Global Medical Textiles Market Analysis By Type (Woven, Knitted, Non-Woven, Other Types), By Application (Implantable Goods, Non-Implantable Goods, Health and Hygiene Applications, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 19721

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

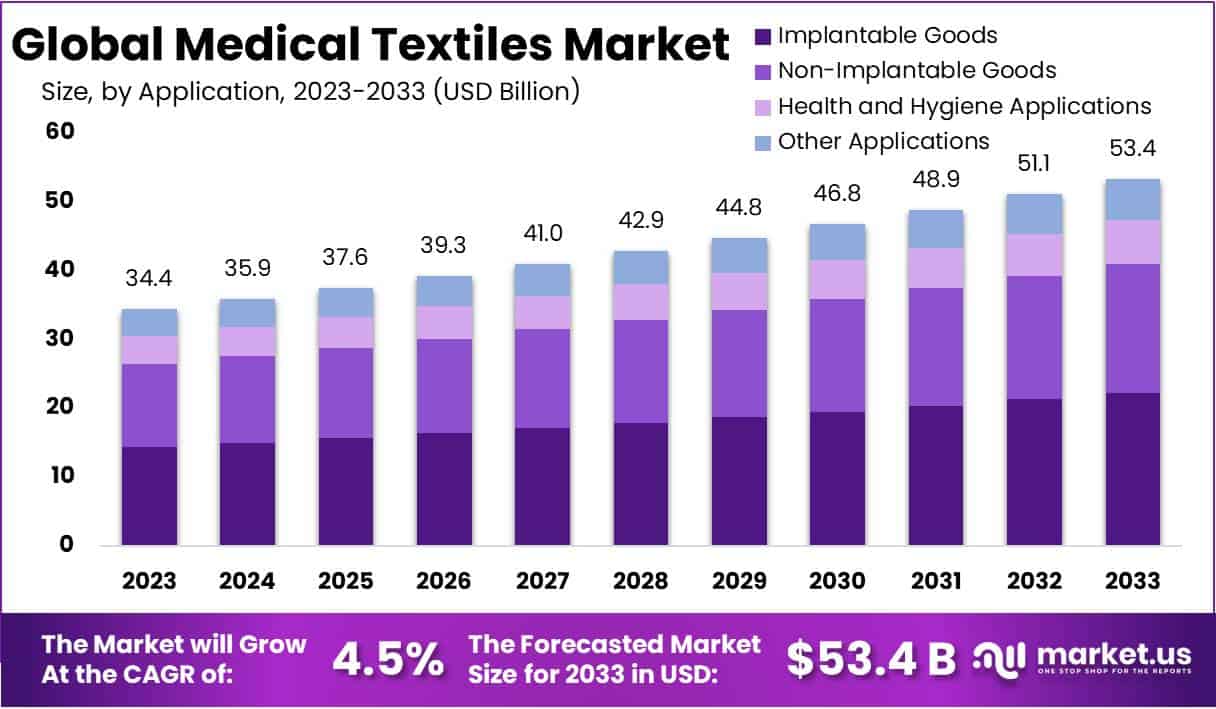

The Medical Textiles Market Size is anticipated to reach approximately USD 53.4 billion by 2033, up from USD 34.4 billion in 2023. This growth is projected to occur at a Compound Annual Growth Rate (CAGR) of 4.5% from 2024 to 2033.

The medical textiles market, crucial for healthcare, provides fabrics tailored for diverse medical needs. Products like surgical gowns, bandages, and bed linens contribute to patient comfort and treatment efficiency. Growth in this sector is fueled by technology, healthcare standards awareness, and factors such as the rising aging population and chronic diseases.

Advancements lead to increased demand for medical-grade products, including implantables like ligaments and tendons. Joint and knee replacement surgeries further propel market growth. Amid the COVID-19 pandemic, the USA saw substantial cases, prompting government investments in healthcare expansion and PPE production. Companies like Honeywell contribute by expanding manufacturing for personal safety equipment.

