Global Microfluidic Devices Market- By Product Type (Microfluidic-Based Devices and Microfluidic Components), By Material (Glass, Silicon, Polymer, PDMS, and Other Materials), By Application (In-Vitro Diagnostics, Pharmaceutical & Life Science Research, and Therapeutics), By End-User (Hospitals & Diagnostic Centers, Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032.

- Published date: Nov. 2023

- Report ID: 26973

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

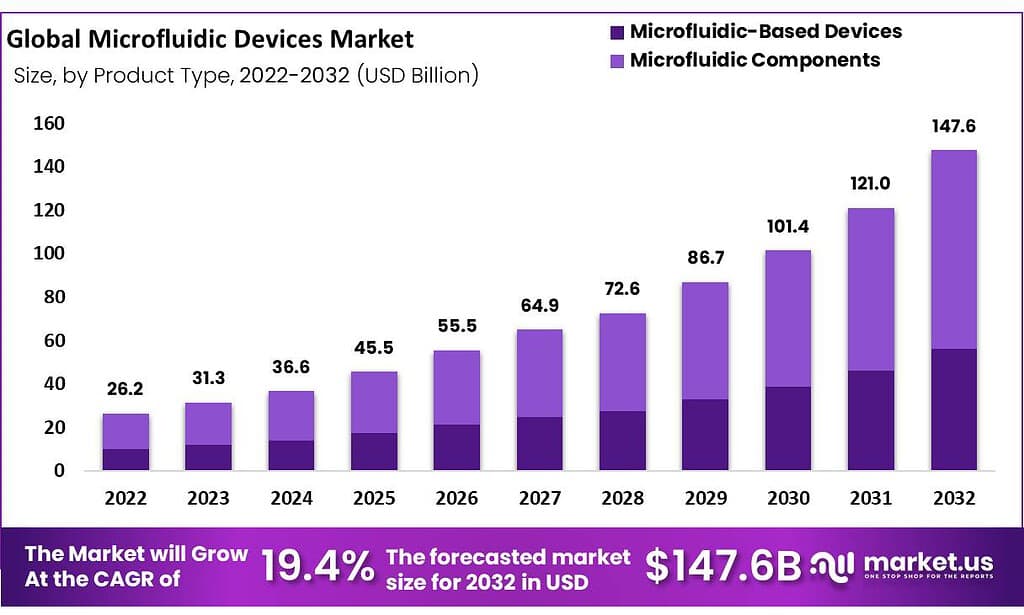

The global microfluidic devices market size is projected to surpass at USD 147.6 Billion by 2032 and it is growing at a CAGR of 19.4% from 2023 and 2032.

Microfluidic devices are used to diagnose or analyze small volumes of fluids in order to carry out physiological, chemical, and biological procedures with microfluidic devices. Due to their efficiency in data interpretation and the requirement for a very small number of samples, microfluidics devices are becoming increasingly popular across a wide range of diagnostic applications.

The market is anticipated to be driven by the growing use of microfluidics devices in diagnostics and other research areas. For instance, the number of microfluidic devices that can be used to treat ophthalmological conditions has increased over the past ten years. The levels of dry eye disease, infections, glucose, and vascular endothelium growth factor have all been successfully assessed using microfluidic methods. The expansion of the microfluidics market is anticipated to be aided by these kinds of applications in the coming years.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Valuation and Growth Rate: The global microfluidic devices market is projected to reach US$ 147.6 billion by 2032, growing at a 19.4% CAGR.

- Product Type Analysis: The microfluidic component segment, encompassing chips, valves, and others, is expected to hold the largest share of the market at 62%.

