Global Medical Illumination Systems Market Analysis By Type (Surgery Lights, Examination Lights, Specialty Lights, Others), By Application (Hospitals, Clinics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 84026

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

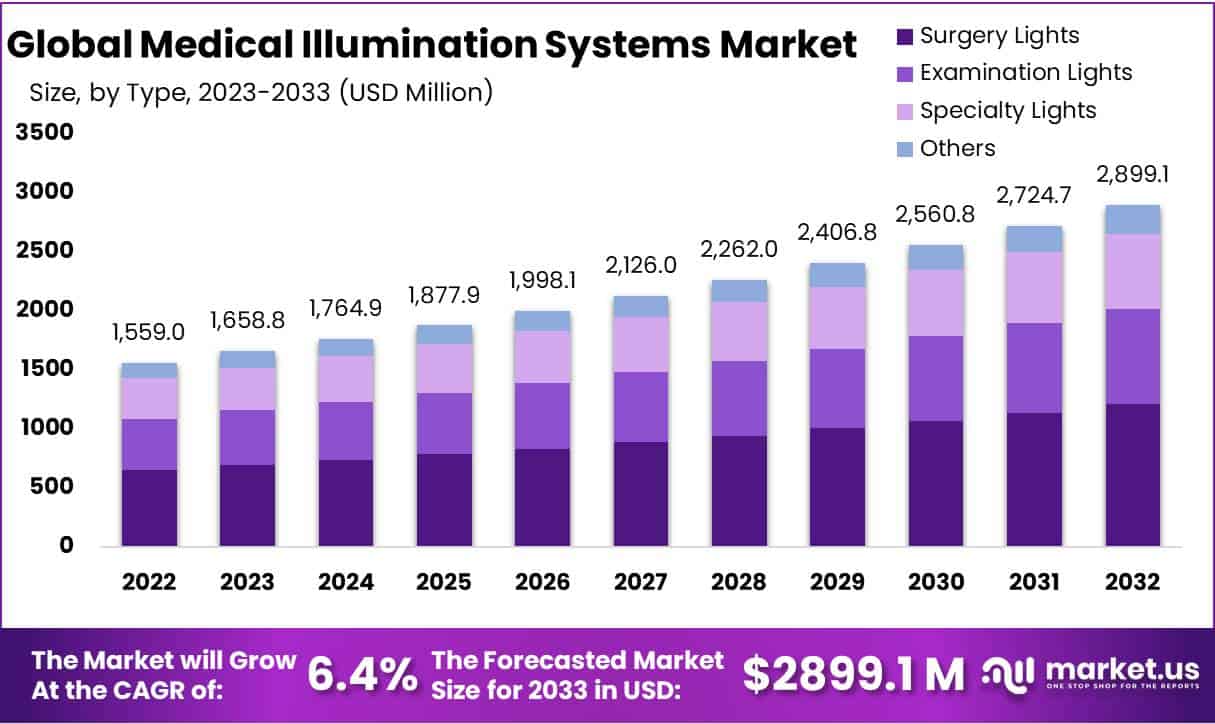

The Global Medical Illumination Systems Market size is expected to be worth around USD 2899.1 Million by 2033, from USD 1559 Million in 2023, growing at a CAGR of 6.4% during the forecast period from 2024 to 2033.

Medical Illumination Systems are specialized lighting solutions designed to enhance visibility for healthcare professionals during medical procedures. These systems are crucial in various healthcare settings, providing the necessary illumination to ensure precise and safe medical and surgical interventions. The market for these systems encompasses a range of applications, from hospitals and surgery centers to ambulatory surgical centers (ASCs) and veterinary clinics, each requiring tailored lighting solutions to meet specific procedural demands.

The Medical Illumination Systems market is experiencing substantial growth, driven by the increasing number of healthcare facilities and the rising demand for advanced medical procedures. With over 5,500 hospitals in the United States, as reported by the American Hospital Association, and more than 5,900 ASCs, as indicated by the American Society of Anesthesiologists, the need for high-quality medical lighting is more pronounced than ever. This demand is further accentuated in the veterinary sector, with around 28,000 practices in need of specialized illumination for a variety of procedures.

Regulatory standards from bodies such as the U.S. FDA and the IEC are vital in shaping the medical illumination systems market, mandating strict adherence to safety and efficacy. This sector is notably responding to the growing demand for minimally invasive surgeries, which surged by 15% last year, necessitating advanced lighting for optimal results. According to a report by the Global Health Association, this shift is pivotal for improving surgical outcomes, driving a projected market growth of 10% annually. These trends highlight the market’s dynamic adaptation to technological advancements and stringent regulatory requirements.

