Global Machinery Breakdown Insurance Market Size, Share, Growth Analysis By Coverage Type (Mechanical Breakdown, Electrical Breakdown, Electronic Breakdown, Additional Coverages), By Equipment Type (Heavy Machinery, Power Equipment, Specialized Equipment), By End-User (Large Enterprises, Small & Medium Enterprises, Public Sector Entities), By Industry Vertical (Manufacturing, Power Generation, Oil & Gas, Mining, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168587

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Finance

- AI Industry Adoption

- Emerging Trends

- US Market Size

- By Coverage Type

- By Equipment Type

- By End-User

- By Industry Vertical

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Trending Factors

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

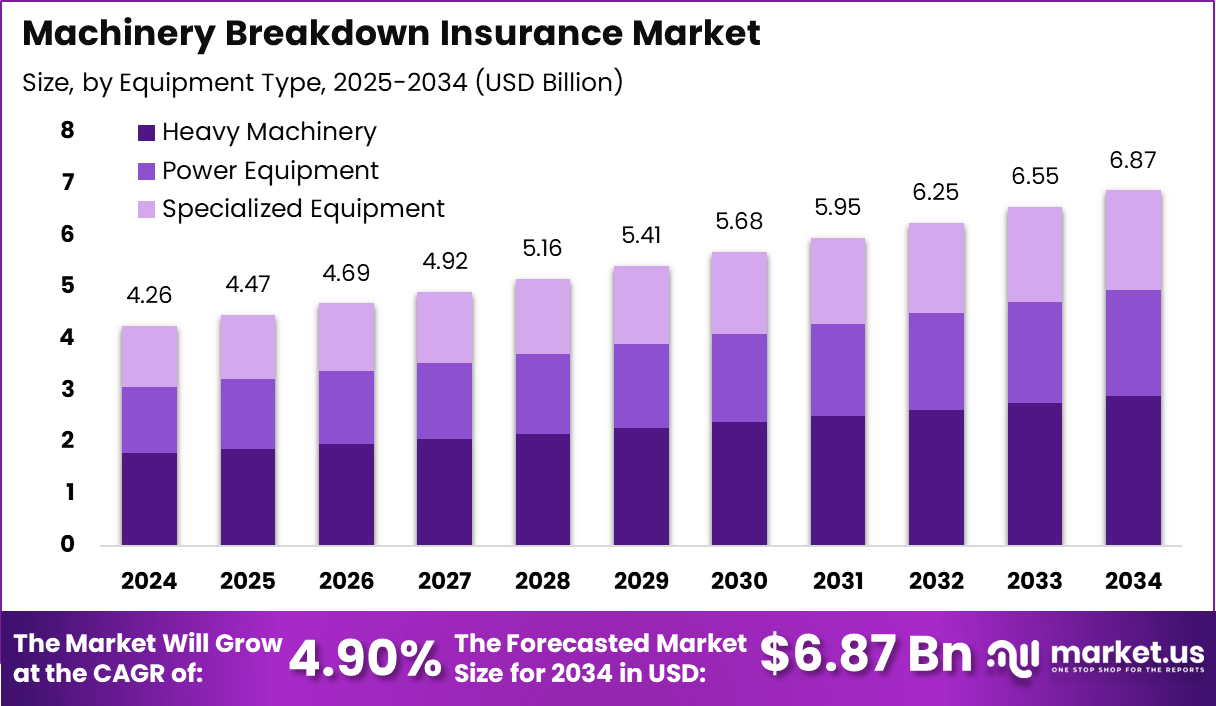

The Machinery Breakdown Insurance Market grows steadily as industries expand their reliance on complex, high-value equipment across manufacturing, energy, utilities, construction, and processing environments. The market reaches a valuation of USD 4.26 billion in 2024 and is expected to advance at a 4.90% CAGR, pushing its size to USD 6.87 billion by 2034.

This growth is driven by rising equipment automation, increasing machine repair costs, and the need for uninterrupted operational continuity. Businesses prioritize policies that safeguard against sudden mechanical failures, production halts, and consequential losses, especially as machinery becomes more digitally integrated and expensive to maintain.

