Global Marine Anti-fouling Coatings Market By Coating Type(Self-Polishing Copolymer, Copper-Based, Hybrid, Silicone-Based, Others), By Technology(Solvent-Borne, Water-Borne, High Solids, Others), By Vessel Type(Cargo Ships, Tankers, Bulk Carriers, Offshore Support Vessels, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122785

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

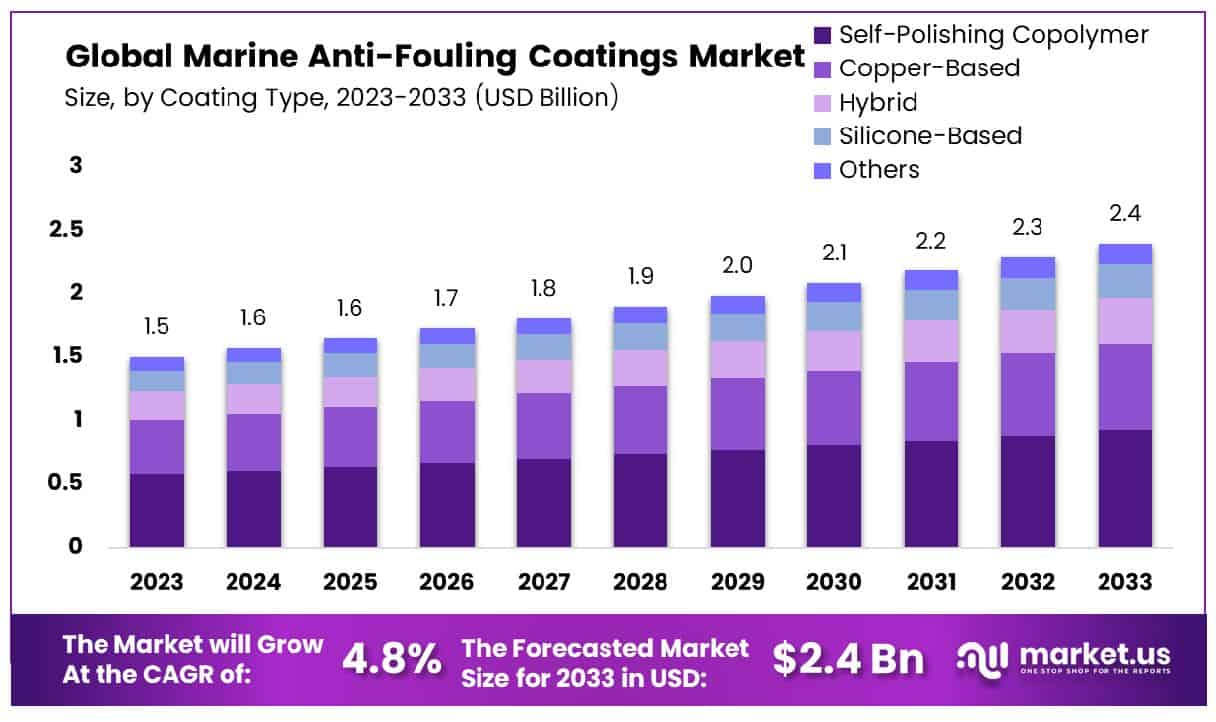

The Global Marine Anti-fouling Coatings Market size is expected to be worth around USD 2.4 Billion by 2033, From USD 1.5 Billion by 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

The Marine Anti-fouling Coatings Market encompasses specialized chemical applications designed to prevent the accumulation of marine organisms on underwater surfaces, such as ships’ hulls and offshore structures. These coatings are critical in enhancing operational efficiency, reducing maintenance costs, and mitigating environmental impacts by decreasing fuel consumption and emissions.

The market’s relevance extends across commercial shipping, naval fleets, and leisure vessels, emphasizing innovations that comply with stringent global environmental regulations. Key market players focus on developing durable, effective, and eco-friendly coatings, crucial for maintaining competitive advantage and operational compliance in the marine industry.

