Global Marketing Automation Software Market Size, Share and Analysis Report By Solution (Campaign Management, Email Marketing, Inbound Marketing, Mobile Applications, Lead Nurturing & Lead Scoring, Reporting & Analytics, Social Media Marketing, Others), By Deployment (On-premise, Hosted), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By End-use (BFSI, Retail, Healthcare, Telecom & IT, Discrete Manufacturing, Government & Education, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175414

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Top Marketing Automation Statistics

- Market Overview

- Investment and Business Benefits

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Solution

- By Deployment

- By Enterprise Size

- By End-Use

- By Region

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

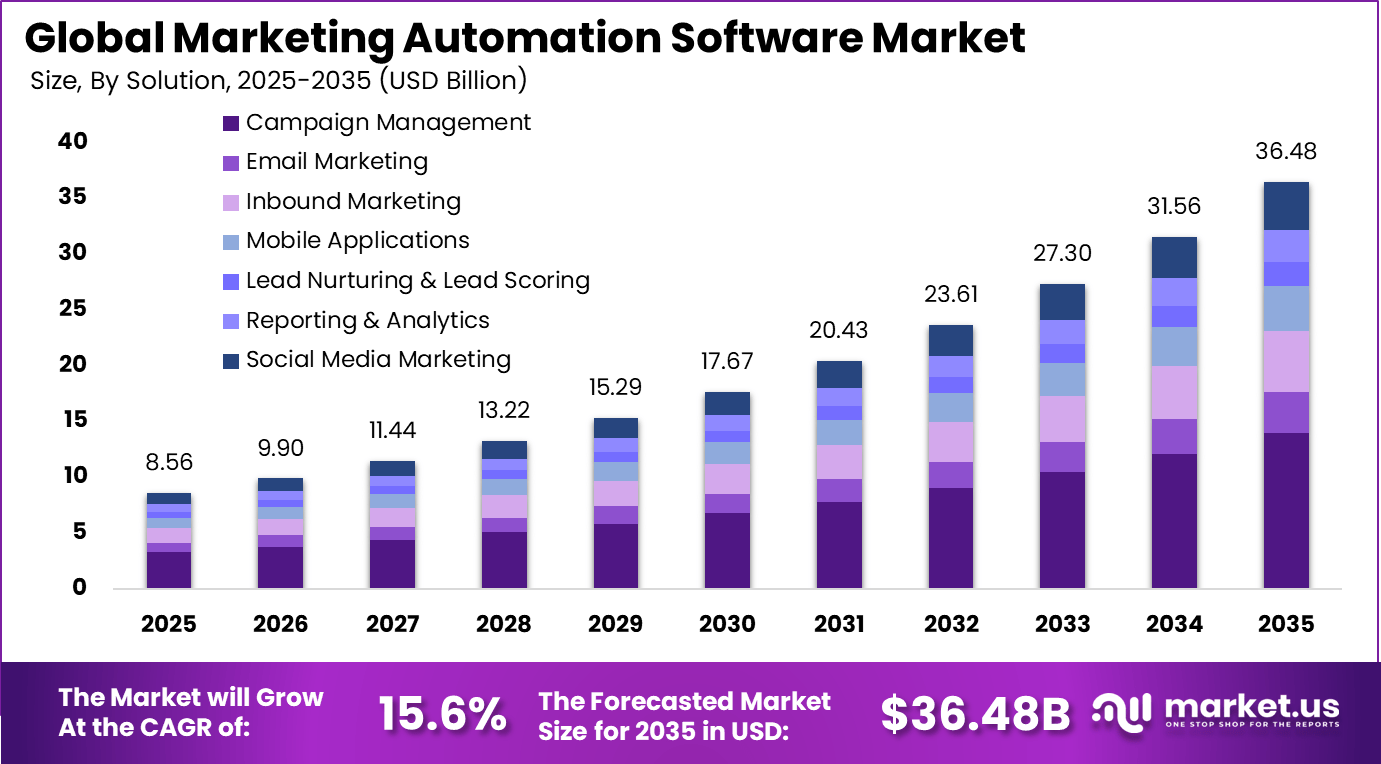

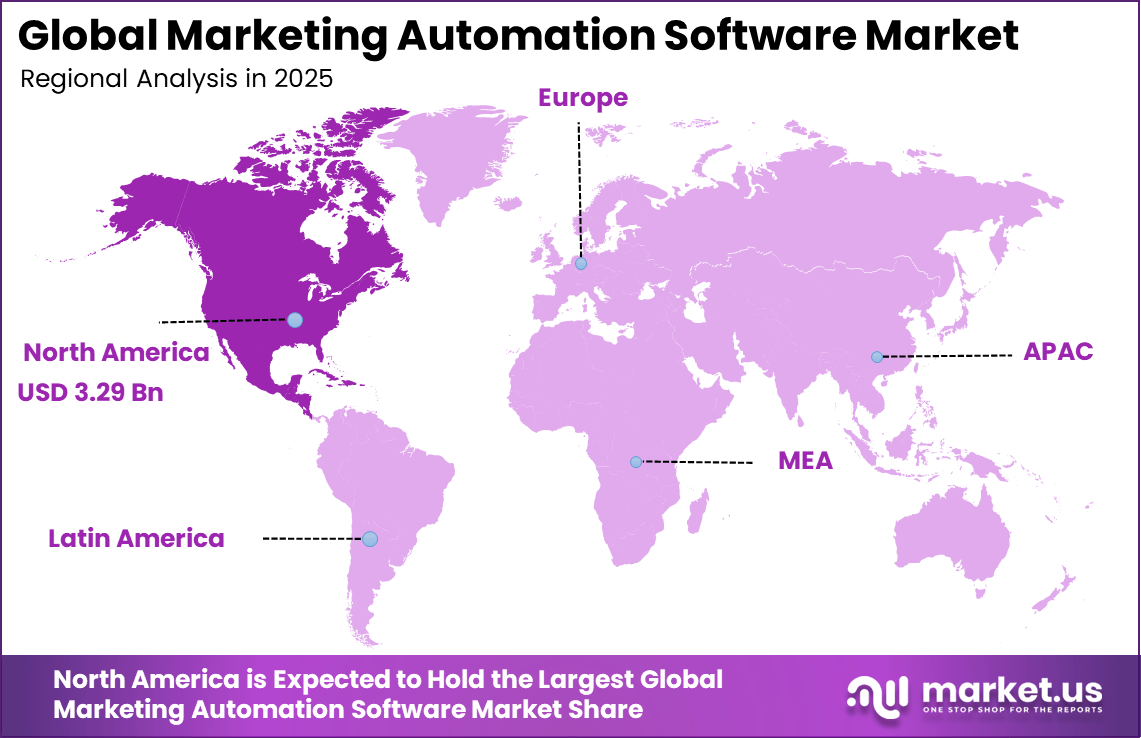

The global marketing automation software market is expected to create a USD 36.48 billion growth opportunity by 2035, driven by rapid digital transformation and enterprise marketing modernization. The market is forecast to expand at a CAGR of 15.6%, highlighting its strong revenue outlook and long-term value creation potential for investors. In 2025, North America held a dominant market position, capturing more than a 38.5% share, holding USD 3.29 billion in revenue.

The Marketing Automation Software market refers to the global industry involved in the development and use of software technologies that enable businesses to automate routine marketing tasks and manage multi-channel marketing campaigns with minimal manual input. These platforms collect and consolidate customer data, support the planning and execution of campaigns, and provide analytics and reporting capabilities to assess performance and engagement.

Automation functions typically include email campaign management, customer segmentation, lead nurturing, and cross-channel interaction tracking to improve efficiency and effectiveness in engaging customers. This market has grown as businesses seek solutions that reduce manual workload, deliver consistent messaging across digital channels, and provide insights that inform marketing strategy.

The proliferation of digital touchpoints in customer journeys and advances in related technologies have expanded the scope and adoption of automation platforms across both business-to-business and business-to-consumer environments. These solutions are widely recognized as foundational components of contemporary marketing operations that enable more data-driven and customer-centric approaches to outreach.

According to Woopra, marketing automation shows strong adoption and measurable returns across industries. Around 72% of companies report success with marketing automation, while 87% of marketing teams are already using automation software or plan to adopt it. Despite this progress, 33% of marketing professionals identify lack of know how as the main barrier to adoption, and 20% of businesses struggle to select the right automation tool.

