Middle East & Africa Electric Scooter Market Market Size, Share, Growth Analysis By Material (Industrial-Grade Aluminum Alloy, Carbon Fiber, Plastic, Composite, Others), By Type (2 Wheel, 3 Wheel), By Design (Foldable, Unfoldable), By Foot Platform (Less Than 3.5 Feet, 5 Feet, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168921

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

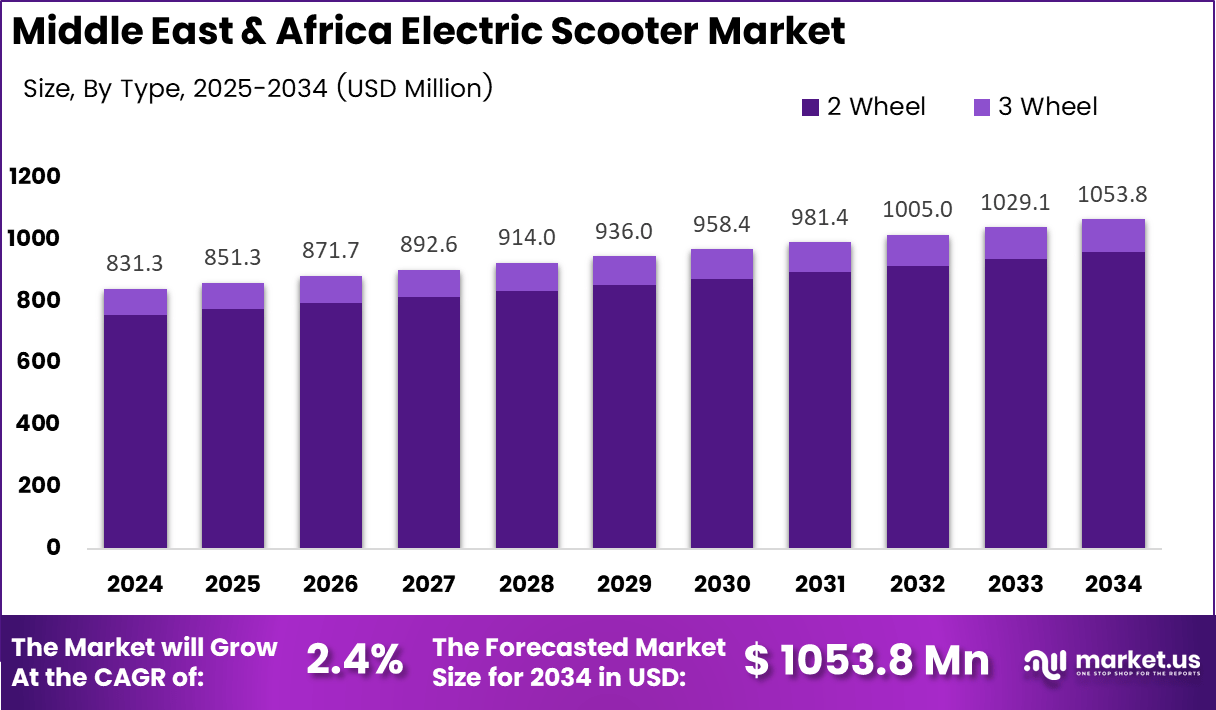

The Middle East & Africa Electric Scooter Market size is expected to be worth around USD 1053.8 million by 2034, from USD 831.3 million in 2024, growing at a CAGR of 2.4% during the forecast period from 2025 to 2034.

The Middle East & Africa electric scooter market represents a fast-evolving mobility segment driven by affordability, sustainability goals, and the expanding adoption of micro-mobility. The market reflects rising demand in urban corridors where fuel dependency, congestion, and growing environmental sensitivities encourage consumers to evaluate cleaner two-wheeler alternatives. The sector increasingly shapes regional transport modernization strategies.

Growing urban populations steadily push governments to support low-emission transport models, improving acceptance of electric scooters across major MEA cities. Furthermore, rising interest in shared mobility pilots strengthens ecosystem development, encouraging private operators and public agencies to expand charging accessibility and regulatory frameworks supporting light electric vehicle (LEV) penetration across high-density mobility zones.

