Global Medical Injection Molding Market Size, Share Analysis Report By Product Type (Medical Devices And Equipment, Surgical Tools, Consumables And Disposables, and Others), By Material (Plastic, Metals, and Rubber), By System (Hot Runner and Cold Runner), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171558

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

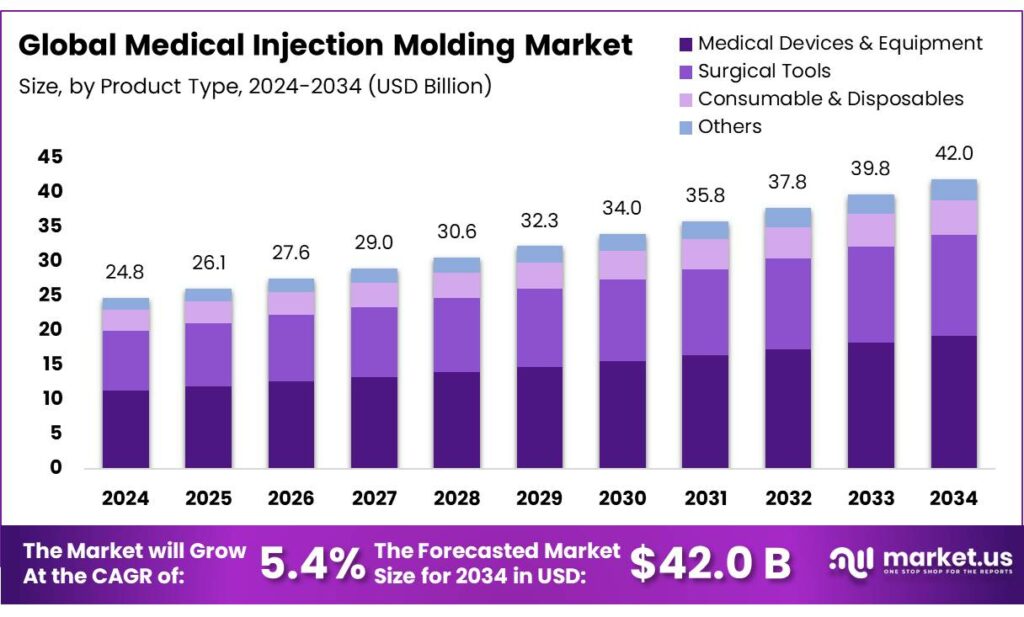

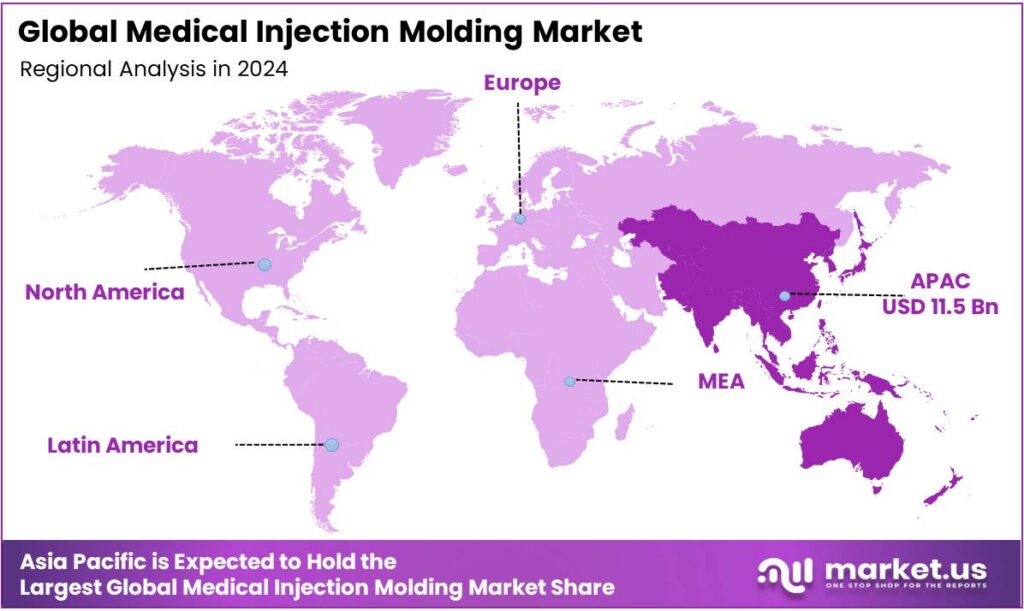

The Global Medical Injection Molding Market size is expected to be worth around USD 42.0 Billion by 2034, from USD 24.8 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 44.9% share, holding USD 19.6 Billion in revenue.

Medical injection molding is a precision manufacturing process that forms plastic or silicone into complex, high-quality components for healthcare by injecting molten material into a mold. The medical injection molding market is driven by the increasing demand for high-precision medical devices and equipment, which require materials such as plastics for their versatility, cost-efficiency, and ease of sterilization.

In addition, hot runner injection molding systems are commonly used in medical manufacturing, offering advantages such as reduced material waste, faster cycle times, and better control over part quality. Key drivers of the market include the growing use of implants, diagnostic equipment, and disposable medical products, which rely on injection molding for