Global Medical Devices Market By Product (Monitoring Devices, Cardiac Monitoring Devices, Neuromonitoring Devices, Respiratory Monitoring Device) By End User (Hospitals & Clinics, Diagnostic Centers, Research laboratory, and Pharmaceutical companies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 95403

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

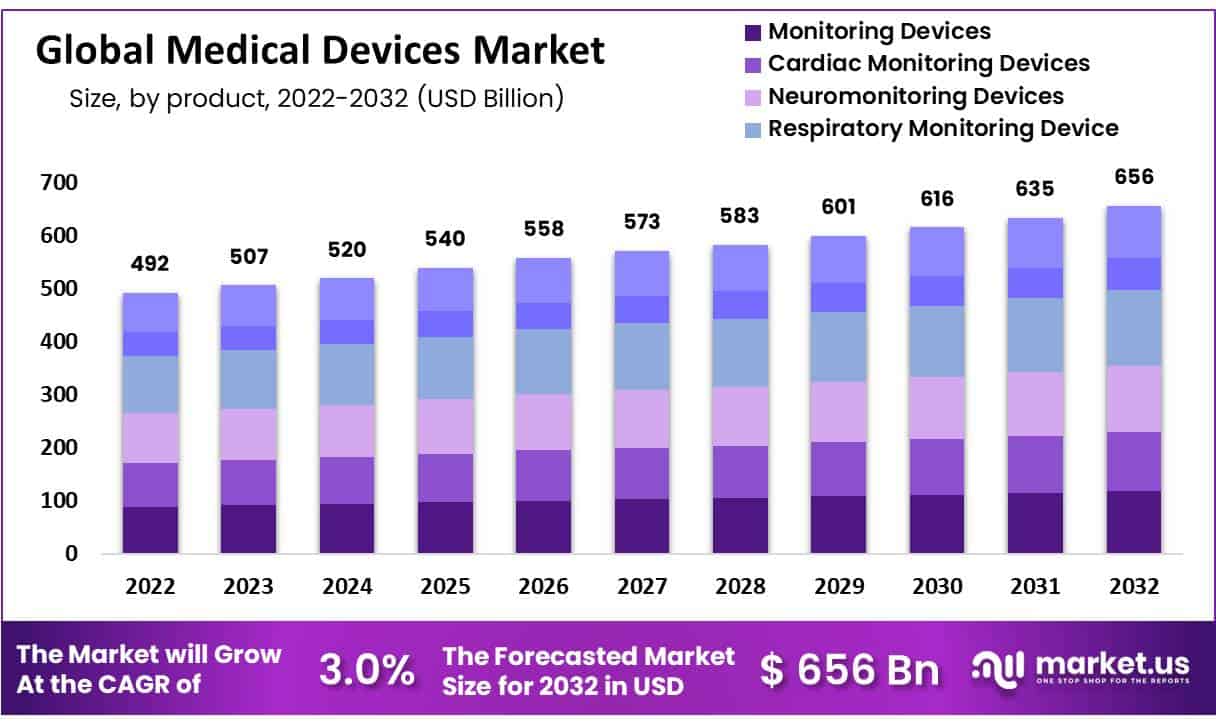

The Global Medical Devices Market size is expected to be worth around USD 656 Billion by 2032 from USD 492 Billion in 2022, growing at a CAGR of 3% during the forecast period from 2022 to 2032.

This medical device market is driven by complex surgeries and growing populations. Technological advancements in medical technology and brain monitoring devices are expected to drive the growth of the medical device market. Medical devices can be used to diagnose and treat injuries or diseases.

Medical devices offer many benefits. They can be used for treating illnesses and improving patients’ quality of life. FDA (Food and Drug Administration) classifies medical devices into three classes: Class I, Class II, and Class III.

Class I and II are subject to special labeling because they have the least regulatory controls. These are those that support or sustain human life. This includes an implant endosseous, an external defibrillator, and a pulse generator. Establishments that produce medical equipment are called medical device establishments. These devices include diagnostic imaging devices, in-vitro diagnosis, and dental equipment.

