Global Mechanical Watch Market Size, Share, Growth Analysis By Price (Entry-Level (Under USD 500), Mid-Tier (USD 500 - USD 3,000), Luxury (USD 3,000 - USD 20,000), Ultra-Luxury (Over USD 20,000)), By End User (Men, Women), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167104

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

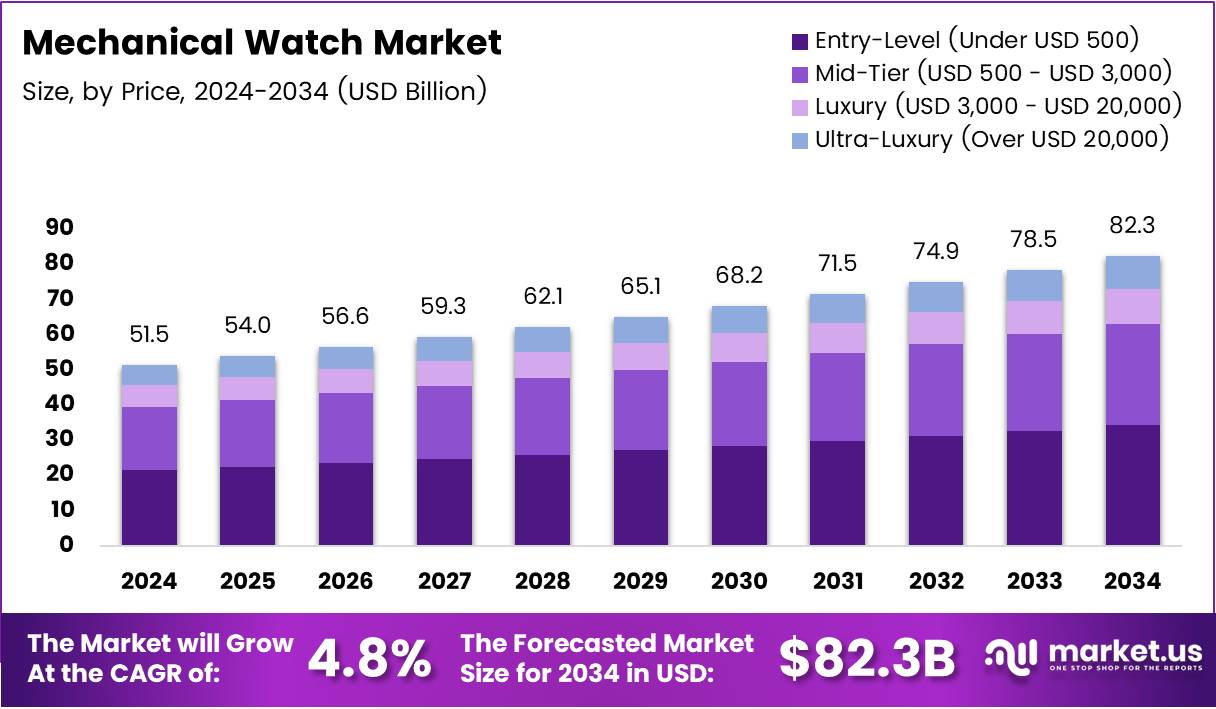

The Global Mechanical Watch Market size is expected to be worth around USD 82.3 Billion by 2034, from USD 51.5 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

The mechanical watch market represents a niche yet enduring segment within the global luxury timepiece industry. These watches, powered by intricate gear systems instead of batteries, symbolize craftsmanship, tradition, and prestige. As consumer preferences shift toward sustainable and long-lasting products, mechanical watches continue to command attention in premium and collector markets.

Driven by rising disposable incomes and growing appreciation for artisanal products, the market shows steady momentum. Collectors and professionals increasingly view mechanical watches as valuable investments. Moreover, emerging economies are witnessing expanding middle-class segments that associate mechanical timepieces with success and sophistication, further fueling consistent demand worldwide.

Governments in luxury-producing nations are promoting exports and supporting local craftsmanship through trade incentives and educational programs. Such initiatives help preserve heritage while stimulating innovation in precision engineering. Additionally, sustainability-focused policies are encouraging manufacturers to adopt environmentally conscious materials and production techniques, strengthening long-term market stability.

Furthermore, digital transformation is reshaping the purchasing experience, as e-commerce platforms and virtual boutiques expand global accessibility. Brands are leveraging storytelling and limited-edition releases to attract new audiences. Meanwhile, rising interest in mechanical restoration and aftersales services opens ancillary business opportunities across international markets.

