Global Lower GI Series Market By Application (Gastroenteritis, Colon Polyps, Tumor, Strictures (Crohn’s Disease), Ulcerative Colitis, other) By Test Types (Double-Contrast, Single-Contrast) By End-Users (Hospitals, Clinics & Diagnostic Laboratories, Research Institution , Other) Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 67591

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

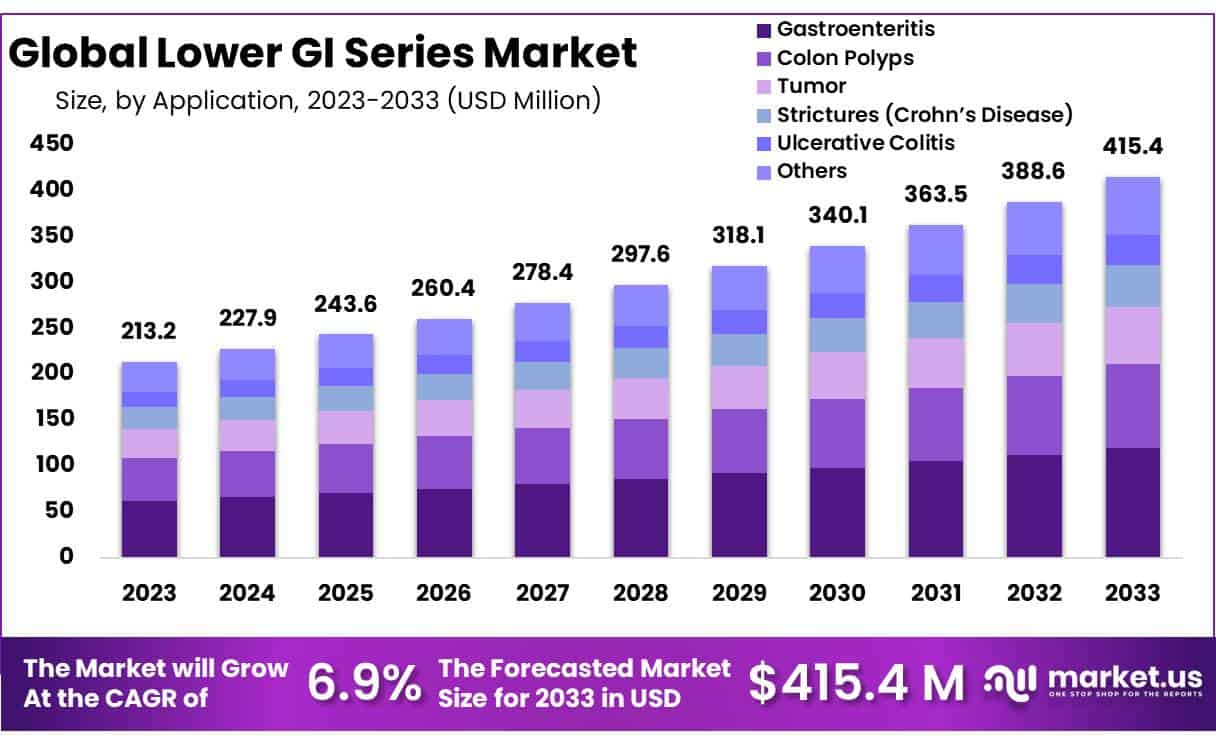

The Global Lower GI Series Market size is expected to be worth around USD 415.4 Billion by 2033 from USD 213.2 Billion in 2023, growing at a CAGR of 6.9% during the forecast period from 2024 to 2033.

Lower GI series or barium enema is a medical procedure used to diagnose diseases and abnormalities within the human large intestine and rectopelvis. Major companies are investing heavily in research and development to introduce more efficient methods and devices, in response to increasing pressure to provide cost-effective approaches.

Lower GI Series Market represents a sector specializing in providing diagnostic tests and procedures aimed at inspecting the lower part of the gastrointestinal (GI) tract. This includes services and technologies to detect, diagnose, and manage conditions affecting the colon, rectum and lower part of the small intestine. These conditions include colorectal cancer, inflammatory bowel disease (IBD), and diverticulitis.

