Global Methyl Isobutyl Ketone Market By Purity(Upto 99%, Above 99%), By Application(Solvents, Rubber Processing Chemicals, Surfactants, Denaturants, Others), By End-use(Paints and Coatings, Pharmaceuticals, Rubber, Others), By Distribution Channel(Direct Sales, Indirect Sales) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122474

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

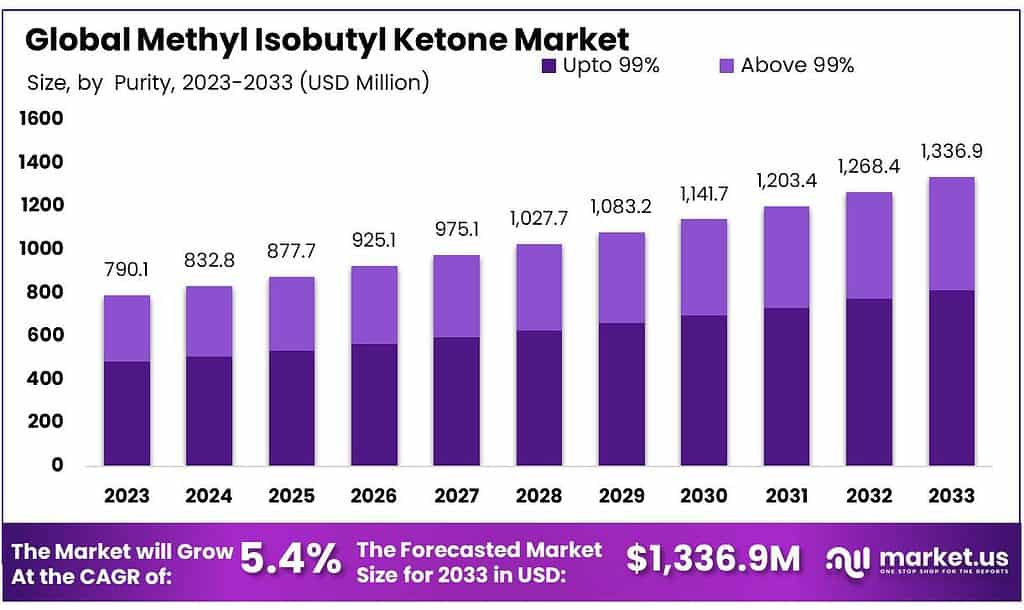

The global Methyl Isobutyl Ketone Market size is expected to be worth around USD 1336.9 Million by 2033, from USD 790.1 Million in 2023, growing at a CAGR of 5.4% during the forecast period from 2023 to 2033.

Methyl Isobutyl Ketone (MIBK) is an organic compound classified as a ketone. It is a colorless liquid with a characteristic sharp, sweet odor, commonly described as having a camphor-like smell. MIBK is widely used in industrial applications primarily as a solvent.

It is effective in varnishes, paints, inks, and other coatings because it has excellent solvency properties. This makes MIBK particularly valuable in the automotive and electronics industries for surface coatings and adhesives.

MIBK also plays a role in chemical synthesis. It serves as an intermediate in the production of other chemicals. For instance, it’s used to synthesize methyl isobutyl carbinol, rubber antioxidants, and some pharmaceuticals. Additionally, MIBK is used in extraction and purification processes due to its solvent properties.

It is particularly useful in the mining industry for the extraction of gold and other precious metals from ore, as it effectively separates the metals from waste material. Safety precautions are essential when handling MIBK due to its flammability and potential health effects, prompting the use of proper protective equipment to minimize exposure risks.

Key Takeaways

- The global MIBK market size is expected to reach USD 1336.9 million by 2033, up from USD 790.1 million in 2023. At a (CAGR) of 5.4% from 2023 to 2033.

- In 2023, the “Up to 99%” purity segment held a dominant position with more than 61.4% market share.

