Global Medicated Shampoo Market By Type (Dandruff Issues, Bald Issues, Scalp Issues, Hairloss Issues), By Distribution Channel (Supermarket and Hypermarket, Pharmacies, Online Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 131915

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

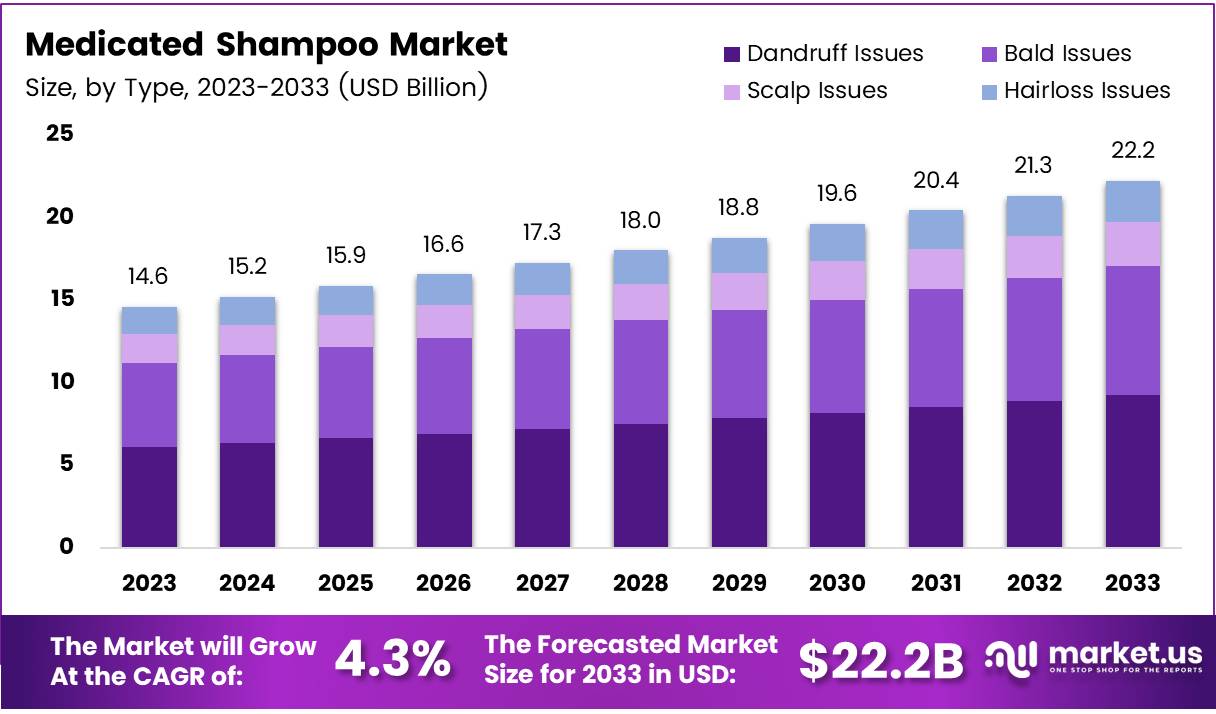

The Global Medicated Shampoo Market size is expected to be worth around USD 22.2 Billion by 2033, from USD 14.6 Billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

Medicated shampoo is designed to address specific scalp and hair issues that go beyond what regular shampoos can handle. These products contain active ingredients to treat conditions like dandruff, seborrheic dermatitis, psoriasis, and fungal infections.

Depending on the condition, the shampoo may include antifungal agents like ketoconazole, tar-based compounds for psoriasis, or other components to reduce inflammation, control sebum production, or prevent microbial growth.

This segment is a notable part of the personal care and pharmaceutical industry, serving a growing number of consumers looking for scalp and hair health solutions. Market growth is fueled by increased awareness of scalp health and the rising prevalence of scalp conditions, as identified in dermatological studies.

The market includes everything from over-the-counter options for mild issues to prescription treatments for serious conditions. Influencing factors include ongoing dermatological research, innovations in formulations, and a consumer shift toward specialized, health-focused personal care products.

The medicated shampoo market is poised for substantial growth, catalyzed by increasing consumer awareness and growing incidence rates of scalp-related conditions. As indicated by U.S. statistics, the shampoo industry, with sales exceeding $3.6 billion in 2023, demonstrates robust consumer engagement and potential for segment-specific expansion, particularly in medicated products.