The market encompasses development, production and distribution of medical imaging equipment and consumables as well as healthcare services relating to these conditions. Hospitals, diagnostic centers, and other healthcare institutions that need reliable methods for conducting lower GI series tests that contribute to patient diagnosis and treatment planning benefit from this market.

According to the National Institute of Diabetes and Digestive and Kidney Diseases, around 60-70 million Americans are currently affected by various forms of gastroenteritis; both major and minor. Unfortunately, due to poor dietary practices and an aging population this figure continues to increase rapidly. Lower GI series market growth is propelled by an increasing prevalence of gastrointestinal diseases and gastric cancer, along with lifestyle shifts. Furthermore, advances in technology, cost-effective methods, and government support for research all play an integral part.

Key Takeaways

- Market Size: Lower GI Series Market size is expected to be worth around USD 415.4 Billion by 2033 from USD 213.2 Billion in 2023.

- Market Growth: The market growing at a CAGR of 6.9% during the forecast period from 2024 to 2033.

- Product Analysis: Gastroenteritis accounts for 28.9% of this market in 2023.

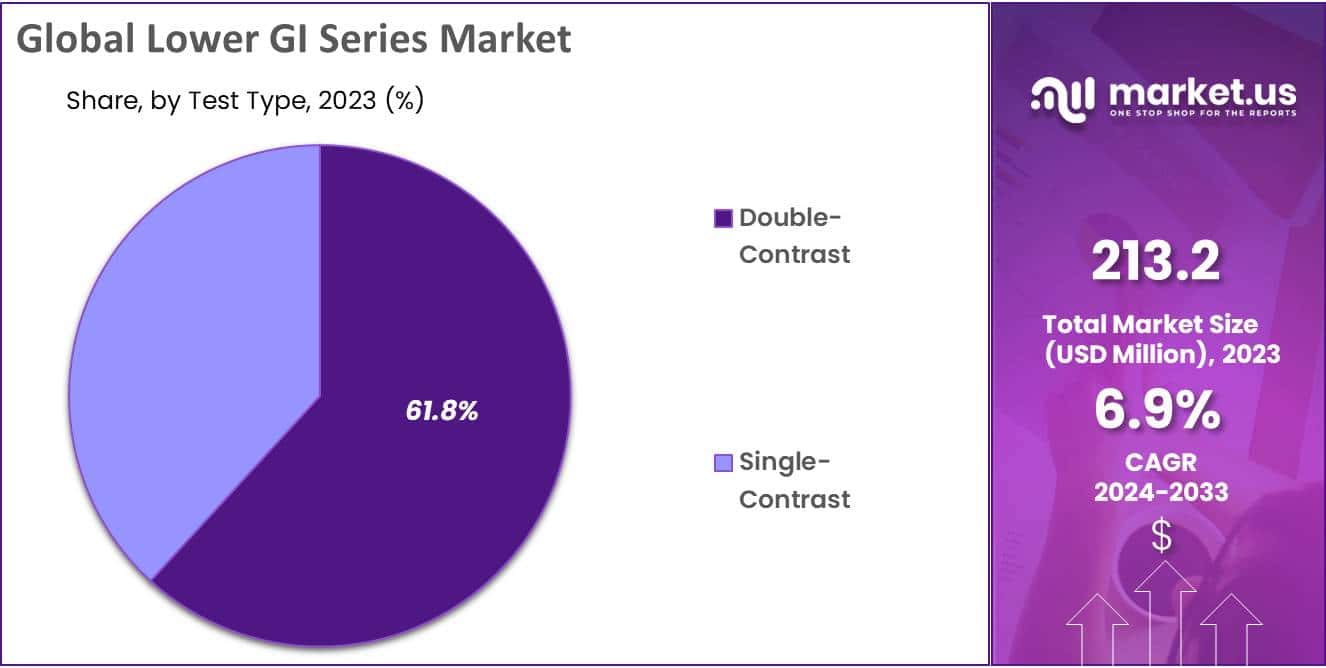

- Application Analysis: Double-Contrast tests dominate with an astounding 61.8% market share.

- End-Use Analysis: Hospitals emerge as the primary end-user, commanding a significant 71.5% share of the market.