The marine anti-fouling coatings market is increasingly significant, driven by the need to manage marine biodiversity and minimize biofouling on marine vessels and structures. The diversity of marine species, as reflected in the recent data indicating approximately 242,000 described species in global oceans, underscores the complexity of marine ecosystems and the challenges posed by biofouling. Annually, around 2,332 new marine species are identified, though about 25% might be reclassifications of existing species. This brings the true number of unique new species to approximately 1,750 each year.

The vast range of estimated total marine species, from 0.3 million to 2.2 million, highlights the extensive, yet largely unexplored marine biodiversity, particularly in deep-sea environments, where only 7% of new species discoveries occur. This uncharted biodiversity presents both a challenge and an opportunity for the development of anti-fouling coatings. The evolving complexity of marine life necessitates advanced coating solutions that are both effective in preventing biofouling and environmentally sustainable.

Furthermore, the growth of the market can be attributed to increased maritime activity, stringent environmental regulations, and the shipping industry’s need to reduce fuel consumption and greenhouse gas emissions. Marine anti-fouling coatings not only contribute to operational efficiency by preventing the accumulation of organisms on hulls, which can lead to increased drag and fuel usage but also play a crucial role in protecting marine ecosystems from potential invasive species transported via global shipping routes.

Key Takeaways

- Market Growth: The Global Marine Anti-fouling Coatings Market size is expected to be worth around USD 2.4 Billion by 2033, From USD 1.5 Billion by 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

- Regional Dominance: The Asia-Pacific marine anti-fouling coatings market holds a 61.5% share, valued at USD 0.9 billion.

- Segmentation Insights:

- By Coating Type: Self-polishing copolymer dominates with a 38.6% market share in coatings.

- By Technology: Water-borne technology is preferred, holding 41.5% of the market segment.

- By Vessel Type: Cargo Ships lead vessel types, comprising 31.5% of the total.

- Growth Opportunities: The marine anti-fouling coatings market is expanding through eco-friendly material innovations and entry into emerging markets, driven by environmental regulations and increased maritime activities in developing regions.

Driving Factors

Increasing Demand for Environmentally Sustainable Coatings

The demand for environmentally sustainable coatings is accelerating the growth of the marine anti-fouling coatings market. This trend is driven by heightened global environmental awareness and stricter regulations aimed at reducing the ecological impact of marine operations. Anti-fouling coatings are critical for reducing the growth of organisms on ship hulls, which if unchecked, can lead to increased fuel consumption and smart greenhouse gas emissions.

The push for sustainability has spurred innovation in coating formulations that are less toxic and more biodegradable, yet effective in preventing biofouling. The market response has been positive, as stakeholders in marine industries seek to comply with environmental standards while maintaining operational efficiency. This shift towards eco-friendly solutions is transforming market dynamics, with a growing preference for coatings that offer long-term performance without compromising ecological integrity.

Expansion of Global Shipping Trade

The expansion of global shipping trade acts as a robust catalyst for the growth of the marine anti-fouling coatings market. As international trade volumes continue to climb, the demand for efficient and durable marine vessels escalates. Anti-fouling coatings play a pivotal role in maintaining the performance of these vessels, significantly reducing the frequency and need for dry-dock repairs. These coatings directly impact fuel efficiency by minimizing the drag caused by marine organisms attached to the hull.

The increased activity in global shipping routes consequently boosts the demand for advanced anti-fouling solutions, as ship operators seek to optimize operational costs and adhere to international maritime pollution standards. This relationship underscores a critical market dynamic where the growth of the shipping industry inherently stimulates the demand for innovative marine coatings that align with global trade efficiency and sustainability goals.

Restraining Factors

Stringent Environmental Regulations on the Use of Toxic Substances in Coatings

Stringent environmental regulations governing the use of toxic substances in marine coatings pose significant challenges to the marine anti-fouling coatings market. These regulations are designed to mitigate the environmental impact of harmful chemicals found in traditional anti-fouling paints, such as tributyltin (TBT), which has been widely banned. Regulatory bodies worldwide are increasingly focusing on reducing the aquatic toxicity and environmental degradation caused by these coatings.