production. The Asia Pacific region plays a dominant role in the market due to its advanced manufacturing capabilities and cost advantages. Despite challenges, such as compliance with evolving quality norms, the market is expected to grow in the near future.

- According to the Centers for Medicare and Medicaid Services, in the United States, the National Health Expenditure (NHE) grew 7.5% to US$4.9 trillion in 2023, or US$14,570 per person, and accounted for 17.6% of Gross Domestic Product (GDP). The rise in healthcare expenditure indicates increased investment in advanced technologies for medical care, including medical injection molding.

Key Takeaways

- The global medical injection molding market was valued at USD 24.8 billion in 2024.

- The global medical injection molding market is projected to grow at a CAGR of 5.4% and is estimated to reach USD 42.0 billion by 2034.

- Based on types of product, medical devices & equipment dominated the medical injection molding market, constituting 45.8% of the total market share.

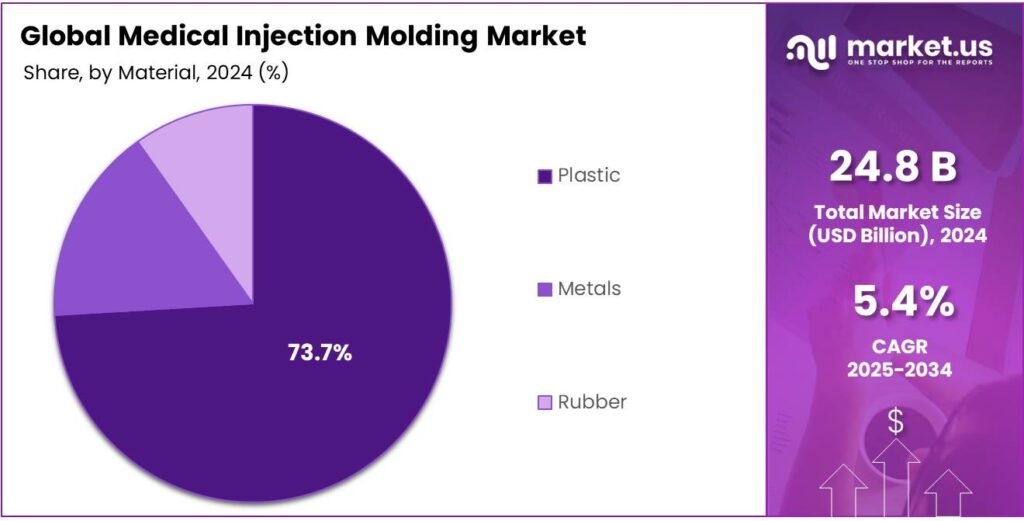

- Based on the material, plastic dominated the medical injection molding market, with a substantial market share of around 73.7%.

- Among the systems, hot runner held a major share in the medical injection molding market, 67.8% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the medical injection molding market, accounting for 46.5% of the total global consumption.

