Global MarTech Data Platform Market Size, Share, Growth Analysis By Platform Type (Customer Data Platforms (CDPs), Data Management Platforms (DMPs), Analytics & Insights Platforms, Others), By Deployment (Cloud-based, On-premise), By Organization Size (Large Enterprises, SMEs), By Application (Customer Segmentation & Profiling, Personalization & Targeting, Campaign Management & Measurement, Customer Journey Analytics, Others), By End-User (Retail, BFSI, Technology, Media, & Telecom (TMT), Travel, Healthcare, Discrete Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167705

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Data

- AI Industry Adoption

- Emerging Trends

- US Market Size

- By Platform Type

- By Deployment

- By Organization Size

- By Application

- By End-User

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Trending Factors

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

The MarTech Data Platform Market is undergoing rapid expansion as brands increasingly rely on unified data engines to consolidate, analyze, and activate customer intelligence across digital touchpoints. With organizations shifting toward hyper-personalized marketing, automation, and AI-driven decisioning, the demand for scalable data platforms continues to rise sharply.

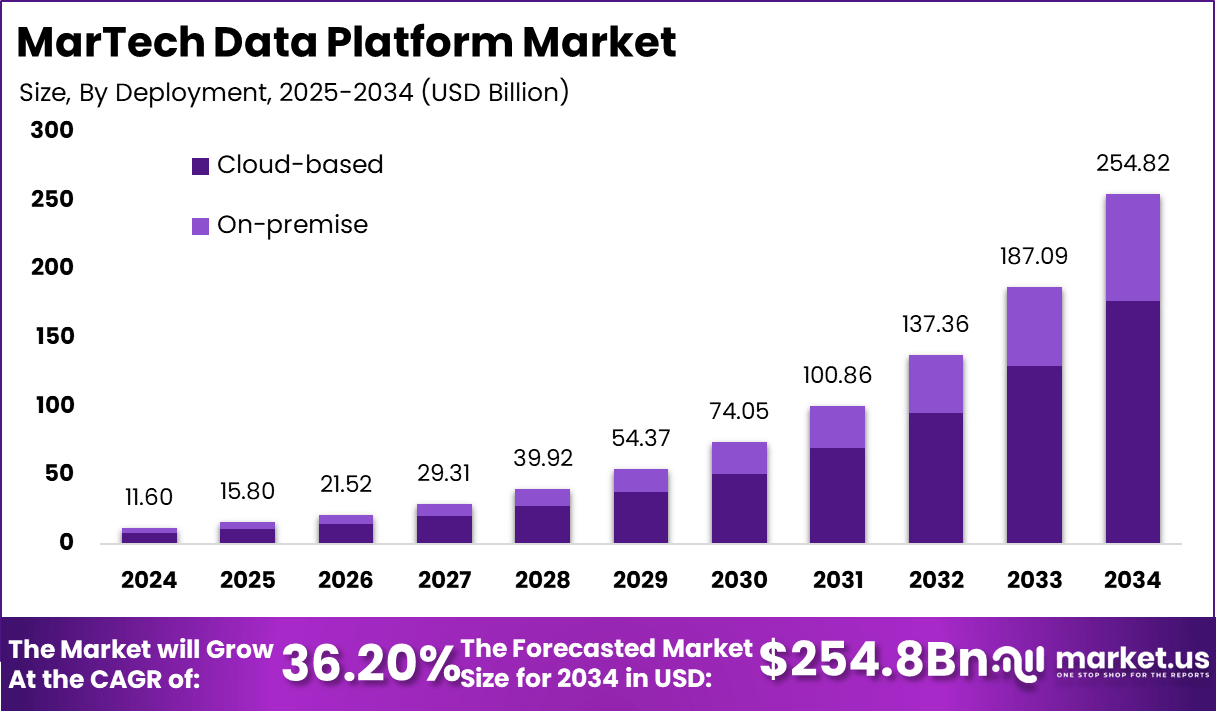

The market reached a valuation of USD 11.6 billion in 2024 and is projected to grow at a strong CAGR of 36.20%, ultimately achieving USD 254.8 billion by 2034. This growth reflects the surge in omnichannel engagement, real-time analytics adoption, and enterprise-wide digital transformation initiatives.

