Global Mass Spectrometers Market By Product (Instruments, Consumables & Services), By Technology (Quadrupole Liquid Chromatography-Mass Spectrometry, Gas Chromatography-Mass Spectrometry (GC-MS), Fourier Transform-Mass Spectrometry (FT-MS), Time-of-Flight Mass Spectrometry (TOFMS), Matrix-Assisted Laser Desorption/Ionization-Time-of-Flight Mass Spectrometry (MALDI-TOF), Magnetic Sector Mass Spectrometry, Others), By Application (Proteomics, Metabolomics, Glycomics, Others), By End-use (Government & Academic Institutions, Pharmaceutical & Biotechnology Companies, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 41476

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

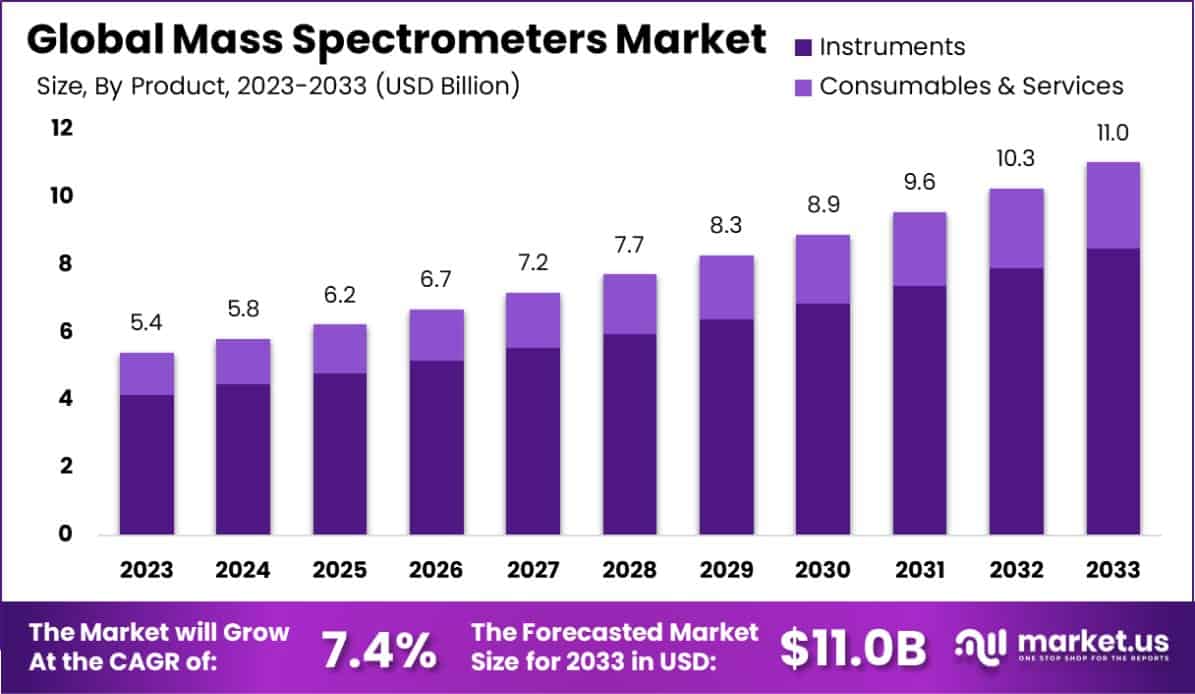

The Global Mass Spectrometers Market is expected to be worth around USD 11.0 billion by 2033, up from USD 5.4 billion in 2023, growing at a CAGR of 7.4% during the forecast period from 2024 to 2033.

Mass spectrometers are analytical devices that measure the mass-to-charge ratio of charged particles to identify and quantify substances within a sample. This technology is pivotal in various scientific applications, including pharmacology, environmental testing, and biochemistry.

The mass spectrometer market is driven by the increasing need for precise analytical techniques in research and development across pharmaceuticals, biotechnology, and environmental sciences. The market’s expansion is further supported by technological advancements in mass spectrometry, which enhance sensitivity and throughput.

The growth of the mass spectrometers market can be attributed to rising investments in pharmaceutical and biotechnological research, coupled with stringent regulatory standards requiring high precision in substance analysis.

Demand for mass spectrometers is bolstered by the growing emphasis on quality control in smart manufacturing environments and the rising prevalence of diseases requiring new therapeutic drugs.

Significant opportunities within the mass spectrometers market arise from the increasing application in clinical diagnostics and personalized medicine, where rapid, accurate results are crucial for effective treatment planning.

