Global Metagenomics Market By Product Type (Kits & Reagents, Software and Sequencing & Data Analytics Services), By Technology (Shotgun Sequencing, Whole Genome Sequencing, 16S Sequencing and Others), By Application (Environmental, Clinical Diagnostics, Drug Discovery, Biotechnology, Food & Nutrition and Others), By Workflow (Sequencing, Pre-sequencing and Data Analysis), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 176479

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

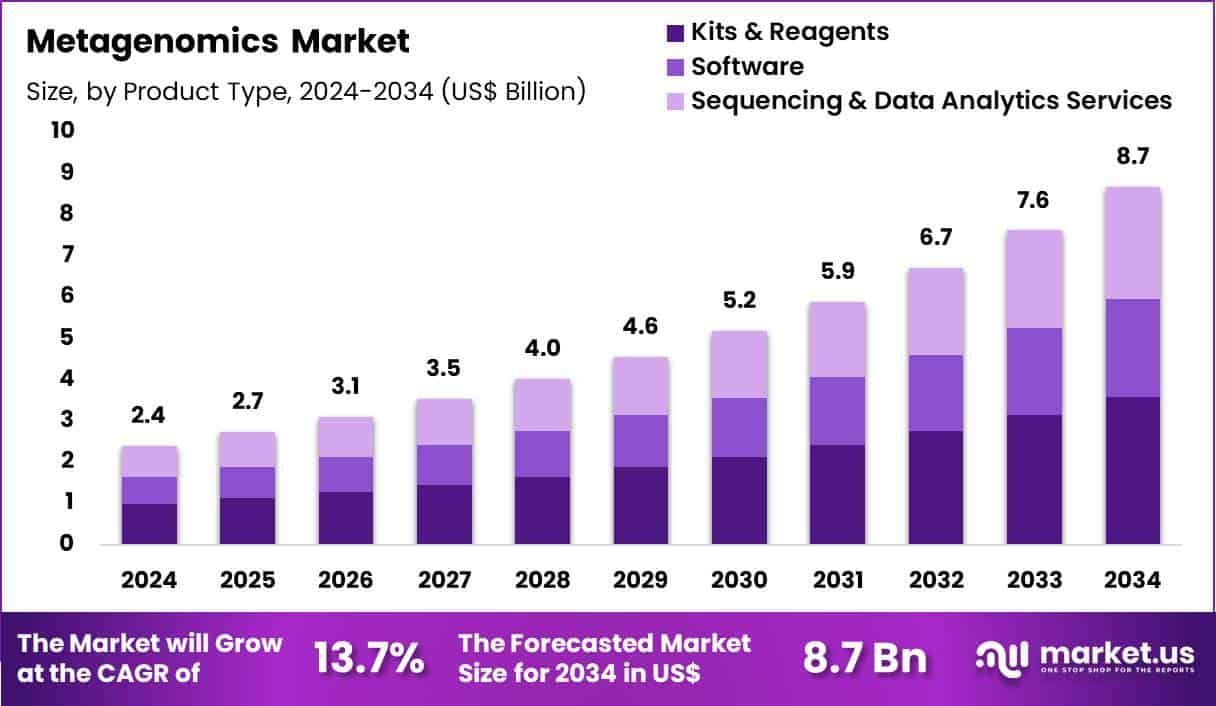

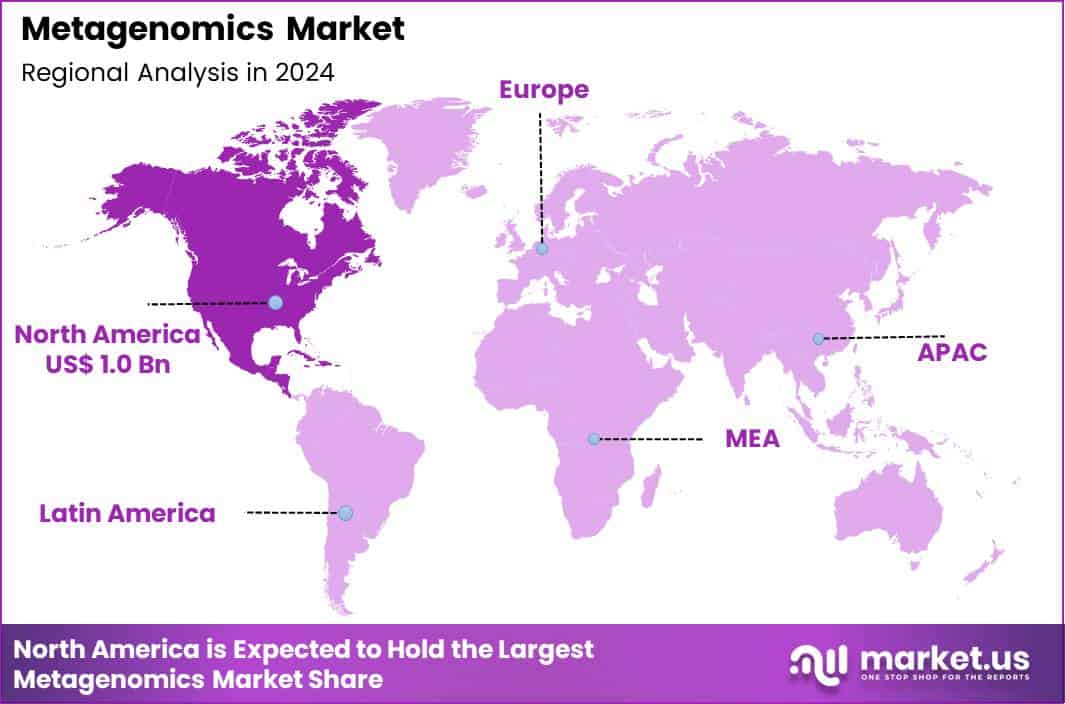

Global Metagenomics Market size is expected to be worth around US$ 8.7 Billion by 2034 from US$ 2.4 Billion in 2024, growing at a CAGR of 13.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.9% share with a revenue of US$ 1.0 Billion.

Increasing demand for comprehensive microbial analysis accelerates the metagenomics market as researchers and industries seek tools that uncover complex community structures without culturing individual organisms. Scientists increasingly apply shotgun sequencing to environmental samples, identifying microbial diversity in soil and water ecosystems to guide bioremediation strategies and agricultural microbiome optimization.

These techniques support clinical diagnostics by profiling gut microbiota in patients with inflammatory bowel disease or obesity, revealing dysbiosis patterns that inform probiotic therapies and dietary interventions. Pharmaceutical developers utilize metagenomics in drug discovery, screening unculturable microbes for novel antibiotics and enzymes with industrial applications.

Environmental scientists employ targeted 16S rRNA sequencing to monitor pathogen contamination in wastewater, enabling early detection of public health threats like antibiotic-resistant bacteria. Veterinary applications involve analyzing animal microbiomes to enhance livestock health and productivity through tailored feed additives.