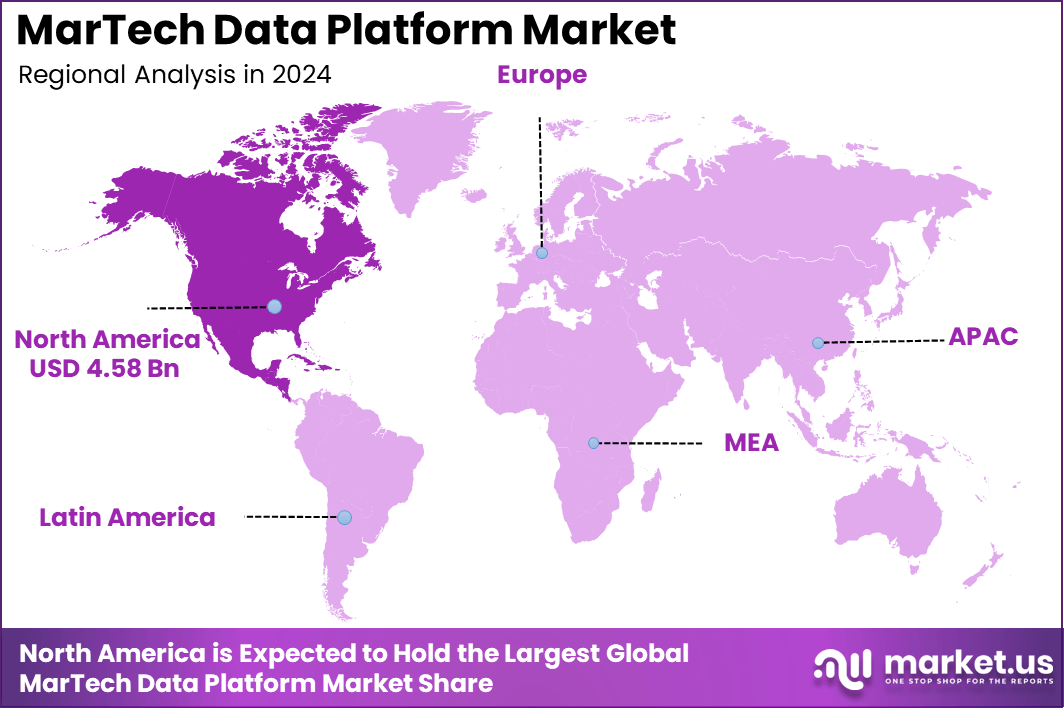

North America remains the dominant region, accounting for 39.5% of the global share and recording a market size of USD 4.58 billion in 2024. The region benefits from mature digital infrastructure, high adoption of cloud-based marketing systems, and strong enterprise investment in customer data unification technologies.