Key Takeaways

- Market Growth: The global medical devices market is projected to reach approximately USD 656 billion by 2032, growing at a CAGR of 3% from USD 492 billion in 2022.

- Driving Factors: Complex surgeries and growing populations are driving the market. Technological advancements in medical technology and brain monitoring devices are expected to fuel growth.

- FDA Classification: Medical devices are classified into three classes by the FDA – Class I, Class II, and Class III, with varying levels of regulatory controls.

- Segment Analysis:

- The In-Vitro Diagnostics (IVD) segment is expected to have a higher CAGR due to increased demand for diagnostic testing for chronic and infectious diseases.

- Other segments include wound management, minimally invasive surgery, cardiovascular and orthopedic devices, and ophthalmic and diabetes care.

- End-User Dominance: Hospitals and ambulatory surgery centers dominated the global medical devices market in 2022, driven by healthcare spending and infrastructure.

- COVID-19 Impact: The pandemic initially led to a decrease in elective procedures but increased demand for hospital equipment. The long-term impact includes rising chronic diseases and a shift towards homecare settings.

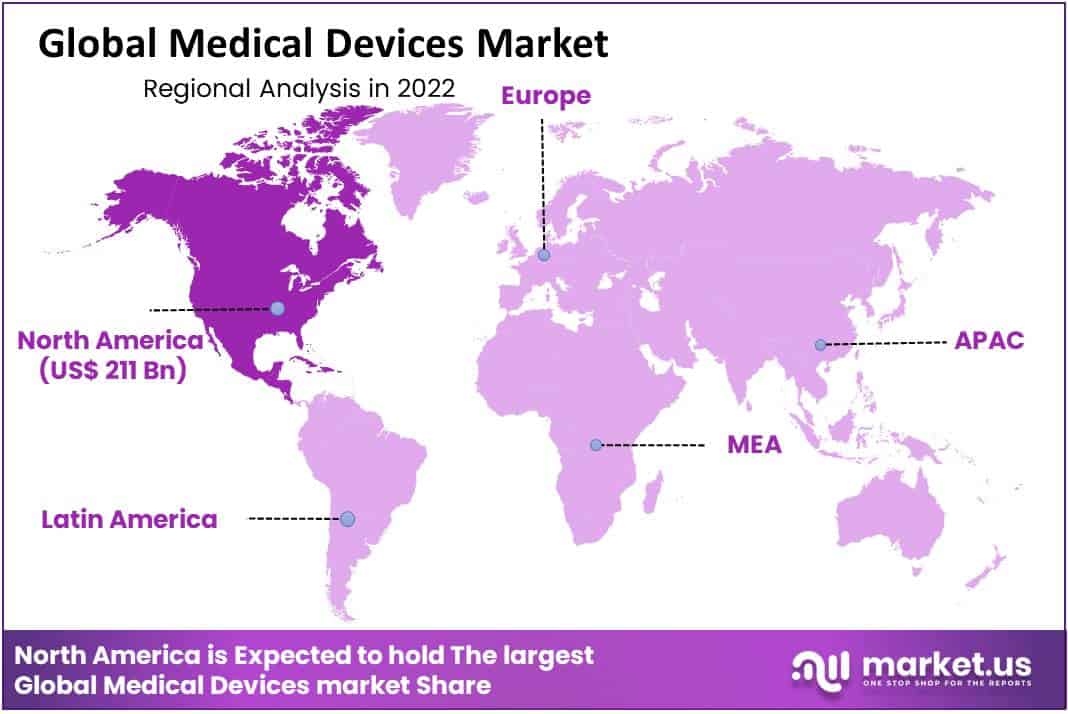

- Regional Analysis: North America dominates the market due to technological advancements, healthcare spending, and a growing geriatric population. The United States saw a high prevalence of heart disease in 2021, increasing the demand for medical devices.

- Players Analysis: The global medical devices market is highly fragmented, with Medtronic having a significant market share. Many players invest heavily in R&D and global distributor networks to diversify their product offerings.

