Global Metallic Stearates Market By Product Type (Zinc Stearate, Calcium Stearate, and others), By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec 2023

- Report ID: 13363

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

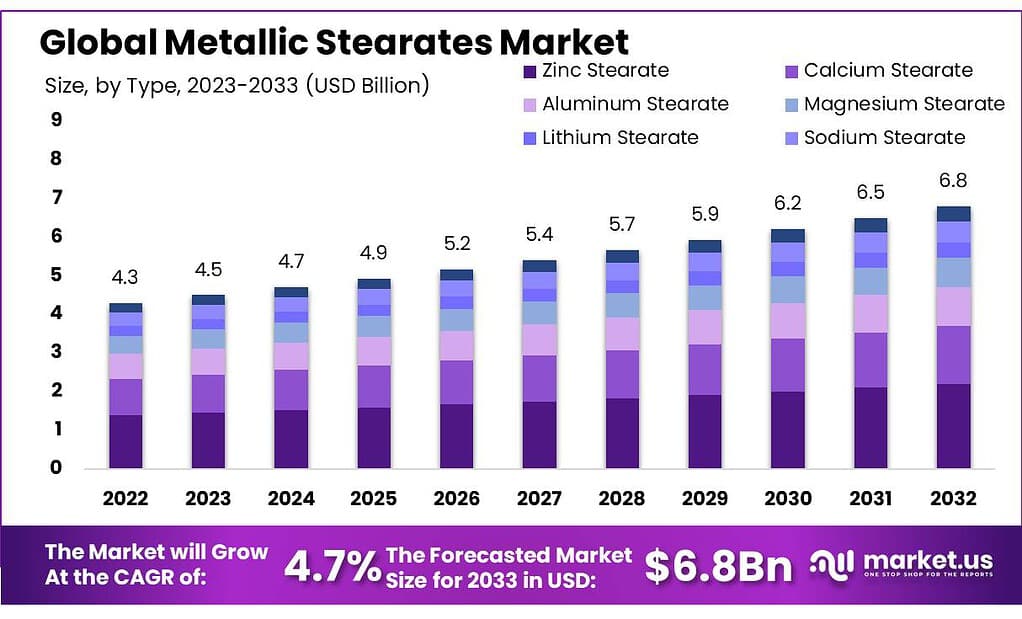

The Metallic Stearates Market size is expected to be worth around USD 6.8 billion by 2033, from USD 4.3 Bn in 2023, growing at a CAGR of 4.7% during the forecast period from 2023 to 2033.

Market growth is expected to be driven by the growing plastics and rubber industries, as well as increasing demand for cosmetics and pharmaceutical products. Many products can be used as metallic stearates. These include aluminum, zinc, and calcium stearate. They are used in a wide variety of applications such as plastics and rubber, pharmaceuticals, and cosmetics.

Actual Numbers Might Vary in the Final Report

Key Takeaways

- Market Projection: The market size is anticipated to reach around USD 6.8 billion by 2033, growing at a CAGR of 4.7% from USD 4.3 billion in 2023.

- Dominant Type: Zinc Stearate claimed a significant market share of over 33.2%, valued for its multifaceted utility across industries like plastics, rubber, cosmetics, and pharmaceuticals.

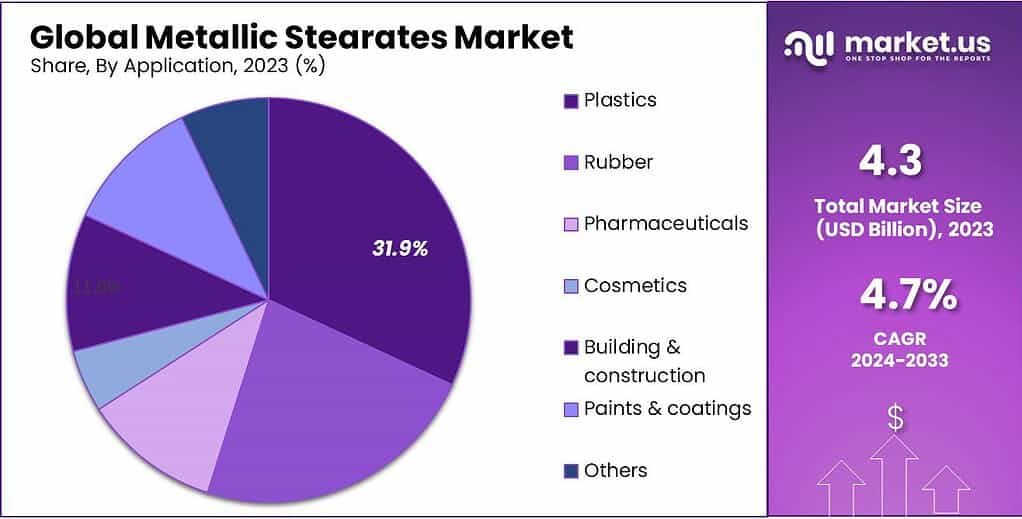

- Application Domination: Plastics emerged as the leading application segment, commanding over 31.9% of the market share, showcasing the pivotal role of metallic stearates in altering and enhancing various plastic properties.