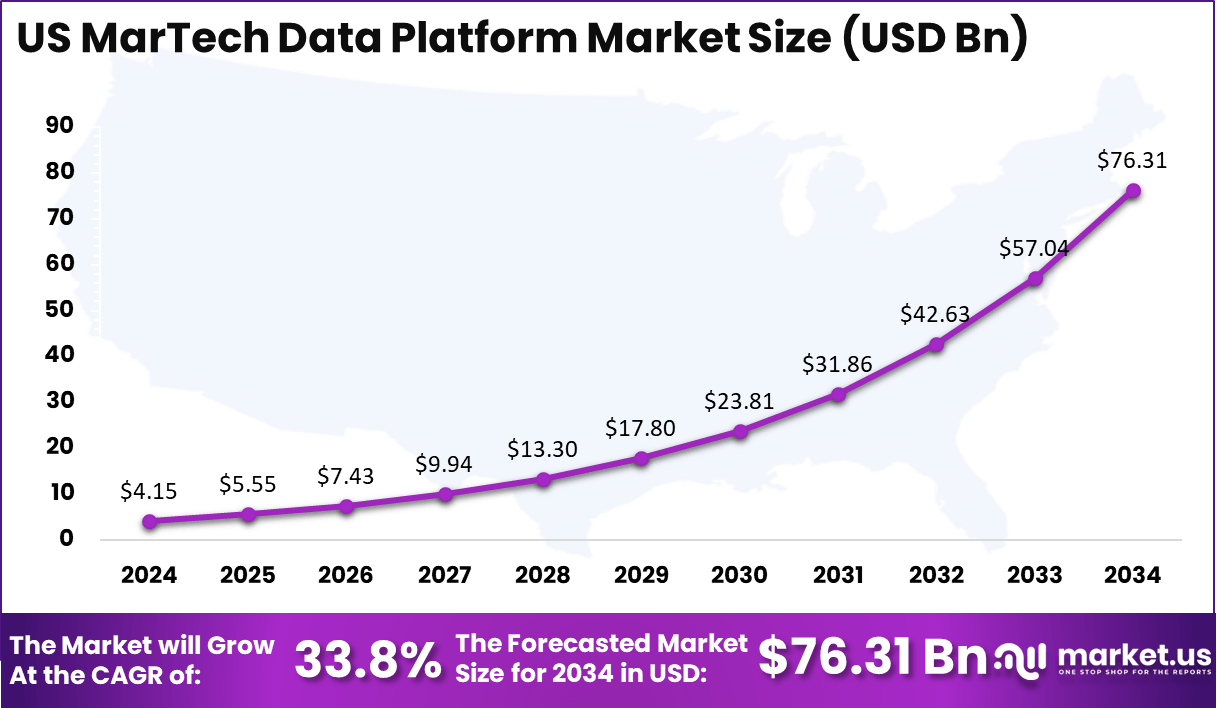

The US leads within the region with a valuation of USD 4.15 billion in 2024 and is projected to reach USD 76.31 billion by 2034, advancing at a CAGR of 33.8%. The country’s rapid shift toward AI-powered segmentation, predictive engagement, and real-time customer journey orchestration continues driving strong demand for MarTech data platforms across major industries, including retail, BFSI, telecommunications, and media.

The MarTech Data Platform Market is emerging as a critical foundation for modern marketing operations as enterprises prioritize unified, real-time customer intelligence to power more precise and personalized engagement. Businesses today manage vast volumes of behavioral, transactional, and omnichannel interaction data, making advanced data platforms essential for transforming this information into actionable insights.

MarTech data platforms integrate customer data, analytics engines, identity resolution, segmentation tools, and activation workflows into a centralized ecosystem, enabling brands to streamline campaigns, improve attribution accuracy, and enhance marketing ROI.

The shift toward automation, AI-driven decisioning, and predictive modeling has further elevated the importance of scalable data infrastructure across digital-first industries. As customer journeys become increasingly complex, companies rely on MarTech data platforms to connect touchpoints across web, mobile, social, in-store, and third-party channels.

These platforms also support compliance with evolving privacy regulations while maintaining accurate, consent-driven profiles. Cloud adoption, rising marketing technology investments, and the proliferation of digital commerce continue to accelerate platform deployment across global enterprises. With organizations seeking deeper personalization, higher efficiency, and real-time customer visibility, MarTech data platforms are becoming indispensable to long-term marketing transformation and competitive differentiation.

Recent developments in the MarTech Data Platform space in 2025 include significant mergers, acquisitions, new product launches, and funding rounds that are reshaping this market. Notably, the customer data platform (CDP) sector has seen a surge in acquisition activity, with six CDP companies acquired in the first half of 2025.

Key acquisitions included Informatica at $8 billion by Salesforce, mParticle for $300 million by Rokt, and Lytics by ContentStack. These acquisitions emphasize the move to embed CDPs within broader product ecosystems, bringing real-time data activation and AI-powered customer engagement capabilities into core marketing tools. Employment in these firms also increased by 3.4% in six months, a sign of growth and investment in this sector.

Besides acquisitions, funding rounds have been strong, such as Coho AI CDP’s $436 million funding in April 2025, signaling strong investor confidence. The market is also seeing consolidation moves like the merger of data infrastructure vendors Fivetran and dbt Labs through an all-stock deal, aiming to unify data movement and transformation services for marketers.

In terms of technology, composability is a key trend, enabling more flexible use of data from cloud warehouses without needing to move it into specific CDP databases. AI remains a driving force, with increasing use of generative AI for content creation and campaign optimization.

The overall MarTech landscape continues to grow with over 15,000 solutions in 2025, a 9% increase over the previous year, including a significant share of AI-native tools. Marketing technology spending remains cautious, but innovation in privacy-first data management and real-time personalization platforms is accelerating.

Venture capital funding targets startups focusing on first-party data and AI-driven automation, with successful examples like Jasper AI raising $125 million. M&A activity rose sharply, up 118% year over year, reflecting ongoing market reconfiguration as companies seek to integrate marketing data platforms with customer engagement systems for better data-driven decision making and personalized customer experiences.

Key Takeaways

- The MarTech Data Platform Market reached USD 11.6 billion in 2024.

- The market is expected to grow at a CAGR of 36.20% through the forecast period.

- The global market value is projected to reach USD 254.8 billion by 2034.

- North America accounted for 39.5% market share in 2024 with a size of USD 4.58 billion.

- The US recorded USD 4.15 billion in 2024 and is expected to reach USD 76.31 billion by 2034, advancing at a CAGR of 33.8%.

- By Platform Type, Customer Data Platforms (CDPs) dominated with a 56.8% share.

- By Deployment, Cloud-based platforms led with 69.4% adoption.

