Global Low Voltage Vacuum Contactors Market Size, Industry Analysis Report By Product Type (AC Contactor, DC Contactor), By Application (Industrial, Commercial, Residential), By End-User (Manufacturing, Utilities, Oil & Gas, Mining, Others), By Voltage Rating (Up to 1kV, 1kV-5kV, Above 5kV) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157882

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

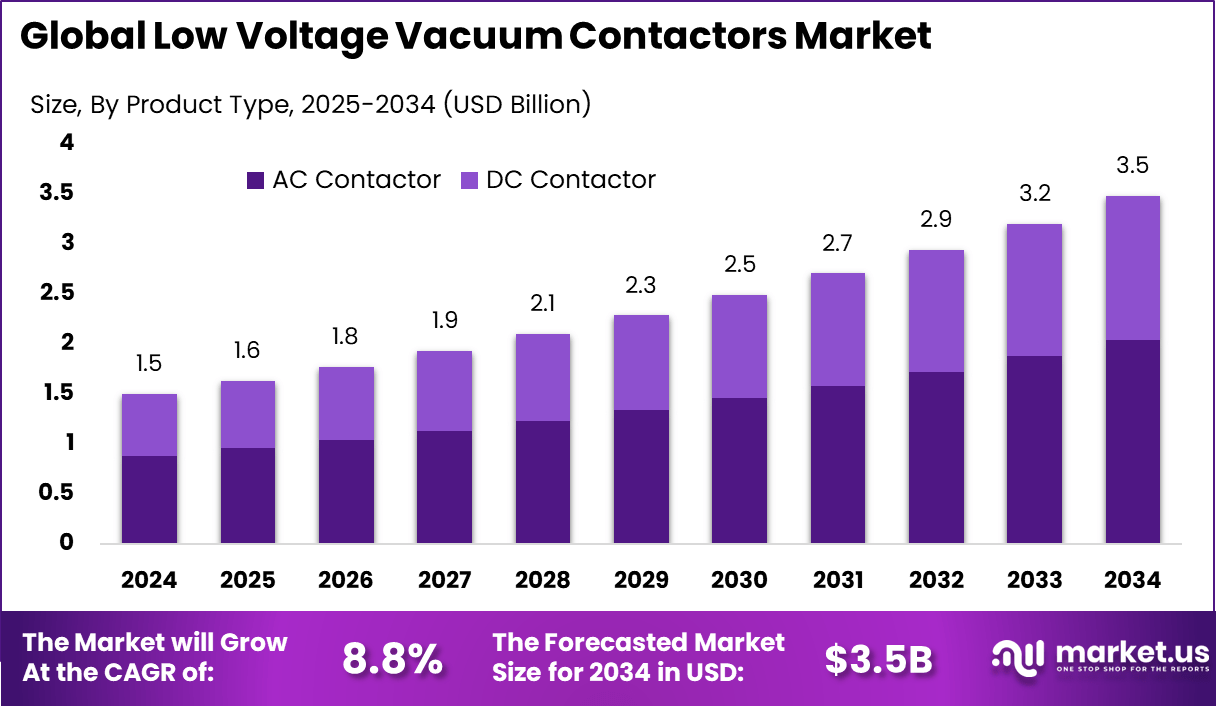

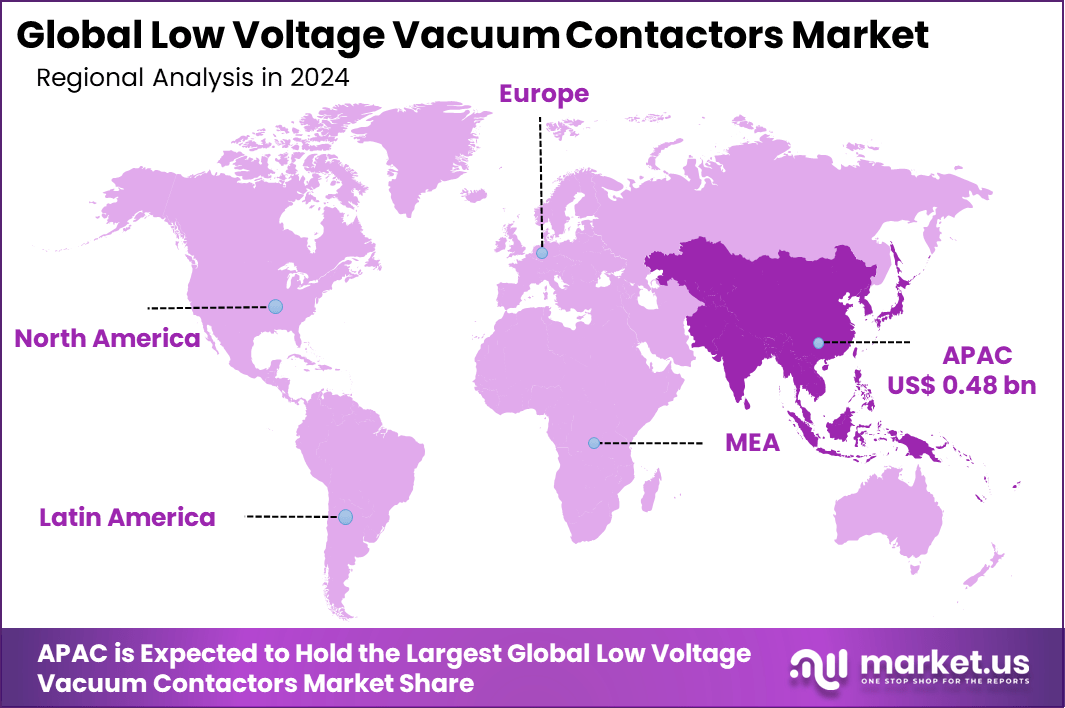

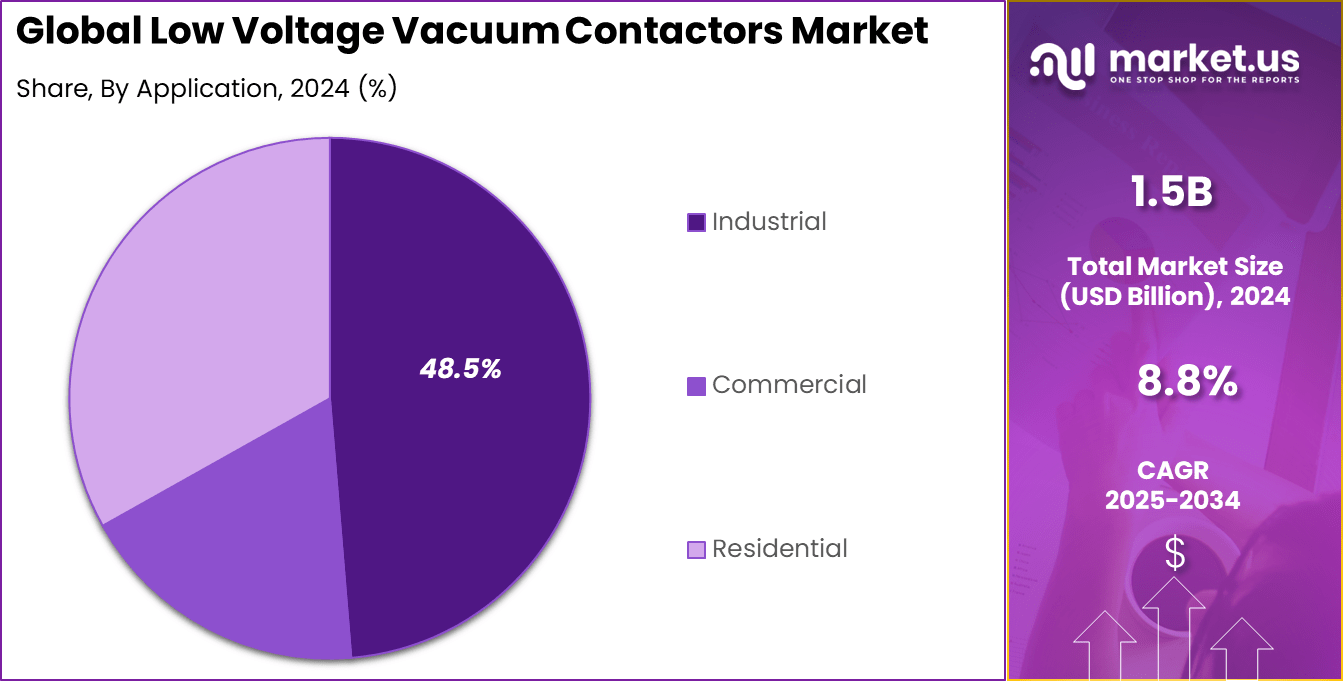

The Global Low Voltage Vacuum Contactors Market size is expected to be worth around USD 3.5 billion by 2034, from USD 1.5 billion in 2024, growing at a CAGR of 8.8% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 32.6% share, holding USD 0.48 billion in revenue.

The Low Voltage Vacuum Contactors Market focuses on electrical switching devices used primarily in industrial and commercial applications to control and protect electrical circuits