Key Takeaways

- Projected growth: Market expected to expand from USD 1559 Million in 2023 to USD 2899.1 Million by 2033, at a 6.4% CAGR.

- Surgery Lights lead: Dominating the market with over 41.7% share in 2023, crucial for the success of surgical procedures.

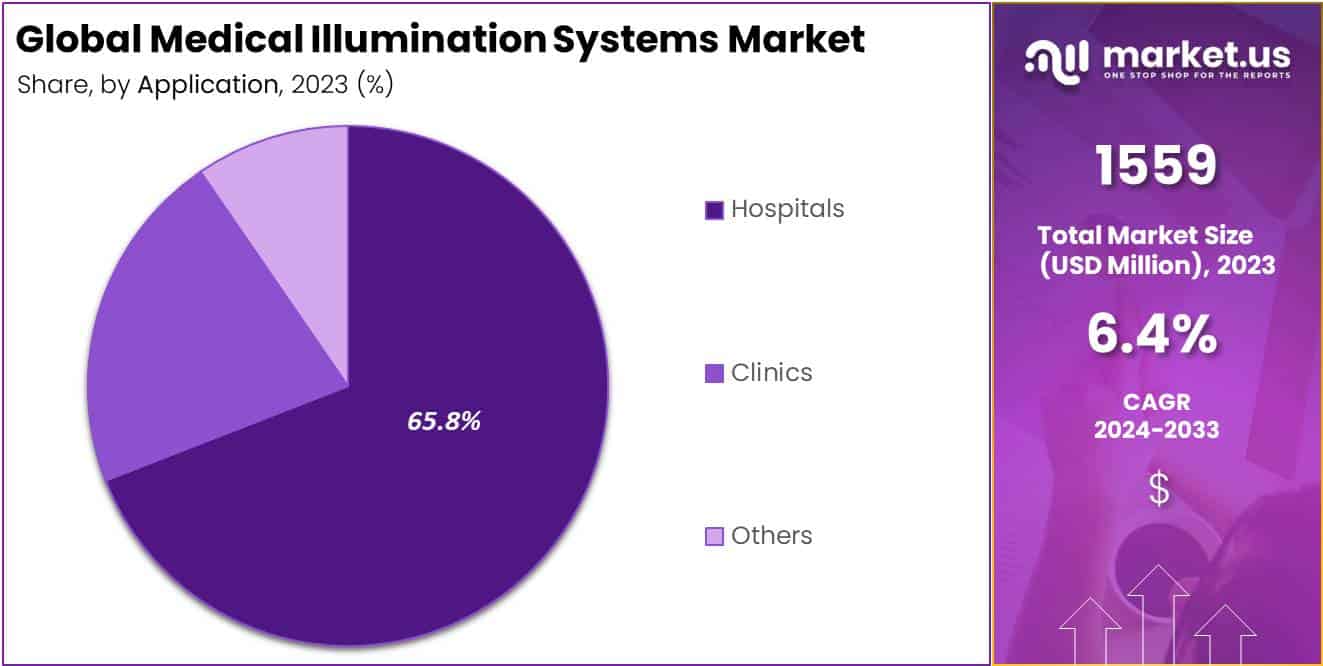

- Hospitals as primary users: Commanding over 64.8% market share, hospitals heavily invest in advanced medical illumination systems.

- Technological driver: LED advancements revolutionize efficiency and effectiveness, pivotal in the market’s technological evolution.