As energy diversification goals accelerate, countries in the region invest in EV infrastructure, offering early incentives, tariff optimizations, and pilot charging corridors. These initiatives improve consumer confidence and create scalable opportunities for manufacturers and service providers. The market benefits from policy-driven adoption as sustainability commitments align with national clean-transport visions and decarbonization roadmaps.

Additionally, evolving ride-sharing habits and app-based mobility platforms are beginning to integrate electric scooters into last-mile connectivity models. These digital mobility shifts stimulate recurring demand by reducing ownership barriers while supporting tourism, delivery services, and workforce commuting. Businesses increasingly explore electric scooters to minimize operating expenses and improve route efficiency across urban delivery clusters.

Toward commercial growth, logistics operators consider electric scooters as fuel-efficient alternatives, particularly where dense neighborhoods restrict conventional vehicles. This operational shift expands procurement opportunities and drives future investment across fleet electrification programs. Rising consumer awareness of the total cost of ownership also improves market readiness for broader EV two-wheeler adoption.

According to regional commuter surveys, nearly 62% of MEA respondents explore electric two-wheelers to counter rising fuel prices, reflecting a clear behavioral transition. As per the savings calculator insights, annual petrol spending often reaches ₹4,486.67, whereas EV operating costs reduce to around ₹1,293.80, highlighting compelling economic advantages and predictable charging expenses. Moreover, 68% of users identify charging-cost stability as the primary adoption driver, strengthening the region’s shift toward cost-efficient electric mobility.

Key Takeaways

- Global Middle East & Africa Electric Scooter Market size is projected to reach USD 1053.8 million by 2034, growing from USD 831.3 million in 2024, with a CAGR of 2.4% from 2025 to 2034.

- Industrial-Grade Aluminum Alloy leads the By Material segment, holding a 42.8% share in 2024 due to its durability and performance in varied climates.

- 2 Wheel electric scooters dominate the By Type segment with a 91.2% market share, offering superior agility and affordability.