Manufacturers pursue opportunities to integrate artificial intelligence with metagenomic pipelines, automating data interpretation and expanding applications in personalized nutrition based on individual gut profiles. Developers advance portable sequencing devices that enable field-based analysis, broadening utility in biodiversity conservation and rapid outbreak response.

These innovations facilitate multi-omics integration, combining metagenomics with metabolomics to uncover functional pathways in chronic diseases. Opportunities emerge in regulatory-compliant platforms for food safety testing, detecting microbial contaminants in supply chains.

Companies invest in cloud-based analytics that scale processing for large datasets, supporting collaborative research consortia. Recent trends emphasize long-read sequencing technologies that resolve complex genomes, positioning metagenomics as a cornerstone for microbiome-based therapeutics and environmental monitoring.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.4 Billion, with a CAGR of 13.7%, and is expected to reach US$ 8.7 Billion by the year 2034.

- The product type segment is divided into kits & reagents, software and sequencing & data analytics services, with kits & reagents taking the lead with a market share of41. 2%.

- Considering technology, the market is divided into shotgun sequencing, whole genome sequencing, 16S sequencing and others. Among these, shotgun sequencing held a significant share of 38.9%.

- Furthermore, concerning the application segment, the market is segregated into environmental, clinical diagnostics, drug discovery, biotechnology, food & nutrition and others. The environmental sector stands out as the dominant player, holding the largest revenue share of 34.7% in the market.