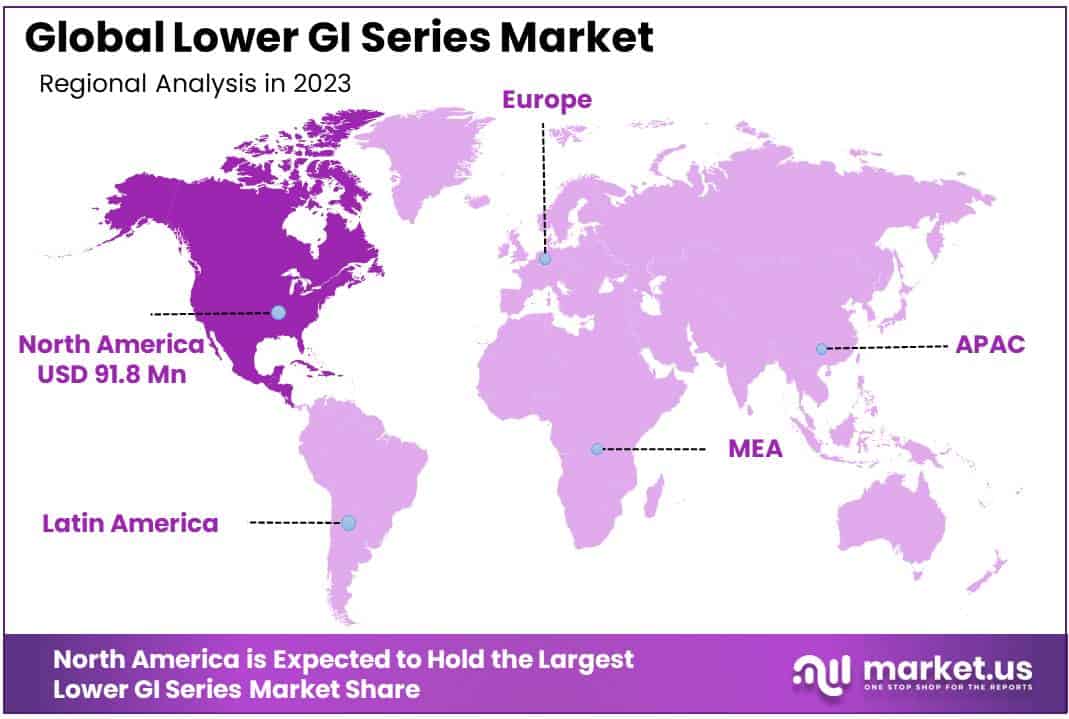

- Regional Analysis: The Americas hold a substantial portion of the global market, 43.1% in 2023.

Application Analysis

Lower GI Series Market covers various conditions affecting the lower gastrointestinal tract, such as gastroenteritis, colon polyps, tumors, strictures associated with Crohn’s Disease and ulcerative colitis. Gastroenteritis accounts for 28.9% of this market due to its widespread occurrence and need for diagnostic procedures like Lower GI series for accurate diagnosis and management.

Colon polyps, tumors, strictures related to Crohn’s Disease and ulcerative colitis all play an integral part of market dynamics. Due to advancements in medical technology and rising awareness about gastrointestinal health conditions, diagnostic imaging techniques like the Lower GI series will become even more essential in early detection, evaluation and monitoring of disease progression. With increasing advances in healthcare technology and rising awareness about lower gastrointestinal conditions expected, this market should experience continued expansion serving patient diagnosis needs across various conditions of the lower gastrointestinal system.

Test Type Analysis

In test types analysis two primary test types are used: Double-Contrast and Single-Contrast procedures. Double-Contrast tests dominate with an astounding 61.8% market share. This test method utilizes barium and air together to produce detailed images of the lower gastrointestinal tract by providing enhanced visibility of its intestinal lining – helping detect polyps, tumors, or strictures more readily.

On the other hand, single-contrast tests use only one contrast agent, typically barium, to outline the structure of your colon. While still used in certain circumstances, single-contrast procedures represent only a minority share of market sales compared with double-contrast procedures.

Double-Contrast tests remain popular choices among clinicians and patients due to their superior diagnostic capabilities and widespread adoption, driving growth of the Lower GI series market.