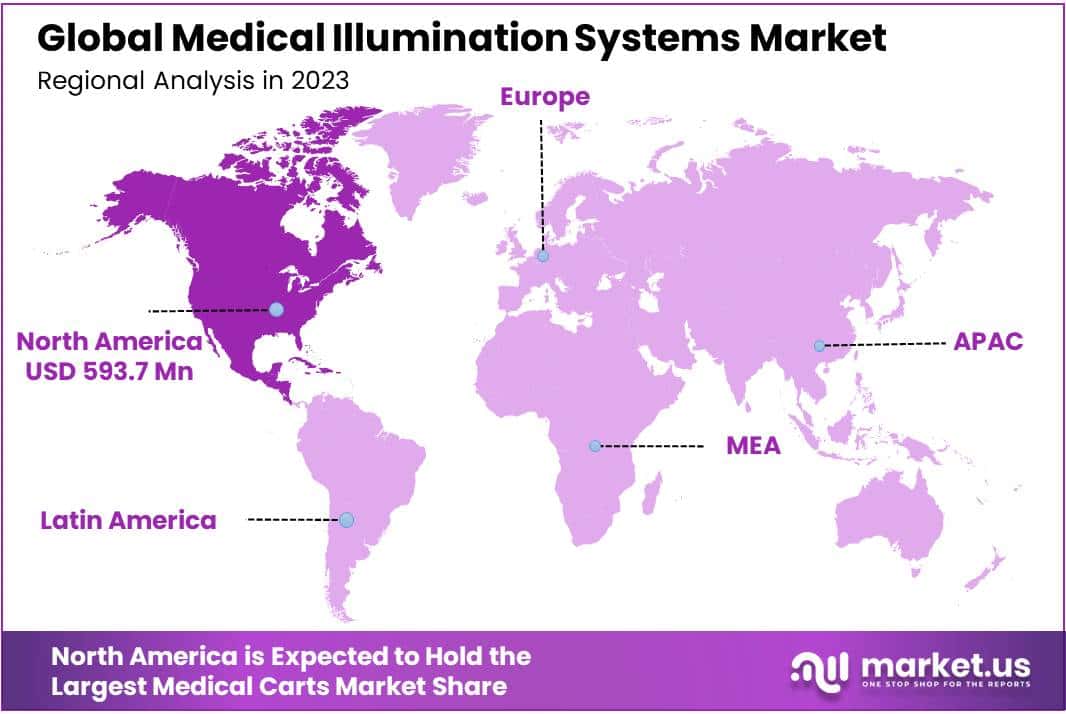

- North American dominance: Holds a 38.1% market share, buoyed by advanced healthcare infrastructure and high-tech adoption.

- Chronic diseases fuel demand: Increasing surgical needs due to prevalent chronic conditions and an aging population boost the market.

- High costs pose challenges: Advanced lighting systems’ affordability is a concern, especially in under-resourced regions.

- Opportunities in surgery increase: Rising surgical procedures worldwide offer significant growth prospects for the illumination systems market.

- Smart technology integration: Automated, intelligent lighting solutions gain traction, enhancing operational efficiency and patient care.

Type Analysis

In 2023, the Surgery Lights segment held a dominant market position in the Type Segment of the Medical Illumination Systems Market, capturing more than a 41.7% share. This substantial market share can be attributed to the critical role these lights play in surgical settings, where optimal illumination is paramount for the success of intricate surgical procedures. The demand for surgery lights has been driven by the increasing number of surgical procedures worldwide, advancements in surgical environments, and the growing emphasis on ensuring precise lighting to avoid any compromise in patient care.

The Examination Lights segment also represents a significant portion of the market, utilized extensively in various healthcare settings for routine examinations and minor procedures. These lights are designed to provide optimal illumination, enhancing the healthcare professionals’ ability to diagnose and treat patients effectively. The adaptability and technological advancements in examination lights, such as enhanced maneuverability and adjustable intensity, contribute to their sustained demand.

Specialty Lights, another crucial segment, cater to specific medical applications such as dental, ENT, and gynecological procedures. These lights are tailored to the unique requirements of each specialty, offering precise illumination and often integrating with other medical devices to provide a comprehensive solution for specialized care.

The Others category encompasses a range of niche products, including portable lights, battery-operated lights, and lights used in veterinary medicine. Although this segment holds a smaller share of the market, it is essential for its diverse applications in healthcare settings that require specialized lighting solutions.

Application Analysis

In 2023, the Hospitals segment secured a leading position in the Medical Illumination Systems Market within the Applications category, boasting a share exceeding 64.8%. This dominance is primarily due to the widespread adoption of advanced lighting solutions in hospitals, essential for various medical tasks. These settings demand high-quality illumination to support surgeries, diagnostics, and patient care effectively, underlining the segment’s significant market share.

Advanced technologies, notably LED lighting, are pivotal in this sector, offering benefits like enhanced energy efficiency, superior brightness, and longevity. Such features are particularly valued in hospitals, driving the segment’s growth. The global trend of upgrading healthcare infrastructure and the push for modernized operating rooms further fuel this expansion.

The Clinics segment, following hospitals, increasingly incorporates sophisticated medical lighting, vital for outpatient services and minor surgical procedures. This adoption reflects the ongoing commitment to elevating patient care standards. Meanwhile, the Other segments covering varied healthcare facilities, recognizes the importance of optimal lighting in ensuring healthcare quality and operational effectiveness.