The mass spectrometers market is positioned for substantial growth, driven by escalating demands in the realms of pharmaceuticals, biotechnology, and clinical diagnostics. This expansion is underpinned by significant financial commitments to enhance analytical capabilities, as evidenced by recent funding injections into prominent research initiatives and facilities.

For instance, the University of Georgia received an $18 million award from the National Science Foundation to advance glycoscience—a field reliant on precise analytical tools like mass spectrometry.

Additionally, the renaming of the USask Soil Sciences Laboratory to the BMO Soil Analytical Laboratory highlights a strategic $2 million investment in agricultural and environmental research.

Further bolstering this trend, the Jackson Laboratory’s enhancement of mass spectrometry capabilities, supported by a $1.6 million NIH grant, underscores the technology’s critical role in addressing complex diseases.

Moreover, diagnostics firms are also witnessing robust funding, with one such entity securing over $20 million recently, emphasizing the growing investor confidence in technologies that offer precise diagnostic solutions.

These developments not only reflect the broadening applications and increased funding but also signal robust market opportunities and a heightened focus on innovation within the field of mass spectrometry.

Key Takeaways

- The Global Mass Spectrometers Market is expected to be worth around USD 11.0 billion by 2033, up from USD 5.4 billion in 2023, growing at a CAGR of 7.4% during the forecast period from 2024 to 2033.

- In 2023, Instruments held a dominant market position in the By Product segment of the Mass Spectrometers Market, with a 77.1% share.

- In 2023, Quadrupole Liquid Chromatography-Mass Spectrometry held a dominant market position in the By Technology segment of the Mass Spectrometers Market, with a 38.1% share.

- In 2023, Proteomics held a dominant market position in the By Application segment of the Mass Spectrometers Market, with a 47.2% share.

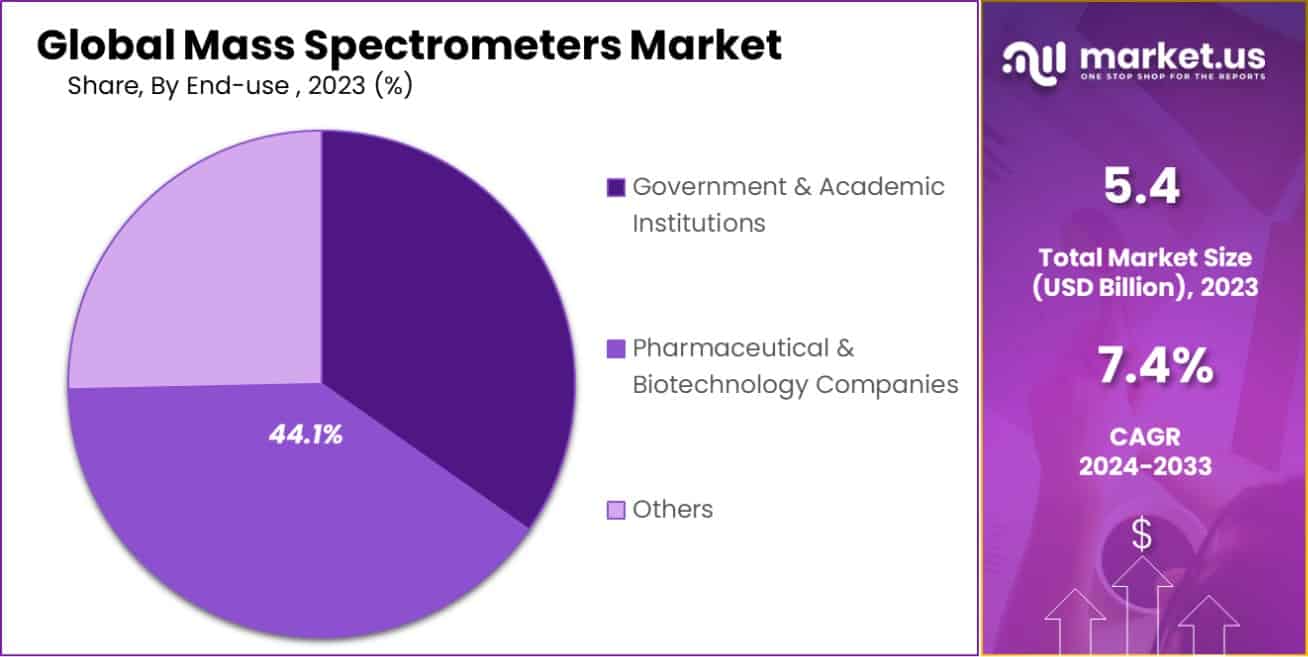

- In 2023, Pharmaceutical & Biotechnology Companies held a dominant market position in the end-use segment of the Mass Spectrometers Market, with a 44.1% share.

