Global MiFi Market Size, Share Report By Product Type (Standalone MiFi Devices, Integrated MiFi Solutions, Smart MiFi Hotspots), By Cellular Technology (MiFi Routers 5G, MiFi Routers 4G/LTE, MiFi Routers 3G), By End User (Frequent Travelers, Remote Workers, Families or Teams, Backup Users, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153802

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- US Market Size

- Product Type: Standalone MiFi Devices

- Cellular Technology: MiFi Routers 4G/LTE

- By End User: Remote Workers

- Key Drivers of Demand

- Key Features and Trends

- Opportunities and Challenges

- Key Market Segments

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

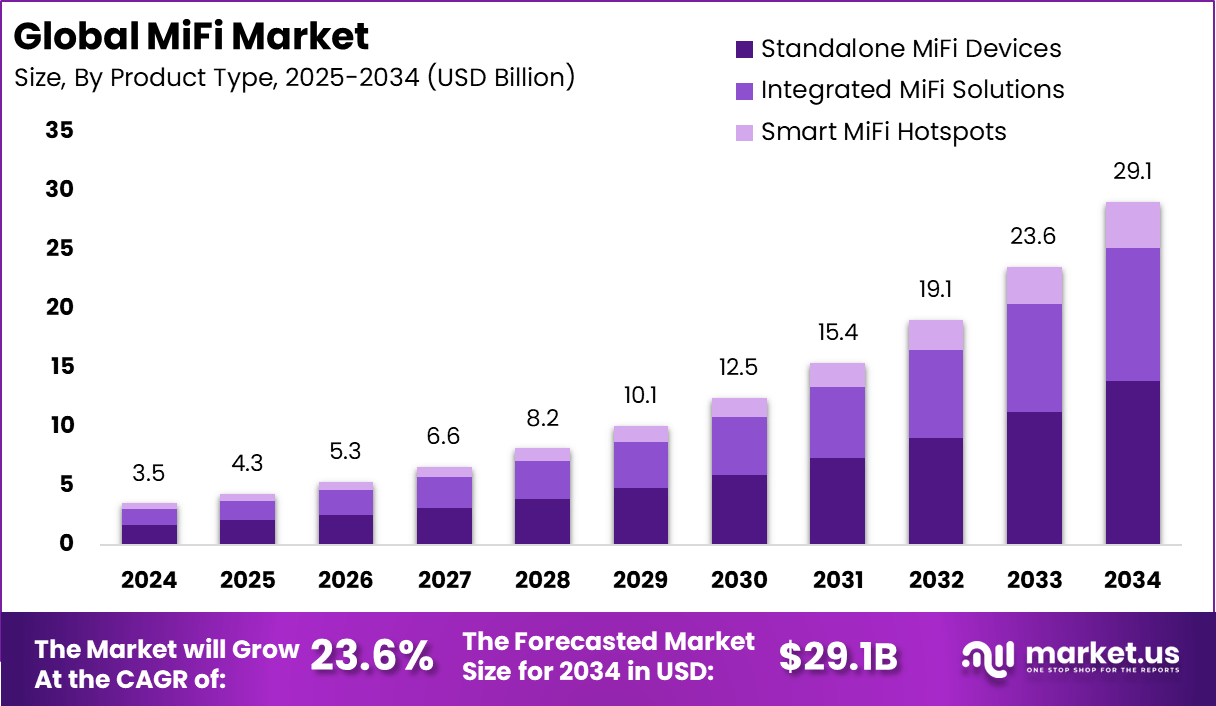

The Global MiFi Market size is expected to be worth around USD 29.1 Billion By 2034, from USD 3.5 billion in 2024, growing at a CAGR of 23.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.5% share, holding USD 1.3 Billion revenue.

The MiFi market refers to the industry surrounding portable wireless devices that create personal mobile Wi-Fi hotspots by connecting to cellular networks. People use MiFi devices to access the internet wherever they are, without relying on fixed broadband or public Wi-Fi. These devices offer seamless connectivity for travelers, business professionals, students, and anyone needing internet on the move, particularly in locations where wired connections are unavailable or unreliable.