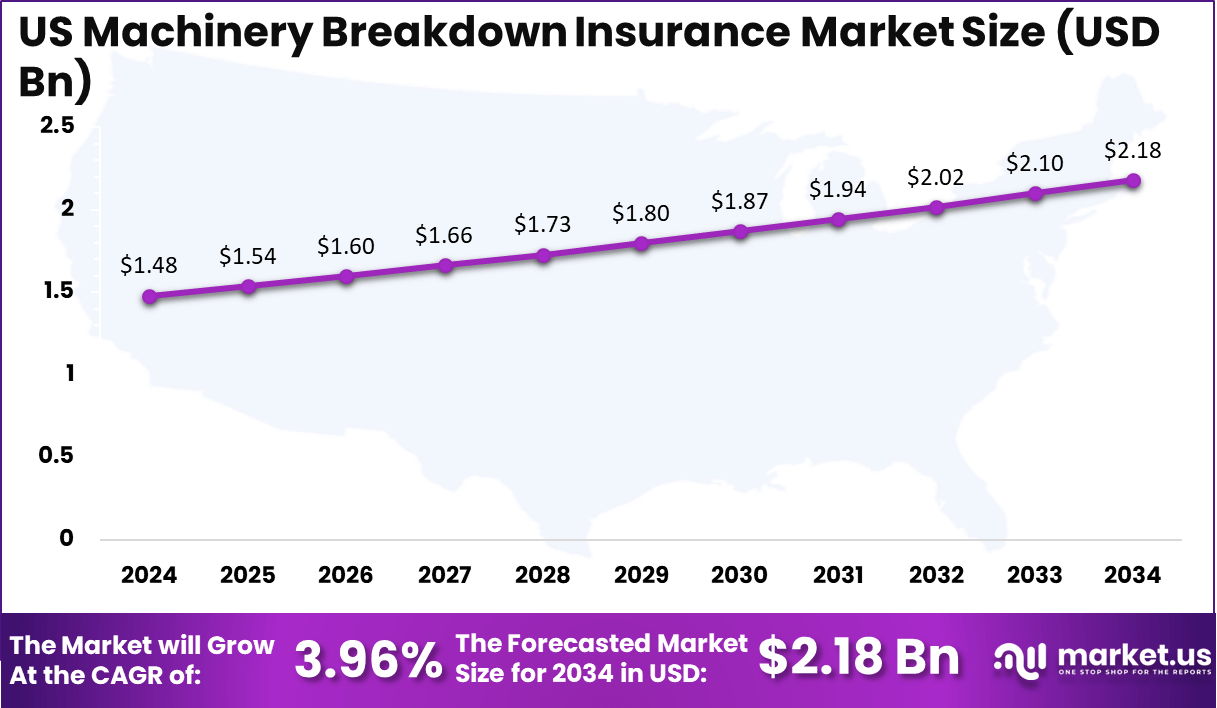

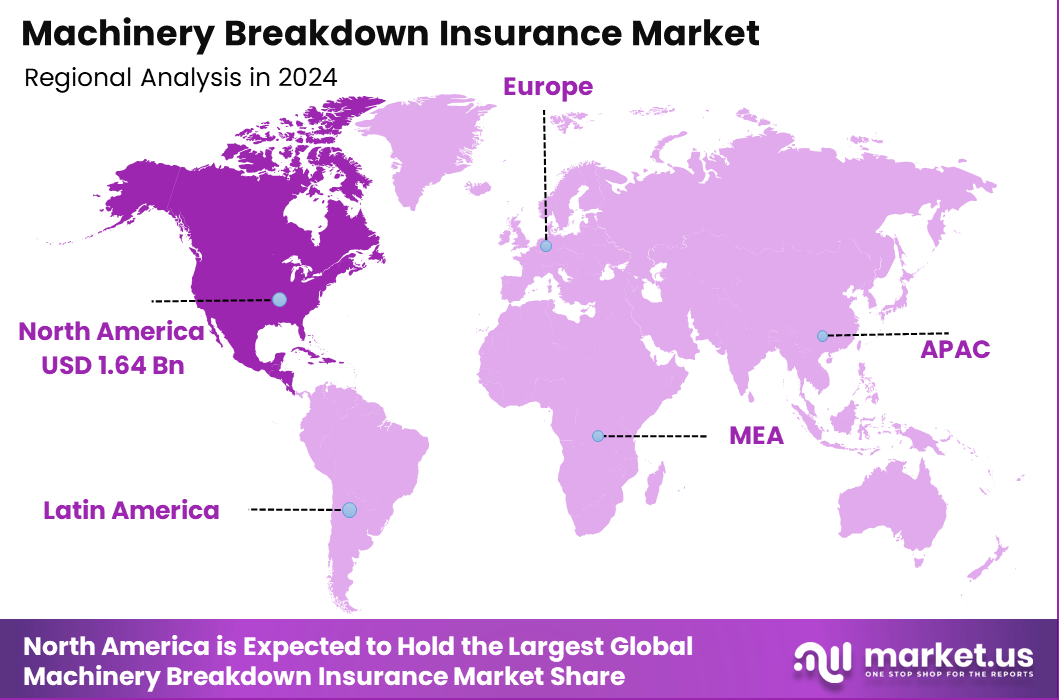

North America dominates the landscape with a 38.5% share, supported by mature industrial infrastructure, widespread equipment modernization, and strong awareness of risk-transfer mechanisms. The region accounts for USD 1.64 billion in 2024, with the US contributing USD 1.48 billion, reflecting the country’s high adoption of advanced manufacturing systems, energy-intensive industries, and stringent operational reliability standards. The US market is projected to grow to USD 2.18 billion by 2034, driven by asset-heavy sectors and expanding industrial automation, recording a 3.96% CAGR.

Overall, the market benefits from the increasing complexity of machinery, heightened cost pressures associated with downtime, and the strategic shift toward preventative financial protection as industries digitize their operational ecosystems. The Machinery Breakdown Insurance Market strengthens as industries intensify their dependence on advanced, automated, and high-performance equipment.

Modern machinery integrates complex electrical, mechanical, hydraulic, and digital components, making it increasingly susceptible to sudden failures that can halt production and generate substantial financial losses. As manufacturing, energy, processing, and utility operations scale up their technological footprints, businesses actively seek insurance solutions that safeguard against unexpected breakdowns, repair expenses, and operational disruption.

Growing industrial automation, rising maintenance challenges, and the increasing cost of spare parts further accelerate the demand for machinery breakdown coverage. Companies prioritize policies that protect productivity, ensure business continuity, and reduce vulnerability to downtime in asset-heavy environments.

North America remains a key region due to strong adoption of reliability-focused practices, advanced industrial systems, and a high awareness of risk mitigation frameworks. The US market, driven by expanding automation and strict operational standards, continues to lead in policy uptake.

The property damage insurance market in 2025 is characterized by dynamic shifts shaped by climate risks, technology adoption, regulatory adjustments, and evolving consumer expectations. Insurers faced an estimated $56 billion in catastrophe-related losses in the first quarter alone, with California wildfires comprising about $40 billion of these losses.

