Global Luxury Apparels Market By Product Type (Topwear, Bottomwear, Others), By End-User (Men, Women), By Distribution Channel (Online Stores, Offline Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 39324

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

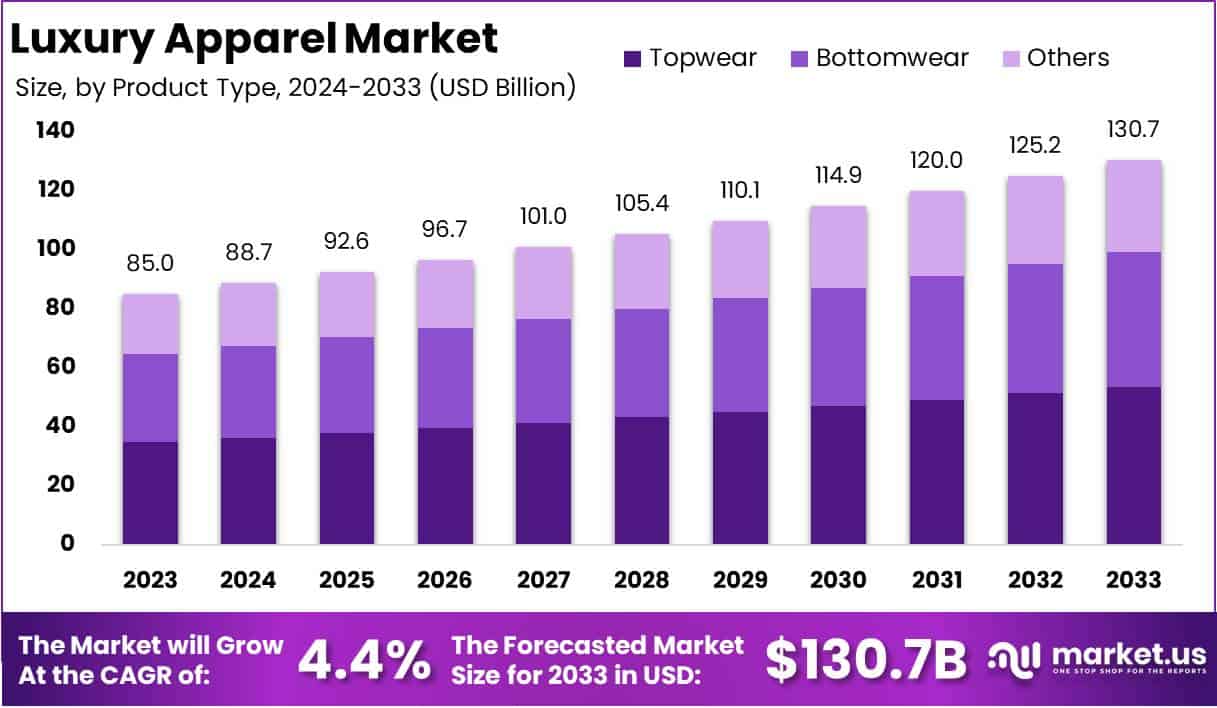

The Global Luxury Apparels Market size is expected to be worth around USD 130.7 Billion by 2033, from USD 85.0 Billion in 2023, growing at a CAGR of 4.4% during the forecast period from 2024 to 2033.

Luxury apparels encompasses high-quality clothing, often crafted from premium materials with exceptional attention to detail and designed by prestigious fashion houses. Brands in this category, such as Gucci, Chanel, and Louis Vuitton, are known for combining superior craftsmanship with exclusive designs that cater to discerning clientele seeking status, sophistication, and exclusivity.

These products are positioned at a premium price point and are often associated with a high level of personalization, rarity, and brand heritage. Beyond the physical garment, luxury apparels offers an experience of exclusivity, prestige, and identity, contributing to the brand’s allure and the customer’s sense of self-expression and status.

Geographically, the market is heavily concentrated in regions such as North America, Europe, and increasingly, Asia-Pacific, where rising wealth and a growing middle and upper class are driving demand.