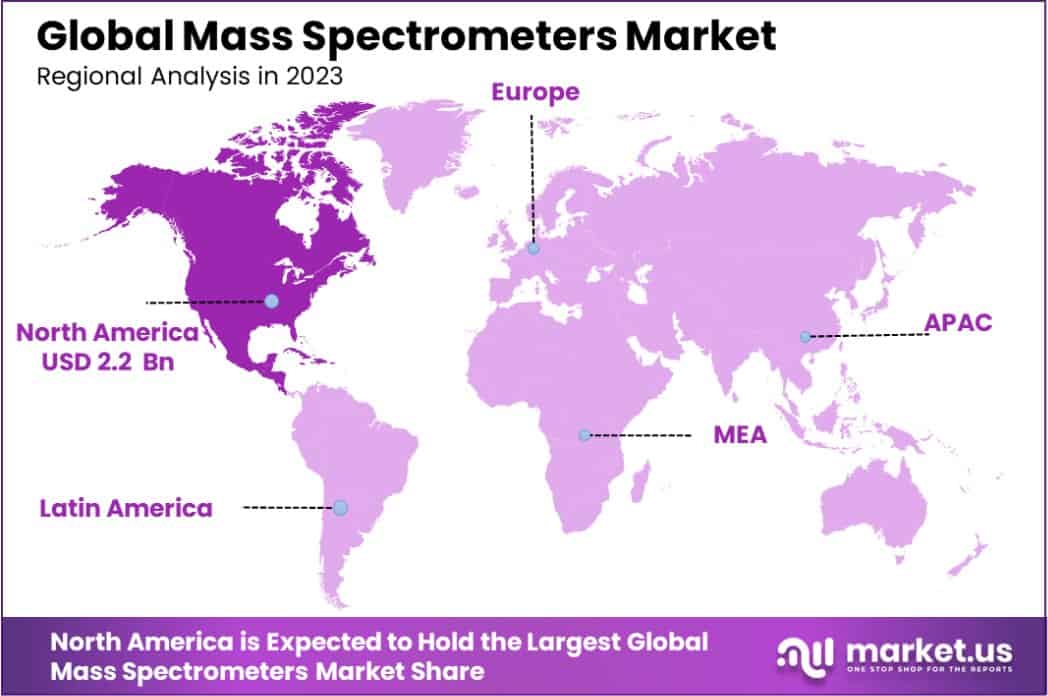

- North America dominated a 42.2% market share in 2023 and held USD 2.2 Billion in revenue from the Mass Spectrometers Market.

By Product Analysis

In 2023, Instruments held a dominant market position in the By Product segment of the Mass Spectrometers Market, commanding a 77.1% share. This prominence is attributed to the critical need for high-precision, technologically advanced instruments in key industries such as pharmaceuticals, biotechnology, and environmental monitoring.

The robust demand for instruments is driven by their essential role in facilitating complex analyses and enhancing operational efficiencies in research and diagnostic applications.

Meanwhile, the Consumables & Services sector accounted for the remaining market share. This segment benefits from the ongoing need for regular replenishments and maintenance services, which are integral to the consistent performance and longevity of mass spectrometers.

The dependency on consumables like calibration compounds, standards, and various reagents, along with professional services for installation, optimization, and repair, sustains a steady revenue stream within this segment.

Overall, the market dynamics reflect a strong inclination towards investing in durable and sophisticated instrumentation, which is expected to maintain its lead due to the escalating requirements for accuracy and detail in scientific assessments.

The consumables and services segment, while smaller, is vital for the sustained operation and precision of the instruments, ensuring holistic growth in the mass spectrometers market.

By Technology Analysis

In 2023, Quadrupole Liquid Chromatography-Mass Spectrometry (LC-MS) held a dominant market position in the By Technology segment of the Mass Spectrometers Market, with a 38.1% share.

This technology’s predominance is driven by its versatility and reliability in providing precise quantitative and qualitative analyses across diverse samples, making it indispensable in pharmaceuticals, life sciences, and environmental testing.