Despite the increased loss severity, the market witnessed a softening phase globally with property insurance rates declining by 8% in Q3 2025, driven by ample capacity, favorable reinsurance terms, and intensified competition across regions like the U.S., U.K., Europe, Korea, and Australia. However, Japan and India maintained firmer pricing due to local market conditions and regulatory nuances.

Underwriting losses continued to challenge the sector, with the American Property Casualty Insurance Association reporting a $26.5 billion net underwriting loss in 2023, up from $4.9 billion the previous year, pushing insurers to revisit pricing models and enhance risk selection.

Technology played a transformative role, with AI, automation, and predictive analytics now integral to underwriting and claims processing, helping insurers improve accuracy and customer experiences. Personalization has become a cornerstone, with insurers embedding insurance products in everyday digital platforms to meet consumer demand for simplicity and responsiveness.

Climate change remains a dominant risk driver; insurers are incorporating granular geospatial data and predictive climate modeling. Environmental, Social, and Governance (ESG) considerations guide investment and underwriting decisions, reflecting broader societal expectations.

Meanwhile, claims costs continue to rise, influenced by inflation in repair and replacement expenses, labor shortages, and supply chain disruptions. Deductibles for home insurance have increased by nearly 25% year-over-year in high-risk areas, particularly Florida and Texas.

Key Takeaways

- Global Machinery Breakdown Insurance Market valued at USD 4.26 Billion in 2024, projected to reach USD 6.87 Billion by 2034.

- The market grows at a steady CAGR of 4.90% during the forecast period.

- North America leads with a 38.5% share, supported by a strong industrial infrastructure.

- Regional market size reaches USD 1.64 billion in 2024, reflecting high adoption across asset-intensive sectors.

- The US accounts for USD 1.48 billion in 2024, expected to increase to USD 2.18 billion by 2034, at a 3.96% CAGR.

- Mechanical Breakdown emerges as the leading coverage type with 36.9% market share.

- Heavy Machinery dominates the equipment type segment, capturing 42.1% of total demand.