Top driving factors shaping the MiFi market include the explosive demand for high-speed internet access, especially via mobile devices, and the spread of remote work and distance learning. The resurgence of global travel and tourism has fueled the need for portable connectivity, while increased awareness about online security has pushed consumers and enterprises to seek personal and encrypted mobile internet solutions.

Scope and Forecast

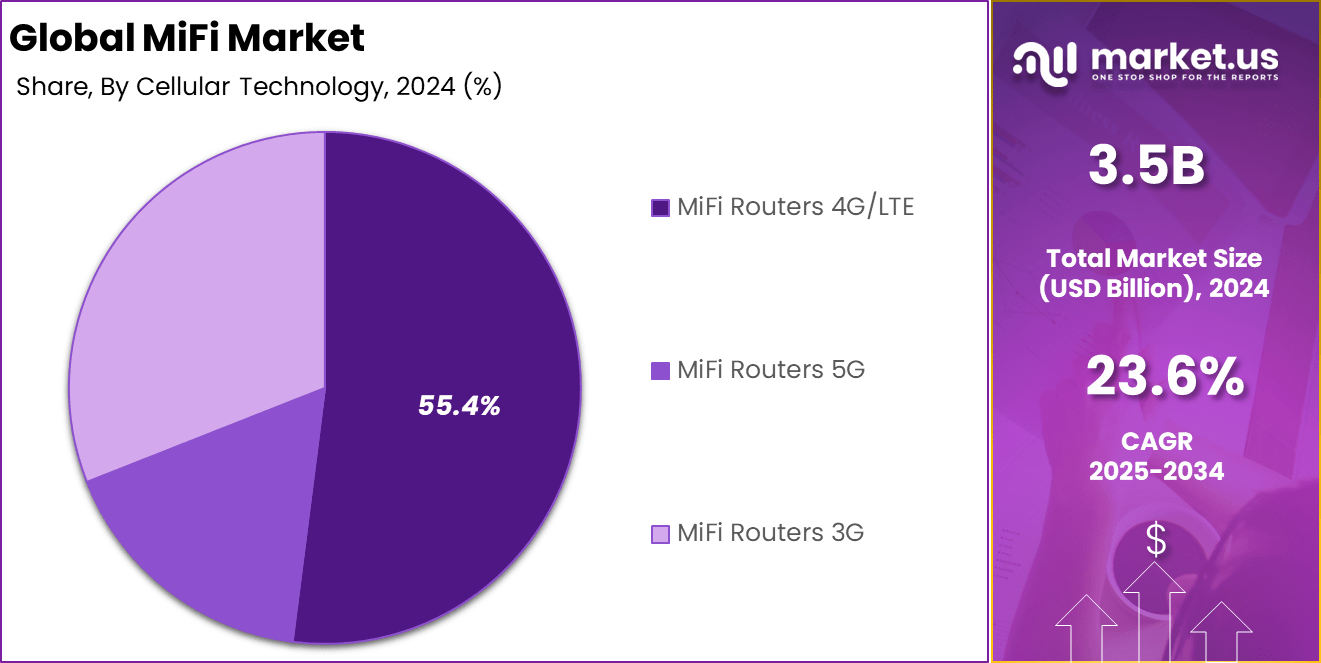

Report Features Description Market Value (2024) USD 3.5 Bn Forecast Revenue (2034) USD 29.1 Bn CAGR(2025-2034) 23.6% Leading Segment MiFi Routers 4G/LTE – 55.4% Largest Market North America [38.5% Market Share] Largest Country US: 1.14 Billion, CAGR: 20.4% Key Insight Summary

- The global market is projected to reach USD 29.1 Billion by 2034, growing at a rapid CAGR of 23.6%, as mobile connectivity becomes essential in work and travel.

- In 2024, North America led the market with a 38.5% share, generating USD 1.3 Billion in revenue, driven by strong 5G infrastructure and demand from mobile professionals.

- Standalone MiFi devices accounted for 47.7% of the market by product type, favored for their portability, ease of use, and secure internet access in non-traditional workspaces.