Type Analysis

In-vitro Diagnostics (IVD), Segment to Boost the Growing Prevalence Of Infectious Diseases during 2022-2032

The In-Vitro Diagnostics segment (IVD), is expected to see a higher CAGR. This is due to the increasing use of real-time diagnostic testing for accurate diagnosis of chronic and infectious diseases like diabetes, cancer, and HIV/AIDS. In 2022, the others segment held a dominant share due to increased demand for medical equipment, such as gloves, masks and gloves, surgical lights, and fetal monitors. Due to increased investment by medical device companies in new wound devices and bioactive treatments in the market, the wound management segment will also grow at a significant rate.

The Minimally Invasive Surgery segment is expected to grow due to technological advances in surgical robots and increased use by healthcare providers. The segments of cardiovascular and orthopedic devices are expected to grow at a rapid pace due to an increasing number of patients with different orthopedic and cardiac conditions. The growing incidence of retinal and diabetes disorders in the general population will likely increase the demand for ophthalmic and diabetes care, which will drive market growth for medical devices over the forecast period.

End-User Analysis

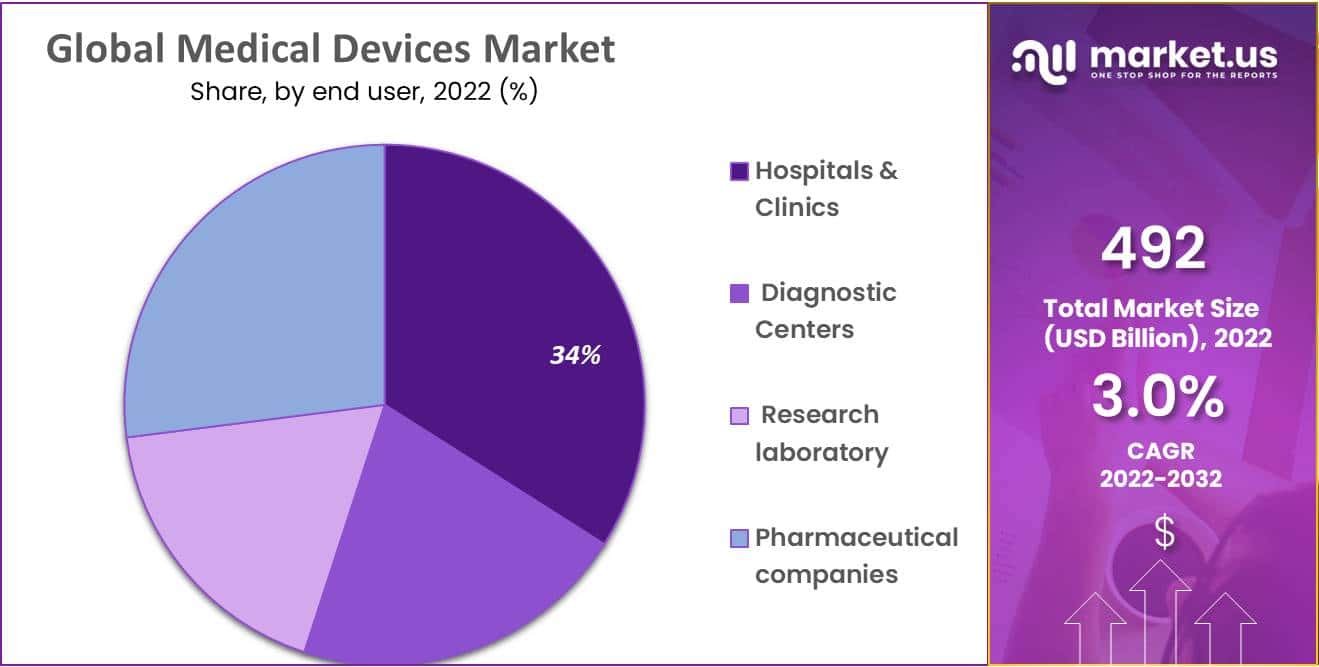

According to end users, hospitals and other ambulatory surgery centers dominated 2022’s global medical devices market.