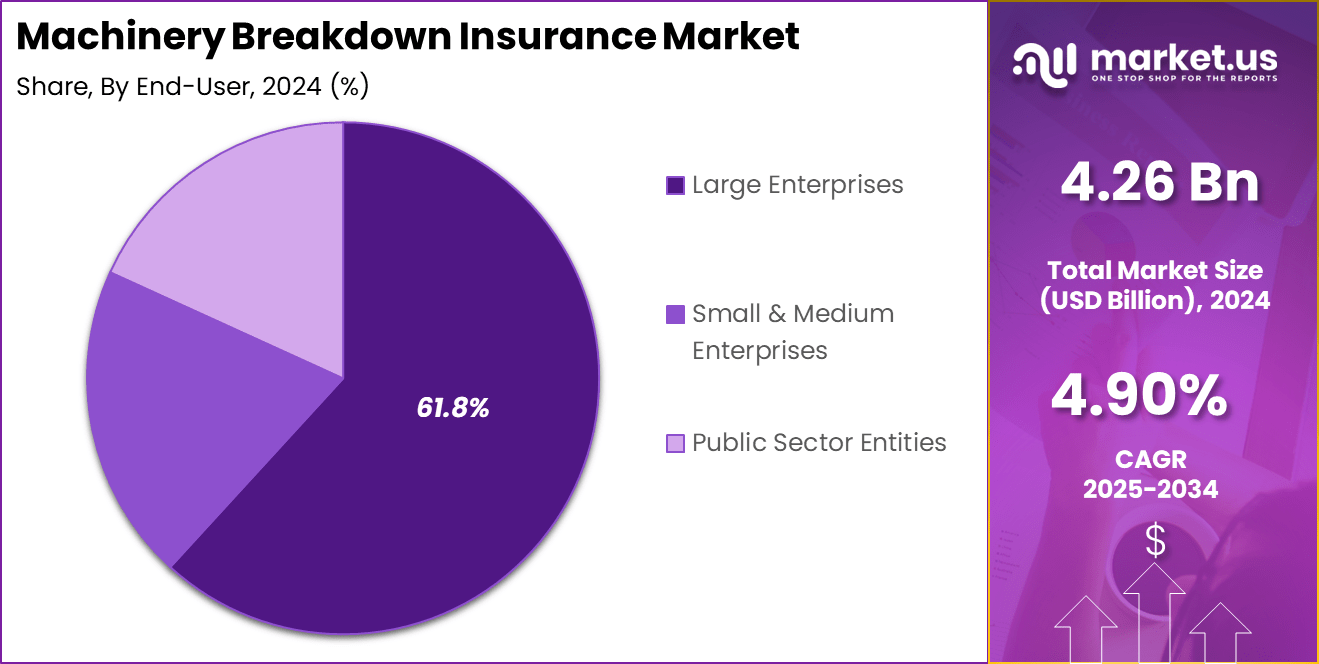

- Large Enterprises remain the primary end-users, contributing 61.8% to the global market.

- Manufacturing stands as the top industry vertical, accounting for 29.4% of overall adoption.

Role of Finance

Finance plays a central role in driving economic stability, business growth, and long-term value creation across industries. It enables organizations to allocate resources efficiently, manage risks, and sustain operations in both stable and uncertain environments.

Through budgeting, forecasting, and capital planning, finance helps companies make informed decisions about investments, expansion, and technology adoption. Strong financial management ensures that businesses maintain liquidity, optimize cash flows, and secure funding through equity, debt, or internal reserves to support strategic initiatives.

Finance also strengthens organizational resilience by identifying potential risks, assessing market fluctuations, and implementing mitigation strategies that protect assets and ensure continuity. In addition, it supports performance evaluation by analyzing key financial metrics, profitability patterns, and cost efficiencies, enabling leaders to refine their operational and growth strategies.

At the macro level, finance drives national development by promoting savings, investment, and capital formation, which fuel industrial expansion and infrastructure advancement. It also plays a crucial role in global trade by enabling credit, facilitating payments, and supporting regulatory compliance.

Ultimately, the role of finance extends beyond transactions; it shapes decision-making, enhances accountability, and fosters sustainable growth. Whether in corporations, governments, or household settings, finance remains essential for building stable and prosperous economic systems.

AI Industry Adoption

AI industry adoption accelerates rapidly as organizations integrate intelligent systems to enhance productivity, reduce operational costs, and improve decision-making accuracy. Companies across manufacturing, healthcare, finance, retail, logistics, and public services deploy AI to automate repetitive tasks, streamline workflows, and analyze large datasets at unprecedented speed.