The market is dynamic, influenced by seasonal trends, cultural factors, and rapid shifts in consumer expectations for sustainability and inclusivity from luxury brands. This sector’s competitive landscape is dominated by a mix of heritage brands and newer entrants, who are both competing to capture a share of the global demand for high-end fashion.

Several key factors are fueling growth in the luxury apparels market. The expanding wealth among high-net-worth individuals globally, particularly in emerging economies, provides a stable consumer base for luxury brands. Urbanization and the rise of the affluent middle class in markets like China, India, and Southeast Asia have opened new avenues for market expansion.

Digital transformation, specifically e-commerce and social media, is another driving force, making luxury more accessible and visible to a global audience while influencing purchasing behaviors. Additionally, there is a notable trend towards personalization and sustainability within luxury fashion, with brands increasingly integrating eco-conscious materials and practices to appeal to environmentally aware consumers.

Demand in the luxury apparels market is robust, underpinned by consumers’ desire for exclusivity, brand prestige, and the ability to display social status through fashion choices. There is a growing demand among millennials and Gen Z consumers who prioritize unique, high-quality products that offer an emotional connection and reflect their personal values.

Digital innovation and e-commerce channels have further broadened access, enabling consumers to purchase luxury items across borders with ease, thus boosting demand in markets beyond traditional luxury centers.

Demand is also highly responsive to economic conditions, though the sector has shown resilience, with high-income consumers maintaining or even increasing their luxury spending despite macroeconomic pressures.

The luxury apparels market offers several opportunities for growth and innovation. Digital transformation continues to create new engagement channels, with augmented reality (AR), virtual try-ons, and personalized online experiences allowing brands to reach a broader, younger, and tech-savvy audience.

The trend toward sustainability and ethical consumption also presents a significant opportunity, with consumers increasingly demanding transparency around sourcing and production processes.

Furthermore, expanding into untapped and underserved markets, particularly in Asia and the Middle East, can provide new growth avenues. Collaborative opportunities, such as high-profile partnerships with artists or influencers, and the growing acceptance of resale and rental luxury fashion, offer additional ways for luxury apparels brands to innovate while appealing to the evolving preferences of modern consumers.

According to The Fact Shop, the luxury apparels market is experiencing a dynamic shift driven by consumer behavior, sustainability challenges, and evolving fashion trends. In the United States, the average consumer owns approximately seven pairs of blue jeans, reflecting a robust demand for durable, high-quality denim. Additionally, women are projected to buy an average of 145 bags over their lifetimes, underscoring a strong preference for luxury accessories.

However, challenges persist as nearly 7 million tons of textiles are discarded annually, with only 12% being recycled. Furthermore, clothing designs often fail to accommodate women outside the standard height range of 5’4” to 5’8”, highlighting a need for more inclusive sizing. While entry-level fashion designers earn around $23,000 annually, experienced designers command salaries exceeding $150,000, illustrating the field’s potential for growth and talent retention.

According to Worldmetrics, as of this year, the U.S. luxury apparels market is markedly steering towards sustainability and ethical manufacturing, reflecting the values of a conscientious consumer base. Notably, 64% of Americans now favor sustainable fashion products, and nearly 70% show a preference for eco-friendly apparels.

This shift is evident as over 40% of consumers are set to increase their spending on environmentally friendly clothing in the upcoming year. Furthermore, the industry, predominantly supported by a labor force that is 80% female, employs over 1.8 million people, highlighting the significant role of gender in shaping market dynamics.

This data underscores a growing trend where 35% of consumers prioritize purchases from brands that resonate with their personal and ethical values, illustrating a critical shift in consumer behavior towards more responsible fashion.

Key Takeaways

- The global luxury apparels market is projected to grow from USD 85.0 billion in 2023 to USD 130.7 billion by 2033, driven by a steady CAGR of 4.4%.

- Topwear dominates with a 41% market share, reflecting strong consumer demand for visible, brand-centric pieces that convey status.