End-Users Analysis

In the Lower GI series market, various end-users play pivotal roles in driving demand and utilization of diagnostic procedures. Hospitals emerge as the primary end-user, commanding a significant 71.5% share of the market. This dominance can be attributed to hospitals being central hubs for diagnosing and treating gastrointestinal conditions. With a wide range of medical specialties and comprehensive diagnostic facilities, hospitals cater to the diverse needs of patients requiring Lower GI series examinations.

Additionally, Clinics & Diagnostic Laboratories serve as important end-users in the Lower GI series market. These facilities offer convenient access to diagnostic services, particularly for outpatient care and routine screenings.

Research Institutions also contribute to the utilization of Lower GI series, primarily for academic and investigational purposes. Their involvement fosters advancements in diagnostic techniques and contributes to the overall understanding of gastrointestinal diseases.

Market Segments

Application

- Gastroenteritis

- Colon Polyps

- Tumor

- Strictures (Crohn’s Disease)

- Ulcerative Colitis

- other

Test Types

- Double-Contrast

- Single-Contrast

End-Users

- Hospitals

- Clinics & Diagnostic Laboratories

- Research Institution

- Other

Driver

The global prevalence of gastrointestinal disorders is a critical driver for the lower GI series market. According to the World Health Organization (WHO), colorectal cancer is the third most common cancer globally, with an estimated 1.8 million new cases diagnosed in 2018. Inflammatory bowel disease (IBD) affects up to 6.8 million individuals worldwide, as reported by the International Foundation for Gastrointestinal Disorders. These statistics underscore the growing need for diagnostic procedures like lower GI series.

Trend

What’s really catching on in the lower GI series world is how technology is making these tests a lot less scary and much more accurate. Think about it like upgrading from an old, bulky TV to a sleek, smart TV. The new gadgets and techniques doctors are using now help them see what’s happening inside you better than ever before.

This means they can spot problems early, often before you even feel sick. And with more people talking about how important it is to check on your gut health, it’s becoming more common for folks to get these tests done. So, technology and awareness are like the big wave pushing this market forward.

Restraint

The high cost of diagnostic procedures poses a significant restraint. Setting up a lower GI series facility can require an initial investment of up to USD 500,000, with annual maintenance costs ranging from 5% to 10% of the initial investment, according to the Healthcare Financial Management Association (HFMA). Additionally, a study in the Journal of Radiology Nursing highlights that out-of-pocket costs for patients undergoing a lower GI series can exceed USD 2,000, where insurance coverage is limited or absent.

Radiation exposure concerns also add to the restraint, with the U.S. Food and Drug Administration (FDA) estimating that the average radiation dose for a lower GI series is approximately 4.5 mSv, equivalent to about 18 months of natural background radiation.

Opportunity

An emerging opportunity within the lower GI series market lies in the development of minimally invasive and non-invasive diagnostic techniques. Innovations such as virtual colonoscopy and capsule endoscopy offer patients alternatives to traditional lower GI series procedures, reducing discomfort and enhancing convenience.

Furthermore, the growing trend towards personalized medicine and precision diagnostics opens avenues for targeted lower GI series solutions tailored to individual patient needs. Collaborations between healthcare institutions and technology providers can drive further advancements in lower GI series technology, unlocking new opportunities for market expansion and improved patient care.

Regional Analysis

On the regional basis, the Americas, Europe, Asia Pacific, and the Middle East & Africa. The Americas hold a substantial portion of the global market, 43.1%, thanks to significant investments in healthcare research and development, along with its robust economy that supports R&D activities. The growth of the Lower GI Series Market in this region is further propelled by an expanding patient demographic and an aging population.

Europe stands as the second-largest market, with Asia Pacific quickly catching up due to its advancements in technology. These technological advancements are expected to enhance the efficiency and accuracy of diagnoses. Asia Pacific is witnessing rapid growth, driven by an increasing rate of communicable diseases. Countries like India and China are ramping up their investment in healthcare research and development, promising a significant boost to the market.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Player Analysis

The Lower GI Series Market report offers an exhaustive profile of its leading participants through sections dedicated to competitive landscape and company profiles. Each major market participant is assessed in terms of product or service offerings, financial health, notable advancements, strategic market approaches, geographic reach and distinctive attributes. Furthermore, for leading three to five companies, an exhaustive SWOT analysis is provided which details strengths, weaknesses, opportunities and threats alongside details regarding strategic focus, tactics against competition and competitive edges.