Product Type Analysis

Medical Devices & Equipment are a Prominent Segment in the Medical Injection Molding Market.

The medical injection molding market is segmented based on types of products into medical devices & equipment, surgical tools, consumables & disposables, and others. The medical devices & equipment led the medical injection molding market, comprising 45.8% of the market share, due to the higher complexity, customization, and precision required for these products. Medical devices such as diagnostic instruments, implantable devices, and drug delivery systems demand advanced materials and intricate molding processes to meet stringent regulatory standards.

These devices often require high-performance polymers and tight tolerances, driving up production costs and, consequently, their revenue potential. In contrast, consumables and disposables, while essential, are generally produced in higher volumes with less complexity, resulting in lower per-unit revenue. Additionally, the rapid technological advancements and innovation in medical devices further fuel demand, while surgical tools, though important, often have more standardized designs and lower unit costs, which limit their overall revenue contribution in comparison.

Material Analysis

Plastic Material Dominated the Medical Injection Molding Market.

On the basis of material, the medical injection molding market is segmented into plastic, metals, and rubber. Plastic material dominated the medical injection molding market, comprising 73.7% of the market share. It is the most commonly used material in medical injection molding due to its versatility, cost-effectiveness, and ability to meet stringent regulatory standards. Plastics such as polypropylene, polycarbonate, and polyethylene can be molded into complex shapes with high precision, making them ideal for producing a wide range of medical components such as syringes, diagnostic devices, and surgical instruments.

Additionally, plastic materials can be sterilized easily, ensuring compliance with healthcare hygiene standards. In addition, the lighter weight of plastic compared to metals makes it ideal for disposable items, reducing shipping costs and improving patient comfort. While metals and rubber are used in specific applications, plastic offers superior flexibility, easier integration with other materials, and faster production cycles.

System Analysis

Hot Runner Systems Held a Major Share of the Medical Injection Molding Market.

Based on the system, the medical injection molding market is segmented into hot runner and cold runner. Among the systems, 67.8% of the medical injection molding is manufactured by hot runner systems. Most medical injection molding systems use hot runners instead of cold runners due to their ability to improve efficiency, reduce material waste, and enhance part quality. In hot runner systems, the plastic is kept molten throughout the entire molding process, which ensures a consistent flow of material into the mold cavities.

This eliminates the need for additional material that is usually discarded with cold runners, reducing waste and improving cost-effectiveness, especially in high-volume production. Additionally, hot runners allow for faster cycle times, as the material is always at the ideal temperature, leading to better flow control and less risk of defects such as short shots or incomplete fills. These advantages are particularly crucial in the medical device sector, where precision, quality, and efficiency are paramount. Similarly, hot runners support the molding of complex designs with minimal scrap, which is vital for producing the intricate, high-precision parts required in medical devices.

Key Market Segments

By Product Type

- Medical Devices & Equipment

- Surgical Tools

- Consumable & Disposables

- Syringes

- Test tubes

- Petri dishes

- Drip chambers

- Others

- Others

By Material

- Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- Polycarbonate (PC)

- Polystyrene (PS)

- Others

- Metals

- Rubber

By System

- Hot Runner

- Cold Runner

Drivers

Increased Utilization of Implants and Disposable Medical Items Drives the Medical Injection Molding Market.

The increasing utilization of implants and disposable medical items is a key driver in the growth of the medical injection molding market. Implants, particularly those used in orthopedic and dental procedures, have seen a surge in demand due to advancements in medical technology and the aging population. According to the American Academy of Implant Dentistry, more than half a million individuals in the US alone opt for dental implants each year. Similarly, in the United States alone, over 7.5 million orthopedic devices are implanted each year. These implants, often requiring precision molding, necessitate high-quality plastic materials that can ensure biocompatibility and durability.

Additionally, the rise in disposable medical products such as syringes, catheters, and diagnostic devices is further propelling the demand for injection molding services. For instance, single-use syringes, which are critical for preventing cross-contamination in healthcare settings, are predominantly produced through injection molding. The shift toward disposable products is driven by concerns over infection control and cost-effectiveness. The ability of injection molding to produce these complex, high-precision items in large volumes while maintaining stringent quality standards supports its widespread adoption across the medical device sector.