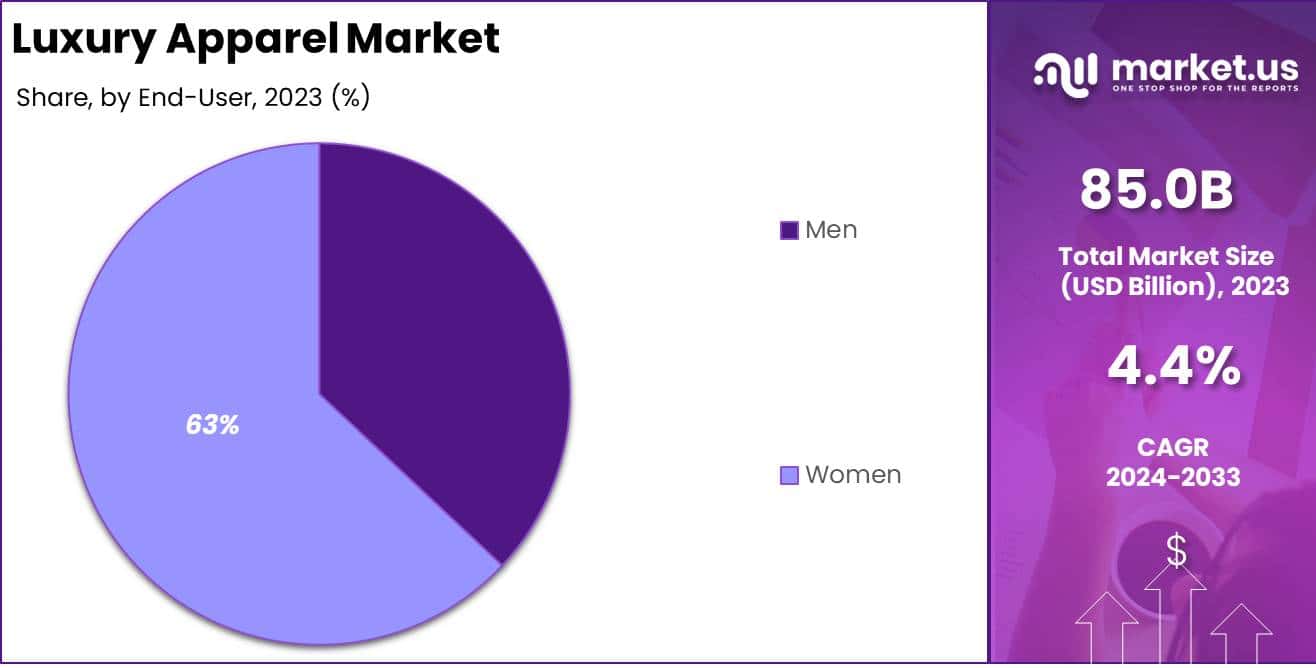

- The women’s segment leads with 63% market share, emphasizing the high spending power and influence of female consumers in the luxury apparels sector.

- Offline stores retain a dominant 67% market share, underscoring the importance of experiential, in-person shopping for luxury apparels.