Automation is viewed as highly effective for digital channels, with 83% of marketers stating that social media marketing is well suited for automation. More than 75% of companies achieve a positive marketing ROI within one year of implementation, and the average marketing automation ROI is reported at 544%, highlighting its strong impact on efficiency and revenue generation.

For instance, in September 2025, ActiveCampaign showcased “Autonomous Marketing” at the Fall 2025 event, featuring AI agents for campaign creation and optimization. The updates focus on predictive personalization and workflow automation, reducing manual tasks for marketers.

Key Takeaway

- In 2025, the Campaign Management segment led the Global Marketing Automation Software Market with a 38.3% share, reflecting strong demand for tools that manage multi-channel campaigns and customer journeys.

- In 2025, the On-premise deployment segment held a dominant 57.4% share, driven by data control, security, and regulatory compliance requirements.

- In 2025, Large Enterprises accounted for 70.5% of total adoption, supported by complex marketing operations and higher investment capacity.

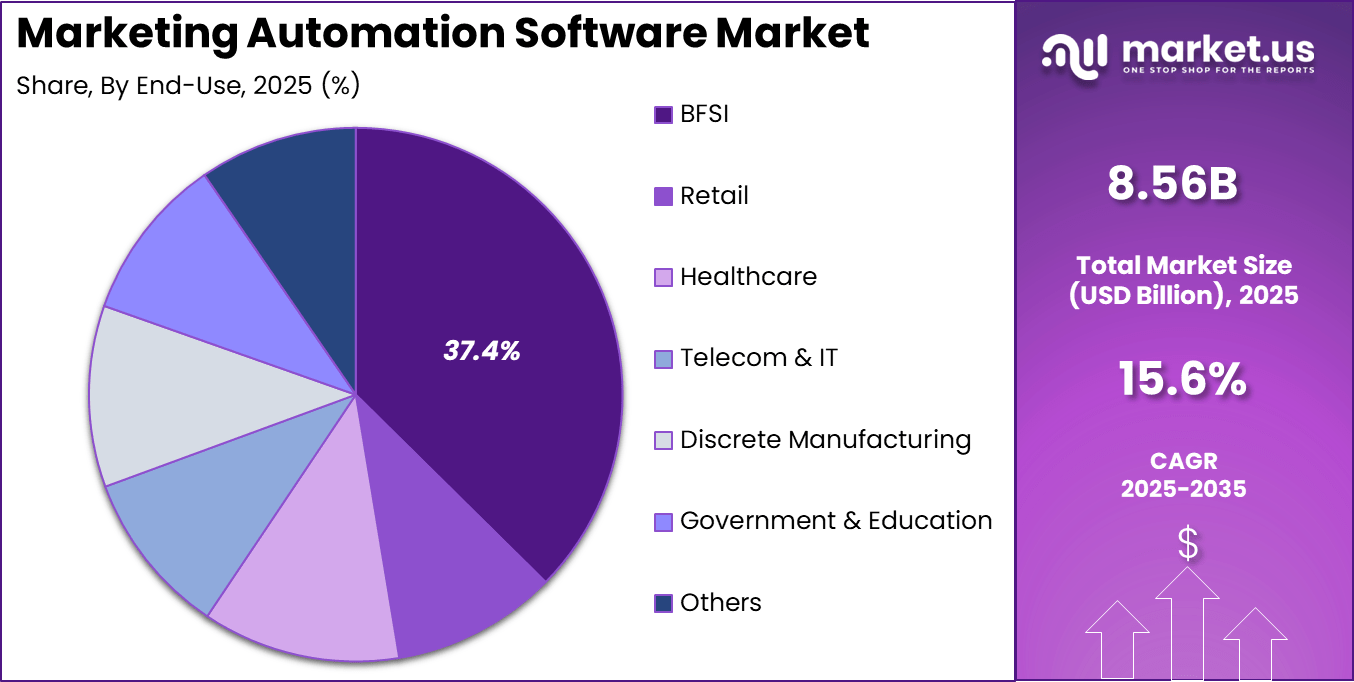

- In 2025, the BFSI sector captured 37.4% of market demand, highlighting extensive use of automation for customer engagement, lead nurturing, and compliance-driven communication.