Restraints

Compliance Challenges Might Delay the Growth of the Medical Injection Molding Market.

Compliance challenges in the medical device industry significantly impact the medical injection molding market, as manufacturers must navigate stringent regulatory and operational requirements. Preparing and maintaining device master files (DMFs) can be resource-intensive, requiring meticulous documentation of product specifications, manufacturing processes, and quality control procedures. Additionally, managing extensive supplier controls and ensuring that each component meets regulatory standards such as ISO 13485 or FDA regulations introduces further complexity. Furthermore, manufacturers are required to conduct comprehensive biomechanical and toxicological evaluations to assess the safety of materials used in medical devices, which is a time-consuming and costly process.

Post-production surveillance and risk analysis, including integrating principles such as failure mode and effects analysis (FMEA), are critical in monitoring long-term product performance and ensuring ongoing compliance. Moreover, adapting to evolving quality standards, such as IEC 62304 for software validation, necessitates the integration of updated protocols into existing systems, a process that can be both challenging and costly for manufacturers.

Opportunity

Demand for Diagnostic Equipment Creates Opportunities in the Medical Injection Molding Market.

The growing demand for diagnostic equipment presents significant opportunities for the medical injection molding market, driven by the increasing need for accurate and rapid diagnostics in healthcare. As medical technologies evolve, devices such as blood glucose monitors, pregnancy tests, and portable ultrasound equipment require advanced plastic components that can be produced with high precision and reliability through injection molding. For instance, according to the International Diabetes Federation, by 2023, nearly 589 million adults lived with diabetes globally (1 in 9), with over 250 million unaware of their condition, leading to 3.4 million annual deaths.

This prevalence creates the demand for glucose monitoring systems whose components, which include sensors, casings, and connectors, are often manufactured using injection molding. The increasing adoption of point-of-care diagnostic devices, designed for home use or in outpatient settings, further fuels the demand for lightweight, durable, and cost-effective molded parts. As healthcare providers focus on providing faster, more accessible diagnostics, the ability to efficiently produce these complex devices in large quantities supports the expansion of the medical injection molding sector.

Trends

A Focus on Automation in the Medical Injection Molding.

The ongoing trend towards automation in the medical injection molding sector is transforming the production of medical devices, enhancing efficiency and precision. Automation technologies, including robotic arms, automated material handling systems, and integrated inspection systems, are increasingly being employed to streamline the manufacturing process. For instance, robotic arms are used for tasks such as part removal, assembly, and packaging, significantly reducing manual labor while ensuring higher production speeds and consistent product quality.

In addition, automated inspection systems are capable of performing high-precision quality checks, ensuring that parts meet stringent medical standards. This focus on automation is particularly critical in the production of high-volume, high-precision products such as surgical instruments, IV components, and diagnostic devices, where error-free manufacturing is essential. By minimizing human intervention, automation reduces the risk of contamination, improves throughput, and lowers production costs, which are crucial factors in the highly regulated medical industry.

Geopolitical Impact Analysis

Geopolitical Tensions Are Reshaping the Dynamics of the Medical Injection Molding Market.

The geopolitical tensions are significantly impacting the medical injection molding market. Trade disruptions, particularly between major economies such as the U.S. and China, have led to supply chain uncertainties. Tariffs on raw materials and components used in the injection molding process, such as specialized polymers and metals, have increased production costs for manufacturers.

Additionally, the Israel-Hamas war had sabotaged trade routes in the Red Sea and the Suez Canal, which led to delays for an outgoing trip from Asia to Europe. Similarly, the conflict revolving around the South China Sea had restricted deliveries of semiconductor products, essential in molding machines and medical devices, to other countries, such as the US.