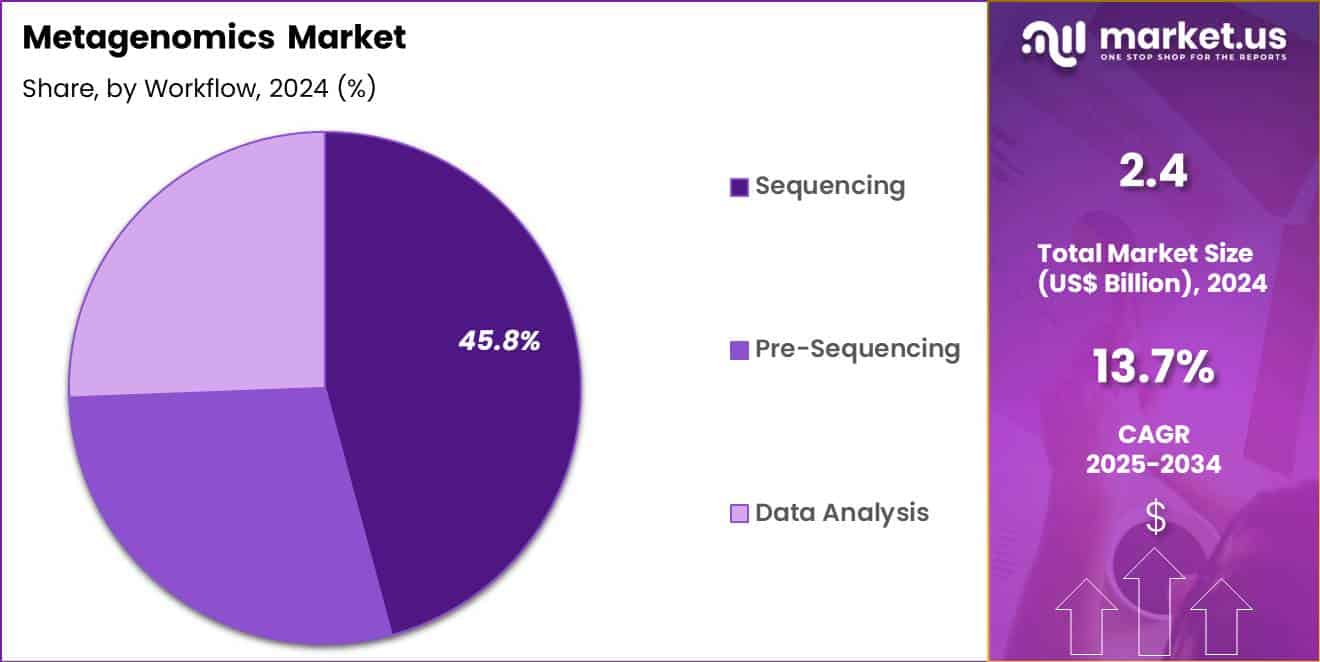

- The workflow segment is segregated into sequencing, pre-sequencing and data analysis, with the sequencing segment leading the market, holding a revenue share of 45.8%.

- North America led the market by securing a market share of 40.9%.

Product Type Analysis

Kits and reagents contributed 41.2% of growth within product type and led the metagenomics market due to their essential role in sample preparation, DNA extraction, and library construction. Research laboratories and commercial testing facilities rely heavily on standardized kits to ensure reproducibility and accuracy across diverse sample types. Expanding environmental and clinical studies increase sample throughput, which directly raises recurring demand for consumables. Researchers prefer ready-to-use reagent kits to reduce protocol variability and accelerate project timelines.

Growth strengthens as assay complexity increases and studies move toward multi-omics integration. Kit manufacturers continuously optimize chemistry for low-biomass and complex samples, improving success rates. Funding for large-scale microbiome initiatives supports bulk purchasing behavior. Regulatory and quality requirements further reinforce use of validated reagents. The segment is expected to remain dominant as metagenomics workflows continue to scale globally.

Technology Analysis

Shotgun sequencing accounted for 38.9% of growth within technology and dominated the metagenomics market due to its ability to deliver comprehensive and unbiased microbial profiling. Researchers adopt shotgun approaches to capture functional and taxonomic information across entire microbial communities.

The method supports high-resolution analysis that benefits environmental monitoring, antimicrobial resistance studies, and ecosystem research. Advancements in sequencing depth and cost efficiency improve accessibility across academic and commercial settings.