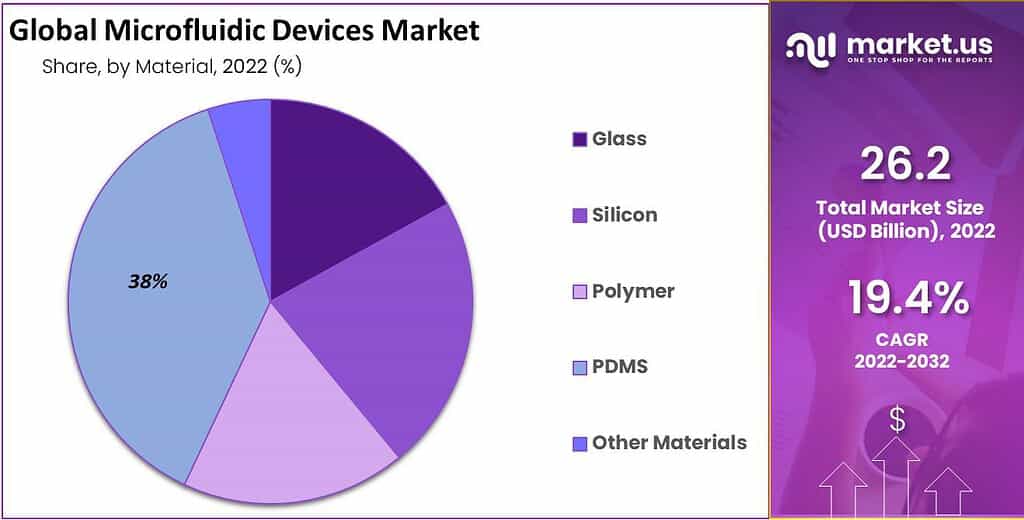

- Material Analysis: Polydimethylsiloxane (PDMS) holds the highest share of the market at 38%. This widely-used polymer in microfluidics is preferred due to its robustness, optical transparency, biocompatibility, and other beneficial properties that allow for the creation of complex microfluidic device designs.

- Application Analysis: The pharmaceutical and life science sector currently holds the largest share of the market. Factors such as increased research in microfluidics, high-throughput screening, and the demand for devices for rapid disease diagnosis contribute to its leading position.

- End-User Analysis: Hospitals and diagnostic centers are expected to experience the highest growth rate, driven by the increasing use of microfluidic technology for rapid disease diagnosis.

- Drivers: Cost-effective materials like polymers and paper are driving market growth, enabling the production of disposable, flexible, and durable chips and sensors.

- Restraints: Stringent FDA approval processes pose a significant challenge for companies launching novel products in the United States.

- Opportunities: Microfluidics-based 3D cell culture systems offer opportunities for developing subcutaneous patches and controlled-release intelligent pills.

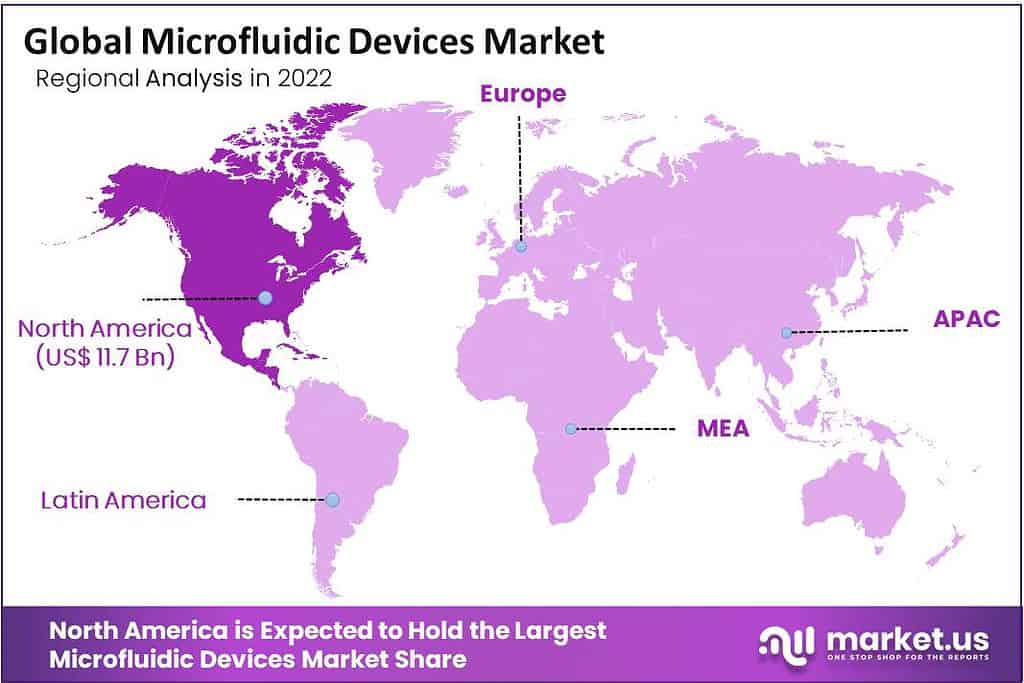

- Regional Analysis: North America dominates the market, while Asia Pacific shows significant growth potential, with a focus on pharmaceuticals and medical devices.

- Key Market Players: Key players such as Illumina, Inc., PerkinElmer, Inc., and Thermo Fisher Scientific are driving market growth through strategic partnerships and product innovations.

Product Type Analysis

The microfluidic Component Segment Will Hold the Largest Share of the Market.

The segment is categorized into chips, valves, and others. Due to its high potential in numerous applications, including biomedical, immunoassays, life science, diagnostics & molecular testing, drug delivery, and many others, the microfluidic component segment is projected to hold the maximum share of 62% of the market. Also, due to its improved sensitivity, cost-effectiveness, faster reaction time, and ease of integration into devices, it is also anticipated to continue dominating the market with a high CAGR over the forecast period.