- 4G/LTE MiFi routers held a dominant 55.4% share by cellular technology, reflecting wide coverage, cost-efficiency, and proven reliability across diverse regions.

- Remote workers represented the largest end-user group, capturing 38.4% share, as flexible work culture and gig economy models expand globally.

Analysts’ Viewpoint

Investment opportunities in the MiFi market are increasingly attractive as industries ranging from health care to logistics seek reliable mobile connectivity. There is a strong business case for supporting enterprise mobility strategies with MiFi solutions, and ongoing investments into 5G infrastructure open up new possibilities for manufacturers, software developers, and network providers to innovate and offer value-added services.

Among business benefits, MiFi provides cost-effective, flexible connectivity that is easy to set up and scale. With pay-as-you-go data options and compatibility with multiple service providers, organizations can manage costs while ensuring connectivity for teams of all sizes. The devices’ portability allows businesses and freelancers to operate efficiently from virtually anywhere, while the added security features provide peace of mind against cyberattacks.

The regulatory environment for MiFi devices is complex but mature, with most countries having standards in place for device interoperability, spectrum allocation, and security requirements. Governments are actively promoting investment in 5G infrastructure, which indirectly supports MiFi market expansion. However, tariffs on hardware components and international trade restrictions can impact manufacturing costs and supply chain logistics, especially for global brands.

US Market Size

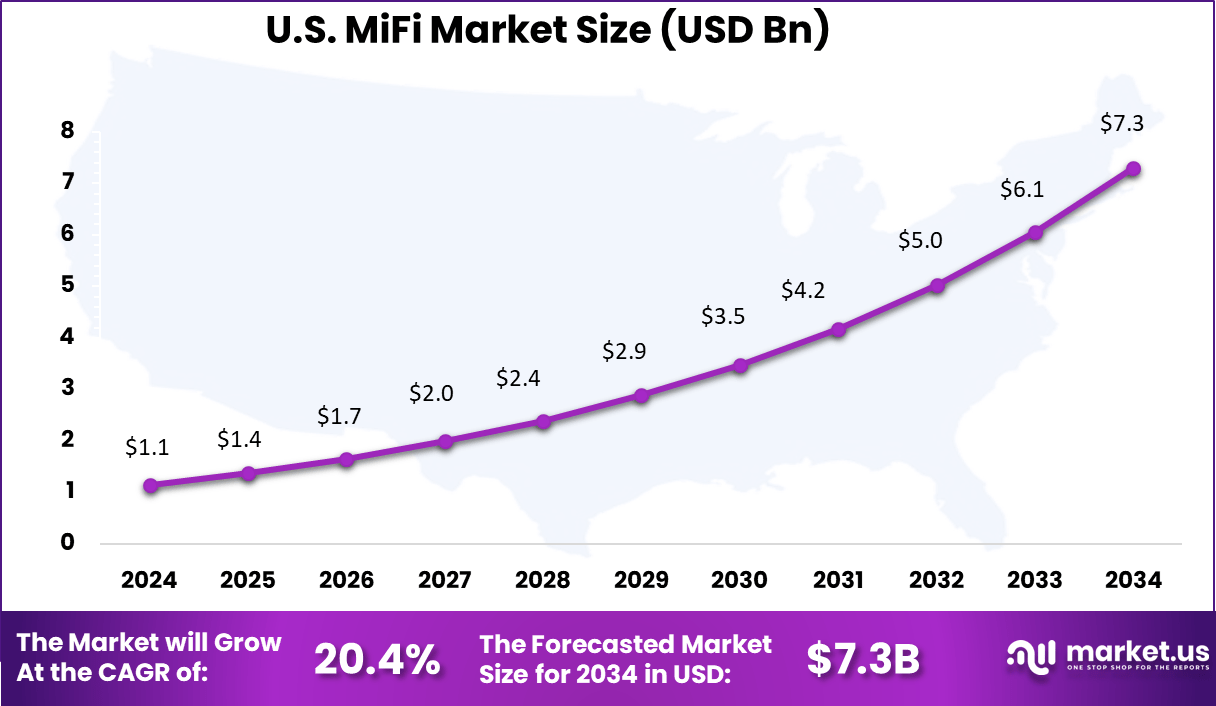

The U.S. MiFi Market was valued at USD 1.1 Billion in 2024 and is anticipated to reach approximately USD 7.3 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 20.4% during the forecast period from 2025 to 2034.

