Global Mealworms Market Size, Share Analysis Report By Product Type (Whole Mealworms, Mealworm Powder, Mealworm Oil), By Application (Animal Feed, Pet Food, Agriculture, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153554

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

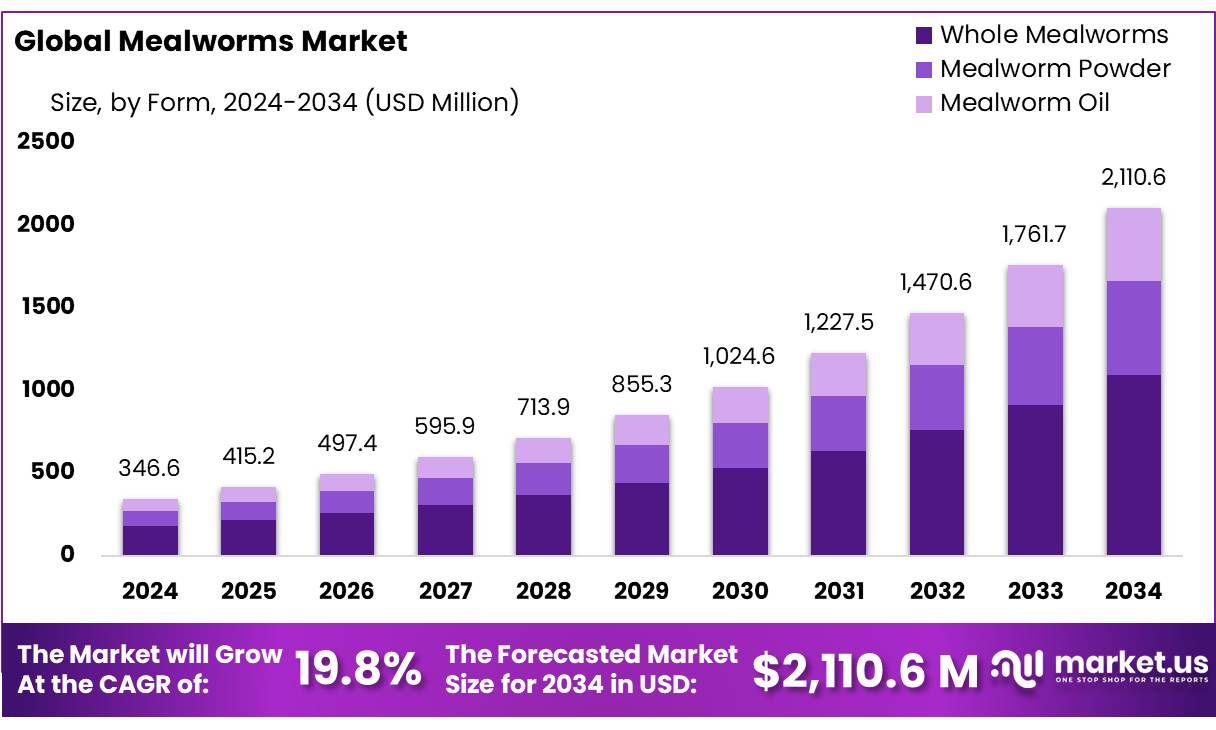

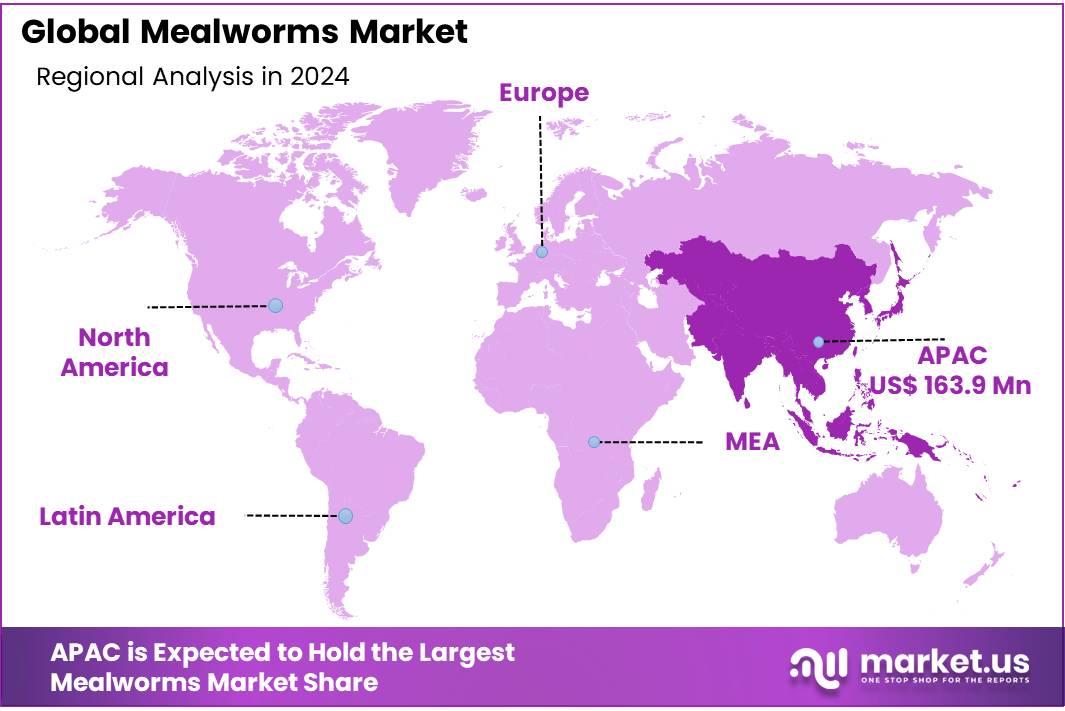

The Global Mealworms Market size is expected to be worth around USD 2110.6 Million by 2034, from USD 346.6 Million in 2024, growing at a CAGR of 19.8% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 47.3% share, holding USD 163.9 Million revenue.

Mealworms (the larvae of Tenebrio molitor) are increasingly processed into concentrates—powders and protein extracts—offering a high-value, sustainable ingredient for food and feed industries. They provide approximately 14–25g of protein per 100g of raw larvae, along with essential micronutrients such as potassium, iron, zinc, and oleic acids. The European Food Safety Authority (EFSA) and EU Novel Food Regulation have officially recognized mealworm larvae and their derivatives as safe for human consumption, permitting use in food products since June 2021 and January 2025.

The mealworm concentrates is evolving rapidly, driven by advancements in farming technologies and growing consumer demand for sustainable food sources. In the United States, the National Science Foundation (NSF) awarded a $2.2 million grant to establish the Center for Environmental Sustainability Through Insect Farming. This initiative aims to explore the use of insects, including mealworms, as food and feed in agriculture, addressing global food shortages and promoting sustainable practices.