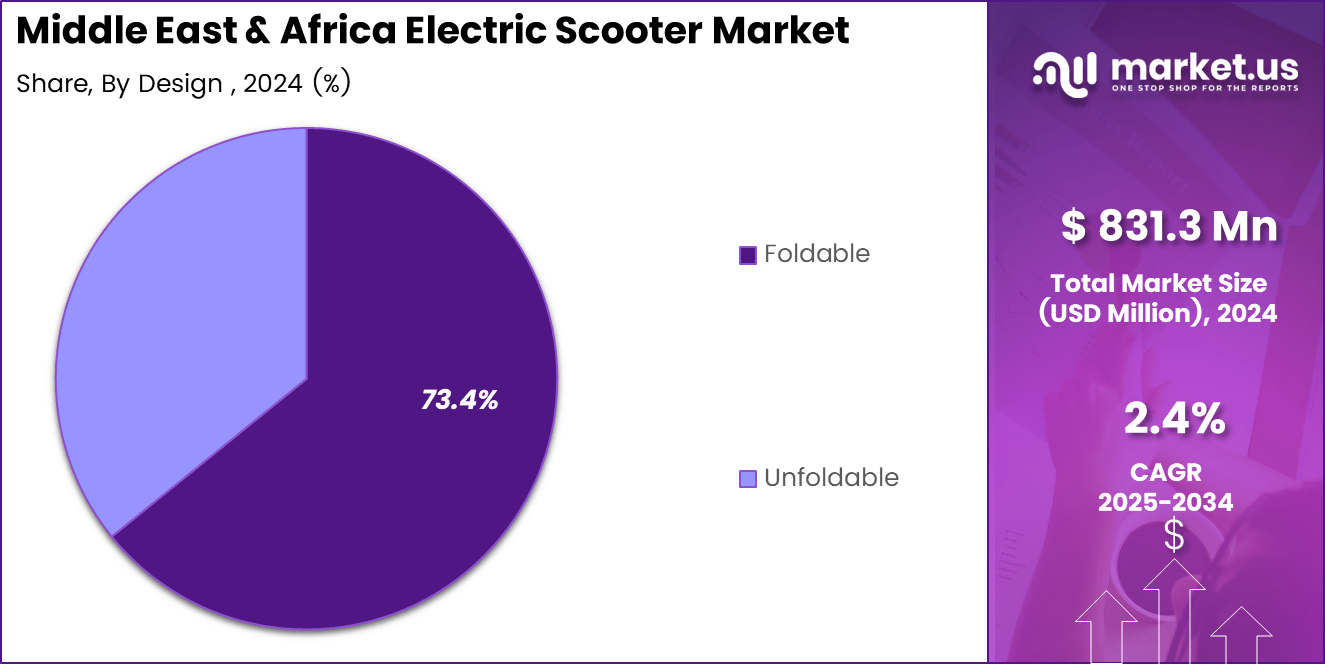

- Foldable scooters dominate the By Design segment with a 73.4% share in 2024, driven by commuter demand for portability and compact storage.

- Less than 3.5-foot platforms lead the By Foot Platform segment with a 58.6% share, appealing to consumers for enhanced maneuverability.

- GCC countries in the Middle East & Africa are leading the adoption of electric scooters, driven by eco-mobility policies and government incentives.

- Electric scooter adoption in urban MEA regions is strengthened by the growing interest in shared mobility models and ride-sharing platforms.

- Government initiatives support infrastructure development, including charging stations and subsidies for electric vehicle adoption, fueling market growth.

- Large-scale fleet electrification opportunities are driving demand from postal, food delivery, and micro-mobility operators, reducing operating costs and supporting sustainable logistics.

- Smart scooter adoption is rising with IoT connectivity, enabling features like remote diagnostics, GPS tracking, and anti-theft alerts for commercial fleet management.

By Material Analysis

Industrial-Grade Aluminum Alloy dominates with 42.8% due to its durability and wide structural use across MEA electric scooter production.

In 2024, Industrial-Grade Aluminum Alloy held a dominant market position in the By Material Analysis segment of the Middle East & Africa Electric Scooter Market, with a 42.8% share. Its strength-to-weight balance supports safer frames, while enhanced corrosion resistance improves long-term performance in varied regional climates.

Carbon Fiber continues gaining interest as MEA riders seek lightweight mobility solutions. Its premium feel and high rigidity enhance handling, especially in dense cities transitioning toward modern micro-mobility. Although costly, rising local adoption of performance-oriented scooters accelerates its relevance as governments promote energy-efficient transport.

Plastic materials remain popular due to affordability and ease of molding. Their use in external panels, fenders, and storage elements suits mass-market scooters. Cost-sensitive MEA consumers display strong preference for scooters with predictable maintenance, making durable plastic components an essential part of mid-range product offerings.

Composite materials gradually expand as manufacturers integrate hybrid structures for strength, safety, and vibration absorption. Their favorable fatigue resistance aligns with longer commuting distances across MEA markets. Improved production technologies also encourage adoption, helping brands deliver higher-quality frames without significantly increasing overall vehicle weight.

Other materials cover steel, reinforced polymers, and emerging lightweight blends adapted for specialized EV formats. These materials support niche models and heavy-duty scooters navigating mixed terrains across the region. As regulatory bodies encourage safer mobility frameworks, diversified material innovations strengthen overall market adaptability and compliance.

By Type Analysis

2 Wheel dominates with 91.2% due to widespread consumer familiarity and higher daily commute suitability.

In 2024, 2 Wheel held a dominant market position in the By Type Analysis segment of the Middle East & Africa Electric Scooter Market, with a 91.2% share. This format remains preferred for agility, affordability, and ease of navigation in congested MEA cities, shifting toward low-cost electric mobility.

3 Wheel models serve a growing niche of riders seeking improved balance and load stability. Their appeal increases among older commuters and delivery operators requiring steadier platforms. As infrastructure matures and last-mile logistics expand, adoption of three-wheel electric scooters is projected to grow at a steady pace.

By Design Analysis

Foldable scooters dominate with 73.4% as commuters prioritize portability and compact storage.

In 2024, Foldable held a dominant market position in the By Design Analysis segment of the Middle East & Africa Electric Scooter Market, with a 73.4% share. Urban consumers value compact folding frames for seamless integration with public transit, ride-sharing models, and office or home storage.

Unfoldable scooters remain essential for users prioritizing sturdier frames, wider decks, and higher load support. These models frequently appeal to commercial fleets and delivery services. With MEA logistics expanding rapidly, unfoldable designs maintain strong operational relevance, especially for routes requiring consistent structural rigidity.