This growth is being supported by the country’s widespread 5G infrastructure, high smartphone penetration, and expanding remote work culture. The U.S. has also seen strong adoption of MiFi devices among business travelers, emergency services, and educational institutions that require constant internet access on-the-go.

In 2024, North America held a dominant market position, capturing more than a 38.5% share and generating USD 1.3 billion in revenue within the MiFi market. This leadership can be attributed to the region’s early rollout of 5G infrastructure, high internet usage, and strong demand for mobile broadband solutions across remote workforces, logistics, and travel sectors.

The U.S., in particular, has shown rapid adoption of MiFi routers due to the widespread use of multiple smart devices per user and the growing need for uninterrupted connectivity during commuting, fieldwork, and emergency operations. The presence of major technology hubs and innovation-friendly policies in North America has supported the development and commercialization of advanced MiFi devices.

Consumers in this region tend to prioritize fast, secure, and portable connectivity options, further boosting demand. Additionally, rising concerns about public Wi-Fi security have encouraged professionals and students alike to opt for private MiFi units. This blend of digital maturity, high disposable income, and mobile-first behavior continues to strengthen North America’s leadership in the global MiFi market.

Product Type: Standalone MiFi Devices

In 2024, Standalone MiFi Devices captured the largest share in the market, accounting for 47.7% of the total demand. This dominance can be linked to their compact design, ease of use, and the ability to connect multiple devices without relying on a fixed broadband setup.

These portable units are especially useful in areas where internet infrastructure is poor or unreliable. The flexibility they offer to users, particularly during travel or remote work situations, has made them the preferred option. Their plug-and-play nature has also gained traction among tech-savvy consumers seeking reliable mobile internet.

Cellular Technology: MiFi Routers 4G/LTE

Among the various cellular technologies, 4G/LTE MiFi Routers emerged as the most widely adopted, holding a commanding 55.4% share in 2024. The high-speed connectivity and wide network coverage of 4G/LTE networks have made these devices ideal for both personal and professional use.

The stable performance and cost-efficiency compared to 5G options have further reinforced their popularity. As many regions across the globe are still transitioning toward full 5G rollout, 4G/LTE remains the go-to standard, providing a perfect balance between affordability and reliable speed.

By End User: Remote Workers

Remote Workers represented the leading end-user group in 2024, contributing to 38.4% of the total market share. This segment has seen rapid growth as companies continue to embrace hybrid and flexible work models. MiFi devices offer remote professionals secure, dedicated internet access, even in locations where public Wi-Fi is not available or is considered risky.

The ability to work efficiently from home, co-working spaces, or during travel has made MiFi a practical tool for professionals across industries. The sustained rise in freelancing and digital nomad lifestyles has further boosted this segment’s importance.

Key Drivers of Demand

Driver Details 5G Network Expansion Rapid deployment of 5G technology, enabling much faster speeds and lower latency for MiFi devices. Remote Work & Mobile Office Surge in remote/hybrid work models is increasing demand for secure and portable high-speed internet. Travel & Tourism Recovery International travel rebound fuels MiFi adoption for seamless, affordable connectivity abroad. Digital Education & Telehealth MiFi enables access to distance learning and remote healthcare where wired connections are unavailable. Security and Privacy Growing concern about risks from public Wi-Fi boosts demand for personal secured hotspots. Device Miniaturization Improved battery life and design portability make MiFi devices more user-friendly and versatile. Key Features and Trends

Feature/Trend Details 5G-Enabled MiFi Next-gen MiFi delivers gigabit speeds, ultra-low latency, supports IoT, and multitasking. Enhanced Battery & Portability Latest models feature longer battery life (30–60+ hours) and compact designs. Advanced Security Incorporation of encrypted networks, password protection, and robust authentication. Multi-Device Connectivity Support for simultaneous connections to 10+ devices – ideal for households/businesses. Affordable 5G Devices Competition and volume manufacturing are reducing costs, boosting mass-market appeal. IoT Integration MiFi increasingly powers connected devices, smart homes, and business IoT deployments. Opportunities and Challenges