The prominent growth of this segment can be attributed to rising healthcare spending, better healthcare infrastructure, and an attractive reimbursement policy. The WHO report on healthcare infrastructure shows that most developing countries don’t have an average number of 1 million people in hospitals. These countries heavily invest in healthcare infrastructure development. For example, it is predicted that healthcare infrastructure spending will rise over the next five years.

Key Market Segments

Based on Product

- Monitoring Devices

- Cardiac Monitoring Devices

- Neuromonitoring Devices

- Respiratory Monitoring Device

- Multi-Parameter Monitoring Devices

- Hemodynamic Monitoring Devices

- Fetal and Neonatal Monitoring Devices

- Temperature Monitoring Devices

- Weight Monitoring Devices

- Diagnostic Devices

- Surgical ENT Devices.

- Endoscopes

- Imaging Devices

- Diagnostic Molecular Devices

- Drug Delivery Devices

- Surgical Devices

- Bio Implants and Stimulation Devices

- Treatment Equipment

- Infusion Pumps

- Medical lasers and LASIK surgical machines

- Others

Based on End-User

- Hospitals & Clinics

- Diagnostic Centers

- Research laboratory

- Pharmaceutical companies (Shopping Plazas, Military, Corporate Sectors, Hostels)

Drivers

Increased Prevalence of Chronic Conditions to Boost Medical Devices Demand

Owing to sedentary lifestyles, as well as other factors, there is an increasing number of chronic diseases such as diabetes, cancer, and other infections. Healthcare agencies in different countries are working to increase the rate of diagnosis and treatment through a growing number of awareness programs. The number of people who require diagnostic tests and procedures is increasing due to the increased prevalence of these conditions in the population. According to the International Diabetes Federation, 537 million people will be affected by diabetes in 2021.

This number is expected to rise to 643 million by 2030, and 783 million by 2045, according to IDF. According to the American Cancer Society (ACS), the number of new cases of cancer in 2021 was also 1.9 million. Due to the increasing number of joint fractures and impaired vision in the elderly, there is a growing demand for orthotic and ophthalmic procedures. According to Osteoarthritis Alliance’s 2021 data, the incidence of knee osteoarthritis in the elderly is highest among those aged 45-65 years. 45% of people with osteoarthritis have reached 65 or older.

These factors, along with rising per capita healthcare spending in developed and emerging countries and improved reimbursement policies, are driving the increasing number of patients who seek treatment and diagnosis. This is driving the demand for medical equipment in these countries.

The shift towards homecare settings is driving up demand for portable devices

The healthcare system in different countries is under immense pressure due to the rising incidence of chronic medical conditions and the treatment of those suffering from them. Globally, this has resulted in a significant increase in the economic burden associated with treating these diseases. Hospital inpatient costs are much higher than those for whom they are treated. In addition, longer stays in hospitals can lead to a higher economic burden.

According to an American Journal of Managed Care (AJMC) 2021 article, home care management costs were reduced by 19% in a recent randomized study comparing patients in a hospital and those in a hospital. With the increasing economic burden and a growing population over 60, there has been a shift in preference to home healthcare services. The adoption of home healthcare services in developed countries is on the rise due to the increased efforts of healthcare agencies and key players to create and launch easy-to-use medical devices, such as wearable and portable devices for chronic diseases.

Shimmer Research, a global leader of wearable technology applications, introduced Verisense Pulse+ in March 2021. This sensor is for the Verisense platform and provides photoplethysmograms, galvanic skin responses, and an inertial measuring unit. This device measures clinical trial patients’ heart rate and oxygen saturation. It also measures their activity and sleep levels.

Restraints

Global Medical Devices Market growth may be impeded by factors such as a shortage of skilled workers and doctors and a lack of standards and protocols.

Regulatory changes will most likely lead to higher prices for new products and services. These regulatory changes affect data protection. These changes also impact equipment approval procedures. Additional clinical information has been requested by the US Food and Drug Administration (FDA). This is to support safety and efficacy claims for medical devices, such as endoscopies.

