Global Machinery Rental and Leasing Market Size, Share, Growth Analysis Service Type (Rental, Leasing), Equipment Type (Construction Equipment, Industrial Equipment, Agricultural Equipment, Material Handling Equipment), Customer Type (Small and Medium Enterprises (SMEs), Large Corporations, Government Agencies, Individual Users), Mode of Rental (Offline, Online), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176571

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

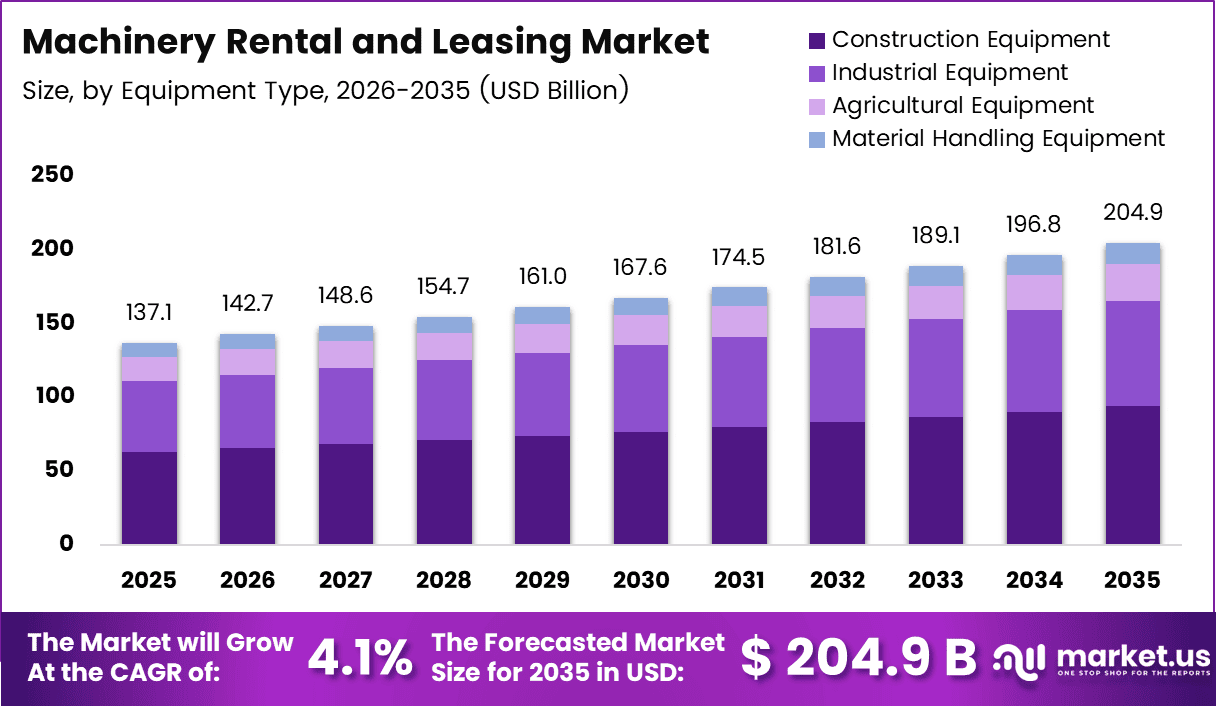

Global Machinery Rental and Leasing Market size is expected to be worth around USD 204.9 Billion by 2035 from USD 137.1 Billion in 2025, growing at a CAGR of 4.1% during the forecast period 2026 to 2035.

The machinery rental and leasing market encompasses services where businesses and individuals access construction, industrial, agricultural, and material handling equipment through rental or leasing arrangements. This model eliminates upfront capital expenditure while providing operational flexibility. Moreover, it enables access to modern technology without ownership responsibilities or depreciation concerns.

The market has gained significant traction as companies increasingly adopt asset-light business strategies. Rising capital costs of heavy machinery make ownership economically challenging for many enterprises. Consequently, rental services offer cost-effective alternatives with minimal maintenance obligations. Additionally, short-term project requirements align perfectly with flexible rental arrangements.

