilizing these systems for critical missions in conflict zones around the world.

The U.S. military’s focus on enhancing its ISR capabilities and reducing risks to personnel has led to a substantial increase in drone procurement and deployment. Additionally, North America’s technological infrastructure and innovation ecosystem support the rapid development and integration of advanced drone technologies.

The region’s strong regulatory framework and government support also play a crucial role in maintaining its leading position. The Federal Aviation Administration (FAA) and other regulatory bodies have established clear guidelines for the use of drones, facilitating their deployment in military operations.

Furthermore, government funding and research initiatives aimed at improving drone technology and cybersecurity measures have bolstered the market’s growth. The focus on developing autonomous and AI-enabled drones is expected to further enhance North America’s capabilities in the coming years

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The military drone market is highly competitive, with key players continuously striving for dominance through strategic acquisitions, new product launches, and mergers. Leading the market is Northrop Grumman Corporation, renowned for its innovation and comprehensive range of unmanned systems. Notably, Northrop Grumman has strengthened its position through strategic acquisitions like Orbital ATK, enhancing its capabilities in advanced aerospace and defense technologies.

The Boeing Company follows closely, leveraging its extensive aerospace experience to develop cutting-edge drone technology. Boeing has made significant strides with new product launches such as the MQ-25 Stingray, an autonomous refueling aircraft, demonstrating its commitment to expanding its unmanned systems portfolio.

General Atomics, known for its iconic Predator and Reaper drones, continues to be a formidable player. The company’s recent merger with Miltec Corporation has expanded its technological expertise and production capabilities, allowing it to maintain a competitive edge in the market.

Top Military Drone Players

- The Boeing Company

- Northrop Grumman Corporation

- AeroVironment Inc.

- General Atomics

- BAE Systems plc

- Elbit Systems Ltd.

- Israel Aerospace Industries Ltd.

- Thales Group

- Textron Systems

- L3Harris Technologies Inc.

- Other Key Players

Recent Developments

- May 2024: AeroVironment was one of the six companies selected by DARPA for the ANCILLARY program to develop advanced VTOL drone technologies, focusing on enhancing launch and recovery capabilities.

- February 2024: The U.S. Air Force selected General Atomics’ Gambit drone for the next phase of the CCA program, which focuses on developing collaborative combat drones to support various missions, including air-to-air combat operations.

- December 2023: General Atomics started flight tests for DARPA’s LongShot program, which aims to develop a drone capable of launching missiles from a bomber or fighter aircraft. This design seeks to extend engagement ranges and improve mission effectiveness while reducing risks to manned aircraft.

Report Scope

Report Features Description Market Value (2023) USD 14.9 Bn Forecast Revenue (2033) USD 48.4 Bn CAGR (2024-2033) 12.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drone Type (Fixed-Wing Drones, Rotary-Wing Drones, Hybrid Drones), By Sight Range(Visual Line of Sight (VLOS), Extended Visual Line of Sight (EVLOS), Beyond Visual Line of Sight (BVLOS)), By Application (Intelligence, Surveillance, and Reconnaissance (ISR), Logistics and Supply, Combat Operations, Other Applications), By Operation (Remote-Piloted Drones, Semi-Autonomous Drones, Fully Autonomous Drones) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The Boeing Company, Northrop Grumman Corporation, AeroVironment Inc., General Atomics, BAE Systems plc, Elbit Systems Ltd., Israel Aerospace Industries Ltd., Thales Group, Textron Systems, L3Harris Technologies Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Military Drone Market?The Military Drone Market encompasses the development, production, and deployment of unmanned aerial vehicles (UAVs) used by military forces for various applications, including surveillance, reconnaissance, target acquisition, and strike missions.

How big is Military Drone Market?The Global Military Drone Market size is expected to be worth around USD 48.4 Billion By 2033, from USD 14.9 Billion in 2023, growing at a CAGR of 12.5% during the forecast period from 2024 to 2033.

What are the major drivers of the Military Drone Market?Major drivers include the increasing need for advanced surveillance systems, the demand for precision strikes with minimal collateral damage, the rise in asymmetrical warfare, technological advancements in UAVs, and the need for enhanced border security.

What are the challenges facing the Military Drone Market?Challenges include regulatory hurdles, concerns over airspace safety, the high cost of development and deployment, cybersecurity threats, ethical concerns over autonomous weapons, and the need for robust anti-drone defense systems.

What are the current trends and advancements in the Military Drone Market?Current trends include the integration of AI for autonomous operations, the development of swarming technology, enhancements in stealth and endurance capabilities, the use of drones for electronic warfare, and the increased focus on anti-drone systems.

Who are the leading players in the Military Drone Market?Leading players include The Boeing Company, Northrop Grumman Corporation, AeroVironment Inc., General Atomics, BAE Systems plc, Elbit Systems Ltd., Israel Aerospace Industries Ltd., Thales Group, Textron Systems, L3Harris Technologies Inc., Other Key Players

-

-

- The Boeing Company

- Northrop Grumman Corporation

- AeroVironment Inc.

- General Atomics

- BAE Systems plc

- Elbit Systems Ltd.

- Israel Aerospace Industries Ltd.

- Thales Group

- Textron Systems

- L3Harris Technologies Inc.

- Other Key Players