Global LPG Vaporizer Market Size, Share, And Business Benefits By Product (Electric, Direct Powered, Water/Steam), By Capacity (40-160 gal/hr, 168-455 gal/hr, 555-1005 gal/hr, Greater Than 168-455 gal/hr), By End-use (Industrial, Agricultural, Commercial, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154753

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

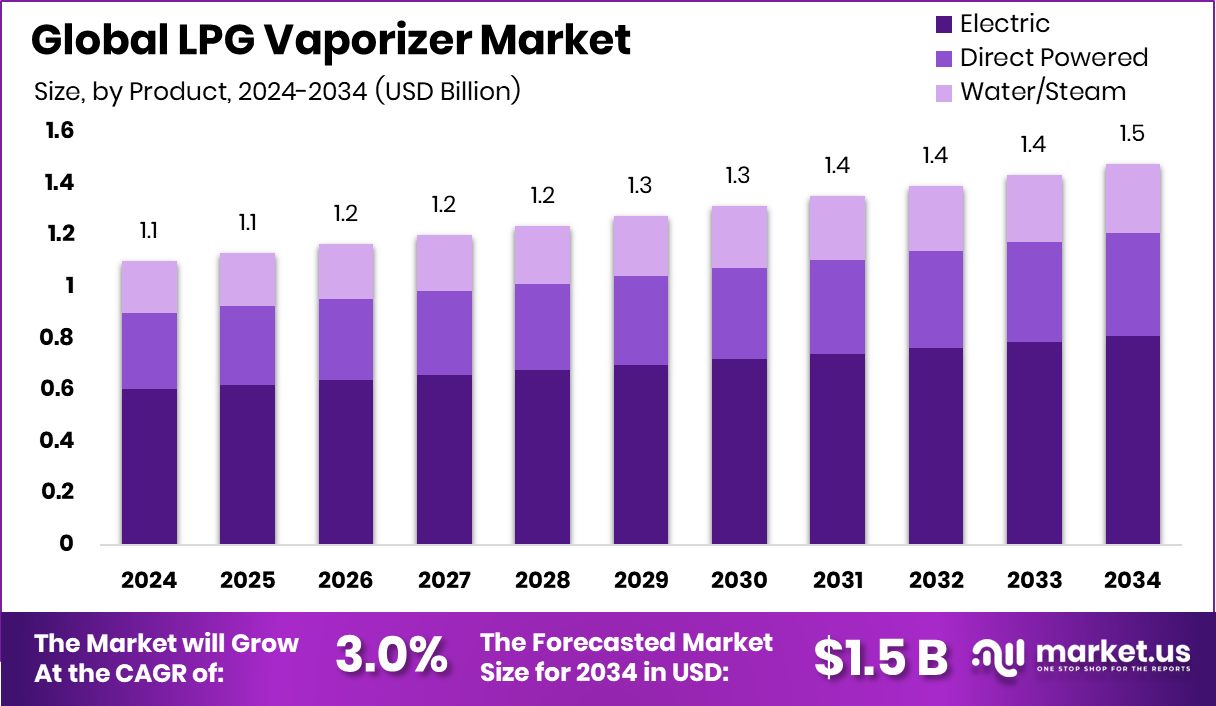

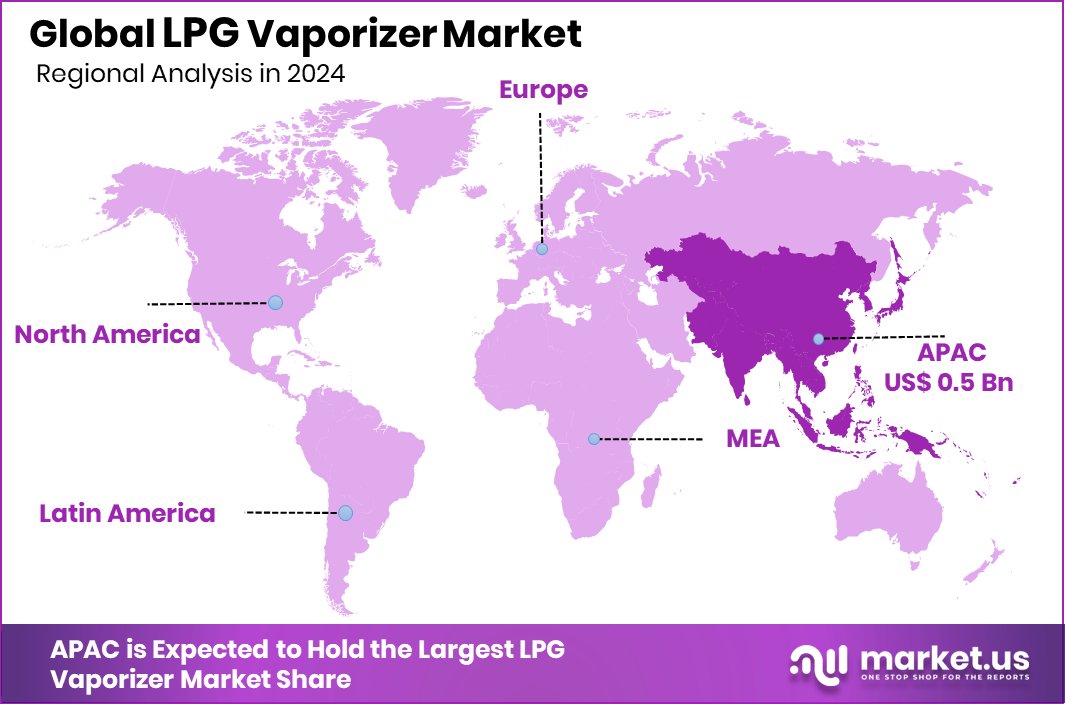

The Global LPG Vaporizer Market is expected to be worth around USD 1.5 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 3.0% from 2025 to 2034. The Asia-Pacific reached a market value of approximately USD 0.5 billion this year.

An LPG vaporizer is a device used to convert liquefied petroleum gas (LPG) from its liquid form into vapor. This is essential in industrial or high-demand applications where the natural vaporization of LPG is not sufficient due to low ambient temperatures or high consumption rates. The vaporizer ensures a consistent gas flow by heating the liquid LPG to the required temperature, thereby avoiding pressure drops or interruptions in gas supply.

The growth of the LPG vaporizer market is primarily driven by the rising consumption of LPG as a cleaner fuel alternative in both developing and developed economies. Government initiatives to reduce dependence on conventional fossil fuels and promote low-emission energy sources have supported wider LPG adoption, increasing the need for efficient vaporization systems. In industrial environments, where demand is steady or high, vaporizers offer reliable fuel delivery, making them a vital component in operations.

Rising demand for LPG in cold climate regions further boosts the need for vaporizers, as natural vaporization becomes inefficient at low temperatures. Moreover, the food processing, textile, and metal industries increasingly use LPG-based energy, creating consistent demand for vaporizer systems.

Opportunities lie in upgrading old infrastructure and replacing manual systems with automated or energy-efficient vaporizers. There is also potential in integrating smart technologies for remote monitoring and control, which can help industries manage fuel use more efficiently and safely. Emerging economies, expanding their industrial base, are also expected to adopt vaporizer systems to meet energy reliability standards.

Key Takeaways

- The Global LPG Vaporizer Market is expected to be worth around USD 1.5 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 3.0% from 2025 to 2034.

- Electric LPG vaporizer holds a 54.8% share due to its efficient and maintenance-free heating process.

- The 168–455 gal/hr segment captures 38.9% and is favored for mid-range industrial and commercial applications globally.