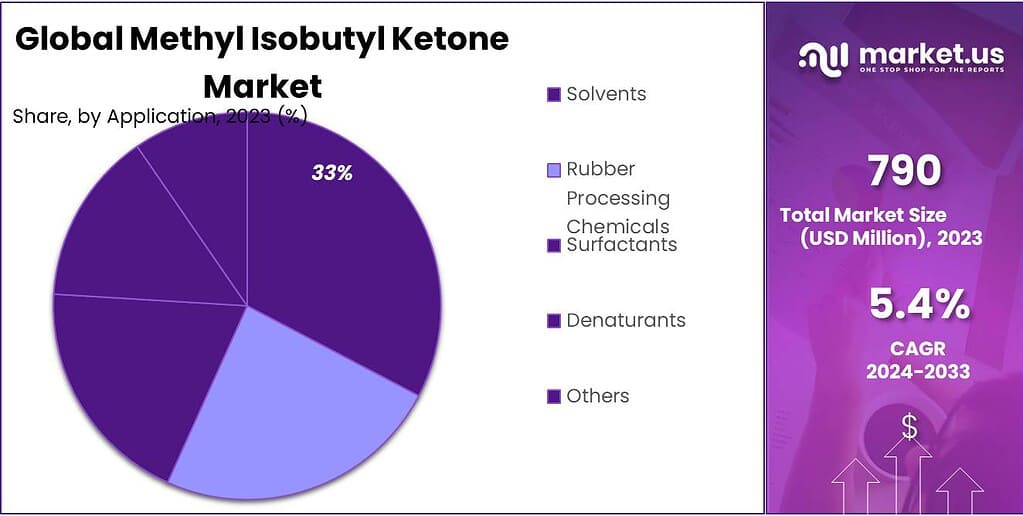

- The “Solvents” segment led the market with a 34.6% share in 2023.

- Indirect Sales channels held a dominant position with more than a 67.5% share in 2023.

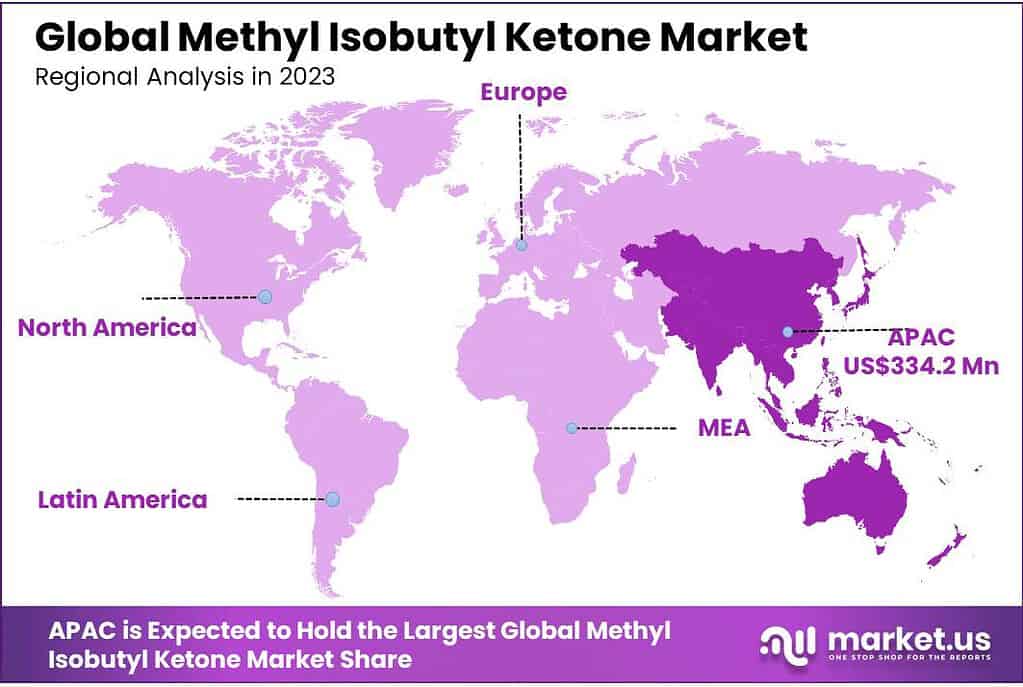

- The Asia Pacific region holds the largest market share at 42.3%, expected to reach USD 334.2 million by the forecast period’s end.