under low voltage conditions. These contactors operate within a vacuum-sealed environment, which helps to extinguish arcs safely and efficiently when the electrical circuit is opened.

This technology is valued for its long service life, minimal maintenance, and high reliability compared to traditional electromechanical contactors. Due to their ability to handle frequent switching and operate safely in intense industrial environments, these contactors have become essential components in motor control, power distribution, lighting, and HVAC systems.

The primary drivers of the low voltage vacuum contactors market include the growing demand for energy-efficient, reliable, and durable electrical equipment. As industries seek to reduce maintenance costs and improve safety standards, the demand for vacuum contactors is rising due to their enhanced longevity and better arc quenching capabilities compared to conventional air-break contactors.

Additionally, increasing industrial automation and the need for advanced motor control solutions in sectors such as manufacturing, oil and gas, and power generation are contributing to market growth. Stringent safety and environmental regulations are also prompting industries to shift toward more reliable and efficient electrical systems, further driving the adoption of vacuum contactors.

Demand for low voltage vacuum contactors is high in industries that require frequent motor switching, such as manufacturing, mining, and water treatment plants. As industrial automation and control systems expand, vacuum contactors are being increasingly used in motor starters, protection circuits, and switchgear.

Key Takeaway

- In 2024, the AC Contactor segment led the market with a 58.6% share.

- By end-use, the Industrial segment dominated, accounting for 48.5% share.

- Within industries, Manufacturing held the top position, securing 33.7% share.

- By voltage range, the 1kV–5kV segment captured 36.7% share.