According to research from the Federation of the Swiss Watch Industry (FH), in the first half of 2025, mechanical watches generated 86% of export turnover, showing a value change of +0.1% compared with 2024. Similarly, Swiss watch exports reached CHF 26.7 billion in 2023, marking a 7.6% rise versus 2022, with wristwatches alone accounting for CHF 25.5 billion and 16.9 million units (+7.2%). Additionally, between 2021–2022, mechanical watches increased 12%, indicating a robust investment appeal for long-term portfolio diversification.

Key Takeaways

- The global mechanical watch market is projected to reach USD 82.3 Billion by 2034, growing from USD 51.5 Billion in 2024 at a 4.8% CAGR.

- Entry-Level watches priced under USD 500 lead the market with a 44.9% share in 2024.

- Men account for the largest end-user segment with a 78.2% market share.

- Offline distribution dominates mechanical watch sales with a 67.1% share.

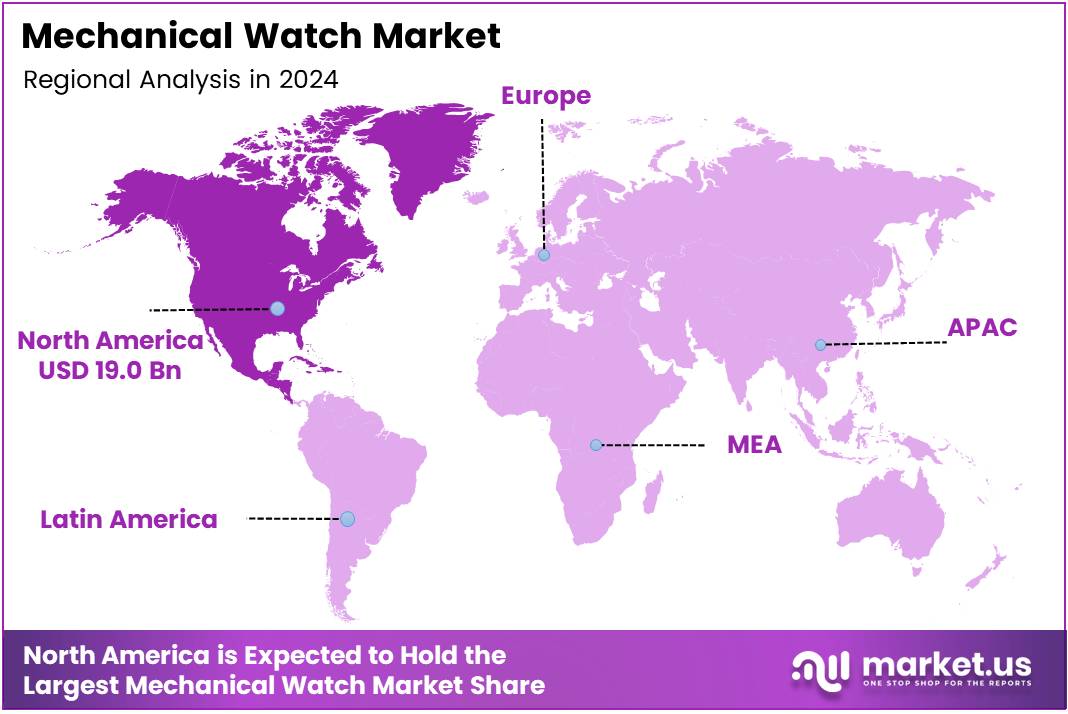

- North America holds the largest regional share at 36.9%, valued at USD 19.0 Billion.

By Price Analysis

Entry-Level (Under USD 500) dominates with 44.9% due to strong affordability and mass-market appeal.

In 2024, Entry-Level (Under USD 500) held a dominant market position in the By Price Analysis segment of Mechanical Watch Market, with a 44.9% share. This segment thrives on accessibility, attracting first-time buyers and casual enthusiasts. Its affordability encourages wider adoption and sustains steady global demand.

The Mid-Tier (USD 500 – USD 3,000) segment continues to grow as buyers transition toward higher craftsmanship. This tier appeals to users seeking premium features without entering luxury pricing. Brands leverage heritage, durability, and design improvements to convert value-driven consumers moving beyond introductory models.

The Luxury (USD 3,000 – USD 20,000) segment benefits from prestige and superior engineering. Consumers in this category prioritize brand reputation, mechanical expertise, and long-term value. As enthusiasts seek intricate movements and artisanal finishing, luxury watches maintain strong desirability across global collector communities.