Other key technologies shaping the market landscape include Gas Chromatography-Mass Spectrometry (GC-MS), Fourier Transform-Mass Spectrometry (FT-MS), Time-of-Flight Mass Spectrometry (TOFMS), and Matrix-Assisted Laser Desorption/Ionization-Time-of-Flight Mass Spectrometry (MALDI-TOF).

Each of these technologies caters to specific analytical needs, ranging from complex biomolecular structures to rapid high-throughput screening, thus diversifying the market’s portfolio.

Magnetic Sector Mass Spectrometry and other emerging technologies also contribute to the market, though to a lesser extent. These technologies are often tailored for specialized applications that require high resolution and exact mass measurements, catering to niche markets within geosciences and advanced materials research.

The varied applications and continuous advancements across these technologies underscore a dynamic market environment. LC-MS’s leading share reflects its broad applicability and the ongoing technological integrations that enhance its efficacy and user-friendliness, sustaining its growth and prevalence in the mass spectrometry market landscape.

By Application Analysis

In 2023, Proteomics held a dominant market position in the By Application segment of the Mass Spectrometers Market, with a 47.2% share.

This leadership reflects the critical role of mass spectrometry in proteomic research, which involves the large-scale study of proteins, crucial for understanding disease mechanisms and developing targeted therapies.

The integration of mass spectrometry in proteomics has been pivotal in advancing biomarker discovery and therapeutic development, thereby driving significant demand within this sector.

Other important segments include Metabolomics and Glycomics, which also rely on mass spectrometry for their complex analyses of small molecules and carbohydrates, respectively. These applications are essential in providing insights into metabolic disorders and the role of carbohydrates in biological processes, further emphasizing the versatility of mass spectrometers.

The “Others” category encompasses a range of emerging applications, such as environmental testing, forensic analysis, and chemical material examination, each contributing to the market’s expansion. As mass spectrometry technology continues to evolve, its application in these diverse fields is expected to increase, supporting sustained growth and innovation across the board.

Overall, the dominance of Proteomics in the market is underpinned by the expanding need for protein analysis in the biomedical field, positioning it as a key driver of growth and development in the mass spectrometry market.

By End-use Analysis

In 2023, Pharmaceutical & Biotechnology Companies held a dominant market position in the By End-use segment of the Mass Spectrometers Market, with a 44.1% share. This segment’s prominence is primarily due to the critical role mass spectrometry plays in drug discovery, development, and quality control processes within the pharmaceutical and biotechnology industries.

The technology’s ability to provide detailed molecular insights accelerates the identification of potential drug targets and the validation of biomarkers, making it indispensable for these sectors.

Government & Academic Institutions also form a significant portion of the market, utilizing mass spectrometry for a wide range of scientific studies, from environmental analysis to advanced research in chemistry and biology. These institutions often drive the foundational research that underpins further commercial applications in pharmaceuticals and biotechnology.

The “Others” category, which includes hospitals, clinical laboratories, and food and beverage industries, also relies on mass spectrometry for various analytical purposes. Although a smaller share of the market, the demand in this segment is bolstered by the need for stringent quality control measures and regulatory compliance.

Overall, the extensive adoption of mass spectrometry by pharmaceutical and biotechnology companies underscores its essential role in fostering innovation and ensuring product safety and efficacy, thereby solidifying its market dominance.

Key Market Segments

By Product

- Instruments

- Consumables & Services

By Technology

- Quadrupole Liquid Chromatography-Mass Spectrometry

- Gas Chromatography-Mass Spectrometry (GC-MS)

- Fourier Transform-Mass Spectrometry (FT-MS)

- Time-of-Flight Mass Spectrometry (TOFMS)

- Matrix-Assisted Laser Desorption/Ionization-Time-of-Flight Mass Spectrometry (MALDI-TOF)

- Magnetic Sector Mass Spectrometry

Others

By Application

- Proteomics

- Metabolomics

- Glycomics

- Others

By End-use

- Government & Academic Institutions

- Pharmaceutical & Biotechnology Companies

- Others

Drivers

Key Drivers in the Mass Spectrometry Market

The mass spectrometry market is experiencing robust growth driven primarily by advancements in technology and expanding applications in life sciences and pharmaceuticals. As analytical accuracy and the range of detectable compounds improve, more industries adopt these instruments for quality control, environmental testing, and biomedical research.

The integration of mass spectrometry in these sectors is propelled by the need for precise, rapid testing methods that can handle complex samples. Furthermore, government and regulatory bodies worldwide are enforcing stricter safety standards and monitoring requirements, which in turn fuels demand for sophisticated testing equipment like mass spectrometers.