- Driving Factors: The surge in polymer utilization across industries like automotive, construction, packaging, and electronics is fostering the demand for metallic stearates due to their crucial role in enhancing polymer quality and efficiency.

- Environmental Challenges: Stringent environmental regulations pose hurdles due to potential health and environmental risks associated with metallic stearates, impacting their usage in certain industries.

- Sustainable Shift: The industry is witnessing a shift towards bio-based metallic stearates, offering eco-friendly alternatives that align with sustainability goals without compromising on performance.

- Price Volatility: Fluctuations in raw material prices, like stearic acid and metal oxides, pose challenges for manufacturers, impacting production costs and potentially influencing market demand.

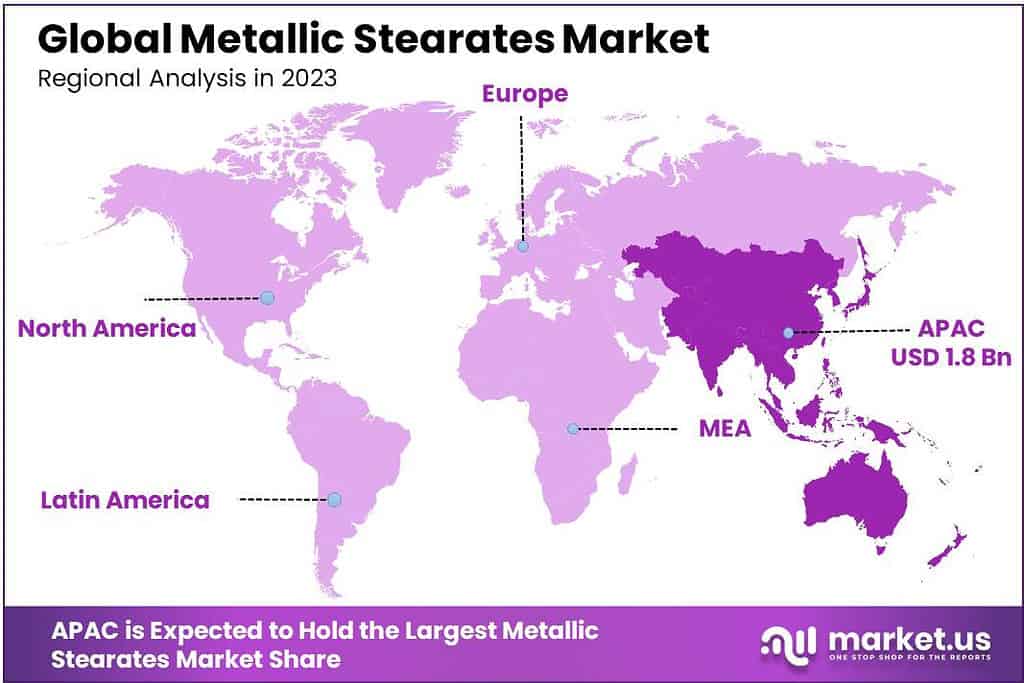

- Regional Insights: Asia Pacific leads the market share (over 42.3%) due to increased demand in countries like India and China, driven by construction and automobile production. North America follows suit, driven by cosmetic and pharmaceutical industry demand.

- Market Players: Key players focus on differentiation, expansions, and product innovations to maintain market presence, emphasizing eco-friendly alternatives and product efficacy.

Type Analysis

In the landscape of Metallic Stearates, 2023 witnessed Zinc Stearate asserting its dominance by securing a substantial market share of more than 33.2%. This particular type stands out due to its multifaceted utility across diverse industries.

Zinc Stearate’s versatility shines through its functions as a lubricant, release agent, and stabilizer, finding extensive applications in sectors such as plastics, rubber, cosmetics, and pharmaceuticals. Its widespread use signifies not only its pivotal role in these industries but also its preference over other metallic stearates, establishing itself as a cornerstone in various manufacturing processes.