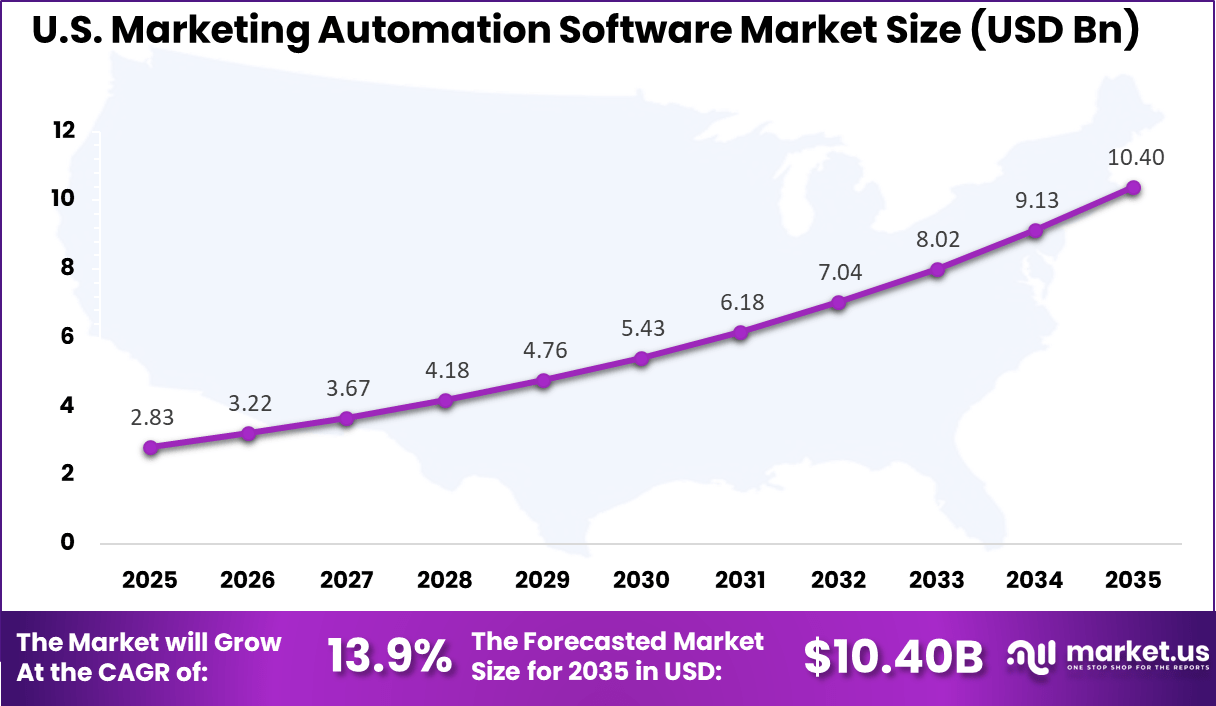

- The U.S. Marketing Automation Software Market reached USD 2.83 Billion in 2025, expanding at a strong 13.9% CAGR, supported by advanced digital marketing practices.

- In 2025, North America maintained market leadership with more than a 38.5% share, backed by early technology adoption and mature enterprise marketing ecosystems.

Top Marketing Automation Statistics

- According to oracle, 35% of organizations use marketing automation to streamline marketing and sales activities, showing a clear focus on improving operational coordination.

- 34% adopt these solutions to improve customer engagement, while another 34% aim to enhance the overall customer experience across multiple touchpoints.

- 30% implement marketing automation to reduce manual work, highlighting efficiency as a key adoption driver.

- 28% rely on automation to increase the number of leads captured through structured and repeatable processes.

- 50% of marketers expect marketing automation platforms to integrate easily with existing content management, CRM, and ERP systems.

- 45% prioritize lead qualification and lead scoring capabilities to support stronger sales readiness and conversion performance.

- 35% seek content creation tools and automated email workflows to manage campaigns more consistently.

- Only 12% consider ecommerce storefront integration an essential feature, indicating limited dependence on direct commerce functions.

- 63% of organizations implementing marketing automation expect to see measurable benefits within 6 months.

- 44% confirm that a return on investment is achieved within 6 months, reflecting relatively fast value realization.

- 31% continue to face challenges in clearly proving marketing attribution and return on investment.