The prevalence of scalp issues, such as seborrheic dermatitis affecting up to 10% of the population and notable hair loss by mid-adulthood—as experienced by 40% of both men and women—underscores a broad market need. These statistics not only highlight the widespread nature of these conditions but also underline the substantial market for products offering effective treatment solutions.

Government investment and regulatory frameworks play pivotal roles in shaping the medicated shampoo market. Regulatory bodies such as the FDA in the United States ensure that medicated shampoos meet stringent safety and efficacy standards before reaching consumers. This oversight is crucial for maintaining consumer trust and market integrity, especially when products claim therapeutic benefits.

Additionally, government-funded research into dermatological conditions and their treatments can lead to innovations in medicated shampoo formulations, thereby driving market growth. These regulations and investments ensure that the products available not only meet health and safety standards but also cater to the evolving needs of consumers seeking effective and safe scalp care solutions.

Integrating consumer usage patterns and demographic data offers a clearer picture of the medicated shampoo market’s potential. According to the Environmental Working Group’s (EWG) 2023 cosmetics survey, about one-third of respondents use shampoo daily, with another 30% using it weekly.

This high frequency of use establishes a solid foundation for the routine incorporation of medicated shampoos into daily personal care regimens, especially among those suffering from chronic scalp conditions.

Furthermore, the insights into hair loss statistics reveal that, as reported by Treatment Rooms London, approximately 40% of men experience noticeable hair loss by the age of 35, and a similar percentage of women exhibit visible hair loss by the age of 40. Additionally, Columbia Doctors notes that hair loss, encompassing both thinning and breaking, is a prevalent issue, with most individuals shedding between 50 to 100 hairs daily.

Key Takeaways

- The Medicated Shampoo Market is projected to maintain a steady size of USD 22.2 Billion over a decade, with a CAGR of 4.3% from 2024 to 2033.

- Dandruff treatments dominated the market in 2023 with a 27% share, highlighting strong consumer demand driven by greater product awareness and effectiveness.

- Supermarkets/hypermarkets were the preferred purchase point in 2023, holding 46.1% of the market due to their convenience and consumer trust.

- North America leads with a 32.6% market share or USD 4.7 billion, attributed to prevalent scalp conditions and an advanced healthcare sector.

- Increasing dermatological issues such as dandruff and psoriasis are driving demand for medicated shampoos.

- Asia-Pacific and Latin America offer significant growth opportunities due to rising incomes and a focus on personal care.

Type Analysis

Medicated Shampoo Segments: Dandruff Leads with 27%

In 2023, Dandruff Issues held a dominant market position in the By Type Analysis segment of the Medicated Shampoo Market, with a 27% share. This prevalence underscores the significant consumer demand for solutions targeting dandruff, reflecting widespread concerns over scalp health and hygiene. The segment’s prominence is driven by increasing awareness and the availability of specialized products designed to combat dandruff effectively.

Following closely, Bald Issues fueled by a growing demographic experiencing hair thinning and baldness, and the rising acceptance of medicated solutions to mitigate these conditions.

Scalp Issues, which include various scalp conditions beyond dandruff. This reflects an informed consumer base seeking targeted treatments for diverse scalp health challenges.

Lastly, Hair loss Issues held significant portion of the market can be attributed to the escalating concerns over hair loss among both men and women, and the increasing trust in medicated shampoos as a preventive and remedial solution.

The varied needs addressed by these segments highlight the medicated shampoo market’s role in delivering specialized care across multiple hair and scalp health issues.

Distribution Channel Analysis

Supermarket/Hypermarket Dominates Medicated Shampoo Market with 46.1% Share

In 2023, Supermarket/Hypermarket held a dominant market position in the By Distribution Channel Analysis segment of the Medicated Shampoo Market, commanding a 46.1% share. This substantial market share underscores the convenience and consumer trust in purchasing health-related products from easily accessible and reliable retail environments.

Supermarkets and hypermarkets offer a broad selection of medicated shampoos, catering to diverse customer needs with various options for scalp and hair conditions.

Pharmacies, as specialized health-focused outlets, also play a crucial role, providing professional guidance and trust, especially for consumers seeking targeted therapeutic formulations. Their expertise in health care adds a layer of assurance for buyers, making them a preferred choice for those with specific medical recommendations.

Online Stores are rapidly gaining traction, driven by the shift towards digital shopping and the convenience of home delivery. They offer competitive pricing and a wider range of products, including niche brands not available in physical stores.

The online platform’s growth is further facilitated by comprehensive product information and reviews, which help consumers make informed choices. This distribution channel is expected to increase its market penetration in the coming years as consumer behavior continues to evolve towards digital interfaces.