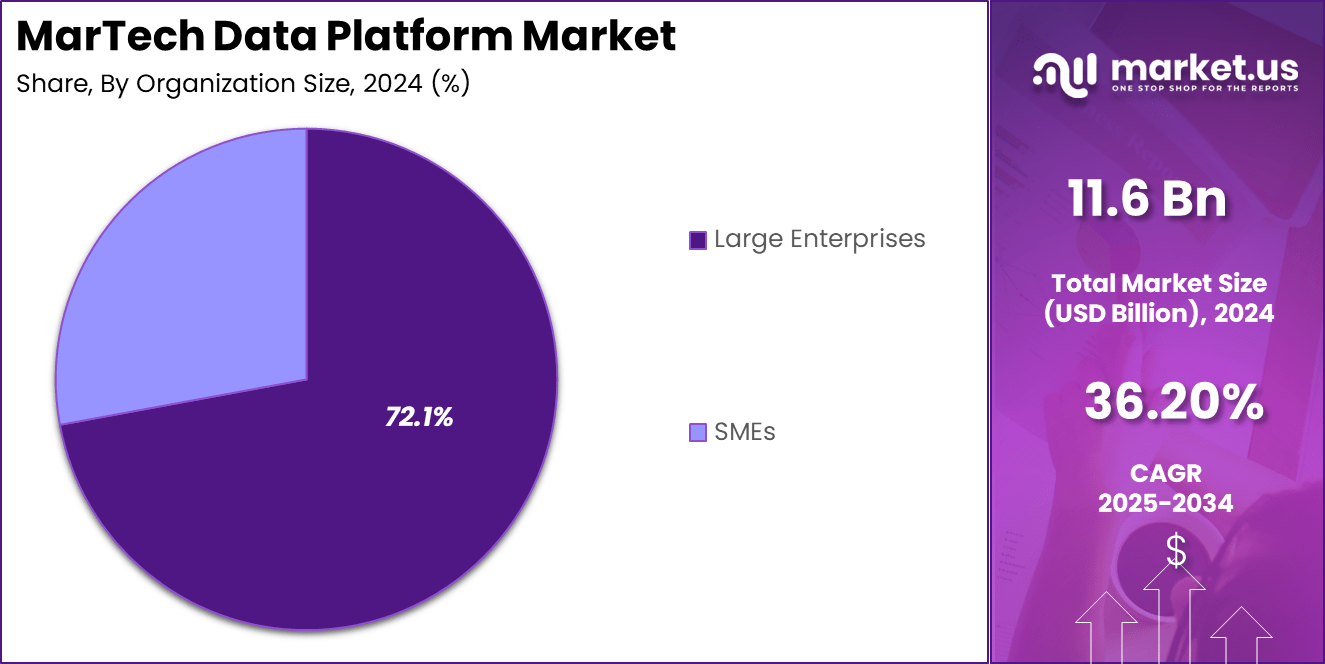

- By Organization Size, Large Enterprises held the highest share at 72.1%.

- By Application, Campaign Management & Measurement accounted for 52.3% adoption.

- By End-User, the Retail sector led with a 31.9% share.

Role of Data

Data plays a transformative role in modern MarTech ecosystems, serving as the core engine that powers personalization, automation, and real-time decision-making. In today’s digital landscape, every customer interaction – whether through websites, mobile apps, social media, in-store systems, or connected devices – generates valuable behavioral and transactional information.

This data enables brands to build unified customer profiles, understand intent, and deliver experiences tailored to individual preferences. Marketers increasingly rely on data to optimize campaigns, measure performance, and refine segmentation strategies, resulting in higher engagement rates and improved return on marketing investment.

Data also fosters predictive capabilities, allowing organizations to anticipate customer needs, recommend relevant products, and automate next-best-action workflows. With advanced analytics and AI-driven modeling, companies can identify patterns across millions of data points in seconds, helping them react quickly to market shifts and customer behavior changes.

Data integrity and governance play an equally important role, ensuring that information is accurate, privacy-compliant, and safely managed across systems. As global privacy regulations tighten and marketing complexity increases, the importance of clean, connected, and actionable data becomes even more critical. Ultimately, data empowers marketers to move from generic mass outreach to meaningful, insight-driven engagement that strengthens customer relationships and drives sustained business growth.

AI Industry Adoption

AI industry adoption has accelerated across global markets as organizations recognize the transformative impact of intelligent automation, predictive analytics, and real-time decision-making. Today, more than 70% of enterprises have adopted at least one AI-driven solution, ranging from chatbots and recommendation engines to fraud detection systems and advanced forecasting models.

Industries such as retail, BFSI, healthcare, telecom, and manufacturing lead adoption as they integrate AI to improve operational efficiency, reduce costs, and enhance customer engagement. Retailers use AI to personalize experiences for millions of customers, while banks rely on machine learning to analyze high-volume transactions and detect anomalies within milliseconds.