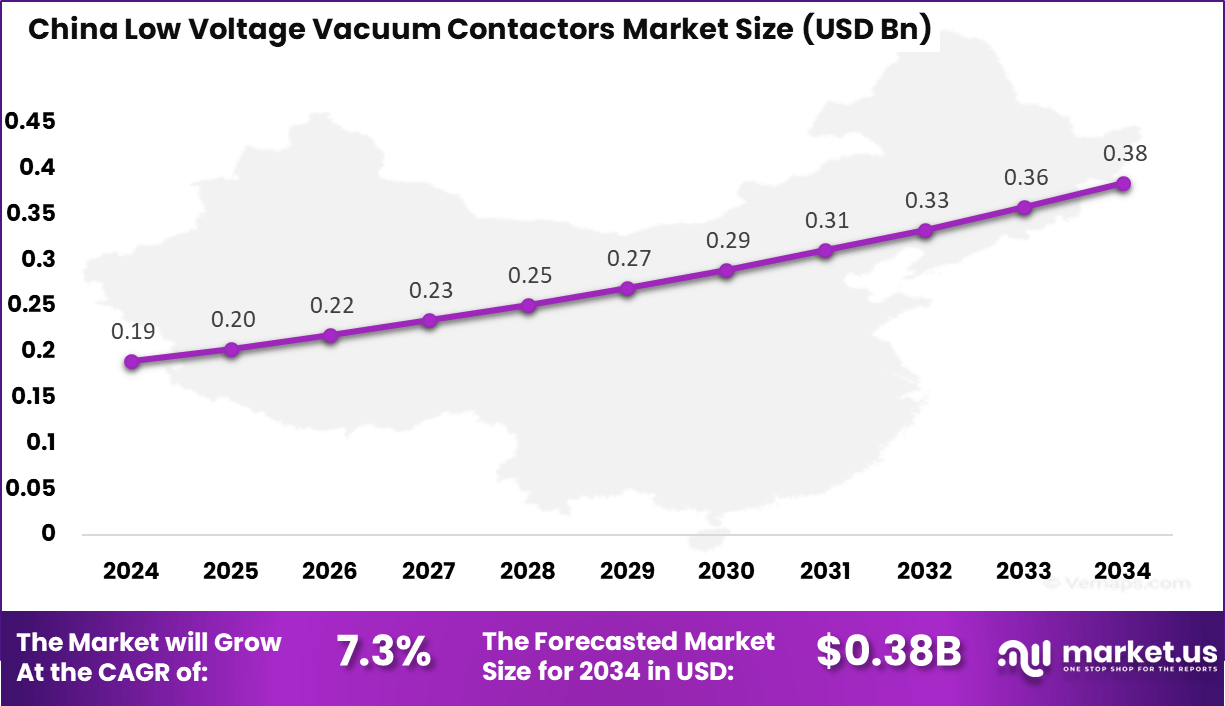

- The China market was valued at USD 0.19 Billion in 2024, growing at a steady 7.3% CAGR.

- Regionally, Asia Pacific led the global market with 32.6% share in 2024.

Analysts’ Viewpoint

Technological advancements are significantly enhancing the capabilities of low voltage vacuum contactors. Innovations include improved vacuum interrupters, advanced coil and contact materials, and integration with digital control systems. The increasing trend towards smart grids and automated systems is driving the need for more sophisticated control equipment, including vacuum contactors.

The adoption of low voltage vacuum contactors is primarily driven by their enhanced performance, reliability, and longevity. Vacuum contactors offer faster and more effective arc quenching, reducing the risk of damage to electrical systems. Their ability to function without the need for regular maintenance or replacement of components makes them more cost-effective over time.

These contactors also provide higher switching capacity and better protection for electrical equipment, making them ideal for environments where reliability is critical. The growing preference for energy-efficient solutions and low-maintenance systems in both industrial and commercial sectors is also contributing to the market adoption.

Investment and Business Benefits

There are considerable investment opportunities in the development of new vacuum contactor technologies, particularly those focused on improving energy efficiency, reducing operational costs, and increasing lifespan. Companies that specialize in smart grid technology and industrial automation are expected to benefit from integrating vacuum contactors into their systems.

Additionally, investment in emerging markets, where industrial infrastructure is expanding, offers significant potential for vendors offering cost-effective and high-performance vacuum contactor solutions. Innovations in digital controls and integration with remote monitoring systems will further enhance investment opportunities in this space.

Businesses adopting low voltage vacuum contactors benefit from improved operational efficiency, reduced downtime, and lower maintenance costs. The enhanced durability and reliability of vacuum contactors ensure that equipment operates safely and efficiently, reducing the likelihood of electrical failures. These solutions also support compliance with stringent safety and environmental regulations.

China Market Forecast

The market for Low Voltage Vacuum Contactors within China is growing tremendously and is currently valued at USD 0.19 billion, the market has a projected CAGR of 7.3%. The market for low-voltage vacuum contactors in China is experiencing significant growth driven by the country’s rapid industrial development, robust investments in renewable energy, and extensive infrastructure initiatives.

The surge in smart manufacturing, electric vehicle adoption, and power grid modernization is causing an increase in demand for reliable low-voltage switching solutions. Furthermore, the adoption of decarbonization and industrial automation policies by governments is driving the use of vacuum contactors in many industries.

For instance, In April 2025, Huawei has been advancing power distribution with its smart substation solutions, which combine intelligent control systems with cutting-edge switching technologies like low-voltage vacuum contactors. These solutions utilize digital monitoring, AI-driven predictive maintenance, and remote management features to enhance grid stability, operational efficiency, and equipment longevity.