To reduce production costs, textile manufacturers integrate across their value chain. Companies like ATEX Technologies and Bally Ribbon Mills produce raw materials, contributing to the medical textile manufacturing process.

Efforts towards sustainable practices are evident, as highlighted by the Ministry of Textiles and The South India Textile Research Association’s ‘Meditex 2023’ event. Sessions focused on topics like the advantages of medical textiles, the significance of indigenous products, entrepreneurial opportunities, and industry standards, certification, and regulatory requirements.

Key Takeaways

- Market Size Projection: The Medical Textiles Market is expected to grow at a 4.5% CAGR, reaching approximately USD 53.4 billion by 2033 from USD 34.4 billion in 2023.

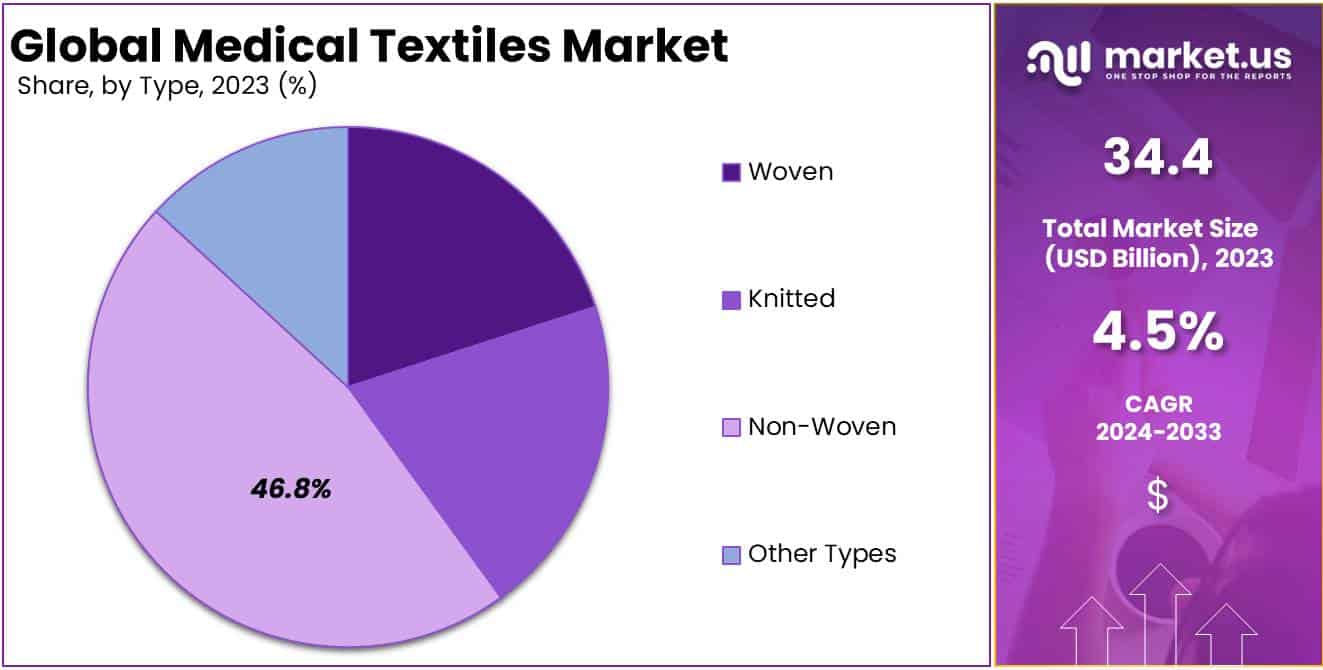

- Non-Woven Dominance: Non-Woven textiles held a 46.8% market share in 2023 due to cost-effectiveness and enhanced barrier properties, driving diverse medical applications.

- Application Leadership: Health and Hygiene Applications secured a 46.8% market share in 2023, emphasizing global health safety concerns.