- Marketing automation contributes to a 12.2% reduction in marketing overhead by automating repetitive activities and centralizing campaigns.

- More than 10% of businesses report direct marketing cost reductions after adopting unified automation platforms.

- Sales productivity improves by 14.5% as a result of better lead management and automated marketing workflows.

Market Overview

The primary driving factor for the Marketing Automation Software market is the need to handle complex and repetitive marketing processes at scale. Organizations face increasing pressure to engage audiences across digital channels and to tailor communications based on customer behaviour patterns. Automation software meets this need by scheduling and executing tasks such as email delivery, social media interactions, and customer follow-ups without requiring constant manual intervention.

Another significant factor is the emphasis on data-driven marketing and measurable performance outcomes. Marketing automation platforms provide analytics and reporting tools that help teams assess campaign effectiveness, refine strategies, and make evidence-based adjustments. As a result, the market is influenced by the growing expectation that marketing investments should be quantifiable and aligned with broader business goals.

Demand for Marketing Automation Software is shaped by the requirement to streamline internal processes and increase overall marketing productivity. Many organizations experience constraints in resources and personnel, which drives the adoption of systems that can execute routine functions and free staff to focus on strategic initiatives. The result is sustained interest in platforms that can ensure consistent execution of marketing activities and reduce the risk of human error.

Investment and Business Benefits

Investment opportunities can be found in platforms that integrate emerging technologies to support deeper personalization and real-time analytics. Solutions that leverage machine learning to automate predictive decision-making and content customization are increasingly valued for their ability to enhance campaign outcomes and operational agility.

There are also opportunities in the integration of marketing automation with other enterprise systems such as customer relationship management and data platforms. Tools that enable seamless data flow and unified customer insights are sought after as businesses pursue comprehensive views of customer interactions and behaviour.

Marketing automation software offers measurable improvements in efficiency by handling routine activities and reducing the need for manual intervention. Organizations benefit from faster campaign execution and improved workflow coordination, which contribute to better resource utilization and reduced operational overhead.

A further benefit is enhanced lead management and conversion tracking. Automation supports systematic nurturing of prospects through predefined workflows, prioritizing high-value leads and improving alignment between marketing efforts and sales outcomes. The analytics provided by these systems help organizations refine strategies and achieve higher effectiveness in their marketing programs.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Rising demand for personalized marketing Data driven campaign execution and targeting ~6.8% Global Short Term Digital transformation in BFSI Automated customer engagement and compliance ~5.9% North America, Europe Short Term Growth of omnichannel marketing Unified campaign orchestration across platforms ~5.1% Global Mid Term Increasing marketing data volumes Need for automation and analytics ~4.4% Global Mid Term Enterprise focus on ROI measurement Performance tracking and attribution models ~3.6% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Data privacy regulations Compliance with data protection laws ~4.9% North America, Europe Short Term High implementation complexity Integration with legacy IT systems ~4.2% Global Mid Term High software licensing costs Budget constraints for mid sized firms ~3.6% Emerging Markets Mid Term Skill gaps Shortage of marketing automation specialists ~3.1% Global Mid Term Vendor lock in concerns Limited flexibility across platforms ~2.4% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration High deployment cost Infrastructure and customization expenses ~6.1% Emerging Markets Short to Mid Term Complex user interfaces Longer onboarding and training cycles ~5.0% Global Mid Term Data integration challenges Fragmented customer data sources ~4.3% Global Mid Term Security concerns Handling sensitive customer information ~3.7% North America, Europe Long Term Limited adoption by SMEs Preference for simpler marketing tools ~2.8% Global Long Term By Solution

Campaign management accounts for 38.3%, making it the leading solution segment in marketing automation software. These tools help organizations plan, execute, and track marketing campaigns across multiple channels. Automated workflows improve timing and message consistency. Centralized control enables better coordination between marketing teams. Performance tracking supports informed decision-making.

The dominance of campaign management is driven by the need for structured outreach. Enterprises manage large volumes of customer interactions. Automation reduces manual effort and errors. Data-driven insights help refine campaign strategies. This sustains strong demand for campaign management solutions.