This adoption is supported by advancements in machine learning, natural language processing, computer vision, and predictive analytics, enabling businesses to solve complex problems that traditional systems cannot address efficiently. Enterprises increasingly adopt AI-powered tools for customer service, fraud detection, quality inspection, demand forecasting, and personalized marketing.

The growing availability of cloud-based AI platforms and low-code development tools further democratizes access, allowing even small and mid-sized firms to implement AI capabilities without heavy infrastructure investments. At the same time, industries modernize their IT architectures to support real-time data processing, edge computing, and seamless AI integration into core processes.

AI adoption is also driven by competitive pressures, as companies leveraging automation achieve faster turnaround times, higher accuracy, and better customer experiences. Governments and regulatory bodies promote AI innovation through policy frameworks, funding programs, and national AI strategies, accelerating industry transformation. Overall, AI adoption reshapes operational models, strengthens digital resilience, and opens new pathways for innovation across global industries.

Emerging Trends

Emerging trends across global industries reflect a strong shift toward digitalization, sustainability, and intelligent automation, reshaping how businesses operate and compete. One of the most prominent trends is the widespread adoption of artificial intelligence and machine learning, enabling companies to enhance decision-making, personalize customer experiences, and automate complex tasks.

Alongside AI, the rise of edge computing and advanced analytics supports real-time data processing, improving operational agility in fast-moving environments such as manufacturing, logistics, and healthcare. Sustainability continues to dominate strategic priorities, with organizations investing in renewable energy, low-carbon technologies, and circular economy models to meet regulatory expectations and reduce environmental impact.

Electrification of transport, green buildings, and waste-to-energy solutions gain momentum as industries strive to meet global climate commitments. Cybersecurity also emerges as a critical trend due to increasing digital vulnerabilities, prompting companies to adopt zero-trust frameworks, multi-factor authentication, and AI-driven threat detection tools.

Consumer behavior is evolving toward hyper-convenience, fueling growth in omnichannel commerce, digital payments, and personalized digital services. At the same time, remote and hybrid work models reshape workforce dynamics, increasing demand for cloud collaboration tools and digital skill development. Collectively, these emerging trends accelerate transformation, drive innovation, and create new growth opportunities across global markets.

US Market Size

The US market demonstrates steady expansion driven by rising industrial automation, the modernization of manufacturing assets, and the growing adoption of risk-mitigation solutions across equipment-intensive sectors.

As industries increase their reliance on technologically advanced machinery and interconnected operational systems, the need for protection against equipment failure, unplanned downtime, and escalating repair costs strengthens the demand for specialized insurance products. In this landscape, the US market reaches USD 1.48 billion in 2024, reflecting strong uptake across manufacturing, energy, utilities, and infrastructure development.

With a projected increase to USD 2.18 billion by 2034, the market maintains a healthy 3.96% CAGR, supported by continued capital investments in heavy machinery, predictive maintenance technologies, and reliability-centered operational practices. Growing adoption of Industry 4.0 tools, such as smart sensors and real-time monitoring systems, enhances machinery performance but also introduces new failure risks, reinforcing the importance of insurance coverage that protects against both mechanical and electrical breakdowns.

Additionally, stringent operational safety guidelines, rising labor costs, and the need to maintain uninterrupted production cycles drive companies to prioritize comprehensive equipment protection strategies. As industrial activity scales and supply chain resilience becomes a national focus, the US market continues to strengthen as a critical component of operational risk management across major industries.

By Coverage Type

Mechanical Breakdown stands as the leading coverage type with 36.9%, reflecting its critical role in protecting industries from the most common and costly disruptions associated with heavy-duty machinery and mechanical components. This segment gains strong traction due to the high frequency of failures in rotating equipment, compressors, turbines, pumps, and production machinery that undergo continuous stress, vibration, friction, and wear.

As manufacturing, energy, mining, construction, and processing operations scale up production volumes, the exposure of mechanical systems to breakdowns increases significantly, reinforcing the need for robust insurance coverage. Industrial environments rely heavily on mechanical assets that form the backbone of operational output, making even short downtime events financially damaging.

Mechanical Breakdown coverage helps organizations manage repair and replacement expenses, safeguard against unexpected stoppages, and maintain business continuity. It also becomes essential as companies integrate advanced machinery with tighter tolerances, higher operating speeds, and complex moving parts, amplifying susceptibility to component fatigue and mechanical strain.