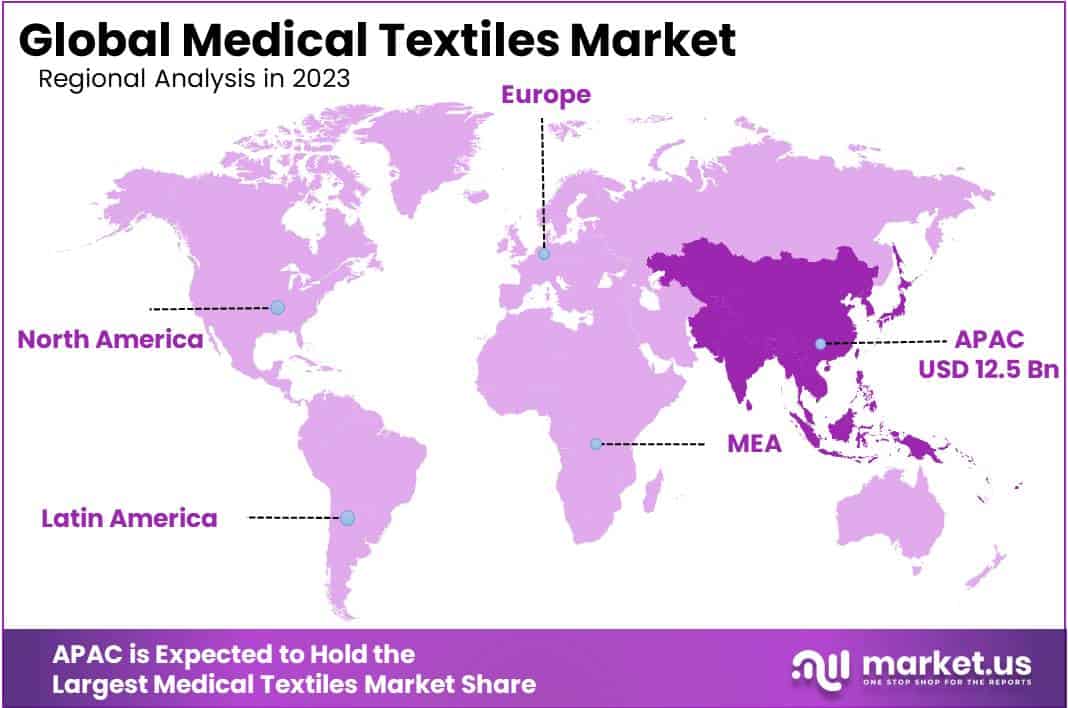

- Geographical Dominance – Asia Pacific: In 2023, Asia Pacific led with a 36.2% market share and a value of USD 12.4 billion, driven by rapid healthcare infrastructure expansion.

- Innovative Emphasis – North America: North America, with a strong focus on innovation, saw the United States leading the market, backed by significant R&D investments.

- Europe’s Blend of Tradition and Tech: Europe combines traditional expertise and modern technology, benefitting from a strong textile manufacturing heritage in its growing medical textiles market.

- Stringent Regulatory Challenges: Stringent compliance standards pose challenges, necessitating substantial investments in testing and quality control measures for medical textile manufacturers.

- Emerging Latin American Market: Latin America’s market is growing, fueled by increased healthcare expenditure, demand for quality medical services, and a focus on public health.

- Sustainable Trend: A growing trend in the market is the focus on sustainable and eco-friendly medical textiles, aligning with the broader movement towards environmentally friendly healthcare solutions.

Type Analysis

In 2023, the Non-Woven segment held a dominant market position in the medical textiles market, capturing more than a 46.8% share. This prominence can be attributed to the segment’s unique characteristics, including its cost-effectiveness, versatility, and enhanced barrier properties, making it highly suitable for various medical applications such as surgical gowns, masks, and drapes. Non-woven textiles are known for their excellent fluid resistance, breathability, and ability to filter bacteria, thus offering significant advantages in sterile environments.