This report is versatile, permitting clients to customize the company list to meet specific client needs. When exploring competitive landscape, this report gives a deep dive into five top companies’ rankings, significant actions such as recent developments, collaborations, mergers, acquisitions, new product introductions as well as their overall presence through regional footprint analysis and Ace matrix evaluation.

Market Key Players

- Allied Digestive Health

- Boston Scientific

- Capital Digestive Care

- CRH Medical

- Iterative Scopes

- Fujifilm Medical

- Gastro Health

- GI Alliance

- Medtronic

- Micro-Tech Endoscopy

- Motus GI

- Olympus

- One GI

- PE GI Solutions

- Other Key Players

Recent Developments

- Boston Scientific (January, 2024): Launched the new Flex-AX Arthroscope for improved visualization during colonoscopies .

- Capital Digestive Care (February, 2024): Merged with GI Alliance to form a leading GI provider network.

- Iterative Scopes (March, 2024): Received FDA approval for their AI-powered colonoscopy platform, enhancing polyp detection.

- One GI (February, 2024): Partnered with Gastro Health to offer comprehensive GI services to patients.

- Micro-Tech Endoscopy (January, 2024): Launched the new EndoLight+ colonoscope with improved maneuverability.

- Gastro Health (February, 2024): Partnered with One GI to offer comprehensive GI services to patients.

Report Scope

Report Features Description Market Value (2023) USD 213.2 Billion Forecast Revenue (2033) USD 415.4 Billion CAGR (2024-2033) 6.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (Gastroenteritis, Colon Polyps, Tumor, Strictures (Crohn’s Disease), Ulcerative Colitis, other) By Test Types (Double-Contrast, Single-Contrast) By End-Users (Hospitals, Clinics & Diagnostic Laboratories, Research Institution , Other) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Allied Digestive Health, Boston Scientific, Capital Digestive Care, CRH Medical, Iterative Scopes, Fujifilm Medical, Gastro Health, GI Alliance, Medtronic, Micro-Tech Endoscopy, Motus GI, Olympus, One GI, PE GI Solutions, Other Key Players, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Lower GI Series Market?The Lower GI Series Market refers to the industry surrounding the diagnostic tests and procedures used to examine the lower gastrointestinal tract. These include various technologies and services for detecting and managing conditions like colorectal cancer, inflammatory bowel disease, and diverticulitis.

How big is the Lower GI Series Market?The global Lower GI Series Market size was estimated at USD 213.2 Billion in 2023 and is expected to reach USD 415.4 Billion in 2033.

What is the Lower GI Series Market growth?The global Lower GI Series Market is expected to grow at a compound annual growth rate of 6.9%. From 2024 To 2033

Who are the key companies/players in the Lower GI Series Market?Some of the key players in the Lower GI Series Markets are Allied Digestive Health, Boston Scientific, Capital Digestive Care, CRH Medical, Iterative Scopes, Fujifilm Medical, Gastro Health, GI Alliance, Medtronic, Micro-Tech Endoscopy, Motus GI, Olympus, One GI, PE GI Solutions, Other Key Players.

What drives the growth of the Lower GI Series Market?Key drivers include the rising prevalence of gastrointestinal disorders, increased awareness of gastrointestinal health, and advancements in medical imaging technology. These factors lead to a higher demand for diagnostic procedures, contributing to market growth.

What challenges does the Lower GI Series Market face?Challenges include the high costs associated with diagnostic procedures, concerns over radiation exposure, and limited insurance coverage for newer, less invasive tests. Additionally, accessibility issues in rural or underserved areas pose significant challenges.

What opportunities exist in the Lower GI Series Market?Opportunities lie in the development of minimally invasive and non-invasive diagnostic methods, such as virtual colonoscopy and capsule endoscopy. The trend towards personalized medicine and precision diagnostics also presents significant growth prospects for the market.

-

-

- Allied Digestive Health

- Boston Scientific

- Capital Digestive Care

- CRH Medical

- Iterative Scopes

- Fujifilm Medical

- Gastro Health

- GI Alliance

- Medtronic

- Micro-Tech Endoscopy

- Motus GI

- Olympus

- One GI

- PE GI Solutions

- Other Key Players