In 2024, Asia Pacific held a dominant market position in the Global Low Voltage Vacuum Contactors Market, capturing more than a 32.6% share, holding USD 0.48 billion in revenue. Asia Pacific held a dominant market position due to its established industrial base, fast-paced urban expansion, and significant energy infrastructure investments.

Countries like China, India, Japan, and South Korea are driving demand through extensive manufacturing activities, expanding renewable energy capacity, and ongoing grid modernization projects. Furthermore, there are government programs supporting smart grids, industrial automation, and renewable energy solutions that amplify the widespread application across the region.

For instance, In June 2025, the Asia Pacific region maintained leadership in the Low Voltage Vacuum Contactors market, fueled by rapid industrialization, urbanization, and heavy investments in renewable energy, smart manufacturing, and power infrastructure.

Product Type Analysis

In 2024, AC contactors hold the majority share within the low voltage vacuum contactors market at 58.6%. These contactors are widely preferred due to their efficiency in handling alternating current systems, which are predominant in various industrial and commercial applications. They facilitate the switching of electrical circuits without sparking or electrical noise, thus enhancing equipment longevity and operational safety.

The AC contactors’ superior performance in motor control, lighting, and HVAC systems makes them a core component in electrical infrastructure, particularly in environments demanding high reliability and frequent switching. The evolution of AC contactor designs with improved compactness, durability, and energy efficiency further propels their adoption.

Manufacturers are integrating advanced vacuum technology to reduce wear and tear on moving parts, lowering maintenance costs and downtime. As industries continuously upgrade their electrical systems to meet modern standards, AC contactors remain a key element for ensuring effective power distribution and operational excellence.

For instance, In April 2025, Schneider Electric introduced its TeSys Deca Advanced Snap series, an upgraded low-voltage motor management solution integrating advanced AC contactor technology. Designed for easy installation, enhanced safety, and greater operational resilience, the product line supports high-frequency switching and remote diagnostics, addressing the rising demand for smart, efficient, and low-maintenance vacuum contactor solutions in industrial automation.

Application Analysis

|In 2024, Industrial applications represent 48.5% of the low voltage vacuum contactors market, reflecting their critical role in powering and controlling industrial machinery and manufacturing processes. These contactors are integral to industries like manufacturing, energy, and utilities where robust electrical control systems are vital for continuous operations.

Their use extends to motor starters, conveyor belts, robotics, and heavy machinery, where reliable switching ensures operational safety and efficiency. The increasing focus on industrial automation and the modernization of electrical infrastructure drives demand within this segment. As industries adopt IoT and smart grid technologies, vacuum contactors are increasingly embedded within intelligent control systems for real-time monitoring and predictive maintenance.

For instance, In June 2025, Indian microcap firm RMC Switchgears Ltd reached its upper circuit after securing a major supply agreement for low-voltage products used in industrial automation and power distribution. The deal shows rising demand in India’s industrial sector for reliable, efficient, and locally made low-voltage vacuum contactor solutions, driven by rapid infrastructure growth and modernization.

End-User Analysis

In 2024, the manufacturing sector stands as the leading end-user segment, accounting for 33.7% of the market. As manufacturing plants rely heavily on electrical machinery and automated systems, low voltage vacuum contactors facilitate efficient and safe control of electrical loads. These contactors are used in motor control centers, automation systems, and essential manufacturing equipment, underscoring their significance in maintaining uninterrupted production workflows.

The ongoing drive toward Industry 4.0 and smart manufacturing accelerates the adoption of vacuum contactors that feature enhanced switching capabilities and compatibility with digital control systems. Manufacturers seek technology that reduces downtime and maintenance while improving operational efficiency, making vacuum contactors an indispensable part of modern manufacturing infrastructure.

For instance, in May 2024, Liyond Electric emphasized its growing portfolio of low-voltage vacuum contactors specifically designed for the manufacturing sector, where reliable motor control and high switching endurance are critical. These solutions cater to end users requiring continuous operation, minimal maintenance, and enhanced safety, supporting a broad range of manufacturing processes such as metal processing, chemical production, and automated assembly lines.