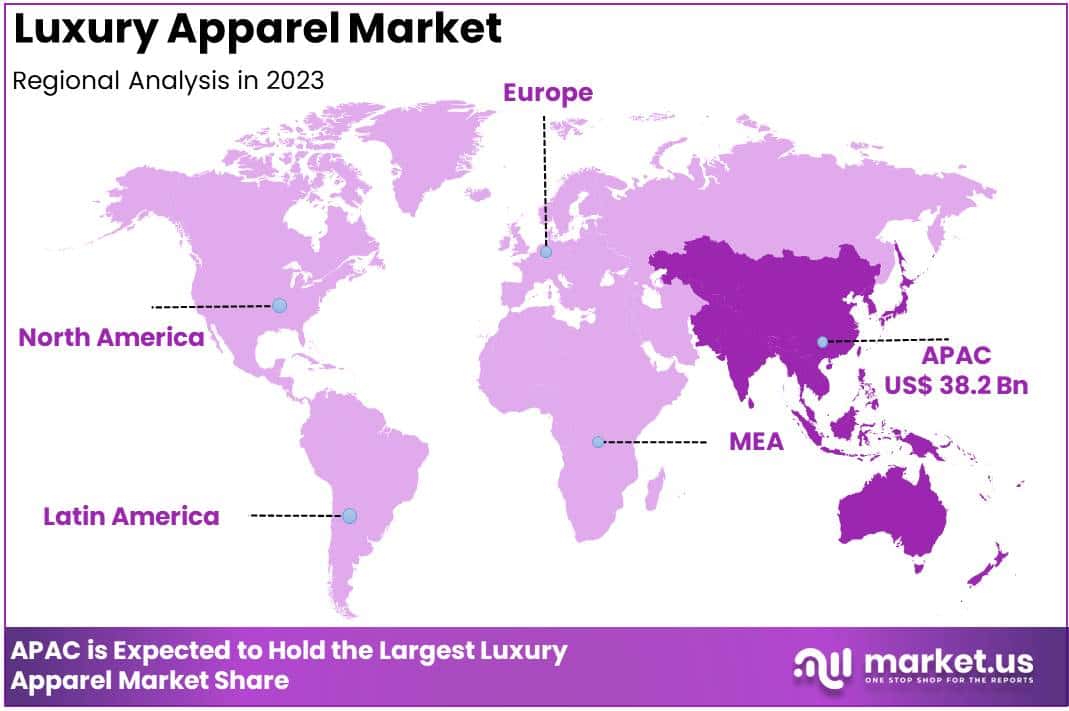

- Asia-Pacific holds the largest regional share at 38.2%, driven by rapid wealth growth and brand-conscious consumers in key markets like China and India.

By Product Analysis

Topwear Dominates Luxury Apparel Market with 41% Market Share

In 2023, Topwear held a dominant market position in the Luxury Apparel Market by product type, capturing more than a 41% share. This segment benefits significantly from global fashion trends that emphasize style, quality, and brand prestige. Consumers’ preference for luxury topwear, which includes tailored shirts, blouses, and designer tops, is driven by the visibility and status these items confer in social and professional settings.

luxury bottomwear, which includes items like designer trousers, skirts, and premium jeans, holds a substantial portion of the market. This category leverages the blending of comfort with luxury, appealing to consumers looking for versatile pieces that offer both style and functionality for various occasions.

The ‘Others’ category in the Luxury Apparel Market encompasses a wide range of products including luxury outerwear, formal wear, and seasonal specialties that cater to specific consumer needs during different times of the year.

While this segment does not command as large a share as topwear or bottomwear, it plays a critical role in rounding out the offerings of luxury fashion brands, often incorporating innovative designs and limited-edition collections.

This segmentation of the Luxury Apparel Market shows how different product types cater to varied consumer preferences and occasions, with topwear leading the charge due to its broad appeal and status-enhancing qualities.

By End-User Analysis

Women Segment Dominating End-User in Luxury Apparel Market with 63% Market Share

In 2023, women held a dominant position in the luxury apparels market by end-user, capturing over 63% of the market share. This significant lead reflects ongoing demand for high-end fashion among female consumers, who continue to drive trends and influence luxury apparels collections.

Growth in this segment is attributed to an increasing preference for premium brands and exclusive styles, supported by a rise in disposable income among women across key markets.

Additionally, the influence of social media and digital fashion platforms has amplified brand reach, catering to a well-informed female audience that prioritizes quality, exclusivity, and brand heritage in their fashion choices.

While women currently dominate the luxury apparels market, the men’s segment has shown robust growth, fueled by a rising interest in high-end clothing among male consumers. Men’s luxury apparels has expanded beyond traditional suits and formal wear to include casual and athleisure luxury items, capturing a growing market share.

The shift is driven by evolving lifestyle preferences, greater spending power, and increased brand consciousness among men, particularly in urban regions. Additionally, luxury brands are increasingly targeting male demographics through product line diversification and targeted marketing campaigns, further supporting the segment’s upward trajectory.

By Distribution Channel Analysis

Offline Stores Dominating Distribution Channel in Luxury Apparel Market with 67% Market Share

In 2023, offline stores held a dominant market position in the luxury apparels market by distribution channel, capturing over 67% of the market share. This preference is driven by consumers’ desire for an immersive, tactile shopping experience, allowing them to assess the quality and authenticity of luxury garments firsthand.

Offline stores, including specialty stores, supermarkets/hypermarkets, and brand-exclusive stores, contribute significantly to this channel’s dominance. Among these, specialty and brand stores are particularly influential, as they offer curated selections and personalized service, both highly valued by luxury consumers.