This market is also supported by ongoing innovations that enhance device throughput and user-friendliness, making these advanced analytical technologies more accessible to a broader range of users.

Restraint

Challenges Limiting Mass Spectrometry Growth

The expansion of the mass spectrometry market is notably hindered by high equipment costs and the complexity of operations. These instruments require significant capital investment, which can deter small laboratories and institutions with limited budgets from adopting this technology.

Additionally, the need for specialized training to operate mass spectrometers and interpret their results adds another layer of challenge, potentially restricting their widespread use. Maintenance costs and the need for frequent calibration also contribute to the overall expense, impacting the market negatively.

This situation is further exacerbated in regions with limited access to technical support and the infrastructure required to support such advanced technologies. These factors collectively act as significant barriers, slowing the adoption rate of mass spectrometry across various potential new markets.

Opportunities

Expanding Opportunities in Mass Spectrometry

The mass spectrometry market presents substantial opportunities, particularly in emerging markets and the biotechnology sector. As global health challenges intensify, there is a rising demand for new drug development and diagnostic methods, where mass spectrometry plays a crucial role due to its precision and reliability.

Emerging markets offer new terrain for growth as healthcare infrastructure improves and investments in research increase. Furthermore, the integration of artificial intelligence and machine learning with mass spectrometry is opening up innovative applications in predictive analytics and personalized medicine.

These technological advancements not only enhance the capabilities of mass spectrometers but also make them more user-friendly, thereby expanding their potential user base. Such developments are expected to drive market expansion and encourage the adoption of mass spectrometry in new scientific and industrial fields.

Challenges

Key Challenges in Mass Spectrometry

The mass spectrometry market faces significant challenges, including regulatory hurdles and the rapid pace of technological change. Navigating complex regulatory environments can delay product launches and increase costs, as compliance with various international standards is mandatory for market entry.

The swift evolution of technology also presents a challenge, as it can render existing instruments outdated quickly, compelling manufacturers to continuously innovate and upgrade. This dynamic can strain resources and complicate long-term planning for both manufacturers and users.

Additionally, the high level of technical expertise required to operate and maintain these instruments can limit their adoption in regions lacking skilled professionals. These factors together create substantial obstacles to the growth of the mass spectrometry market, affecting its expansion and penetration into less developed markets.

Growth Factors

Growth Drivers for Mass Spectrometry

The mass spectrometry market is primed for growth, driven by its critical role in regulatory compliance and safety testing across various industries. As global regulations become stricter, especially in pharmaceuticals, food safety, and environmental monitoring, the demand for reliable and precise analytical methods like mass spectrometry intensifies.

Additionally, ongoing technological advancements are making these instruments faster, more accurate, and easier to use, which expands their application range. The growth of industries such as biotechnology, where mass spectrometry is essential for protein characterization and biomarker discovery, further fuels this demand.

Moreover, the increasing focus on research and development activities by governments and private sectors worldwide supports the market’s expansion by funding the adoption of advanced analytical techniques. These factors collectively contribute to the sustained growth of the mass spectrometry market.

Emerging Trends

Emerging Trends in Mass Spectrometry

Emerging trends in the mass spectrometry market are shaping its future, with a notable shift towards miniaturization and automation. These trends are making mass spectrometers more accessible and easier to use in various settings, from advanced research labs to on-field testing scenarios.

Miniaturized devices are being developed to offer portability and cost-effectiveness, catering to the needs of smaller labs and expanding the technology’s reach. Automation, on the other hand, enhances efficiency and reproducibility, allowing for high-throughput analysis which is vital in clinical diagnostics and drug development.

Additionally, the integration of mass spectrometry with other analytical techniques, such as chromatography, is improving the analytical capabilities and applications of these instruments. Such innovations are not only broadening the market but also opening up new possibilities in personalized medicine and environmental monitoring.

Regional Analysis

The mass spectrometry market exhibits varied dynamics across different regions, reflecting distinct economic, technological, and regulatory landscapes. North America dominates the global market, accounting for 42.2% with a valuation of USD 2.2 billion.

This leadership is driven by a well-established pharmaceutical sector, ongoing investments in biotechnology research, and stringent regulatory standards requiring high-precision analytical tools.

Europe follows, characterized by strong government support for research and development, particularly in pharmaceuticals and environmental monitoring, which propels the demand for advanced mass spectrometry solutions. The region’s emphasis on maintaining high health and safety standards further supports market growth.