The Woven segment, while smaller in comparison, plays a critical role in the medical textiles market. Woven medical textiles are favored for their durability and ability to maintain shape and strength under stress. These properties make them ideal for applications that require longevity and strength, such as in medical sutures and implantable textiles. However, the higher costs of production and less flexibility compared to non-woven textiles are factors that somewhat limit this segment’s growth.

Knitted textiles in the medical field are highly valued for their elasticity, which allows them to conform to various body shapes and movements. This segment finds extensive use in products like medical hosiery, orthopedic braces, and bandages. The stretchability and porosity of knitted textiles make them ideal for applications requiring flexibility and breathability. Nevertheless, the intricate manufacturing process and the need for specialized machinery for production can impact the market reach of this segment.

Other types of medical textiles encompass a variety of materials, including advanced textiles and composite materials. These are typically used in niche applications where specific properties such as high tensile strength, conductivity, or biodegradability are required. Although this segment holds a smaller portion of the market, its importance is growing with the advent of new materials and technologies in medical applications.

Application Analysis

In 2023, the Health and Hygiene Applications segment held a dominant market position in the Medical Textiles market, capturing more than a 46.8% share. This substantial market share can be attributed to the increasing global emphasis on hygiene and health safety, especially in the wake of recent public health challenges. Products within this segment, including sanitary and medical hygiene products, have witnessed escalated demand due to their essential role in infection control and personal hygiene maintenance in both medical and domestic settings.

The Implantable Goods segment, comprising items such as surgical sutures, soft tissue implants, and vascular grafts, also represents a significant portion of the market. Advances in biomedical technologies and the growing prevalence of chronic diseases have catalyzed the demand for these goods. The market growth in this segment is fueled by the rising number of surgical procedures globally and the ongoing innovations in implantable textile materials.

The Non-Implantable Goods segment, which includes products like bandages, gauzes, and wound care fabrics, is another vital component of the medical textiles market. The demand in this segment is primarily driven by the increasing incidence of injuries and the need for effective wound management solutions. These products are essential for ensuring patient comfort and accelerating the healing process, making them indispensable in both emergency care and routine medical procedures.

Other Applications in the Medical Textiles market encompass a diverse range of products, including but not limited to, textile-based products for dental applications, orthopedic textiles, and textile sensors. This segment’s growth is propelled by continuous research and development activities aimed at enhancing the functionality and effectiveness of medical textiles in various applications.

Key Market Segments

Type

- Woven

- Knitted

- Non-Woven

- Other Types

Application

- Implantable Goods

- Non-Implantable Goods

- Health and Hygiene Applications

- Other Applications

Drivers

Increasing Demand for Non-Invasive Medical Procedures

The growth of the Global Medical Textiles Market can be attributed to the increasing demand for non-invasive medical procedures. Medical textiles play a crucial role in the development of products such as wound dressings, surgical gowns, and implantable textiles. As advancements in medical technology continue, there is a growing preference for minimally invasive surgeries and treatments.

This trend drives the demand for medical textiles, as they are essential in the production of medical devices and materials used in these procedures. The adoption of non-invasive techniques not only enhances patient comfort but also reduces recovery times, contributing to the market’s growth.

According to the Singapore Manufacturing Federation, Singapore’s healthcare system, renowned for its excellence, is poised for significant growth. The medical technology sector is forecasted to expand at a double-digit rate. This growth is underpinned by substantial investments in new hospital infrastructure, including 5,000 additional beds and a new national cancer center by 2030, and the needs of an aging population. High import quotas further enhance opportunities for international medical technology manufacturers.