While Electrical Breakdown, Electronic Breakdown, and Additional Coverages continue to expand, Mechanical Breakdown remains dominant due to its relevance across traditional and modern industries. Its prominence reflects ongoing investments in high-value mechanical equipment, rising maintenance challenges, and the strategic importance of minimizing operational disruptions across global industrial sectors.

By Equipment Type

Heavy Machinery holds a dominant 42.1% share in the equipment type segment, reflecting its extensive use across construction, mining, manufacturing, agriculture, and large-scale industrial operations. These machines—including excavators, loaders, cranes, drilling rigs, bulldozers, and production-line machinery-operate under intense workloads, harsh environments, and continuous duty cycles, making them highly susceptible to mechanical stress, component fatigue, and sudden breakdowns.

As industries expand automation and increase reliance on high-capacity equipment to boost productivity, the financial stakes tied to machinery failures continue to rise, strengthening the demand for comprehensive insurance protection. The high replacement cost of heavy machinery, coupled with expensive spare parts and lengthy repair times, places pressure on enterprises to secure coverage that mitigates unplanned downtime and safeguards operational continuity.

Breakdowns in these machines can halt entire projects or production flows, leading to substantial revenue losses and contract penalties, further elevating the importance of insurance in risk management strategies. While Power Equipment and Specialized Equipment also gain attention due to growing digitalization and electrical integration, Heavy Machinery remains the largest segment due to its ubiquity, capital intensity, and the critical role it plays in asset-heavy industries. Its dominant position reflects ongoing infrastructure development, increased mechanization, and the rising complexity of modern industrial machinery.

By End-User

Large Enterprises account for 61.8% of the market, reflecting their extensive dependence on large-scale, capital-intensive machinery and their need for robust risk-transfer mechanisms to ensure uninterrupted operations. These organizations typically manage multiple production sites, large fleets of industrial equipment, and high-value assets that operate continuously under demanding conditions.

As a result, they face elevated exposure to mechanical, electrical, and electronic failures that can disrupt output, delay project timelines, and significantly inflate operational costs. Insurance adoption becomes a strategic priority for large enterprises seeking to reduce financial vulnerability and maintain resilience against unexpected equipment breakdowns.

Their strong financial capability also enables them to invest in comprehensive coverage plans that include repair, replacement, and business interruption protection. Industries such as manufacturing, power generation, oil & gas, metals, chemicals, and heavy engineering rely heavily on advanced machinery with sophisticated components, increasing both the likelihood and cost of potential failures.

In comparison, Small & Medium Enterprises and Public Sector Entities also contribute to market growth but at a smaller scale due to limited asset bases and budget constraints. The leadership of Large Enterprises remains intact as they expand automation, adopt Industry 4.0 systems, and continue upgrading their machinery portfolios, further reinforcing the need for reliable machinery breakdown insurance solutions.

By Industry Vertical

Manufacturing leads the industry verticals with 29.4%, driven by its intensive reliance on high-value machinery, continuous production cycles, and strict operational efficiency requirements. This sector depends on a wide range of assets-including CNC machines, compressors, boilers, conveyors, robotics, and automated assembly lines-that operate at high speeds and under constant mechanical, electrical, and thermal stress.

Any unexpected equipment failure can halt production instantly, creating substantial downtime losses, delivery delays, and contractual penalties. As manufacturers scale automation through Industry 4.0, smart systems, and precision machinery, the risk of complex failures increases, reinforcing the need for comprehensive machinery breakdown insurance.

Power Generation, Oil & Gas, and Mining also experience significant exposure due to heavy-duty machinery, turbines, drilling systems, and extraction equipment that function in extreme conditions. Healthcare facilities rely on critical equipment such as sterilizers, HVAC systems, imaging machines, and laboratory devices, making equipment reliability essential for patient safety and service continuity.

Other sectors-including food processing, chemicals, utilities, and infrastructure-further support market demand as they depend on uninterrupted machinery performance to maintain product quality, safety standards, and operational consistency. Manufacturing remains the dominant vertical due to its vast machinery footprint, high asset value, and the significant financial impact associated with unplanned production stoppages.