As a result, manufacturers are compelled to invest heavily in research and development to formulate coatings that meet these stringent standards without compromising on efficacy. This regulatory pressure slows the adoption of existing products and extends the time and financial investment required to bring new, compliant products to market. While this factor curtails rapid market expansion, it also drives innovation toward safer and more sustainable solutions, reshaping the market landscape.

High Cost of Raw Materials for Advanced Anti-fouling Coatings

The high cost of raw materials for advanced anti-fouling coatings is another key factor that restrains market growth. The development of new and environmentally friendly anti-fouling products often requires unique, high-quality raw materials that are more expensive than those used in traditional formulations. These costs are exacerbated by the volatile prices of key components, such as copper and specific biocide agents, which are integral to the effectiveness of these coatings.

The increased production costs are typically passed on to the consumer, leading to higher prices for end-users and potentially limiting market penetration, especially in cost-sensitive regions. Combined with stringent environmental regulations, the high cost of raw materials necessitates a delicate balance between performance, compliance, and affordability in the marine anti-fouling coatings market. Together, these factors significantly shape the competitive dynamics and strategic decisions within the industry.

By Coating Type Analysis

Self-polishing copolymer dominates with a 38.6% market share, favored for its efficacy and longevity in marine applications.

In 2023, the Marine Anti-fouling Coatings Market observed significant developments in the By Coating Type segment, with Self-Polishing Copolymer emerging as a predominant choice. This type of coating secured more than a 38.6% share, underscoring its appeal in marine applications due to its effective fouling prevention and reduced maintenance requirements. The market segments for anti-fouling coatings also include Copper-Based, Hybrid, Silicone-Based, and Other types, each catering to specific performance criteria and environmental considerations.

Copper-based coatings, known for their biocidal properties, remain a popular choice for preventing organism growth on hulls, though environmental regulations are tightening around their use. Hybrid coatings are gaining traction as they combine the benefits of hard and soft coatings, offering versatility and long-term protection. Silicone-based coatings, notable for their low friction and high durability, are increasingly preferred for vessels that operate at high speeds or require frequent cleaning. The Others category includes specialized coatings that may incorporate novel materials or cater to niche market needs.

The dominance of Self-Polishing Copolymer can be attributed to its advanced formulation which allows for gradual surface erosion, continuously exposing a fresh, active layer that combats marine growth. This mechanism not only ensures consistent performance but also aligns with the industry’s push toward more sustainable practices by reducing the frequency and intensity of maintenance procedures.

As environmental regulations become stricter and the demand for more efficient maritime operations increases, the market for Marine Anti-fouling Coatings is expected to evolve. Innovations in coating technology and shifts in regulatory frameworks will likely influence the market dynamics, steering growth across different coating types based on their ecological impact and operational efficiencies.

By Technology Analysis

Water Borne technology leads with 41.5% usage, preferred for its environmental benefits and efficiency in application.

In 2023, the By Technology segment of the Marine Anti-fouling Coatings Market was notably led by Water Borne Coatings, which captured over a 41.5% market share. This segment outperformed others such as Solvent-Borne, High Solids, and various other technology classifications. Waterborne coatings’ prominence is primarily due to their reduced environmental impact and compliance with stringent global VOC (Volatile Organic Compounds) emission standards.

Solvent-borne coatings, while effective, face regulatory challenges due to their high VOC content, which has prompted a shift towards more sustainable alternatives. Solids coatings are another significant segment, offering lower VOC emissions than traditional Solvent-Borne coatings and providing durable protection against fouling. The Others category encompasses emerging technologies that may include new compositions or innovative application methods that meet specific niche requirements.