In contrast, countries in South Asia, such as Vietnam and India, are increasingly becoming key players in medical device manufacturing, offering a more stable and cost-effective alternative. Additionally, rising concerns about healthcare security amid geopolitical instability are driving governments to invest in local manufacturing capabilities, creating new opportunities for injection molding suppliers. Despite the challenges, these factors are likely to reshape the market dynamics and foster regional growth in the medical injection molding sector.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Medical Injection Molding Market.

In 2024, the Asia Pacific dominated the global medical injection molding market, holding about 46.5% of the total global consumption. The region holds the largest share of the global medical injection molding market, driven by a combination of factors such as a large manufacturing base, lower production costs, and increasing demand for medical devices.

According to the India Brand Equity Foundation, healthcare spending accounted for 3.3% of India’s GDP in 2022 and is expected to rise to 5% by 2030. Countries such as China, India, and Japan are prominent players, leveraging their advanced manufacturing capabilities and growing healthcare infrastructure. For instance, China has become a global hub for the production of medical devices, including disposable syringes, catheters, and diagnostic equipment, all of which are produced via injection molding.

The region’s strong emphasis on cost-efficiency, coupled with an expanding middle class and aging population, has significantly boosted the demand for both domestic and international medical devices. Japan has the world’s most rapidly aging population, with nearly 30% of its people over 65, and a median age of 49. Furthermore, the Asia Pacific’s regulatory environment has evolved to accommodate international standards, making it an attractive region for foreign investments in medical manufacturing.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the medical injection molding market focus on several strategic activities to expand their market reach and boost sales. The companies prioritize technological advancements, such as integrating automation and advanced molding techniques, to enhance production efficiency, reduce costs, and meet the growing demand for high-precision medical devices.

In addition, many players emphasize expanding their product portfolios by investing in research and development to create new materials and innovative designs that align with evolving healthcare needs. Similarly, many companies are exploring regional manufacturing hubs to reduce dependency on global supply chains and mitigate geopolitical risks. Furthermore, the companies emphasize collaborations and partnerships with medical device manufacturers that help them expand market access.

The Major Players in The Industry

- C&J Industries

- The Rodon Group

- EVCO Plastics

- Majors Plastics, Inc.

- Proto Labs, Inc.

- Formplast GmbH

- H&K Müller GmbH & Co. KG

- Hehnke GmbH & Co. KG

- TR Plast Group

- D&M Plastics, LLC.

- Majors Plastics, Inc.

- Tessy Plastics

- Currier Plastics, Inc.

- Phillips-Medisiz

- Other Key Players

Key Development

- In April 2025, C&J Industries announced that it had completed an expansion of its facility and injection mold plastics capacity. The 25,000-square-foot addition included a 12,000-square-foot injection molding cleanroom equipped with 20 cleanroom and white-room presses, increasing capacity by more than 100,000 hours of production.

- In April 2025, Fictiv, a global supply chain solutions leader, partnered with EVCO Plastics, a leading custom plastics and contract manufacturer, to enable customers to efficiently bring innovations from concept to scale production.

Report Scope

Report Features Description Market Value (2024) USD 24.8 Bn Forecast Revenue (2034) USD 42.0 Bn CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Medical Devices & Equipment, Surgical Tools, Consumables & Disposables, and Others), By Material (Plastic, Metals, and Rubber), By System (Hot Runner and Cold Runner) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape C&J Industries, The Rodon Group, EVCO Plastics, Majors Plastics, Inc., Proto Labs, Inc., Formplast GmbH, H&K Müller GmbH & Co. KG, Hehnke GmbH & Co. KG, TR Plast Group, D&M Plastics, LLC, Majors Plastics, Inc., Tessy Plastics, Currier Plastics, Inc., Phillips-Medisiz, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Medical Injection Molding MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Medical Injection Molding MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- C&J Industries

- The Rodon Group

- EVCO Plastics

- Majors Plastics, Inc.

- Proto Labs, Inc.

- Formplast GmbH

- H&K Müller GmbH & Co. KG

- Hehnke GmbH & Co. KG

- TR Plast Group

- D&M Plastics, LLC.

- Majors Plastics, Inc.

- Tessy Plastics

- Currier Plastics, Inc.

- Phillips-Medisiz

- Other Key Players