Key Market Segments

By Coverage Type

- Mechanical Breakdown

- Electrical Breakdown

- Electronic Breakdown

- Additional Coverages

By Equipment Type

- Heavy Machinery

- Power Equipment

- Specialized Equipment

By End-User

- Large Enterprises

- Small & Medium Enterprises

- Public Sector Entities

By Industry Vertical

- Manufacturing

- Power Generation

- Oil & Gas

- Mining

- Healthcare

- Others

Regional Analysis

North America maintains a leading position with 38.5% of the global market, supported by its highly advanced industrial ecosystem, strong adoption of automation technologies, and significant investments in heavy machinery across manufacturing, energy, utilities, and construction.

The region’s market size, reaching USD 1.64 billion in 2024, reflects mature risk-management practices and a high awareness of financial protection mechanisms among enterprises. Industries in the US and Canada rely extensively on sophisticated mechanical and electronic equipment, making machinery breakdown insurance an essential component of operational continuity strategies.

The region benefits from well-established industrial standards, stringent regulatory frameworks, and a strong focus on preventive maintenance, all of which contribute to higher uptake of insurance products. Manufacturing hubs across the US continue to modernize their machinery portfolios with robotics, automated systems, and smart production technologies, increasing exposure to complex breakdown scenarios.

Similarly, the energy and utilities sectors, which operate turbines, transformers, boilers, and high-capacity generators, depend heavily on protection against mechanical and electrical failures. Growing digitalization and interconnected industrial processes further amplify the risk of system faults, reinforcing the demand for comprehensive insurance coverage. With consistent technological upgrades, expanding infrastructure projects, and a focus on minimizing downtime, North America solidifies its dominance as the most influential regional market.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The market grows steadily as industries expand automation, invest in high-value machinery, and adopt advanced production technologies that increase exposure to sudden failures. Rising maintenance expenses and the high cost of mechanical and electrical repairs drive companies to secure comprehensive insurance coverage.

The growing complexity of modern equipment-such as CNC machines, robotics, turbines, and heavy construction machinery-further elevates risk levels, especially in asset-intensive sectors like manufacturing, power generation, and oil & gas. North America’s 38.5% contribution highlights strong adoption driven by stringent operational reliability standards.

The increasing emphasis on reducing downtime, improving equipment lifecycle management, and safeguarding against financial losses strengthens demand. As industries integrate predictive maintenance, IoT sensors, and digital monitoring systems, the need for insurance protection rises due to new electrical and electronic failure pathways, ensuring that machinery breakdown insurance remains essential across global markets.

Restraint Factors

Market expansion is restricted by the high cost of premiums, especially for small and medium enterprises that operate with tight budgets and limited asset bases. Many organizations hesitate to invest in insurance due to perceived low breakdown probability or reliance on internal maintenance teams. Complex claim processes, strict documentation requirements, and long settlement timelines also discourage adoption.

Older facilities with outdated machinery often face higher risk assessments, resulting in steep premiums that further limit coverage uptake. In emerging regions, a lack of awareness about machinery breakdown insurance and an insufficient understanding of risk-transfer benefits reduce market penetration.

Additionally, disputes between insurers and enterprises regarding coverage limits, exclusions, and depreciation values create uncertainty. Rapid technological advancements introduce new failure modes, but not all insurers update coverage terms quickly, creating gaps in protection. These factors collectively slow adoption, particularly among cost-sensitive industries and developing economies.

Growth Opportunities

Significant opportunities emerge from the increased adoption of Industry 4.0 systems, robotics, and digitally connected machinery, creating demand for insurance products tailored for advanced equipment. Insurers can capitalize by designing specialized coverage for smart manufacturing assets, renewable energy systems, and high-value industrial machinery.

The rise of infrastructure development, construction megaprojects, and modernization of power plants expands the customer base, particularly for heavy machinery protection, which currently accounts for 42.1% of the equipment segment. Growth prospects strengthen in developing regions where industrialization accelerates, and enterprises seek risk-mitigation solutions for newly acquired machinery.

Offering flexible premiums, bundled coverage, and value-added services, such as predictive maintenance analytics, remote diagnostics, and risk-assessment consultations, creates new revenue streams. As more large enterprises, holding 61.8% market share, adopt comprehensive insurance strategies, insurers gain opportunities to expand solutions targeting medium enterprises and public sector entities. This shift increases long-term market expansion potential.

Trending Factors

A major trend shaping the market is the integration of IoT-based monitoring systems and predictive maintenance tools that help identify machine failures before they occur. Insurers increasingly adopt data-driven underwriting models using real-time performance data to evaluate risks more accurately.