Several driving factors contribute to the expansion of the mealworm concentrate industry. The global shift towards sustainable food systems, coupled with the need to reduce greenhouse gas emissions from traditional agriculture, has accelerated interest in insect-based proteins. Government initiatives play a crucial role in this transition. For example, the European Union has authorized the use of dried Tenebrio molitor larvae as a novel food, facilitating their inclusion in various food products. Similarly, Singapore has approved 16 insect species, including mealworms, for human consumption, reflecting a progressive regulatory approach.

Mealworm farming offers several advantages over traditional livestock production. For instance, producing one kilogram of fresh mealworms results in a Global Warming Potential (GWP) of 2.7 kg CO2-equivalent, with significant contributions from feed grain production and energy use. In contrast, the production of one kilogram of edible protein from mealworms has a GWP of 14 kg CO2-equivalent, highlighting the efficiency of mealworms in converting feed into protein. Additionally, mealworm farming requires less land and water compared to conventional livestock, making it a more resource-efficient option.

Government initiatives are also supporting the growth of the mealworm industry. In the United States, the National Science Foundation awarded a $2.2 million grant to establish the Center for Environmental Sustainability Through Insect Farming. This center aims to explore the use of insects, including mealworms, as food and feed to address global food shortages and promote sustainability.

Key Takeaways

- Mealworms Market size is expected to be worth around USD 2110.6 Million by 2034, from USD 346.6 Million in 2024, growing at a CAGR of 19.8%.

- Whole Mealworms held a dominant market position, capturing more than a 51.8% share of the global mealworms market.