In healthcare, AI-driven diagnostics, patient monitoring, and predictive care models are reshaping clinical workflows, with adoption now surpassing 55% among major providers. Telecom companies leverage AI to optimize network performance and automate service operations, reducing downtime and improving user experience.

Manufacturing is experiencing a major shift toward AI-enabled automation, with predictive maintenance reducing equipment failures by nearly 30% and improving productivity across smart factories.

Cloud AI services have also played a significant role in accelerating adoption, offering scalable, cost-efficient tools accessible even to mid-sized enterprises. As organizations continue investing in digital transformation, AI adoption is expected to deepen further, reshaping business processes, decision-making, and competitive advantage across nearly every sector.

Emerging Trends

Emerging trends in the MarTech Data Platform landscape reflect the rapid convergence of AI, automation, and real-time data activation across modern marketing ecosystems. One of the most significant trends is the rise of AI-powered customer intelligence, with over 60% of enterprises now using machine learning for segmentation, predictive scoring, personalization, and dynamic journey optimization. Generative AI is also transforming content creation, enabling brands to automate campaign assets, audience insights, and cross-channel testing at unprecedented speed.

Another major trend is the shift toward real-time data streaming, where companies process millions of events per second to deliver instant personalization across web, app, email, and social platforms. Privacy-centric data architecture is gaining importance as well, with consent-driven identity resolution, zero-party data capture, and secure data clean rooms becoming essential in complying with global regulations. The rise of composable MarTech stacks is enabling enterprises to integrate modular tools through APIs, replacing rigid monolithic systems with flexible, scalable architectures.

Cloud-native platforms continue to dominate deployment, supporting elastic scaling, faster onboarding, and universal data accessibility. Additionally, omnichannel orchestration and unified analytics dashboards are becoming standard features as brands strive to maintain consistent customer experiences across fragmented digital environments. Together, these trends indicate a future where MarTech data platforms become more intelligent, automated, secure, and deeply embedded in end-to-end marketing operations.

US Market Size

The US MarTech Data Platform market is experiencing exceptional growth as enterprises rapidly expand their investment in customer intelligence, real-time analytics, and AI-driven marketing automation. Valued at USD 4.15 billion in 2024, the US remains the largest and most technologically advanced market in this ecosystem.

The nation’s strong digital maturity, high cloud adoption, and widespread use of omnichannel marketing tools create a fertile environment for scalable data platforms. Companies across retail, BFSI, media, technology, and healthcare increasingly rely on unified data infrastructure to consolidate customer interactions, improve segmentation accuracy, and activate personalized campaigns with measurable ROI.

The market is projected to reach USD 76.31 billion by 2034, growing at a robust CAGR of 33.8%. This momentum is further fueled by the rising adoption of AI-powered analytics, identity resolution engines, and predictive customer modeling, all of which require advanced data platforms to function effectively. US enterprises are also accelerating migration to cloud-based marketing ecosystems, enabling faster data processing, deeper integrations, and unified customer views across sprawling digital touchpoints.

Additionally, stricter privacy regulations and heightened focus on first-party data strategies are pushing organizations toward more sophisticated and compliant data platforms. As marketing becomes increasingly data-driven, the US continues to lead global innovation and adoption in MarTech data platform technologies.

By Platform Type

Customer Data Platforms (CDPs) dominate the MarTech Data Platform Market with a 56.8% share, reflecting their central role in helping brands unify fragmented customer information into a single, actionable profile. CDPs ingest data from web, mobile, CRM, e-commerce, offline systems, and third-party sources, enabling marketers to activate real-time personalization and journey orchestration.

Their ability to resolve identities, manage consent, and maintain clean, continuously updated profiles makes them essential for enterprises navigating privacy regulations and pursuing advanced segmentation strategies. As personalization and predictive engagement accelerate across industries, CDPs continue to serve as the core intelligence layer powering modern marketing ecosystems.

Data Management Platforms (DMPs) remain relevant for audience targeting, especially in advertising environments. Although third-party cookie restrictions have reduced traditional DMP reliance, they are increasingly evolving toward first-party and contextual audience aggregation.

Analytics & Insights Platforms also play a critical role by transforming raw customer data into measurable performance indicators, predictive models, and journey-level insights. These systems help organizations evaluate campaigns, forecast trends, and optimize omnichannel engagement.

The “Others” category includes identity resolution engines, customer journey hubs, and real-time decisioning systems that complement core platforms. Together, these solutions enable marketers to orchestrate seamless, data-driven experiences across constantly expanding digital touchpoints.