Material Analysis

The PDMS Segment held the Highest Share of the Market

The microfluidics market was dominated by the polydimethylsiloxane (PDMS) sector with a revenue share of 38%. Due to its numerous advantages, PDMS is a widely used polymer in microfluidics. Robustness, nontoxicity, gas and oxygen permeability, optical transparency, biocompatibility, low cost, elastomeric properties, and the ability to stack multiple layers make complex microfluidic device designs possible are some of the benefits of PDMS. Also, due to its permeability, low autofluorescence, and biocompatibility, PDMS is anticipated to gain traction in a number of biomedical and biotechnology engineering applications during the forecast period.

Note: Actual Numbers Might Vary in the final report

Application Analysis

The Pharmaceutical and Life Science Sector accounted for the Largest Share of the Market

The market is divided into in-vitro diagnostics, pharmaceutical and life science research, and therapeutics. Due to increased research in the field of microfluidics, high-throughput screening, the use of sensors, and chips for various applications to discover drugs, cell analysis, carry immunoassays, microarray, and rising demand for devices for rapid and early disease diagnosis, among other factors, the pharmaceutical and life science sector currently holds the leading position. Additionally, the segment is likely to expand at a higher CAGR over the forecast period.

Because of the increasing use of microfluidic devices for infectious disease detection and drug delivery, the diagnosis and treatment market will also significantly contribute to the market’s expansion. Devices known as ‘lab-on-a-chip’ have shown great promise for the screening of molecular diseases. Additionally, the chips are utilized for glucose tests, pregnancy tests, and other point-of-care diagnostic tests.

End-User Analysis

Hospitals and Diagnostic Centers Segment to Register Largest CAGR During the Forecast Period

Hospitals and diagnostic centers, academic and research institutions, and pharmaceutical and biotechnology companies make up the majority of the market’s segmentation. During the forecast period, hospitals and diagnostic centers are expected to experience the highest CAGR.

The growing use of diagnostic devices based on microfluidics, the rising adoption of microfluidic technology for the rapid diagnosis of various chronic diseases, and technological advancements are primarily responsible for this segment’s substantial share and rapid growth rate.

Key Market Segments

Based on Product Type

- Microfluidic-Based Devices

- Microfluidic Components

- Microfluidic Chips

- Microfluidic Valves

- Other Components

Based on Material

- Glass

- Silicon

- Polymer

- PDMS

- Other Materials

Based on Application

- In-Vitro Diagnostics

- Clinical Diagnostics

- Point-of-care Testing

- Veterinary diagnostics

- Pharmaceutical & Life Science Research

- Lab Analytics

- Microdispensing

- Microreaction

- Therapeutics

- Drug Delivery

- Wearable Devices

Based on End-User

- Hospitals & Diagnostic Centers

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Other End-Users

Drivers

Adoption of Cost-Effective Materials for Manufacturing Will Drive the Market Growth

The attention to the utilization of low-cost materials for producing microfluidic chips and sensors is one of the primary and significant factors driving the expansion of the market for microfluidic devices. Chips and sensors are made with high-quality materials and components so that micro fluids can flow accurately and aid in drug delivery, disease diagnosis, and cellular analysis.

Glass, PDMS, silicone, and other materials are some of the materials used in manufacturing. Since glass is a costly material, manufacturers today focus on using cheaper materials like polymers and paper to produce chips and sensors. Paper is a useful substrate for making chips and sensors that are disposable, easy to use, flexible, and durable.

In addition, the microfluidic industry’s expensive reagents and materials have become obvious roadblocks, and getting around them is every company’s primary strategy for making microfluidic devices. The development of low-cost, powerful platforms based on application and technical requirements has taken precedence.

Restraints

Lengthy and Complex Process for the Approval of FDA.

To ensure the marketing and sale of their products in international markets, medical device manufacturers must adhere to stringent regulatory policies. Because the majority of the leading global players are based in the United States, the country is a major manufacturing hub for microfluidics devices.

To guarantee the safety and effectiveness of medical devices, the FDA in the United States has established stringent regulatory standards and guidelines. However, the FDA’s approval process for medical devices has become more time-consuming and complicated over the past few years. This presents a significant obstacle for businesses launching novel products in the United States.

Opportunities

The Involvement of Microfluidics-Based 3D Cell Culture Systems

The use of microfluidics in 3D cell culture has made it possible to create microenvironments that replicate the spatiotemporal chemical gradients, mechanical microenvironments, and tissue-tissue interface of living organs and support tissue differentiation. Researchers have begun creating tumors on chips as a result of the growing popularity of organ-on-a-chip models. The study of cancer cell proliferation and the creation of novel anticancer medications benefit from these chips.