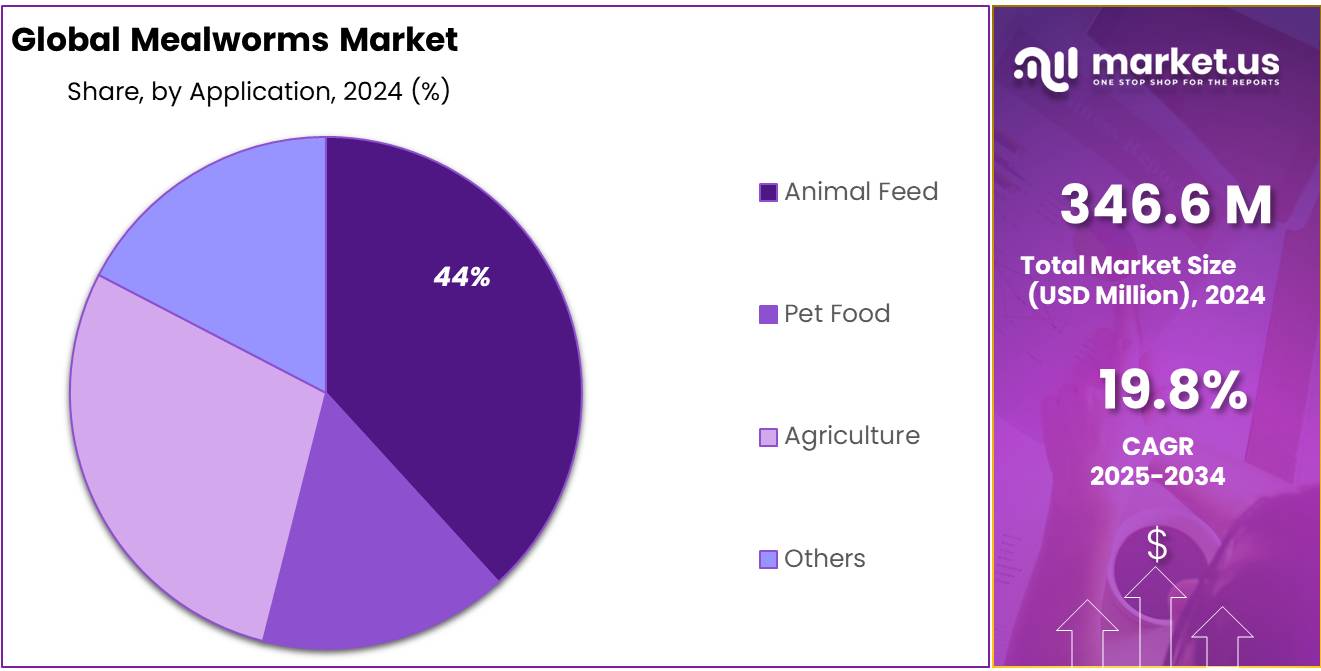

- Animal Feed held a dominant market position, capturing more than a 44.1% share of the global mealworms market.

- Asia-Pacific (APAC) region leads the global mealworms market, commanding a substantial 47.3% share, equating to approximately USD 163.9 million.

By Product Type Analysis

Whole Mealworms dominate with 51.8% share in 2024 due to rising demand for natural protein sources

In 2024, Whole Mealworms held a dominant market position, capturing more than a 51.8% share of the global mealworms market by product type. This strong market presence can be attributed to their ease of use, high protein content, and wide acceptance in both pet feed and animal nutrition sectors. Whole mealworms are often preferred by pet owners and small-scale farmers due to their unprocessed, natural form and minimal preparation requirements.

They are rich in protein, essential amino acids, and healthy fats, making them a nutritious option for birds, reptiles, poultry, and aquaculture. In addition, the growing awareness around sustainable feeding practices has encouraged more use of whole insects in animal diets. Their shelf stability and cost-effectiveness further support their leading market position. As demand for eco-friendly, high-protein feed ingredients continues to grow, whole mealworms are expected to maintain their popularity through 2025.

By Application Analysis

Animal Feed leads with 44.1% share in 2024 driven by protein-rich and sustainable nutrition needs

In 2024, Animal Feed held a dominant market position, capturing more than a 44.1% share of the global mealworms market by application. This leadership is largely due to the high protein and nutrient density of mealworms, which makes them a valuable alternative to traditional feed sources such as fishmeal and soybean meal. Mealworms offer essential amino acids, vitamins, and healthy fats that support growth and health in poultry, aquaculture, and pet animals.

Their natural digestibility and minimal allergenic properties also make them suitable for sensitive animal diets. As sustainability concerns grow, farmers and feed manufacturers are increasingly turning to insect-based proteins like mealworms to reduce the environmental impact of feed production. Additionally, favorable regulations in regions such as Europe and North America supporting the use of insect protein in animal feed are helping to expand this segment. The strong demand for efficient and eco-friendly protein sources is expected to keep the animal feed segment at the forefront through 2025.

Key Market Segments

By Product Type

- Whole Mealworms

- Mealworm Powder

- Mealworm Oil

By Application

- Animal Feed

- Pet Food

- Agriculture

- Others

Emerging Trends

Latest Trends in the Mealworm Industry: Sustainable Protein Source

The mealworm industry is seeing growing interest due to its potential as a sustainable and eco-friendly protein source. Mealworms are emerging as a valuable ingredient in animal feed, especially in the aquaculture and poultry industries, where protein demands are high.