The substantial share held by Water Borne technology in the marine anti-fouling coatings market is driven by its advantages in terms of environmental safety and regulatory compliance. These coatings minimize the release of harmful substances into marine environments, an attribute increasingly valued in light of global environmental conservation efforts. Additionally, the ease of application and cleanup associated with water-based formulations not only reduces operational costs but also aligns with the maritime industry’s sustainability goals.

Looking forward, the demand for water-borne anti-fouling coatings is expected to continue growing as the industry prioritizes ecological impact and regulatory adherence. Innovations in this technology, aimed at enhancing performance and reducing costs, will further cement its position in the market and drive the development of next-generation marine coatings.

By Vessel Type Analysis

Cargo Ships constitute 31.5% of the market, reflecting their critical role in global maritime logistics and transportation.

In 2023, the By Vessel Type segment of the Marine Anti-fouling Coatings Market was predominantly led by Cargo Ships, which secured a commanding 31.5% market share. This segment was followed by Tankers, Bulk Carriers, Offshore Support Vessels, and a collection of Other vessel types, each tailored to specific operational needs and environmental pressures.

Cargo Ships, serving as the backbone of global trade, require durable and efficient anti-fouling solutions to minimize downtime and maintenance costs. The high market share of Cargo Ships in this segment is indicative of the critical need for coatings that can withstand extensive voyages and diverse marine conditions. Tankers, another key segment, also rely heavily on anti-fouling coatings to prevent biofouling, which can affect fuel efficiency and increase greenhouse gas emissions.

Bulk Carriers represent a significant portion of the market, with specific needs related to their large deadweight tonnage and the variety of bulk goods they transport. Offshore Support Vessels, which assist in the operations of offshore oil and gas fields, require robust anti-fouling solutions to handle the harsh environments and stationary periods that can promote organism growth.

The dominance of Cargo Ships in the anti-fouling coatings market can be attributed to the increasing volume of global maritime trade, necessitating extended protection against organisms that can adhere to hulls and impair a ship’s performance. As regulatory pressures mount and environmental sustainability become more critical, the demand for advanced, eco-friendly anti-fouling coatings is expected to rise across all vessel types, reinforcing the need for innovation and regulatory compliance in this market sector.

Key Market Segments

By Coating Type

- Self-Polishing Copolymer

- Copper-Based

- Hybrid

- Silicone-Based

- Others

By Technology

- Solvent-Borne

- Water-Borne

- High Solids

- Others

By Vessel Type

- Cargo Ships

- Tankers

- Bulk Carriers

- Offshore Support Vessels

- Others

Growth Opportunities

Development of New Eco-Friendly Materials

The global marine anti-fouling coatings market is witnessing significant growth opportunities, particularly with the development of new eco-friendly materials. This advancement is driven by stringent environmental regulations and the marine industry’s shift towards sustainability. Innovations in biocide-free and low-VOC (Volatile Organic Compounds) coatings are set to redefine industry standards, offering enhanced longevity and reduced environmental impact.

These new materials not only meet regulatory compliance but also provide superior protection against biofouling, which can degrade vessel performance and increase fuel consumption. As shipping companies increasingly prioritize eco-efficiency to reduce carbon footprints, the demand for these advanced coatings is expected to surge. Consequently, companies investing in research and development of environmentally friendly anti-fouling solutions are likely to capture significant market share and benefit from competitive advantages.

Expansion into Emerging Markets

Emerging markets present a lucrative growth avenue for the marine anti-fouling coatings industry. Regions such as Southeast Asia, Africa, and Latin America are experiencing rapid growth in maritime activities due to increased trade and investment in shipbuilding capacities. However, these markets have traditionally had lower adoption rates of advanced coating technologies, primarily due to cost constraints and limited regulatory pressures.

By targeting these regions, coating manufacturers can tap into new customer bases that are gradually embracing more sophisticated maritime operations. Strategic partnerships with local firms and government bodies can facilitate market entry and adaptation to local market conditions. Additionally, tailoring products to meet the specific needs and environmental conditions of these emerging markets can further enhance market penetration and growth prospects.