It is anticipated that the major advantages of microfluidics, such as biocompatibility and controlled release of drugs, will present significant opportunities for the adoption of technology. Researchers are also focusing on developing subcutaneous patches and controlled-release intelligent pills in addition to wearable, implantable, and portable devices.

The release can be better controlled by constructing diffusion barriers using microtechnologies. Pharmaceutical and healthcare companies need to get in on the fast-growing market. Utilizing microfluidics technologies, medical device companies are making significant investments in the creation of new drug-delivery devices.

Regional Analysis

North America Dominates the Global Microfluidic Devices Market During the Forecast Period

North America holds the microfluidics market with a share of 44.7% in 2022 and is estimated to exhibit the highest CAGR during the forecast period. The primary driving force behind the market’s expansion is an increase in research funding from businesses and government agencies. The industry-academia collaboration to accelerate the commercialization of lab-built devices has been motivated by the demand for microfluidics devices in the research and diagnostics fields.

Due to its expanding economy, advanced research infrastructure, and affordable labor, Asia Pacific is anticipated to grow at a high rate over the forecast period. Investors from all over the world are eager to get their hands on the untapped APAC microfluidics market. Foreign companies dominate the market for microfluidic-based diagnostic tests. However, significant players in the region are presenting novel, cost-effective, and interesting solutions that have the potential to increase their market share in the coming years.

China’s government has devised a strategic plan to establish the nation as a major player and significantly improve the local economy. Made in China 2025 is the name of this plan, which places an emphasis on pharmaceuticals and medical devices. From this strategic plan’s perspective, this is expected to benefit from spending money because it is a crucial tool for diagnostics and life sciences applications.

Note: Actual Numbers Might Vary in the final report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

SCHOTT AG Enrolled in A Purchase Contract to Achieve the Microfluidic Company M

To expand their market presence, major players in the microfluidics market are employing a variety of strategies, such as geographical expansion partnerships, mergers and acquisitions, and strategic collaborations. For instance, SCHOTT AG entered into a purchase contract with MINIFAB, a microfluidic company, with the expectation that this initiative would enable both partners to significantly expand their diagnostics product range.

Market Key Players

- Illumina, Inc.

- PerkinElmer, Inc.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Thermo Fisher Scientific

- Agilent Technologies, Inc.

- Abbott

- Hoffmann-La Roche Ltd

- Other Key Players.

Recent developments

- In March 2022- The Miro Canvas, a compact and simple-to-use digital microfluidics platform that enables on-demand automation of intricate next-generation sequencing (NGS) sample preparation protocols, was introduced by Miroculus Inc.

- In January 2022- uFluidix launched a funding-required call for manufacturing projects. In thermoplastic microfluidic chips, the uFluidix team is now optimizing for new process variables after doubling its manufacturing capacity over the past year.

Report Scope

Report Features Description Market Value (2023) US$ 31.3 Bn Forecast Revenue (2032) US$ 147.6 Bn CAGR (2023-2032) 19.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type- Microfluidic-Based Devices and Microfluidic Components; By Material– Glass, Silicon, Polymer, PDMS, and Other Materials; By Application- In-Vitro Diagnostics, Pharmaceutical & Life Science Research, and Therapeutics; and By End-User- Hospitals & Diagnostic Centers, Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, and Other End-Users. Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Illumina, Inc., PerkinElmer, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, Thermo Fisher Scientific, Agilent Technologies, Inc., Abbott, F. Hoffmann-La Roche Ltd, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a microfluidic device?Microfluidic systems are small-scale devices that manipulate and control materials and fluids at a microscale (typically between 10-9 and 10-6 liters). These devices are used in a variety of applications including medical diagnosis, chemical analysis and drug discovery.

What are the factors driving the microfluidic device market?The microfluidic device market is growing due to a variety of factors. These include the demand for point of care testing, the development and use of lab-on a chip technology, as well as the rise in chronic disease prevalence.

What are the main applications of microfluidics?Microfluidics devices are used for a wide range of applications including drug discovery, environmental monitoring, molecular diagnosis, and cell analysis.

What are the major players on the microfluidic device market?The microfluidic device market is dominated by Illumina, Inc., PerkinElmer, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, Thermo Fisher Scientific, Agilent Technologies, Inc., Abbott, F. Hoffmann-La Roche Ltd, Other Key Players.,

Microfluidic Devices MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

Microfluidic Devices MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Illumina, Inc.

- PerkinElmer, Inc.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Thermo Fisher Scientific

- Agilent Technologies, Inc.

- Abbott

- Hoffmann-La Roche Ltd

- Other Key Players.