The Ultra-Luxury (Over USD 20,000) segment progresses by targeting elite buyers. Limited editions, bespoke craftsmanship, and rare materials elevate exclusivity. With high-net-worth individuals fueling demand, this segment thrives through personalization and rarity-driven purchasing behaviors.

By End User Analysis

Men dominate with 78.2% due to strong preference for mechanical craftsmanship and collectible value.

In 2024, Men held a dominant market position in the By End User Analysis segment of Mechanical Watch Market, with a 78.2% share. Mechanical watches remain a preferred accessory for men, symbolizing status, engineering appreciation, and personal style. Collectability further strengthens sustained male-driven demand.

The Women segment continues expanding steadily as brands introduce elegant designs and smaller case sizes. Increasing interest in premium accessories and refined aesthetics encourages women buyers to explore mechanical options. Enhanced marketing toward female consumers supports the segments gradual market penetration.

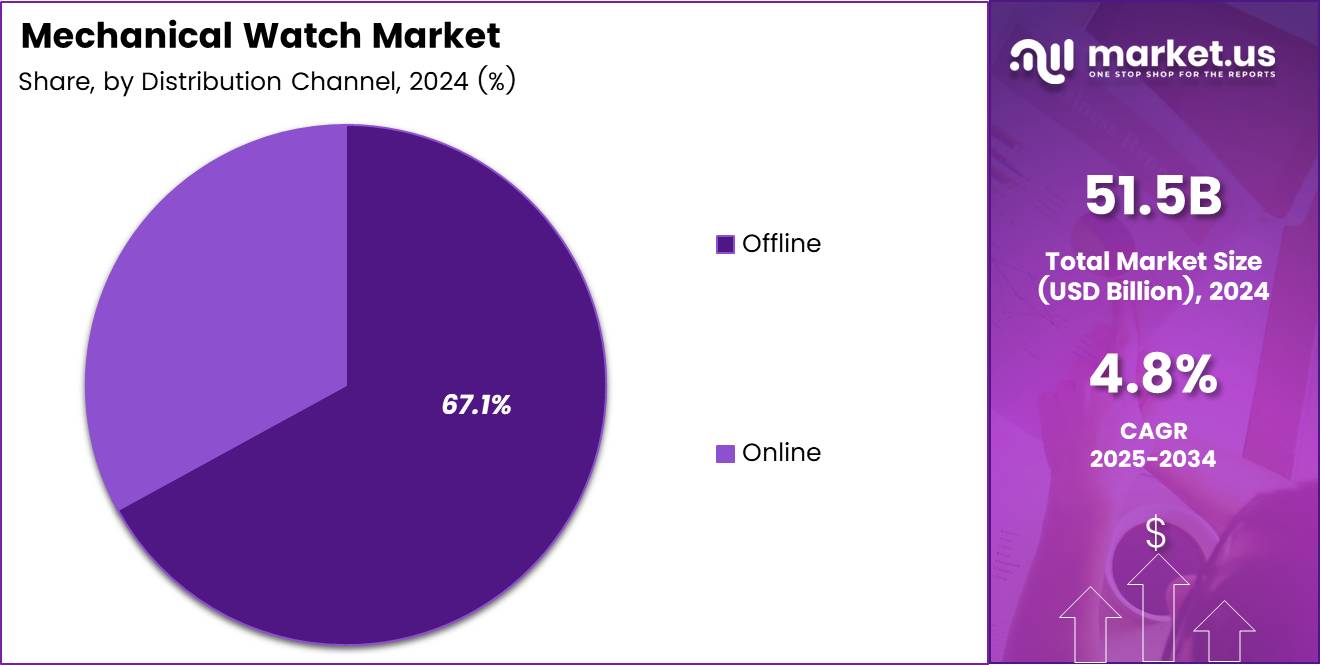

By Distribution Channel Analysis

Offline dominates with 67.1% due to trust-driven purchases and experiential retail environments.

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of Mechanical Watch Market, with a 67.1% share. Consumers prefer in-store experiences for high-value mechanical watches, relying on physical inspection, expert guidance, and brand-certified retailers.

The Online segment grows rapidly as digital platforms offer convenience and broader model availability. Improved authentication processes and virtual showcases attract younger buyers who prioritize ease of comparison. E-commerce expansion continues supporting rising digital adoption in mechanical watch retailing.