While offline stores maintain a dominant position, the online stores segment is rapidly expanding as digital channels become increasingly integral to the luxury shopping experience. High-income consumers, especially among younger demographics, are turning to online platforms for the convenience of browsing exclusive collections and limited editions.

Luxury brands are investing in high-end digital interfaces and virtual shopping experiences to replicate the in-store luxury appeal, capturing a significant share of tech-savvy consumers who value both accessibility and prestige.

Key Market Segments

By Product Type

- Topwear

- Bottomwear

- Others

By End-User

- Men

- Women

By Distribution Channel

- Online Stores

- Offline Stores

- Specialty Stores

- Supermarkets/Hypermarkets

- Brand Stores

- Others

Driver

Expanding Wealth and Rising Affluent Middle Class

The global luxury apparels market is seeing accelerated growth, driven in large part by the increasing wealth of high-net-worth individuals (HNWIs) and the rise of the affluent middle class, especially in emerging markets. As incomes increase, particularly across Asia-Pacific, the demand for luxury goods, including high-end apparels, has grown substantially.

China and India, in particular, are witnessing an expansion in their middle class, with an anticipated growth rate of 6–8% annually. This demographic shift is creating a new consumer segment that aspires to own luxury apparels as a symbol of status and success.

Affluent consumers from these regions are increasingly interested in premium fashion, often prioritizing high-quality, exclusive products that elevate their social standing. This surge in wealth is pushing luxury brands to expand their reach and product offerings in these fast-growing markets, meeting rising expectations for premium and distinctive fashion choices.

Further, as the economic landscape improves globally, demand for luxury apparels has become less dependent on mature markets like Europe and North America. Today’s luxury consumers are younger, digitally savvy, and globally minded, looking for brands that not only offer quality but also resonate with their values and aspirations.

This diversification of demand is beneficial for market growth, helping luxury brands stabilize revenue streams across multiple regions.

Moreover, these consumers are influenced by the status, prestige, and sense of exclusivity associated with luxury brands, which drives their willingness to pay premium prices. This combination of expanding wealth, new affluent demographics, and a global outlook is creating fertile ground for sustained growth in the luxury apparels market over the coming years.

Restraint

Counterfeit Market Undermining Luxury Brand Equity and Revenue

One of the most significant restraints impacting the luxury apparels market is the proliferation of counterfeit goods, which not only undermines brand equity but also leads to revenue losses for genuine luxury brands.

The global counterfeit market for luxury goods has grown rapidly, valued at approximately $500 billion, with fake luxury apparels accounting for a substantial portion of these sales.

The rise of online platforms and social media has made counterfeit goods more accessible, often reaching consumers in both developed and developing markets. This increase in availability creates confusion among consumers and dilutes the exclusivity and premium image that luxury brands work to establish.

As consumers are sometimes unable to differentiate between genuine and counterfeit items, the trust and perceived value associated with luxury apparels brands can diminish, directly impacting brand reputation and long-term profitability.

Moreover, the counterfeit market not only impacts sales but also influences consumer perceptions of luxury. Many consumers, especially in emerging markets, may be introduced to a brand through a counterfeit product, which can lead to disappointing experiences that tarnish the brand’s image.

Luxury brands invest significantly in quality, design, and heritage to cultivate their status and appeal however, counterfeit goods erode these investments by delivering substandard experiences under the guise of recognized brands.

Despite efforts to combat counterfeit goods through anti-counterfeiting technologies and strict regulations, the persistence of this issue remains a major restraint, challenging the luxury apparels market’s growth potential. Luxury brands will need to implement more innovative solutions to safeguard their reputation and ensure consumers continue to see the value in purchasing authentic luxury apparels.

Opportunity

Digital Innovation and E-commerce

Digital transformation and the rise of e-commerce present substantial growth opportunities for the global luxury apparels market by enhancing market reach and consumer engagement.

Online channels now allow luxury brands to connect directly with a global audience, breaking down geographic barriers and making luxury apparels accessible to consumers in markets where physical retail presence may be limited. As of 2024, online luxury apparels sales are projected to account for nearly 25% of the total luxury market, up from just 10% five years ago.