Asia Pacific presents significant growth opportunities, spurred by rapid industrialization and expansion of pharmaceutical and biotechnology sectors, especially in China and India. Increasing healthcare expenditure and rising awareness about environmental pollution also contribute to the adoption of mass spectrometry in the region.

Meanwhile, the Middle East & Africa and Latin America are emerging markets where growth is primarily driven by the gradual establishment of regulatory frameworks and increasing investment in healthcare infrastructure. These regions show potential for higher growth rates as they continue to develop their technological and regulatory capabilities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global mass spectrometry market is significantly shaped by the activities and innovations of key players such as Bruker Corporation, Thermo Fisher Scientific, Inc., and PerkinElmer, Inc. These companies are pivotal in driving technological advancements and expanding the market’s reach across various applications.

Bruker Corporation has consistently focused on expanding its product portfolio through robust R&D investments, which have enhanced its technological offerings in the high-performance mass spectrometry sector.

This strategy not only strengthens its position in traditional markets such as pharmaceuticals and biotechnology but also allows it to penetrate new industrial segments.

Thermo Fisher Scientific, Inc. is a leading figure in the mass spectrometry market, known for its integrated solutions and wide range of instruments. In 2023, Thermo Fisher’s strategic acquisitions and collaborations have further solidified its market dominance, particularly in emerging regions.

The company’s commitment to innovation is evident in its development of user-friendly and highly efficient mass spectrometry solutions, making it a preferred partner for clinical and research laboratories worldwide.

PerkinElmer, Inc. focuses on expanding its footprint in the diagnostics and applied markets, leveraging mass spectrometry technologies to cater to the growing demands for environmental testing and food safety.

The company’s strategic initiatives aimed at geographical expansion and technology upgrades have enabled it to maintain a competitive edge. Overall, these companies exemplify strategic agility and technological prowess, addressing both market demands and challenges.

Their efforts not only drive growth within the mass spectrometry market but also set the pace for future innovations, ensuring their leadership positions in an increasingly competitive landscape.

Top Key Players in the Market

- Agilent Technologies, Inc.

- Danaher Corporation

- Waters Corporation

- Bruker Corporation

- Thermo Fisher Scientific, Inc.

- Perkinelmer, Inc.

- Shimadzu Corporation

- Kore Technologies, Ltd.

- Hiden Analytical

- Leco Corporation

- FLIR Systems, Inc.

- Eurofins Scientific

- Rigaku Corporation

- Other Key Market Players

Recent Developments

- In February 2024, Kore Technologies, Ltd. completed a strategic acquisition of a smaller analytical instruments firm. This move aims to broaden Kore’s technology base and strengthen its position in the European market, specifically targeting the food safety and clinical research sectors.

- In January 2024, Shimadzu Corporation announced the launch of a new triple quadrupole mass spectrometer. This product is designed to enhance sensitivity and accuracy in pharmaceutical and environmental testing, meeting the growing demands for more stringent analytical standards.

Report Scope

Report Features Description Market Value (2023) USD 5.4 Billion Forecast Revenue (2033) USD 11.0 Billion CAGR (2024-2033) 7.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Instruments, Consumables & Services), By Technology(Quadrupole Liquid Chromatography-Mass Spectrometry, Gas Chromatography-Mass Spectrometry (GC-MS), Fourier Transform-Mass Spectrometry (FT-MS), Time-of-Flight Mass Spectrometry (TOFMS), Matrix-Assisted Laser Desorption/Ionization-Time-of-Flight Mass Spectrometry (MALDI-TOF), Magnetic Sector Mass Spectrometry, Others), By Application(Proteomics, Metabolomics, Glycomics, Others), By End-use(Government & Academic Institutions, Pharmaceutical & Biotechnology Companies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Agilent Technologies, Inc., Danaher Corporation, Waters Corporation, Bruker Corporation, Thermo Fisher Scientific, Inc., Perkinelmer, Inc., Shimadzu Corporation, Kore Technologies, Ltd., Hiden Analytical, Leco Corporation, FLIR Systems, Inc., Eurofins Scientific, Rigaku Corporation, Other Key Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mass Spectrometer MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Mass Spectrometer MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Agilent Technologies, Inc.

- Danaher Corporation

- Waters Corporation

- Bruker Corporation

- Thermo Fisher Scientific, Inc.

- Perkinelmer, Inc.

- Shimadzu Corporation

- Kore Technologies, Ltd.

- Hiden Analytical

- Leco Corporation

- FLIR Systems, Inc.

- Eurofins Scientific

- Rigaku Corporation

- Other Key Market Players