This dominance of Zinc Stearate reflects its pivotal position in the Metallic Stearates market, backed by its unique properties and wide-ranging applicability. As a key ingredient in multiple industrial applications, its significance goes beyond being a mere constituent, playing a crucial role in enhancing product quality, functionality, and production efficiency.

This substantial market share illustrates the confidence and reliance placed upon Zinc Stearate as the go-to choice among metallic stearates, solidifying its leadership position within the market landscape.

Application Analysis

In 2023, the Metallic Stearates market witnessed Plastics as the frontrunner among application segments, commanding a substantial market share exceeding 31.9%. This dominance signifies the pivotal role of metallic stearates within the plastics industry, where they serve as essential additives.

Their incorporation into plastics formulations contributes significantly to altering and enhancing various properties, including viscosity, stability, and color. The prevalence of metallic stearates in plastics underscores their critical function in improving product quality and performance.

The significant market share held by Plastics in the Metallic Stearates sector underscores the widespread reliance on these additives to achieve desired outcomes in plastic manufacturing processes.

Their versatility in manipulating and fine-tuning plastic properties underscores their indispensability within the industry. This commanding position highlights the preference for metallic stearates in the plastics domain, emphasizing their integral role in shaping the characteristics and usability of plastic-based products across diverse sectors.

Actual Numbers Might Vary in the Final Report

Кеу Маrkеt Ѕеgmеntѕ

By Type

- Zinc Stearate

- Aluminum Stearate

- Calcium Stearate

- Magnesium Stearate

- Sodium Stearate

- Lithium Stearate

- Other Products

By Application

- Plastics

- Pharmaceuticals

- Rubber

- Building & construction

- Cosmetics

- Paints & coatings

- Other Applications

Drivers

The upsurge in polymer utilization across various industries owes itself to the unique attributes these materials offer—strength, durability, flexibility, and lightweight nature. Industries such as automotive, construction, packaging, and electronics have witnessed an increasing reliance on polymers. This surge in polymer demand inherently fuels the need for metallic stearates, essential additives pivotal in polymer production processes.

Within polymer processing, metallic stearates play multifaceted roles as lubricants, stabilizers, and release agents. Their inclusion significantly enhances the quality and efficiency of polymers. For instance, in the production of polyvinyl chloride (PVC) products, metallic stearates are integral additives that enhance processing characteristics and bolster mechanical properties.

The burgeoning demand for high-performance polymers, coupled with the necessity to optimize polymer processing efficiency, acts as a catalyst propelling the growth trajectory of the metallic stearates market. This symbiotic relationship between polymer demand and the pivotal role of metallic stearates underscores their indispensable contribution to enhancing the overall quality and functional aspects of polymer-based products across diverse industries.

Restraints

The stringent environmental regulations present a significant hurdle impeding the growth trajectory of the metallic stearates market. Numerous nations have enforced stringent guidelines governing the utilization of metallic stearates, primarily due to the potential environmental and health risks associated with these additives.

Concerns arise from the tendency of metallic stearates to emit toxic gases when subjected to combustion, posing environmental threats. Additionally, their propensity to accumulate in soil and water sources raises concerns about environmental pollution.

Regulatory bodies have categorized certain metallic stearates as hazardous chemicals, further constraining their application in specific industries and applications. These classifications restrict their usage, especially in contexts where environmental and health risks are deemed higher.

The implementation of such regulatory frameworks limits the scope of utilization for metallic stearates, posing challenges for industries reliant on these additives in various manufacturing processes.

The stringent regulations imposed due to the perceived environmental and health hazards associated with metallic stearates create barriers to their widespread usage across multiple industries. Addressing these concerns becomes pivotal for the market’s growth, necessitating innovations and approaches that mitigate the environmental impact while maintaining the efficacy of metallic stearates in industrial applications.

Opportunities

The current shift toward sustainable practices presents a realm of fresh opportunities for metallic stearates within the market landscape. Growing environmental consciousness surrounding the impact of conventional metallic stearates has prompted numerous end-use industries to explore more sustainable alternatives without compromising performance.

This burgeoning demand has spurred the emergence of bio-based metallic stearates—a notable innovation derived from renewable sources, boasting a reduced environmental footprint in contrast to traditional counterparts.

Bio-based metallic stearates are garnering attention as safer and more sustainable alternatives, positioning themselves as favored options across several end-use industries. Their derived-from-renewable-sources nature aligns with the sustainability goals of various sectors, facilitating a shift towards eco-friendly practices. The attributes of these bio-based variants not only cater to environmental concerns but also offer performance capabilities akin to conventional metallic stearates, making them increasingly sought-after in diverse industrial applications.