Growth opportunities are expanding across multiple sectors including infrastructure development and smart city initiatives. The integration of advanced technologies such as telematics and IoT enhances fleet management efficiency. Furthermore, environmental considerations are driving demand for electric and low-emission rental equipment. Therefore, service providers are modernizing their fleets accordingly.

Small and medium enterprises represent a substantial customer segment due to limited capital availability. These businesses benefit from operational flexibility without long-term financial commitments. However, rental companies face challenges including high maintenance costs and equipment availability during peak periods. Nevertheless, the market continues expanding globally.

According to Contractors Rental, over 2,000 pieces of equipment valued at over $180 million are available with 20 dedicated delivery professionals and 65 field service technicians providing service 24/7. This demonstrates the scale of operations in the rental sector.

According to Titan Machinery, leasing offers numerous benefits including 100% financing, accelerated tax write-offs, improved cash flow, and access to modern equipment. These advantages make leasing increasingly attractive compared to outright purchases. Additionally, flexibility at lease-term end provides strategic advantages for businesses.

The shift from ownership to rental models reflects broader economic trends favoring operational efficiency. Rapid technology upgrades make equipment ownership economically inefficient as machinery becomes obsolete faster. Therefore, rental services enable businesses to access latest technology without depreciation risks. The market outlook remains positive with sustained growth expected.

Key Takeaways

- Global Machinery Rental and Leasing Market is projected to reach USD 204.9 Billion by 2035 from USD 137.1 Billion in 2025, growing at a CAGR of 4.1%

- Rental services dominate the market with 76.3% share in the service type segment

- Construction Equipment holds the largest share at 45.8% in the equipment type segment

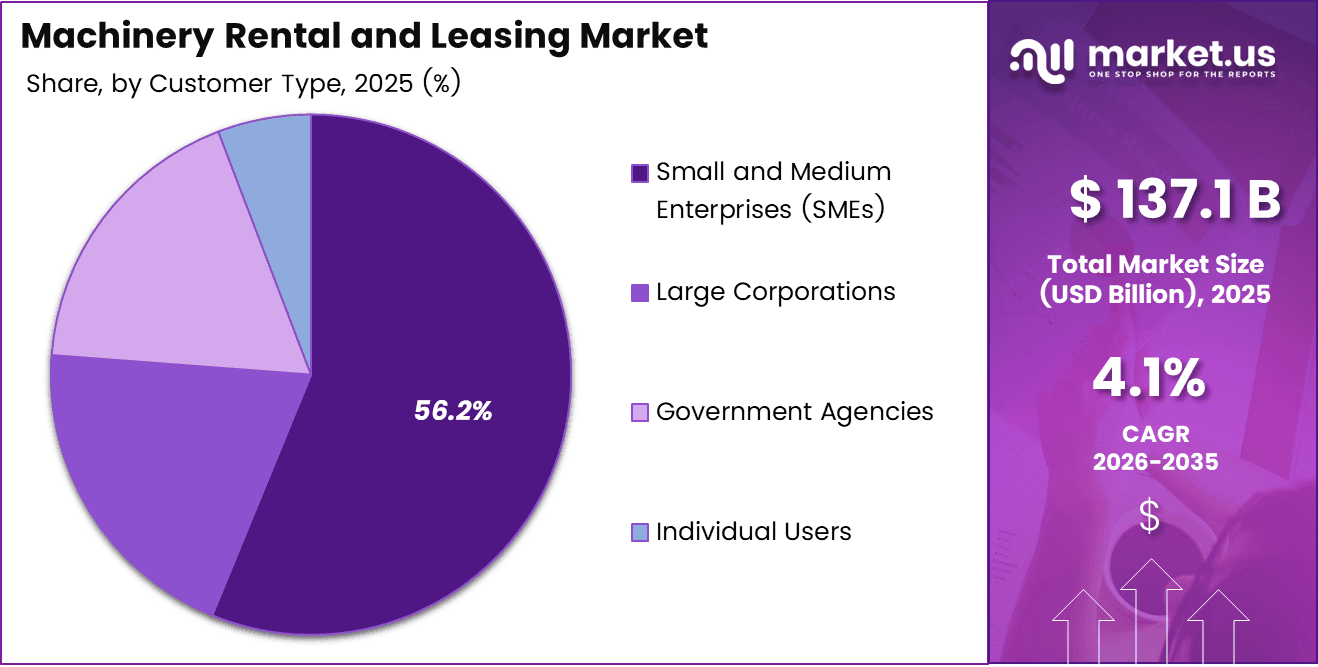

- Small and Medium Enterprises account for 56.2% market share in the customer type segment