- According to a report by the Food and Agriculture Organization (FAO), the global demand for protein sources in animal feed is projected to increase by 30% by 2030. Mealworms, being rich in protein and essential amino acids, provide an alternative to conventional feed ingredients like soy and fishmeal, which are often linked to deforestation and overfishing.

In addition to animal feed, there is increasing interest in mealworms as a human food source. The FAO has recognized the importance of edible insects as a viable solution to global food security challenges. Mealworms are high in protein (up to 50% of their dry weight), healthy fats, and fiber, making them a nutritious alternative for human consumption. The European Union has approved mealworms for human consumption in 2021, creating new opportunities for the industry to expand into human food products. Several food companies have already begun experimenting with mealworm-based snacks and protein powders, responding to the rising demand for sustainable food sources.

- According to a study by Wageningen University, mealworm production uses 99% less land and 96% less water than beef production. These environmental benefits align with global sustainability goals, and governments around the world are beginning to invest in insect farming to reduce carbon footprints and increase food security.

Drivers

Sustainability and Environmental Benefits Driving the Mealworm Industry

The growing concern over sustainability in the food industry is one of the key driving factors for the rise of mealworms as a viable alternative protein source. Mealworms, as a sustainable protein, are considered a solution to the global challenges of food security and environmental degradation.

- According to the Food and Agriculture Organization (FAO), the livestock sector accounts for 14.5% of global greenhouse gas emissions, a figure expected to rise without a shift to more sustainable protein sources. As the demand for more eco-friendly food solutions increases, mealworms, which require less land, water, and feed compared to traditional livestock, are gaining attention.

Mealworms can be produced with significantly fewer resources than conventional animal protein sources. They require only 2 kg of feed to produce 1 kg of body weight, compared to 8 kg of feed needed for cattle. The environmental impact of mealworm farming is also much lower—producing fewer greenhouse gases and requiring much less water than beef or poultry production. According to the European Commission, mealworms require 1/10th the water consumption of cattle, making them a highly resource-efficient option.

In addition, several government initiatives are driving the mealworm industry forward. The European Union’s Farm to Fork Strategy, aimed at making food systems fair, healthy, and environmentally-friendly, has recognized insect-based protein as a sustainable alternative. In 2021, the EU authorized the use of dried yellow mealworms as food for humans, marking a significant step towards mainstream acceptance. These policies and environmental benefits align with the growing consumer preference for sustainable food options, further fueling the mealworm market’s growth.

Restraints

Regulatory Challenges and Consumer Acceptance as a Restraining Factor for Mealworms

One major restraining factor for the mealworm industry is the regulatory challenges and consumer acceptance of insect-based food. While the environmental benefits of mealworms are widely recognized, the shift towards incorporating them into mainstream diets faces significant hurdles, particularly due to regulatory concerns and a lack of consumer trust.

In many countries, regulations surrounding the use of insects in food products are still evolving. For instance, while the European Union has approved mealworms for human consumption, many countries have yet to establish clear regulations for insect-based food products, creating a barrier for broader adoption.

Insects as food are still met with resistance in many cultures due to their unfamiliarity as a dietary source. The United Nations’ FAO has highlighted that while edible insects offer numerous nutritional benefits, consumer reluctance remains a significant barrier. Research by the FAO in 2013 revealed that a large portion of consumers in Western countries are unwilling to accept insects as food, citing disgust and cultural biases as major reasons. As mealworm farming expands, overcoming this cultural resistance will require a concerted effort in education and marketing to highlight the nutritional benefits and sustainability of insect protein.

Moreover, there are concerns over the safety of mealworms as a food product. Although mealworms have been approved in the EU, food safety regulations regarding insect farming standards—such as contamination, pesticide use, and quality control—are still being developed. Ensuring consistent safety standards across the industry will be crucial for gaining wider consumer and regulatory acceptance.

Opportunity

Increasing Demand for Sustainable Protein Driving Mealworm Growth

One major growth opportunity for the mealworm industry is the rising global demand for sustainable protein sources. As the world faces challenges like population growth and environmental degradation, the need for alternative proteins that require fewer resources and produce less environmental impact has never been more urgent.

Mealworms, with their high efficiency in converting feed into edible protein, present an ideal solution to this problem. The Food and Agriculture Organization (FAO) has projected that global food demand will increase by 70% by 2050, making it necessary to find alternative protein sources that do not rely on traditional animal agriculture.