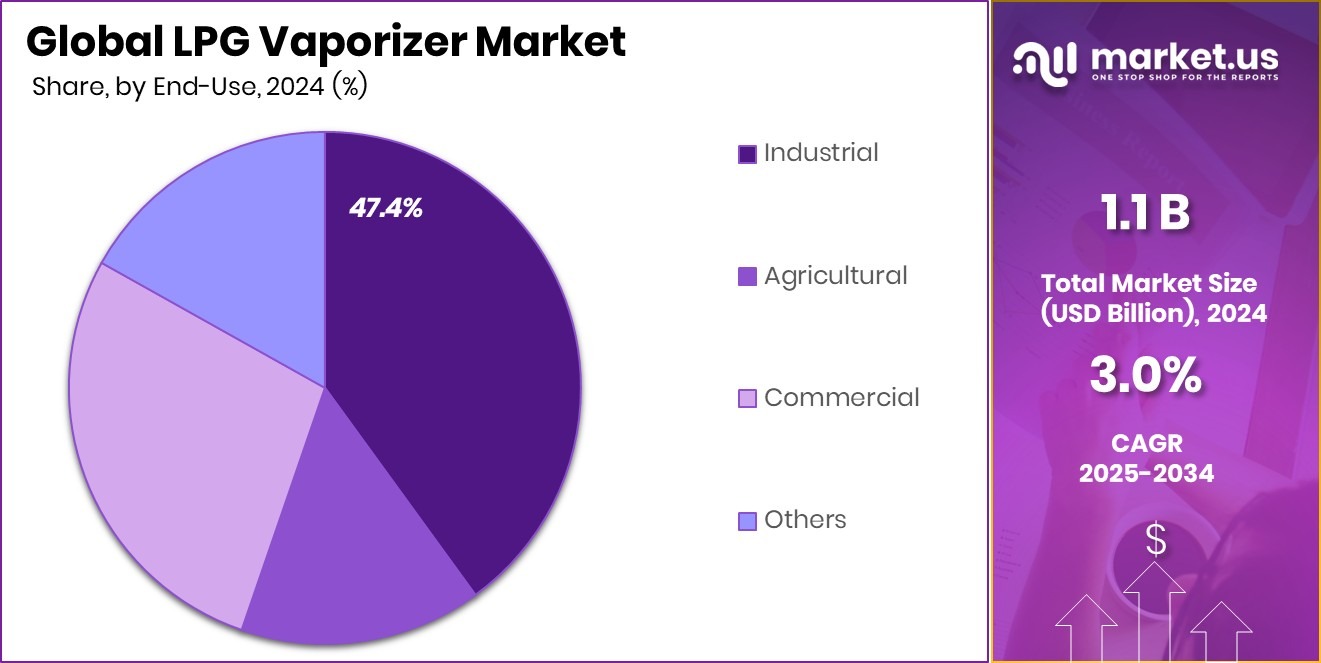

- The industrial sector leads with a 47.4% share, driven by continuous fuel demand and process heating needs.

- The Asia-Pacific reached a market value of approximately USD 0.5 billion this year.

By Product Analysis

Electric LPG vaporizers dominate the market with a 54.8% share.

In 2024, Electric held a dominant market position in the byproduct segment of the LPG Vaporizer Market, with a 54.8% share. This dominance can be attributed to the growing demand for energy-efficient and low-maintenance vaporization solutions across industrial and commercial applications.

Electric LPG vaporizers offer consistent performance without the need for an external heat source, which makes them ideal for regions with reliable electrical infrastructure. Their compact design, ease of installation, and reduced operational costs have further contributed to their wider acceptance, especially in sectors requiring a continuous and stable fuel supply.

Additionally, the electric variant is preferred in environments where clean and emission-free operations are crucial, supporting sustainability goals and workplace safety standards. Their ability to function effectively in colder climates, where natural vaporization is hindered, has reinforced their deployment in geographically diverse regions.

The 54.8% market share reflects not just technical superiority but also market trust in electric vaporizers for critical applications. The segment’s continued growth is expected to benefit from infrastructure modernization and industrial automation trends, which favor electric solutions due to their integration capabilities with digital monitoring systems.

By Capacity Analysis

168-455 gal/hr capacity vaporizers hold 38.9% of the total demand.

In 2024, 168–455 gal/hr held a dominant market position in the By Capacity segment of the LPG Vaporizer Market, with a 38.9% share. This capacity range has emerged as the most preferred choice across medium-scale industrial and commercial applications, where moderate yet continuous LPG supply is essential. The 168–455 gal/hr vaporizers strike a balance between operational efficiency and cost-effectiveness, making them suitable for sectors that require stable gas output without the complexities of managing high-capacity systems.

Their popularity is also driven by their adaptability across various operational settings, including manufacturing plants, food processing units, and commercial heating systems. These units offer sufficient capacity to meet the fuel needs of daily operations while maintaining a compact footprint and manageable maintenance requirements. The 38.9% market share demonstrates the trust and wide acceptance of this capacity range among end users seeking reliable and scalable vaporization solutions.

As demand for LPG grows in industrial applications, particularly in regions transitioning to cleaner fuel sources, the 168–455 gal/hr segment is expected to remain at the forefront. Its dominance in 2024 reflects both the technical suitability and commercial viability of this capacity range in meeting mid-tier consumption requirements efficiently.

By End-use Analysis

Industrial end-use leads the LPG vaporizer market with a 47.4% share.