- Offline rental mode commands 82.4% market share compared to online platforms

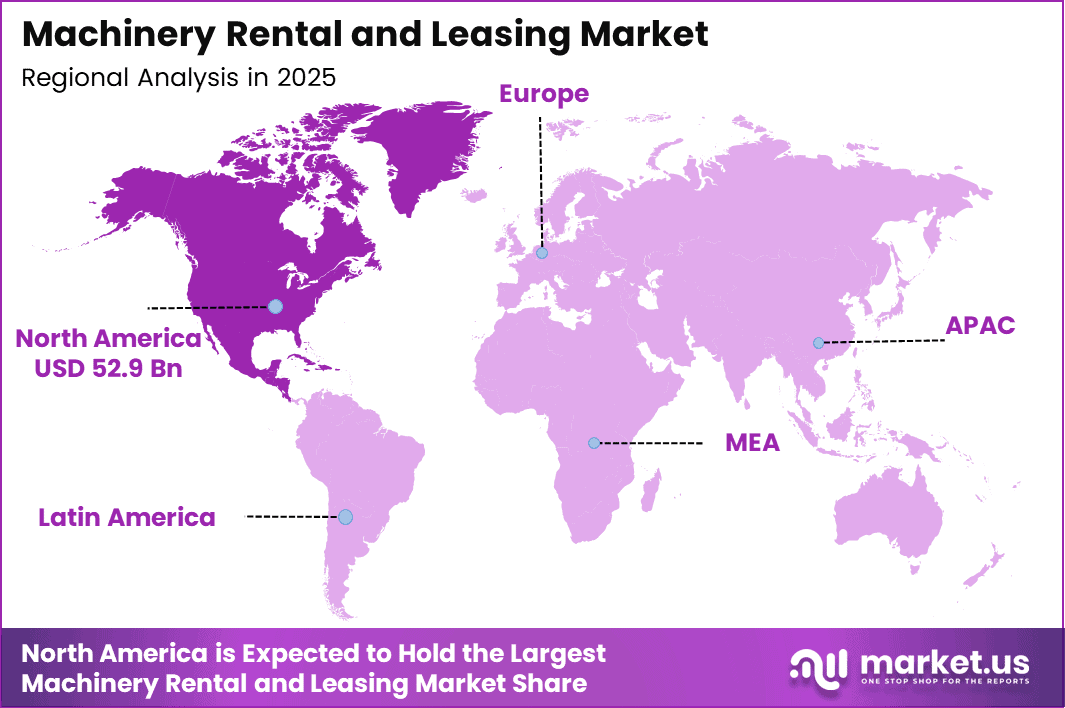

- North America leads the regional market with 38.6% share valued at USD 52.9 Billion

Service Type Analysis

Rental dominates with 76.3% due to flexibility and lower financial commitment requirements.

In 2025, Rental held a dominant market position in the Service Type segment of Machinery Rental and Leasing Market, with a 76.3% share. Rental services provide businesses immediate equipment access without long-term contractual obligations or substantial capital investment. Moreover, short-term projects benefit from flexible rental arrangements that align with project duration. This model appeals particularly to enterprises seeking operational agility.

Leasing offers structured financial arrangements with predetermined terms and longer commitments. This option provides 100% financing solutions with accelerated tax benefits and improved cash flow management. Additionally, leasing enables businesses to access modern equipment while spreading costs over extended periods. However, it requires greater financial commitment compared to traditional rental services.

Equipment Type Analysis

Construction Equipment dominates with 45.8% due to extensive infrastructure development activities.

In 2025, Construction Equipment held a dominant market position in the Equipment Type segment of Machinery Rental and Leasing Market, with a 45.8% share. Infrastructure projects worldwide require excavators, bulldozers, cranes, and specialized construction machinery on temporary basis. Moreover, rising urbanization and smart city initiatives drive sustained demand. Therefore, rental services provide cost-effective access to expensive construction equipment.