Key Market Segments

By Price

- Entry-Level (Under USD 500)

- Mid-Tier (USD 500 – USD 3,000)

- Luxury (USD 3,000 – USD 20,000)

- Ultra-Luxury (Over USD 20,000)

By End User

- Men

- Women

By Distribution Channel

- Offline

- Online

Drivers

Growing Demand for Hand-Crafted and Limited-Edition Mechanical Models Drives Market Growth

The mechanical watch market is expanding as more wealthy consumers around the world look for luxury timepieces. This rising affluent group values exclusivity, making mechanical watches an attractive choice due to their craftsmanship and heritage appeal. As incomes grow, buyers are increasingly willing to invest in premium watches that reflect status and personal taste.

Premium watch brands are also strengthening their heritage marketing. By highlighting their long histories, traditional skills, and iconic designs, these companies attract consumers who appreciate authenticity. This strategy builds trust and reinforces the emotional value of mechanical watches in a competitive luxury market.

Hand-crafted and limited-edition models remain major growth drivers. These pieces appeal to collectors and enthusiasts who seek unique designs made by skilled artisans. Their exclusivity helps brands maintain high price points and strong demand.

In addition, specialized retail boutiques and immersive showrooms are expanding globally. These locations provide customers with personalized, high-end shopping experiences. By allowing consumers to explore craftsmanship up close, brands create deeper engagement and encourage premium purchases.

Restraints

High Production Costs Due to Skilled Labor and Intricate Craftsmanship Limit Market Expansion

Mechanical watches require expert craftsmanship, which significantly increases production costs. Skilled watchmakers spend many hours assembling intricate components, making the manufacturing process both slow and expensive. These high costs limit the ability of brands to scale production and often result in higher retail prices.

Another key restraint is strong competition from smartwatches. Smartwatches offer advanced features at lower price points, attracting younger and tech-focused consumers. This shift reduces the mass-market appeal of traditional mechanical watches, especially among buyers who prioritize functionality over craftsmanship.

While luxury buyers still value mechanical watches, the broader consumer base is increasingly choosing digital alternatives that offer fitness tracking, notifications, and connectivity. This trend places pressure on traditional watchmakers to refine their value proposition.

Mechanical watch brands also face challenges in communicating their relevance in a technology-driven world. Without continuous innovation in design and marketing, they risk losing visibility among mainstream consumers.

Growth Factors

Penetration Into Emerging Luxury Markets in Asia and the Middle East Creates Major Expansion Opportunities

Emerging luxury markets in Asia and the Middle East offer strong growth potential for mechanical watch brands. Rising incomes and growing interest in premium lifestyle products are driving demand in these regions. Consumers are increasingly drawn to luxury watches as symbols of success and cultural status.

Sustainable sourcing and eco-friendly materials present another important opportunity. As global buyers become more environmentally conscious, brands that promote ethical manufacturing can appeal to a new segment of responsible luxury consumers. This shift can also enhance brand reputation and long-term loyalty.

Customization and bespoke services are becoming attractive to collectors who want unique pieces. Personalized dials, engravings, and tailored designs allow buyers to create one-of-a-kind watches, strengthening emotional connection and increasing willingness to pay higher prices.

Certified pre-owned programs are also growing rapidly. These programs allow consumers to purchase authenticated mechanical watches at more accessible price points. By promoting trust and transparency, brands can tap into a wider audience and encourage repeat purchases.

Emerging Trends

Revival of Vintage-Inspired Mechanical Watch Designs Shapes Current Market Trends

Vintage-inspired mechanical watches are gaining traction as consumers embrace nostalgic designs. This trend reflects growing appreciation for classic aesthetics, traditional craftsmanship, and timeless styling. Brands are re-introducing heritage models to meet rising demand.

Independent micro-brands are also becoming more popular. These smaller companies focus on creativity and limited-run models, appealing to enthusiasts who want originality and affordability. Their strong online presence enables them to reach global audiences quickly.

Collector culture is expanding, fueled by active online watch communities. Social media platforms, forums, and digital marketplaces encourage discussions, sharing, and trading, further boosting interest in mechanical watches. This community-driven enthusiasm contributes to the market’s long-term resilience.

Blockchain technology is emerging as a key trend for authentication. By tracking ownership history and verifying originality, blockchain helps prevent counterfeiting and enhances buyer confidence. This technology adds modern value to a traditional product category.

Regional Analysis

North America Dominates the Mechanical Watch Market with a Market Share of 36.9%, Valued at USD 19.0 Billion

North America stands as the leading region in the global mechanical watch market, holding a substantial 36.9% share and generating revenues of USD 19.0 Billion. The region’s dominance is driven by strong consumer preference for luxury timepieces, robust spending power, and a mature market for premium lifestyle products. Additionally, a well-established retail network and rising demand for collector-grade mechanical watches continue to support sustained growth.