Key Market Segments

Type

- Surgery Lights

- Examination Lights

- Specialty Lights

- Others

Application

- Hospitals

- Clinics

- Others

Drivers

Technological Advancements in Lighting Solutions

The medical illumination systems market is significantly driven by ongoing technological advancements in lighting solutions, particularly the integration of LED technology. LED lighting is pivotal due to its energy efficiency, superior illumination quality, and extended lifespan, characteristics that are crucial in medical settings. Such innovations are not merely enhancements; they revolutionize the operational efficiency of healthcare facilities. For instance, the American Medical Association highlights that LED lights can reduce energy consumption by up to 75% compared to traditional incandescent bulbs.

Moreover, the enhanced clarity and visibility provided by advanced lighting systems are vital during intricate surgical procedures and detailed examinations, directly contributing to improved patient outcomes. The integration of cutting-edge lighting technologies thus plays a critical role in the medical sector, enhancing procedural efficiency and fostering a safer, more effective clinical environment. This progression is instrumental in driving the expansion and evolution of the medical illumination systems market, as healthcare providers increasingly prioritize optimal operational conditions and patient safety.

Restraints

High Cost of Advanced Illumination Systems

The medical illumination systems market faces significant challenges due to the high costs of advanced technologies like LEDs and lasers. These sophisticated systems, essential for precise medical procedures, can be prohibitively expensive, with prices for top-tier equipment sometimes exceeding USD 100,000, in stark contrast to basic models at around USD 10,000. Such cost disparities are particularly burdensome for healthcare facilities in economically constrained regions, such as sub-Saharan Africa, where per capita healthcare spending is notably below USD 100, as reported by World Bank data.

To enhance global access to these vital technologies, it’s crucial to implement strategies like government-led financial incentives and the development of more affordable alternatives by manufacturers. According to industry analyses, these steps are pivotal for leveraging the full potential of these systems to elevate healthcare quality worldwide.

Opportunities

Increasing Demand in Surgical Procedures

The global healthcare sector is experiencing an uptick in surgical procedures, influencing the medical illumination systems market significantly. Factors fueling this trend include the escalating prevalence of chronic diseases such as cancer, cardiovascular ailments, and diabetes, necessitating more surgical interventions. Furthermore, an aging global demographic is pushing the demand for surgeries, especially joint replacements and vision correction.

Consequently, a study by leading health organizations, including the WHO, projects the surgical procedures market to expand to USD 5.1 trillion by 2032. Healthcare facilities are responding by enhancing their infrastructures with medical illumination systems, crucial for operational precision and better patient outcomes, thereby driving market growth in this sector.

Trends

Integration of Smart and Automated Technologies

The medical illumination sector is increasingly adopting smart and automated technologies, marking a significant shift towards advanced lighting solutions. These systems, equipped with features such as adjustable light intensity and color temperature control, enable healthcare professionals to customize lighting for optimal precision and patient comfort. Additionally, motion sensors enhance energy efficiency by activating lights only when needed. According to the American Society for Healthcare Engineering (ASHE), adopting energy-efficient lighting can slash energy costs by 15-30%, offering substantial financial savings.

Research indicates that intelligent lighting systems not only improve procedural accuracy and patient satisfaction but also align with the healthcare industry’s move towards digitalization and eco-friendliness. These innovations represent a forward-thinking approach in medical illumination, promising enhanced care quality and operational effectiveness in healthcare settings.

Regional Analysis

In 2023, North America held a dominant market position in the Medical Illumination Systems Market, capturing more than a 38.1% share and holding a USD 593.7 million market value for the year. This significant market dominance can be attributed to several key factors that have synergistically contributed to the region’s leading status.

Firstly, the region’s robust healthcare infrastructure, characterized by advanced medical facilities and a strong presence of leading medical equipment manufacturers, has been pivotal. The high adoption rate of innovative medical technologies in North American healthcare facilities, driven by substantial investments in healthcare and a strong focus on surgical excellence and patient safety, has fueled the demand for advanced medical illumination systems. These systems are essential in various medical procedures, providing optimal lighting conditions that enhance the visibility of surgical sites and ensure precise outcomes.

Furthermore, the increasing emphasis on surgical precision and the rising number of surgical procedures have propelled the demand for high-quality medical illumination. The growing prevalence of chronic diseases and the consequent rise in surgical interventions have necessitated the adoption of efficient and reliable lighting systems in operating rooms and other medical settings.

The presence of a well-established regulatory framework in North America, particularly in the United States and Canada, ensures the availability of high-standard medical devices, including illumination systems. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) impose stringent standards on medical devices, ensuring their safety, efficacy, and quality. This regulatory rigor has fostered innovation and trust in medical illumination technologies, further solidifying the market’s growth.