This inclination towards adopting bio-based metallic stearates heralds an era of promising opportunities within the market, offering industries a viable, eco-conscious alternative that addresses environmental concerns while maintaining performance standards. Embracing such sustainable measures not only aligns with evolving industry norms but also opens new avenues for growth and innovation within the metallic stearates domain.

Challenges

The metallic stearates market faces a notable challenge stemming from the volatility in prices of its raw materials, namely stearic acid and metal oxides. These crucial components in metallic stearates production are susceptible to considerable price fluctuations influenced by diverse factors like supply-demand dynamics, geopolitical events, and alterations in trade policies.

The inherent volatility in these raw material prices poses significant challenges for manufacturers, impacting their profitability and elevating overall production costs.

The ripple effect of such volatility often translates into increased prices for metallic stearates, passed on to customers as heightened product costs. This resultant rise in prices can subsequently impact the demand for metallic stearates, especially in markets sensitive to pricing fluctuations. The higher prices may deter potential consumers, particularly those operating in price-sensitive sectors, potentially hampering the market’s growth trajectory.

Navigating these price fluctuations becomes a crucial task for stakeholders in the metallic stearates market. Managing production costs and stabilizing prices amidst volatile raw material markets are key challenges that necessitate strategic planning and efficient resource management. Finding innovative ways to counterbalance these fluctuations while maintaining competitive pricing remains pivotal to sustain demand and fostering market growth despite such price-related challenges.

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 42.3% in 2023. The product has been in high demand due to the robust economic growth in India and China over the last few years. The product demand for paints, coatings, rubber, and plastics has increased due to the increase in construction activity and automobile production.

North America was the second-largest regional market. The high demand from the cosmetic and pharmaceutical industries has driven the demand for products from Canada and the U.S. In the coming years, there will be a rise in R&D in the area of metallic stearates to develop efficient products for commercial use.

Actual Numbers Might Vary in the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Key players are positively affected by product differentiation and expansions. Manufacturers are focused on creating products with better surface properties. Manufacturers are focused on the incorporation of vegetable oil-based stearic acids into their products. To increase their participation in the value chain, companies emphasize product launches, capacity expansion, and partnerships.

Market Key Players

- Dover Chemical Corporation

- Baerlocher GmbH

- Valtris Specialty Chemicals

- Faci Spa

- PMC Biogenix, Inc.

- Peter Greven GmbH & Co. KG

- WSD Chemical limited

- CHNV Technology

- Sun Ace Kakoh

- Mallinckrodt plc

Recent Developments

In April 2023,Dover Chemical Corporation recently made the switch from Dover Light & Power to AEP Ohio as its electricity provider, with Shane Gunnoe, Mayor of Dover assuring residents that residential electricity rates would not increase as a result.

In October 2022, Dover Chemical Corp. recently reached an agreement to pay approximately USD 1.4 million to settle lengthy environmental reviews concerning chemical impacts to local waterways and riverbanks near their facility, as well as fund habitat restoration projects in Tuscarawas County and neighboring counties.

Report Scope

Report Features Description Market Value (2023) USD 4.3 Bn Forecast Revenue (2033) US$ 6.8 Bn CAGR (2024-2033) 4.7% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Zinc Stearate, Aluminum Stearate, Calcium Stearate, Magnesium Stearate, Sodium Stearate, Lithium Stearate, Other Products), By Application(Plastics, Pharmaceuticals, Rubber, Building & construction, Cosmetics, Paints & coatings, Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Baerlocher GmbH, Dover Chemical Corporation , Valtris Specialty Chemicals , Faci Spa , PMC Biogenix, Inc., Peter Greven GmbH & Co. KG, WSD Chemical limited, CHNV Technology, Sun Ace Kakoh, Mallinckrodt plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are metallic stearates?Metallic stearates are compounds derived from natural fatty acids, typically stearic acid, and metal salts. They are often in the form of powders or flakes and have various applications across industries.

What are the common uses of metallic stearates?They find applications as lubricants, release agents, stabilizers, thickeners, and anti-caking agents in industries such as plastics, rubber, pharmaceuticals, cosmetics, construction, and food processing.

How are metallic stearates produced?They are typically produced through the reaction of stearic acid with metal oxides or metal hydroxides. The process involves precipitation, filtration, and drying to obtain the final product.

-

-

- Dover Chemical Corporation

- Baerlocher GmbH

- Valtris Specialty Chemicals

- Faci Spa

- PMC Biogenix, Inc.

- Peter Greven GmbH & Co. KG

- WSD Chemical limited

- CHNV Technology

- Sun Ace Kakoh

- Mallinckrodt plc