Europe Mechanical Watch Market Trends

Europe represents a significant market for mechanical watches, supported by rich horological heritage and a strong culture of craftsmanship appreciation. Consumers in the region show a preference for traditional watchmaking and precision engineering, which sustains stable demand. The market benefits from high adoption among luxury buyers and lifestyle-focused consumers, contributing to consistent regional growth.

Asia Pacific Mechanical Watch Market Trends

Asia Pacific is one of the fastest-growing regions, driven by rising disposable incomes and increasing interest in premium and collectible watches. Expanding urbanization and a growing affluent population further stimulate market adoption. Moreover, cultural emphasis on luxury goods and rising brand consciousness enhance the region’s long-term growth outlook.

Middle East & Africa Mechanical Watch Market Trends

The Middle East & Africa region shows steady demand for mechanical watches, supported by a strong luxury-oriented consumer base in key markets. High purchasing power and preference for premium lifestyle accessories contribute to sustained market potential. Additionally, growing tourism and retail expansion strengthen the visibility and accessibility of mechanical watches.

Latin America Mechanical Watch Market Trends

Latin America exhibits a gradually developing mechanical watch market influenced by rising urbanization and evolving consumer preferences. While price sensitivity remains a factor, aspirational buying behavior and growing interest in premium accessories support market progress. Improved retail infrastructure and expanding e-commerce platforms also facilitate broader product availability across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Mechanical Watch Company Insights

The global mechanical watch market in 2024 continues to be shaped by a combination of heritage craftsmanship, strategic brand positioning, and sustained demand from collectors and high-net-worth consumers. Among the industry leaders, several brands stand out for their influence and ability to define luxury watchmaking trends.

Rolex remains the cornerstone of the market, leveraging its unmatched brand equity and consistent demand-supply discipline. In 2024, the company continues to command strong resale values and maintain long waitlists, reinforcing its status as a symbol of prestige and reliability.

Patek Philippe sustains its influence through ultra-high-end craftsmanship and generational appeal. Its limited production strategy, combined with strong collector loyalty, enables the brand to maintain price stability and enhance long-term value retention across key models.

Audemars Piguet builds on the enduring appeal of the Royal Oak line while expanding into contemporary materials and boutique-only strategies. The brand’s exclusivity and modern marketing approaches continue to attract a younger luxury clientele seeking distinctive mechanical pieces.

Swatch Group plays a dual role by supporting high-end maisons like Breguet and Omega while democratizing mechanical watch ownership through brands such as Tissot. Its vertically integrated manufacturing and multi-brand portfolio allow it to serve a wide spectrum of mechanical watch consumers globally.

Overall, 2024 sees the mechanical watch segment balancing tradition with measured innovation. Demand remains resilient despite macroeconomic uncertainties, driven largely by brand storytelling, craftsmanship, and the rising perception of luxury watches as alternative investment assets.

Top Key Players in the Market

- Rolex

- Patek Philippe

- Audemars Piguet

- Swatch Group

- LVMH

- Richemont

- Seiko Group

- Citizen Watch Co.

- Casio

- Fossil Group

Recent Developments

- In August 2024: Chanel acquired a 25% stake in independent Swiss watchmaker MB&F, a move that secures long-term financial stability for MB&F while strategically strengthening Chanel’s footprint in the ultra-luxury horology segment.

- In June 2025: LVMH expanded its Watches Division with the acquisition of L’Epée 1839, reinforcing its commitment to high-craftsmanship mechanical timepieces and adding a prestigious Swiss manufacturer to its portfolio.

- In July 2025: Indian homegrown brand Argos Watches raised Rs 6.5 crore in an angel round, positioning itself to aggressively scale operations and aiming to double its revenue in the current fiscal year.

Report Scope

Report Features Description Market Value (2024) USD 51.5 Billion Forecast Revenue (2034) USD 82.3 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Price (Entry-Level (Under USD 500), Mid-Tier (USD 500 – USD 3,000), Luxury (USD 3,000 – USD 20,000), Ultra-Luxury (Over USD 20,000)), By End User (Men, Women), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Rolex, Patek Philippe, Audemars Piguet, Swatch Group, LVMH, Richemont, Seiko Group, Citizen Watch Co., Casio, Fossil Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Rolex

- Patek Philippe

- Audemars Piguet

- Swatch Group

- LVMH

- Richemont

- Seiko Group

- Citizen Watch Co.

- Casio

- Fossil Group