Industrial Equipment includes manufacturing machinery, power generation units, and processing equipment for various industrial applications. This segment serves sectors requiring temporary capacity expansion or specialized machinery for specific operations. Additionally, rapid technology evolution encourages industrial firms to rent rather than purchase equipment. Consequently, this category experiences steady growth.

Agricultural Equipment encompasses tractors, harvesters, and specialized farming machinery used during specific seasons. Farmers and agricultural enterprises prefer rental arrangements to avoid idle equipment during off-seasons. Furthermore, modern precision agriculture technology becomes accessible through rental services. This segment shows particular strength in regions with seasonal agricultural cycles.

Material Handling Equipment covers forklifts, pallet jacks, conveyors, and warehouse machinery essential for logistics operations. E-commerce growth has significantly increased demand for material handling solutions in warehousing facilities. Moreover, temporary peak-season requirements make rental options particularly attractive. Therefore, this segment benefits from expanding logistics infrastructure globally.

Customer Type Analysis

Small and Medium Enterprises dominate with 56.2% due to limited capital availability and operational flexibility needs.

In 2025, Small and Medium Enterprises (SMEs) held a dominant market position in the Customer Type segment of Machinery Rental and Leasing Market, with a 56.2% share. SMEs typically lack substantial capital for purchasing expensive machinery outright. Moreover, rental arrangements provide access to modern equipment without depleting financial reserves. Consequently, this customer segment represents the largest market share across all regions.

Large Corporations utilize rental services for project-based requirements, capacity expansion, and equipment trials before purchase decisions. These enterprises maintain core equipment fleets while renting specialized or supplementary machinery. Additionally, large corporations leverage rental services during peak demand periods. However, they represent smaller market share compared to SMEs.

Government Agencies engage rental services for infrastructure projects, public works, and emergency response situations. Budget constraints and project-specific requirements make rental arrangements financially prudent. Furthermore, government contracts often involve temporary equipment needs aligned with project timelines. Therefore, this segment contributes steady demand.

Individual Users include contractors, small business owners, and homeowners requiring machinery for specific tasks. This segment primarily rents construction and material handling equipment for short-term applications. Moreover, individual users prioritize accessibility and affordability over long-term ownership. Consequently, rental services perfectly address their occasional equipment needs.

Mode of Rental Analysis

Offline dominates with 82.4% due to established relationships and equipment inspection requirements.

In 2025, Offline held a dominant market position in the Mode of Rental segment of Machinery Rental and Leasing Market, with an 82.4% share. Traditional brick-and-mortar rental outlets provide hands-on equipment inspection and personalized customer service. Moreover, established relationships between rental companies and clients facilitate trust and repeat business. Therefore, offline channels continue dominating despite digital transformation trends.

Online platforms are emerging rapidly as digital booking systems gain acceptance among younger demographics and tech-savvy businesses. These platforms offer convenient comparison shopping, instant availability verification, and streamlined booking processes. Additionally, online rental services reduce transaction time and expand geographic reach. However, customers still prefer physical inspection for expensive machinery rentals.

Drivers

Rising Capital Costs and Asset-Light Business Models Drive Market Expansion

Heavy machinery prices continue escalating due to advanced technology integration and manufacturing costs. Businesses increasingly recognize that substantial capital investments in equipment ownership create financial strain. Moreover, depreciation and obsolescence risks make outright purchases economically inefficient. Therefore, rental and leasing arrangements emerge as preferred alternatives for accessing necessary equipment.

Short-term infrastructure and construction projects require specialized machinery for limited durations. Purchasing equipment for temporary projects results in significant idle capacity and maintenance expenses. Consequently, rental services align perfectly with project-based requirements and operational timelines. Additionally, this approach eliminates concerns about equipment disposal after project completion.

Small and medium enterprises particularly benefit from operational flexibility provided by rental arrangements. These businesses can scale equipment capacity according to demand fluctuations without permanent financial commitments. Furthermore, rapid technology upgrades in machinery make ownership increasingly impractical for many organizations. Therefore, rental models enable access to latest equipment innovations without substantial capital expenditure.