Key Market Segments

By Type

- Dandruff Issues

- Bald Issues

- Scalp Issues

- Hairloss Issues

By Distribution Channel

- Supermarket/Hypermarket

- Pharmacies

- Online Stores

Drivers

Scalp Conditions Boost Medicated Shampoo Demand

The medicated shampoo market is experiencing significant growth primarily driven by the rising prevalence of dermatological disorders. As more individuals face challenges with scalp-related conditions such as dandruff, psoriasis, and seborrheic dermatitis, the demand for medicated shampoos that offer targeted treatment options is increasing.

Furthermore, growing awareness of the importance of scalp health and its direct connection to overall hair vitality is encouraging consumers to seek specialized medicated products. This trend is further supported by the increasing geriatric population, who are more prone to scalp issues due to aging, thus boosting the demand for these therapeutic shampoos. Together, these factors are shaping the market dynamics, indicating a sustained interest in scalp health solutions.

Restraints

Medicated Shampoo Market Restraints: Side Effects Deter Users

In the medicated shampoo market, the presence of ingredients that can lead to adverse side effects constitutes a significant constraint on growth. These side effects, ranging from mild irritations to more severe allergic reactions, foster consumer reluctance as they seek safer and more gentle alternatives.

This concern is compounded by a growing preference among consumers for natural remedies over chemical treatments. Many are turning to essential oils, herbal extracts, and other organic products, perceiving them as safer for managing scalp conditions like dandruff and psoriasis.

This shift towards alternative treatments challenges the medicated shampoo market, as it must compete not only with these natural alternatives but also with a consumer base increasingly wary of chemical side effects. This environment pressures manufacturers to innovate and possibly reformulate their products to maintain consumer trust and market share.

Growth Factors

Untapped Markets Drive Medicated Shampoo Growth

The medicated shampoo market is poised for significant growth, particularly through strategic expansion into emerging markets in regions like Asia-Pacific and Latin America. These areas present lucrative opportunities as rising disposable incomes and a growing emphasis on personal care spur demand for specialized hair care solutions.

Additionally, there’s a rising trend towards natural and organic products among consumers worldwide, creating a fertile ground for introducing medicated shampoos with organic and natural formulations. Such products cater to the increasing consumer preference for health-conscious alternatives in personal care.

Furthermore, ongoing technological advancements in formulation technology not only enhance the efficacy of medicated shampoos but also boost consumer trust and adoption rates by offering superior performance and benefits. These factors collectively mark a promising horizon for market growth, fueled by geographic expansion, innovative product formulations, and advanced technology in product development.

Emerging Trends

Personalized Hair Care Solutions Gain Traction

The personalized hair care solutions are significantly influencing consumer preferences. Individuals are seeking products tailored to their specific scalp and hair needs, driving demand for customized formulations. This trend is paralleled by the rising popularity of anti-pollution shampoos, which address concerns about environmental pollutants affecting scalp health.

Additionally, the integration of probiotics into shampoo formulations represents an innovative approach to maintaining and enhancing the health of the scalp’s microbiome. These probiotics help balance the natural bacteria on the scalp, promoting better overall scalp health and potentially improving hair condition.

Collectively, these trends underscore a shift towards more specialized and health-conscious hair care solutions in the medicated shampoo market.

Regional Analysis

North America Leads Medicated Shampoo Market with 32.6% Share, Valued at USD 4.7 Billion

The global Medicated Shampoo Market is characterized by diverse regional dynamics and consumer preferences, influencing its growth and market penetration in various geographies.

In North America, the Medicated Shampoo Market is the most dominant, holding a substantial share of 32.6% with a market value of USD 4.7 billion. This dominance is driven by a high prevalence of scalp-related disorders, such as dandruff and psoriasis, and a well-established healthcare sector that promotes awareness and accessibility to specialized hair care solutions.

The market is further bolstered by the presence of key industry players who are continuously innovating and expanding their product lines to meet the specific needs of this demographic.

Regional Mentions:

Europe, the market exhibits strong growth due to increasing consumer awareness about hair and scalp health and the availability of medicated shampoos through widespread pharmaceutical and retail channels. European consumers show a high preference for products with organic and natural ingredients, pushing manufacturers to reformulate and innovate.

Asia Pacific region, the market is rapidly expanding, fueled by rising disposable incomes and changing lifestyles. Increased adoption of Western grooming habits among the growing middle-class population, coupled with a higher incidence of scalp conditions due to environmental factors, is pushing demand for medicated shampoos.