Mealworms require far fewer resources than traditional livestock—only 2 kg of feed to produce 1 kg of body weight compared to 8 kg of feed for cattle. They also emit significantly fewer greenhouse gases and consume far less water. The European Commission’s Farm to Fork Strategy, aimed at reducing the environmental footprint of the food system, is a key driver behind this shift. In fact, the EU’s efforts to reduce greenhouse gas emissions have spurred interest in insect protein, with mealworms now officially approved for human consumption in several countries within the EU.

Moreover, with growing awareness around sustainability and the environmental impact of traditional animal protein production, there is an increasing consumer demand for eco-friendly food options. According to the World Economic Forum, over 60% of global consumers are willing to pay a premium for sustainable food products. As a result, companies that embrace mealworms as a protein source stand to gain a competitive edge in the growing market for plant-based and alternative proteins. This shift is further supported by government policies and initiatives in various countries that are actively promoting the development of sustainable food sources.

Regional Insights

The Asia-Pacific (APAC) region leads the global mealworms market, commanding a substantial 47.3% share, equating to approximately USD 163.9 million. This dominance is attributed to several factors, including the region’s deep-rooted entomophagy traditions, rapid urbanization, and increasing consumer awareness of sustainable protein sources.

Countries like China, Thailand, and Vietnam are at the forefront of mealworm production, leveraging their agricultural expertise and favorable climatic conditions. In China, for instance, advancements in insect farming technologies have bolstered production capacities, making it a significant player in the market. Thailand and Vietnam are also expanding their mealworm farming operations, focusing on both domestic consumption and export opportunities.

The demand for mealworms in APAC is primarily driven by the growing need for alternative protein sources in animal feed and human consumption. With the region’s large livestock and aquaculture industries, mealworms offer a sustainable solution to the challenges posed by traditional feed ingredients. Additionally, the increasing popularity of plant-based diets among consumers has spurred interest in insect-based protein products.

Government initiatives in several APAC countries are further propelling market growth. For example, Thailand’s Department of Livestock Development has been promoting insect farming as a means to enhance food security and reduce environmental impact. Similarly, China’s support for insect protein research and development underscores the strategic importance of this sector.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ynsect is a global leader in the insect protein industry, specializing in the production of mealworms and other insects for use in animal feed, pet food, and fertilizers. Based in France, Ynsect has developed innovative insect farming technologies that focus on sustainability and reducing environmental impacts. The company’s mealworm-based products have gained traction across various industries due to their high nutritional value and eco-friendly nature, positioning Ynsect as a key player in the global market.

Exo Terra is a leading brand in the pet care industry, known for offering high-quality mealworm-based products for reptiles and amphibians. The company is dedicated to providing nutritious and sustainable food options for pet owners, with mealworms being one of its flagship products. Exo Terra’s mealworms are rich in protein and essential nutrients, making them an ideal food source for various pet species. The company’s commitment to quality and sustainability has made it a prominent player in the market.

Protix is a global leader in insect-based protein production, focusing on using mealworms to create sustainable and nutritious ingredients for animal feed and pet food. Headquartered in the Netherlands, Protix has built a state-of-the-art insect farming facility to produce high-quality proteins with minimal environmental impact. The company’s innovative farming techniques and dedication to sustainability have positioned it as one of the leading players in the insect protein industry.

Top Key Players Outlook

- Ynsect

- All Things Bugs

- Aspire Food Group

- Exo Terra

- Protix

- Tiny Farms

- Hargol Food Tech

- Entomo Farms

- Better Origin

- The Bug Farm

Recent Industry Developments

In 2024, Protix secured a €37 million ($40.3 million) loan from the European Investment Bank to support its expansion into international markets, including a new production plant in Poland.

In 2024, Aspire achieved approximately 50–60% of this capacity, aiming for full-scale operations in the first half of 2025.

Report Scope

Report Features Description Market Value (2024) USD 346.6 Mn Forecast Revenue (2034) USD 2110.6 Mn CAGR (2025-2034) 19.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Whole Mealworms, Mealworm Powder, Mealworm Oil), By Application (Animal Feed, Pet Food, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ynsect, All Things Bugs, Aspire Food Group, Exo Terra, Protix, Tiny Farms, Hargol Food Tech, Entomo Farms, Better Origin, The Bug Farm Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ynsect

- All Things Bugs

- Aspire Food Group

- Exo Terra

- Protix

- Tiny Farms

- Hargol Food Tech

- Entomo Farms

- Better Origin

- The Bug Farm