Growth accelerates as bioinformatics tools mature and enable deeper interpretation of complex datasets. Shotgun sequencing supports discovery-driven research, which attracts funding and collaborative projects. Environmental and clinical studies increasingly require strain-level resolution, strengthening preference for this technology. Integration with high-throughput platforms enhances scalability. The segment is anticipated to sustain leadership as demand rises for detailed microbial ecosystem insights.

Application Analysis

Environmental applications generated 34.7% of growth within application and emerged as the leading segment due to expanding use of metagenomics in ecosystem monitoring and biodiversity assessment. Governments and research institutions deploy metagenomic tools to study soil, water, and air microbiomes for climate and sustainability initiatives.

Environmental surveillance programs rely on these techniques to detect pollution impact and microbial shifts. The ability to analyze unculturable organisms increases scientific value and adoption. Growth strengthens as climate change research intensifies and regulatory bodies demand data-driven environmental assessments.

Agricultural sustainability programs use metagenomics to improve soil health and crop resilience. Long-term ecological studies require continuous sampling, which sustains workflow demand. Collaboration between academia and public agencies further supports expansion. The segment is projected to remain dominant as environmental genomics becomes central to global monitoring strategies.

Workflow Analysis

Sequencing contributed 45.8% of growth within workflow and led the metagenomics market due to its central role in generating primary genomic data. Sequencing represents the most resource-intensive step, driving instrument usage and consumable demand. High sample volumes across environmental and clinical projects elevate sequencing throughput requirements. Advances in sequencing speed and accuracy encourage broader adoption across research settings.

Growth continues as studies transition from pilot projects to large population-scale analyses. Funding agencies prioritize data generation to support downstream analytics and interpretation. Sequencing providers expand capacity to meet rising demand. Workflow optimization reduces turnaround time and improves project efficiency. The segment is expected to maintain dominance as data generation remains the foundation of metagenomic research.

Key Market Segments

By Product Type

- Kits & Reagents

- Software

- Sequencing & Data Analytics Services

By Technology

- Shotgun Sequencing

- Whole Genome Sequencing

- 16S Sequencing

- Others

By Application

- Environmental

- Clinical Diagnostics

- Drug Discovery

- Biotechnology

- Food & Nutrition

- Others

By Workflow

- Sequencing

- Pre-sequencing

- Data Analysis

Drivers

Continuous technological innovations in NGS platforms is driving the market.

The ongoing advancements in next-generation sequencing platforms have significantly enhanced the efficiency and accuracy of metagenomic analysis, thereby propelling market growth. These innovations enable faster processing of complex environmental samples, facilitating broader applications in research and diagnostics.

Improved sequencing throughput allows for the simultaneous analysis of diverse microbial communities, addressing the demand for comprehensive genomic insights. Key players are continuously refining platform capabilities to reduce error rates and increase read lengths, which supports detailed metagenomic studies. This technological progress lowers barriers to entry for smaller laboratories, expanding the user base for metagenomics tools.

The integration of automated workflows in NGS systems streamlines data generation, making metagenomics more accessible to non-specialists. Enhanced software algorithms complement hardware improvements, enabling better assembly of metagenomic sequences from mixed populations. Government-backed research programs leverage these innovations to advance microbiome studies, further stimulating market expansion.

The drive for cost-effective sequencing solutions encourages competition among manufacturers, fostering rapid development cycles. Ultimately, these advancements position metagenomics as a pivotal tool in addressing global health and environmental challenges.

Restraints

Data privacy and security concerns are restraining the market.

The heightened focus on protecting sensitive genomic data poses significant challenges to the widespread adoption of metagenomics technologies in collaborative research environments. Strict regulations governing data sharing require robust security measures, increasing operational complexities for service providers and users. Concerns over potential misuse of microbial genomic information limit participation in large-scale studies, hindering data aggregation efforts.

Smaller institutions often lack the infrastructure to comply with privacy standards, restricting their involvement in metagenomics projects. The risk of data breaches deters investment in cloud-based analytical platforms essential for handling large metagenomic datasets. Regulatory variations across regions complicate international collaborations, delaying project timelines and market penetration. This restraint affects the scalability of metagenomics applications in clinical settings where patient data is involved.

Industry stakeholders are working on standardized protocols to address these issues, though progress is gradual. Despite the scientific potential, privacy hurdles impede the full realization of metagenomics in public health initiatives. Ensuring compliance remains a critical factor in overcoming this market limitation.