Middle East & Africa shows potential growth in the medicated shampoo market, driven by an expanding urban population and increasing availability of international brands through modern retail formats. However, the market is still nascent, with traditional hair care practices somewhat limiting the adoption of specialized medicated products.

Latin America is witnessing moderate growth in this market. Factors such as urbanization, improving healthcare infrastructure, and rising awareness about personal hygiene are contributing to the growth. Nevertheless, economic volatility in major economies like Brazil and Argentina poses challenges to rapid market expansion.

Overall, the Medicated Shampoo Market is poised for continued growth across these regions, with North America maintaining its leading position due to robust consumer demand and advanced healthcare awareness.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global medicated shampoo market has witnessed significant activity from leading companies aiming to consolidate their positions and expand their market share. Procter & Gamble, a perennial giant in the personal care space, continues to innovate with formulations that appeal to consumers facing scalp health issues, such as dandruff and dermatitis.

Similarly, Johnson & Johnson Services, Inc., and Unilever have leveraged their extensive distribution networks to increase accessibility and customer penetration in both developed and emerging markets.

Sanofi-Aventis and Kramer Laboratories Inc. are noteworthy for their specialized offerings that cater to niche markets, including treatments for severe scalp conditions. These companies have invested heavily in research and development to enhance the efficacy of their products, thus driving customer loyalty and establishing a strong foothold in the medicated segment.

On the natural and organic front, The Hain Celestial Group and Avalon Organics have been at the forefront, appealing to the growing segment of consumers seeking chemical-free and environmentally friendly options. Their products, which are often based on natural ingredients known for their therapeutic properties, have seen increased acceptance as consumers become more health-conscious.

Asian market players like Shiseido Company, Dabur, and Himalaya Wellness Company have capitalized on regional growth by aligning their products with local consumer preferences and herbal traditions, thus gaining a competitive edge.

Lastly, Henkel AG & Co. KGaA and Kao Corporation continue to expand their global reach by blending innovative science with consumer-centric marketing strategies, ensuring their products meet the diverse needs of global consumers. This strategic diversity among key players underscores a dynamic and competitive market landscape in 2023.

Top Key Players in the Market

- Procter & Gamble

- Sanofi-Aventis

- Kramer Laboratories Inc.

- Hain Celestial Group

- Shiseido Company

- Summers Laboratories, Inc.

- Coty Inc.

- Dabur

- Nizoral

- Himalaya Wellness Company

- Johnson & Johnson Services, Inc.

- Unilever

- Henkel AG & Co. KGaA

- Kao Corporation

- Avalon Organics

Recent Developments

- Jul 2024: D2C haircare brand Moxie Beauty successfully raised $2.1 million in a funding round led by Fireside Ventures. The investment aims to expand its product line and enhance its direct-to-consumer marketing strategies, focusing on innovative, sustainable haircare solutions.

- Jan 2024: Jupiter, a company specializing in hair and scalp care products, secured $3 million in funding to broaden its research and development efforts. This capital infusion will help Jupiter enhance its product offerings and strengthen its market presence in the competitive beauty industry.

- Apr 2024: Xponentia, following the final closure of its second fund in December 2023, invested Rs 75 crore ($9 million) in Traya, a hair care platform. This investment is intended to accelerate Traya’s market expansion and product innovation within the hair wellness sector.

- Dec 2023: Straand, a rising name in the haircare industry, secured $4 million from a group of investors including Unilever Ventures. The funding is earmarked for advancing product innovation and increasing market penetration, particularly focusing on eco-friendly and organic haircare solutions.

Report Scope

Report Features Description Market Value (2023) USD 14.6 Billion Forecast Revenue (2033) USD 22.2 Billion CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Dandruff Issues, Bald Issues, Scalp Issues, Hairloss Issues), By Distribution Channel(Supermarket/Hypermarket, Pharmacies, Online Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Procter & Gamble, Sanofi-Aventis, Kramer Laboratories Inc., Hain Celestial Group, Shiseido Company, Summers Laboratories, Inc., Coty Inc., Dabur, Nizoral, Himalaya Wellness Company, Johnson & Johnson Services, Inc., Unilever, Henkel AG & Co. KGaA, Kao Corporation, Avalon Organics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Procter & Gamble

- Sanofi-Aventis

- Kramer Laboratories Inc.

- Hain Celestial Group

- Shiseido Company

- Summers Laboratories, Inc.

- Coty Inc.

- Dabur

- Nizoral

- Himalaya Wellness Company

- Johnson & Johnson Services, Inc.

- Unilever

- Henkel AG & Co. KGaA

- Kao Corporation

- Avalon Organics