By Purity

In 2023, the “Up to 99%” purity segment of the Methyl Isobutyl Ketone (MIBK) market held a dominant position, capturing more than 61.4% market share. This segment primarily caters to standard industrial applications where extremely high purity is not a critical requirement. It is favored for its cost-effectiveness and sufficient efficacy in various applications such as solvents in paints, coatings, and other chemical processes.

Conversely, the “Above 99%” purity segment, while smaller, targets specialized applications that demand high purity levels of MIBK. These include sensitive electronic components manufacturing and high-grade pharmaceutical preparations. This segment benefits from the premium pricing of high-purity MIBK, driven by its necessity in industries where impurities could compromise product quality or safety.

By Application

In 2023, the “Solvents” segment held a dominant position in the Methyl Isobutyl Ketone (MIBK) market, capturing more than a 34.6% share. This segment leads due to the widespread use of MIBK as a solvent in paints, coatings, and adhesives, where its effectiveness in dissolving various substances is highly valued. Additionally, its low solubility in water and good evaporation rate makes it ideal for surface coatings.

Other application segments include Rubber Processing Chemicals, Surfactants, and Denaturants. MIBK’s role in rubber processing involves improving the blend of materials to enhance product durability. As a surfactant, it aids in reducing surface tension in liquids, and as a denaturant, it renders substances unfit for consumption. The diverse applications of MIBK underline its versatility and broad utility across multiple industries, supporting its continued market relevance.

By End-use

In 2023, the “Paints and Coatings” segment held a dominant market position in the Methyl Isobutyl Ketone (MIBK) market, capturing more than a 36.5% share. This segment leverages MIBK’s effectiveness as a solvent in the formulation of various paint and coating products, enhancing their application properties and finish quality.By Distribution Channel

In 2023, the “Indirect Sales” channel held a dominant market position in the Methyl Isobutyl Ketone (MIBK) market, capturing more than a 67.5% share. This channel’s success is attributed to its extensive reach, enabling MIBK manufacturers to distribute their product through various resellers, distributors, and retailers, effectively expanding their market presence. Indirect sales are crucial for penetrating markets where direct relationships with end users are less established, offering flexibility and local access to customers across diverse industries.

In 2023, the “Direct Sales” segment of the Methyl Isobutyl Ketone (MIBK) market was predominant, aligning closely with industrial buyers who prefer streamlined purchasing processes. This method ensures they receive bulk quantities directly from manufacturers, facilitating better price negotiations and more reliable supply chains.

Conversely, “Indirect Sales” involve distributors and traders who play a crucial role in reaching smaller or more geographically dispersed customers. This channel supports the market by enhancing the accessibility of MIBK to a wider range of end-users, including those in niche markets that require smaller volumes.

Key Market Segments

By Purity

- Upto 99%

- Above 99%

By Application

- Solvents

- Rubber Processing Chemicals

- Surfactants

- Denaturants

- Others

By End-use

- Paints and Coatings

- Pharmaceuticals

- Rubber

- Others

By Distribution Channel

- Direct Sales

- Indirect Sales

Driving Factors

Growth in the Paints and Coatings Industry

One of the primary drivers for the Methyl Isobutyl Ketone (MIBK) market is its significant role in the paints and coatings industry. MIBK serves as an effective solvent in this sector, which is growing rapidly due to increasing urbanization and industrialization globally.

As cities expand and the construction of residential and commercial buildings increases, so does the demand for paints and coatings. MIBK’s properties make it particularly useful for formulating high-quality paints that dry quickly and evenly, providing a durable finish. This makes it a preferred choice among manufacturers for applications ranging from automotive to decorative paints.

Additionally, the push towards more environmentally friendly and less volatile organic compound (VOC) emitting products is shaping the development of new paints and coatings formulations. MIBK fits well into this trend as it helps in reducing the VOC content without compromising the quality of the final product.

The expansion of the automotive industry, especially in emerging economies, further propels the demand for MIBK. Vehicles require coatings that can withstand extreme conditions and provide lasting aesthetic appeal, aspects where MIBK-based solvents excel. Its ability to dissolve a wide range of resins and its moderate evaporation rate makes it suitable for high-performance coatings used in automotive and other industrial applications.