Latest Trends

Adoption of Nanotechnology in Anti-Fouling Coatings

The global marine anti-fouling coatings market is undergoing a transformation with the adoption of nanotechnology, which enhances coating efficacy and environmental compliance. Nanotechnology enables the development of coatings with improved surface smoothness and reduced thickness, which significantly decrease drag and improve fuel efficiency. These nano-coatings also offer precise control over the release of biocides, which can extend the lifespan of the coating while minimizing ecological impact.

The integration of nanotechnology in anti-fouling coatings aligns with the increasing environmental regulations and the shipping industry’s push toward operational efficiency and sustainability. Companies that lead in this technology are positioned to gain substantial market share, as more ship operators and builders demand high-performance solutions that also contribute to environmental conservation.

Increased Use of Silicone-Based Anti-Fouling Coatings

Silicone-based anti-fouling coatings are gaining popularity due to their non-toxic and effective fouling-prevention properties. These coatings function by creating a low-friction surface that inhibits organism attachment and facilitates easy removal of fouling through natural water flow. The increased adoption is particularly evident as industries seek alternatives to traditional biocidal anti-fouling agents, which are facing stricter regulatory scrutiny due to their environmental impact.

Silicone-based coatings are proving to be a viable and sustainable alternative, offering long-term cost savings through reduced maintenance and fuel consumption. This trend is expected to continue as technological advancements improve the durability and effectiveness of silicone-based solutions, making them more appealing to a broader segment of the maritime industry.

Regional Analysis

The Asia-Pacific region dominates the marine anti-fouling coatings market, holding 61.5% with revenues reaching USD 0.9 billion.

The global marine anti-fouling coatings market is segmented into several key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Among these, Asia Pacific dominates the market with a significant 61.5% share, amounting to USD 0.9 billion, largely due to extensive shipbuilding activities and the presence of major shipping routes in countries like China, South Korea, and Japan.

In North America, the market is driven by advancements in eco-friendly coating technologies and stringent environmental regulations, particularly in the United States and Canada. This region is focusing on innovation in biocide-free and silicone-based coatings, which are less harmful to marine ecosystems.

Europe follows closely, with a strong emphasis on sustainability and the adoption of stringent EU regulations against toxic chemicals in marine coatings. European ship operators are increasingly adopting advanced anti-fouling systems that minimize environmental impact while enhancing vessel efficiency, supporting the growth of the market in this region.

The Middle East & Africa (MEA) market is expanding due to the increasing marine trade activities and investments in ship repair and maintenance facilities, particularly in the Gulf Cooperation Council (GCC) countries, which are enhancing their maritime infrastructure.

Latin America, though smaller in comparison, is seeing gradual growth. The expansion is supported by the development of port infrastructure and an increase in maritime trade, particularly in countries like Brazil and Argentina.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In the global marine anti-fouling coatings market in 2023, several key players are pivotal in driving industry trends and market dynamics. Among these, AkzoNobel, PPG Industries, and Hempel A/S are leaders, each leveraging their robust research and development capabilities to innovate and enhance product offerings.

AkzoNobel, a long-standing leader in the industry, continues to focus on sustainable solutions that meet stringent environmental regulations. The company’s commitment to eco-efficiency has led to the development of advanced biocide-free coatings, which are increasingly favored as regulations on marine pollution tighten globally. This strategic focus not only enhances AkzoNobel’s market position but also caters to the growing demand for environmentally friendly marine solutions.

PPG Industries, known for its technological prowess, has expanded its anti-fouling product line to include coatings that offer longer durations between dry dockings, thereby reducing maintenance costs and downtime for shipping companies. PPG’s emphasis on cost-effective and high-performance solutions aligns with the market’s need for durability and operational efficiency.

Hempel A/S, with its repeated appearance among the market leaders, underscores its significant market share and influence. Hempel’s strategy revolves around continuous innovation and geographic expansion, aiming to meet the local and global demands of maritime operators.