Industries shift toward comprehensive coverage combining mechanical, electrical, and electronic breakdown protection due to rising complexity in modern machinery. The dominance of manufacturing with a 29.4% share underscores a trend toward specialized insurance for automated production lines and robotics.

Sustainability initiatives also influence market trends, as companies seek insurance for energy-efficient machinery and eco-friendly equipment. Digital claim-processing platforms, AI-assisted inspections, and remote assessment technologies streamline customer experience, making insurance more accessible.

As supply chains digitize and global projects scale, insurers focus on customizable, sector-specific products that align with modern industrial needs, marking a transition from traditional coverage to highly adaptive, technology-enabled insurance models.

Competitive Analysis

The competitive landscape of the Machinery Breakdown Insurance Market is characterized by a mix of global insurers, regional underwriters, and specialized commercial insurance providers competing through product innovation, sector-focused policies, and advanced risk-assessment capabilities. Leading companies strengthen their position by offering highly customizable coverage options that address mechanical, electrical, and electronic failures, aligning with the market’s technical diversity.

With segments such as Mechanical Breakdown holding 36.9% and Heavy Machinery representing 42.1%, major insurers increasingly focus on industries where equipment carries higher operational and financial risk, including manufacturing, power generation, oil & gas, and mining. Large Enterprises, which contribute 61.8%, remain the primary target segment for market leaders due to their large asset portfolios and higher insurance spending capacity.

Competitors differentiate themselves through value-added services such as predictive maintenance insights, IoT-based monitoring, digital claim management, and remote diagnostics—capabilities that appeal to sectors adopting Industry 4.0 technologies. North America, with 38.5% market share, remains the region with the highest competition, driven by advanced industrial infrastructure and stricter operational compliance.

Insurers increasingly integrate AI-based risk modeling and real-time equipment health analytics to improve underwriting accuracy and reduce claim costs. Partnerships with equipment manufacturers, maintenance companies, and industrial automation vendors further enhance competitiveness, enabling insurers to provide more precise coverage and faster response times. Overall, the market’s competitive intensity continues to rise as insurers shift toward technology-driven, efficiency-focused, and sector-specialized solutions.

Top Key Players in the Market

- Allianz

- Zurich Insurance Group

- Chubb

- AXA XL

- AIG

- Liberty Mutual

- Travelers

- FM Global

- Hartford Steam Boiler (HSB)

- Berkshire Hathaway

- Swiss Re

- Munich Re

- Sompo International

- Markel

- QBE Insurance

- Others

Recent Developments

- November 12, 2025: Siemens Energy announced the global rollout of its upgraded SGT-800 gas turbine monitoring suite, integrating AI-driven anomaly detection for rotating components. Early field trials across European power plants showed a 22% reduction in unplanned outage incidents, supporting stronger reliability-based maintenance programs.

- October 28, 2025: Caterpillar introduced its Enhanced Equipment Health Management Platform for heavy machinery fleets, providing real-time alerts on hydraulic pressure loss, overheating components, and early wear patterns. Mining and construction operators reported up to 30% improvement in equipment uptime during pilot deployments.

- September 19, 2025: ABB launched its PredictiveGuard 2.0 system for industrial motors and drives, enabling continuous vibration analysis, shaft misalignment detection, and electrical fault prediction. Initial deployments in manufacturing sites reduced failure-related production stoppages by nearly 18%.

Report Scope

Report Features Description Market Value (2024) USD 4.26 Billion Forecast Revenue (2034) USD 6.87 Billion CAGR(2025-2034) 4.90% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Coverage Type (Mechanical Breakdown, Electrical Breakdown, Electronic Breakdown, Additional Coverages), By Equipment Type (Heavy Machinery, Power Equipment, Specialized Equipment), By End-User (Large Enterprises, Small & Medium Enterprises, Public Sector Entities), By Industry Vertical (Manufacturing, Power Generation, Oil & Gas, Mining, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz, Zurich Insurance Group, Chubb, AXA XL, AIG, Liberty Mutual, Travelers, FM Global, Hartford Steam Boiler (HSB), Berkshire Hathaway, Swiss Re, Munich Re, Sompo International, Markel, QBE Insurance, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Machinery Breakdown Insurance MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Machinery Breakdown Insurance MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz

- Zurich Insurance Group

- Chubb

- AXA XL

- AIG

- Liberty Mutual

- Travelers

- FM Global

- Hartford Steam Boiler (HSB)

- Berkshire Hathaway

- Swiss Re

- Munich Re

- Sompo International

- Markel

- QBE Insurance

- Others