For Instance, in August 2025, Adobe Systems Inc. enhanced Marketo Engage for advanced lead scoring and campaign analytics. It integrates creative assets from Experience Cloud, streamlining content delivery in nurture programs. Marketers gain better attribution insights, making campaigns more effective. This update targets teams seeking unified data for precise targeting.

By Deployment

On-premise deployment holds 57.4%, reflecting preference for local system control. Organizations retain direct oversight of customer data. On-premise systems support strict data security requirements. Customization options meet internal process needs. Reliability remains a key factor.

Adoption of on-premise deployment is driven by regulatory and privacy concerns. Enterprises in regulated sectors favor internal hosting. Local deployment reduces dependency on external networks. System performance remains predictable. This sustains continued use of on-premise solutions.

For instance, in October 2025, Oracle Corporation upgraded Eloqua with on-premise options tied to Oracle CX for secure data handling. It supports heavy custom integrations without cloud reliance, ideal for compliance-heavy setups. Firms keep full control, running campaigns on internal servers with strong governance. This appeals to those prioritizing privacy in deployments.

By Enterprise Size

Large enterprises represent 70.5%, making them the primary adopters of marketing automation software. These organizations manage complex and large-scale marketing operations. Automation supports coordination across regions and departments. Data integration improves customer insights. Scale increases the need for efficiency.

Adoption among large enterprises is driven by operational complexity. Manual marketing processes become inefficient at scale. Automation improves consistency and speed. Centralized platforms support governance. This sustains strong enterprise-level adoption.

For Instance, in July 2025, Microsoft Corporation expanded Dynamics 365 for large firms with deeper marketing automation. It ties CRM data to campaigns, enabling predictive personalization at scale. Enterprises benefit from seamless integrations, reducing silos and boosting ROI tracking. The focus aids global ops handling massive customer bases.

By End-Use

The BFSI sector accounts for 37.4%, making it a key end-use segment. Financial institutions use marketing automation for customer engagement. Personalized communication supports relationship management. Compliance remains critical in messaging. Automation helps manage regulatory requirements.

Growth in BFSI adoption is driven by digital customer interactions. Institutions engage customers across multiple channels. Automation ensures consistent messaging. Data-driven campaigns improve effectiveness. This sustains steady adoption in BFSI.

For Instance, in October 2025, Adobe Systems Inc. integrated Marketo for BFSI with privacy-focused campaign tools. It handles consent management and multichannel finance marketing, ensuring compliant outreach. Insurers gain from adaptive content, fitting personalized services like policy renewals. Demand grows with digital banking shifts.

By Region

North America accounts for 38.5%, supported by strong adoption of digital marketing technologies. Enterprises in the region invest in automation to improve efficiency. Mature digital infrastructure supports deployment. Marketing strategies rely on data-driven tools. The region remains influential.

For instance, in May 2025, Adobe Systems Inc. announced the Marketo Engage roadmap at Adobe Summit 2025, featuring AI-powered content creation, a visual journey builder, and advanced BI analytics. Key enhancements include GenAI for email, dynamic chat improvements, and integrations with Adobe Express for streamlined workflows. These developments reinforce North America’s dominance in intelligent marketing automation platforms.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn) Adoption Maturity North America Enterprise digital marketing automation 38.5% USD 3.29 Bn Advanced Europe Regulatory compliant customer engagement tools 29.8% USD 2.55 Bn Advanced Asia Pacific Rapid enterprise digitalization 20.6% USD 1.76 Bn Developing Latin America Growing adoption of CRM driven marketing 6.4% USD 0.55 Bn Developing Middle East and Africa Early adoption in BFSI and telecom 4.7% USD 0.40 Bn Early

The United States reached USD 2.83 Billion with a CAGR of 13.9%, reflecting solid growth. Expansion is driven by enterprise digital marketing investments. Automation adoption continues to rise. Customer engagement remains a priority. Market momentum remains stable.

For instance, in September 2025, HubSpot advanced its marketing automation leadership with new AI marketing features for 2025, including AI-driven personalization, predictive analytics, and dynamic content optimization. These updates leverage AI to analyze customer behavior patterns and deliver real-time, tailored campaigns, helping businesses stay competitive in a data-first world. HubSpot’s focus on voice-of-customer analysis and automated A/B testing exemplifies U.S. innovation in intelligent marketing automation.