Opportunities

Initiatives and funding from government bodies for large-scale sequencing projects is creating growth opportunities.

Government-funded programs aimed at advancing genomic research provide substantial support for metagenomics applications in public health and environmental monitoring. These initiatives enable the development of large databases for microbial diversity, fostering innovation in diagnostic and therapeutic strategies. Collaborations between public agencies and private entities facilitate the transfer of technology to metagenomics-focused projects.

The emphasis on pandemic preparedness through sequencing projects opens avenues for metagenomics in pathogen surveillance systems. Funding allocations prioritize interdisciplinary research, integrating metagenomics with other omics fields for comprehensive insights. Regional policies promoting biotechnology hubs attract investments in metagenomics infrastructure and training. This opportunity aligns with global efforts to combat antimicrobial resistance through microbial community analysis.

Key organizations are establishing grant programs to encourage novel metagenomics methodologies in underserved areas. Strategic partnerships enhance resource sharing, amplifying the impact of government initiatives on market expansion. Overall, these funding mechanisms catalyze the transition of metagenomics from research to practical applications.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the metagenomics market through research funding levels, healthcare priorities, and corporate R&D discipline that executives review regularly. Inflation and higher interest rates constrain grant availability and venture spending, which slows expansion plans for some sequencing programs.

Geopolitical tensions disrupt supplies of reagents, enzymes, sequencing consumables, and high performance computing hardware, increasing cost and delivery risk. Current US tariffs on imported instruments and components raise capital and operating expenses for labs and service providers, which tightens margins and delays upgrades. These pressures weigh on smaller research groups and emerging service firms.

On the positive side, trade friction encourages domestic manufacturing, supplier diversification, and cloud based analysis that reduces hardware dependence. Rising focus on infectious disease surveillance, microbiome research, and environmental monitoring sustains demand. With strategic partnerships and workflow efficiency, the market can navigate volatility and maintain confident growth.

Latest Trends

Integration of artificial intelligence in metagenomics analysis is a recent trend in the market.

In 2025, the incorporation of artificial intelligence tools has transformed data interpretation in metagenomics by automating complex pattern recognition tasks. These AI systems enhance the identification of microbial taxa from sequencing data, improving overall analytical precision.

Thermo Fisher Scientific introduced an artificial intelligence–driven metagenomics analysis platform that automates microbial identification and delivers detailed functional insights, enabling faster and more accurate interpretation of complex microbiome data. This innovation boosts accuracy by approximately 35%, facilitating faster insights into microbial communities.

AI algorithms integrate multi-omics data to predict functional pathways in environmental samples. Clinical applications benefit from AI-driven predictions of disease-associated microbiomes, aiding personalized medicine. The trend emphasizes scalable solutions for handling increasing data volumes from high-throughput sequencing.

Regulatory frameworks are adapting to validate AI outputs in metagenomics workflows. Industry collaborations focus on training models with diverse datasets for global applicability. These developments address traditional bottlenecks in data processing, elevating metagenomics efficiency.

Regional Analysis

North America is leading the Metagenomics Market

North America holds a 40.9% share of the global Metagenomics market, illustrating significant advancement in 2024 attributable to heightened applications in microbiome therapeutics and environmental monitoring, where next-generation sequencing deciphers complex microbial communities for drug discovery and disease modeling.

Dominant enterprises such as Qiagen and Oxford Nanopore Technologies have released streamlined kits for shotgun sequencing and amplicon analysis, empowering researchers to probe gut dysbiosis links to metabolic syndromes with unprecedented resolution. The locale’s dense cluster of biotech incubators has nurtured startups specializing in bioinformatics pipelines that handle vast datasets from soil and human samples, expediting insights into antibiotic resistance patterns.

Directives from the Environmental Protection Agency have mandated metagenomic assessments in water quality surveillance, broadening industrial uptake beyond academia. Surging interest in personalized nutrition has catalyzed integrations with wearable tech for real-time microbial profiling, targeting obesity and inflammatory disorders. Consortia involving federal labs and private sectors have standardized protocols for virome studies, mitigating outbreaks through predictive analytics.