Moreover, technological advancements and innovations in paint formulations continue to open new avenues for MIBK. As the paints and coatings industry strives for more advanced and sustainable solutions, the demand for MIBK is expected to remain strong.

The continuous growth in this sector, supported by economic developments and infrastructural upgrades, solidifies MIBK’s position as a critical component in the manufacturing of modern coatings, ensuring its market growth and expanded application scope.

Restraining Factors

Environmental and Health Concerns

One major restraint facing the Methyl Isobutyl Ketone (MIBK) market is the growing concern over its environmental and health impacts. MIBK is classified as a volatile organic compound (VOC), which means it can contribute to air pollution and have detrimental effects on environmental quality.

These emissions can lead to the formation of ground-level ozone and smog, which pose serious health risks such as respiratory problems, eye irritation, and other ailments. The increasing stringency of environmental regulations globally, aimed at reducing VOC emissions, directly impacts the production and use of MIBK in industries.

Furthermore, the health risks associated with MIBK exposure are significant restraints. Workers in industries that use MIBK are at risk of exposure through inhalation or skin contact, which can lead to symptoms like headache, dizziness, and nausea.

Chronic exposure may lead to more severe health issues, including neurological damage. These health concerns have prompted regulatory agencies to implement strict guidelines on the use of MIBK, compelling companies to look for safer, less toxic alternatives.

As the global market moves towards more sustainable and safer products, the demand for MIBK may be adversely affected. Manufacturers in the paints, coatings, and adhesives industries are increasingly pressured to find alternative solvents that do not compromise worker safety or environmental standards.

This shift is driven not only by regulatory compliance but also by growing consumer awareness and demand for environmentally friendly products. As a result, the development and adoption of alternative solvents that are less harmful to health and the environment could significantly restrain the growth of the MIBK market.

Growth Opportunities

Expansion in Emerging Markets

A significant opportunity for the Methyl Isobutyl Ketone (MIBK) market lies in its expansion into emerging markets, particularly in Asia, Africa, and South America. These regions are witnessing rapid industrial growth, increased urbanization, and a rising middle class, which drive demand for products that use MIBK, such as paints, coatings, and adhesives.

As infrastructure development and automotive production increase in these areas, the need for MIBK as a solvent in these applications also grows. This presents a lucrative opportunity for manufacturers to establish or expand their presence in these burgeoning markets.

Moreover, emerging markets often have less stringent environmental regulations compared to developed regions, which can initially ease the introduction and usage of MIBK-based products. However, as these economies grow and environmental awareness increases, there will also be opportunities for innovation in sustainable practices.

Companies that invest in environmentally friendly technologies and formulations involving MIBK can gain a competitive edge. By leveraging local manufacturing and supply chains, companies can reduce costs and improve the efficiency of their operations, making their products more attractive in competitive markets. This strategic focus on emerging markets could significantly boost the global MIBK market, tapping into new consumer bases and industrial applications.

Latest Trends

Increasing Use of MIBK in Green Applications

A major trend in the Methyl Isobutyl Ketone (MIBK) market is its increasing application in environmentally friendly products. As global environmental regulations tighten and consumer preferences shift towards sustainable products, manufacturers are innovating to develop MIBK formulations that minimize environmental impact.

This includes creating solvent blends that reduce volatile organic compound (VOC) emissions and enhancing the efficiency of MIBK in industrial processes to lower overall energy consumption. This trend not only helps companies comply with stricter regulations but also aligns with the growing demand for green chemistry solutions across various industries, including paints, coatings, and adhesives.

This shift is pushing the MIBK market towards more sustainable practices, offering significant growth opportunities for companies that can innovate effectively in this space.

Regional Analysis

In the Methyl Isobutyl Ketone (MIBK) Market, the Asia Pacific region stands out as a key player, holding a leading market share of 42.3%. Analysts project the market to reach a value of USD 334.2 million by the end of the forecast period. This growth is fueled by extensive adoption across critical sectors such as solvents, rubber processing chemicals, and pharmaceuticals.