Restraints

High Maintenance Costs and Equipment Availability Challenges Limit Market Growth

Rental companies face substantial maintenance and repair expenses that directly impact profit margins. Heavy machinery requires regular servicing, spare parts replacement, and comprehensive safety inspections. Moreover, equipment downtime during maintenance periods reduces revenue-generating capacity. Consequently, these operational costs create financial pressure on rental service providers.

Peak demand periods in construction and agriculture sectors create equipment shortages across rental networks. Limited availability during critical project phases forces customers to seek alternative solutions or purchase equipment. Additionally, seasonal demand fluctuations complicate inventory management and capacity planning for rental companies. Therefore, maintaining optimal fleet size remains challenging.

Transportation logistics for heavy machinery add complexity and expense to rental operations. Delivering specialized equipment to remote project sites requires significant resources and coordination. Furthermore, equipment mobilization costs can substantially increase overall rental expenses for customers. These factors collectively restrain market growth and operational efficiency.

Growth Factors

Infrastructure Development and Technology Integration Accelerate Market Expansion

Smart city initiatives and large-scale infrastructure projects create sustained demand for construction and industrial equipment. Governments worldwide are investing heavily in transportation networks, utilities, and urban development. Moreover, these mega-projects require diverse machinery on temporary basis, favoring rental arrangements. Therefore, infrastructure spending directly correlates with rental market growth.

Mining and energy sectors increasingly adopt rental equipment to manage operational costs and maintain flexibility. These industries face volatile commodity prices requiring agile capital allocation strategies. Additionally, specialized mining and energy equipment rental eliminates substantial upfront investments. Consequently, rental adoption in these sectors presents significant growth opportunities.

E-commerce expansion drives explosive demand for warehousing facilities equipped with material handling equipment. Distribution centers require forklifts, conveyors, and automated systems to manage increasing order volumes. Furthermore, seasonal peaks in e-commerce create temporary capacity requirements perfectly suited for rental solutions. Emerging economies with developing rental infrastructure offer substantial untapped market potential for expansion.

Emerging Trends

Digital Transformation and Sustainability Reshape Industry Landscape

Telematics and IoT integration enables real-time fleet monitoring, predictive maintenance, and operational efficiency improvements. Rental companies leverage connected equipment data to optimize utilization rates and reduce downtime. Moreover, customers benefit from performance analytics and usage tracking capabilities. Therefore, smart machinery rental represents the industry’s technological future.

Environmental regulations and corporate sustainability commitments drive demand for electric and low-emission rental equipment. Manufacturers are developing battery-powered alternatives to traditional diesel machinery across all equipment categories. Additionally, customers increasingly prioritize environmentally responsible equipment choices for their projects. Consequently, green rental fleets are becoming competitive differentiators.

Online platforms for equipment rental booking are transforming traditional business models and customer interactions. Digital marketplaces enable instant availability verification, transparent pricing, and seamless transaction processes. Furthermore, long-term leasing contracts are gaining preference over short-term rentals for predictable costs and guaranteed equipment access. These trends indicate fundamental shifts in customer preferences and service delivery models.

Regional Analysis

North America Dominates the Machinery Rental and Leasing Market with a Market Share of 38.6%, Valued at USD 52.9 Billion

North America maintains market leadership with 38.6% share valued at USD 52.9 Billion due to extensive infrastructure spending and mature rental industry. The United States hosts numerous established rental companies with comprehensive equipment fleets and nationwide service networks. Moreover, construction activity and industrial operations sustain consistent equipment demand. Canada contributes significantly through resource sector and infrastructure development projects.

Europe Machinery Rental and Leasing Market Trends

Europe demonstrates strong rental market presence driven by stringent environmental regulations and sustainability initiatives. Countries including Germany, France, and the United Kingdom maintain well-developed rental infrastructure serving construction and industrial sectors. Additionally, European Union infrastructure investments and green energy projects generate substantial equipment requirements. The region shows particular strength in electric and low-emission machinery adoption.

Asia Pacific Machinery Rental and Leasing Market Trends

Asia Pacific represents the fastest-growing regional market supported by rapid urbanization and infrastructure development. China, India, and Southeast Asian nations are investing heavily in transportation networks, smart cities, and industrial facilities. Moreover, growing SME presence and limited capital availability encourage rental adoption. Therefore, this region offers substantial growth potential for international rental companies.