Category Highlights Opportunities – Rapid 5G network rollout globally

– High adoption in emerging markets (Asia-Pacific)

– Strategic telecom-manufacturer partnerships

– Government initiatives supporting digital and mobile connectivity

– Growth in sectors like travel, remote work, education, and telemedicineChallenges – High upfront cost of 5G MiFi devices

– Variable 5G coverage, especially in rural/remote areas

– Competition from tethering/mobile plans and integrated 5G phones

– Battery limitations for power users

– Cyclical tariffs and supply chain disruptions

– Security risks from improper device setupKey Market Segments

By Product Type

- Standalone MiFi Devices

- Integrated MiFi Solutions

- Smart MiFi Hotspots

By Cellular Technology

- MiFi Routers 5G

- MiFi Routers 4G/LTE

- MiFi Routers 3G

By End User

- Frequent Travelers

- Remote Workers

- Families or Teams

- Backup Users

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the MiFi market, Huawei Technologies Co., Ltd. and ZTE Corporation have established themselves as prominent players due to their extensive R&D investments and wide international presence. Their MiFi devices are known for strong performance, battery life, and multi-user connectivity. These firms have continued to scale their offerings across emerging and developed markets.

NETGEAR, D-Link Corporation, and Inseego have maintained significant positions through robust product portfolios and advanced firmware technologies. These companies offer devices catering to various connectivity needs, including home office, travel, and enterprise use. Inseego’s focus on LTE and 5G-enabled solutions is shaping premium offerings.

Companies such as Simo Holdings, Inc., TP-Link Systems, Inc., uCloudLink Group Inc., and ASUSTeK Computer Inc. are strengthening their global presence by offering affordable and feature-rich MiFi solutions. These firms focus on plug-and-play usability, compatibility with various SIM cards, and cross-border internet access. Operators like Orange also play a key role by bundling MiFi hardware with service plans.

Major Players

Leading companies in the MiFi market include:

- Huawei Technologies Co, Ltd.

- NETGEAR

- D-Link Corporation

- Inseego

- ZTE Corporation

- Simo Holdings,Inc.

- TP-Link System, Inc.

- Orange

- uCloudLink Group Inc.

- ASUSTeK Computer, Inc.

- Others

Recent Developments

- June 2025: NETGEAR acquired cybersecurity firm Exium to integrate advanced SASE (Secure Access Service Edge) into its product range, focusing on seamless networking and security for small and medium enterprises. NETGEAR reported a 14.9% revenue increase year-over-year for 2024, reflecting effective innovation and strategic shifts that supported its MiFi and wireless business.

- October 2024: Huawei launched its 5G-Aᴬ Solutions at the Global Mobile Broadband Forum, targeting the mobile AI era. These solutions boost network performance and support the advance of 5G and AI-converged services, equipping carriers for next-generation mobile broadband demands.

- February 2024: At Mobile World Congress, D-Link revealed new wireless infrastructure solutions for core-to-edge connectivity, emphasizing network scalability and manageability for enterprises. This approach reinforced their commitment to holistic, cloud-managed MiFi and networking solutions.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Standalone MiFi Devices, Integrated MiFi Solutions, Smart MiFi Hotspots), By Cellular Technology (MiFi Routers 5G, MiFi Routers 4G/LTE, MiFi Routers 3G), By End User (Frequent Travelers, Remote Workers, Families or Teams, Backup Users, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Huawei Technologies Co., Ltd., NETGEAR, D-Link Corporation, Inseego, ZTE Corporation, Simo Holdings, Inc., TP-Link System, Inc., Orange, uCloudLink Group Inc., ASUSTeK Computer, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Huawei Technologies Co, Ltd.

- NETGEAR

- D-Link Corporation

- Inseego

- ZTE Corporation

- Simo Holdings,Inc.

- TP-Link System, Inc.

- Orange

- uCloudLink Group Inc.

- ASUSTeK Computer, Inc.

- Others