Driver Analysis

The marketing automation software market is being driven by the increasing need for organisations to streamline repetitive marketing tasks, improve campaign efficiency, and deliver personalised customer experiences at scale. Digital channels generate large volumes of data, making manual execution of campaigns and customer journeys inefficient and error-prone.

Marketing automation software helps centralise campaign management, automate email and social outreach, score leads, and segment audiences, enabling teams to focus on strategy and creative optimisation. Demand for measurable return on marketing investment and greater alignment between sales and marketing functions further reinforces investment in solutions that support multi-channel orchestration and real-time engagement.

Restraint Analysis

A key restraint in the marketing automation software market relates to integration challenges and technical complexity faced by organisations during deployment. To realise full value, marketing automation platforms must connect seamlessly with customer relationship management systems, content management tools, ecommerce platforms, and analytics systems.

Disparate data formats, legacy systems, and siloed processes can create barriers to unified data flows and consistent customer views, limiting the effectiveness of automated campaigns. Organisations with limited technical expertise or inadequate data governance may encounter delays, increased costs, or underutilised functionality, slowing adoption.

Opportunity Analysis

Emerging opportunities in the marketing automation software market are linked to the integration of artificial intelligence and predictive analytics that enhance targeting, content personalisation, and campaign optimisation. AI-powered features can analyse behavioural patterns, forecast customer intent, and recommend the optimal timing and content for engagement, supporting more relevant interactions across channels.

There is also potential for vertical-specific automation solutions designed to address unique marketing needs in industries such as healthcare, financial services, retail, and technology, where regulatory requirements and customer behaviours vary. Enhanced analytics and visualisation capabilities that tie marketing activities to revenue outcomes can further expand strategic value.

Challenge Analysis

A central challenge confronting this market involves balancing automation intelligence with transparency, control, and user trust. Marketing teams must understand how algorithms influence audience selection, content recommendations, and performance predictions to ensure alignment with brand strategy and customer expectations.

In environments where decision makers require clear explanations of automated outcomes, lack of interpretability in AI-driven insights can hinder confidence and adoption. Ensuring that platforms provide actionable, comprehensible insights without obscuring underlying logic requires thoughtful design and stakeholder education.

Emerging Trends

Emerging trends in the marketing automation software landscape include the increasing use of real-time customer data platforms that unify behavioural, transactional, and engagement data to support personalised automation across devices and channels. Another trend is the adoption of AI-enabled content optimisation that dynamically adjusts messaging and creative elements based on performance signals.

Platforms are also embedding cross-functional workflow tools that align marketing, sales, and customer service activities to create consistent and seamless customer experiences. Self-service interfaces and low-code automation builders are gaining traction, enabling broader participation from non-technical users.

Growth Factors

Growth in the marketing automation software market is supported by the continuous expansion of digital marketing channels, rising expectations for personalised customer journeys, and the need to improve operational productivity. Organisations are prioritising tools that reduce manual effort, increase campaign responsiveness, and provide measurable performance insights.

Advances in analytics, artificial intelligence, and cloud computing enhance the scalability and accessibility of automation solutions for enterprises of varied sizes. As businesses seek to deepen customer relationships, optimise resource allocation, and drive revenue growth, marketing automation remains a foundational component of modern customer engagement strategies.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Pattern Large enterprises Very High ~70.5% Campaign efficiency and ROI Long term platform investments BFSI organizations High ~37.4% Compliance driven customer engagement Strategic deployments Technology vendors High ~18.6% Platform expansion and innovation R and D intensive Digital agencies Moderate ~9.2% Campaign automation services Project based SMEs Low ~4.7% Cost sensitive adoption Selective usage Technology Enablement Analysis

Technology Layer Enablement Role Impact on Growth (%) Adoption Status Marketing analytics engines Campaign performance measurement ~6.9% Mature Customer data platforms Unified customer profiling ~6.1% Growing AI driven personalization Automated content and targeting ~5.4% Growing On premise integration tools Data control and compliance ~4.6% Mature Workflow automation Lead nurturing and scoring ~3.8% Mature Key Market Segments

By Solution

- Campaign Management

- Email Marketing

- Inbound Marketing

- Mobile Applications

- Lead Nurturing & Lead Scoring

- Reporting & Analytics

- Social Media Marketing

By Deployment

- On-premise

- Hosted

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By End-Use

- BFSI

- Retail

- Healthcare

- Telecom & IT

- Discrete Manufacturing

- Government & Education

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading enterprise-focused vendors such as Adobe Systems Inc., Salesforce Inc., and Oracle Corporation dominate large-scale deployments. Their platforms support campaign orchestration, customer journey management, and data-driven personalization. Strong integration with CRM, analytics, and cloud ecosystems improves adoption. IBM Corporation and Microsoft Corporation strengthen this segment through AI-driven insights and enterprise security. Demand is driven by large organizations seeking unified and compliant marketing operations.