Restraints

Stringent Regulatory Compliance

One of the key restraints in the Global Medical Textiles Market is the presence of stringent regulatory compliance and quality standards. Medical textiles used in healthcare applications must adhere to strict safety and quality regulations to ensure patient safety. These regulations can vary from one region to another and often require manufacturers to invest in extensive testing, documentation, and quality control measures. Complying with these regulations can be time-consuming and costly, particularly for smaller market players. Navigating the regulatory landscape effectively while maintaining product quality poses a challenge for companies operating in this market.

Opportunities

Trends

Sustainable and Eco-Friendly Medical Textiles

A notable trend in the global medical textiles market is the increasing focus on sustainability and eco-friendly materials. As environmental consciousness rises, manufacturers are exploring and adopting sustainable practices, including the use of biodegradable and recycled materials in medical textiles. This trend aligns with the broader movement towards environmentally friendly healthcare solutions.

Regional Analysis

In 2023, the Asia Pacific region held a dominant market position in the medical textiles market, capturing more than a 36.2% share, with a market value of USD 12.4 billion for the year. This significant market share can be attributed to the rapid expansion of healthcare infrastructure and increasing investments in medical facilities in countries such as China, India, and Japan. The region’s burgeoning population, coupled with rising health awareness, has spurred demand for advanced medical textiles. Furthermore, the presence of key players in the textile industry, combined with technological advancements in fiber technology and non-woven fabric production, has bolstered the region’s market dominance.

In North America, the market for medical textiles is characterized by a strong emphasis on innovation and quality. With a well-established healthcare system and stringent regulatory standards, the market in this region is driven by the demand for high-performance and sustainable medical textiles. The United States leads the region, backed by heavy investments in research and development, which have resulted in cutting-edge products catering to a range of medical applications. The presence of global healthcare corporations and the adoption of advanced technologies in textile manufacturing further contribute to the market growth.

Europe’s medical textiles market is marked by a blend of traditional expertise and modern technology, particularly in countries like Germany, the UK, and France. The market benefits from the region’s strong textile manufacturing heritage, combined with a robust healthcare infrastructure. The increasing elderly population and the growing prevalence of chronic diseases have led to a heightened demand for medical textiles. Additionally, the region’s commitment to sustainability and environmental standards is driving innovations in biodegradable and eco-friendly medical textiles.

The Middle East & Africa region presents a growing market for medical textiles, primarily driven by the healthcare sector’s expansion and modernization, especially in the Gulf Cooperation Council (GCC) countries. Investments in healthcare infrastructure, along with rising medical tourism in countries like the United Arab Emirates and Saudi Arabia, are key growth drivers. The market is also benefiting from increasing government initiatives to diversify economies and reduce dependence on oil revenues, leading to the development of the healthcare and textile sectors.

Latin America’s medical textiles market is emerging, fueled by the growing healthcare sector in countries like Brazil, Mexico, and Argentina. The region is experiencing an increase in healthcare expenditure and a rising demand for quality medical services, which in turn is propelling the market for medical textiles. The presence of local and regional textile manufacturers, combined with improving economic conditions, is supporting the market’s growth. Additionally, the increasing focus on public health and disease prevention in the region is likely to drive future market expansion.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Medical Textiles Market is characterized by a diverse array of key players, each contributing to the sector’s dynamic growth. Prominent among these are companies specializing in the manufacture of non-woven fabrics, woven fabrics, and knitted fabrics, which are crucial for producing medical textiles. These entities typically focus on innovation in fiber technology, enhancing the functionality and safety of products like surgical gowns, face masks, and other medical garments.

Moreover, leading companies in this market are increasingly investing in research and development to address the growing demand for advanced medical textiles. This includes the creation of smart textiles embedded with sensors for patient monitoring and textiles with improved antimicrobial properties.

The competitive landscape is also shaped by collaborations and partnerships among key players, aiming to expand their product portfolios and geographical reach. These strategic alliances are pivotal in fostering technological advancements and meeting the evolving needs of healthcare sectors worldwide. The market is poised for continued growth, driven by rising healthcare standards and the increasing prevalence of chronic diseases.