By Foot Platform Analysis

Less than 3.5 Feet dominates with 58.6% due to enhanced maneuverability and lightweight configurations.

In 2024, Less Than 3.5 Feet held a dominant market position in the By Foot Platform Analysis segment of the Middle East & Africa Electric Scooter Market, with a 58.6% share. Compact platforms support quick acceleration and agile cornering, meeting MEA commuters’ preference for highly responsive personal mobility.

The 5 Feet segment caters to riders preferring extended deck space for a balanced stance and comfort. Longer platforms accommodate varied foot orientations during longer commutes, appealing to taller riders and those requiring extra stability. As comfort-driven upgrades rise, this category gains gradual adoption.

Other platform sizes include adjustable and extended-width decks tailored for specialized or premium scooter models. These configurations suit riders demanding custom ergonomics or additional cargo support. With MEA’s diverse commuter base expanding, alternative deck formats enable manufacturers to address varied usability expectations.

Key Market Segments

By Material

- Industrial-Grade Aluminum Alloy

- Carbon Fiber

- Plastic

- Composite

- Others

By Type

- 2 Wheel

- 3 Wheel

By Design

- Foldable

- Unfoldable

By Foot Platform

- Less Than 3.5 Feet

- 5 Feet

- Others

Drivers

Expansion of eco-mobility policies across GCC economies accelerating two-wheel electrification

Expansion of eco-mobility policies across GCC economies is steadily driving electric scooter adoption as governments encourage cleaner mobility choices. Policy frameworks promoting emission-free commuting create stronger demand for two-wheel electrification, especially in dense metropolitan regions. This regulatory momentum aligns with long-term carbon-neutrality programs across MEA nations.

Rising fuel price volatility further accelerates the shift toward cost-efficient electric commuting. Households seek predictable operating costs as petrol expenses fluctuate, making EV scooters a financially stable alternative. This trend becomes more visible in high-traffic cities, where consumers prioritize affordable mobility that lowers recurring daily travel expenses.

Government incentives for local assembly and EV component manufacturing also strengthen market growth. Regional production lowers import costs and builds supply-chain reliability, enabling wider availability of entry-level and mid-range electric scooters. These incentives create manufacturing clusters that support skills development and long-term industrial capacity.

Restraints

Limited charging infrastructure coverage across non-urban MEA corridors

Limited charging infrastructure coverage across non-urban MEA corridors remains a major restraint for mass adoption. Rural and semi-urban locations offer fewer public charging points, discouraging long-distance or intercity EV commuting. This infrastructure gap slows market penetration outside major capital cities and business hubs.

High upfront costs of lithium-ion battery packs also reduce affordability among price-sensitive commuters. While EVs offer lower running expenses, the initial purchase value remains noticeably higher than conventional ICE scooters. This pricing gap restricts adoption among first-time buyers and small businesses with limited investment budgets.

Growth Factors

Large-scale fleet electrification potential in postal, food-delivery, and micro-mobility operators

Large-scale fleet electrification presents a strong opportunity as postal, food-delivery, and micro-mobility operators seek low-maintenance and high-uptime vehicles. Electric scooters reduce fuel overheads and improve operational efficiency, encouraging businesses to upgrade their mobility fleets and support cleaner logistics networks.

Investments in renewable-powered charging hubs further expand opportunity as MEA countries integrate solar-backed charging stations. These hubs reduce electricity costs and support sustainable EV ecosystems, enabling both individuals and enterprises to transition toward greener transportation infrastructure without burdening the grid.

expansion of battery-swapping networks reduces downtime for commercial riders. Instant battery replacement allows continuous usage, making EV scooters more practical for high-frequency delivery operations. This model improves productivity and supports predictable fleet scheduling.

Localization of EV component production lowers the total cost of ownership. Building domestic manufacturing capabilities reduces import duties and creates competitive pricing, increasing accessibility for mass-market consumers and fleet operators across MEA.

Emerging Trends

Surge in smart scooter adoption featuring IoT connectivity and remote diagnostics

Surging smart scooter adoption reflects a shift toward IoT-enabled mobility solutions. Remote diagnostics, GPS tracking, and anti-theft alerts enhance user experience and fleet management efficiency. These digital features make EV scooters more appealing to tech-driven commuters and commercial operators.