The 510(k), the premarket approval process, has been sped up by more than 55% over the past decade. The potential loss of revenue from delayed product releases, as well as the increased costs associated with stringent approval processes, has put pressure on investments in new product development. This can have a negative impact on the growth of the medical device and equipment markets.

Opportunity

Focusing on medical devices, such as devices for the elderly, high-performance websites, and collaborations with government agencies.

In-vitro Diagnostics is the largest segment of the market for medical devices segmented by type. By 2025, it will have US$ 33,600 million in global annual sales. Segmented by spending, the public segment will hold the largest market share for medical devices. It will be able to achieve US$ 1,14 600 million in global annual sales by 2020.

The segmented market for medical devices by the end user will be most favorable to hospitals and clinics. They can expect to be able to make US$ 1,819,000,000,000 in worldwide annual sales by 2025. The USA will be the world’s largest market for medical devices, with US$ 55,700 million. Medical device companies should focus on disposable medical products, contactless medical equipment, portable medical devices, and wearable medical gadgets.

Trends

Wearable medical technologies such as wearables are becoming more common in the wake of the coronavirus outbreak.

It is now easier to remotely diagnose, treat and monitor patients. Remote patient monitoring devices, Artificial Intelligence (AI), wearable medical equipment, and electronic health records are just a few examples of these technologies. This allows patients to be monitored in their own hospitals and homes via contactless technology. This is critical in controlling COVID-19.

Patients and doctors can keep an EHR for their patients, which means they don’t have to deal with the traditional paperwork that has to be passed through several people involved in treatment. The data can be viewed on both their personal devices and by doctors.

Manufacturers of medical equipment are looking for ways to reuse their production lines to make high-demand supplies to combat Coronavirus. These products include hand sanitizers (hand soaps), ventilators, personal protective equipment (PPE), as well as face masks, and other medical supplies. AirCo is a liquor producer that has changed its focus to producing hand sanitizers.

INKSmith Canada also makes face shields. It was a startup that made tech tools and design more accessible to children. Markforged is a Massachusetts-based company that 3D prints, and Formlabs (Massachusetts-based Formlabs) make personal protective equipment like face shields. They offer nasal swabs to conduct COVID-19 testing. They also offer nasal swabs for COVID-19 testing.

Regional Analysis

North America will reap the benefits of technologically advanced medical devices, high treatment rates, and government support to detect diseases early. There are many ongoing projects.

According to regional analysis, North America will be the largest market for medical devices in the future. The rising prevalence of chronic diseases, high healthcare spending, and the presence of key players are some of the reasons for this market dominance. Canada’s growing geriatric population is expected to boost market growth over the forecast period.

According to the United Nations Population Fund’s 2022 statistics, Canada has a large age group between 15 and 64 years. This group accounts for approximately 65% of Canada’s total population. The same source predicts that 19% of Canadians will be 65 or older by 2022.

Geriatrics are more likely to develop chronic conditions like respiratory disease, cardiopulmonary disease, and orthopedic disorders. This will drive market growth in the forecast period. An increase in cardiopulmonary bypass procedures has been caused by a rising number of chronic diseases, such as stroke, heart disease, and cardiovascular disease.

There has been a rise in demand for medical equipment. According to the American Heart Association’s 2022 statistics, the United States had a 6.8% heart disease prevalence in 2021. This is 1.8% more than the total population. This will increase the demand for medical equipment that can improve diagnosis and treatment. This will likely increase the market’s growth during the forecast period.

A Cardiovascular Diabetology research study published in June 2021 found that 31% more physical activity results in Type II diabetes (27,000), heart disease (10,300), stroke (2200), myocardial injuries (1500), stroke deaths (405), or deaths from coronary diseases (350). Lifestyle changes that cause physical inactivity may increase the risk of developing heart disease.

As more heart surgeries are performed to clear blocked arteries, this will lead to a rise in demand for medical devices. This should help boost the market growth. This market is growing because companies are focusing on developing advanced products and using different business strategies, such as acquisitions or collaborations, on keeping their market position.