Voltage Rating Analysis

In 2024, the 1kV-5kV voltage rating segment holds a substantial share of 36.7% within the low voltage vacuum contactors market. This medium voltage range is crucial for controlling and protecting electrical circuits in power distribution networks, industrial machinery, and renewable energy installations. Contactors designed for this voltage bracket support applications requiring higher power management capabilities and enhanced reliability.

Growth in this segment is driven by infrastructure development, increased industrial activity, and the expanding integration of renewable energy sources like solar and wind power. Medium voltage vacuum contactors are essential for ensuring safe switching operations while minimizing energy losses and maintenance needs.

For Instance, For instance, in September 2024, Hertz Power introduced solutions in the 1kV–5kV range, aligning with low-voltage vacuum contactors used in industrial and utility sectors. This range is vital for medium-capacity load switching, balancing performance, safety, and cost efficiency in motor control, mining, and distributed energy systems.

Key Market Segments

By Product Type

- AC Contactor

- DC Contactor

By Application

- Industrial

- Commercial

- Residential

By End-User

- Manufacturing

- Utilities

- Oil & Gas

- Mining

- Others

By Voltage Rating

- Up to 1kV

- 1kV-5kV

- Above 5kV

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Demand for Reliable Electrical Systems

The growing need for reliable and efficient electrical systems across multiple industries is a key driver for the low voltage vacuum contactors market. Sectors such as manufacturing, utilities, oil and gas, and mining rely heavily on robust electrical switching equipment to maintain continuous operations.

Vacuum contactors offer superior performance in switching electrical circuits with minimal maintenance, making them highly suitable for these critical applications. As industries modernize and automate their operations, the demand for such reliable contactors continues to rise steadily. Additionally, the expansion in industrial infrastructure worldwide fuels this growth further.

These contactors are increasingly favored due to their ability to handle frequent switching while ensuring safety. Their durability in tough operating environments and contribution to energy efficiency support industrial modernization goals. Consequently, this widespread industrial reliance on dependable electrical systems significantly propels the market growth for low voltage vacuum contactors.

For instance, in March 2025 at Hannover Messe, Siemens presented new industrial automation solutions featuring low-voltage vacuum contactors. These innovations support efficiency and sustainability in manufacturing by enabling safe, reliable, and high-performance switching for automated, digitally connected systems.

Restraint

High Initial Cost of Vacuum Contactors

One major restraint in the low voltage vacuum contactors market is the relatively high initial purchase cost when compared to traditional electromechanical contactors. While vacuum contactors deliver enhanced reliability and longer equipment life, the upfront investment can be a significant barrier, especially for small and medium-sized companies operating under tight budget constraints.

Moreover, the advanced technology involved requires skilled handling and technical expertise for proper installation and maintenance. Many potential end-users may lack this know-how, creating further hesitation in committing to these products. Overcoming this cost barrier and the associated technical learning curve is essential for the broader acceptance of vacuum contactors in the market.

For instance, In September 2024, solid-state relays (SSRs) are increasingly being utilized in AC motor control applications, offering faster switching speeds, reduced mechanical wear, and enhanced control capabilities. This poses competition to traditional low-voltage vacuum contactors, as SSRs are gaining traction in sectors where electronic control and ultra-fast switching are prioritized.

Opportunities

Growth in Renewable Energy Sector

The push toward renewable energy sources represents a significant opportunity for the low voltage vacuum contactors market. As countries globally aim to reduce carbon emissions, investments in renewable power systems such as solar and wind farms are rapidly increasing. Vacuum contactors are vital components in these systems, used to manage electrical circuits efficiently while minimizing energy loss. Their ability to operate reliably under varying loads and challenging environmental conditions makes them an ideal choice.

Government initiatives and supportive policies encouraging renewable energy adoption create a favorable environment for the expansion of this market segment. Moreover, the integration of smart grid technologies alongside renewables provides additional avenues for deploying advanced vacuum contactors. This convergence of sustainable energy growth and technological innovation presents lucrative prospects for manufacturers and suppliers.