The integration of digital tools such as virtual try-ons, artificial intelligence (AI)-driven personalization, and interactive customer service has elevated the online shopping experience, making it more tailored and appealing to a wider audience. This digital shift is also crucial in engaging younger consumers, who are more inclined to shop online and prefer brands that offer interactive, immersive experiences.

The growth of e-commerce not only boosts accessibility but also opens up new opportunities for personalization, which is increasingly valued in the luxury segment. With data-driven insights, luxury brands can tailor their offerings to individual preferences, further enhancing customer satisfaction and loyalty.

Additionally, digital channels offer an effective platform for storytelling, allowing brands to communicate their heritage, craftsmanship, and values more effectively than traditional retail could.

This approach resonates strongly with consumers who prioritize brand authenticity and sustainable practices, particularly millennials and Gen Z shoppers. By embracing digital innovation, luxury apparels brands can cultivate a stronger connection with global consumers, enhancing both sales growth and brand loyalty in the long term.

Trends

Sustainability and Ethical Production Becoming Core Consumer Expectations

Sustainability and ethical production practices are becoming defining trends in the luxury apparels market, with consumers increasingly expecting luxury brands to adopt environmentally conscious and socially responsible approaches. Today’s luxury apparels consumers are more aware of the environmental impact of fashion and are vocal in their demand for brands to adopt sustainable materials, minimize waste, and ensure fair labor practices.

In 2024, nearly 60% of luxury consumers indicate that they prefer brands that demonstrate a commitment to sustainability, reflecting a shift toward conscious consumption. This trend has led many luxury brands to rethink their production processes, sourcing, and overall business models, with a strong focus on reducing environmental impact and ensuring ethical standards.

Brands that prioritize sustainability not only align with consumer values but also strengthen their competitive advantage in an increasingly scrutinized market. Sustainable practices such as circular fashion, where products are designed to be reused or recycled, and transparency in supply chains appeal to consumers seeking both quality and ethical integrity.

Additionally, the use of eco-friendly materials and sustainable production methods resonates particularly with younger, environmentally aware demographics, who view luxury as an investment not only in quality but also in positive social impact.

As sustainability continues to shape consumer preferences, luxury brands that lead in ethical production will benefit from increased loyalty, enhanced brand reputation, and a stronger alignment with the evolving values of the global luxury apparels market.

Regional Analysis

Asia-Pacific Leads Luxury Apparel Market with Largest Market Share of 38.2%

The Luxury Apparel Market, Asia-Pacific held a substantial market share of 38.2% in 2023, translating to a revenue of USD 32.4 billion. This region’s dominance is driven by a burgeoning middle class, increasing brand consciousness, and the expansion of luxury retail outlets in economies such as China, Japan, India, and South Korea.

The luxury market in Asia-Pacific is further buoyed by a young and affluent demographic eager to engage with high-end fashion brands.

North America remains a key player in the luxury apparels sector, characterized by a steady demand for premium fashion items. The U.S. and Canada are notable for their high per capita income and a significant population of consumers willing to invest in luxury goods. The region benefits from established retail infrastructures and a mature e-commerce platform that facilitate easy access to luxury brands.

Europe is traditionally a stronghold for luxury apparels, home to some of the world’s most prestigious fashion houses in France, Italy, and the UK. The region’s market is propelled by a strong tourist influx and local consumer base that holds luxury and craftsmanship in high regard. The European market is sophisticated, with a deep-rooted appreciation for heritage brands and bespoke tailoring.

The luxury market in the Middle East, particularly in the GCC countries, is characterized by high spending on luxury fashion due to significant disposable income and a culturally ingrained luxury shopping tradition. Africa, while still developing in this sector, shows potential for growth with its rising elite consumer segment and increased interest in luxury fashion brands.