Key Regions

North America

- The US

- Canada

- Mexico

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Owing to the presence of numerous market participants on a global and regional level, the global market for medical devices is highly fragmented. Among these businesses, Medtronic has the largest market share thanks to its wide range of products and well-known name on the international stage. In addition, the majority of industry players heavily invest in Research and Development (R&D) to create new products and improve the current product line. These market players also put a lot of effort into growing their global distributor networks, which enables businesses to diversify their product offerings.

The market for Medical Devices has fragmented due to the presence of numerous regional and local players. Market players face intense competition from market leaders, especially those with strong brand recognition and extensive distribution networks. Companies have many expansion strategies to stay ahead of the market. These include partnerships and product launches.

Market Key Players

- Medtronic Plc

- Abbott Laboratories Inc

- Johnson & Johnson

- Siemens Healthineers AG

- Becton, Dickinson, and Company

Other Competitors

- Accord Medical Products Private Limited

- 3M Company

- ARKRAY Healthcare Pvt. Ltd

- Baxter International Inc.

- Agappe Diagnostics Ltd

- Braun Medical Inc.

- BioTelemetry Inc.

- Canon Medical Systems Corporation

- Boston Scientific

- Chart Industries

- Danaher Corporation

- Dentsply Sirona

- Covidien Healthcare

- Fisher & Paykel Healthcare

- Hoffmann-La Roche Ltd

- Envista Holdings Corporation

- Fesenius Medical Care

- FUJIFILM Holdings Corporation

- General Electric Company

- Fresenius Medical Care

- Hitachi Group

- Masimo Corporation

- NIPRO Corporation

- ResMed Inc.

- SIEMENS AG

- SCHILLER Healthcare

- Shanghai Runda Medical Technology Co. Ltd.

- Stanley Healthcare

- Getinge Group

- Hamilton Medical AG

- Koninklijke Philips N.V.

- Lepu Medical Technology Company Co. Ltd

- Metran Co. Ltd

- Nihon Kohden Corporation

- Novartis

- Teleflex Medical

- Themis Bioscience

- Olympus Corporation

- PHILIPS HEALTHCARE

- Roche

- Terumo Corporation

- Shandong WeiGao Group Medical Polymer Company Limited

- Shinva Medical Instrument Company Limited

- Smiths Medical

- Jude

- Stryker Corporation

- SunMed

- Yuwell – Jiangsu Yuyue Medical Equipment & Supply Co. Ltd Yuyue Medical Equipment & Supply Co. Ltd

Recent Development

To strengthen their market position, market leaders depend on partnerships, acquisitions, new product development, and launch.

- Abbott’s recall for its imaging catheter was granted a Class 1 label by FDA in May 2022 due to vascular injury risks. Verily will begin clinical trials for Parkinson’s disease using Verily’s smartwatch on May 20, 2022.

- Johnson & Johnson launched VELYS digital surgery on August 20, 2021. The robot-assisted solution for total knee arthroplasty is now available in the United States.

- Smith & Nephew partnered with Movemedical in January 2021 to expand its inventory automation capabilities and improve customer experience.

- In March 2022, Sylvee was launched by Respira Labs. The AI-powered wearable monitor of the lungs uses acoustic radiation technology to assess lung function and detect changes in lung volume. It can aid in treating and detecting COPD, asthma, and COVID-19.

- In January 2021, in partnership with CapsoVision Inc., PENTAX Medical increased the availability of and licensed the CapsoCam Plus camera-capsule system. Remote administration of the CapsoCam Plus capsule endoscope can now be done via this product expansion. It is available to eligible patients during the COVID-19 pandemic.