For instance, in January 2025, the Dubai Electricity and Water Authority (DEWA) launched a $1.9 billion smart grid initiative to improve sustainability and efficiency. This highlights the rising focus on smart grids and digitalization, which is increasing demand for low-voltage vacuum contactors. These devices play a key role in ensuring reliability, safety, and performance by enabling precise switching for renewable integration, automated load management, and real-time monitoring.

Challenges

Awareness and Technical Expertise Gap

A significant challenge facing the low voltage vacuum contactors market is the lack of widespread awareness and understanding of these advanced devices among potential users. Many organizations, especially smaller ones, remain unfamiliar with the benefits and operational requirements of vacuum contactors compared to traditional alternatives.

Furthermore, the technical expertise required for proper installation, tuning, and maintenance is often lacking. This can lead to improper use or reluctance to deploy vacuum contactors fully, limiting market expansion. To overcome this challenge, focused education, training programs, and demonstration projects highlighting operational advantages are necessary.

Key Players Analysis

In the low voltage vacuum contactors market, ABB, Schneider Electric, Siemens, Eaton, and Mitsubishi Electric dominate with extensive portfolios in power distribution and industrial automation. Their strong global presence and advanced engineering capabilities allow them to serve utilities, manufacturing, and infrastructure projects.

Firms such as Rockwell Automation, Toshiba, Fuji Electric, Larsen & Toubro, and General Electric contribute significantly with tailored solutions for industrial applications. Their expertise in integrating automation with electrical systems enables them to meet rising demand from oil and gas, mining, and heavy industries.

Regional and specialized players including Chint Group, Crompton Greaves, TE Connectivity, Hitachi, WEG, Hubbell, Meidensha, Legrand, NHP Electrical Engineering, and LSIS add depth to the market. They focus on cost-effective and application-specific contactors, addressing local market requirements. Many of these firms also strengthen their positions by developing compact and modular products.

Top Key Players in the Market

- ABB Ltd.

- Schneider Electric SE

- Siemens AG

- Eaton Corporation

- Mitsubishi Electric Corporation

- Rockwell Automation Inc.

- Toshiba Corporation

- Fuji Electric Co., Ltd.

- Larsen & Toubro Limited

- General Electric Company

- Chint Group

- Crompton Greaves Ltd.

- TE Connectivity Ltd.

- Hitachi Ltd.

- WEG S.A.

- Hubbell Incorporated

- Meidensha Corporation

- Legrand SA

- NHP Electrical Engineering Products Pty Ltd.

- LSIS Co., Ltd.

- Others

Recent Developments

- In March 2025, ABB announced a $120 million investment to expand its U.S. manufacturing capacity, including facilities that support the production of low-voltage vacuum contactors. This strategic move aims to meet rising demand driven by data centers, industrial automation, grid modernization, and renewable energy integration while strengthening ABB’s regional supply chain resilience.

- In October 2023, Eaton announced an $85 million investment to expand its North American manufacturing capacity for key electrical components, including switchgear, switchboards, circuit breakers, and related low-voltage vacuum contactor technologies. This expansion is aimed at addressing growing customer demand across utility, commercial, and industrial sectors while enhancing supply chain resilience and shortening lead times.

Report Scope

Report Features Description Market Value (2024) USD 59.1 Bn Forecast Revenue (2034) USD 577.4 Bn CAGR(2025-2034) 25.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (AC Contactor, DC Contactor), By Application (Industrial, Commercial, Residential), By End-User (Manufacturing, Utilities, Oil & Gas, Mining, Others), By Voltage Rating (Up to 1kV, 1kV-5kV, Above 5kV) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB Ltd., Schneider Electric SE, Siemens AG, Eaton Corporation, Mitsubishi Electric Corporation, Rockwell Automation Inc., Toshiba Corporation, Fuji Electric Co., Ltd., Larsen & Toubro Limited, General Electric Company, Chint Group, Crompton Greaves Ltd., TE Connectivity Ltd., Hitachi Ltd., WEG S.A., Hubbell Incorporated, Meidensha Corporation, Legrand SA, NHP Electrical Engineering Products Pty Ltd., LSIS Co., Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Low Voltage Vacuum Contactors MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Low Voltage Vacuum Contactors MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-