In 2024, Industrial held a dominant market position in the By End-use segment of the LPG Vaporizer Market, with a 47.4% share. This significant share highlights the growing reliance of industrial operations on LPG as a cleaner and efficient energy source, especially in sectors where a continuous heat or power supply is critical. Industries such as textiles, metal processing, chemicals, and manufacturing have increasingly adopted LPG vaporizer systems to maintain consistent fuel flow for uninterrupted operations.

The preference for LPG vaporizers in industrial settings is also driven by their ability to handle variable load demands and operate efficiently in diverse environmental conditions. The 47.4% share reflects the segment’s strong alignment with the energy needs of medium to large-scale industrial facilities, where fuel reliability directly impacts productivity and cost control. Furthermore, as industrial users continue to seek alternatives to high-emission fuels, LPG vaporization systems have gained importance due to their low maintenance, safety features, and adaptability to automated systems.

This dominant position in 2024 underscores the critical role industrial applications play in shaping demand trends within the LPG vaporizer market. Continued infrastructure expansion and the transition toward more sustainable fuel options are likely to sustain growth in this segment.

Key Market Segments

By Product

- Electric

- Direct Powered

- Water/Steam

By Capacity

- 40-160 gal/hr

- 168-455 gal/hr

- 555-1005 gal/hr

- >1000 gal/hr

By End-use

- Industrial

- Agricultural

- Commercial

- Others

Driving Factors

Rising Use of LPG in Cold Climates

One of the main driving factors for the LPG vaporizer market is the increasing use of LPG in regions with cold weather. In low temperatures, LPG in liquid form does not vaporize naturally and needs external heating. This is where vaporizers play a key role. They help convert liquid LPG into gas so it can be used smoothly in homes, factories, and commercial buildings.

As more countries in cold regions switch to LPG for heating and industrial use, the demand for vaporizers is also going up. These devices ensure a steady fuel supply, even in freezing temperatures, making them essential for reliable energy use. This trend is expected to push the market growth steadily in the coming years.

Restraining Factors

High Installation and Maintenance Cost Limits Adoption

One major restraining factor in the LPG vaporizer market is the high cost of installation and regular maintenance. Setting up an LPG vaporizer system requires a good amount of investment in equipment, piping, safety systems, and skilled labor. For small businesses or low-consumption users, this upfront cost can be difficult to afford.

Additionally, vaporizers need ongoing servicing to ensure safety and efficiency, which adds to operating expenses over time. In regions with limited technical expertise or low LPG usage, buyers may hesitate to invest in such systems. This cost factor slows down adoption, especially in developing areas, where affordability is a key concern, and alternative fuel options might seem more practical or less expensive to maintain.

Growth Opportunity

Smart and Automated Vaporizers Gaining Demand

A major growth opportunity in the LPG vaporizer market lies in the rising demand for smart and automated vaporizer systems. Industries are now looking for advanced solutions that allow remote monitoring, automatic temperature control, and safety alerts. These modern vaporizers help save energy, reduce manual work, and improve overall efficiency. As factories and commercial users shift towards digital technologies, the adoption of smart vaporizers is expected to grow rapidly.

These systems are especially useful in large-scale operations where fuel supply needs to be stable and well-monitored. With growing awareness about energy management and safety, manufacturers are focusing on developing intelligent vaporizer units, opening new opportunities for innovation and market expansion in both developed and developing regions.

Latest Trends

Eco-Friendly and Energy-Efficient Vaporizers Getting Popular

One of the latest trends in the LPG vaporizer market is the shift toward eco-friendly and energy-efficient vaporizer systems. With rising concerns about energy use and carbon emissions, industries are now preferring vaporizers that consume less power and reduce environmental impact. Newer models are being designed with improved insulation, smart heating controls, and automatic shut-off features to save energy during low-demand periods.

This trend is especially important for businesses aiming to follow green energy standards and reduce operational costs. As awareness around sustainability grows, the demand for such vaporizers is increasing across both industrial and commercial users. This move toward cleaner and smarter equipment is shaping the future of the LPG vaporizer market in a positive direction.

Regional Analysis

In 2024, the Asia-Pacific led the LPG Vaporizer Market with a 46.8% share.

In 2024, Asia-Pacific held the dominant position in the global LPG Vaporizer Market, accounting for 46.8% of the total market share, which translated to a value of approximately USD 0.5 billion. This leading position was driven by strong industrialization, rising LPG consumption in manufacturing and commercial sectors, and growing demand for reliable fuel supply systems across countries such as China, India, and Southeast Asian nations.