Report Scope

Report Features Description Market Value (2022) USD 492 Billion Forecast Revenue (2032) USD 656 Billion CAGR (2023-2032) 3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Product- Monitoring Devices, Cardiac Monitoring Devices, Neuromonitoring Devices, Respiratory Monitoring Device, Multi-Parameter Monitoring Devices, Hemodynamic Monitoring Devices, Fetal and Neonatal Monitoring Devices, Temperature Monitoring Devices, Weight Monitoring Devices, Diagnostic Devices, Surgical ENT Devices, Endoscopes, Imaging Devices, Diagnostic Molecular Devices, Drug Delivery Devices, Surgical Devices, Bio Implants and Stimulation Devices, Treatment Equipment, Infusion Pumps, Medical lasers and LASIK surgical machines, Others; Based on End-User- Hospitals & Clinics, Diagnostic Centers, Research laboratory, Pharmaceutical companies (Shopping Plazas, Military, Corporate Sectors, Hostels) Regional Analysis North America – The US, Canada, Mexico; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Eastern Europe – Russia, Poland, The Czech Republic, Greece Rest of Eastern Europe; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA. Competitive Landscape Medtronic Plc, Abbott Laboratories Inc, Johnson & Johnson, Siemens Healthineers AG, Becton, Dickinson, and Company, Other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How much is the Global Medical Devices Market worth?Global market size is Expected to Reach USD 663 Mn by 2032.

What was the Market Segmentation of the Medical Devices Market?Based on Product- Monitoring Devices, Cardiac Monitoring Devices, Neuromonitoring Devices, Respiratory Monitoring Device, Multi-Parameter Monitoring Devices, Hemodynamic Monitoring Devices, Fetal and Neonatal Monitoring Devices, Temperature Monitoring Devices, Weight Monitoring Devices, Diagnostic Devices, Surgical ENT Devices, Endoscopes, Imaging Devices, Diagnostic Molecular Devices, Drug Delivery Devices, Surgical Devices, Bio Implants and Stimulation Devices, Treatment Equipment, Infusion Pumps, Medical lasers and LASIK surgical machines, Others; Based on End-User- Hospitals & Clinics, Diagnostic Centers, Research laboratory, Pharmaceutical companies (Shopping Plazas, Military, Corporate Sectors, Hostels)

Who are the major players operating in the Medical Devices Market?Medtronic Plc, Abbott Laboratories Inc, Johnson & Johnson, Siemens Healthineers AG, Becton, Dickinson, and Company, Other key players.

Which region will lead the global Medical Devices Market?North America is estimated to be the fastest-growing region during the forthcoming years.

-

-

- Medtronic Plc

- Abbott Laboratories Inc

- Johnson & Johnson

- Siemens Healthineers AG

- Becton, Dickinson, and Company

- Accord Medical Products Private Limited

- 3M Company

- ARKRAY Healthcare Pvt. Ltd

- Baxter International Inc.

- Agappe Diagnostics Ltd

- Braun Medical Inc.

- BioTelemetry Inc.

- Canon Medical Systems Corporation

- Boston Scientific

- Chart Industries

- Danaher Corporation

- Dentsply Sirona

- Covidien Healthcare

- Fisher & Paykel Healthcare

- Hoffmann-La Roche Ltd

- Envista Holdings Corporation

- Fesenius Medical Care

- FUJIFILM Holdings Corporation

- General Electric Company

- Fresenius Medical Care

- Hitachi Group

- Masimo Corporation

- NIPRO Corporation

- ResMed Inc.

- SIEMENS AG

- SCHILLER Healthcare

- Shanghai Runda Medical Technology Co. Ltd.

- Stanley Healthcare

- Getinge Group

- Hamilton Medical AG

- Koninklijke Philips N.V.

- Lepu Medical Technology Company Co. Ltd

- Metran Co. Ltd

- Nihon Kohden Corporation

- Novartis

- Teleflex Medical

- Themis Bioscience

- Olympus Corporation

- PHILIPS HEALTHCARE

- Roche

- Terumo Corporation

- Shandong WeiGao Group Medical Polymer Company Limited

- Shinva Medical Instrument Company Limited

- Smiths Medical

- Jude

- Stryker Corporation

- SunMed

- Yuwell – Jiangsu Yuyue Medical Equipment & Supply Co. LtdYuyue Medical Equipment & Supply Co. Ltd