These companies, along with others like Jotun and Sherwin-Williams, are critical in shaping the competitive landscape of the marine anti-fouling coatings market. Their efforts to combine performance with sustainability are setting new standards in the industry, influencing both market practices and regulatory frameworks worldwide. As environmental considerations become increasingly decisive in product development, these key players’ proactive approaches are expected to yield substantial market advantages.

Market Key Players

- AkzoNobel

- PPG Industries

- Hempel A/S

- Jotun

- Sherwin-Williams Company

- Nippon Paint Marine Coatings

- Chugoku Marine Paints

- Kansai Paint Co., Ltd.

- RPM International Inc.

- Boero Group

- Marine Coatings – BASF SE

- KCC Corporation

- The Chemours Company

Recent Development

- In May 2024, GIT Coatings pioneers graphene-based hard foul release coatings, enhancing vessel efficiency without biocides. EverClean’s robotic hull grooming minimizes biofouling impact sustainably, redefining sustainability maintenance practices for the maritime industry.

- In November 2023, Tnemec introduced HullClad coatings, designed to prevent marine fouling, enhancing vessel performance. Features include self-polishing antifouling paints and extended recoat windows. These coatings offer up to 60-month service life and are low VOC.

Report Scope

Report Features Description Market Value (2023) USD 1.5 Billion Forecast Revenue (2033) USD 2.4 Billion CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Coating Type(Self-Polishing Copolymer, Copper-Based, Hybrid, Silicone-Based, Others), By Technology(Solvent-Borne, Water-Borne, High Solids, Others), By Vessel Type(Cargo Ships, Tankers, Bulk Carriers, Offshore Support Vessels, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AkzoNobel, PPG Industries, Hempel A/S, Jotun, Sherwin-Williams Company, Nippon Paint Marine Coatings, Chugoku Marine Paints, Kansai Paint Co., Ltd., Hempel A/S, RPM International Inc., Boero Group, Marine Coatings – BASF SE, KCC Corporation, Hempel A/S, The Chemours Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Marine Anti-fouling Coatings Market Size in 2023?The Global Marine Anti-fouling Coatings Market Size is USD 1.5 Billion in 2023.

What is the projected CAGR at which the Global Marine Anti-fouling Coatings Market is expected to grow at?The Global Marine Anti-fouling Coatings Market is expected to grow at a CAGR of 4.8% (2024-2033).

List the segments encompassed in this report on the Global Marine Anti-fouling Coatings Market?Market.US has segmented the Global Marine Anti-fouling Coatings Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Coating Type(Self-Polishing Copolymer, Copper-Based, Hybrid, Silicone-Based, Others), By Technology(Solvent-Borne, Water-Borne, High Solids, Others), By Vessel Type(Cargo Ships, Tankers, Bulk Carriers, Offshore Support Vessels, Others)

List the key industry players of the Global Marine Anti-fouling Coatings Market?AkzoNobel, PPG Industries, Hempel A/S, Jotun, Sherwin-Williams Company, Nippon Paint Marine Coatings, Chugoku Marine Paints, Kansai Paint Co., Ltd., Hempel A/S, RPM International Inc., Boero Group, Marine Coatings - BASF SE, KCC Corporation, Hempel A/S, The Chemours Company

Name the key areas of business for Global Marine Anti-fouling Coatings Market ?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Marine Anti-fouling Coatings Market.

Marine Anti-fouling Coatings MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Marine Anti-fouling Coatings MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample - Market Growth: The Global Marine Anti-fouling Coatings Market size is expected to be worth around USD 2.4 Billion by 2033, From USD 1.5 Billion by 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

-

-

- AkzoNobel

- PPG Industries

- Hempel A/S

- Jotun

- Sherwin-Williams Company

- Nippon Paint Marine Coatings

- Chugoku Marine Paints

- Kansai Paint Co., Ltd.

- RPM International Inc.

- Boero Group

- Marine Coatings - BASF SE

- KCC Corporation

- The Chemours Company