Mid-market and growth-oriented players such as HubSpot, Inc., ActiveCampaign LLC, and Klaviyo Inc. focus on usability and fast deployment. Their solutions support email automation, lead nurturing, and customer segmentation. Mailchimp, Zoho Corp., and SAP SE address businesses seeking scalable yet cost-effective tools. Adoption is supported by rising digital marketing spend among small and mid-sized enterprises.

Specialized and vertical-focused vendors such as Braze Inc., Omnisend, and Drip emphasize personalization and omnichannel engagement. Keap, Act-On Software, and Oracle NetSuite support niche use cases. Other vendors expand regional presence and innovation. This competitive landscape reflects steady innovation and broad adoption across industries.

Top Key Players in the Market

- HubSpot, Inc.

- Adobe Systems Inc.

- Oracle Corporation (Eloqua)

- Acoustic L.P.

- Salesforce Inc. (Pardot and Marketing Cloud)

- Microsoft Corporation

- IBM Corporation

- ActiveCampaign LLC

- Klaviyo Inc.

- Act-On Software

- SAP SE

- SugarCRM Inc. (Salesfusion)

- Zoho Corp. (Zoho Marketing Autom.)

- Mailchimp (Intuit)

- Keap

- Omnisend

- Thryv Holdings

- Drip

- Oracle NetSuite

- Braze Inc.

- Others

Recent Developments

- In November 2025, Keap showcased key product innovations at Grow 2025, focusing on AI-driven automation for small businesses. Updates included smarter workflows for customer follow-up, appointment scheduling, and billing reminders, helping users reclaim hours daily while scaling operations efficiently.

- In May 2025, Zoho Corp. highlighted AI-empowered marketing automation at Zoholics 2025, featuring Zoho Campaigns and Social tools for full lifecycle automation. Capabilities include lead scoring, personalized campaigns, and seamless CRM integration for data-driven growth.

Report Scope

Report Features Description Market Value (2025) USD 8.56 Bn Forecast Revenue (2035) USD 36.48 Bn CAGR (2025-2035) 15.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution (Campaign Management, Email Marketing, Inbound Marketing, Mobile Applications, Lead Nurturing & Lead Scoring, Reporting & Analytics, Social Media Marketing, Others), By Deployment (On-premise, Hosted), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By End-use (BFSI, Retail, Healthcare, Telecom & IT, Discrete Manufacturing, Government & Education, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape HubSpot, Inc., Adobe Systems Inc., Oracle Corporation (Eloqua), Acoustic L.P., Salesforce Inc. (Pardot and Marketing Cloud), Microsoft Corporation, IBM Corporation, ActiveCampaign LLC, Klaviyo Inc., Act-On Software, SAP SE, SugarCRM Inc. (Salesfusion), Zoho Corp. (Zoho Marketing Autom.), Mailchimp (Intuit), Keap, Omnisend, Thryv Holdings, Drip, Oracle NetSuite, Braze Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Marketing Automation Software MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Marketing Automation Software MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- HubSpot, Inc.

- Adobe Systems Inc.

- Oracle Corporation (Eloqua)

- Acoustic L.P.

- Salesforce Inc. (Pardot and Marketing Cloud)

- Microsoft Corporation

- IBM Corporation

- ActiveCampaign LLC

- Klaviyo Inc.

- Act-On Software

- SAP SE

- SugarCRM Inc. (Salesfusion)

- Zoho Corp. (Zoho Marketing Autom.)

- Mailchimp (Intuit)

- Keap

- Omnisend

- Thryv Holdings

- Drip

- Oracle NetSuite

- Braze Inc.

- Others