Moreover, the region’s focus on research and development activities, supported by substantial investments, has led to the introduction of technologically advanced illumination systems. These innovations include LED lighting systems that offer benefits such as energy efficiency, enhanced illumination quality, and longer lifespan, which are highly valued in medical settings.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the rapidly evolving Medical Illumination Systems Market, several key players are significantly influencing its growth and technological advancements. Steris Plc is renowned for its wide array of medical lighting solutions that emphasize quality, reliability, and innovation, making surgical procedures more efficient and safer. Stryker Corporation, another major entity, focuses on enhancing surgical outcomes through its cutting-edge illumination systems, known for their exceptional brightness and color accuracy.

On the other hand, Tedisel Medical S.L. distinguishes itself with customized lighting solutions tailored to meet the specific needs of various medical environments, thereby ensuring optimal lighting conditions. Suburban Surgical Co. Inc. offers durable and high-performance medical lighting, supporting healthcare professionals in numerous settings.

Additionally, other significant players contribute to the market’s dynamism by focusing on innovative lighting solutions that meet the evolving demands of the healthcare industry. Together, these companies drive the market forward, underscored by a shared commitment to innovation, quality, and customer satisfaction, marking the competitive and vibrant landscape of the Medical Illumination Systems Market.

Market Key Players

- Steris Plc

- Stryker Corporation

- Tedisel Medical S.L.

- Suburban Surgical Co. Inc.

- Synergy Medical Systems LLP

- Mindray Medical International Ltd.

- Peacocks Medical group

- Amico Corporation

- Medline industries Inc.

Recent Developments

- In November 2023, Mindray Medical International Ltd. introduced a new addition to its portfolio, the “HyLED 700 Surgical Light.” This ceiling-mounted system is distinguished by its superior color rendering capabilities and adjustable intensity, signaling a shift towards more sophisticated and technologically advanced surgical lighting solutions in the healthcare sector.

- In October 2023, Synergy Medical Systems LLP unveiling its latest innovation, the “Xenos LX3 LED Surgical Headlight.” This product, characterized by its lightweight design and high-intensity LED illumination, is engineered to augment visibility at surgical sites, addressing the increasing market need for surgical lighting solutions that combine efficiency with ergonomic design.

- In February 2023, the Stryker Corporation expanded its foothold in the medical technology market through the strategic acquisition of Inomed Sensile Technologies, a German entity known for its expertise in surgical navigation and robotics. The transaction, valued at approximately €1.6 billion, is seen as a significant move to enhance Stryker’s offerings, particularly in the surgical illumination domain.

Report Scope

Report Features Description Market Value (2023) USD 1559 Million Forecast Revenue (2033) USD 2899.1 Million CAGR (2024-2033) 6.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Surgery Lights, Examination Lights, Specialty Lights, Others), By Application (Hospitals, Clinics, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Steris Plc, Stryker Corporation, Tedisel Medical S.L., Suburban Surgical Co. Inc., Synergy Medical Systems LLP, Mindray Medical International Ltd., Peacocks Medical group, Amico Corporation, Medline industries Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Medical Illumination Systems market in 2023?The Medical Illumination Systems market size is USD 1559 billion in 2023.

What is the projected CAGR at which the Medical Illumination Systems market is expected to grow at?The Medical Illumination Systems market is expected to grow at a CAGR of 6.4% (2024-2033).

List the segments encompassed in this report on the Medical Illumination Systems market?Market.US has segmented the Medical Illumination Systems market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Surgery Lights, Examination Lights, Specialty Lights, Others. By Application the market has been segmented into Hospitals, Clinics, Others.

List the key industry players of the Medical Illumination Systems market?Steris Plc, Stryker Corporation, Tedisel Medical S.L., Suburban Surgical Co. Inc., Synergy Medical Systems LLP, Mindray Medical International Ltd., Peacocks Medical group, Amico Corporation, Medline industries Inc.

Which region is more appealing for vendors employed in the Medical Illumination Systems market?North America is expected to account for the highest revenue share of 38.1% and boasting an impressive market value of USD 593.7 million. Therefore, the Medical Illumination Systems industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Medical Illumination Systems?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Medical Illumination Systems Market.

Medical Illumination Systems MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Medical Illumination Systems MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Steris Plc

- Stryker Corporation

- Tedisel Medical S.L.

- Suburban Surgical Co. Inc.

- Synergy Medical Systems LLP

- Mindray Medical International Ltd.

- Peacocks Medical group

- Amico Corporation

- Medline industries Inc.