Market Key Players

- Atex Technologies Inc.

- Life-Threads

- Careismatic Brands

- Bally Ribbon Mills

- Freudenberg & Co. KG

- Trelleborg AB

- Indorama Corporation

- Herculite

- PurThread Technologies Inc.

- Fitesa

- Schouw & Co.

- Kimberly-Clark Corp.

Recent Developments

- In October 2023, Atex Technologies Inc. entered into a strategic partnership with the University of Pittsburgh School of Medicine. This collaboration is aimed at developing an innovative smart wound dressing capable of monitoring the healing process and administering targeted therapy. This initiative marks a significant step in Atex’s efforts to commercialize its biocompatible and conductive textile technology within the medical sector.

- In September 2023, Freudenberg & Co. KG, successfully acquired Fiberweb, a Netherlands-based nonwovens producer. This acquisition is a strategic move to fortify Freudenberg’s presence in the hygiene and medical textiles market. The integration of Fiberweb into Freudenberg’s operations is anticipated to enhance the company’s production capabilities and diversify its product offerings, with a particular emphasis on wipes, feminine hygiene products, and wound care materials.

- In July 2023, PurThread Technologies Inc., unveiled its “SilverClear” line of antimicrobial textiles, incorporating its proprietary silver-infused yarn technology. The SilverClear range, distinguished by its enduring antibacterial and antifungal properties, positions itself as a leading choice for medical applications, including gowns, drapes, and other healthcare textiles.

- In June 2023, Schouw & Co. announced a substantial investment plan, earmarking €20 million towards the expansion of its nonwoven fabric production capacity. This expansion, primarily centered around its Danish facility, is projected to enhance the company’s output in the medical and hygiene product sectors. The completion of this expansion is scheduled for the end of 2024, indicating a significant increase in Schouw & Co.’s manufacturing capabilities in this domain.

Report Scope

Report Features Description Market Value (2023) USD 34.4 Bn Forecast Revenue (2033) USD 53.4 Bn CAGR (2024-2033) 4.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Woven, Knitted, Non-Woven, Other Types), By Application (Implantable Goods, Non-Implantable Goods, Health and Hygiene Applications, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Atex Technologies Inc., Life-Threads, Careismatic Brands, Bally Ribbon Mills, Freudenberg & Co. KG, Trelleborg AB, Indorama Corporation, Herculite, PurThread Technologies Inc., Fitesa, Schouw & Co., Kimberly-Clark Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Medical Textiles market in 2023?The Medical Textiles market size is USD 34.4 billion in 2023.

What is the projected CAGR at which the Medical Textiles market is expected to grow at?The Medical Textiles market is expected to grow at a CAGR of 4.5% (2024-2033).

List the segments encompassed in this report on the Medical Textiles market?Market.US has segmented the Medical Textiles market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Woven, Knitted, Non-Woven, Other Types. By Application the market has been segmented into Implantable Goods, Non-Implantable Goods, Health and Hygiene Applications, Other Applications.

List the key industry players of the Medical Textiles market?Atex Technologies Inc., Life-Threads, Careismatic Brands, Bally Ribbon Mills, Freudenberg & Co. KG, Trelleborg AB, Indorama Corporation, Herculite, PurThread Technologies Inc., Fitesa, Schouw & Co., Kimberly-Clark Corp.

Which region is more appealing for vendors employed in the Medical Textiles market?North America is expected to account for the highest revenue share of 36.2% and boasting an impressive market value of USD 3.2 billion. Therefore, the Medical Textiles industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Medical Textiles?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Medical Textiles Market.

-

-

- Atex Technologies Inc.

- Life-Threads

- Careismatic Brands

- Bally Ribbon Mills

- Freudenberg & Co. KG

- Trelleborg AB

- Indorama Corporation

- Herculite

- PurThread Technologies Inc.

- Fitesa

- Schouw & Co.

- Kimberly-Clark Corp.