Though smaller in scale compared to other regions, Latin America’s luxury apparels market is growing, driven by increased economic stability and a rising number of high-net-worth individuals. Countries like Brazil and Mexico are seeing an expansion of luxury boutiques and an increased presence of European luxury brands.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global luxury apparels market in 2024 is shaped by prominent players such as Gucci, Prada S.p.A., Dior SE, Ralph Lauren Corporation, Armani S.p.A., Chanel, Burberry, LVMH, Dolce & Gabbana, Valentino S.p.A., and other significant brands. Each player is navigating a competitive landscape characterized by a blend of heritage appeal and modern consumer expectations.

Gucci continues to lead with innovative designs that resonate with younger consumers, leveraging digital strategies and strong collaborations to enhance brand appeal. Prada S.p.A. focuses on sustainable luxury, appealing to the environmentally conscious high-net-worth individual. Dior SE combines haute couture with premium ready-to-wear segments, maintaining its strong brand equity by positioning itself at the forefront of both tradition and contemporary fashion.

Ralph Lauren Corporation, with its American luxury positioning, captures market share by blending classic designs with evolving lifestyle trends, appealing to affluent consumers globally. Armani S.p.A. maintains its stronghold with a timeless aesthetic, while also diversifying into sustainable initiatives to align with current market demands.

Chanel, a leader in timeless luxury, capitalizes on its exclusivity and heritage, consistently releasing limited editions and high-end collections to uphold its premium market position.

Burberry, leveraging its British heritage, stands out with digital and direct-to-consumer strategies, enhancing its visibility among younger audiences. LVMH, with its vast portfolio of luxury brands, utilizes cross-brand synergies to reinforce its market leadership, particularly through innovative omnichannel approaches.

Dolce & Gabbana and Valentino S.p.A. emphasize Italian craftsmanship and cultural elements, attracting consumers looking for exclusivity and artistry. Collectively, these brands, along with other key players, are adapting to shifting consumer values, focusing on sustainability, digital engagement, and regional expansion to sustain growth in a highly competitive luxury landscape.

Top Key Players in the Market

- Gucci

- Prada S.p.A.

- Dior SE

- Ralph Lauren Corporation

- Armani S.p.A.

- Chanel

- Burberry

- LVMH

- Dolce & Gabbana

- Valentino S.p.A.

- Other Key Players

Recent Developments

- In 2024, Nordstrom Family proposes a $3.8 billion buyout to take the company private, offering $23 per share. The financing plan includes contributions from family members, Mexico’s El Puerto de Liverpool, and new bank funding.

- In 2023, Tapestry, Inc. agrees to acquire Capri Holdings for $8.5 billion, offering Capri shareholders $57 per share in cash. This acquisition brings together luxury brands like Coach, Kate Spade, Versace, and Jimmy Choo under one company.

- In 2023, Shein acquires Missguided, a UK fast-fashion brand, aiming to broaden Shein’s global marketplace model and expand its product offerings to over 150 million customers.

- In 2024, The Row secures $1 billion in investment from Chanel, L’Oréal, and prominent investors like Natalie Massenet. This deal supports The Row’s unique luxury positioning and future growth.

- In 2024, Ruffini Partecipazioni Holding partners with LVMH to reinforce its standing as Moncler’s largest shareholder, with LVMH purchasing a 10% stake in Ruffini’s investment vehicle Double R.

- In 2024, Frasers Group reacquires part of Matches Fashion’s intellectual property. This follows Frasers’ earlier decision to place Matches in receivership, marking a strategic recovery move for the e-commerce brand.

- In 2023, Kering completes the acquisition of a 30% stake in Valentino, following regulatory approval. This move aligns with Kering’s strategy to strengthen its luxury portfolio.

Report Scope

Report Features Description Market Value (2023) USD 85.0 Billion Forecast Revenue (2033) USD 130.7 Billion CAGR (2024-2033) 4.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Topwear, Bottomwear, Others), By End-User (Men, Women), By Distribution Channel (Online Stores, Offline Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Gucci, Prada S.p.A., Dior SE, Ralph Lauren Corporation, Armani S.p.A., Chanel, Burberry, LVMH, Dolce & Gabbana, Valentino S.p.A., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Gucci

- Prada S.p.A.

- Dior SE

- Ralph Lauren Corporation

- Armani S.p.A.

- Chanel

- Burberry

- LVMH

- Dolce & Gabbana

- Valentino S.p.A.

- Other Key Players