By Deployment

The cloud-based segment leads the MarTech Data Platform market with a 69.4% share, driven by the growing need for scalable, agile, and easily integrated marketing data environments. Cloud platforms enable real-time data ingestion, identity resolution, segmentation, and activation across thousands of touchpoints without the limitations of on-premise infrastructure.

Marketing teams prefer cloud deployment because it supports faster implementation, automatic updates, and elastic scaling during high campaign traffic. Cloud systems also integrate seamlessly with CRM, analytics, advertising, and automation tools through APIs, allowing enterprises to unify data sources and activate insights instantly.

The rise of AI-driven personalization, real-time decisioning, and omnichannel orchestration further accelerates cloud adoption, as these capabilities require high-performance computing and rapid data processing that cloud platforms deliver efficiently.

On-premise deployment continues to hold relevance for organizations that prioritize full data control, stringent governance, and strict compliance requirements. Industries such as banking, healthcare, and government often select on-premise systems to maintain sensitive customer data within internal infrastructure.

While on-premise platforms offer deeper customization and tight integration with legacy systems, they demand higher infrastructure investment and longer deployment timelines. As data privacy regulations strengthen globally, some enterprises continue to favor on-premise models for specialized security needs, though overall adoption shifts steadily toward cloud-based MarTech architectures.

By Organization Size

Large enterprises dominate the MarTech Data Platform market with a 72.1% share, driven by their strong need for unified customer intelligence, advanced analytics, and multi-channel orchestration at scale. These organizations manage massive data volumes across web, mobile, CRM, advertising, in-store systems, and partner ecosystems, making centralized data platforms essential for operational efficiency.

Large enterprises also invest heavily in AI-driven personalization, identity resolution, and predictive modeling, all of which require sophisticated data infrastructure. Their complex marketing stacks and broad customer bases demand real-time insights, cross-functional integration, and stringent compliance capabilities, positioning MarTech data platforms as a core component of enterprise digital strategy.

Additionally, large brands prioritize customer experience transformation, allocating substantial budgets toward cloud-based and composable marketing architectures.

Small and medium-sized enterprises (SMEs) are steadily increasing adoption as digital commerce and data-driven marketing become mainstream. SMEs benefit from MarTech data platforms by gaining clearer customer visibility, automating segmentation, and improving campaign targeting without large technical teams.

Cloud-based, low-code platforms make deployment affordable and accessible, helping SMEs compete with larger players through personalized engagement. While adoption among SMEs grows at a healthy pace, budget constraints and lower data complexity mean their uptake is more gradual compared to large enterprises. Over time, expanding digital marketplaces and rising customer expectations are expected to accelerate adoption within the SME segment.

By Application

Campaign Management & Measurement leads the MarTech Data Platform market with a 52.3% share, driven by the rising need for real-time, data-driven execution and performance optimization across digital channels. Modern marketers rely on unified platforms to plan, activate, and track campaigns across web, mobile, email, social, and advertising ecosystems.

These platforms centralize performance metrics, automate reporting, and provide actionable insights that enable rapid adjustments to targeting, messaging, and budget allocation. The shift toward AI-driven optimization and predictive modeling further strengthens this segment, allowing brands to identify high-value audiences, forecast outcomes, and measure ROI with greater accuracy. As marketing complexity increases, campaign management becomes the strategic core of customer engagement, making advanced data platforms indispensable.

Customer Segmentation & Profiling remains a critical application area, helping organizations categorize audiences based on behavior, demographics, intent, and historical interactions. Personalization & Targeting builds on segmentation by delivering tailored content in real time across touchpoints.

Customer Journey Analytics has gained traction as companies track multi-step interactions and optimize end-to-end experiences. The Others category includes attribution modeling, identity resolution workflows, and consent management. Together, these applications enable marketers to unify insights, improve decision-making, and orchestrate cohesive experiences across increasingly fragmented digital environments.

By End-User

The retail sector leads the MarTech Data Platform market with a 31.9% share, driven by the industry’s strong dependence on real-time customer insights, personalized engagement, and omnichannel experience optimization. Retailers handle massive volumes of transactional, behavioral, and loyalty data across e-commerce platforms, physical stores, mobile apps, and digital advertising channels.

MarTech data platforms enable them to unify this information, build precise customer profiles, and deliver tailored product recommendations, targeted promotions, and dynamic pricing strategies. The rise of AI-driven personalization, predictive demand forecasting, and cross-channel attribution further strengthens the retail sector’s reliance on advanced data infrastructure.

As consumer expectations for seamless shopping experiences grow, retailers increasingly adopt these platforms to improve retention, boost conversion rates, and optimize marketing performance.