Key economies in the region, including China, India, Japan, and South Korea, play pivotal roles in this upward trend. These countries demonstrate a significant rise in MIBK usage, driven by increasing demand for raw materials in various industries, including petrochemicals and construction. Additionally, the region’s emphasis on sustainable practices and stringent regulatory frameworks further enhances its position in the global MIBK market.

In North America, the MIBK market is experiencing steady expansion. This growth is driven by rising demand from industries utilizing MIBK for the production of coatings, adhesives, and other chemical intermediates. The region’s robust industrial base and advancements in chemical processing technologies contribute significantly to the adoption of MIBK solutions.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

The Methyl Isobutyl Ketone (MIBK) market is highly competitive, with key players including Arkema S.A., Celanese Corporation, Eastman Chemical Company, Kumho P&B Chemicals Inc., Mitsubishi Chemical Corporation, Mitsui Chemicals, Royal Dutch Shell plc, Sasol Limited, Sigma-Aldrich, and The Dow Chemical Company. These companies are leading the market through extensive research and development efforts, robust product portfolios, and strategic expansions.

Arkema S.A. and Eastman Chemical Company focus on innovative solutions and sustainability, while Royal Dutch Shell and Sasol Limited leverage their vast industrial experience and global presence. Mitsui Chemicals and Mitsubishi Chemical Corporation are enhancing their market positions through advancements in chemical processing technologies and expanding their product applications. These key players are crucial in shaping the MIBK market dynamics, and driving growth through technological innovation and strategic collaborations.

Market Key Players

- Arkema S.A.

- Celanese Corporation

- Eastman Chemical Company

- Kumho P&B Chemicals Inc.

- Mitsubishi Chemical Corporation

- Mitsui Chemicals

- Royal Dutch Shell plc

- Sasol Limited

- Sigma-Aldrich

- The Dow Chemical Company

Recent Development

For instance, in January 2023, Arkema boosted its production capacity by upgrading its manufacturing facilities, resulting in a 5% increase in output. By March 2023, the company had launched a new line of eco-friendly MIBK products, catering to the increasing market demand for sustainable solutions.

Celanese Corporation has shown robust performance throughout 2023 and into 2024. The company has focused on enhancing its production and distribution capabilities to meet the growing global demand for MIBK.

Report Scope

Report Features Description Market Value (2023) USD 790.1 Million Forecast Revenue (2033) USD 1336.9 Million CAGR (2024-2033) 5.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity(Upto 99%, Above 99%), By Application(Solvents, Rubber Processing Chemicals, Surfactants, Denaturants, Others), By End-use(Paints and Coatings, Pharmaceuticals, Rubber, Others), By Distribution Channel(Direct Sales, Indirect Sales) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Arkema S.A., Celanese Corporation, Eastman Chemical Company, Kumho P&B Chemicals Inc., Mitsubishi Chemical Corporation, Mitsui Chemicals, Royal Dutch Shell plc, Sasol Limited, Sigma-Aldrich, The Dow Chemical Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Methyl Isobutyl Ketone Market?Methyl Isobutyl Ketone Market size is expected to be worth around USD 1336.9 Million by 2033, from USD 790.1 Million in 2023

What is the projected CAGR at which the Global Methyl Isobutyl Ketone Market is expected to grow at?The Global Methyl Isobutyl Ketone Market is expected to grow at a CAGR of 5.4% (2024-2033).List the key industry players of the Global Methyl Isobutyl Ketone Market?Arkema S.A., Celanese Corporation, Eastman Chemical Company, Kumho P&B Chemicals Inc., Mitsubishi Chemical Corporation, Mitsui Chemicals, Royal Dutch Shell plc, Sasol Limited, Sigma-Aldrich, The Dow Chemical Company

Methyl Isobutyl Ketone MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Methyl Isobutyl Ketone MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Arkema S.A.

- Celanese Corporation

- Eastman Chemical Company

- Kumho P&B Chemicals Inc.

- Mitsubishi Chemical Corporation

- Mitsui Chemicals

- Royal Dutch Shell plc

- Sasol Limited

- Sigma-Aldrich

- The Dow Chemical Company