Middle East & Africa Machinery Rental and Leasing Market Trends

Middle East and Africa experience demand growth from construction megaprojects and oil and gas sector activities. Gulf Cooperation Council nations invest substantially in infrastructure and economic diversification initiatives. Additionally, African markets show emerging rental adoption as construction industries develop. However, market penetration remains lower compared to developed regions.

Latin America Machinery Rental and Leasing Market Trends

Latin America demonstrates moderate growth supported by mining operations, agricultural activities, and infrastructure development. Brazil and Mexico represent primary markets with established rental industries serving diverse sectors. Moreover, economic development and urbanization trends support gradual market expansion. Nevertheless, economic volatility occasionally impacts equipment investment and rental demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

United Rentals Inc. maintains the leading position in North American equipment rental with comprehensive fleet offerings across construction and industrial segments. The company announced acquisition of H&E Equipment Services Inc. in January 2025 valued at USD 4.8 billion, expanding capacity in strategic markets. Moreover, this transaction provides attractive risk-adjusted returns while strengthening competitive positioning. The company demonstrates consistent growth through strategic acquisitions and organic expansion.

Ashtead Group plc operates extensively through its Sunbelt Rentals brand across United States, Canada, and United Kingdom markets. The company provides construction equipment, industrial tools, and specialty rental solutions to diverse customer segments. Additionally, Ashtead maintains strong financial performance through operational efficiency and market penetration strategies. Therefore, the company represents a major international player.

Herc Holdings Inc. delivers equipment rental solutions serving construction, industrial, and infrastructure sectors throughout North America. The company emphasizes customer service excellence, fleet modernization, and technology integration to enhance competitive advantages. Furthermore, Herc focuses on expanding specialty equipment offerings and digital platform capabilities. Consequently, the company maintains strong market presence.

WillScot Mobile Mini Holdings Corp. specializes in modular space and portable storage solutions alongside traditional equipment rental services. The company serves construction sites, industrial facilities, and commercial enterprises requiring temporary infrastructure. Moreover, WillScot combines equipment rental with workspace solutions creating comprehensive project support. This integrated approach differentiates the company’s market positioning.

Key players

- United Rentals Inc.

- Ashtead Group plc

- Herc Holdings Inc.

- WillScot Mobile Mini Holdings Corp.

- Aggreko plc

- Maxim Crane Works

- Caterpillar (The Cat Rental Store)

- Finning International

- Kiloutou SAS

- Loxam Group

Recent Developments

- January 2026 – Volvo Construction Equipment completed acquisition of Swecon following European Commission approval. The transaction acquired Swecon’s business operations in Sweden, Germany, and the Baltics including Entrack, valued at an enterprise value of 7 billion SEK. This strategic acquisition expands Volvo CE’s distribution network and market presence across Northern Europe.

- January 2025 – United Rentals announced acquisition of H&E Equipment Services Inc. in a $4.8 billion transaction. This acquisition will expand capacity in strategic United States markets and provides attractive risk-adjusted returns. The combination strengthens United Rentals’ position as the industry leader.

Report Scope

Report Features Description Market Value (2025) USD 137.1 Billion Forecast Revenue (2035) USD 204.9 Billion CAGR (2026-2035) 4.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Service Type (Rental, Leasing), Equipment Type (Construction Equipment, Industrial Equipment, Agricultural Equipment, Material Handling Equipment), Customer Type (Small and Medium Enterprises (SMEs), Large Corporations, Government Agencies, Individual Users), Mode of Rental (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape United Rentals Inc., Ashtead Group plc, Herc Holdings Inc., WillScot Mobile Mini Holdings Corp., Aggreko plc, Maxim Crane Works, Caterpillar (The Cat Rental Store), Finning International, Kiloutou SAS, Loxam Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Machinery Rental and Leasing MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Machinery Rental and Leasing MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- United Rentals Inc.

- Ashtead Group plc

- Herc Holdings Inc.

- WillScot Mobile Mini Holdings Corp.

- Aggreko plc

- Maxim Crane Works

- Caterpillar (The Cat Rental Store)

- Finning International

- Kiloutou SAS

- Loxam Group