The BFSI sector uses MarTech data platforms to enhance customer acquisition, automate communication, and improve personalization across digital banking and insurance services. Technology, Media, and Telecom (TMT) companies leverage these platforms to manage high engagement volumes and deliver contextual content to millions of users.

The travel sector adopts data platforms to personalize booking experiences and enhance loyalty programs. Healthcare organizations use them for patient engagement and digital outreach, while discrete manufacturing applies data-driven marketing to support B2B sales cycles. The Others category includes education, real estate, and professional services seeking better customer intelligence and targeted engagement.

Key Market Segments

By Platform Type

- Customer Data Platforms (CDPs)

- Data Management Platforms (DMPs)

- Analytics & Insights Platforms

- Others

By Deployment

- Cloud-based

- On-premise

By Organization Size

- Large Enterprises

- SMEs

By Application

- Customer Segmentation & Profiling

- Personalization & Targeting

- Campaign Management & Measurement

- Customer Journey Analytics

- Others

By End-User

- Retail

- BFSI

- Technology, Media, & Telecom (TMT)

- Travel

- Healthcare

- Discrete Manufacturing

- Others

Regional Analysis

North America holds a dominant position in the MarTech Data Platform market, accounting for 39.5% of the global share with a valuation of USD 4.58 billion in 2024. The region’s leadership is driven by strong digital maturity, high marketing technology adoption, and the presence of major cloud, AI, and analytics providers.

Enterprises across retail, BFSI, technology, media, telecom, and healthcare heavily invest in advanced data platforms to unify customer information, automate engagement, and enhance personalization across rapidly expanding digital ecosystems. The widespread shift toward omnichannel marketing and real-time campaign execution further accelerates platform adoption, as organizations seek deeper customer insights and measurable marketing performance.

North America also benefits from a well-established infrastructure supporting cloud computing, SaaS environments, and AI-driven analytics, enabling faster deployment and scalability of MarTech data platforms. The region’s strict focus on data privacy, first-party data strategies, and consent-based marketing fuels demand for platforms with strong governance, identity resolution, and compliance capabilities.

US enterprises, in particular, are accelerating investment in predictive analytics, customer journey orchestration, and automated segmentation, strengthening the region’s innovation leadership. With businesses prioritizing customer experience transformation and measurable ROI, North America continues to act as the global hub for advanced MarTech data platform adoption and technological evolution.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The MarTech Data Platform market is driven by rapid digital transformation, rising demand for real-time customer insights, and the explosive growth of omnichannel engagement. Over 70% of global enterprises now use AI-powered marketing tools, increasing the need for centralized data platforms that unify behavioral, transactional, and identity data. The rise of e-commerce, which grew by more than 20% annually across major markets, also accelerates adoption as brands require accurate segmentation and cross-channel measurement.

Cloud adoption surpassing 65% globally further supports platform scalability and integration. Additionally, the shift toward first-party data strategies – driven by stricter privacy regulations and the decline of third-party cookies – pushes organizations to adopt advanced MarTech platforms for consent management, identity resolution, and personalized engagement. Together, these factors strengthen the market’s momentum and make unified data platforms essential for modern marketing operations.

Restraint Factors

Despite rapid growth, the market faces several restraints. High deployment and integration costs remain a major challenge for small and mid-sized enterprises, as advanced platforms require robust infrastructure, skilled teams, and continuous optimization. Nearly 40% of businesses report difficulties integrating fragmented data sources, especially when dealing with legacy CRM, ERP, and on-premise systems. Data privacy regulations such as GDPR and CCPA add complexity, requiring strict governance, encryption, and consent tracking – processes that many organizations struggle to maintain.

Additionally, data quality issues affect performance, with studies showing that up to 30% of enterprise customer data is inaccurate or incomplete, limiting personalization effectiveness. The skills gap in AI, analytics, and data engineering further slows adoption, as many firms lack specialized talent to manage large-scale MarTech ecosystems. These challenges collectively hinder seamless implementation and reduce ROI for certain organizations.

Growth Opportunities

The MarTech Data Platform market presents significant growth opportunities as enterprises prioritize data-driven marketing and AI-enabled customer engagement. The global volume of digital interactions is expected to surpass hundreds of billions per day, creating increased demand for real-time analytics and identity resolution. The rapid rise of generative AI offers opportunities for automated segmentation, content creation, and predictive modeling, enabling brands to scale engagement efficiently.

Emerging markets in Asia Pacific, Latin America, and the Middle East—where digital adoption is growing above 15% annually—represent high-potential expansion zones for MarTech providers. The shift toward composable and API-first MarTech stacks creates opportunities for modular integration, allowing businesses to customize and scale faster. Growing investment in first-party and zero-party data strategies also opens new avenues for privacy-compliant personalization. Additionally, industries such as healthcare, travel, BFSI, and manufacturing are accelerating digital engagement, expanding the platform’s addressable market across new verticals.