North America showed steady growth due to widespread LPG usage in commercial heating and agricultural applications, while Europe followed closely with increasing adoption in industrial fuel switching initiatives. The Middle East & Africa region reflected gradual growth, supported by the rising use of LPG as an alternative fuel in remote and off-grid applications.

Latin America showed moderate performance, mainly led by industrial demand in select countries where LPG serves as a cleaner substitute for other fuels. Overall, Asia-Pacific’s dominance in the LPG vaporizer market is expected to continue, backed by infrastructure expansion, energy diversification efforts, and growing preference for clean-burning fuels across emerging economies within the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ADCENG Gas Equipment is recognized for its robust and reliable vaporizer units designed for heavy industrial usage. In 2024, the company continued to emphasize product durability and safety, deploying vaporizers capable of handling substantial usage in any environment. Their systems are often selected in operations requiring consistent LPG vaporization under variable load conditions. With a focus on tailored solutions and local support capabilities, ADCENG maintained stable traction in markets that demand resilient equipment and dependable after-sales service.

Algas‑SDI has positioned itself as a strong contender in supplying vaporizers with diverse configurations catering to mid-range and large-scale applications. In 2024, the company furthered its approach by enhancing modular designs and improving heat exchange efficiency. These improvements align with an increased need for energy-efficient systems in industrial and commercial settings. Confidence in Algas‑SDI’s technology has been underpinned by positive feedback regarding ease of installation and operational consistency, supporting its market presence, particularly in regions with growing LPG-powered infrastructure.

Alternate Energy Systems Inc. continued to drive innovation through the integration of smarter controls and automation in its vaporizer offerings. In 2024, the company advanced features such as remote monitoring and dynamic temperature control, catering to clients seeking enhanced operational insight and reduced manual supervision. This strategy proved beneficial in segments prioritizing digital integration and energy management. Their ability to blend traditional vaporization technology with modern connectivity positioned Alternate Energy Systems as a forward-leaning player in the expanding LPG vaporizer landscape.

Top Key Players in the Market

- ADCENG Gas Equipment (Pty) Ltd.

- Algas-SDI

- Alternate Energy Systems Inc

- Anil Engineering Pvt. Ltd.

- FAS Flüssiggas-Anlagen GmbH

- Maxquip

- Meeder Equipment Company

- PEGORARO GAS TECHNOLOGIES Srl

- PSG

- SHV Energy

- Standby Systems, Inc.

- TransTech Energy, LLC

Recent Developments

- In May 2024, Algas‑SDI remained focused on designing and manufacturing LP‑Gas vaporizers, synthetic gas systems, and industrial heating burners. This reaffirmed its position in developing and deploying clean‑fuel hardware worldwide, with proven expertise in LPG vaporizer technology.

- In May 2024, Anil Engineering Pvt. Ltd. is renowned for manufacturing LPG storage tanks, cryogenic vessels, safety valves, and LPG vaporizers under ISO 9001:2015 standards. The firm has leveraged over five decades of expertise to expand its vaporizer portfolio with innovative models tailored for industrial and commercial use.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Billion Forecast Revenue (2034) USD 1.5 Billion CAGR (2025-2034) 3.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Electric, Direct Powered, Water/Steam), By Capacity (40-160 gal/hr, 168-455 gal/hr, 555-1005 gal/hr, >1000 gal/hr), By End-use (Industrial, Agricultural, Commercial, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADCENG Gas Equipment (Pty) Ltd., Algas-SDI, Alternate Energy Systems Inc, Anil Engineering Pvt. Ltd., FAS Flüssiggas-Anlagen GmbH, Maxquip, Meeder Equipment Company, PEGORARO GAS TECHNOLOGIES Srl, PSG, SHV Energy, Standby Systems, Inc., TransTech Energy, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ADCENG Gas Equipment (Pty) Ltd.

- Algas-SDI

- Alternate Energy Systems Inc

- Anil Engineering Pvt. Ltd.

- FAS Flüssiggas-Anlagen GmbH

- Maxquip

- Meeder Equipment Company

- PEGORARO GAS TECHNOLOGIES Srl

- PSG

- SHV Energy

- Standby Systems, Inc.

- TransTech Energy, LLC