Subscription-based EV mobility models are gaining popularity among urban commuters. Flexible monthly plans reduce ownership risks and allow users to access scooters without major upfront expense. This model supports students, professionals, and short-distance travelers seeking cost-efficient mobility options.

Increased demand for durable scooters designed for high-temperature MEA climates also shapes market trends. Heat-resistant battery designs and reinforced components improve performance reliability. Manufacturers adapt products for extreme weather, ensuring long-term durability in desert conditions across GCC and North African markets.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Middle East & Africa Electric Scooter Market Company Insights

The Middle East & Africa electric scooter landscape in 2024 reflects steady modernization as leading manufacturers strengthen product portfolios and regional distribution models.

Honda Motor Co., Ltd shows a stable presence by offering reliable two-wheel electric platforms suited for urban commuting. Its focus on durability and balanced performance aligns well with MEA’s growing demand for practical and energy-efficient mobility options.

Alpha Architect 1-3 Month Box ETF remains an unconventional entry in the mobility space, yet its relevance emerges through investments that indirectly influence EV-related innovation. Although not a manufacturer, its strategic positioning reflects broader financial interest toward sustainable transport technologies, shaping future EV growth trajectories in MEA markets.

GreenPower Motor Company Inc. contributes momentum through its expertise in electric transportation technologies, supporting commercial and personal mobility shifts across the region. Its emphasis on electric platforms positions the company as a valuable contributor to the evolving EV ecosystem, particularly as MEA countries expand green-mobility initiatives.

Mahindra & Mahindra Ltd maintains strong visibility with its established two-wheeler and electric mobility capabilities. The brand’s growing emphasis on localized solutions and energy-efficient commuter vehicles strengthens its competitive stance in MEA, especially in markets transitioning toward low-maintenance and cost-effective electric scooters.

The overall competitive environment displays rising technological adoption, product diversification, and broader investment in electrification pathways. As governments accelerate eco-mobility policies and infrastructure deployment, key players are expected to refine regional strategies, expand assembly capabilities, and deliver purpose-built scooters suited for varying climatic and commuting conditions across the Middle East & Africa markets.

Top Key Players in the Market

- Honda Motor Co Ltd

- Alpha Architect 1-3 Month Box ETF

- GreenPower Motor Company Inc

- Mahindra & Mahindra Ltd

- PIERER Mobility AG

- Gogoro Inc

- BMW AG

- ATHER

Recent Developments

- In Dec 2025, EV LAB, a multi brand electric mobility platform, announced a strategic investment in Pure Electric to expand access to high performance e scooters across the UAE and the Middle East.

The investment supports regional market expansion and accelerates adoption of premium electric micromobility solutions. - In Dec 2025, Pure Electric launched a new lineup of three e scooters in the UAE, including the Air⁴ with a 710W motor, the Pure x McLaren with a 900W motor and 50 km range, and the Pure Flex featuring a foldable design.

The launch strengthens Pure Electric’s premium product portfolio and targets performance driven urban mobility users. - In Dec 2024, WEG acquired Volt Electric Motor, a manufacturer of industrial and commercial electric motors based in Türkiye.

The acquisition expands WEG’s manufacturing footprint and reinforces its position in the global electric motor and industrial automation market.

Report Scope

Report Features Description Market Value (2024) USD 831.3 Million Forecast Revenue (2034) USD 1053.8 Million CAGR (2025-2034) 2.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Industrial-Grade Aluminum Alloy, Carbon Fiber, Plastic, Composite, Others), By Type (2 Wheel, 3 Wheel), By Design (Foldable, Unfoldable), By Foot Platform (Less Than 3.5 Feet, 5 Feet, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Honda Motor Co Ltd, Alpha Architect 1-3 Month Box ETF, GreenPower Motor Company Inc, Mahindra & Mahindra Ltd, PIERER Mobility AG, Gogoro Inc, BMW AG, ATHER Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Middle East & Africa Electric Scooter MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Middle East & Africa Electric Scooter MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Honda Motor Co Ltd

- Alpha Architect 1-3 Month Box ETF

- GreenPower Motor Company Inc

- Mahindra & Mahindra Ltd

- PIERER Mobility AG

- Gogoro Inc

- BMW AG

- ATHER