Trending Factors

Several key trends are shaping the future of MarTech data platforms. The most prominent is the integration of generative AI, with more than 60% of enterprises now exploring its use for real-time personalization, automated campaign generation, and predictive recommendations. Real-time data streaming is becoming a standard requirement, with companies processing millions of events per second to support instant customer interactions. Privacy-first data architecture is another major trend, driven by tightening regulations and the shift toward first-party data.

Clean rooms, consent management tools, and secure data collaboration environments are increasingly used to maintain compliance. The rise of composable MarTech stacks allows organizations to build flexible, API-driven ecosystems rather than traditional monolithic platforms. Omnichannel customer journey orchestration is also gaining traction as brands focus on consistent experiences across web, mobile, apps, email, and social platforms. Together, these trends highlight the industry’s shift toward intelligent, secure, and highly adaptive marketing data infrastructure.

Competitive Analysis

The competitive landscape of the MarTech Data Platform market is intensifying as enterprises demand more advanced, scalable, and AI-driven capabilities to manage customer intelligence. Leading technology providers compete by offering unified platforms that integrate customer data, analytics, automation, identity resolution, and omnichannel activation into a seamless ecosystem.

Vendors differentiate through real-time processing speed, data accuracy, AI-powered insights, and the ability to handle billions of daily customer interactions. Providers with strong cloud-native architectures gain a competitive edge as businesses increasingly adopt scalable, composable, and API-first MarTech environments.

Competition is also rising among CDP vendors, analytics platforms, and AI-driven marketing suites that aim to deliver deeper personalization and predictive modeling. Companies offering embedded AI, automated segmentation, and cross-channel journey optimization continue to attract enterprise adoption. Security and privacy capabilities – including consent management, zero-party data handling, and compliance with global regulations – are becoming critical competitive factors as businesses prioritize trust and transparency.

Regional players strengthen competition by offering localized data governance, industry-specific integrations, and cost-efficient deployment models, especially in North America and Asia Pacific. Partnerships between cloud providers, CRM vendors, and marketing automation platforms are expanding the ecosystem further. Overall, competition centers on intelligence, speed, interoperability, and the ability to deliver measurable, data-driven marketing performance at scale.

Top Key Players in the Market

- Salesforce

- Adobe

- Oracle

- Microsoft

- SAP

- HubSpot

- Tealium

- Segment

- mParticle

- Bloomreach

- ActionIQ

- Lytics

- Zeotap

- Acquia

- Others

Recent Developments

- November 22, 2025: Adobe unveiled its Unified Customer Graph Engine within Adobe Experience Platform, enabling marketers to consolidate identity, behavioral, and intent data into real-time profiles. Early adopters reported up to 45% faster activation of personalized campaigns across web, mobile, and social channels.

- November 16, 2025: Snowflake introduced its Marketing Data Clean Room Extensions, designed to support privacy-safe collaboration between brands, agencies, and publishers. The upgrade allows real-time audience matching and attribution analysis while maintaining zero-copy data practices, reducing data movement costs by nearly 30%.

- November 11, 2025: HubSpot launched its AI Marketing Orchestration Layer, integrating generative AI workflows for segmentation, content creation, and campaign optimization. Pilot users saw a 40% reduction in manual campaign setup time and improved conversion performance across B2B funnels.

Report Scope

Report Features Description Market Value (2024) USD 11.6 Billion Forecast Revenue (2034) USD 254.8B Billion CAGR(2025-2034) 36.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Platform Type (Customer Data Platforms (CDPs), Data Management Platforms (DMPs), Analytics & Insights Platforms, Others), By Deployment (Cloud-based, On-premise), By Organization Size (Large Enterprises, SMEs), By Application (Customer Segmentation & Profiling, Personalization & Targeting, Campaign Management & Measurement, Customer Journey Analytics, Others), By End-User (Retail, BFSI, Technology, Media, & Telecom (TMT), Travel, Healthcare, Discrete Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Salesforce, Adobe, Oracle, Google, Microsoft, SAP, HubSpot, Tealium, Segment, mParticle, Bloomreach, ActionIQ, Lytics, Zeotap, Acquia, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  MarTech Data Platform MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

MarTech Data Platform MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Salesforce

- Adobe

- Oracle

- Microsoft

- SAP

- HubSpot

- Tealium

- Segment

- mParticle

- Bloomreach

- ActionIQ

- Lytics

- Zeotap

- Acquia

- Others