Moreover, philanthropy from foundations has supplemented grants, fostering cross-disciplinary teams focused on climate-resilient agriculture via root-associated microbiomes. The National Institutes of Health awarded over $207 million in 2024 to support innovative biomedical research projects, including those measuring protein function in the gut microbiome to develop microbial therapies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts envision considerable momentum in the microbial genomics domain across Asia Pacific throughout the forecast period, as ministries allocate budgets to erect sequencing centers that decipher environmental samples for pathogen surveillance. Corporations in Taiwan and Thailand devise automated platforms that expedite data processing for biodiversity mapping, while investigators in Cambodia calibrate algorithms to trace viral evolution in wildlife reservoirs.

Clinics in Laos incorporate these techniques into routine diagnostics, pinpointing resistance genes in clinical isolates to refine treatment strategies. Philanthropists in Papua New Guinea underwrite expeditions that catalog oceanic microbes, unveiling enzymes for industrial biocatalysis. Administrators in Fiji harmonize data-sharing pacts with neighboring states, amplifying regional databases for outbreak forecasting.

Scientists in Timor-Leste experiment with portable sequencers for field deployments, monitoring soil health amid agricultural shifts. Producers in Macao refine cultivation methods for rare strains, supplying pharma firms with novel bioactive compounds. Chinese firm MoonBiotech raised RMB 300 million through Series C+ financing in 2024, bolstering efforts to commercialize microbial resources amid state-driven biotech priorities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the metagenomics market pursue growth by advancing sequencing throughput, expanding bioinformatics analytics, and optimizing sample prep technologies that collectively enable deeper community profiling at reduced operational cost. They strengthen customer value by offering scalable platforms and cloud-enabled software that support multi-omics integration and real-time data interpretation for academic, clinical, and industrial users.

Firms also forge strategic collaborations with research consortia and pharmaceutical developers to anchor long-term projects and co-develop tailored solutions that address specific ecological, diagnostic, or therapeutic questions. Expanding sales and support networks in Europe, North America, and Asia Pacific enhances regional responsiveness and capitalizes on rising investments in microbiome science.

Illumina Inc. serves as a prominent sequencing leader with a comprehensive suite of next-generation sequencing instruments, reagents, and informatics tools, supported by a global commercial footprint and strong engagement with life science innovators. The company accelerates performance through disciplined R&D funding, targeted partner alliances, and a customer-focused commercialization strategy that translates emerging research demands into marketable offerings.

Top Key Players

- Illumina

- Thermo Fisher Scientific

- QIAGEN

- Agilent Technologies

- Oxford Nanopore Technologies

- Pacific Biosciences

- Roche

- BGI Genomics

- Novogene

- Zymo Research

Recent Developments

- In 2024, MGI Tech introduced an end-to-end Human Microbiome Metagenomics Sequencing solution designed to simplify complex sequencing workflows. The offering integrates all major steps, from sample handling and nucleic acid extraction to sequencing and data analysis, with a strong focus on automation and adaptable throughput. Validation across more than 130,000 stool samples highlights the package’s reliability and consistent performance across multiple sequencing platforms.

- In April 2024, Microbiome Insights Inc. expanded its service portfolio with the launch of long-read sequencing capabilities for amplicon-based and shotgun metagenomics applications. Built on advanced high-throughput sequencing technologies and proprietary bioinformatics pipelines, the service supports detailed microbial profiling and is positioned for use across academic research, clinical studies, and industry-driven microbiome projects.

Report Scope

Report Features Description Market Value (2024) US$ 2.4 Billion Forecast Revenue (2034) US$ 8.7 Billion CAGR (2025-2034) 13.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Kits & Reagents, Software and Sequencing & Data Analytics Services), By Technology (Shotgun Sequencing, Whole Genome Sequencing, 16S Sequencing and Others), By Application (Environmental, Clinical Diagnostics, Drug Discovery, Biotechnology, Food & Nutrition and Others), By Workflow (Sequencing, Pre-sequencing and Data Analysis) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Illumina, Thermo Fisher Scientific, QIAGEN, Agilent Technologies, Oxford Nanopore Technologies, Pacific Biosciences, Roche, BGI Genomics, Novogene, Zymo Research Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Illumina

- Thermo Fisher Scientific

- QIAGEN

- Agilent Technologies

- Oxford Nanopore Technologies

- Pacific Biosciences

- Roche

- BGI Genomics

- Novogene

- Zymo Research